Crypto

What Is Collector Crypt (CARDS)?

Tokenized Pokémon card trading exploded in 2025, with platforms like Collector Crypt and Courtyard driving $124.5M in August alone. Here’s how $CARDS fits into the picture.

Quick Overview

- Collector Crypt is a Solana-based platform for tokenized Pokémon TCG trading.

- It processed $150M YTD trading volume and generated $75M revenue in 2025.

- The $CARDS token launched Aug 29, 2025, hitting a $450M FDV within a week.

- Revenue comes from a Gacha machine system, driving ~$5.7M weekly user spending.

- Risks include high volatility, low circulating supply, and regulatory uncertainty.

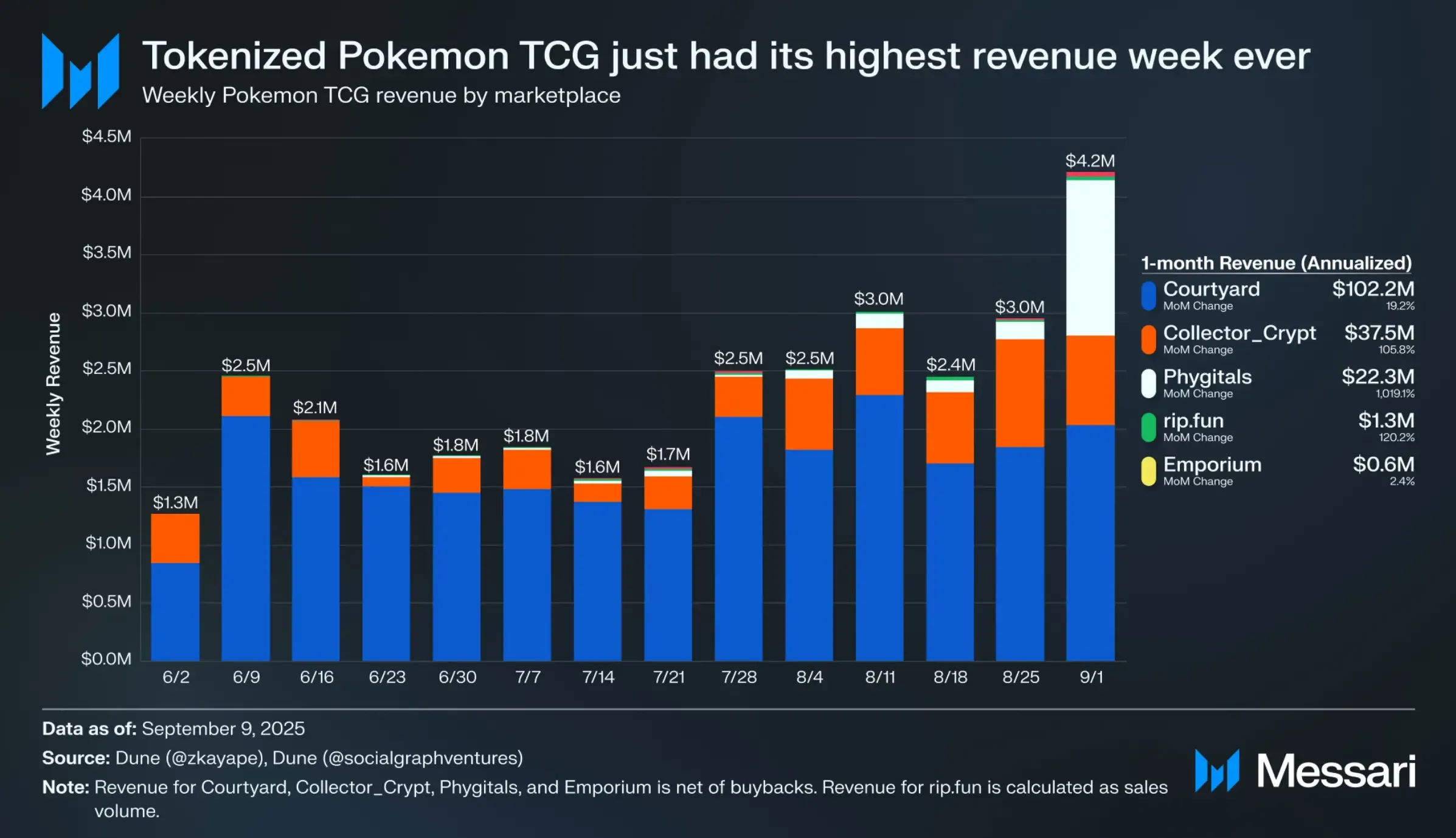

Sector Revenue Overview

The tokenized Pokémon TCG market isn’t just trending — it’s exploding. In August 2025, four platforms together processed $124.5 million in trading volume. That’s a 5.5× jump since January, evidence of blockchain collectibles crossing into mainstream adoption.

Courtyard remains the heavyweight with $78.4M in August sales, up 49% MoM. Collector Crypt isn’t far behind, clocking $44M on a blistering 124% MoM surge. On the smaller end, Phygitals grew 245% to hit $2M, while Ripdotfun — an experimental Base-chain entrant — still handles thinner flows.

Fresh data confirms the surge. According to Messari and Dune, the week of Sept 1, 2025 marked the highest revenue week ever for tokenized Pokémon TCG marketplaces, with $4.2M in aggregate weekly revenue. Courtyard’s run-rate now exceeds $102M annualized, while Collector Crypt is tracking $37.5M and Phygitals hit $22.3M. Even Ripdotfun, still in closed beta, grew to $1.3M annualized.

Zooming out, the global TCG market is valued at $7.8B in 2025 and forecast to reach $11.8B by 2030 (7.9% CAGR). Tokenization adds rocket fuel, offering instant liquidity, global reach, and fewer friction points compared to legacy trading models.

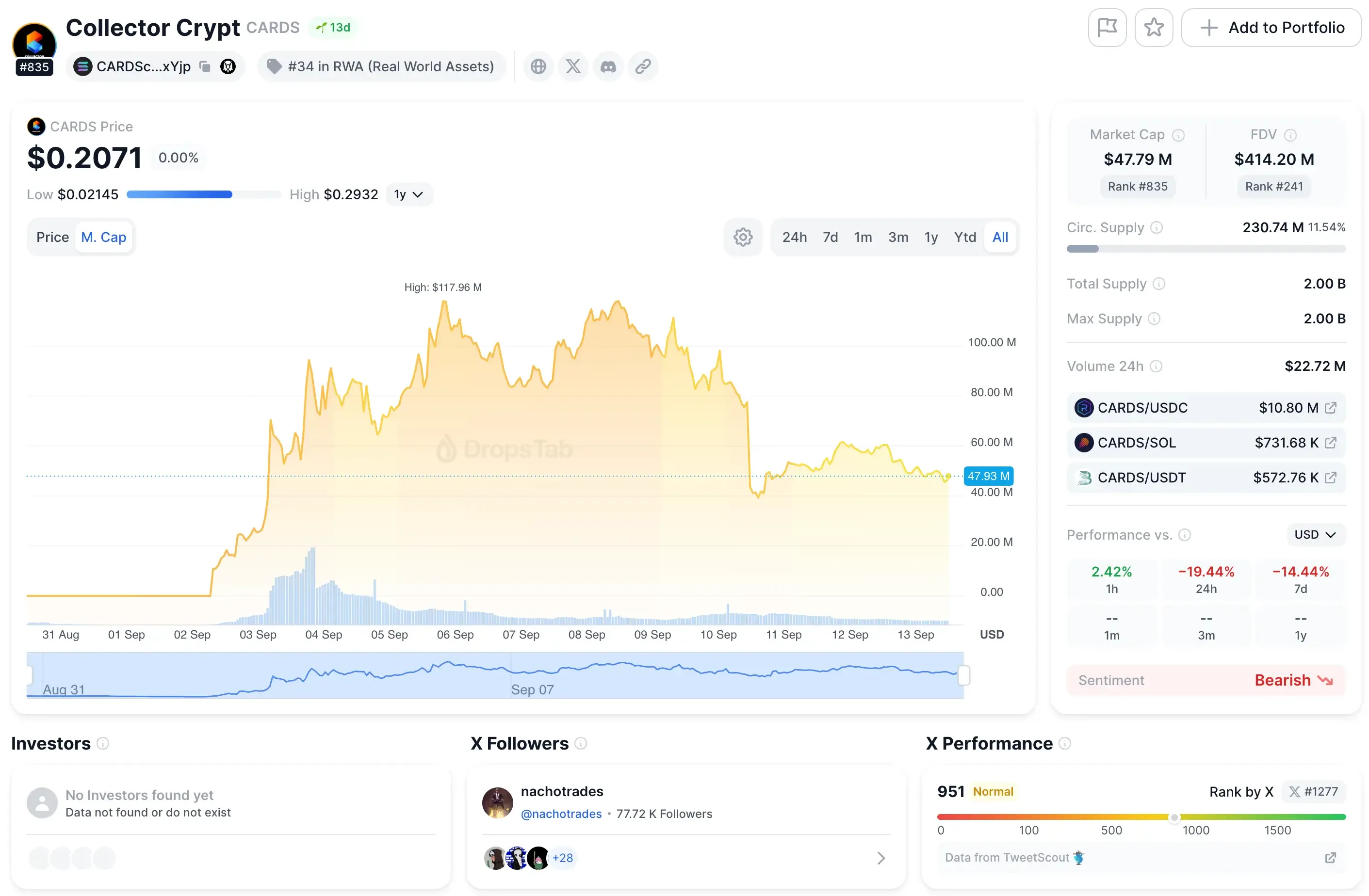

Collector Crypt $CARDS Performance

Collector Crypt has quickly become the flagship of Solana’s tokenized Pokémon TCG scene. In just months, the platform has booked $75M in total revenue and averaged 69% monthly net revenue growth. Trading activity has already crossed $150M YTD, giving Collector Crypt market-leader status despite its 2025 launch.

The token side adds another layer of momentum. $CARDS debuted on Aug 29, 2025, and within a week ripped nearly 10× higher, hitting a $450M FDV.

Behind those numbers sits the Gacha machine model — a high-frequency revenue engine. Players spent an average of $5.7M per week over the past five weeks, driving $666K in weekly revenue, much of which funnels into token buybacks. At this clip, Collector Crypt projects $38M in annualized revenue.

Market analysts are starting to highlight the platform’s financial efficiency. One estimate pegs Collector Crypt at $360M annualized revenue against a $95M market cap, or just 0.26× revenue multiple, despite 100% monthly growth and positive net profit. Compared with eBay’s 15% fees, Collector Crypt charges 4%, while its users spend an average $18.6K vs. $499 at competitors — underscoring why some investors see $CARDS as undervalued.

Competitor Analysis

Courtyard still wears the crown. Its $54.21M in total gross revenue reflects a wild climb — from just $50K in Jan 2024 to $50M by July 2025, a 100× leap in 18 months. Backed by a $30M Series A led by Forerunner Ventures, Courtyard leans on a mystery pack model with 90% buyback guarantees and fee-free secondary trades, positioning itself closer to institutional-grade infrastructure.

Phygitals is smaller but moving fast. With $2.11M in gross revenue and 245% MoM growth, it’s carving momentum across multiple chains.

Ripdotfun, built on Base, is still micro-scale at $108K gross revenue. But its hook is novel: video-verified pack openings and 1:1 redemption for physical cards, a twist designed to win collector trust.

The strategies diverge:

- Collector Crypt = high-velocity Gacha mechanics + Solana speed.

- Courtyard = institutional-grade vault storage + guarantees.

- Phygitals = multi-chain reach.

- Ripdotfun = niche authenticity UX.

Growth Drivers in Tokenized Pokémon TCG Market

The expansion isn’t random — several forces are pushing tokenized Pokémon cards into the spotlight.

First, the supply side. The Pokémon Company printed 9.7B cards in FY2024, nearly 3× the volume of two years prior. That flood of cardboard feeds tokenization platforms with the raw inventory they need for secondary markets.

Second, demographics. Millennials and Gen Z are far more comfortable blending collectibles with crypto infrastructure, turning nostalgia into a digital-native asset class. At the same time, the global RWA tokenization market hit $30B in 2025, compounding at ~8% weekly as institutions chase new yield opportunities.

Third, infrastructure. Chains like Solana and Polygon make trading instant and nearly free — a stark contrast to the shipping delays and trust issues of physical card deals. Collector Crypt’s own data shows 27% average weekly trading volume growth since January, suggesting the activity isn’t just hype but sticky engagement.

Solana’s infrastructure has also powered other viral experiments such as ORE — a project that evolved from fair-launch mining into a deflationary, revenue-driven gambling protocol. You can explore its mechanics and explosive growth in this research on Ore Mining in Solana.

Finally, authentication. Blockchain ownership stamps out counterfeit risk, while PSA and CGC grading integration ensures quality before tokenization. Together, they solve the credibility gap that has haunted physical card markets for decades.

Risks and Sustainability

The numbers look flashy, but cracks are visible beneath the surface. Volatility is brutal — $CARDS shed 26.6% from its ATH within days. With only 20% of tokens circulating, thin float magnifies swings and liquidity stress.

Traders echo the mixed picture. Some view $CARDS as one of the few bets the market broadly agrees on, noting potential upside still on the table. Yet others caution that broader weakness makes it difficult to gauge conviction, even compared with other speculative platforms like Pump or Zora.

Revenue dependence is another issue. Collector Crypt leans almost entirely on Gacha mechanics, not diversified fee streams. If demand cools, income collapses. Inventory pressure compounds this: management is already struggling to source enough graded packs to keep the machine spinning.

Then comes regulation. Tokenized collectibles still sit in a gray zone. Securities classification, cross-border compliance, and consumer protection rules could easily reshape business models. At the same time, bigger incumbents — eBay or major TCG publishers — could enter the blockchain lane and crowd out crypto-native upstarts.

Even the buyback engine, marketed as a safety net, has fragility. Unlike protocols with steady fee income, Collector Crypt’s commitments depend on continuous Gacha demand. If users slow down, liquidity support vanishes, triggering potential reflexive sell pressure.

In crypto culture, traders often shorthand such scenarios as NGMI — “Not Gonna Make It,” a slang term for projects seen as unlikely to survive. We broke down the full meaning of NGMI in this research.

Conclusions for Traders and Investors

Collector Crypt is the pure upside play. With $38M projected annual revenue and deep Solana ecosystem hooks, it’s the sector’s highest-risk, highest-reward bet. The catch: thin float and heavy volatility demand disciplined sizing.

The numbers prove it — $124.5M in monthly volumes validate tokenization beyond bonds or real estate. Authenticated collectibles are pulling in real capital, not just hype.

Watch the pulse. Weekly Gacha revenue and inventory levels are the best forward indicators of platform health. Buyback consistency and trade volume stability serve as early warning signs for stress.

The tokenized Pokémon TCG market is where nostalgia meets crypto infra. The opportunity is real, but so are the risks — sustainability hinges on whether platforms can balance explosive growth with structural durability.