Crypto

Hyperliquid Hypurr NFT Airdrop

Hyperliquid’s Hypurr NFT airdrop turned 4,600 cat avatars into one of crypto’s hottest rewards — $45M traded in a day, floor over $75K, and whales paying nearly half a million for rare pieces.

Quick Overview

- 4,600 Hypurr NFTs airdropped to early Genesis Event users.

- $45M+ in 24h trading, floor price climbed from $68.9K to $75.2K.

- Whales and founders spent up to $470K on rare traits.

- HyperEVM deployment gave Hypurr fast, cheap, bot-resistant trading.

- Risks: wallet hacks, $11.9B HYPE unlocks, whale concentration.

Hypurr NFTs have been deployed on the HyperEVM

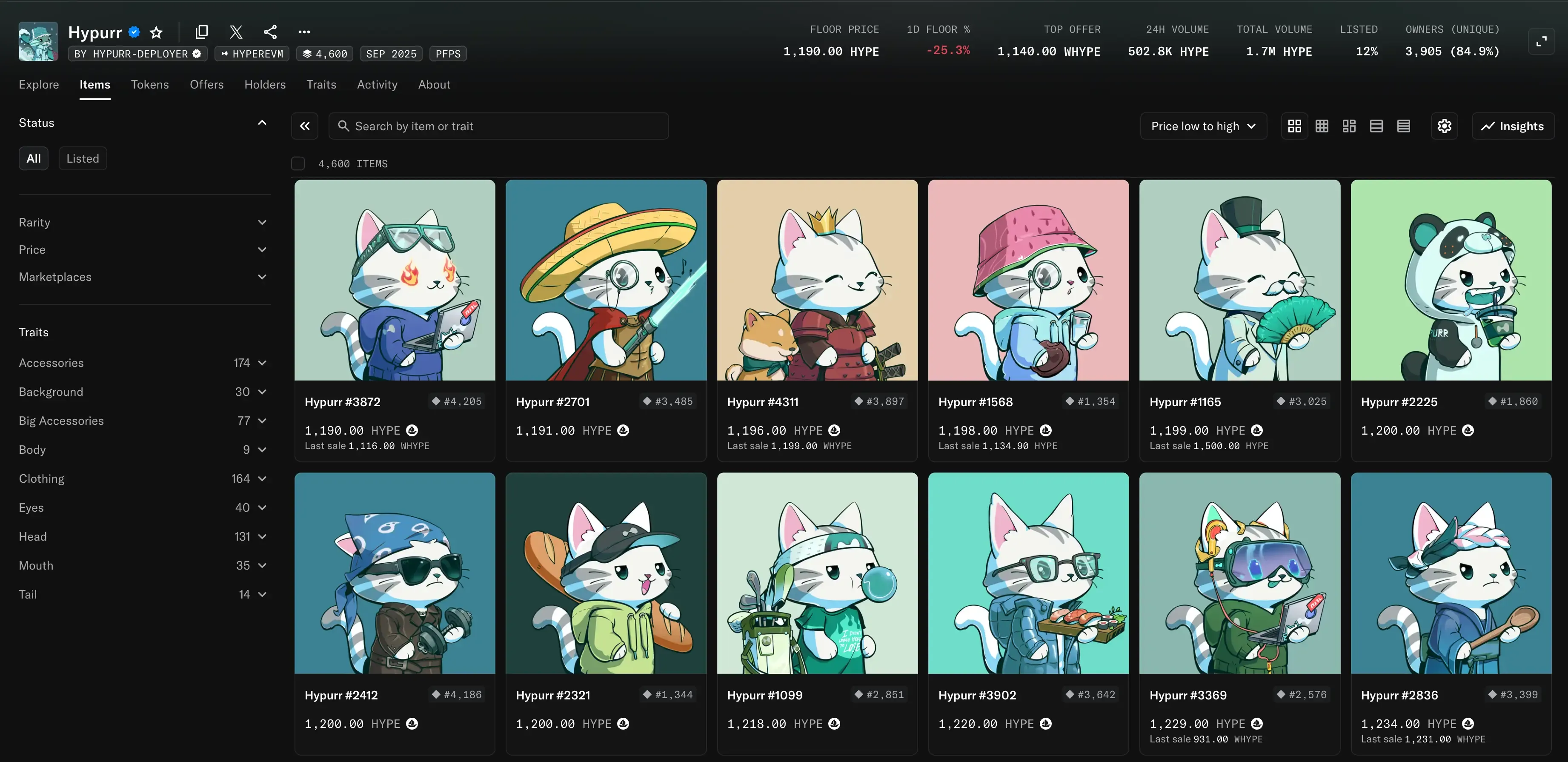

On September 28, Hyperliquid dropped its long-teased Hypurr NFT collection — 4,600 cartoon cats that turned into one of the wildest NFT airdrops we’ve seen in years. Within the first 24 hours, the floor rocketed to $75,200, pushing total trading past $45 million.

These weren’t random giveaways either. Every NFT went to early users who showed up during the November 2024 Genesis Event, making Hypurr more like a badge of loyalty than a speculative mint. Even so, the market couldn’t resist. One piece sold for nearly $470,000, cementing Hypurr as a record-setting airdrop in terms of immediate value creation.

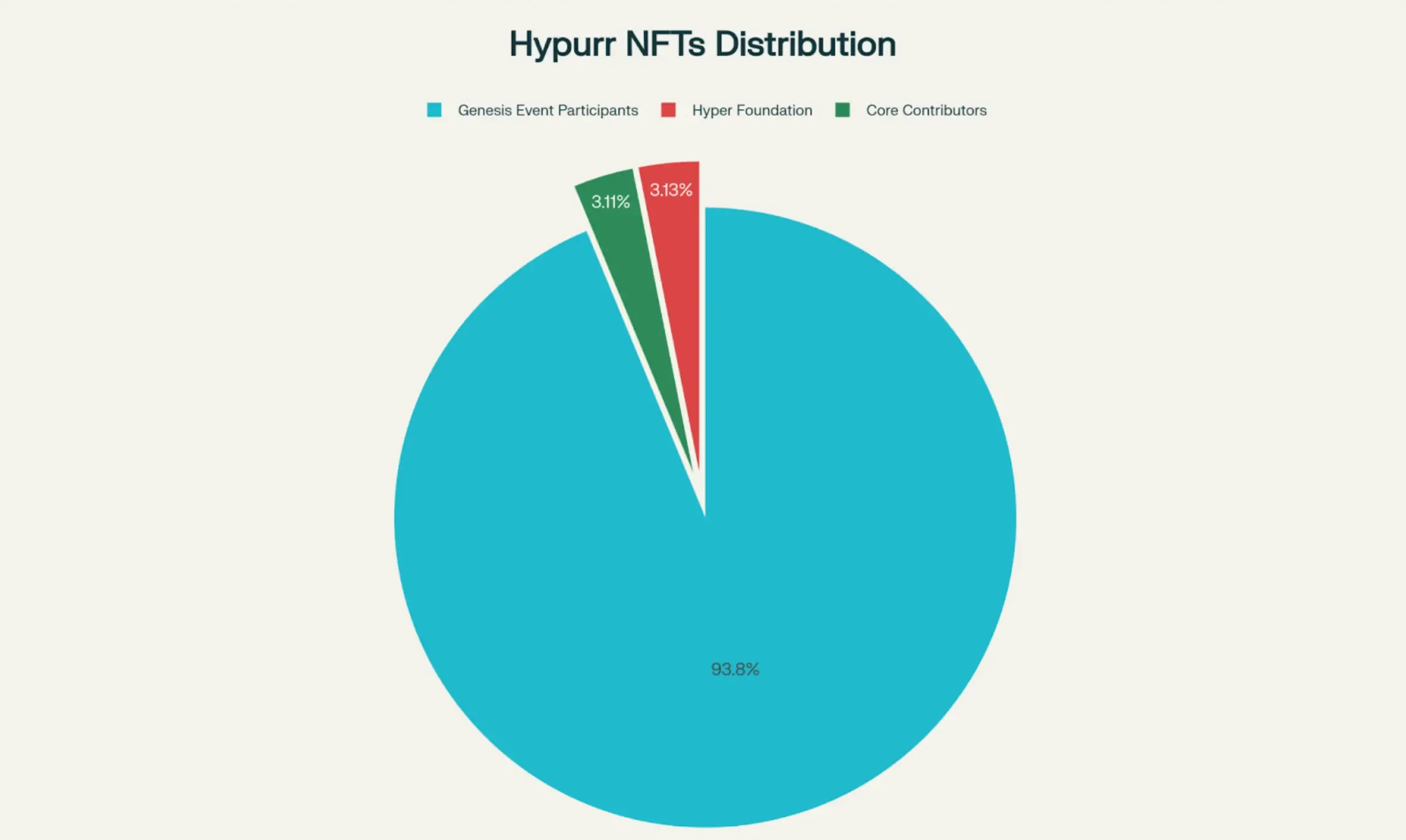

Distribution and Supply Architecture

The Hypurr drop wasn’t just a free-for-all. It rolled out on HyperEVM mainnet under a carefully engineered allocation plan meant to reward real users, not opportunists. Out of 4,600 total NFTs:

- 4,313 (93.8%) went directly to Genesis Event participants who opted in during November 2024.

- 144 (3.1%) landed with the Hyper Foundation.

- 143 (3.1%) were reserved for core contributors — the developers, artists, and team members who built the project.

Behind the scenes, the Foundation ran clustering analysis and compliance checks to weed out sybil attacks. The goal was simple: stop a single actor from hoarding dozens of NFTs, a problem that plagues most high-profile drops. By doing so, Hyperliquid framed Hypurr not as another botted mint, but as a fair distribution model aligned with its broader philosophy of sustainability and user-first design.

Market Activity

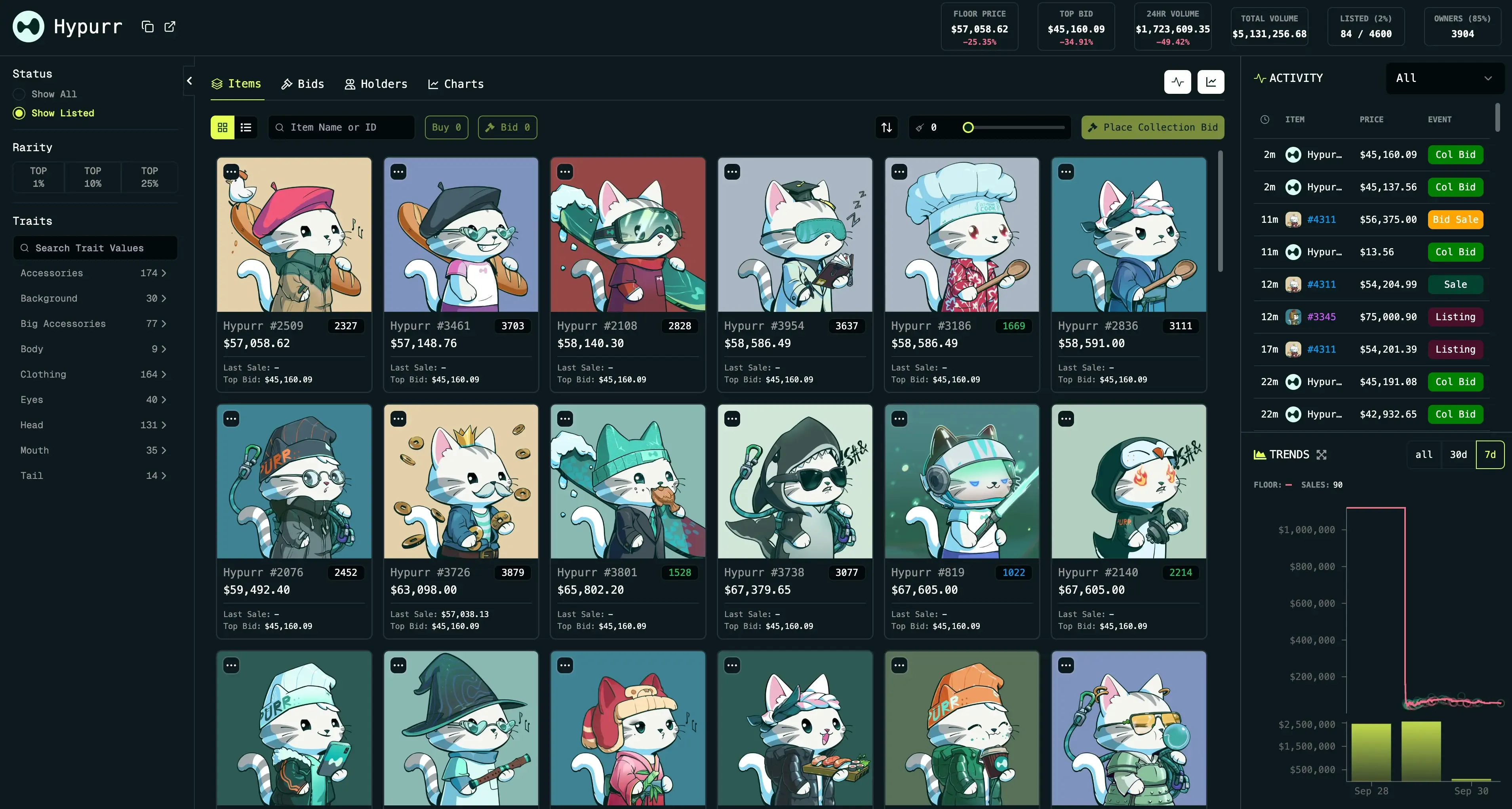

Trading lit up the moment Hypurr went live. On day one, OpenSea logged 952,000 HYPE tokens in volume — roughly $45 million — while the floor climbed from $68,900 at launch to $75,200 within hours. Not a sleepy rollout, but a stampede.

Since then, activity hasn’t slowed. Between Drip and OpenSea, the collection now shows ~4000 unique holders and a remarkably high ~90% distribution rate. Total volume has crossed $5 million, pointing to interest that goes well beyond first-day hype.

Even before the official drop, trading had already begun. DripTrade’s OTC desk let early buyers lock in deals as high as $88,000 per NFT — but only with collateral posted and a seven-day settlement window. That system turned out to be a clever way to establish pricing and force real commitments, preventing the kind of empty speculation that usually swirls around pre-launch NFTs.

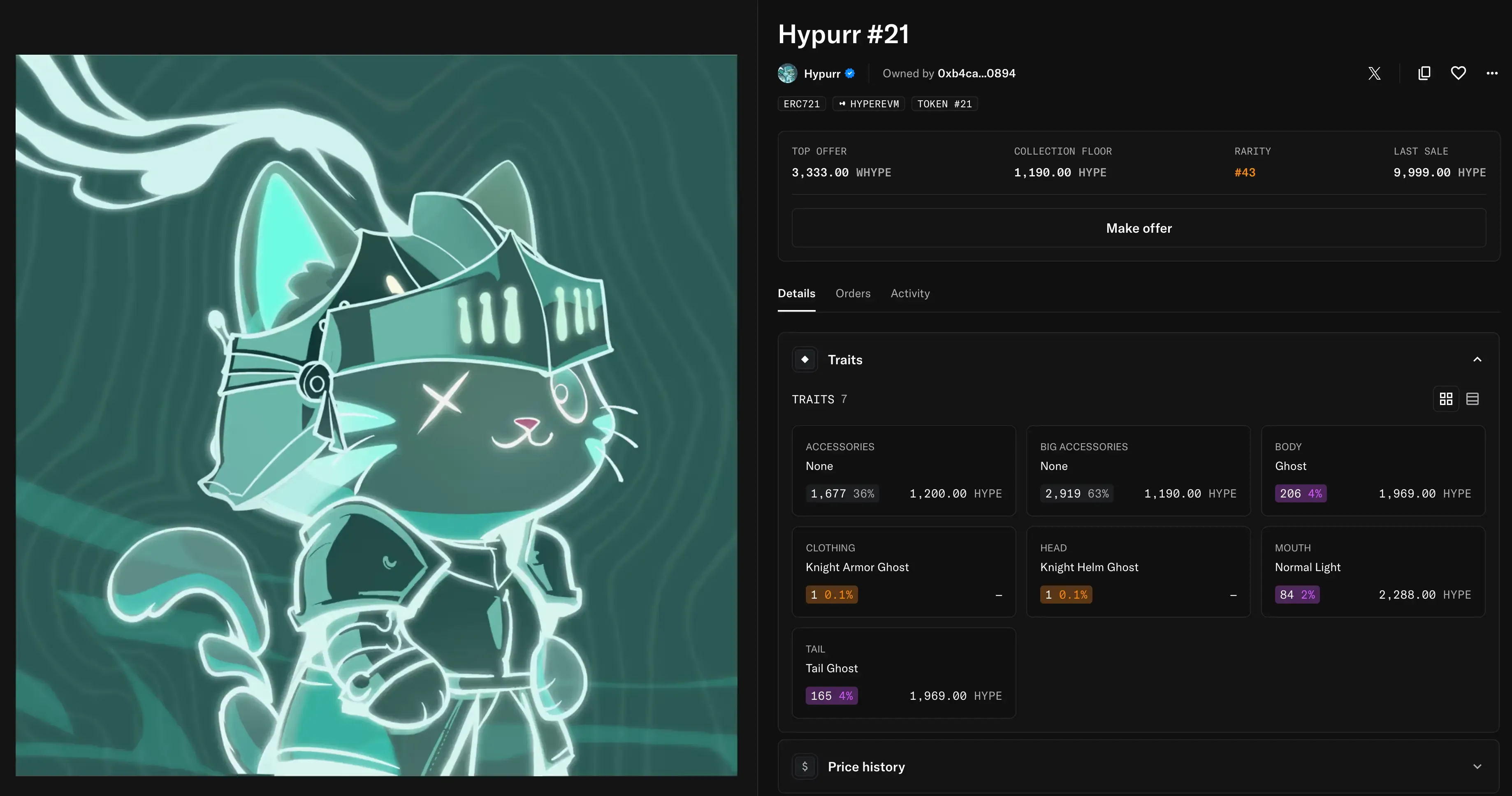

Whale Purchases

The early trades weren’t just retail flippers — whales and founders jumped in hard. The standout was Hypurr #21, kitted out with rare Knight Ghost Armor and Knight Helm Ghost traits, which sold for 9,999 HYPE tokens ($467,000–470,000). That deal set the collection’s price ceiling and gave traders a benchmark for rarity value.

One of the biggest scoops came from Pastel Alpha founder Cooker, who grabbed eight Hypurr NFTs — IDs 1603, 2669, 2704, 4069, 4171, 568, 780, and 952 — for around $500,000 total. It wasn’t just a flex. Moves like this show how influencers can tilt markets, pulling in fresh attention and liquidity.

Institutional names are circling too. The Unit protocol founder dropped nearly $470,000 on a single NFT, a buy that pushed Hypurr beyond retail enthusiasm and into the category of institutional-grade collectibles. These chunky buys do two things at once: they stabilize the floor and they squeeze supply for smaller collectors, raising the stakes for everyone else trying to get exposure.

Trading Platforms

Most Hypurr trading happens where you’d expect: OpenSea dominates volumes thanks to its reach:

While Drip has carved out a niche for more community-driven trades:

Because the collection lives on HyperEVM, these NFTs plug straight into Hyperliquid’s financial rails — making them more than just static cat pictures. They’re designed to sit inside a broader DeFi stack.

Before launch, DripTrade’s OTC desk gave well-capitalized buyers a head start. Deals required collateral up front and a binding seven-day settlement, which cut down on empty speculation and created real price discovery ahead of distribution. Not many NFT drops offer that kind of structure.

On the technical side, Hypurr avoids the usual headaches of NFT mints. HyperEVM + HyperBFT consensus delivers sub-second finality, cheap fees, and scalability that Ethereum mainnet or other congested L1s struggle to match. For traders, that means flipping or transferring high-value NFTs feels closer to swapping tokens on a DEX than waiting in a queue on OpenSea.

Hyperliquid’s User Reward Philosophy

The Hypurr drop wasn’t built to squeeze revenue. It was framed as a thank-you to early believers, a collectible “memento” for those who backed Hyperliquid during the 2024 Genesis Event. That stance fits with the project’s self-funded model, a stark contrast to venture-backed protocols that push profit-driven NFT launches.

Even outside observers picked up on this. As trader @BawsaXBT put it: “Notice how Hyperliquid didn’t raise funds from the Hypurr NFTs? That’s because it was airdropped to their early supporters. No mint. No price tag. Just pure ‘thanks for supporting.’”

The cats themselves carry a personal touch. Each avatar mirrors the quirks of the community — moods, hobbies, little personality cues. That kind of design creates emotional weight, even if trading data shows most participants are chasing upside first and sentiment second.

That shift in behavior didn’t go unnoticed either. As @stevenyuntcap argued: “NFT traders from last cycle would reflexively sell any airdropped NFTs… Hypurr has proven that if you just make everyone a community member first, the instinct will be to keep it from the start.”

The airdrop also landed at a calculated moment. Hyperliquid had just rolled out permissionless spot quote assets and launched USDH, its stablecoin backed by cash and U.S. Treasuries. Together, these upgrades add liquidity and transactional depth, giving NFTs like Hypurr more functionality than simple collectibles.

Of course, speculation creeps in. Traders whisper about future perks — HYPE token airdrops, fee discounts, governance rights. Yet the Foundation is blunt: “no utility is promised or guaranteed.” Long-term value, then, depends on whether Hyperliquid can keep expanding its ecosystem and transform these cat avatars into assets with real use cases.

Risks and Security Concerns

The celebration didn’t last long. Within hours of launch, blockchain sleuth ZachXBT flagged the theft of 8 Hypurr NFTs — roughly $400,000 gone after attackers compromised wallets tied to Genesis participants. It was a reminder that even with tight distribution rules, wallet security remains a glaring weak spot during hyped drops.

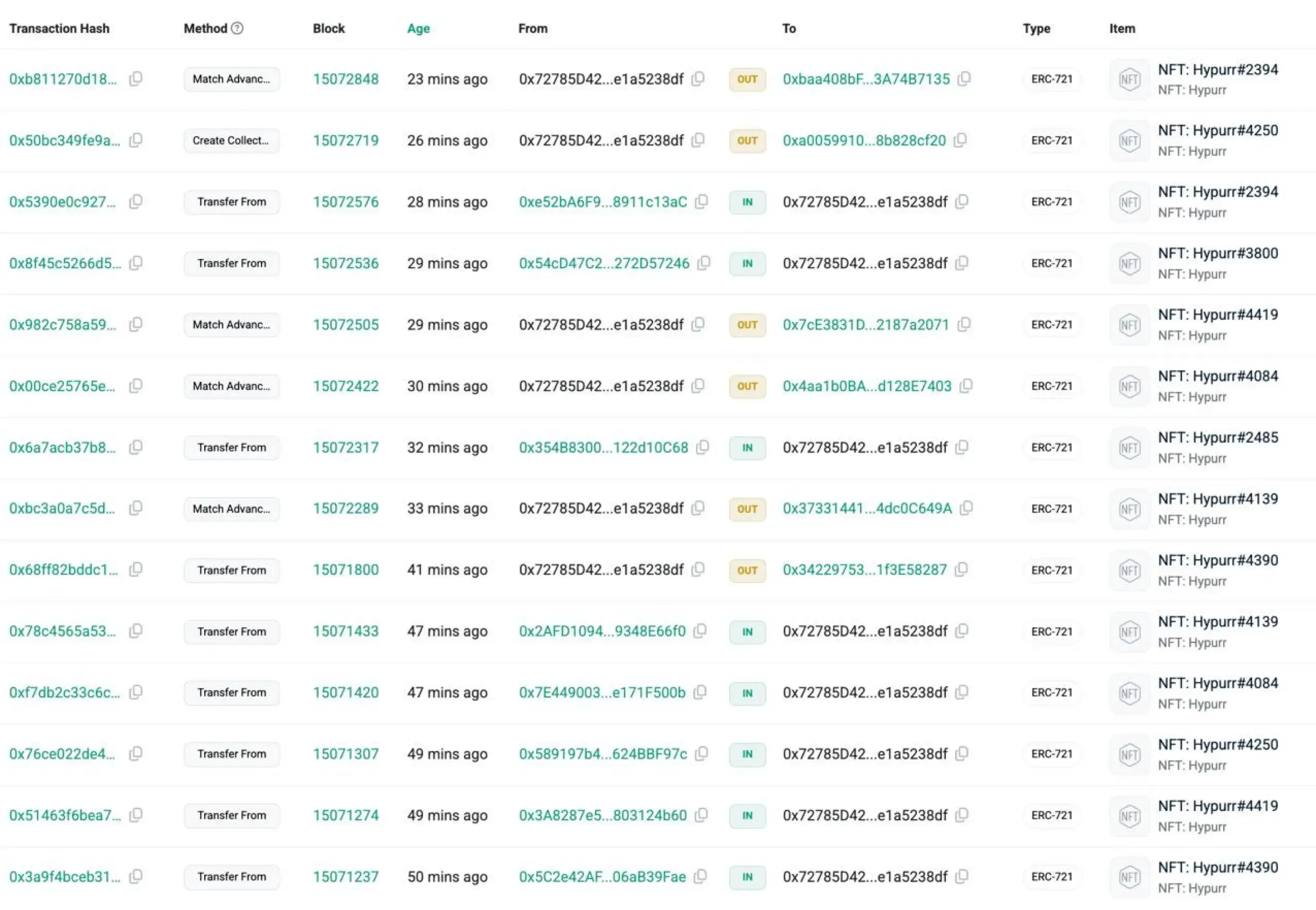

Address: 0x72785D42874E965086829eA789a703fe1a5238df

And this wasn’t an isolated scare. Hyperliquid has weathered a string of security hits: a $773,000 HyperDrive exploit, a $3.6 million HyperVault rug, and a $13.5 million JELLY token manipulation. Taken together, those incidents fuel doubts about whether the platform’s defenses can keep up as it battles giants moving $13B+ in daily perps volume.

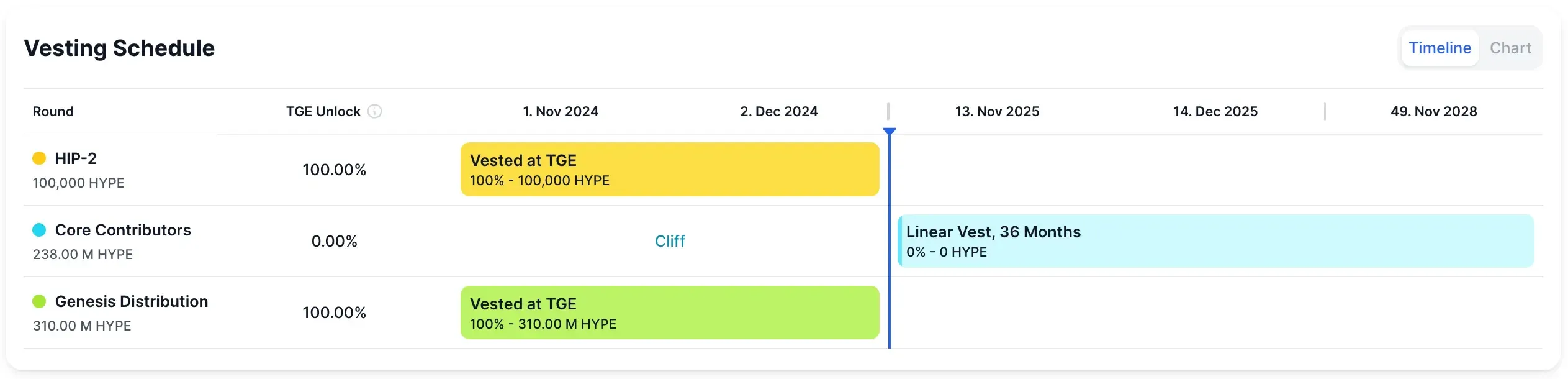

Market structure adds its own risks. Starting November 29, 2025, 237.8M HYPE tokens — worth $11.9B at today’s price — begin vesting linearly over 24 months. That’s ~$500M a month hitting the market. Buybacks cover only 17% (~$87M), leaving a gap of $413M monthly that could crush both HYPE and Hypurr valuations if demand falters.

Concentration is another weak point. The largest holder sits on 13 NFTs, a chunk big enough to shake liquidity if dumped under stress. Combine that with speculative pricing on “possible utilities” (discounts, airdrops, governance) and the setup is fragile.

So where does this leave Hypurr? For now, trading is hot and community energy is undeniable. But long-term value hangs on two things: Hyperliquid’s ability to ship real NFT utility and its capacity to shore up security before the next exploit hits. Until then, Hypurr is both a powerful reward experiment and a stress test for DeFi-native NFTs.