Crypto

Strategy Transferred BTC to Fidelity Custody — The Hidden Play

Institutional exits, Fidelity’s omnibus custody, and delayed SEC reporting give Strategy a clean path to unload 50,000–100,000 BTC without on-chain traces. The setup is already in motion.

Quick Overview

- Institutions dumped $5.38B in Strategy exposure once spot ETFs made MSTR obsolete.

- Strategy moved 165,709 BTC into Fidelity’s omnibus pool — the perfect place to sell quietly.

- Several black-swan signals now matter: Q4 earnings, exchange inflows, OTC blocks, derivatives skew.

- A stealth unwind could take the form of a trickle, a 50K flush, or a 100K forced sale.

- Expect 50,000–100,000 BTC to hit the market between Q4 2025 and Q1 2026 — before the filings confirm it

The Stealth Dump Thesis

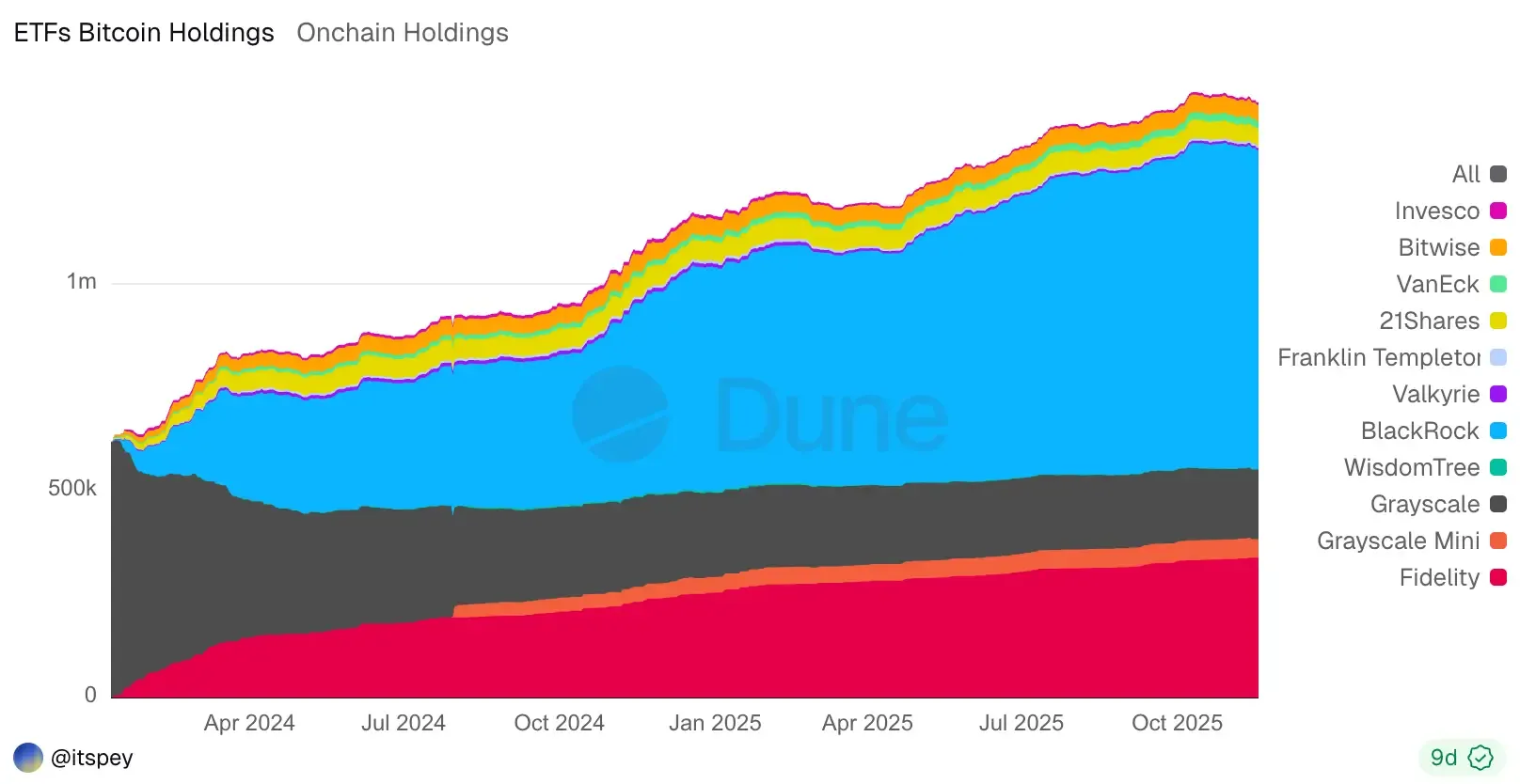

The story really starts with the Q2–Q3 2025 filings. You could see the air leaking out in real time. BlackRock, Fidelity, Vanguard, and Capital International dumped roughly $5.38B in Strategy exposure — almost an even billion each. Just a cold rotation into spot Bitcoin ETFs like the iShares Bitcoin Trust (IBIT), which offer plain BTC with none of Strategy’s leverage, dilution, or debt scars.

And once that option existed, MSTR stopped being a clever proxy. It became a burden — too much convertible debt, too much volatility, too many moving parts you don’t get with simply holding BTC. The old “premium” that kept institutions in the stock shrank as Bitcoin drifted between $80K–$105K. Hard to justify paying extra for a wrapped version of something you can now buy directly.

What’s wild is that, even as institutions quietly rotated out, Strategy was still pushing a very different picture to the market. They posted this a few days before the Fidelity move — a kind of “nothing to see here” reassurance built on 1.41% BTC appreciation math.

It reads polished, maybe even confident, but when a company leans this hard on model assumptions, it usually means the real issue is somewhere offscreen — on the balance sheet, in the cash flows, or in the custody structure about to change.

This follows the same problem we flagged in our breakdown of Strategy’s math error — too much BTC, too much debt, and a capital structure that starts to crack once MSCI selling kicks in next year.

What’s left is an uncomfortable thought that almost writes itself: if management doesn’t liquidate part of this oversized treasury, shareholders — or activists — will do it for them.

Opportunity: The Omnibus Trap

Then came the pivot — 165,709 BTC quietly moved into Fidelity’s omnibus custody. The shift looks operational, maybe even boring, until you pick at the edges.

Inside an omnibus pool, attribution dissolves. On-chain, all those coins now sit under a single label: “Fidelity Custody.” Arkham tracks the inflow with ~92% accuracy, but once they're mixed, any outbound transfer could belong to Strategy… or a pension fund… or an ETF. Nobody outside Fidelity can say for sure. That’s the trick.

The second piece is even more slippery. Fidelity’s internal ledger lets two institutions swap BTC without touching the blockchain at all. Strategy could offload 50,000 BTC to a sovereign wealth fund, BlackRock, whoever — and the settlement happens inside Fidelity’s cold storage. Zero on-chain footprint.

And there’s a timing angle. Strategy only has to file an 8-K when the asset sale becomes “material.” Moving coins into omnibus custody doesn’t qualify. Selling through an OTC desk over a few weeks technically does, but the filing usually lags. By the time it hits EDGAR, the trade is over and the market has digested the pressure. Retail finds out last, as usual.

The Black Swan: Timing & Triggers

A black swan here won’t arrive as one dramatic explosion. It will creep in through a handful of signals, any one of which could flip sentiment instantly.

Signal 1 — The Q4 Earnings Cliff

Everything hinges on Q4 2025 earnings in February. That filing will quietly reveal whether Strategy added to its BTC stack… or chipped away at it. If the treasury shrinks and there’s no matching equity raise or bond issuance, you’re looking at a hidden liquidation. Markets usually take months to process this kind of thing. Three, sometimes six. Which means traders absorb the damage long before they know what hit them.

And you can feel that tension spilling into traditional finance too. JPMorgan quietly hiked margin requirements on MSTR to 95%, then began refusing to deliver shares to clients trying to transfer out. One trader summed it up bluntly:

When a prime broker makes a Nasdaq component essentially non-borrowable and non-movable — after dumping $134M of its own exposure — it usually means they’re bracing for something bigger than a price swing.

Signal 2 — Fidelity Hot Wallet Transfers

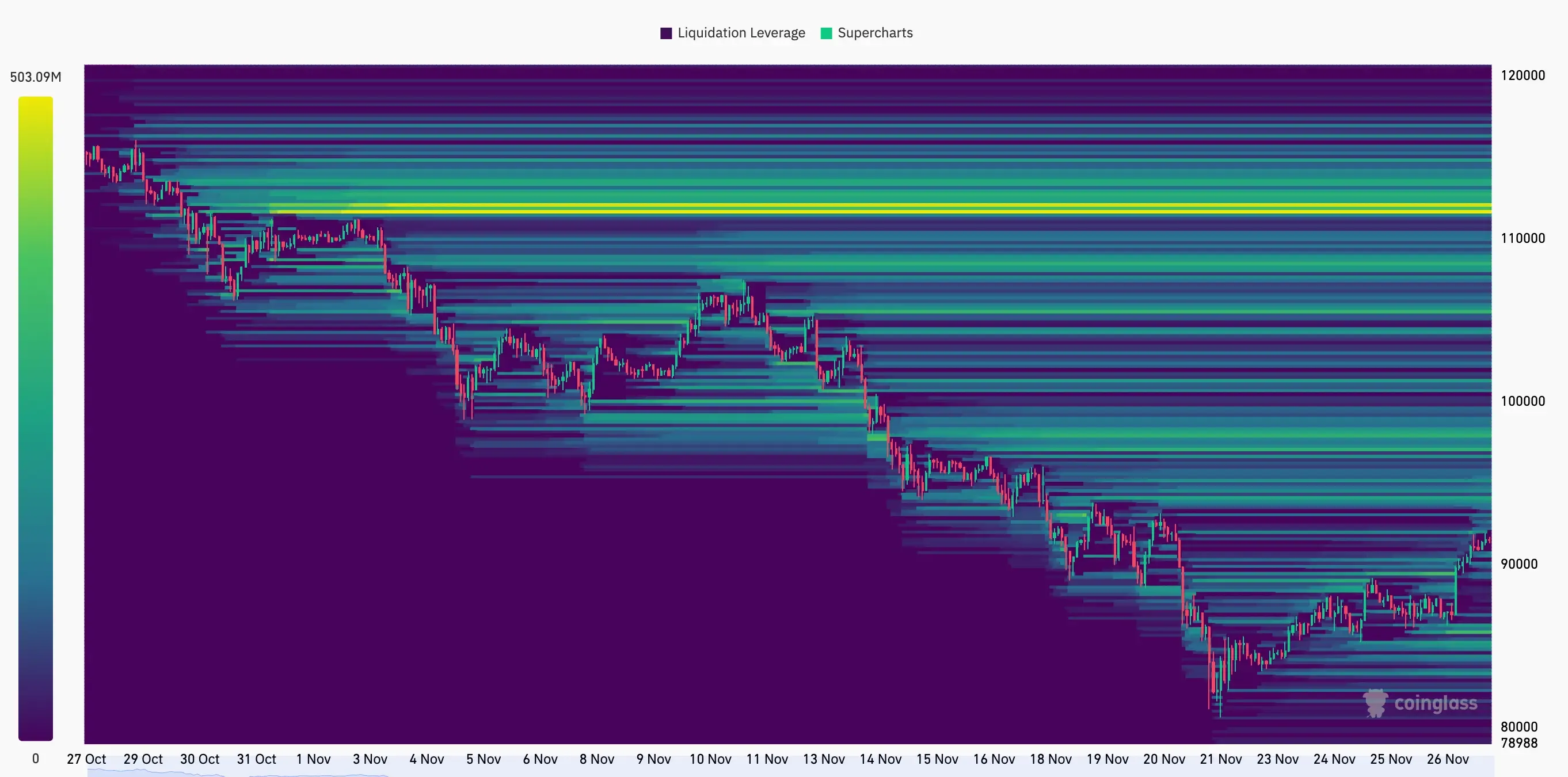

Then there’s the obvious trigger — the one everyone pretends they’ll catch in time. If any of Fidelity’s omnibus addresses push 10,000+ BTC into Coinbase, Binance, or Kraken hot wallets, the party’s over. You’ll see it ripple across the microstructure fast:

- order books leaning hard on the ask side

- funding sinking deep into negative territory

- open interest spiking as over-levered longs get clipped

The distribution says it all: thin liquidity underneath, overloaded liquidation bands above, and a market that can’t absorb a surprise 10,000 BTC transfer without snapping. That’s exactly the setup where a Fidelity outflow turns into a multi-venue cascade.

Signal 3 — OTC Block Trade Reports

Every so often Genesis, Coinbase Prime, B2C2, Galaxy, or Kraken Institutional leak block trade summaries to Bloomberg and Refinitiv terminals. When a report shows 5,000 BTC or more sold by “a large corporate holder,” there aren’t many suspects. Strategy sits alone in that weight class. Traders know it too.

And these OTC flows aren’t happening in a vacuum. Institutions aren’t just reducing exposure — they’re rotating into instruments that give them cleaner, protected Bitcoin upside. JPMorgan, for example, is already pitching a structured note tied to BlackRock’s IBIT: fixed minimum returns, 1.5x upside if BTC rips into 2028, and downside buffers if the market stalls.

That’s the part most people miss. These desks aren’t just dumping. They’re migrating into vehicles engineered to outperform MSTR without touching its leverage, dilution, or balance-sheet risk. OTC prints tell you what’s leaving. Products like this tell you where it’s going.

Signal 4 — Derivatives Front-Running

People inside these structures almost always hedge before the real selling begins. It’s habit. It’s survival. So keep an eye on futures books across CME, Binance, even whatever rises from the FTX ashes. When you suddenly get:

- a burst of short open interest

- funding staying negative for two full days

- BTC options skew tilting toward puts

…it usually means someone big is positioning for bad weather.

What a “Stealth Dump” Actually Looks Like

There are three real ways a liquidation of this size can unfold, and none of them look like the dramatic red candle people imagine. The model below is built around Strategy’s 165,709 BTC now sitting inside Fidelity’s omnibus pool.

1. This is the quiet version. Roughly 2,000 BTC a week moves through Fidelity’s internal ledger. No blockchain activity, no hot-wallet jumps, nothing you can point to. The only thing you feel is a slow 5–10% bleed across spot markets as whispers spread and liquidity thins. It can drag on for two months or more, and most traders won’t connect the dots until it’s over.

2. Then there’s the middle scenario — a 50,000 BTC release over three to five days, routed through OTC desks. This one does show up on the chain: a big, obvious outflow from Fidelity toward Coinbase or Binance. Price reacts instantly. You get a 15–30% intraday hit, liquidations firing across every exchange, and a fast, ugly reset. It’s violent but survivable if you’re paying attention.

3. The nightmare path is the forced unwind: 100,000 BTC or more hitting the market in hours. Multiple Strategy-linked wallets dumping simultaneously, OTC desks scrambling to source bids, funding collapsing toward -50%, and order books just… disappearing. This is the scenario where even experienced traders freeze, because everything breaks at once.

The Uncomfortable Truth

Here’s the part most people don’t want to say out loud: Strategy doesn’t owe the market real-time transparency on any of this. A custodial rotation isn’t a “material event.” It’s housekeeping. Which means they can move 165,709 BTC into Fidelity — done already — without telling anyone what comes next.

From there the playbook is almost boring. Sell slices of the stash through Fidelity’s OTC desk. Keep everything inside the internal ledger so nothing hits the chain. Let the accountants sweep it into the Q4 earnings notes three months later.

And when the numbers show a smaller treasury? Easy. Blame “market conditions,” “capital allocation,” or whatever corporate euphemism fits that quarter’s narrative.

By that point the damage is baked in. Somewhere between $5–15B worth of sell pressure has already rolled across spot books. BTC trades heavy, Strategy stock gets hammered, and the retail crowd that treated MSTR as a Bitcoin ETF learns a harsh lesson — the insiders always get the exit first.

You can already see what that kind of silent pressure looks like. BTC climbed to $125K this cycle, stalled, and then slid for months without any single headline to blame. It’s the kind of chart that tells you exactly how a slow bleed works.

A market drifting like this doesn’t need a dramatic trigger. It just needs one large seller operating where no one can see them.

Conclusion

The Fidelity transfer isn’t noise. It’s the opening move. Once you see the structure — the omnibus pool, the timing window, the earnings lag — the question shifts. Not if Strategy sells, but how far they go and how quietly they try to do it.

A realistic expectation? Somewhere in the ballpark of 50,000–100,000 BTC leaking into the market between Q4 2025 and Q1 2026. Maybe in clean OTC blocks. Maybe in a messy drip. Either way, the supply shock lands before the disclosure does.