Alpha

ICOs Are Back in 2025 with New Rules and Bigger Demand

ICOs are making a comeback in 2025, fueled by a bullish market, retail demand, and new platforms like Sonar. With projects like Plasma and Pump.fun raising hundreds of millions, token sales are evolving—not disappearing.

TL;DR

- ICOs are back amid bullish momentum, retail demand, and loosened regulatory pressure

- Projects like Plasma and Pump.fun raised $500M+ in minutes via revamped token sale models

- Airdrops became key legal workarounds post-2018 crackdown

- Platforms like Sonar (Echo/Cobie) offer compliant public sale infrastructure

- Regulatory uncertainty remains; MiCA in EU and “utility-only” talks in the U.S. may shape the future

- Today’s ICOs emphasize transparency, KYC, and long-term participation

Table of Contents

- 1. Understanding Token Sales Mechanics

- 2. ICO History of the 2017–2018 Boom

- 3. Reasons for the Decline of ICOs: Regulation and the Howey Test

- 4. Airdrops Instead of Token Sales

- 5. The Return of the ICO Trend in 2025

- 6. Notable Launches of 2025

- 7. How to Participate in an ICO (Using CoinList as an Example)

- 8. What’s Next for ICOs

Understanding Token Sales Mechanics

Initial Coin Offering (ICO) is a method used by crypto projects to raise investment. Essentially, a project team allocates a portion of the total token supply for sale, typically in exchange for cryptocurrency or fiat. In addition to tokens, investors may receive access to additional benefits, such as future project services. ICOs resemble crowdfunding but in crypto format: investments go directly to the project without intermediaries, and participants receive tokens with specific functionality (staking, governance, etc.) in return.

A key distinction between ICOs and similar token distribution methods lies in the venue and format of the sale. In an ICO, the sale typically takes place on the project’s own website or via ICO platforms (e.g., Coinlist). In an IEO (Initial Exchange Offering), tokens are sold through a cryptocurrency exchange: the exchange conducts the sale in coordination with the project and subsequently lists the token. An IDO (Initial DEX Offering) is conducted on a decentralized exchange (DEX).

Roughly speaking, ICO = direct from the website, IEO = via centralized exchange, IDO = via decentralized exchange, usually with a prepared liquidity pool. ICOs offer maximum autonomy and openness (“anyone can participate without documentation”), while IEOs/IDOs benefit from exchange-driven marketing. However, from a legal standpoint, all of them may fall under securities laws if they meet the criteria of the Howey test.

The main characteristic of ICOs is the absence of intermediaries and the potential for high-risk, high-reward returns. An investor personally selects the project and commits funds, hoping for token appreciation and engagement with the project. Conversely, IEOs and IDOs are often marketed as “safer” options (allegedly because the exchange has conducted due diligence on the project). But as the SEC warns, IEOs—like ICOs—can still violate registration requirements if the token sale constitutes an investment contract.

Here’s how the difference breaks down:

- ICO (Initial Coin Offering) – Token sale conducted directly by the project. No exchange involved. Direct “team–investor” contact. Example: Ethereum’s ICO in 2014.

- IEO (Initial Exchange Offering) – Sale through a centralized exchange. The exchange organizes and promotes the project’s token sale. Example: Binance Launchpad.

- IDO (Initial DEX Offering) – Sale through a decentralized exchange (DEX), usually by purchasing from a liquidity pool. In practice, it’s a form of automatic token swap.

ICOs attract developers due to their simplicity: no need for IPO-level regulatory processes, and tokens can be distributed immediately to all interested parties. However, this also puts investors at risk of encountering scams, as everything happens without audits or disclosure of documentation.

ICO History of the 2017–2018 Boom

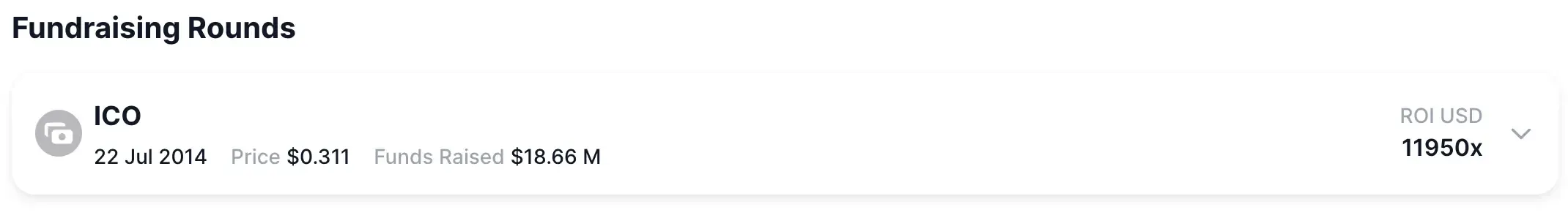

ICOs originated back in 2013–2014. The first major example was the Mastercoin project (which raised around $0.5 million in 2013), but the real breakthrough came with Ethereum. In 2014, Ethereum held an ICO, selling over 60 million ETH at a price of approximately $0.31 per coin. In just a few weeks, Ethereum raised about $18 million (60 million ETH at $0.31). This not only helped fund the development of the platform but also set a completely new trend: Ethereum’s infrastructure made it easy to launch new tokens (ERC-20) and decentralized applications.

Following Ethereum’s success, the ICO industry expanded rapidly. In 2017, thousands of projects conducted token sales. The ICO boom of 2017–2018 brought in roughly $10 billion for project teams.

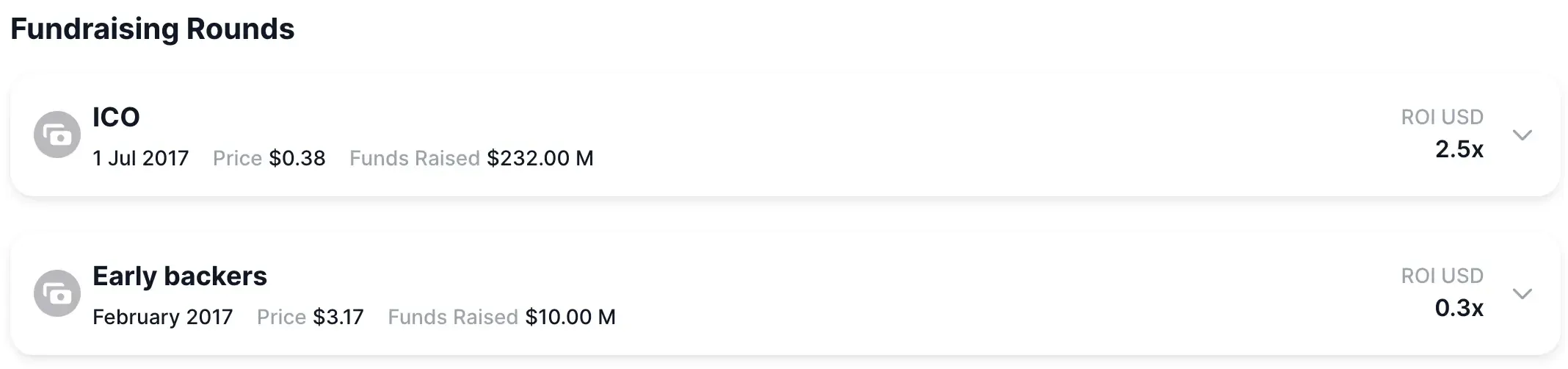

For example, in July 2017, Tezos held an ICO and raised $232 million in just a few days.

That same year, EOS (Block.one) raised an astounding $4 billion through an ICO—one of the largest ICOs in history.

The messaging app Telegram planned an ICO and managed to attract around $1.7 billion in funding (although these were technically private sales for large investors).

The impact of ICOs was massive: the emergence of new tokens enabled the creation of a startup ecosystem without the need for venture capital. Many investors profited by identifying and investing in early-stage projects (e.g., Ethereum grew from $0.31 to several hundred dollars in a short span of time).

As @0xChainMind noted, some token sales made history: ETH raised $18M in 2014 and later hit $4,800, NEO launched at $0.03 and peaked at $180, and EOS pulled in $4B—still the largest ICO ever. These early sales proved that early access to tokens could deliver life-changing returns.

Reasons for the Decline of ICOs: Regulation and the Howey Test

After the ICO boom, the market experienced a sharp decline. The primary reason was increased regulatory pressure. In the United States, the SEC (Securities and Exchange Commission) made it clear that many tokens are, in fact, securities.

SEC Chair Gary Gensler repeatedly stated: “Most crypto tokens are securities under the Howey Test.”

In other words, as his predecessor Jay Clayton said: “Without prejudging any particular token, most crypto tokens are securities.”

If a token is classified as a security, its sale must comply with securities laws—this includes financial disclosures and proper registration. Virtually no project that launched through an ICO followed these procedures. As a result, the SEC began targeting ICO projects. For example, in 2019 the Commission charged Kik Interactive with the unlawful sale of its Kin token, which had raised $100 million. The SEC argued that the company sold unregistered securities, and the court sided with the regulator: Kin tokens were deemed securities, and Kik Interactive was fined $5 million.

In 2020–2021, other high-profile cases followed. Telegram (TON) agreed to return $1.2 billion to investors and pay an $18.5 million penalty for promising to issue the Gram token without registration.

At the time, the SEC stated: “New and innovative businesses can operate in our markets—but not at the expense of registration requirements.”

Crypto lawyers regularly cite the Howey Test: almost all token sales were built on promises of future profit—a classic indicator of securities.

In addition, the SEC issued investor warnings. For instance, in its 2020 bulletin on IEOs, the regulator explained that IEOs are essentially similar to ICOs, only conducted through online platforms. If a crypto asset offering includes profit promises, then IEOs may also require registration like traditional securities.

All this led to a “freeze” of traditional ICOs in the U.S. Many projects either canceled their sales, moved operations abroad, or replaced ICOs with “private rounds” involving accredited investors. It wasn’t just about the fines: Block.one had to pay $24 million for the EOS ICO, Telegram $18.5 million for Gram/TON, and Kik $5 million for Kin. The risk of personal liability cooled the enthusiasm of many startup founders. And the SEC continued to emphasize: unregistered ICOs are violations of the law.

Airdrops Instead of Token Sales

In response to bans and legal risks, airdrops emerged as an alternative to ICOs. Instead of selling tokens for money, projects began distributing them for free in exchange for “loyalty” to the service—a practice that, at least on paper, does not equate to selling securities. Airdrops typically involve giving users tokens for free or in return for completing simple tasks. This serves both as a marketing strategy and a way to engage the community without raising capital directly.

As Cointelegraph notes, “airdrop campaigns are a way to increase a project’s visibility: give away coins for free, then watch their value rise. This boosts recognition, attracts users, and creates a secondary market.”

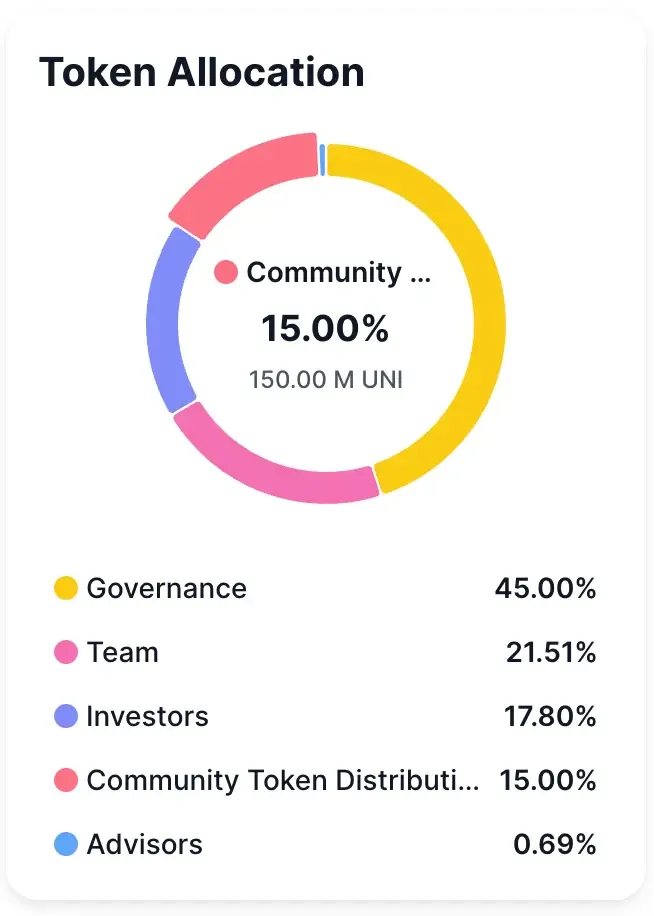

The Uniswap token airdrop is one of the most well-known and widely referenced examples of airdrop practices in the crypto community. In September 2020, Uniswap launched its governance token UNI and conducted a large-scale giveaway—400 UNI tokens were granted to every user who had interacted with the platform before September 1, 2020. At the time of launch, this was worth roughly $1,200 USD. At UNI’s peak price in May 2021, the value of those tokens reached approximately $16,000–$17,000 USD per account, making this airdrop one of the most profitable in Ethereum user history.

Thus, the Uniswap airdrop became a landmark event for the DeFi sector, demonstrating how blockchain projects can effectively incentivize and reward users while ensuring decentralization and scaling of the community.

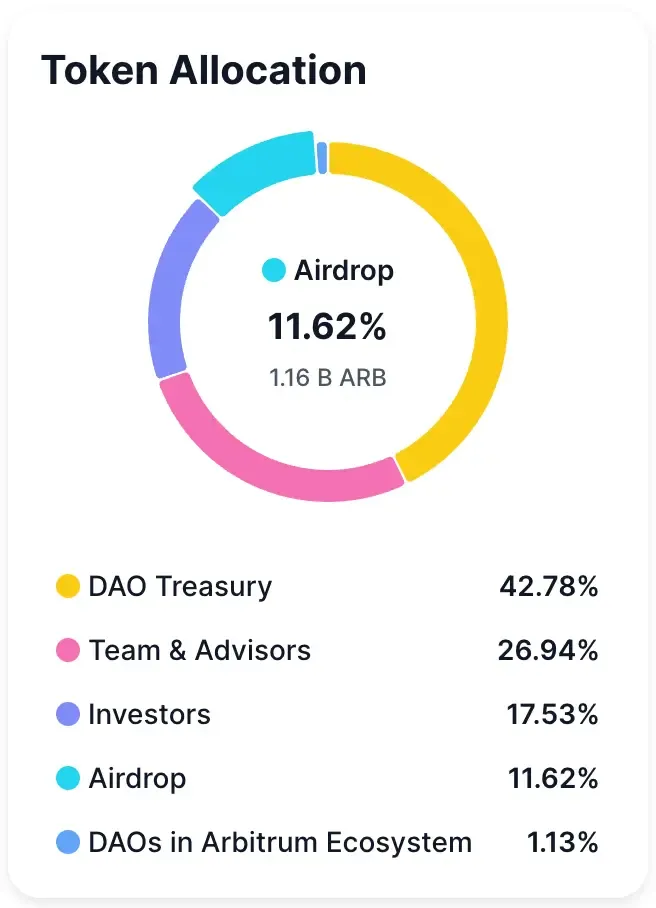

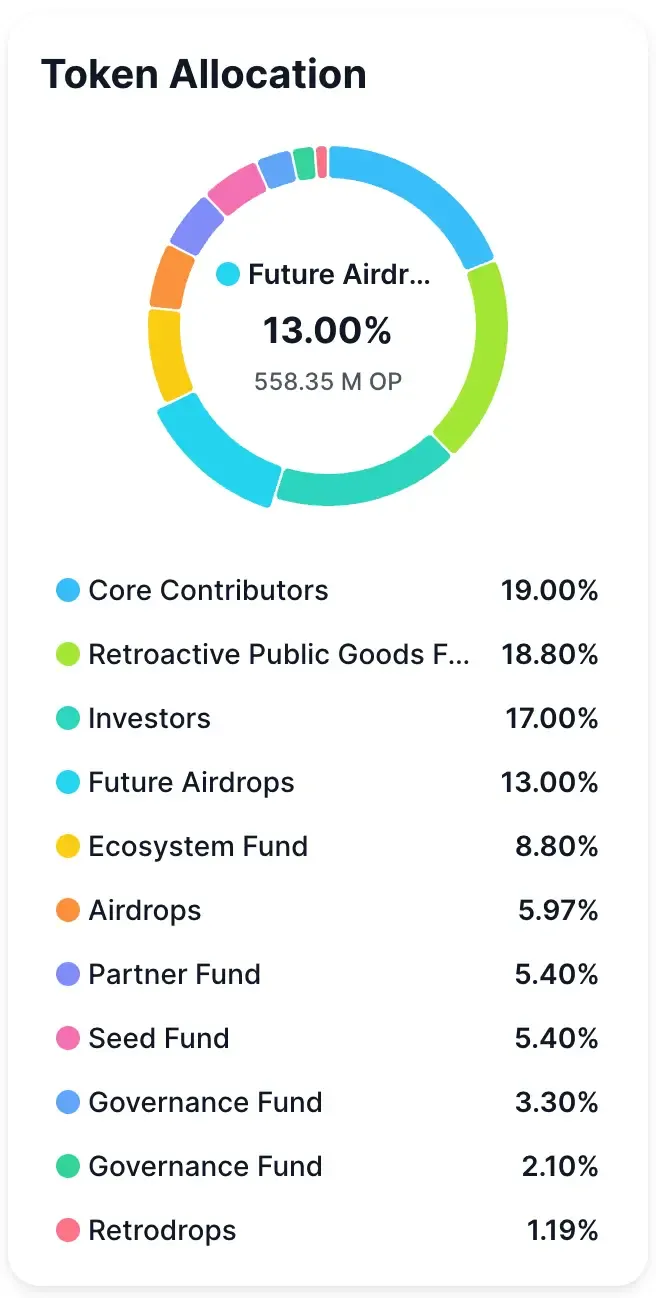

In 2022–2023, several prominent projects issued major airdrops. For example, Arbitrum launched its ARB token, allocating 11.5% of the total supply for distribution to active network participants.

Another notable case was Optimism, which conducted a similar airdrop of its OP token in spring 2022 and continues to reward active users of its network.

Why do projects do this? First, to avoid scrutiny from the SEC: giving away tokens is not formally considered a securities offering (since there is no direct exchange of money). Second, to expand reach: once a person receives tokens, they begin following the project and participating in its community.

As experts explain, airdrops function as a kind of marketing campaign: “ideal for new ecosystems without major VC backing. Information about an airdrop campaign can rapidly grow an audience, far faster than traditional advertising.”

Tokens tend to attract the general public—often at no cost. There have also been clear examples of attempts to sidestep regulations. Some projects explicitly excluded U.S. citizens from eligibility to receive tokens.

“If Americans are excluded, then technically it’s not an offer to U.S. residents,” some project founders assumed.

But the SEC has repeatedly stated that such workarounds may still be treated as fraud under U.S. law. Nonetheless, a trend has taken shape: projects now avoid direct public token sales and instead adopt more complex schemes (NFTs or airdrop points).

As a result, airdrops (and adjacent methods) have become a popular substitute for ICOs. This is evident in their scale. The aforementioned Arbitrum airdrop in early 2023 was one of the most anticipated events in the crypto community. Transitioning to governance tokens via free distributions has now become a core feature of mature DeFi projects.

The Return of the ICO Trend in 2025

Despite the prior downturn, ICOs are once again being discussed in 2025. The key drivers are a new crypto cycle, growing public interest, and a loosening grip from the SEC. Bitcoin has reached new all-time highs, institutional investors are pouring capital in via ETFs, and the potential for an Altseason (altcoin rally) gives renewed hope to the community. Experts note that the market looks fairly optimistic: capitalization is rising, DeFi activity is returning, and small investors are once again hungry for risk and yield. In this bullish environment, projects are seeking funding, and tokens offer a convenient instrument.

However, much has changed between 2017 and 2025. The world now remembers the risks and the scrutiny. Many ICOs today don’t launch “blindly” but rather follow well-considered models. For example, Plasma—a blockchain for stablecoins—announced a public sale of its XPL token using a new approach: investors must first deposit stablecoins into a designated pool, after which they gain the right to purchase XPL at a predetermined price. This structure incentivizes long-term commitment over short-term speculation. Startups also frequently implement strict KYC and country restrictions to avoid regulatory issues.

At the same time, retail investor interest has surged. This is partly due to the mainstream adoption of crypto: by 2025, hundreds of millions of people globally are using it. Analysts observe that U.S. Bitcoin ETFs have attracted large numbers of everyday users who had previously only observed crypto from a distance. These individuals now have free capital to invest and are interested in participating in token sales. Combined with a matured infrastructure (Ethereum and L2 networks are stable, and “safe” tools like Sonar/Echo have emerged), this has created a foundation for the ICO resurgence.

Indeed, some commentators claim we are witnessing a “new ICO boom” (albeit in a more restrained form). Yet, in a rising market, even modest amounts can create a buzz.

Moreover, as noted by Bitget, the name “ICO” matters less than transparency and trust: “Organizations can call it whatever they want—ICO or simply ‘token sale’—what matters is that it’s a way to engage with the community and raise funds transparently.”

In this context, secondary platforms are also gaining traction. For example, the Sonar platform by Echo (Cobie’s firm) was launched to enable secure public token sales that comply with regulatory standards. Sonar debuted during the Plasma ICO (June 2025)—covered in more detail below. This shows that the industry is trying to apply the lessons of 2017–2018 and make ICOs “regulator-ready.”

In summary, the return of the ICO trend in 2025 is driven by a confluence of a bull market, pent-up retail demand, and new tooling. As in previous cycles, this is happening locally: specific projects announce large ICOs and attract attention. The crypto community discusses these launches enthusiastically, and investors are willing to participate. However, this time around, everything is unfolding with stricter “sale ethics” (KYC, lock-ups, legal support) to avoid repeating past mistakes.

Notable Launches of 2025

Two major events in the summer of 2025 serve as clear illustrations of the ICO resurgence.

Plasma Token Sale

The Plasma project is building a blockchain designed for stablecoins. In June 2025, it conducted a public token sale of XPL on the new Sonar platform (by Echo/Cobie). The mechanism was unusual: first, investors deposited USDT/USDC/DAI into a “vault” on Ethereum and earned “points” (which determined allocation eligibility). Only afterward did the direct token sale begin: 10% of all XPL tokens were sold at $0.05 per coin, valuing the network at $500 million. The model aimed to reward committed contributors—the longer and larger your stablecoin deposit, the greater your share.

The allocation for Plasma’s ICO sold out at an astonishing pace. Within the first few minutes, the sale had already raised $500 million. Over 1,100 participants made deposits, and “whales” (the largest investors) took the lion’s share— the top 10 contributors accounted for 40% of the total raise. As a result of the overwhelming demand, the Plasma team expanded the funding cap from the original $250 million to $1 billion. Plasma ultimately raised the full $1B on Cobie’s Sonar platform, stunning the crypto world and establishing itself as a serious DeFi contender.

Pump.fun Token Sale

The second high-profile case involves the meme token launchpad Pump.fun, which operates on Solana. In July 2025, Pump.fun officially launched its $600M PUMP token sale, marking a bold leap from memecoin playground to major crypto contender. The PUMP token has a total supply of 1 trillion tokens, and 33% of that supply (125 billion tokens) was offered in the sale, which lasted only 12 minutes.

Notably, of this 33%, 18% was allocated to large investors and 15% to retail buyers. Leading exchanges such as Gate.io, Bybit, and Bitget participated in the sale and facilitated access for the general public.

The Pump.fun launch is a clear signal: mass-market ICOs are making a comeback.

According to Cointelegraph analysts, the successful PUMP sale “foreshadows the revival of ICOs that had been suppressed by regulatory pressure.”

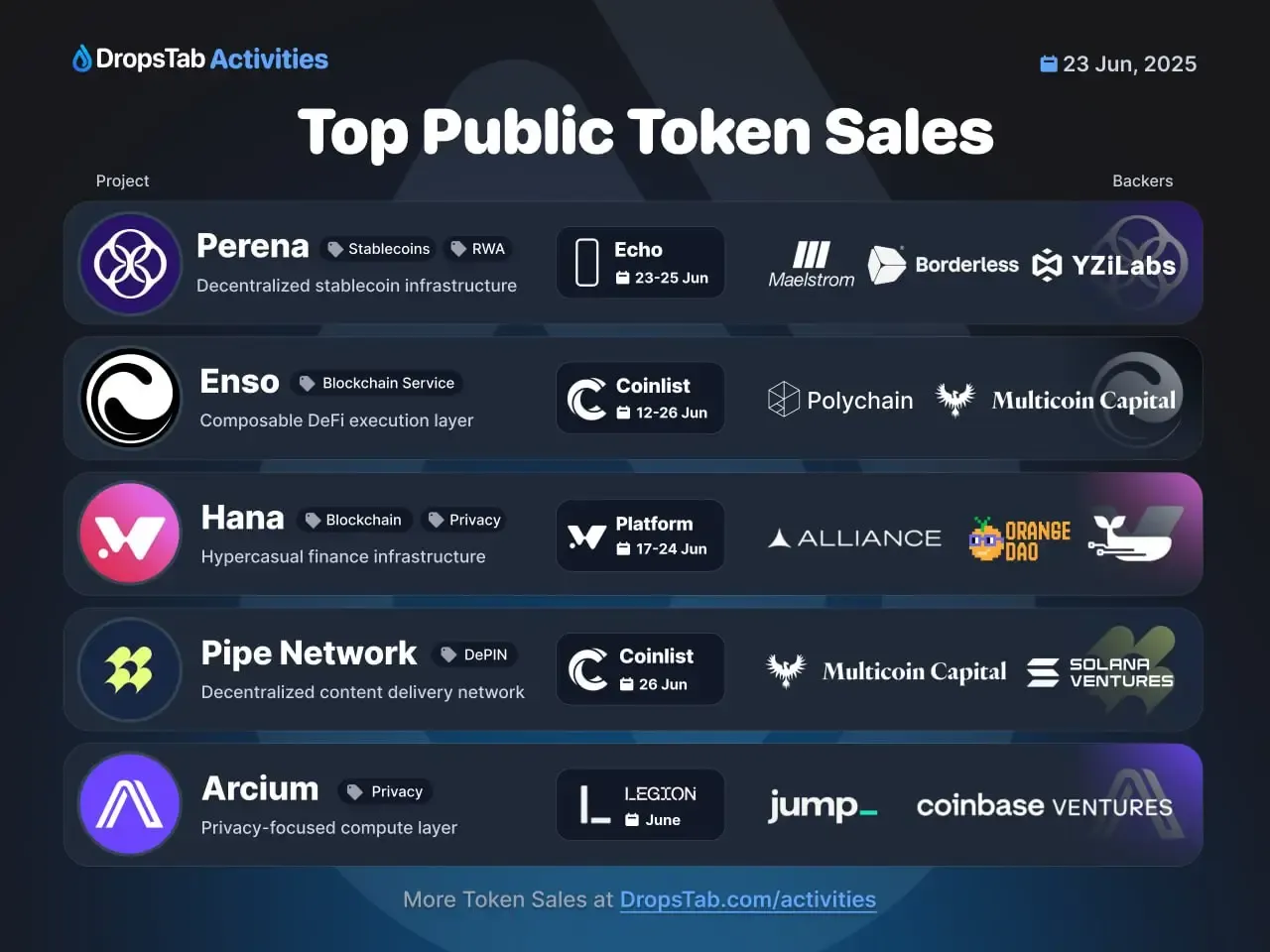

Other Notable Token Sales

- Another closely watched launch is already underway: Lombard’s Buidlpad sale raised $6.75M at a $450M FDV with no vesting and strong DeFi integrations—a structure that reflects how refined token sales have become in 2025.

- Kraken Launchpad also debuted with Yield Basis (YB), a Curve-backed project built by founder Mikhail Egorov. With a $60M crvUSD credit line and a mission to deliver sustainable Bitcoin yields without impermanent loss, the YB sale highlights how major exchanges are reshaping ICO infrastructure.

- Limitless, Base’s leading prediction market, recently completed a $1M token sale via Kaito Launchpad—attracting over $50M in commitments and spotlighting how fast prediction markets are becoming a serious DeFi vertical.

How to Participate in an ICO (Using CoinList as an Example)

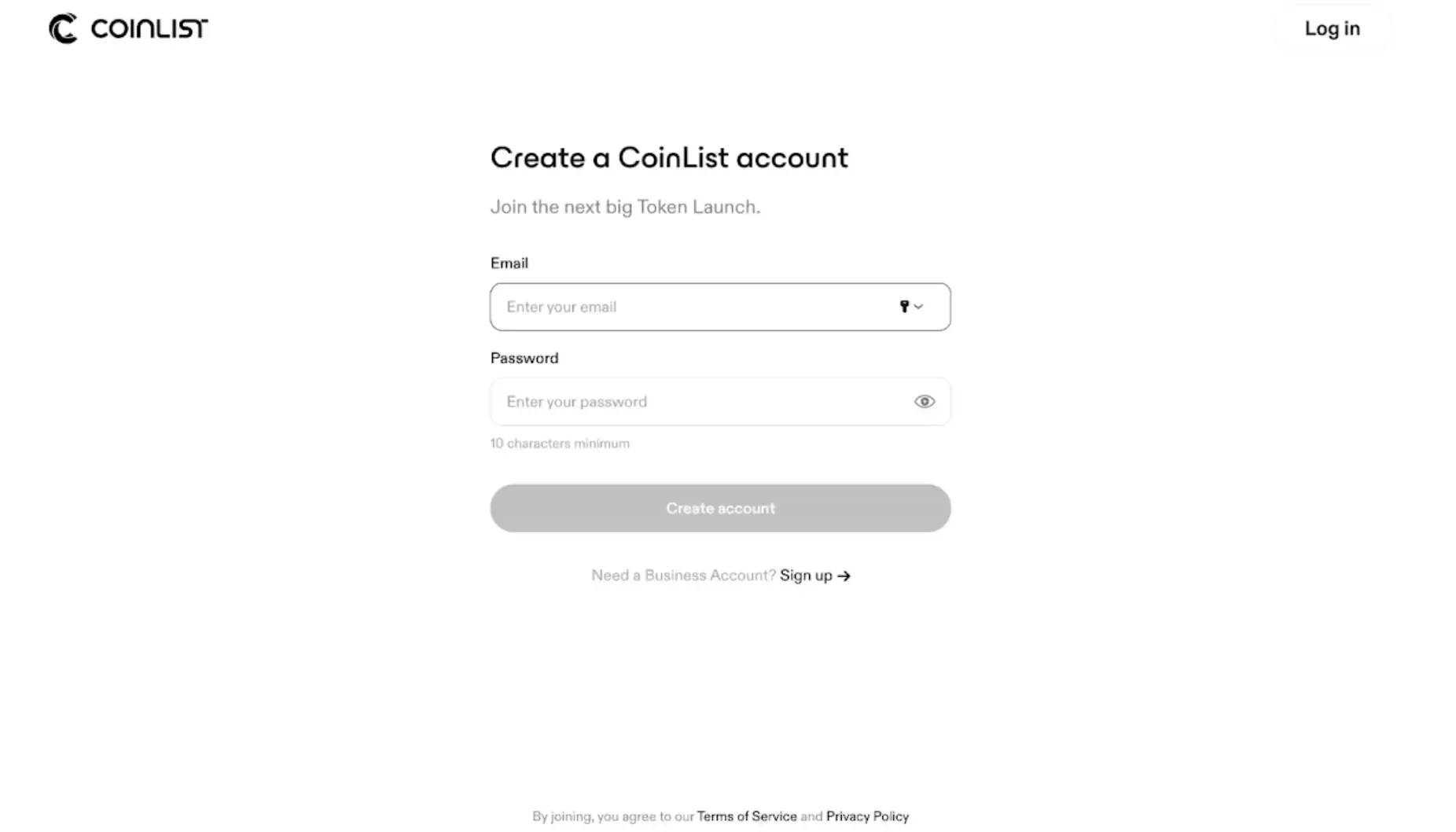

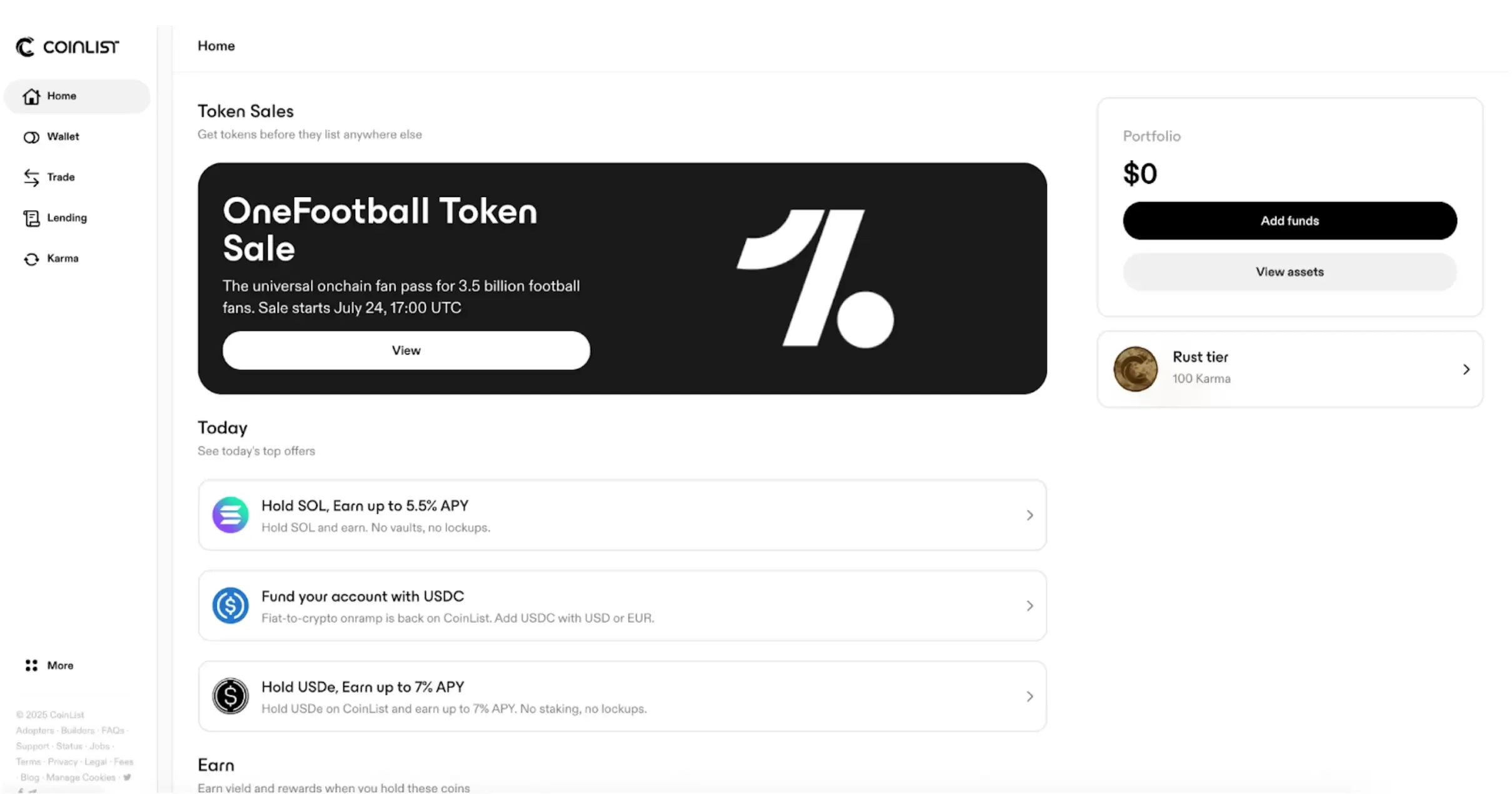

To participate in an ICO, you first need to register on the platform and prepare your account.

- Go to the CoinList website: https://coinlist.co/

- Click the Sign Up button

- Register on the platform

- After registration, complete KYC verification on the platform: https://coinlist.co/dashboard

- In addition to identity verification, you'll need to fund your internal wallet to participate in an ICO. In the Wallet section, follow the website instructions to deposit funds into your account.

- Once your wallet is funded, you can browse active or upcoming ICOs in the Dashboard section: https://coinlist.co/dashboard

CoinList has also released a mobile app. The team promises to add token sale support and additional features soon.

What’s Next for ICOs

The resurgence of ICOs in 2025 is not a random occurrence, but a clear trend. However, the outlook is mixed. On one hand, the success of Plasma and Pump.fun demonstrates that there is consumer demand for such initiatives. New standards and platforms (such as Sonar/Echo) are emerging, making the process more transparent.

On the other hand, regulators are still hesitant to give crypto startups full freedom. For ICOs to become “legal,” new legislative measures may be required. For example, in the U.S., discussions are underway about allowing only “utility” tokens to be launched through approved platforms. In the European Union, the MiCA framework—already in effect—provides a regulatory regime for crypto-assets that could potentially define a new “safe path” for ICO-style offerings in European jurisdictions. Meanwhile, some major players are opting for traditional routes instead—pursuing IPOs to raise institutional capital, gain legitimacy, and scale globally.

As noted by @0xChainMind, token sales in 2025 are not only more competitive—but also more accessible. Many projects now skip VC-only rounds in favor of rewarding real users through airdrops, testnet points, and TGE listings. For those who are early, active, and selective, the upside remains very real.

ICOs are evolving in form but not disappearing. The 2017–2018 period proved that the idea of decentralized fundraising is in demand but needs legal refinement. Today’s ICOs are an attempt to combine the spirit of openness with modern standards of transparency. One thing is clear: demand for crypto assets and the desire to streamline funding into innovative startups will persist.

You can track all major ICOs worth your attention in the Activities section: https://dropstab.com/activities