Alpha

Superform Token Sale on Cookie Launchpad

Superform’s $UP sale lands on December 4 with real traction, strong investors, and launchpad demand likely far above supply. Here’s everything that matters — tokenomics, vesting, risks, pools, and realistic allocation expectations.

Quick Overview

- Superform runs $144M TVL with real users, real yield, and strong backers like Polychain and VanEck.

- $UP sale on Cookie Launchpad: $2.915M across five pools; strict KYC and region bans.

- Tokenomics: 1B supply, no new emissions for 3 years; 25% TGE + 3-month vesting.

- Expect heavy oversubscription — 5–10% real allocation even with “guaranteed” tiers.

Superform Project Overview

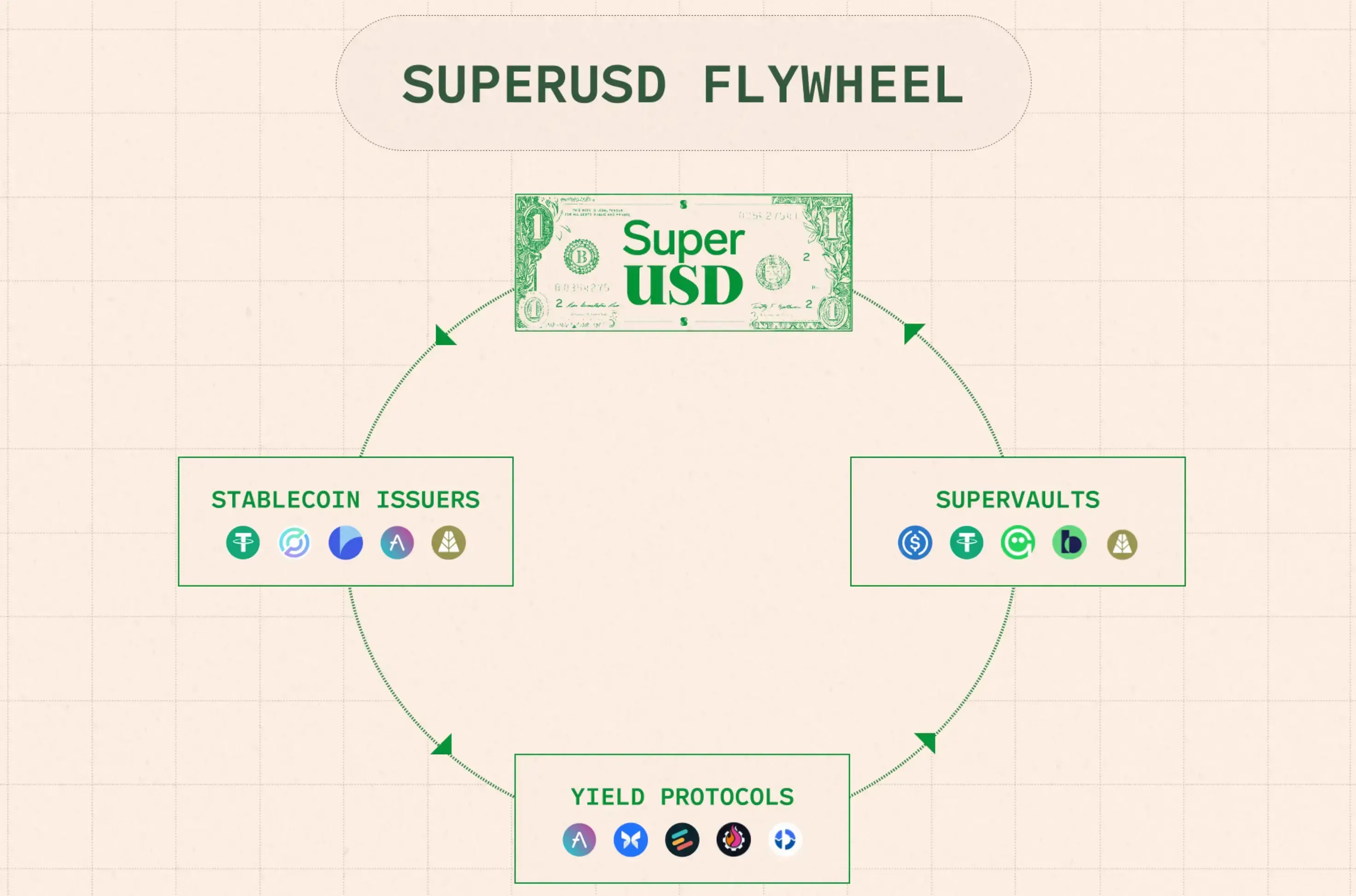

Superform likes to call itself a “user-owned neobank,” which sounds buzzwordy until you poke at the mechanics. It’s a non-custodial, cross-chain yield router that basically hides the messy parts of DeFi yield farming. The founders — Vikram Arun and Blake Richardson from BlockTower Capital, plus Alex Cort who shipped products at Microsoft — have been around real money before. They ran more than $100M in DeFi strategies, and you can feel that institutional muscle in how the system is built.

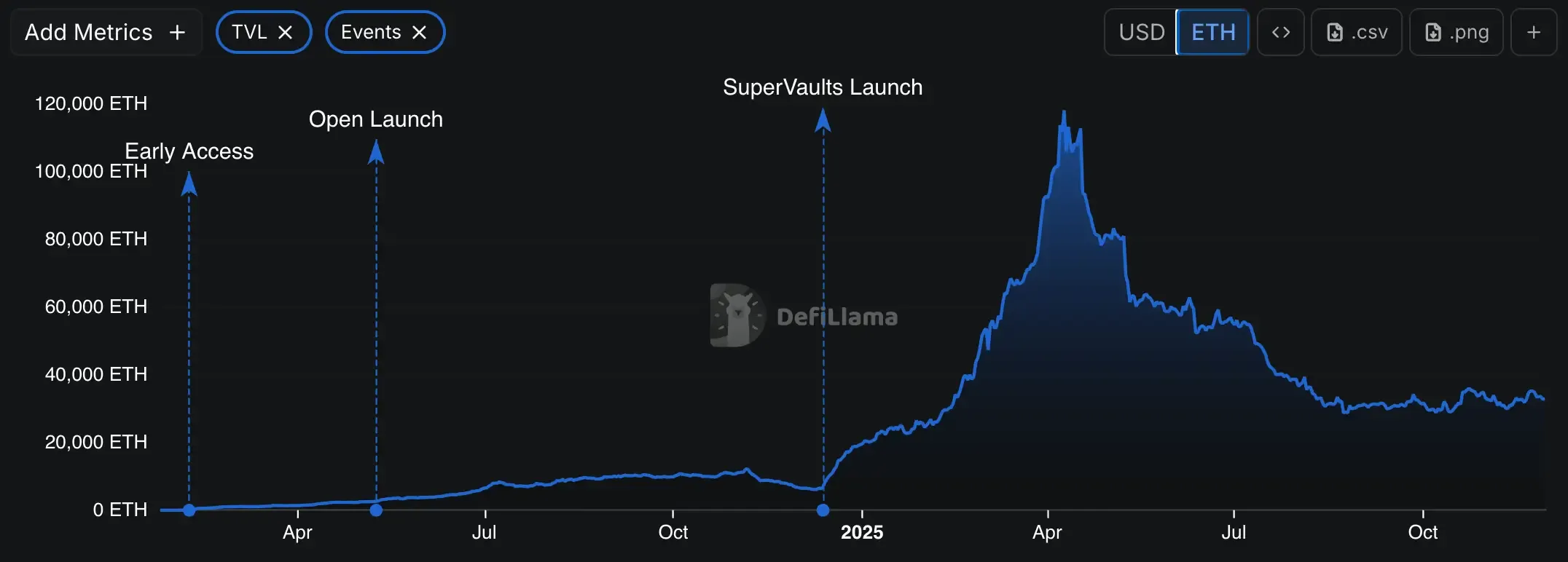

Since launching in Q2 2024, Superform hasn’t exactly been quiet. The dashboard shows roughly $144M TVL, most of it still sitting on Ethereum ($122.77M) with a smaller but growing pocket on Base ($17.67M). More than 150,000 users have touched the app in some way. The workhorse here is SuperVaults — automated vaults that’ve been pumping out a ~9% average APY by shuffling capital across Morpho, Euler, Aave, and even Pendle Principal Tokens. A little complex on the inside, smooth on the outside.

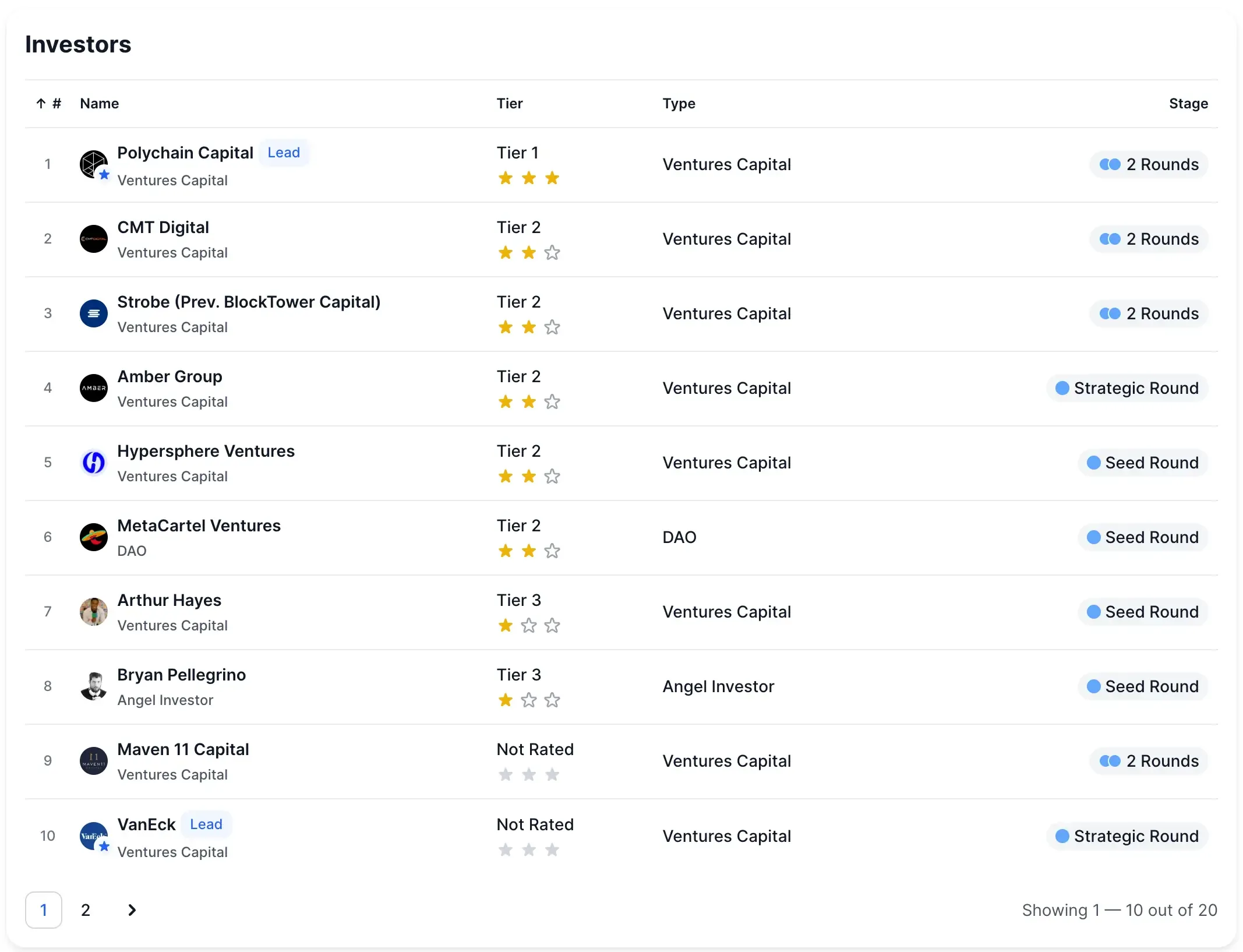

Then there’s the investor list, which reads like someone’s fantasy draft. Across $10.92M raised, you’ve got Polychain Capital leading the seed, VanEck Ventures driving the strategic round, plus Circle Ventures, BlockTower, Maven 11, Amber Group, and a few loud names as angels: Arthur Hayes and Bryan Pellegrino. This combo tends to attract attention — and sometimes unreasonable expectations — but it does tell you one thing: serious players think this thing has legs.

$UP Sale Details

The Cookie Launchpad sale for Superform opens on December 4, 2025, with the important eligibility snapshot already locked for December 1 at 1 PM UTC. If you weren’t positioned by then, you're funneled straight into the public pool — no guaranteed allocation, no exceptions.

Superform is distributing $2.915 million across five distinct groups. You can almost read their priorities from the way the pools are carved up. The Public Pool gets the biggest slice at $1.8M, open to anyone who can pass KYC and isn’t from a restricted region.

Jurisdictions are the usual landmine. Residents of the USA, UK, and China are blocked entirely, along with anyone in OFAC-sanctioned regions such as Russia, Iran, Syria, North Korea, Cuba, and restricted areas of Ukraine.

Participation relies on Legion’s MiCA-compliant KYC, and you must deposit the full USD amount of your intended pledge directly into a smart contract. If the system allocates less than what you requested, the extra comes back — sometimes not instantly, but it does come back.

The Superform Community receives $830,000, reserved for top contributors based on Guild Score. The Top 100 Capital Mindshare Snappers split $170,000, a nod to the Cookie.fun ecosystem. Another $35,000 is set aside for the Top 25 Korean Snappers, a small but intentional regional allocation. Finally, $80,000 is earmarked for COOKIE stakers, but only those hitting eligible tiers.

- If you’re a top capital mindshare snapper, the ceiling is $5,000 for ranks 1–10, dropping to $1,000 for ranks 41–100.

- Superform Contributors can access $3,000 in the 1–100 bracket and $1,000 in the 100–500 bracket.

- Guild Score leaders sit even higher, with $4,000 for the top 10 and $1,000 for ranks 10–100.

- Anyone can request more than their baseline, but the word “guaranteed” dissolves the moment you go above your tier.

Superform (UP) Tokenomics

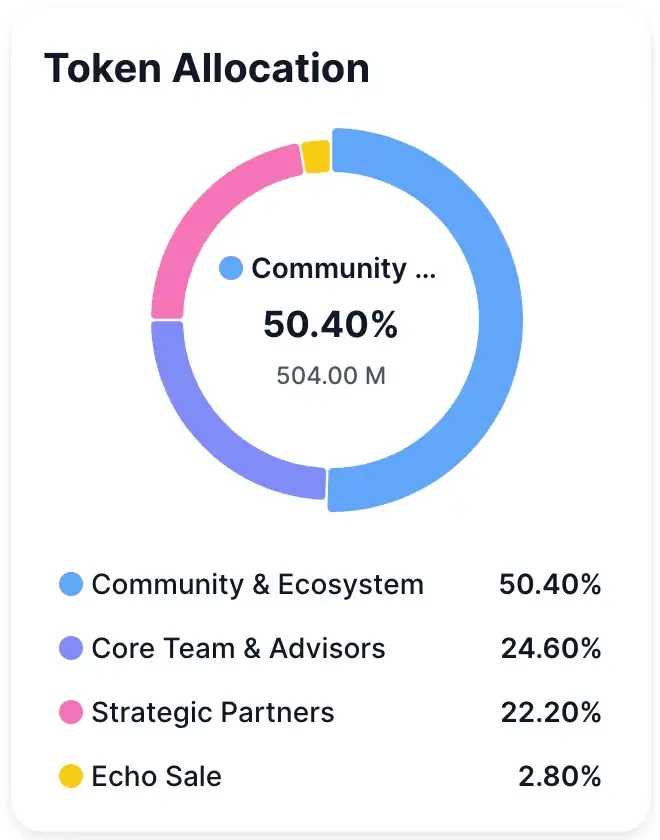

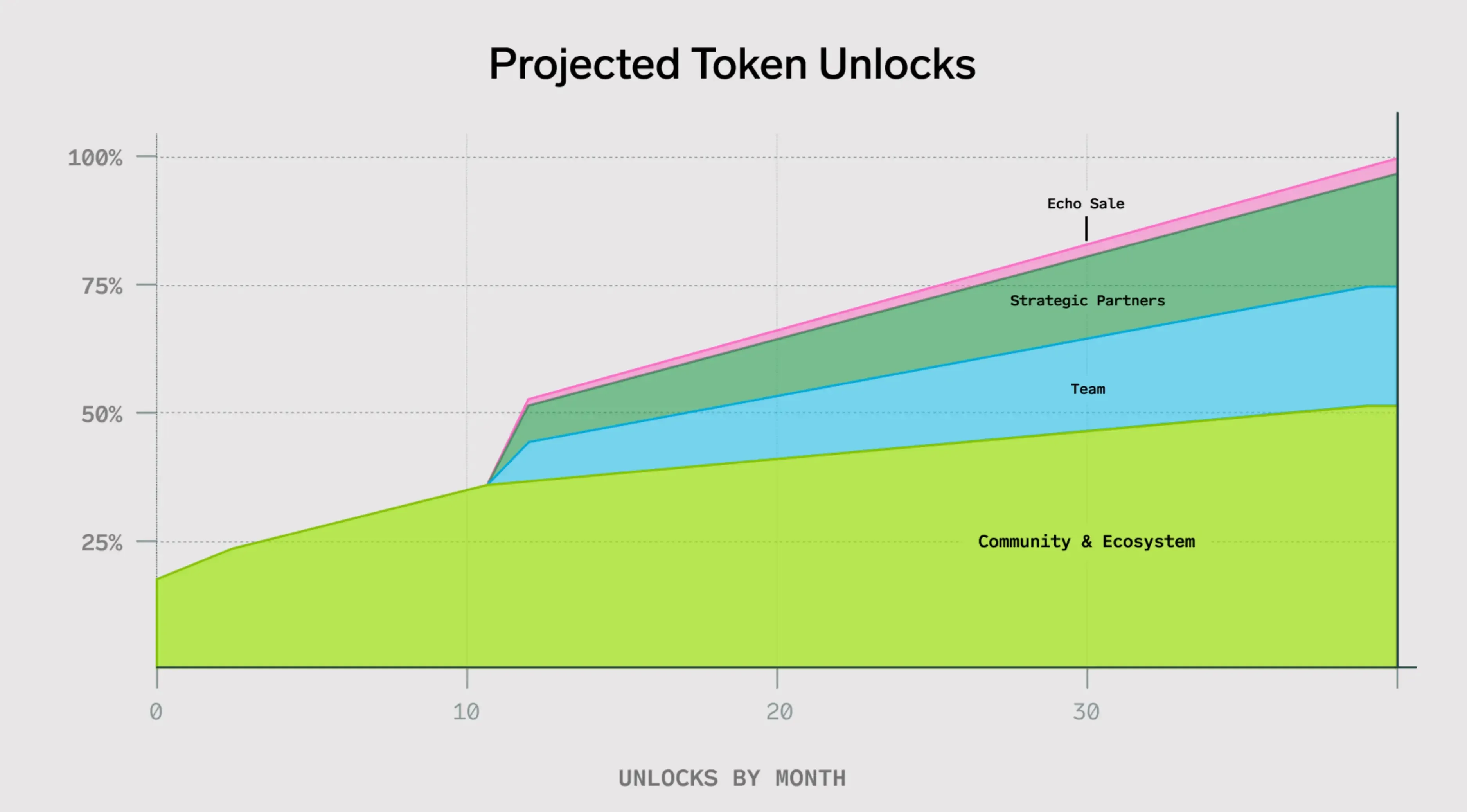

Superform keeps its token distribution fairly clear. The total supply is 1 billion $UP, and it’s divided across four groups. The Community & Ecosystem bucket takes the biggest share at 50.4%, spread across different incentive programs. Team and Advisors hold 24.6%, locked behind a 12-month cliff and then released linearly over 24 months, so three years in total. Strategic Partners — names like VanEck, Polychain, Circle — account for 22.2%. The remaining 2.8% went to the Echo Sale, the small community round from September 2025.

There’s a firm supply rule too: no new emissions for the first three years. After that, inflation can only rise to a maximum of 2% per year, and even that needs explicit approval through sUP governance voting. It’s a neat way of putting the brakes on dilution, unless the community actively chooses otherwise.

For sale participants, the vesting is brutally short compared to most launchpad projects. 25% unlocks at TGE — Superform is aiming for Q1 2026 — and the remaining 75% vests linearly over three months. Faster liquidity access looks great on paper, but it also concentrates sell pressure into a narrow window.

As for utility, $UP acts as the protocol’s coordination tool rather than just a reward token. When you stake UP, you receive sUP, and that’s what gives you voting power over SuperVault settings, SuperAsset weightings, and the broader economic configuration. Over time, Superform plans to add validator bonding with slashing, which means token holders don’t just vote — they take on real economic responsibility for how the network behaves.

Past Launchpad Patterns and Demand Forecast

If you’re trying to guess how chaotic the Superform sale might get, the best reference is VOOI. That sale turned into a stampede: 26x oversubscribed, more than $13M pledged for a $1.25M target, and only 510 out of 3,938 people got any allocation at all — roughly 13%. Cookie actually shut the pool early because demand wouldn’t stop climbing. It was one of those moments where you refresh the page twice and suddenly half the sale is gone.

And it’s not just Cookie showing this pattern — Kraken’s new Launchpad, which also runs on Legion’s infrastructure, is seeing the same early surge. In our research we break down their first sale — Yield Basis (YB) from Curve founder Mikhail Egorov. It’s a useful reference for how aggressively Legion-backed launches are being absorbed.

So what does that mean for $UP? You can map it into four rough oversubscription bands:

- A 10x scenario would imply around $20M in pledges and about 10% of your request being filled.

- A 15x case pushes that to $30M pledged and roughly 6.7% filled.

- The 20x band means close to $40M thrown at the sale with only 5% landing in people’s wallets.

- And if Superform matches VOOI at 26x, you’re looking at $52M pledged and about 3.8% actual allocation.

Now, here’s where it gets interesting. Superform has stronger fundamentals on paper — bigger TVL, deeper investor bench — so the sale could easily drift toward the higher bands. If the oversubscription settles somewhere in the 15–20x pocket, a “$5,000 guaranteed allocation” isn’t really $5,000. It’s something like $250–$333 in real tokens. That’s the uncomfortable math most people forget to run until the distribution page smacks them in the face.

Set expectations early. It saves the headache later.

Conclusion

The product already has real users, real TVL, and real yield, which instantly puts it ahead of the usual launchpad noise. The sale won’t make anyone rich on allocation size — oversubscription will shred most tickets down to 5–10% fills.

Risks exist: a heavy unlock window, jurisdiction bans, and a team/partner chunk that looks big until you remember it’s locked for three years. Still, the audits, the non-custodial architecture, and governance-gated inflation make the setup cleaner than most.