What happened

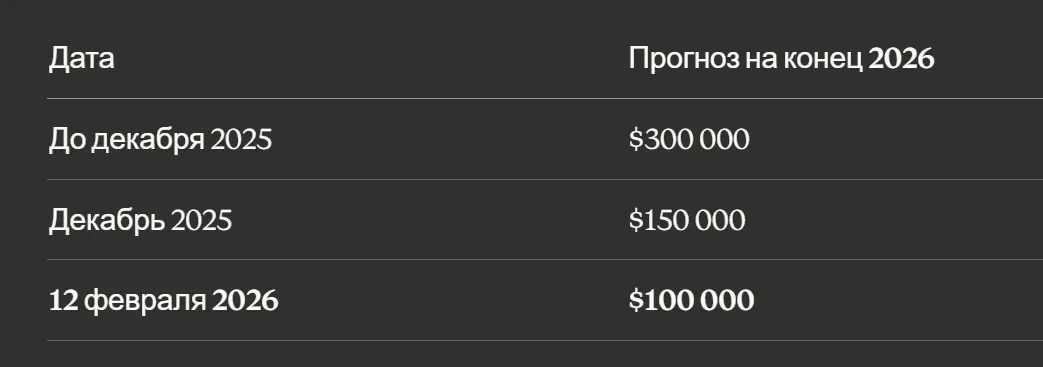

Standard Chartered lowered its Bitcoin target price for the end of 2026 for the second time in three months:

How forecasts have changed

Bank analyst Jeff Kendrick stated bluntly: "We expect further capitulation in the coming months. BTC could go to $50,000 or slightly lower... These will be levels to buy."

Reasons for the downward revision

Outflow from ETFs — Bitcoin ETF holdings have declined by approximately 100,000 BTC from their October 2025 peaks. The total outflow from spot BTC ETFs in the US is estimated at ~$8 billion.

Deteriorating macro environment — weak US economic dynamics and expectations that the Fed will not start cutting rates until the leadership change in June. Bitcoin lost ~47% from its ATH, which coincided with a sell-off in the tech sector and a general risk-off in the markets.

Investor capitulation — retail traders are turning to alternative instruments: leveraged ETFs on AI companies, zero-day options, and betting markets.

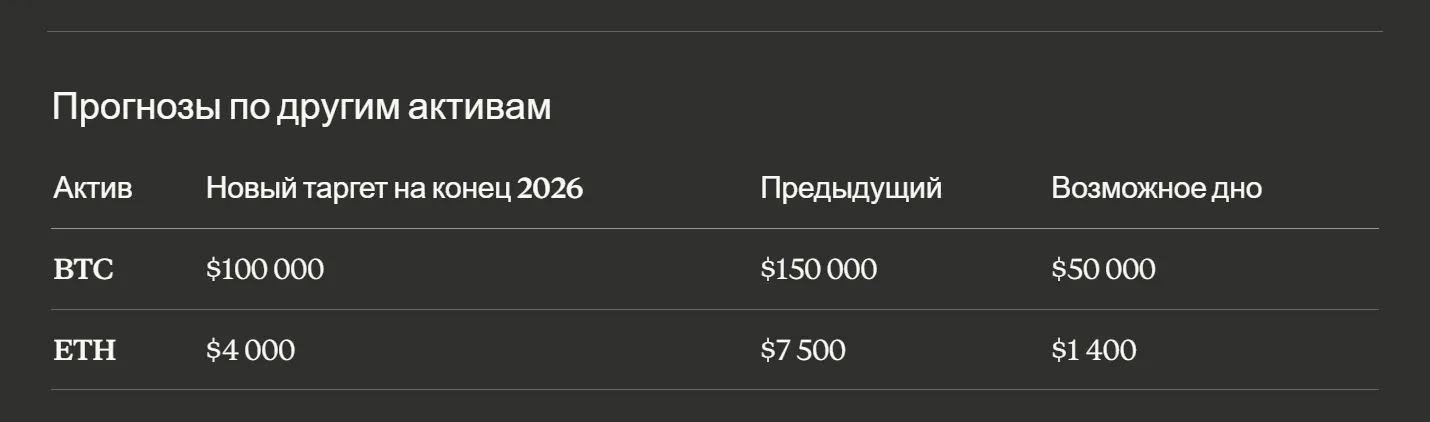

Forecasts for other assets

Forecasts for BTC and ETH

Long-term outlook — unchanged

Despite short-term pessimism, Standard Chartered maintains its target of $500,000 by 2030. The bank believes that the crypto market has matured: the current correction is proceeding in an "orderly" manner, without the collapse of major platforms, as was the case in 2022.

Kendrick emphasizes: "After reaching the bottom, we expect crypto assets to recover in the second half of 2026."