Alpha

Crypto’s IPO Rush: Why Startups Are Heading to Wall Street

Crypto companies are eyeing IPOs to boost funding, gain trust, and scale globally. With Circle’s $1.1B debut and others like Gemini and Kraken lining up, public listings mark a new phase of crypto's push into traditional finance.

TL;DR

- IPOs offer crypto firms access to institutional capital, transparency, and global scaling.

- Circle’s IPO raised $1.1B, valuing it near the USDC supply.

- Gemini, Bullish, Kraken, and others plan to go public soon.

- Listings signal industry maturity and attract traditional finance.

- Experts split: some see huge upside, others warn of a bubble.

- IPO wave could reshape crypto’s future — or trigger corrections.

- Tokenized stocks let crypto users invest in traditional equities like Apple and Tesla via platforms like xStocks (by Kraken).

- US and non-US investors can join IPOs through brokers like Robinhood or Interactive Brokers, but must meet specific legal and tax requirements.

- IPO access requires brokerage approval, capital, and comes with risks like volatility and limited allocation.

Table of Contents

- 1. Crypto Companies and IPOs

- 2. Why Crypto Projects Go Public

- 3. Examples of Completed and Upcoming IPOs

- 4. Opinions from Major Market Players

- 5. How IPOs Will Affect the Crypto Industry

- 6. Synergy Between Stocks and Cryptocurrencies

- 7. How Can a US Resident Participate in an IPO?

- 8. How Can a Non-US Resident Participate in a US IPO?

- 9. Conclusion

Crypto Companies and IPOs

An Initial Public Offering (IPO) is a process where a company first goes public on a stock exchange, offering investors a share in its business. In a traditional IPO, investors buy company shares. In the world of cryptocurrencies, there are similar mechanisms: ICO and IDO.

ICO (Initial Coin Offering) — often called the crypto equivalent of an IPO — is when a company issues and sells tokens of its project. These tokens sometimes provide access to the project's services but do not grant equity ownership.

IDO (Initial DEX Offering) refers to the token offering on a decentralized exchange (DEX). Despite the similar abbreviation, IDO participants also do not become shareholders in the project — they receive tokens that can be immediately traded on DEX platforms.

This table highlights the key differences: IPO offers shares and is tightly regulated, while ICO/IDO sell tokens with far less regulatory oversight.

Why Crypto Projects Go Public

Recently, many crypto companies have seen IPOs as a way to strengthen their positions and scale their business.

First, finances and scaling

Listing on a traditional exchange opens access to vast capital — money from institutional investors, funds, and corporations that rarely participate in ICOs. As noted by Denis Balashov (SkyCapital), public status enables securing “major contracts” and attracting capital for global expansion — so-called mass adoption. According to experts, crypto companies no longer rely solely on ICOs or private investments — going public provides resources for growth and infrastructure development. That said, 2025 has also seen a renewed wave of ICO activity, with revamped models like Sonar and mega-raises from Plasma and Pump.fun redefining token sales — a trend explored in detail here.

Second, legalization and trust

Going public increases project transparency: structure, financials, and compliance practices are disclosed. Banks, pension funds, and institutional investors find it easier and safer to invest in publicly listed stocks than in ephemeral tokens on crypto platforms. As Denis Astafyev (SharesPro) explains, mass listings indicate market maturity — it is a “step toward legalization and institutionalization of the sector.” Regulators also view public companies more favorably: they already follow KYC/AML standards and reporting practices, which many crypto startups lack.

Finally, image and reputation

Listing on a traditional exchange enhances brand recognition and user trust. “After listing, the project becomes more transparent: structure, finances, audits — everything is in plain view,” notes Balashov. This builds trust from both users and regulators. Overall, experts emphasize that the advantages of IPOs for crypto platforms include attracting institutional investors, boosting investment volumes, and strengthening brand positions.

Examples of Completed and Upcoming IPOs

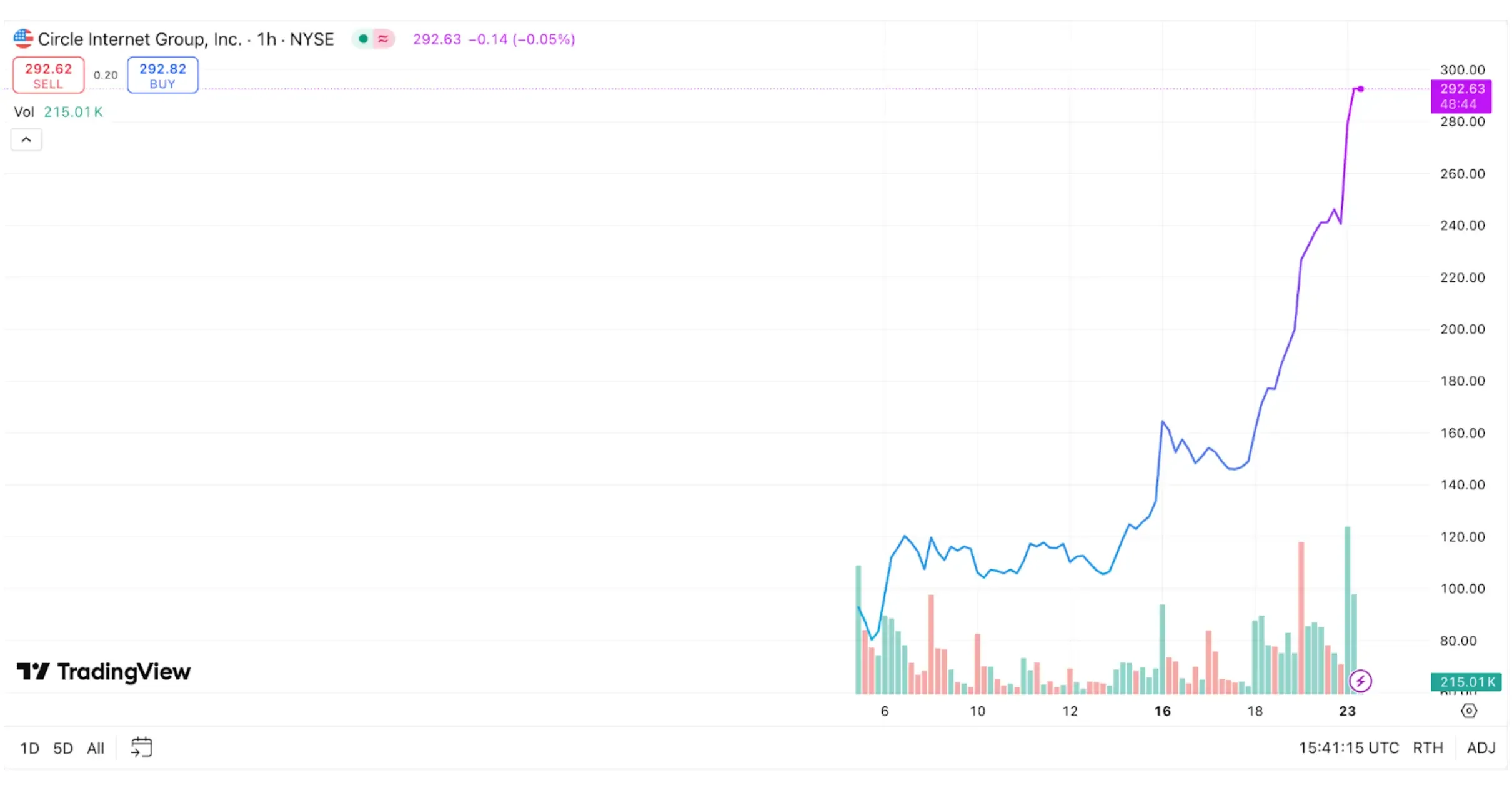

A recent and vivid example is Circle (CRCL), the issuer of the USDC stablecoin. Circle filed for an IPO in May 2025 and listed on the NYSE on June 5, 2025, at $31 per share. At opening, the stock surged to $100, and by the end of the first session, it had risen by 223% (the company raised $1.1 billion, achieving a valuation of ~$6.9 billion).

As of June 23, CRCL’s market cap nearly caught up with the total market cap of the USDC stablecoin — $54 billion for CRCL versus ~$61 billion for USDC. This successful IPO demonstrated investor confidence in stablecoins as a new financial infrastructure. For comparison, the IPO of the major crypto exchange Coinbase (COIN) took place in April 2021, with an initial valuation exceeding $100 billion, although its stock later dropped significantly.

In its IPO filings, Circle disclosed details of an agreement with Binance under which the exchange received an upfront payment of $60.25 million and continues to receive monthly incentives based on the percentage of USDC balances held on the platform.

Circle already shares 50% of the yield from the reserves backing the USDC stablecoin with crypto exchange Coinbase. Such agreements are designed to incentivize USDC adoption by rewarding platforms with a portion of the interest earned on Circle’s reserves.

In July, Circle also entered into a revenue-sharing agreement with Bybit.

In addition, several crypto companies are preparing to go public. Two major exchanges — Gemini (founded by the Winklevoss brothers) and Bullish (a Block.one project involving Peter Thiel) — have filed preliminary IPO applications with the SEC. Details (number of shares, price range) have not yet been disclosed. Other players are also in line: Kraken exchange is considering a U.S. IPO in early 2026.

Another case is Tron (Justin Sun): after the SEC investigation was suspended, the company plans a U.S. IPO through a reverse merger with SRM Entertainment holding.

Another project — Blockchain.com (the “British Coinbase”), valued at around $14 billion as of spring 2022, is also preparing for an IPO.

Meanwhile, Ripple (XRP) has postponed its IPO due to the SEC’s “hostile” actions — CEO Brad Garlinghouse has openly stated that an IPO is not a priority under the current regulatory environment.

On July 14, Grayscale Investments confidentially submitted a draft registration statement on Form S-1 to the SEC for a proposed Initial Public Offering (IPO).

The number of shares and price range have not been determined. The offering will take place following SEC review, subject to favorable market conditions.

Other examples include American Bitcoin, a mining project linked to the Trump family, which recently went public through a SPAC deal (ticker: ABTC). The list of public crypto companies also includes miners (e.g., Marathon) and exchanges such as Coinbase. All these cases set precedents: the buzz around IPOs is growing, and each new market entry encourages more crypto startups to consider going public.

Opinions from Major Market Players

Major investors and analysts have mixed views on the crypto IPO wave.

Some see enormous potential:

For example, Matt Hougan, CIO at Bitwise, considers crypto company stocks “a great value accumulation tool” and urges investors not to miss this wave.

Denis Astafyev, founder of SharesPro, emphasizes that listings demonstrate industry maturity and bring the crypto sector closer to “traditional financial markets,” pushing standards and infrastructure to a new level.

Denis Balashov (SkyCapital) notes that after an IPO, a bank or pension fund can legally invest in crypto tech — something that used to be hard to achieve.

However, there are also skeptics warning of risks:

Arthur Hayes, co-founder of BitMEX, warns that “IPO mania” could overheat the market, repeating the 2017–2018 ICO boom scenario. He believes that by 2027, the number of crypto IPOs could multiply, but a correction will follow.

Astanaev notes that overly widespread listings could create a bubble and trigger a crash.

Many experts urge caution: attractive opportunities do exist, but they require attention to the companies’ fundamentals.

How IPOs Will Affect the Crypto Industry

The mass entry of crypto companies into stock markets, according to experts, marks a new stage of market development. Generally, IPOs attract institutional investors, increase asset liquidity, and strengthen project brands. Listings help integrate the crypto market with traditional finance — opening new opportunities for companies and users, and accelerating the adoption of digital assets.

In the coming years, this could lead to closer interaction between blockchain projects and major banks, expansion of institutional capital in crypto, and emergence of new products (e.g., tokenized shares issuance, crypto company ETFs, etc.). At the same time, regulators will become more involved: public companies must comply with rules, which could boost trust in the industry — but also restrict some existing freedoms.

On the flip side, if demand exceeds reasonable limits, the opposite effect is possible — volatility and corrections. Experts warn that after a short-term “boom,” a consolidation phase is inevitable, and weaker projects will be filtered out. In practice, this means investors must choose platforms with proven financial reporting, and the industry must maintain a balance between innovation and regulatory compliance.

Synergy Between Stocks and Cryptocurrencies

It’s worth noting that it’s not only crypto projects aiming for IPOs — the reverse is also happening, with prominent players from the securities market entering the blockchain space. Many large companies, in collaboration with crypto startups, are issuing tokenized stocks on the blockchain.

For example, the xStocks project, launched under the umbrella of crypto exchange Kraken, has released a range of tokenized shares of well-known companies. These include giants like Apple, Nvidia, Tesla, McDonald’s, and even Circle. This initiative enables crypto users to start building a portfolio of stocks in companies they’re interested in — all without leaving familiar platforms like Jupiter.

You can learn more about the phenomenon of tokenized stocks in our feature on how tokenized stocks are bringing Wall Street to the blockchain.

How Can a US Resident Participate in an IPO?

To take part in an Initial Public Offering (IPO) on US stock exchanges, residents of the United States must comply with certain rules set by both regulatory bodies and brokerage firms.

- US residency status is mandatory for most IPOs.

- Investors must have an active brokerage account with a US firm that offers access to primary offerings.

- Compliance with FINRA Rules 5130 and 5131 — investors must not be considered "restricted persons," which includes employees of financial firms involved in the IPO and their immediate family members.

Choosing a Broker for IPO Access

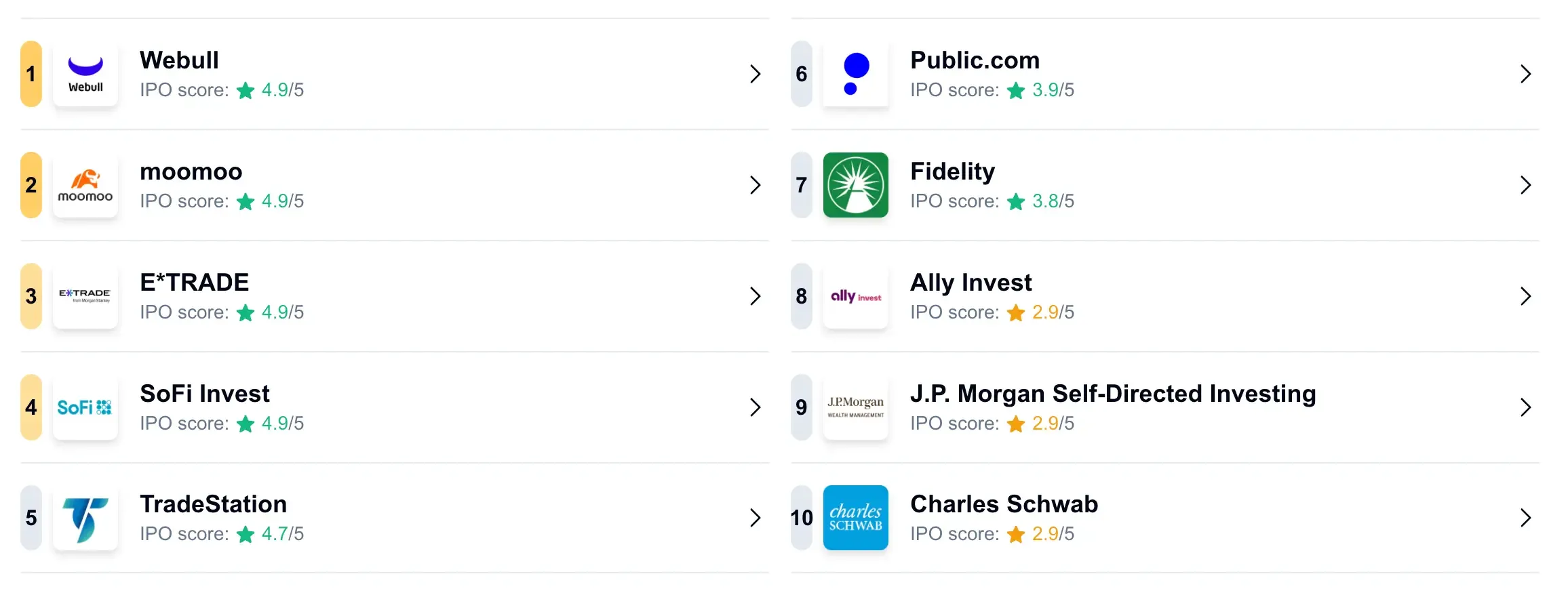

According to independent ratings, the top brokers for IPO investing in 2025 include:

- Webull – best choice for IPOs, offering commission-free stock trading.

- Fidelity – typically requires $100,000–$500,000 in assets for IPO participation.

- E*TRADE – offers IPO access with a user-friendly platform.

- Robinhood – open to all users with no minimum balance required.

- Charles Schwab – known for excellent service and research tools.

Account Requirements by Broker

Minimum balance requirements vary:

- Robinhood – no minimum account balance.

- Webull – typically $500 minimum for IPO eligibility.

- Fidelity – $100,000–$500,000 depending on the IPO.

- E*TRADE – requires completion of an investor profile.

Step-by-Step Process to Participate in an IPO

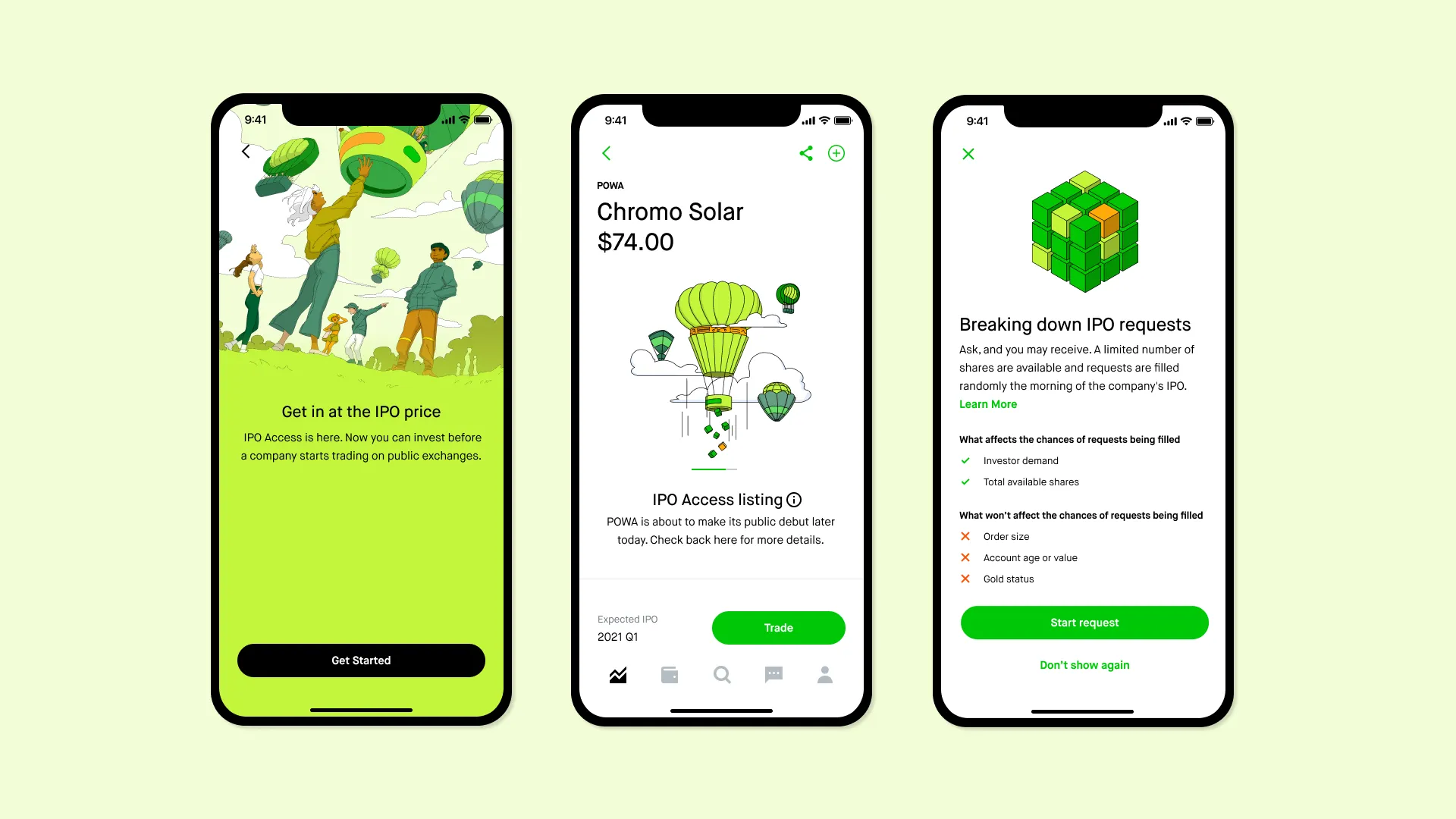

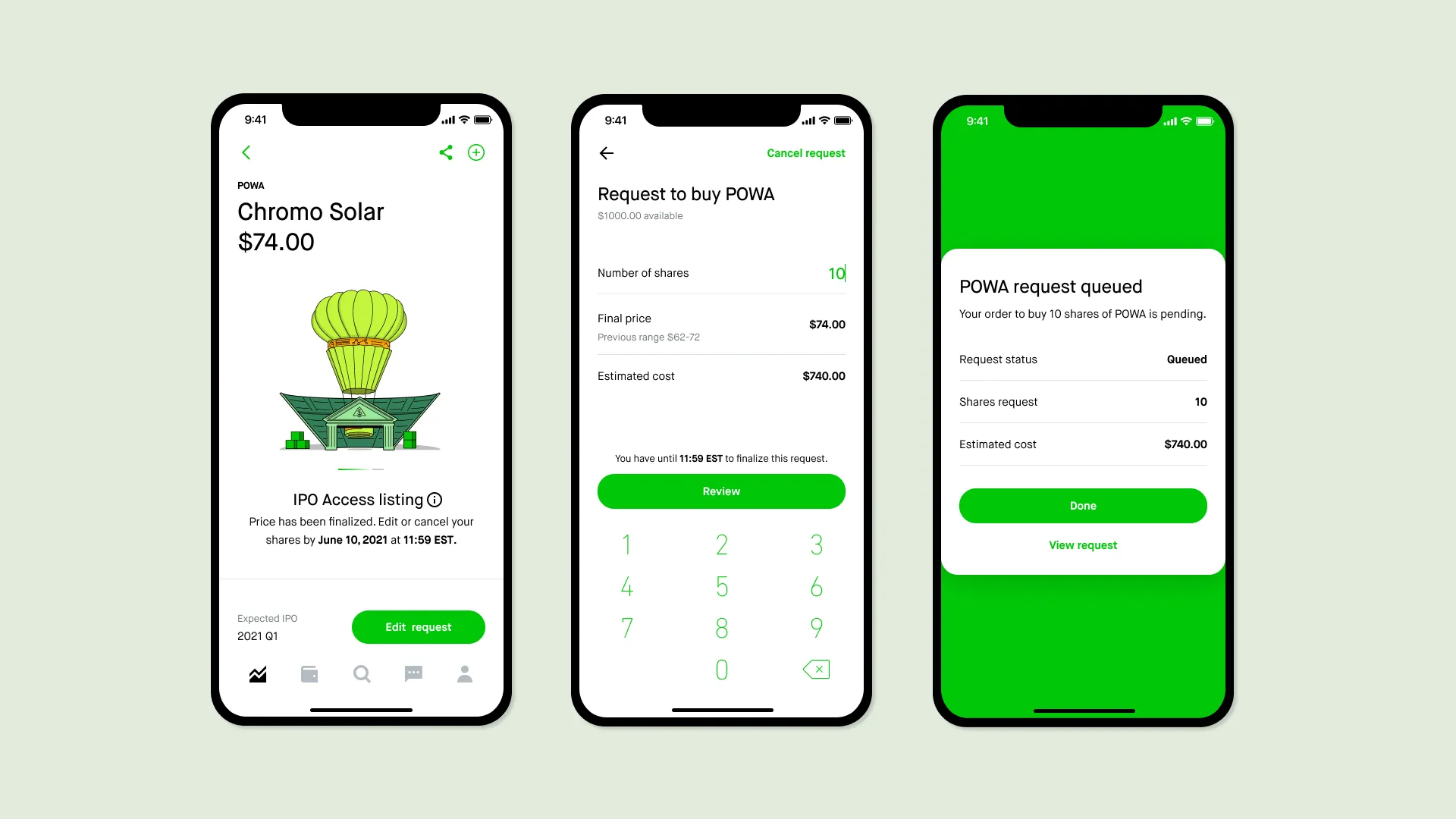

- Open a brokerage account with an IPO-participating broker, ensure sufficient funds are available for investment. Review the prospectus — a mandatory document containing financials, risks, and company information.

- Place a request through your broker’s platform, indicating the maximum number of shares you wish to buy. Complete FINRA eligibility questions to confirm you meet the criteria.

- Allocation phase – your broker will distribute shares based on demand, you may receive fewer shares than requested due to oversubscription, shares are automatically purchased on IPO day at the offering price.

Lock-up for company insiders usually lasts 90–180 days. Retail investors who purchase at IPO can usually sell on the first trading day. Many brokers enforce 30–60 day restrictions on selling IPO shares to prevent speculative flipping.

How Can a Non-US Resident Participate in a US IPO?

Participation in US IPOs is possible for non-US residents through several mechanisms:

Via Local Brokers With International Market Access

This is the most accessible method for non-residents — opening an account with a local broker that offers access to US markets.

Via US-Based Brokers

Interactive Brokers is the most reputable US-based option for international investors:

- SIPC protection up to $500,000

- Access to 150+ markets in 33 countries

However:

- IPO access is limited for retail clients.

- Requires significant capital and trading history.

Note: Most US brokers do not offer IPO access to ordinary retail clients, especially non-residents.

Legal Requirements for Non-US Investors

While US law does not prohibit non-residents from owning shares in US companies, some legal requirements apply:

Tax Obligations

- W-8BEN form – used to certify non-resident status.

- ITIN (Individual Taxpayer Identification Number) – required for receiving income in the US.

Tax Withholding

- Dividends – default withholding rate: 30%

- May be reduced to 15% if a tax treaty applies.

- Capital gains tax – generally not applied to non-residents on US stock sales.

Accredited Investor Status

Some IPOs may require accredited status:

- Annual income above $200,000 (or $300,000 for joint filers)

- Net worth over $1 million (excluding primary residence)

- Possession of professional finance certifications

Practical Steps to Participate

- Choose broker and sign an agreement

- Open and fund your account

- Submit IPO participation request

- Wait for allocation results

- Receive shares after the IPO is executed

Allocation Nuances

- IPO allocations are rarely filled fully

- Expect to receive 10–20% of your requested shares

- Minimum investment amount is usually around $2,000

- Brokers typically charge a 4–5% fee on the transaction amount

Conclusion

Despite the risks, many analysts believe that IPOs by crypto companies pave the way for the industry’s institutionalization and “maturation.” Crypto projects gain new financing channels and status, while investors receive legal access to the sector. However, how this will affect overall market capitalization and crypto volatility — only time will tell.