Crypto

Zcash vs Bitcoin: The Divide Between Privacy and Scale

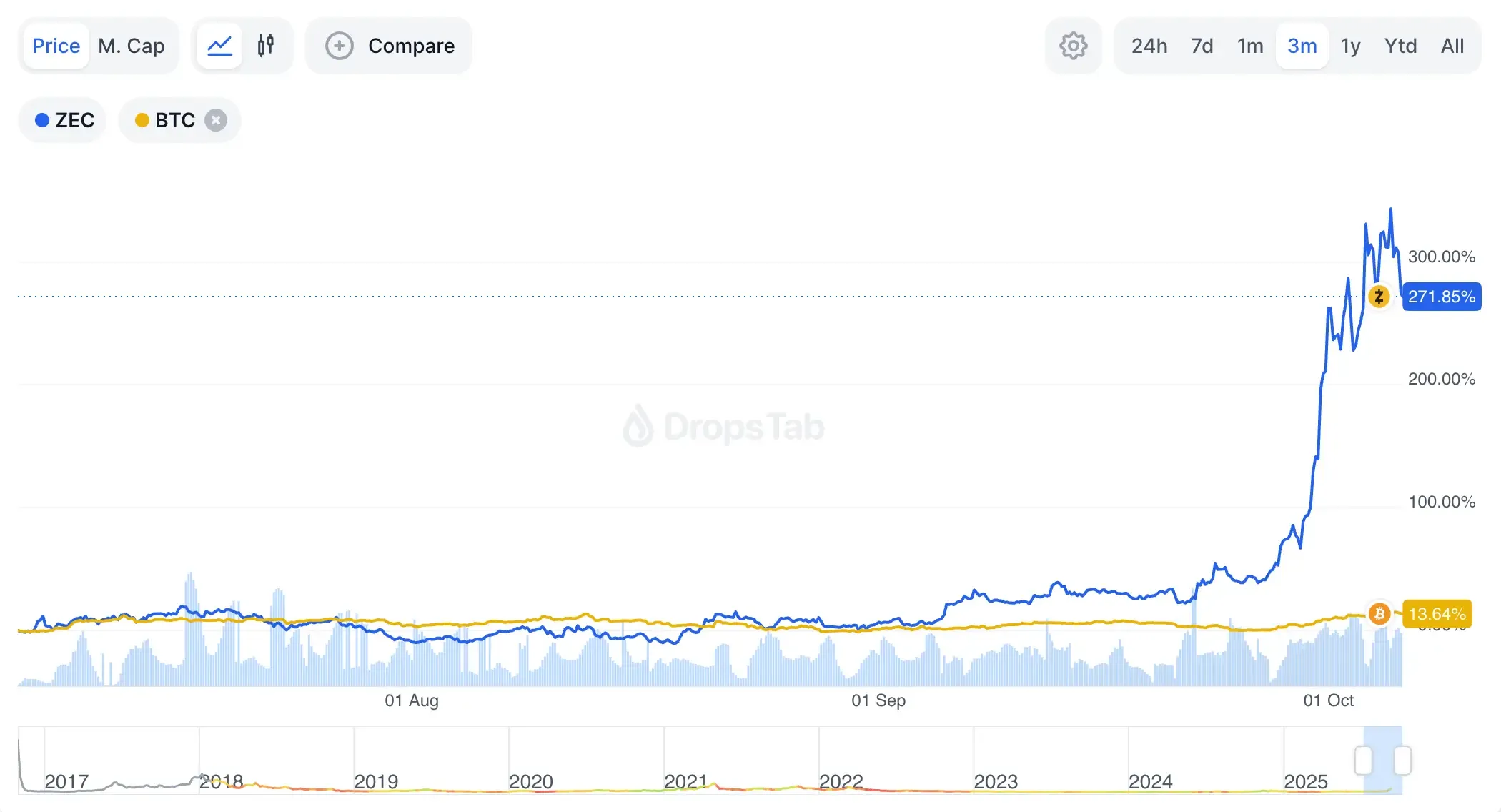

Zcash’s 300% rally in fall 2025 reignited the oldest debate in crypto: transparency or privacy. While Bitcoin cements its place as institutional gold, Zcash is proving that privacy still sells — even in an age of regulation and surveillance.

Quick Overview

- Zcash jumped 300% in October 2025, hitting $160+ on new trust launches and cross-chain swaps.

- Bitcoin holds near $125K, driven by ETF inflows and institutional demand.

- ZEC’s edge is privacy, while Bitcoin prioritizes transparent security.

- Rules diverge: Bitcoin gains approval; Zcash faces tighter oversight.

- Scale vs secrecy — Bitcoin as digital gold, Zcash as programmable privacy.

ZEC’s Explosive Rally vs BTC’s Relentless Climb

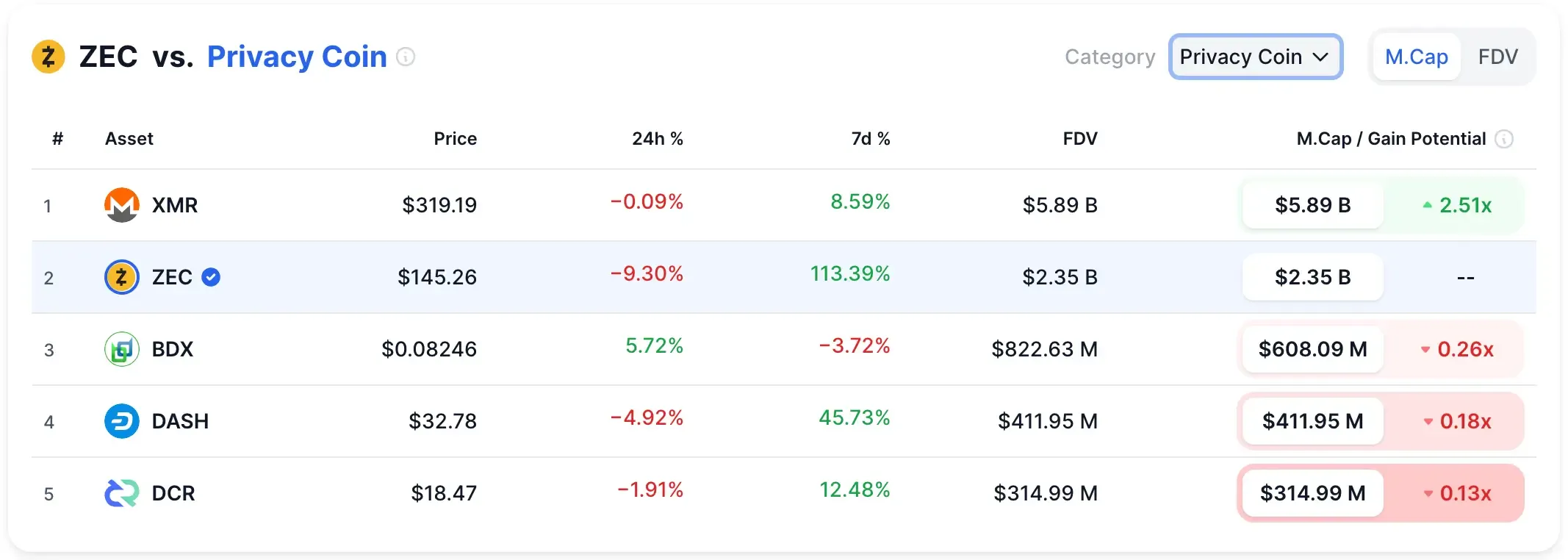

It’s been a while since Zcash stole the spotlight — but this fall, it did. After years of flatlining, ZEC ripped 300% higher in October and hasn’t slowed down through October 2025. The token now hovers between $160 and $165, pushing its market cap to roughly $2.5 billion.

Bitcoin, by contrast, is moving at its usual institutional pace — calm, consistent, and enormous — sitting near $125,000 with a $2.5 trillion market cap.

So what sparked Zcash’s return from the shadows? A mix of catalysts that feel less like coincidence and more like coordination:

- Grayscale rolled out the Zcash Trust for accredited investors, opening the door to regulated exposure.

- ThorSwap added cross-chain shielded swaps between ZEC, BTC, and ETH — a big step for privacy-preserving interoperability.

- And quietly but surely, institutions have started paying attention to assets that guard financial data at a time when surveillance is tightening everywhere.

Even builders outside the Zcash ecosystem have noticed the shift:

“Recent buzz around Zcash is one of the first times I’ve seen legit collaboration across ecosystems,” wrote @0xMert, founder of helius.dev. “NEAR devs are building cross-chain intents DEXs, Cosmos and ETH folks are excited about privacy, Solana guys are helping with marketing, even old-school BTC traders are getting involved.”

Energy Efficiency or Absolute Fortification

Bitcoin still wears the crown when it comes to blockchain security. Its hashrate now tops 975 exahashes per second, guarded by a mining difficulty near 150.8 trillion — a fortress powered by thousands of industrial ASIC farms scattered across the globe. That scale is unmatched, but it comes with a cost few can ignore: colossal energy draw and hardware arms races that shut out smaller players.

Zcash plays a different game. Its network runs at roughly 7.95 gigahashes per second, with difficulty levels in the 70–77 million range — light years apart from Bitcoin’s numbers, but intentionally so. The Equihash algorithm still lets both GPUs and ASICs compete, keeping mining accessible to individuals who can’t drop six figures on specialized rigs. The trade-off is clear: more inclusivity, less brute-force security.

Then there’s decentralization — the quiet variable behind every Proof-of-Work chart. Bitcoin’s mining map has narrowed over time; the top two pools now control about 47% of its total hashrate, raising old worries about centralization risk. Zcash, by contrast, looks more spread out, though full transparency on pool data remains elusive.

Bitcoin prioritizes raw, industrial-grade resilience. Zcash aims for balance — a network that trades some armor for agility, and some power for accessibility.

Privacy Model

Here’s where the two networks part ways completely. Bitcoin and Zcash may share Proof-of-Work roots, but their philosophies around privacy couldn’t be more different.

Bitcoin was built for transparency — every transaction, every address, forever on display. Zcash, on the other hand, was engineered to give users a choice: stay public or go private.

That flexibility comes from its defining feature — shielded transactions powered by zk-SNARKs, a zero-knowledge proof system that hides sender, receiver, and amount while keeping transactions verifiable. And adoption’s been picking up speed. In September 2025 alone, shielded transactions rose 15.5% month over month, pushing the total to 3.06 million ZEC.

The growing use of Zashi and cross-chain bridges is giving that privacy an even more practical edge.

“Onramp onto Solana or whatever chain, use Zashi to bridge some of it to ZEC, shield the ZEC, let it sit, then bridge it out again — you’ve just seeded a new wallet with zero traceability,” explained @0xMert of helius.dev.

The tech behind it has matured, too. The Orchard upgrade and Halo 2 proving system removed the old “trusted setup” phase — a long-standing concern in early cryptography circles. Now the math stands on its own, without any hidden assumptions baked in.

Bitcoin’s privacy story is a different animal. Taproot, rolled out back in late 2021, made multi-sig and smart contract interactions look like regular payments — a neat trick of camouflage. But it’s still privacy through blending, not invisibility. The blockchain remains fully traceable, and all amounts stay in plain view.

Even now, roughly 20% of all ZEC sits in shielded addresses, showing that privacy is growing — slowly, but steadily. Users move between transparent (t-addresses) and shielded (z-addresses) depending on context: compliance, convenience, or conviction.

Bitcoin obscures. Zcash conceals. One leans on simplicity; the other on mathematics.

Regulation & Compliance

The rulebooks are splitting. Bitcoin has become the establishment’s favorite rebel, gradually absorbed into traditional finance through a wave of ETF approvals, government endorsements, and institutional custody deals. In 2025, it’s hard to call it “unregulated” anymore. Under the Trump administration’s crypto-friendly stance, the U.S. has leaned into Bitcoin as a store-of-value narrative — less something to police, more something to integrate.

Zcash, meanwhile, lives in the gray zone — and that zone keeps shrinking. Regulators worldwide have tightened their grip on privacy coins, framing them as compliance headaches rather than innovation frontiers. The FATF’s 2025 Travel Rule expansion now tracks 57% of all privacy coin transactions, forcing exchanges and custodians to flag flows once considered opaque. Over in Europe, MiCA’s rollout cut privacy-coin listings by 22%, trimming liquidity across multiple markets.

As of this year, 97 countries have amended or drafted new privacy-asset rules, many of which hinge on enhanced reporting and transaction monitoring. Zcash’s saving grace — at least for now — is flexibility. Because it offers optional shielding, users can send transparent transactions that satisfy compliance checks, a crucial distinction from always-private coins like Monero that have no such off-ramp.

Still, headwinds are coming. The EU’s planned 2027 ban on anonymous wallet interactions — any transfer over €1,000 requiring identity verification — could choke ZEC’s European reach. Yet not every jurisdiction is tightening the screws. Switzerland and Singapore continue to experiment with regulatory sandboxes for privacy-preserving tech, offering a glimpse of what balanced oversight might look like.

For Bitcoin, regulation looks like legitimization. For Zcash, it’s survival through adaptation.

Outlook

By now, Bitcoin barely resembles its cypherpunk roots — it’s a financial instrument. ETF expansion, corporate treasury adoption, and even central-bank interest have made it the cleanest bridge between crypto and global capital markets.

For a broader look at how Bitcoin’s ecosystem has evolved into a full-stack network, see our deep-dive on the Bitcoin Ecosystem in 2025.

Price targets hovering around $130K–$135K aren’t moonshots anymore; they’re models built on institutional flow and ETF demand curves. Bitcoin’s future feels mapped — slow, heavy, and increasingly centralized around regulated infrastructure.

Zcash’s path is the opposite of predictable. It’s pushing deeper into the gray zone between privacy and compliance, where innovation often outpaces policy. Short-term targets in the $185–$200 range reflect strong momentum ahead of the November halving, but the road is volatile — one regulatory memo could shift everything overnight.

“Hyperliquid adding Zcash makes it structurally easier to onboard and access the token. We should be able to set new all-time highs in market cap,” wrote @0xTulipKing, highlighting how new exchange integrations are giving ZEC a more open runway as 2025 unfolds.

That accessibility boost matters. When liquidity meets narrative — as it now does for Zcash — speculative and fundamental momentum start reinforcing each other.

What makes the comparison fascinating is how both assets have crystallized around their core ideas. Bitcoin has become digital gold — the macro hedge, the collateral layer, the narrative anchor. Zcash remains the lab, still chasing what Bitcoin left behind: programmable confidentiality and user-controlled privacy.

Their metrics of success diverge just as sharply. For Bitcoin, it’s measured in ETF inflows, custody growth, and treasury adoption. For Zcash, it’s technological progress, regulator engagement, and the survival of privacy itself within a tightening policy world.

And yet, the two share DNA — 21 million hard caps, Proof-of-Work security, and the ideological promise of monetary sovereignty. One thrives through scale, the other through secrecy. As 2025 unfolds, their trajectories will keep diverging — but they still orbit the same idea: freedom over one’s own money.