Crypto

The Pros and Cons of Stablecoins

Stablecoins are cryptocurrencies pegged to fiat currencies like the dollar, offering the best of both worlds—crypto speed with price stability. In 2025, they’re powering trading, payments, and DeFi while facing growing regulation and innovation.

Quick Overview

- Stablecoins are cryptocurrencies pegged to fiat currencies to maintain price stability.

- They come in four types: fiat-backed, crypto-backed, algorithmic, and hybrid.

- Widely used for trading, saving, and DeFi transactions.

- Key risks include depegging, regulatory actions, and technical vulnerabilities.

- Stick to trusted platforms and diversify across multiple stablecoins.

What Are Stablecoins

A stablecoin is a cryptocurrency pegged to the price of an asset (most commonly the US dollar or the euro). As the name implies, such coins are designed to maintain price stability relative to the underlying asset. In essence, it’s a “digital dollar” or any other digital currency built on a blockchain. The mechanisms for maintaining price stability may vary: through fiat reserves, other crypto assets, or algorithmic control of issuance.

The goal of stablecoins is to give crypto market participants a way to store value in “digital fiat” and to transact with one another without exchange rate fluctuations. In other words, they emerged as a response to the concern of everyday crypto users: “Why should I hold Bitcoin if its price is so volatile that its dollar value for goods and services constantly swings up and down?” Stablecoins aim to smooth out this volatility and provide users with a convenient means of storage and payment with highly predictable price dynamics.

Most stablecoins are pegged 1:1 to the dollar or another fiat currency: in theory, each coin can be exchanged at any moment for the asset it’s backed by. Because of this, they are often used as full-fledged fiat substitutes: you can store savings, pay for goods, participate in lending, and trade. By definition, price stability is the main advantage of stablecoins.

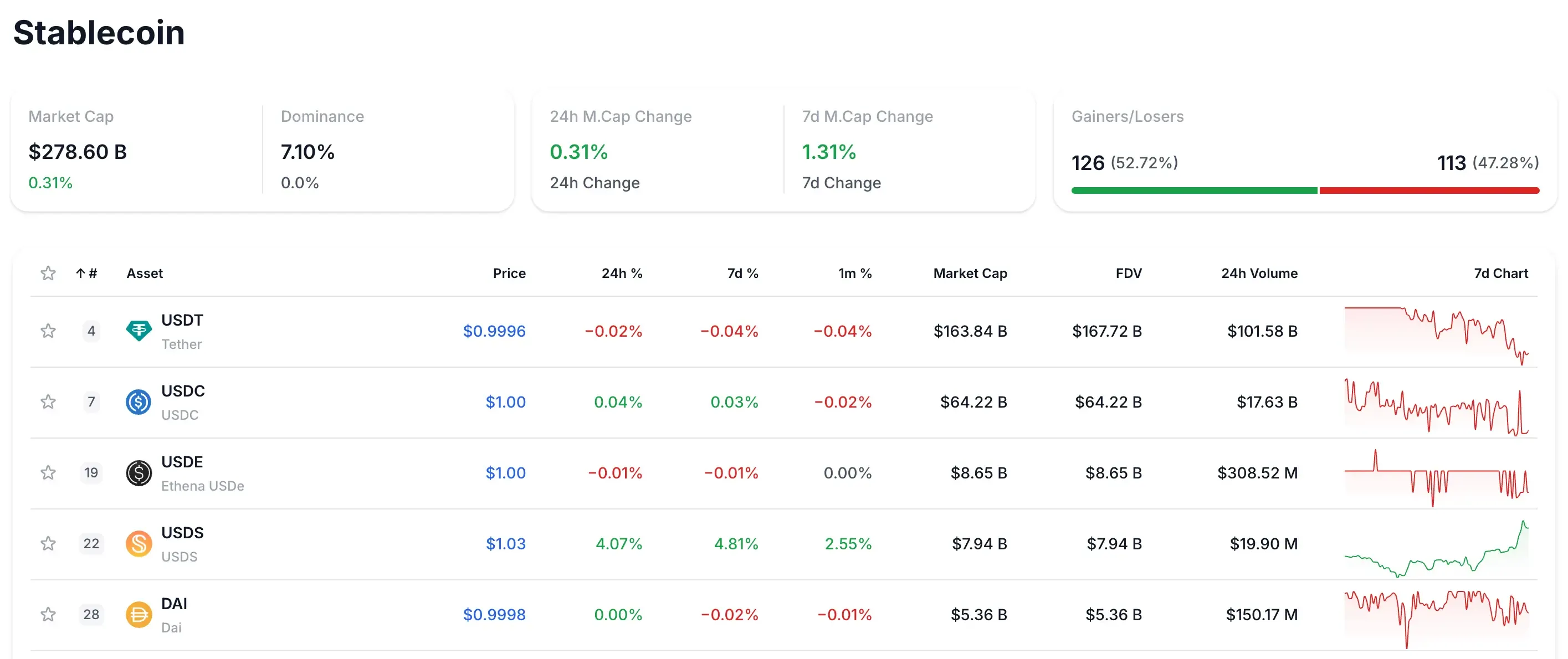

Over time, stablecoins have evolved far beyond their original role. Now with over $297B in circulating value, they form the backbone of trading, DeFi, and cross-border crypto finance — a trend we explored further in our article on digital dollars driving crypto growth.

To explore real-time metrics, top tokens, and emerging projects in this sector, visit the Stablecoins category: https://dropstab.com/categories/stablecoin

Types of Stablecoins

Stablecoins are typically classified based on the mechanisms used to maintain their price stability:

Fiat-backed (fiat-collateralized) stablecoins

These coins are backed by real money or its equivalents (precious metals, securities) held in bank reserves. The classic examples are Tether (USDT) and USD Coin (USDC).

The idea is simple: the issuer holds dollars (or euros, etc.) in reserve equal to the total number of issued coins, thereby guaranteeing a 1:1 peg. As a result, the stablecoin’s dollar value is directly “tied” to fiat.

Advantages

A transparent mechanism, high liquidity, and user trust (in theory, they can be redeemed for fiat).

Drawbacks

Counterparty risk — users must trust the honesty of the issuer and regulators. The community has often criticized USDT for a lack of reserve transparency (though under regulatory pressure, Tether has started publishing reserve reports much more frequently).

Crypto-backed stablecoins

In this case, reserves are composed of other cryptocurrencies. The most well-known example is DAI from MakerDAO. This coin is backed by ETH (and other tokens) held in smart contracts on the Ethereum blockchain. Borrowers overcollateralize with ETH (typically by 150–200%) to mint DAI. If the value of the collateral drops, liquidation occurs: the system sells the collateral to restore the coin’s peg.

Advantages

Decentralization (no central authority), and security ensured by smart contracts.

Drawbacks

High volatility and the need for substantial collateral; during sharp market movements, the system can liquidate positions — as seen during the “crypto winter” at MakerDAO.

Algorithmic stablecoins

These coins maintain their fiat peg not through reserves, but via algorithms that adjust the coin’s supply. When demand fluctuates, the system mints or burns tokens to maintain price stability.

A classic example is TerraUSD (USTC), which followed the dollar via its linkage to the LUNA token and a seigniorage mechanism. As long as trust in the token remained, the price stayed within range — but during major market shocks, such a stablecoin can break its peg (depeg), as happened with TerraUSD in May 2022 (the token lost its peg and collapsed by 97%).

Hybrid (fractional) stablecoins

These combine elements of all previous models: part of the token supply is backed by reserve assets, while the rest is managed algorithmically. FRAX is a clear example: it is partially backed by USDC reserves, with the remainder governed by an issuance algorithm. Similarly, some new projects are introducing models where price stability is supported by both market liquidity and smart contracts. These hybrids aim to combine the stability of fiat reserves with the scalability of algorithms, but the design is more complex and requires careful, precise configuration.

One example of this emerging model is STBL, a hybrid stablecoin launched by Tether co-founder Reeve Collins. It combines real-world asset (RWA) collateral, yield-splitting mechanics, and governance via a three-token system. Positioned as a challenger to USDT, USDC, and DAI in the $225B stablecoin market, STBL is aiming to reshape how value flows within stablecoin ecosystems.

Summary of types

Fiat-backed (USDT, USDC, etc.), crypto-backed (DAI), algorithmic (UST), and hybrid (FRAX). They serve different purposes, but all share the common goal of ensuring stable coin value.

Popular Stablecoins

Let’s list the most well-known stablecoins, their features, and underlying mechanisms:

Tether (USDT)

The oldest and most popular stablecoin (launched in 2014). Initially, each coin was promised to be backed 1:1 with US dollars, but later Tether partially diversified its reserves into bonds, securities, and even Bitcoin.

Pros

Maximum liquidity — USDT trades against thousands of pairs on exchanges. Some companies even use it for international payments to circumvent sanctions and tax regulations.

Cons

High concentration of risk — the issuer is centralized and frequently criticized for a lack of reserve transparency. After lawsuits (e.g., from the New York Attorney General), Tether began publishing regular reserve summaries. In addition to incomplete transparency, there is a risk of user asset freezes. If government agencies file an official request to freeze assets in your wallet, Tether will not side with decentralization or anonymity. There are numerous cases where USDT was frozen at the request of authorities, with no further transfers possible.

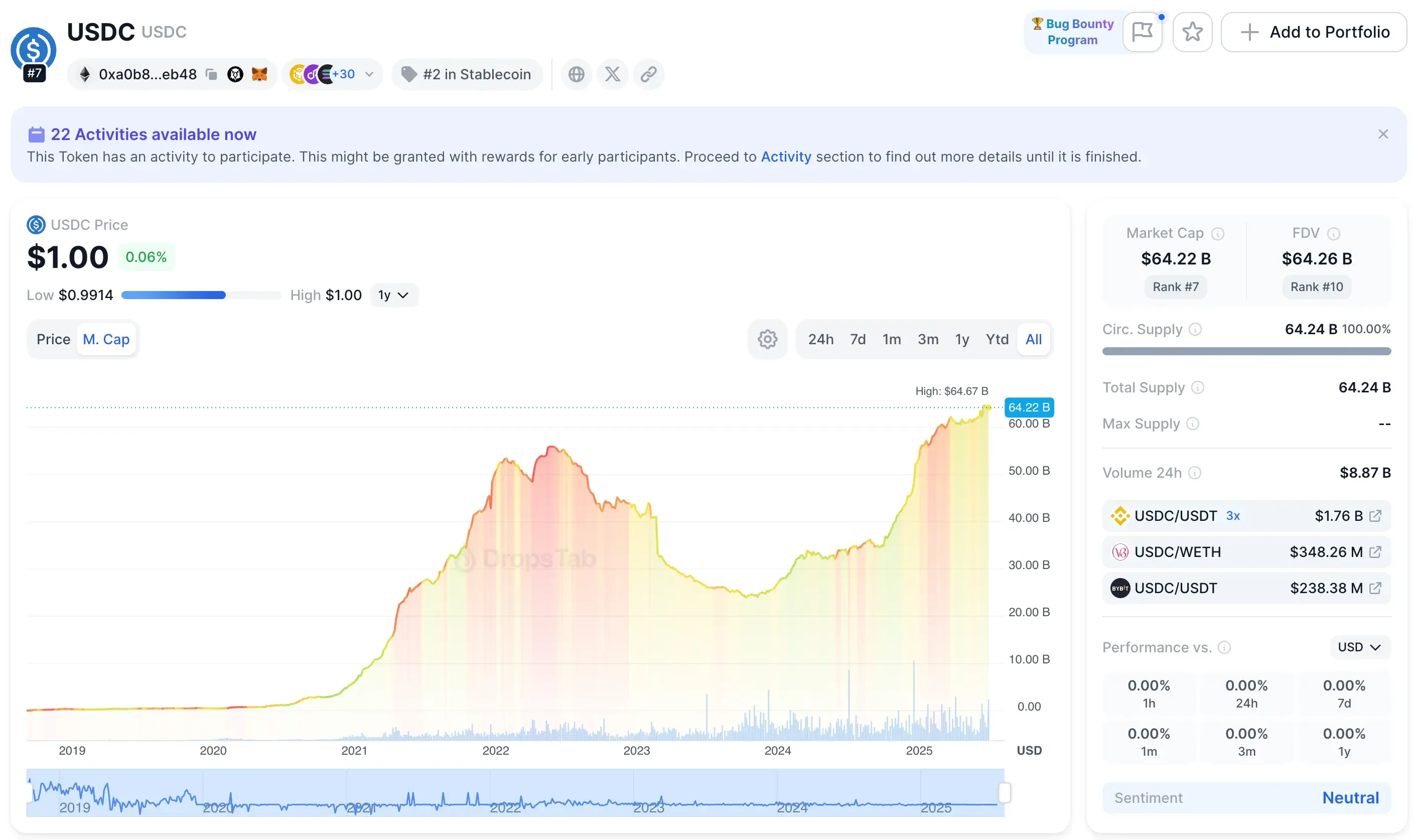

USD Coin (USDC)

A stablecoin from Circle, supported by Coinbase, launched in 2018. Fully backed by US dollars or equivalents held in American banks.

Pros

High transparency — reserves are held in accounts at BNY Mellon, Customers Bank, etc., with frequent audits. USDC currently has a market circulation in the tens of billions of dollars, and Circle positions it as the most regulated stablecoin.

Cons

More limited availability compared to USDT (USDC cannot be purchased outside supported platforms). The key difference from Tether is that USDC was designed from the outset to be fully backed 1:1 by dollars, without questionable assets in its reserves.

Dai (DAI)

A decentralized stablecoin from MakerDAO (Ethereum), launched in 2015. It is “pegged to the dollar” and backed by collateral in ETH and other crypto assets.

Pros

Aims to be a fully algorithmic and decentralized system (no central issuer; collateral rules are embedded in smart contracts).

Cons

Requires significantly higher collateral due to ETH’s volatility; in emergencies, forced liquidations of collateral may occur.

TrueUSD (TUSD)

Created in 2018 by TrustToken. A fiat-backed stablecoin — fully collateralized with US dollars. TUSD stands out as the first “regulated” dollar stablecoin: reserves are 100% in cash and equivalents, held in segregated accounts at financial institutions. Monthly audit reports are published to verify reserve backing.

Pros

High transparency and legal investor protection; considered more reliable in terms of regulatory compliance.

Cons

Less common and familiar (only a few exchanges actively support it).

FRAX

An innovative hybrid stablecoin launched by Frax Finance. The model is fractional-algorithmic: part of the coins are backed (usually by USDC or ETH), while the rest are stabilized via algorithm. When FRAX trades above $1, the protocol gradually reduces collateralization; when it trades below $1, it increases it.

Pros

Less capital-intensive than purely fiat-backed stablecoins and offers some “autonomy” from banks.

Cons

A complex mechanism, and the protocol’s behavior under extreme conditions is not always predictable. As such, FRAX belongs to the emerging “second generation” of stablecoins.

The infographic above includes stablecoins built on permissionless infrastructure with no centralized control or freeze mechanisms — highlighting a growing divide between regulatory-compliant and fully decentralized issuers. For instance, while USDS leads in market cap, its smart contract does include a freeze function, though it is currently disabled. According to co-founder Rune Christensen, any change would require decentralized governance approval.

Other projects and innovations

In 2023–2024, several new solutions emerged: for example, First Digital USD (FDUSD) — a stablecoin from the crypto bank First Digital (Hong Kong), launched in June 2023. It is fully backed by US dollars or equivalent assets held in segregated accounts with mandatory audit control.

Another trend is decentralized stablecoins like USDD (Decentralized USD) from TRON DAO. It is an overcollateralized algorithmic dollar that restores its peg via reserves in USDT and TRX. USDD has grown actively — by summer 2024, its reserve exceeded 120% collateralization, highlighting high capitalization and user trust.

Also worth mentioning is Reserve (RSV) — a stablecoin with a diversified reserve — and other experiments in the “stable” space (crypto-central bank currencies like digital rubles are not yet considered classic stablecoins).

The wave of regulation has also spurred new innovation:

Anchorage Digital and Ethena Labs announced the launch of the first stablecoin fully compliant with the U.S. ‘Genius Act’ — a federally regulated asset designed to meet the Act’s strict requirements for reserve backing, disclosures, and compliance.

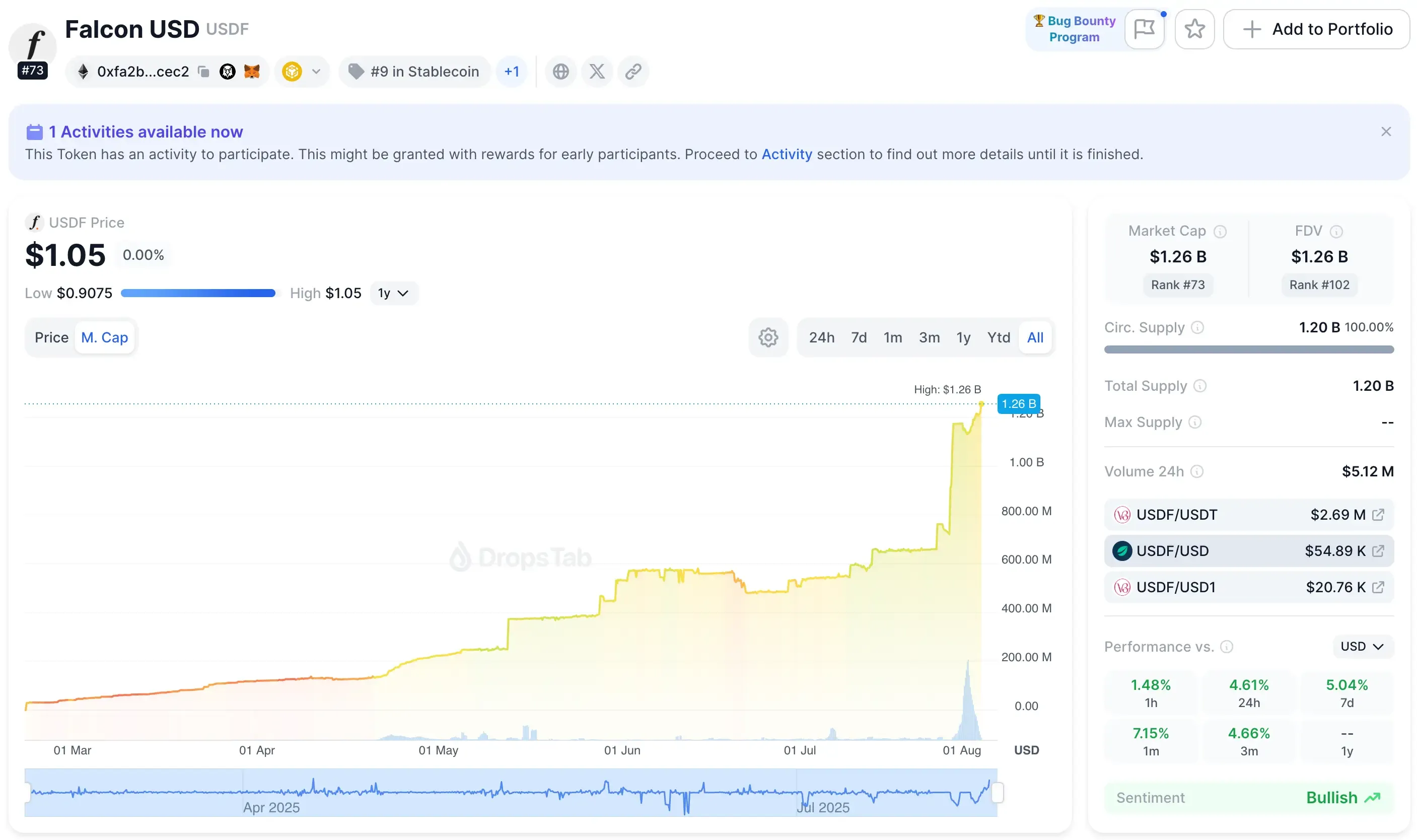

Another fast-growing entrant is Falcon Finance, a universal collateral protocol powering on-chain liquidity and stablecoin issuance.

In July 2025, Falcon secured a $10 million strategic investment from World Liberty Financial, shortly after its USDF stablecoin surpassed $1 billion in market cap — positioning USDF as one of the most prominent new decentralized stablecoins to watch.

So, the market arsenal includes: the American leading trio (USDT, USDC, DAI), less popular options (TUSD), hybrid newcomers (FRAX), fresh projects like FDUSD and USDD, the first GENIUS-compliant stablecoin by Anchorage and Ethena — and now USDF, a rising decentralized asset from Falcon Finance, which recently surpassed $1B in market cap. Each has its strengths (liquidity, transparency, decentralization) and its own pitfalls (centralized freeze risks, algorithmic vulnerabilities, etc.).

Stablecoin Risks

Counterparty risk

Most popular stablecoins (USDT, USDC, etc.) are centralized: they are managed by companies or banks. The issuer may face financial issues, be suspected of fraud, or come under increasing government pressure. In all these scenarios, the reserves may be at risk. Additionally, if the issuer decides to freeze user wallets (due to sanctions or by mistake), holders may lose access to their funds. Clearly, trust in the issuer is crucial: the security of your digital assets depends on the reliability of the company.

Regulatory risk

Authorities around the world are paying increasing attention to stablecoins. Some equate them to securities or electronic money, introduce licensing requirements, or even prohibit their issuance. For example, in the U.S., regulators sanctioned Paxos (issuer of BUSD) for insufficient transparency, leading Paxos to stop issuing new BUSD tokens. In Russia, restrictions on converting fiat rubles into stablecoins have been discussed. Any laws or directives from central banks can destabilize a coin’s price (e.g., if the issuer is under investigation) or complicate the purchasing process.

Notably, on July 19, 2025, President Trump officially signed the crypto 'Genius Act' into law, signaling a new phase of regulatory engagement with digital assets and potentially reshaping how stablecoins are treated under U.S. law.

The “Genius Act” sets new standards for stablecoin oversight: large transactions must comply with KYC/AML, U.S. Treasury authorities can freeze flagged flows, and tiered regulation now applies based on issuance size. All issuers must publish monthly reserve disclosures and be fully backed by cash or treasuries.

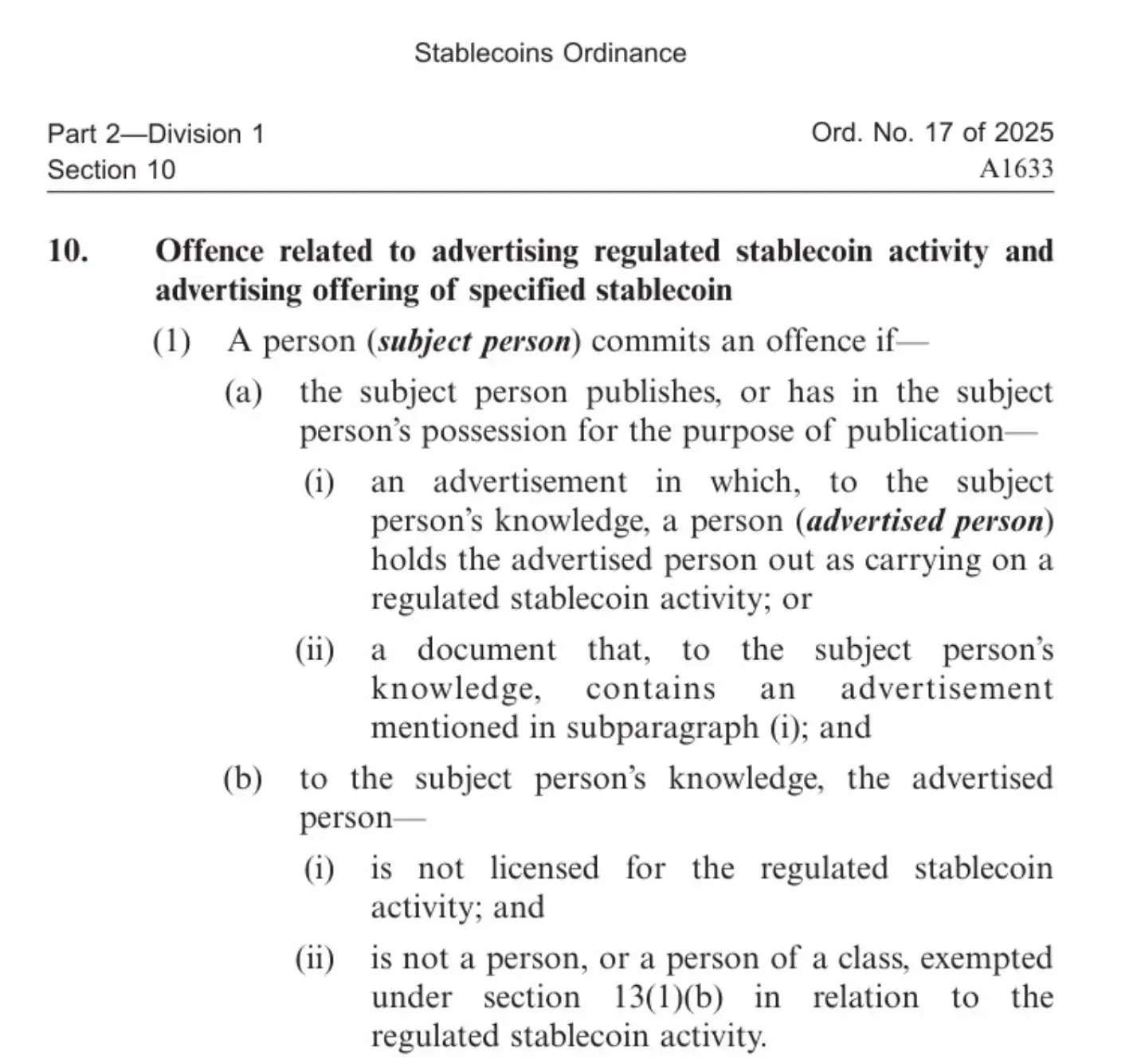

Meanwhile, in Hong Kong, a new law effective August 1, 2025 bans the offering and promotion of unlicensed stablecoins to retail investors — with penalties of up to HK$50,000 (~$6,300) and six months’ imprisonment for violations.

Technical risk

Algorithmic or smart contract-based stablecoins are vulnerable to code errors, oracle manipulation, and technical failures. Crypto-backed stablecoins (like DAI from MakerDAO) can be affected by platform attacks or liquidation mechanism malfunctions. Simple user mistakes (wrong address, incorrect network) can also lead to financial loss. There have been cases where stablecoins had smart contract vulnerabilities that allowed attackers to “mint” new coins to their own wallets.

Liquidity risk

If stablecoin holders suddenly begin panic-selling or the issuer sharply reduces reserves, the peg can quickly break. A liquidity shortage (e.g., a significant supply-demand imbalance) may temporarily drive the price up or down. Additionally, issues in the “external world” — such as a sudden strengthening or weakening of the U.S. dollar — can drastically impact demand for a “digital dollar.”

Depeg risk

This is the most visible threat: when a stablecoin loses its 1:1 peg to USD. Minor deviations from $1 are expected, but significant divergence means the stablecoin is no longer fulfilling its core function. By definition, a depeg occurs when the token’s price significantly diverges from its fixed target (e.g., $1).

For example, in summer 2022, TerraUSD (UST) abruptly lost its dollar peg and crashed by 97% within days. The algorithmic mechanism couldn’t withstand the sudden outflows — UST depegged from the dollar. A similar (though smaller-scale) event affected USDC in spring 2023 due to the collapse of Silicon Valley Bank — the coin's price fell nearly 4% but quickly recovered once payout channels were restored. Ultimately, when reserves or algorithms fall short, “stability” gives way to sharp volatility and market panic.

In conclusion, all stablecoins carry risks — though to varying degrees. According to experts, when choosing a stablecoin, one should consider reserve transparency, audit frequency, regulatory reporting, and the reliability of the team.

Conclusion

Stablecoins have become an integral part of the crypto ecosystem. They allow cryptocurrencies to be “pegged” to familiar units of account and used without major price swings. Should you use them? Definitely yes, if you need to preserve capital within the crypto space without volatility, transfer funds quickly, or interact with DeFi. They are especially useful for traders (to lock in profits), businesses (for international settlements), and those who don’t want to store savings in unstable currencies. Real-world adoption continues to expand:

Visa recently added support for the Avalanche and Stellar blockchains, along with integrated stablecoin settlement using USDG, PYUSD, and EURC — a clear signal that stablecoins are maturing into core components of global payments infrastructure.

Ripple is following a similar path — expanding beyond payments into custody and RLUSD issuance, as part of a broader effort to serve banks and fintechs through regulated infrastructure, as detailed in our analysis of Ripple’s growing role in custody and stablecoins.

However, it's important to remember the risks. Even the most “stable” stablecoin does not guarantee 100% safety: there is always the possibility of freezes, regulatory reclassification, or technical failures. As experts suggest, such coins should be viewed as a “digital version of the dollar” — a convenient tool, but not a cure-all. They are a good alternative to fiat, but not a place to store all your funds.