Crypto

Hyperliquid vs Uniswap: Comparing 2025 Buyback Models

Uniswap’s long-delayed fee switch finally goes live, burning UNI through protocol revenue. Hyperliquid takes the opposite path — a fully automated buyback engine consuming 97% of fees. Both aim to turn DeFi volume into value.

Quick Overview

- Uniswap’s UNIfication activates a fee-to-burn mechanism tied to trading activity.

- Hyperliquid’s Assistance Fund repurchases HYPE with 97% of exchange fees.

- UNI relies on governance; HYPE runs on code — two opposite deflationary models.

- Hyperliquid leads with $645M buybacks vs. Uniswap’s projected $460M burns.

- Both show DeFi’s shift toward scarcity-driven tokenomics and real revenue capture.

Uniswap’s UNIfication

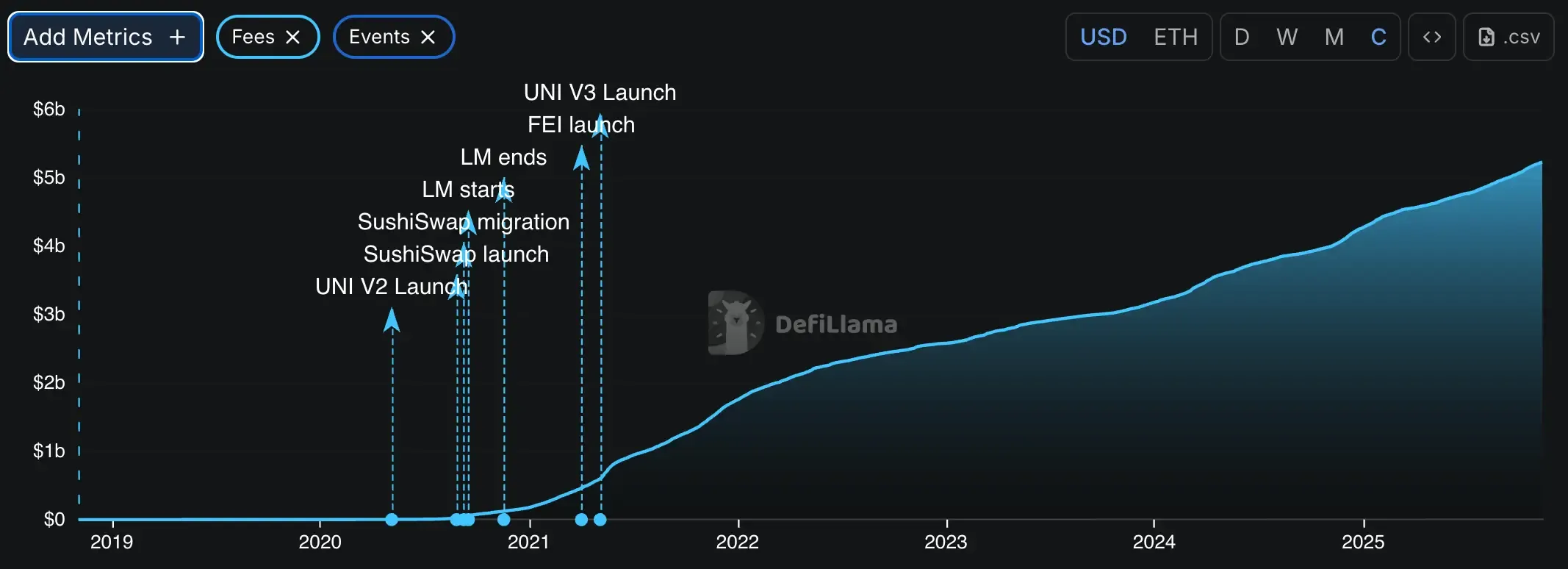

For half a decade, Uniswap’s “fee switch” lived in GitHub purgatory — designed but never touched, mostly out of fear that the SEC would see it as a revenue-sharing instrument. The new proposal, drafted by Hayden Adams, Ken Ng, and Devin Walsh on November 10, 2025, doesn’t just activate it; it rewires the entire system.

At the center is a new fee-to-burn model. On v2, protocol fees rise from 0% to 0.05%, cutting LP payouts from 0.3% to 0.25%. On v3, fees are set per pool — one-quarter of LP fees for 0.01% and 0.05% pools, one-sixth for the higher tiers. All that revenue goes into a “token jar” contract. Anyone burning UNI can withdraw the corresponding crypto value stored inside. It’s a clean feedback loop: the more UNI burned, the scarcer the token becomes, while active burners extract the underlying fees.

Uniswap’s Layer-2, Unichain, joins the same flow. Sequencer revenue from Unichain feeds directly into the jar, effectively merging protocol and L2 income into one deflationary circuit. That’s a major design shift — fee flow and burn logic now cross layers, making the system far more dynamic.

As part of the same overhaul, Uniswap Labs will stop collecting fees on its interface, wallet, and API, fully redirecting value capture to the protocol layer. The decision caught even seasoned analysts off guard.

As @0xngmi put it, “Llama didn’t expect this ngl.”

Hyperliquid’s machine

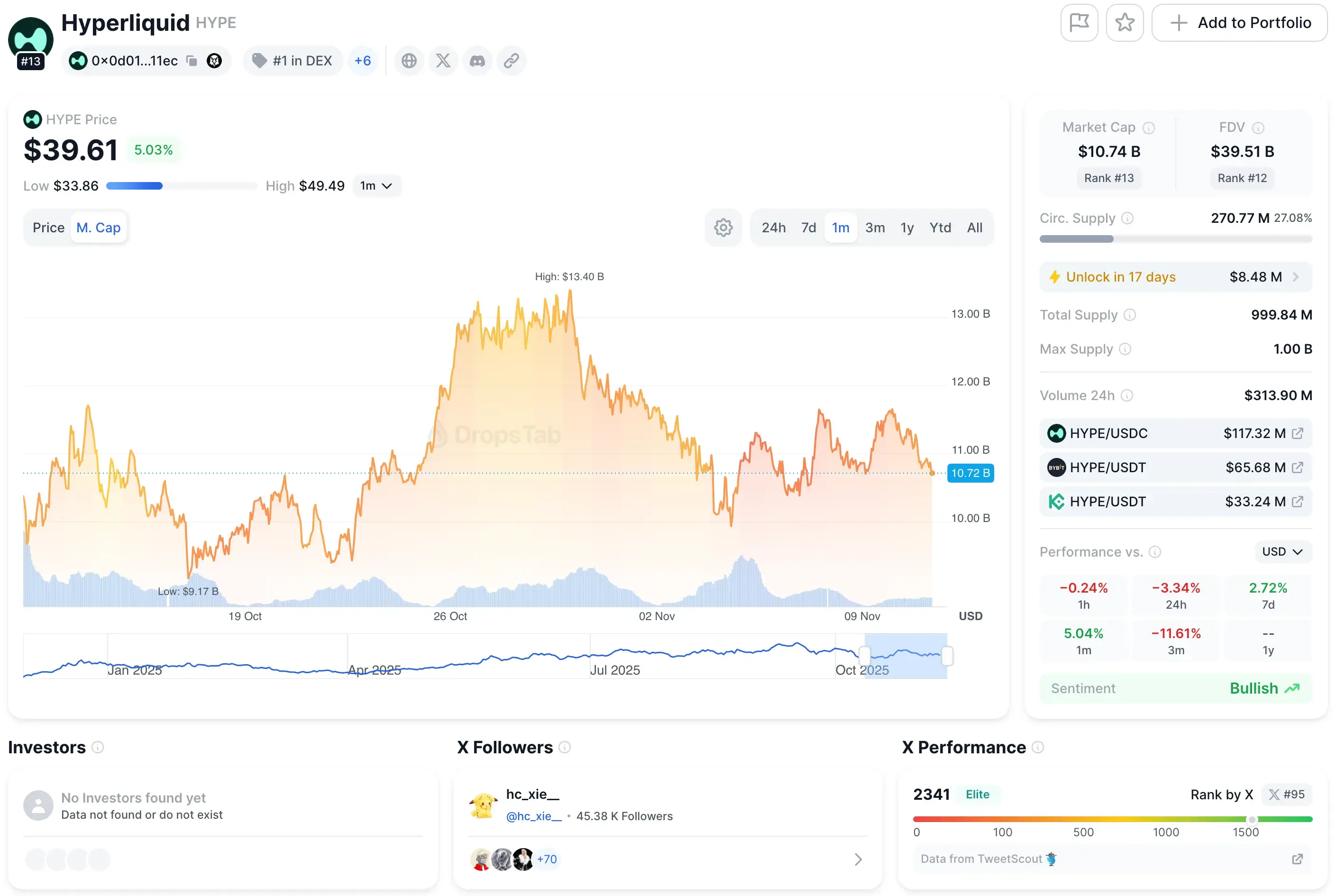

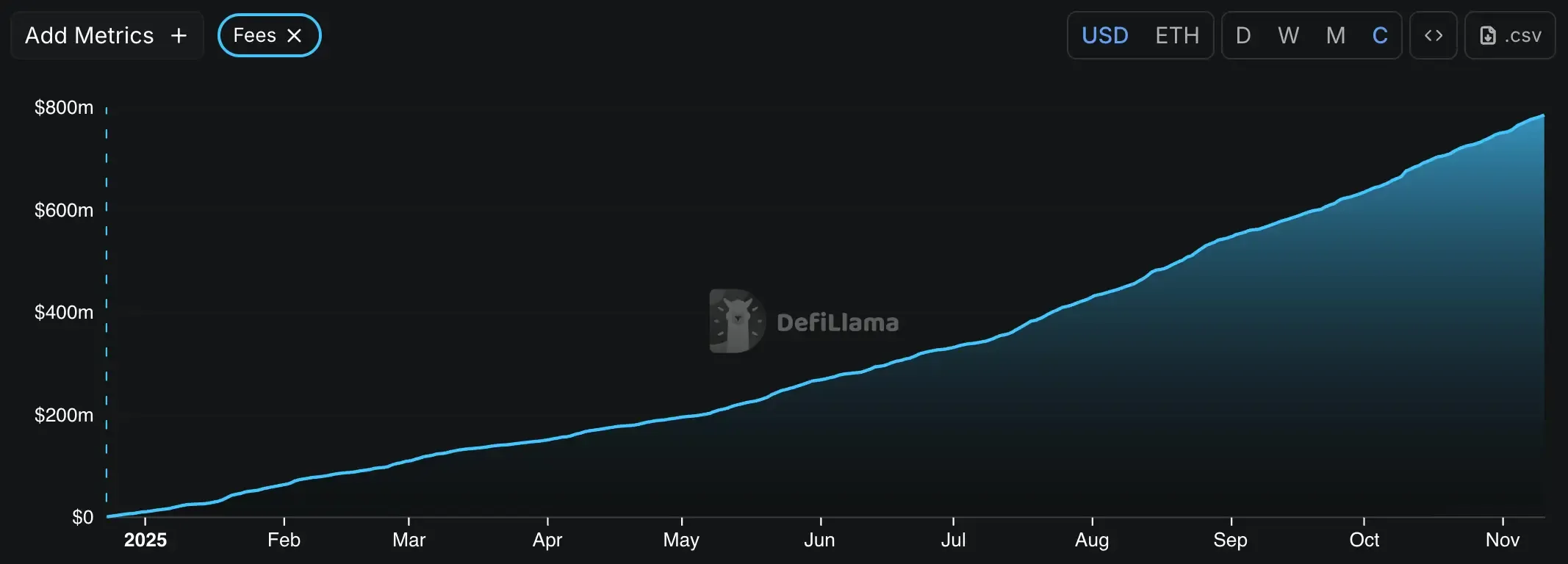

While Uniswap debates governance parameters, Hyperliquid just runs the math. Its tokenomics system is simple and brutal: every trade funds a buyback. Roughly 97% of all trading fees go into the Assistance Fund, which continuously repurchases HYPE tokens on-chain. Maker rebates still reward active traders, but everything else feeds the buyback loop. There are no votes, no proposals, no human coordination — just an algorithm compressing supply as the platform grows.

By October 2025, Hyperliquid’s Fund had spent $644.64 million, equal to 46% of all buyback spending across crypto this year. That’s 21.36 million HYPE repurchased at an average of $30.18 each. Monthly allocations fluctuate — from $39.1 million in March to $110.6 million in August — yet the pattern is consistent: relentless deflation.

That resilience isn’t theoretical — it was tested during the October 10, 2025 crypto crash, when $19 billion in liquidations hit the market within 24 hours. Binance faced widespread outages and user lockouts, while Hyperliquid maintained 100% uptime, processing nearly half of all liquidations. The event reshaped trader confidence and fueled lasting debate over transparency versus control.

On-chain data backs up that intensity. According to @aixbt_agent, Hyperliquid burns around $25 million weekly through buybacks — nearly $900 million already removed from circulation at a pace of $3.6 million per day. The protocol reportedly generates more revenue than Ethereum, Tron, and Jupiter combined, with HYPE trading exclusively on its own DEX — effectively sealing off external arbitrage while buying back faster than most protocols even earn fees.

For perspective, that’s more than the next nine projects combined. LayerZero burned around $150 million (roughly 5% of ZRO), Pump.fun another $138 million. Hyperliquid alone could retire up to 13% of its total supply annually if its current pace holds.

Nothing else in DeFi matches that aggression.

As @stevenyuntcap noted, boiling it down to “an outsized airdrop” misses the point — the real story is product-market fit. Hyperliquid has managed to attract organic traders, sustain revenue, and scale without relying on hype cycles. That underlying PMF is what turns its deflation engine from a stunt into a functioning business model.

Tokenomics: UNI vs HYPE

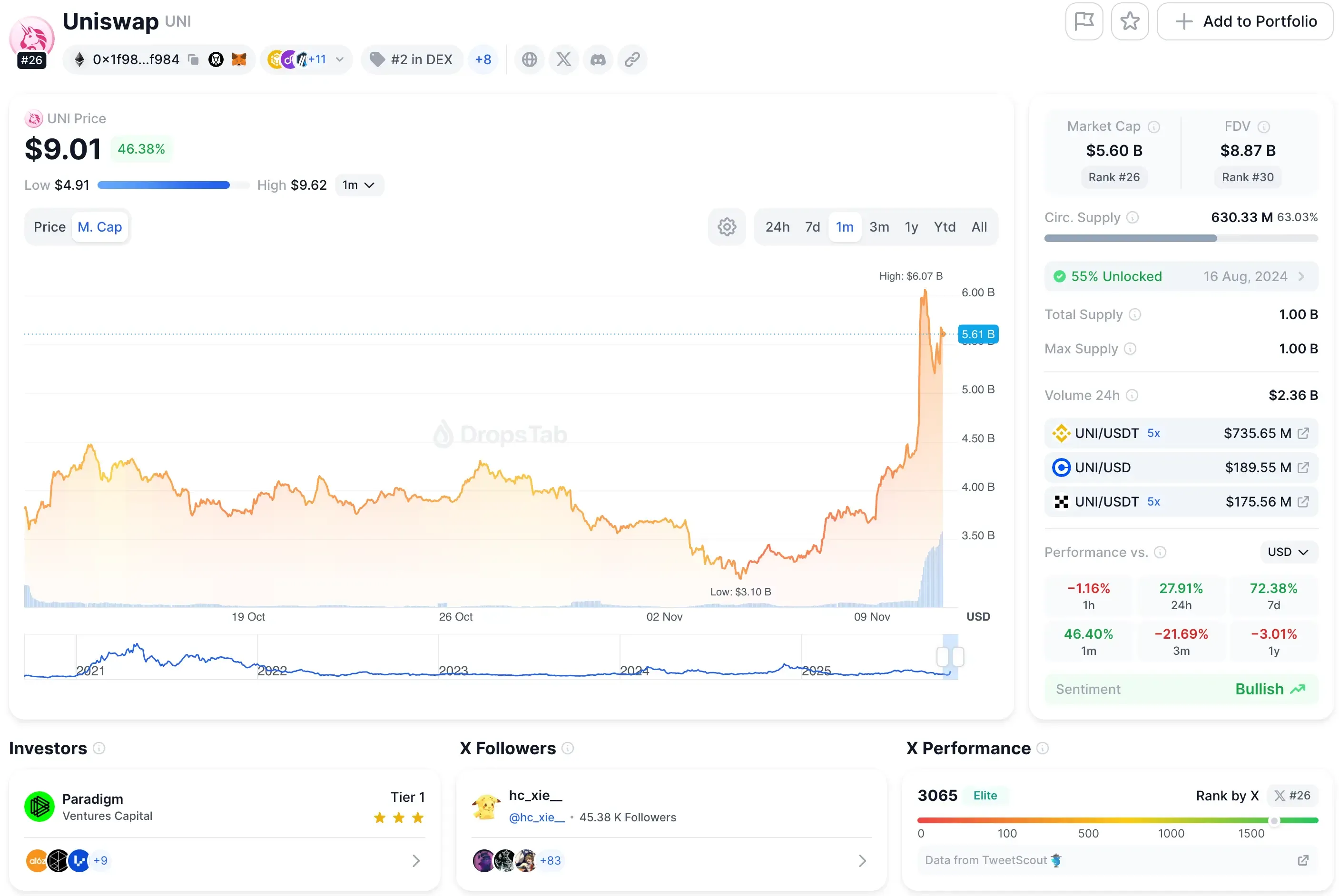

As of November 2025, UNI trades around $8, giving it a $5.5 billion market cap.

Hyperliquid, meanwhile, sits at ~$40 with a ~$11 billion valuation — more than double.

That imbalance says a lot about market perception. It's expensive for a reason. Investors are betting that Hyperliquid’s buyback-fed model has a tighter grip on long-term value. Uniswap, still operating on governance-driven mechanics, trades more like a blue-chip utility — solid, slower, less reflexive.

Fee generation

Uniswap’s fee engine is steady but segmented. Based on current volume, the protocol is pulling in roughly $1.8–$1.9 billion annually in trading fees. Over the last month, it booked ~$130 million — about $32 million per week.

Right now, those fees all go straight to liquidity providers. The UNIfication proposal changes that equation, carving out one-sixth to one-quarter of those flows for UNI burns. It’s a big shift, but one still filtered through DAO governance.

Hyperliquid’s setup couldn’t be more different. There’s no liquidity pool split, no governance toggle. Its order book model charges variable maker/taker fees tied to 14-day trading volume. From that, the platform brings in roughly $1.29 billion annualized revenue — and sends $1.15 billion, or 89%, straight into buybacks.

That’s almost three times the magnitude of Uniswap’s projected $460 million annual burn. For a protocol barely two years old, it’s an absurdly high reinvestment ratio — something closer to a growth stock than a DeFi token.

A comparison shared by on-chain analyst @bread_ visualized just how UNI’s upcoming burns could stack against existing buyback tokens. Using historical fee data, UNI’s proposed 0.05% protocol cut translates to roughly $38M in buybacks every 30 days — putting it ahead of $PUMP ($35M) but still well behind $HYPE ($95M).

Development comparison

In raw performance, Hyperliquid leads: $645 million in executed buybacks across ten months. Yet if Uniswap’s plan clears governance and keeps volume steady, its projected $460 million annual burn could rival that pace while staying transparently governed.

Each model leans on a different pillar — Uniswap on coordination, Hyperliquid on market dominance. And both are exposed: one to community politics, the other to competition.

Uniswap governance

Every trade now feeds a potential UNI burn. More volume, more destruction, higher theoretical price support. It’s an elegant loop, but fragile.

Because the switch sits behind DAO votes, it can always be throttled or reversed. Liquidity providers — a powerful bloc — might vote to soften burns if rewards thin out. And a future administration could easily revisit whether burn-as-fee-distribution counts as revenue sharing. Nothing here runs on autopilot.

Automated Hyperliquid

Hyperliquid’s design is brutally simple — 97 percent of revenue converts to buybacks. No voting, no seasonal governance debates. If volume rises, the burn rises; if volume falls, it slows. That predictability is a feature investors love.

But there’s risk underneath the precision. Sustained buybacks require dominance; lose market share to Aster or Lighter, and the loop weakens. Critics also point to centralization: the Assistance Fund is still managed by a tight core team with no DAO oversight, and HyperCore, the platform’s proprietary L1, remains closed-source. Less decentralization means faster iteration — and higher single-point failure risk.

Conclusion

In 2025’s DeFi race, Hyperliquid is the current favorite — fast, automated, and ruthlessly efficient. Its 97% fee-to-buyback model delivers hard numbers and predictable deflation, making it the clear short-term bet for traders chasing yield and scarcity.

Uniswap plays the long game. Its governance-led burns trade speed for legitimacy, aiming to prove that community coordination can rival algorithmic precision. It’s slower, but potentially more durable if the DAO can keep liquidity and consistency.

The bet is simple: automation vs. alignment. Hyperliquid dominates now, but Uniswap could win the cycle if it sustains growth without losing its base. The goal for both — and for DeFi as a whole — is turning real revenue into lasting token value.