Alpha

Yield Basis (YB) Launch on Kraken Launchpad

Yield Basis, the first project on Kraken Launchpad, promises sustainable Bitcoin yields without impermanent loss. Backed by Curve DAO and Mikhail Egorov.

Quick Overview

- Kraken Launchpad kicks off with Yield Basis (YB)

- Built by Curve founder Mikhail Egorov

- Backed by $60M crvUSD credit line from Curve DAO

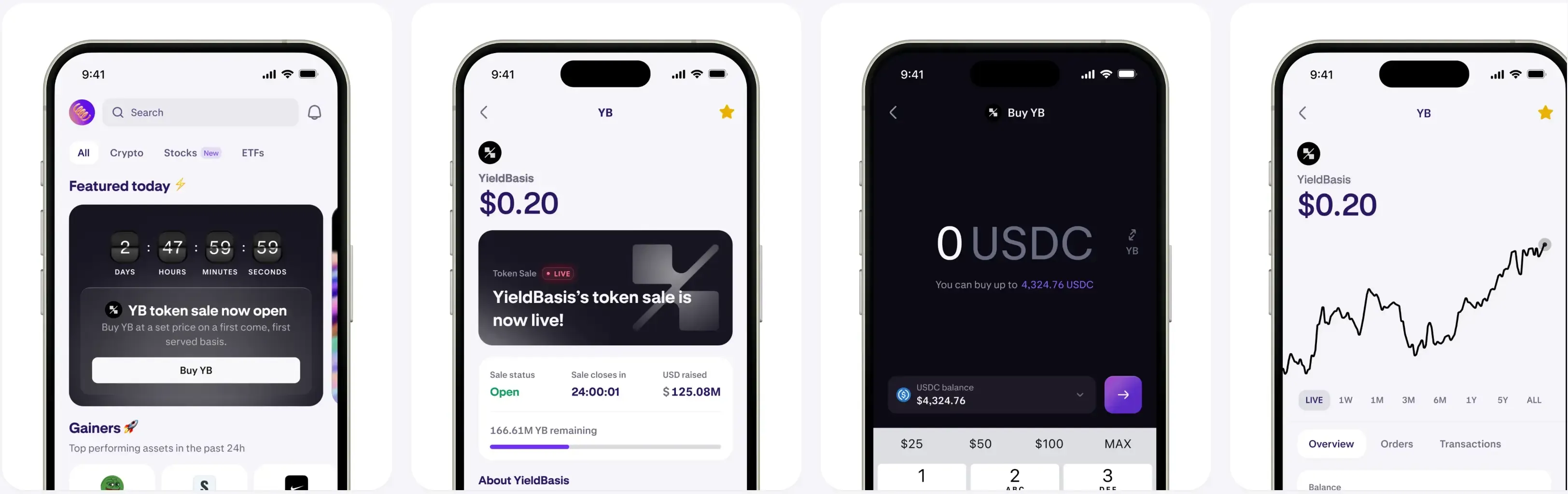

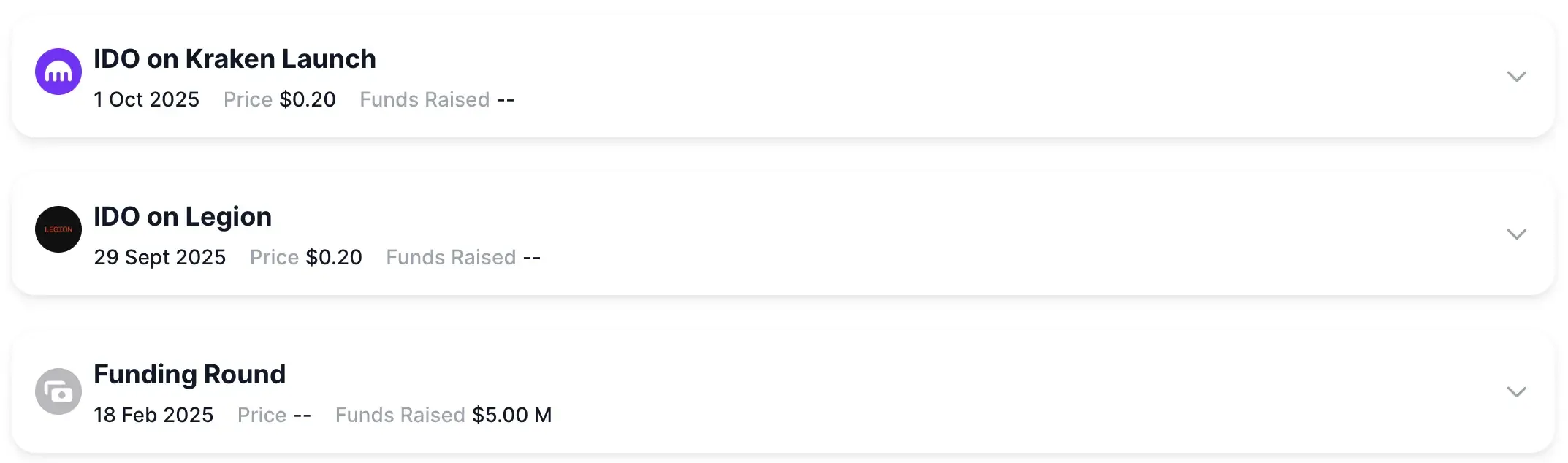

- Token sale begins Sept 29, 2025; listing expected Oct 2025

- Aims for sustainable BTC yields via precise 2x leverage

What Is Yield Basis?

Yield Basis sets out to crack one of DeFi’s oldest headaches: how to earn steady Bitcoin yield without the bleeding effect of impermanent loss. Most liquidity providers have learned the hard way that when BTC swings, pool exposure warps in ways that drain returns. Yield Basis flips that equation with a precise 2x leverage system that constantly rebalances, keeping positions glued to Bitcoin’s actual price movements.

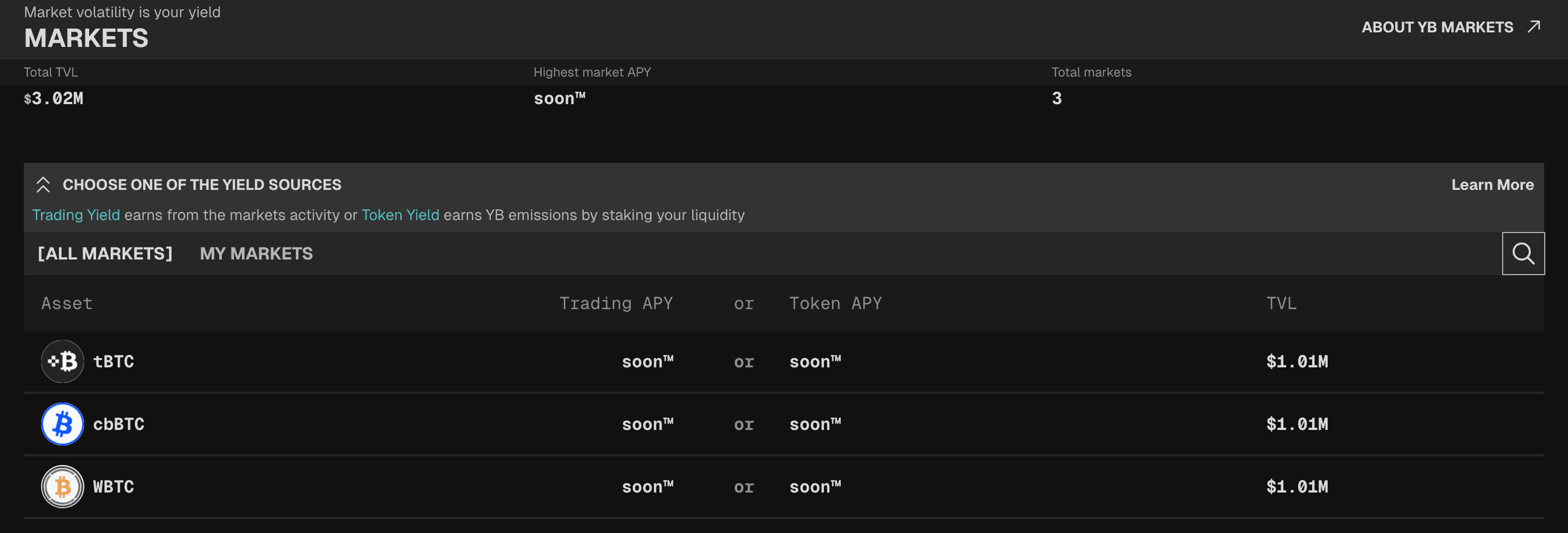

Launch Pools and Early Parameters

At launch, the protocol isn’t trying to boil the ocean. It starts with three Ethereum-based pools — WBTC, cbBTC, and tBTC — each capped at $1 million. That’s $3 million in total initial TVL. Small by DeFi standards, but deliberate. It gives the system room to prove itself under controlled liquidity before scaling wider.

Backtests from 2023 through July 2025 paint a promising picture: an average fundamental APR of 14.87% and 23.57x annual TVL turnover. In other words, volume has been thick relative to deposits, a key metric for yield stability.

For users ready to try it firsthand, the official guide on providing and withdrawing liquidity explains step by step how to interact with Yield Basis pools.

The AMM Mechanism

Where Yield Basis really stands apart is in its AMM design. Traditional automated market makers expose LPs to a square-root function of price, which is where impermanent loss sneaks in. This protocol uses continuous re-leveraging to hold exposure right at 2x — no drift, no half measures.

Mikhail Egorov himself underlined the importance of precision here:

“Keeping this ratio very, very precise” is what makes Yield Basis different from competitors that rely on manual rebalancing. The pitch is simple: if the math holds, LPs track Bitcoin directly and avoid the silent tax of impermanent loss.

Both the Kraken Launchpad debut for Yield Basis and the upcoming Cookie Launchpad sale for Superform sit inside the same Legion-powered launchpad ecosystem, which is quickly attracting high-demand token sales. Superform’s $UP sale on December 4, backed by Polychain and VanEck, is a good example — early interest already exceeds available supply.

Team & Founder Background

Mikhail Egorov isn’t new to building financial plumbing. As the founder of Curve Finance, he spent the last five years designing one of the most resilient AMMs in DeFi — a protocol that’s moved over $2 trillion in volume since launch. His fingerprints are on some of crypto’s most copied mechanics: vote-escrow tokenomics, stablecoin-centric pools, and the governance structures that turned Curve into a backbone for liquidity.

The story hasn’t been without bruises. In 2024–2025, Egorov’s personal positions came under heavy pressure. June 2025 alone saw $140 million in CRV liquidations, leaving Curve with $10 million in bad debt. Later that year, a sudden 12% CRV price drop forced the liquidation of another 918,830 CRV (~$882,000) tied to his accounts. The numbers made headlines, raising questions about risk management.

Even so, among DeFi builders, Egorov’s technical chops aren’t in doubt. Yield Basis is his new attempt to push AMM design further — this time toward sustainable Bitcoin yield. The protocol leans on the same ingredients he refined at Curve: crvUSD credit stability and the vote-escrow model, but now repurposed for Bitcoin liquidity. Whether this becomes his redemption arc or just another experiment is what the market is about to test.

For a deeper dive, Egorov himself discussed YieldBasis token design with Legion and Valueverse (Sept 2025):

Launchpad Details

Kraken Launch isn’t just rolling out another token sale funnel. It’s experimenting with structure — a two-phase process that tries to blend fairness with reach.

Phase 1 sets aside 20% of tokens for anyone carrying a Legion Score. That score isn’t about wallet size. It’s a reputation metric built from on-chain activity, social posts, GitHub commits — the kinds of signals that separate real contributors from bots or airdrop farmers.

Phase 2 is more familiar: open allocation across both Kraken Launch and Legion’s own platform, first-come, first-served. To get in, participants must pass Kraken’s intermediate KYC. Every purchase pays a 0.5% fee, and access is MiCA-compliant in Europe but off-limits for users in the US, Canada, and Australia.

Legion’s philosophy is blunt: merit over money. Co-founder Fabrizio Giabardo put it this way: “The size of your wallet isn’t what matters. What matters is how you’ve contributed to the industry or project itself.”

It’s a design meant to choke out multi-account games and tilt distribution toward developers, DeFi power users, and long-time community builders. Whether that works in practice? That’s the real experiment here. This shift toward merit-based launches mirrors a broader trend: ICOs are making a comeback in 2025, with new platforms and compliance frameworks reshaping how token sales reach the market.

Token Sale Structure

Yield Basis enters the market with a 1 billion token supply, translating to a $200 million fully diluted valuation (FDV) at the sale price of $0.20 per token. The public sale is deliberately small: just 25 million tokens, or 2.5% of supply, with no minimum purchase requirement and a hard cap of $10,000 per participant.

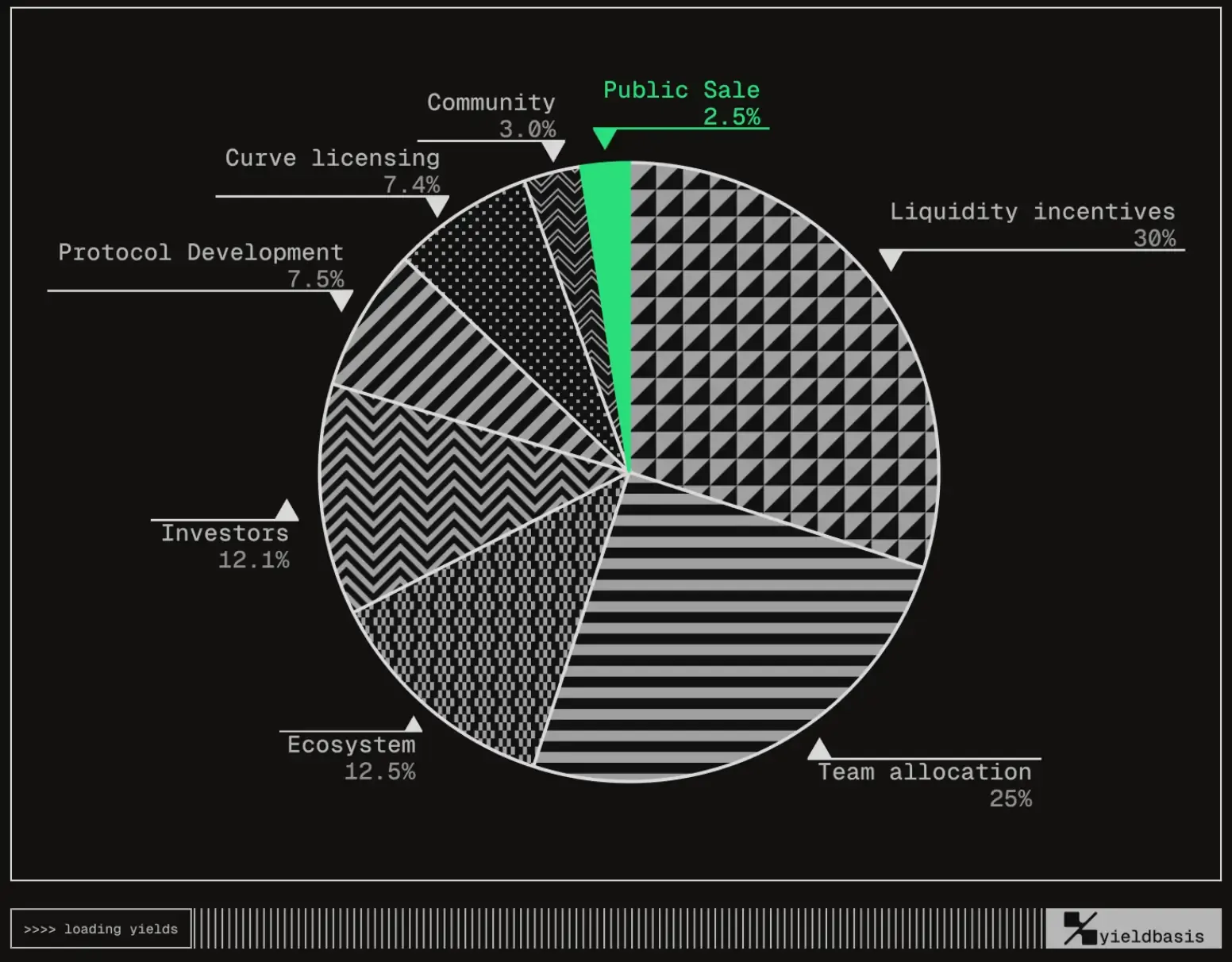

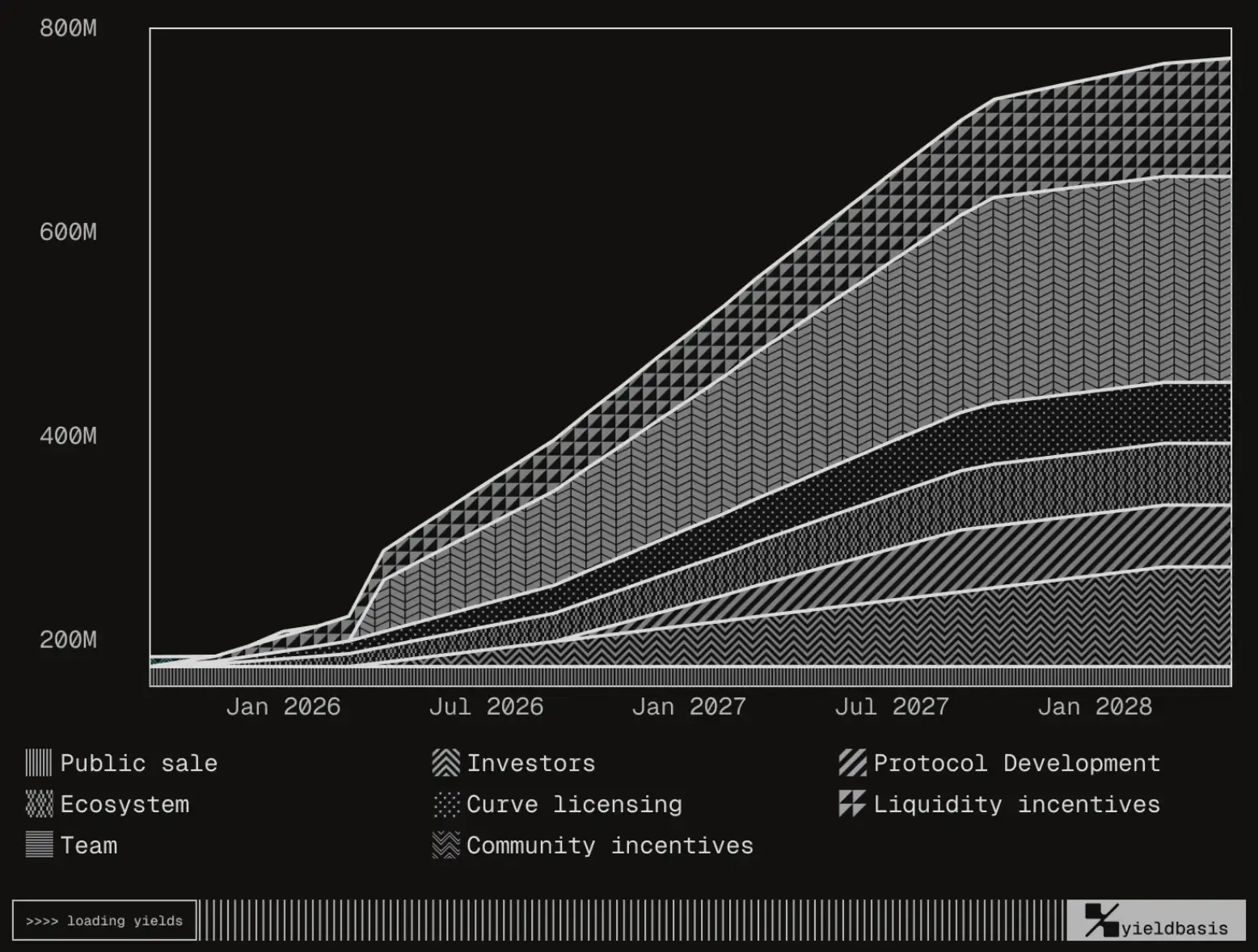

Allocation Breakdown

The distribution is spread across several priorities. 30% of tokens are earmarked for liquidity mining, while 25% go to the team. 15% are set aside as ecosystem reserves, and 12.1% belong to early investors. The remaining slices include 7.5% allocated for Curve protocol licensing fees, 7.4% for developer reserves, and 3% for Curve governance incentives.

Tokenomics Design

In terms of mechanics, Yield Basis sticks close to Egorov’s roots. The system uses a vote-escrow model (veYB), where holders can lock tokens to participate in governance and receive protocol fees paid in crvUSD or wrapped BTC. Unlike many DeFi projects that rely on inflationary emissions, Yield Basis links rewards to actual yield generation. Egorov has described this as a “value-protecting” incentive structure, meant to reduce dilution and align rewards with real performance.

Market Expectations

Market watchers are already speculating. The protocol’s early 2025 raise priced it at a $50 million valuation, but with Curve DAO support and Egorov’s reputation, projections suggest the listing FDV could stretch into the hundreds of millions. The Curve DAO’s formal approval of a $60 million crvUSD credit line underscores institutional confidence and provides a strong backstop for launch.

How to Participate in the YieldBasis (YB) Sale

Sale Details:

- Token Price: $0.20 (FDV $200M)

- Tokens Available: 25M YB (2.5% supply)

- Min/Max Purchase: $0 – $10,000

- Unlocks: No lockup or vesting

- Estimated TGE: October 2025

Steps to Join:

- Create an account on Legion.cc or Kraken Launch.

- Verify your identity by completing KYC and address check.

- Pre-deposit USDC on Ethereum Mainnet before the sale window.

- Join Phase 1 (Sept 29, 10 AM EST / 2 PM UTC) if you have a Legion Score — up to 20% allocation reserved.

- Join Phase 2 (Oct 1, 10 AM EST / 2 PM UTC) for open FCFS access via Kraken or Legion.

- Confirm allocation — successful transactions secure tokens, unsuccessful ones are refunded in USDC.

For a full walkthrough, see Legion’s official article:

Risks

No matter how polished the pitch, Yield Basis isn’t risk-free. The protocol has already gone through six audits, with a seventh underway, and it comes with an emergency stop controlled by Curve’s Emergency DAO multisig. Still — this is leveraged DeFi. Smart contract exploits don’t vanish just because you ran more tests. The automated rebalancing logic, while clever, adds another layer of complexity that attackers love to probe.

Liquidity is another weak spot. Each launch pool is capped at $1 million, which means scalability hasn’t truly been pressure-tested. More concerning: the protocol leans on a $60 million crvUSD credit line, equal to 53% of that stablecoin’s entire supply. Inside Curve DAO, some members flagged this as “extremely extractive” and argued that risk modeling wasn’t deep enough for such a large facility. If anything wobbles in crvUSD, the ripple effects could hit both ecosystems hard.

Governance concentration is also in play. Yield Basis lives and dies by Mikhail Egorov’s leadership and continued Curve support. Meanwhile, the Legion Score system — meant to filter bots — may lock out legitimate retail users who simply don’t have a long on-chain footprint. And the yields? The 14.87% APR is based on backtests that assumed constant volume. If trading activity slows, rewards will too.

Regulation adds yet another shadow. MiCA compliance gives Yield Basis a European runway, but the U.S. — still the world’s biggest crypto market — is off-limits. Legion has floated cooperation with SEC task forces, but there’s no clear path to American market entry. That uncertainty lingers over the long-term roadmap.

Outlook

Yield Basis could mark a turning point for institutional Bitcoin yield. Backed by a $60M Curve DAO credit line and debuting on Kraken Launch, it blends Curve’s infrastructure with a design aimed at eliminating impermanent loss.

The big questions: can it hold its 2x leverage ratio through volatility, scale beyond $3M TVL, and deliver competitive yields without slippage costs eating into returns?

The Kraken-Legion model offers a regulatory playbook — merit-based distribution paired with MiCA compliance. But the project’s fate still hinges on Curve’s health, crvUSD stability, and Egorov’s leadership.