Alpha

Polymarket: How to Actually Make Money Trading It

Polymarket has exploded in volume, and traders are earning real money through information edges, arbitrage, market making, or the potential token airdrop. Here’s the fast, practical breakdown of how people actually profit.

Quick Overview

- Polymarket runs on Polygon and settles everything in USDC.E — cheap, fast, and liquid in major markets.

- Money comes from information asymmetry, simple arbitrage, and market making.

- Market making is the most reliable strategy, often earning.

- POLY airdrop farming adds extra upside through recycled trading volume.

- Manage risk: avoid thin markets, check depth, and size positions carefully.

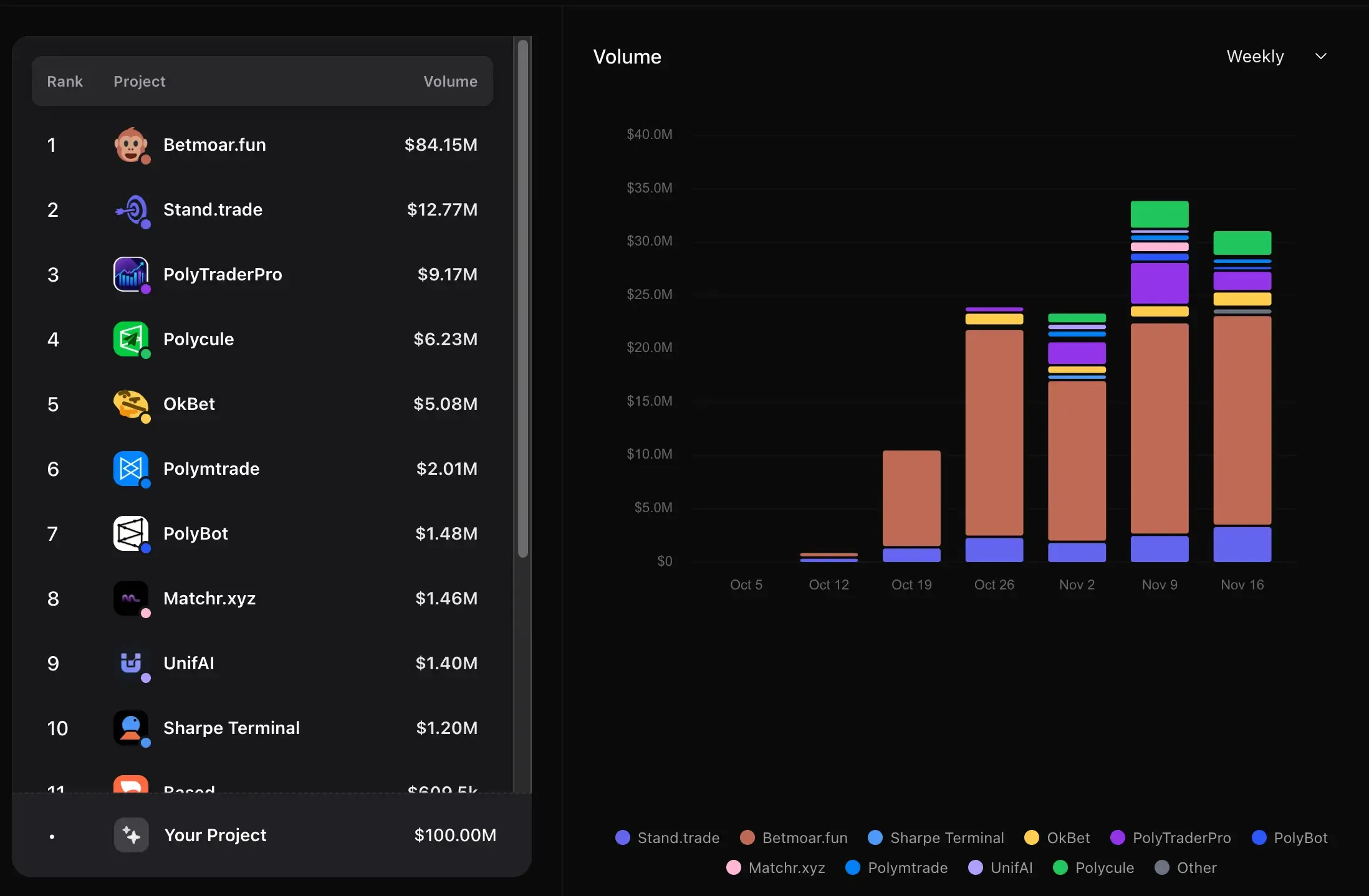

Market Snapshot

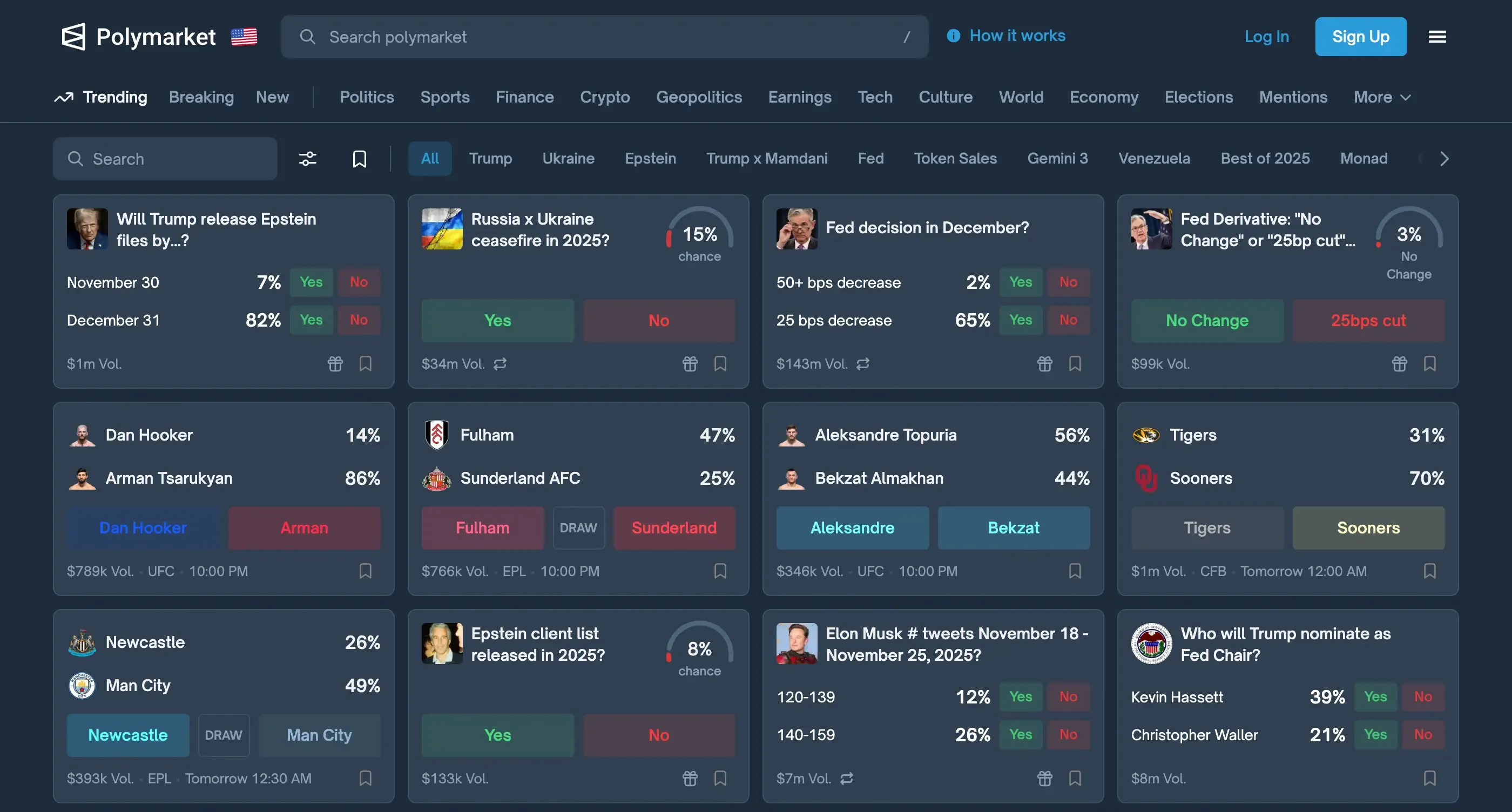

Prediction markets have exploded above $3B/week, with Polymarket consistently holding a top-3 position. Polymarket is a blockchain prediction market built on Polygon, settling every trade in USDC.E. It’s fast, cheap, and smooth enough that most traders barely notice the chain — you just place trades, and they fire.

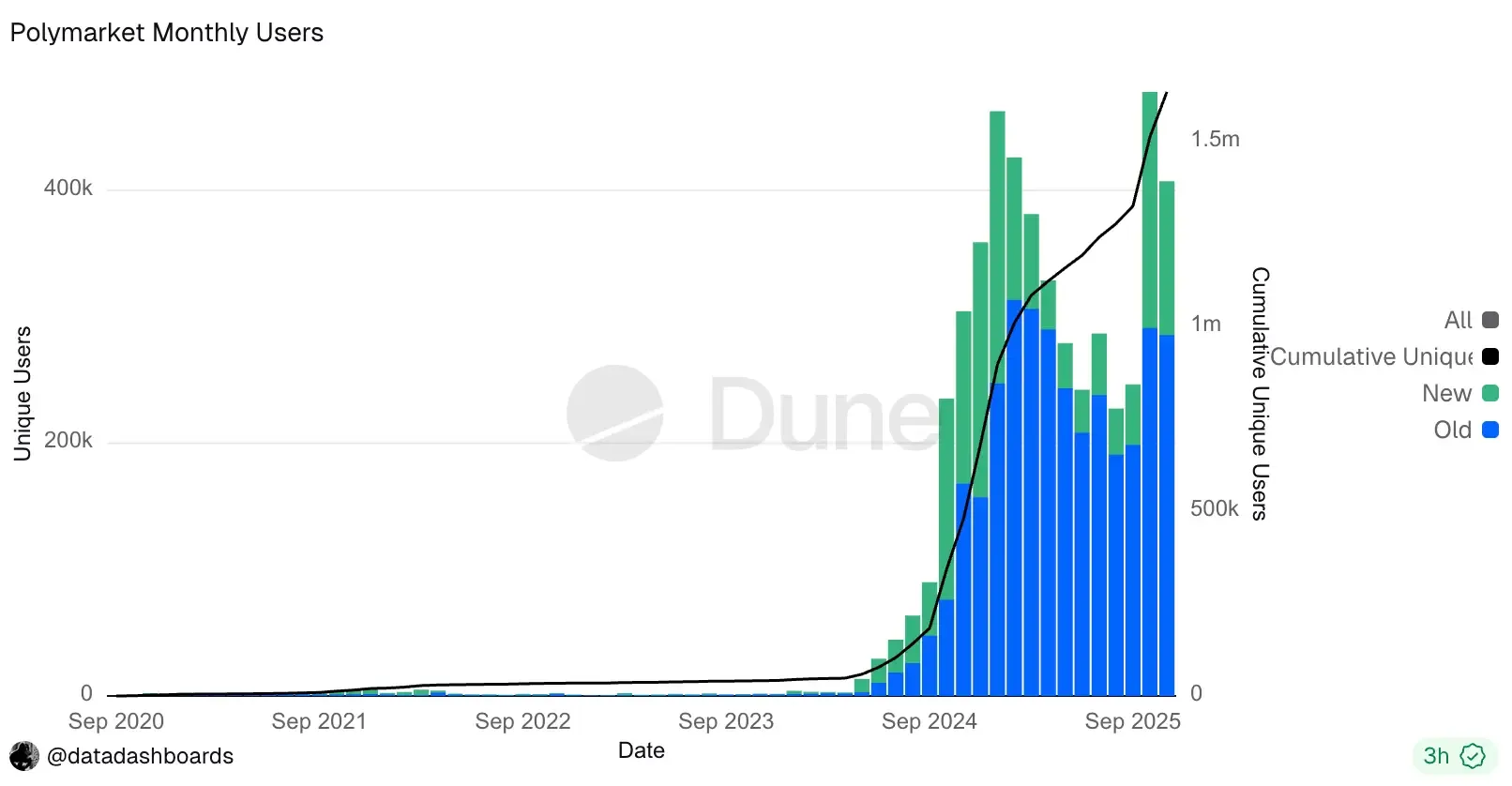

The scale is real: monthly volume now hovers around $3–3.5B, with tens of thousands of daily traders and nearly half a million active users in peak months.

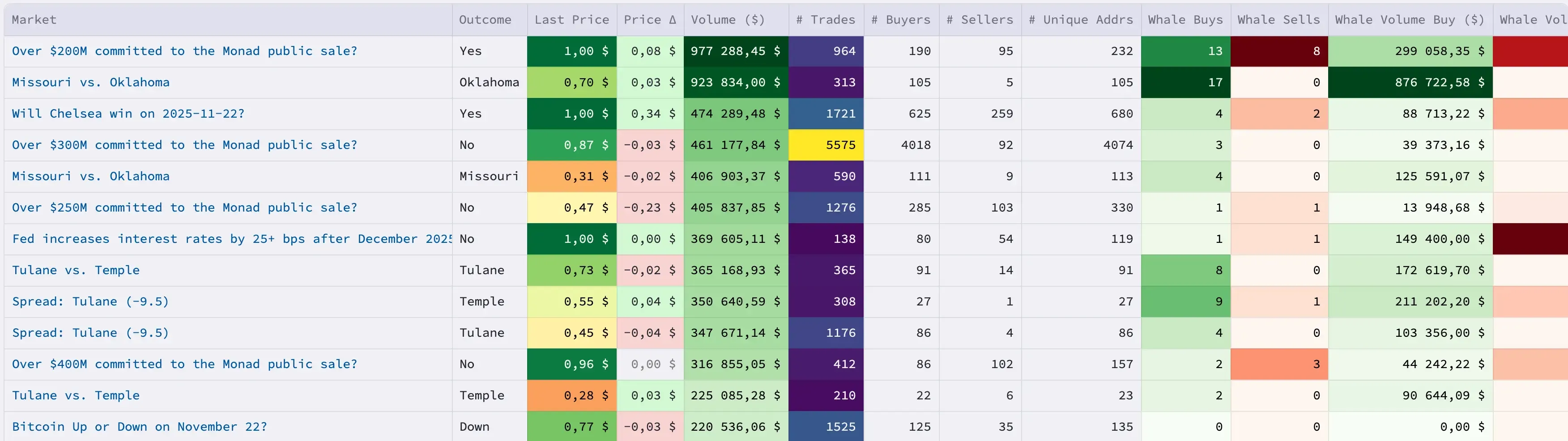

Liquidity is deep in the big markets (politics, sports, macro events) but drops off quickly in smaller ones, where spreads widen and a single whale can swing prices.

And the user base isn’t just large, it sticks — as @Adam_Tehc pointed out in a recent post, almost 394,000 wallets traded during the 2024 election and roughly 26% were still active a year later, compared to just 7% on major DEXs. It’s rare retention for any crypto platform, let alone a prediction market.

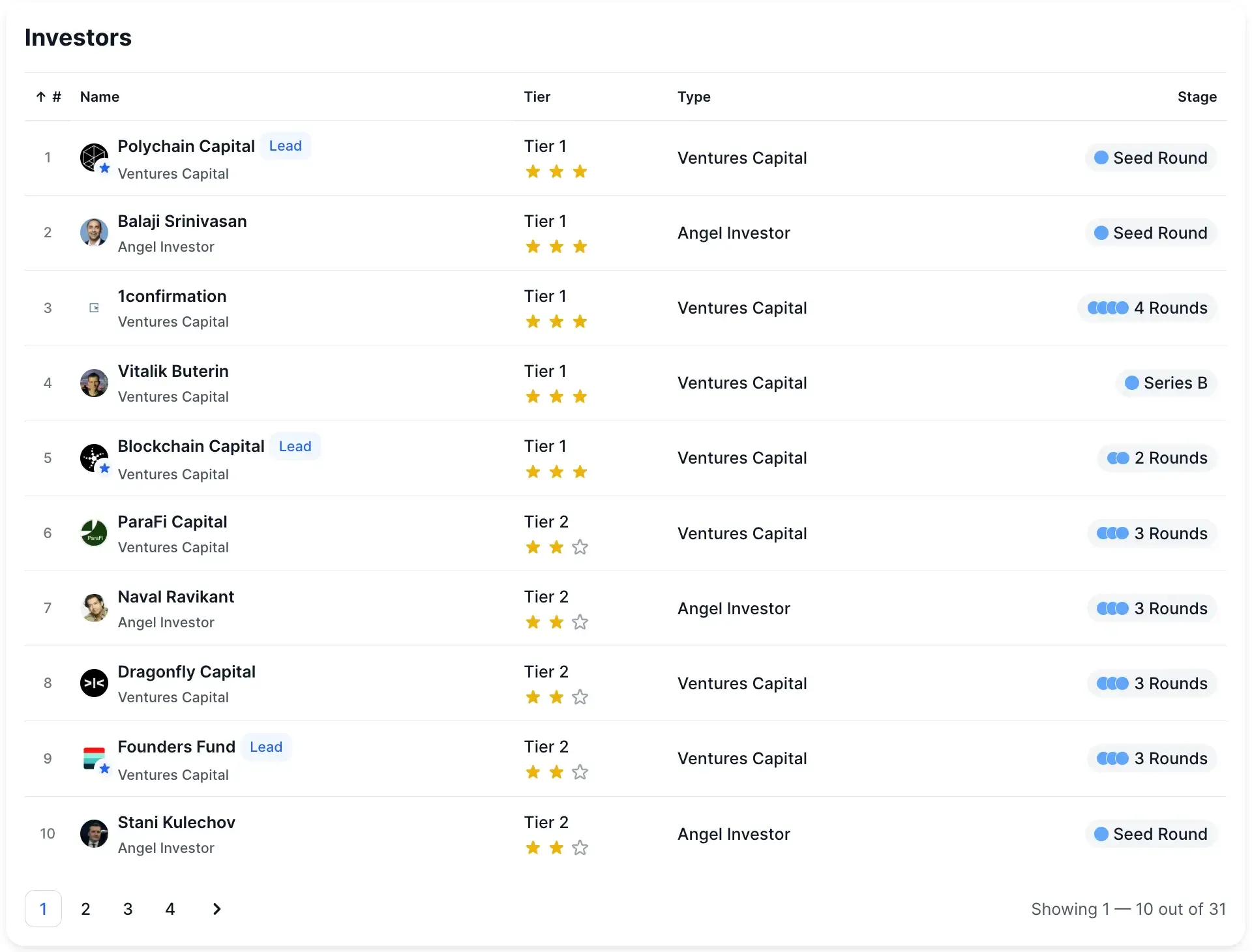

Polymarket’s growth is also backed by serious capital. The platform is funded by top-tier investors including Polychain, Balaji Srinivasan, 1confirmation, Vitalik Buterin, ParaFi, Naval Ravikant, Dragonfly, and Founders Fund — the kind of lineup usually reserved for major exchanges rather than prediction markets.

Bloomberg recently reported that Polymarket is now preparing to raise its next round at a $12B valuation, a sign that institutional money views it as one of the most important emerging trading venues.

How People Actually Make Money

Polymarket looks efficient from a distance, but the surface cracks fast once you trade regularly. Edges come from two places: people knowing things at different times, and the order book occasionally mispricing outcomes.

Right now, even top traders openly claim that “Polymarket is the easiest place in crypto to make six figures,” as Tulip King put it — and the reason is simple: once you understand where the edge comes from, the platform is full of small, repeatable mispricings.

Information Asymmetry

Some traders simply move earlier than the crowd — you see it in their on-chain behavior. Tools like Hashdive flag wallets with unusually high win rates, and when they size into a market, prices often shift minutes later. Many traders just track these wallets and follow their entries. It’s crude, but it works.

Simple Arbitrage

Polymarket’s structure creates mechanical, zero-opinion trades.

If YES + NO > $1, you mint a pair for $1 and sell both legs for instant profit.

If YES + NO < $1, you buy both sides and redeem for $1.

Bots catch most of this, but mispricings still appear during news spikes or in multi-outcome markets where individual options drift. A few seconds of imbalance is often enough to print a small, guaranteed return — and those add up.

Market Making — The Most Scalable Way to Earn

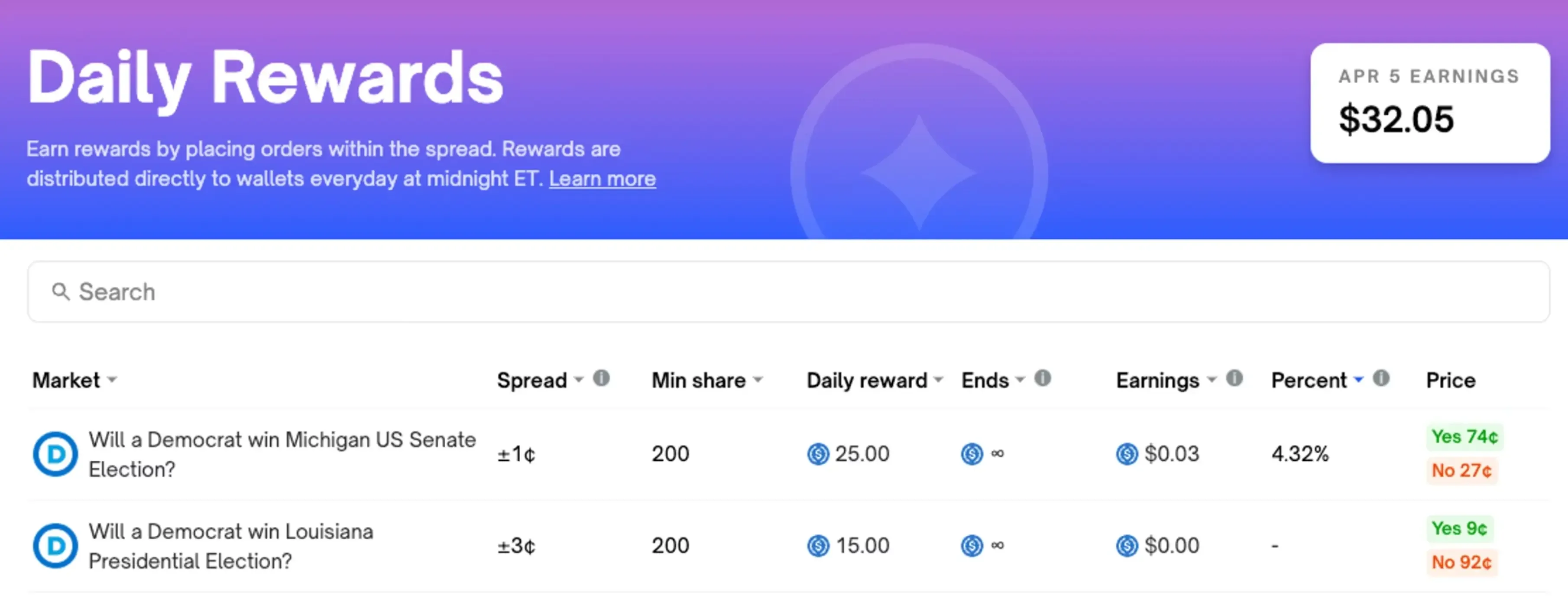

Market making is the most reliable way to earn on Polymarket. Instead of predicting outcomes, you post tight YES/NO limit orders, capture small spreads, and collect Liquidity Rewards for keeping markets active.

How Liquidity Rewards work:

- You earn money for placing competitive limit orders near the midpoint.

- Larger and tighter orders earn more.

- Rewards pay out daily (~midnight UTC) to your wallet.

- The order book shows whether your orders qualify (blue highlight + reward info).

Because you can quote dozens of markets at once — usually through a bot — earnings scale cleanly. That’s why many active makers report steady $200–$800/day during busy cycles. It’s mechanical, low-emotion, and currently the most repeatable income stream on Polymarket.

Extra Upside from $POLY Token Airdrop

Polymarket’s CMO, Matthew Modabber, has confirmed a POLY token and user airdrop, which basically turns normal trading activity into a second revenue stream. The details aren’t public yet, but if past DeFi airdrops are any guide, rewards will likely lean on trading volume, building tools, and liquidity provision rather than pure luck.

Polymarket uses four badges that almost certainly feed into airdrop weighting:

- Traders (active traders + focused content creators)

- Builders (bots, dashboards, scanners, terminals)

- PolyBaddies (same as Traders, lighter competition)

- Team badge (internal)

If you want a meaningful allocation, there are three practical paths:

- Be a dedicated Polymarket creator. Even small X/Twitter accounts get badges if they consistently post Polymarket content.

- Trade actively. Top 20% by volume or PnL is a strong signal; combining trading + content works even better.

- Build tools. Dashboards, bots, scanners, alerts, AI agents — builders get noticed quickly. Apply here: https://builders.polymarket.com

Volume farming still matters, but badges, contribution, and visible participation now carry just as much weight.

How to Start Trading on Polymarket

Getting going is simple. Connect your wallet, and Polymarket automatically creates a proxy wallet for you on Polygon — this handles gasless trades and keeps everything self-custodial.

Deposit USDC on Polygon, refresh the page, and you’re ready to place your first YES/NO order. That’s the whole setup.

If you’re using MetaMask, their new Rewards Program can stack extra benefits while you trade — swaps, futures activity, and referrals now earn points across seven tiers, including Linea token drops and even fee discounts.

Where to Deploy Capital

Sports: These markets behave the most logically because they’re driven by data — injuries, weather, historical stats. If your model shows a probability that diverges even 5–6% from Polymarket’s price, that gap often sticks long enough to exploit, especially in less widely watched games.

Macro / Economic Releases: BLS jobs data, CPI, and Fed decisions reward traders who simply act early. Accuracy is extremely high when you follow calendars and consensus forecasts. Most of the edge comes from placing positions one to four hours before the release, not after.

Politics: Huge volume but messy signals. People bet on emotion, not math, and prices regularly drift 2–5% above fair value. That bias creates opportunities for disciplined traders who fade overconfidence and wait for the line to snap back when polls or news cycles settle.

Risks to Keep in Mind

Polymarket isn’t risk-free.

Even with the recent credibility boost — Haseeb joked that Google integrating Polymarket odds basically flipped public opinion from “prediction markets are sketchy” to “they’re the clearest source of truth” — the platform still carries meaningful trading risks you have to respect.

U.S. users still face regulatory limits, some portion of the platform’s volume comes from wash trading, and smaller markets can be brutally illiquid — spreads can jump to 5–10% and trap anyone sizing too big. The fix is simple: check market depth, keep positions small, and avoid thin markets unless you know exactly what you’re doing.

Conclusion

Polymarket isn't about guessing right — it’s about running a system before everyone else figures out the same tricks.The real bet isn’t on elections or sports. You’re betting on your ability to stay disciplined while the market is still inefficient.

Right now, that crack in the system is wide enough to make money.