Alpha

MegaETH Token Sale on Sonar

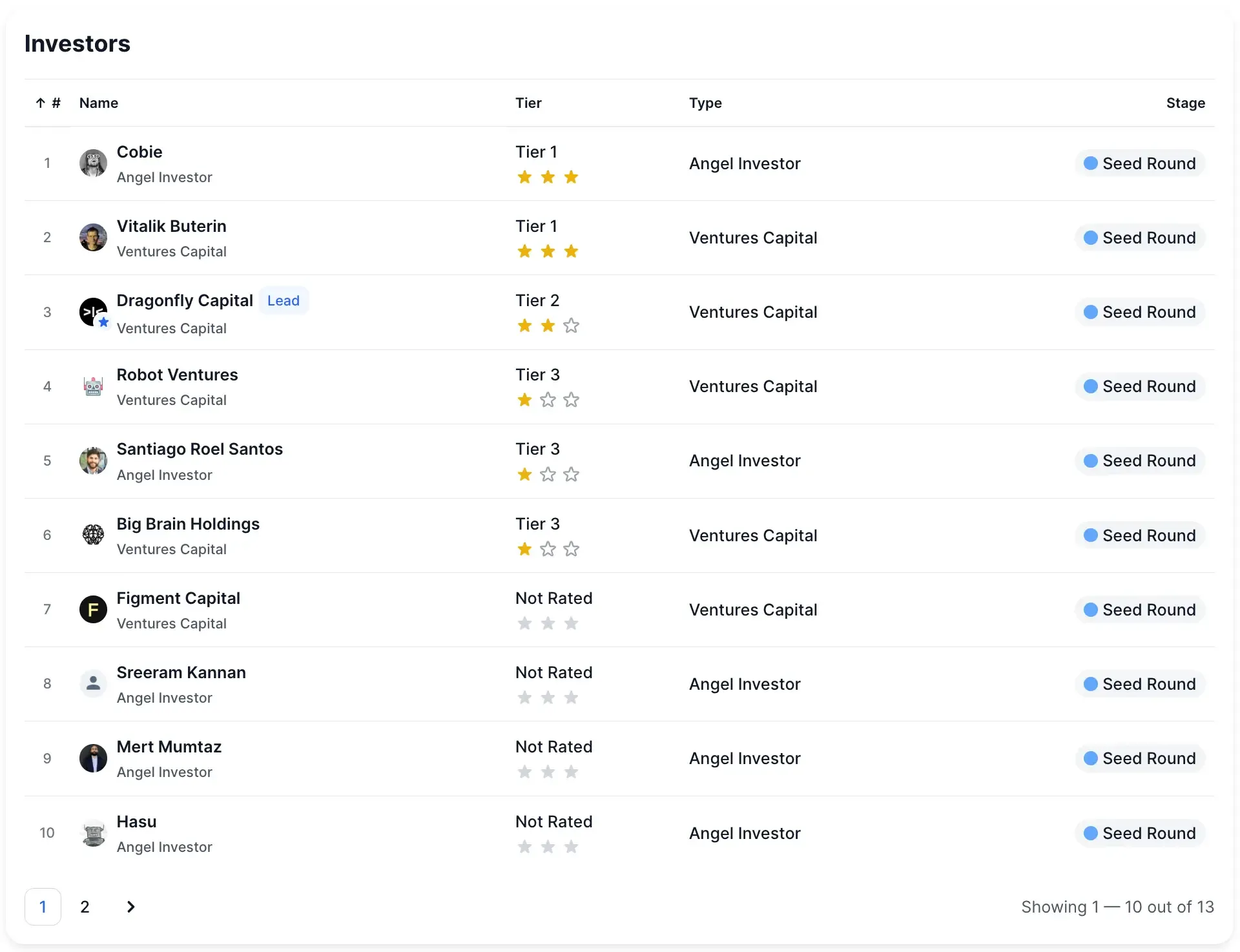

MegaETH, a high-speed Ethereum Layer 2 backed by Vitalik Buterin and Dragonfly Capital, is gearing up for its token sale on Cobie’s Sonar platform — a pivotal step toward its real-time blockchain vision.

Quick Overview

- Sonar sale opens to public with KYC.

- Backed by Vitalik Buterin, Dragonfly, and top-tier investors.

- Raised $57M through seed, community, and NFT rounds.

- MegaETH targets 100,000+ TPS with sub-millisecond latency.

- Aims to redefine Ethereum scaling with real-time execution.

About MegaETH Sale on Sonar

The project is gearing up for its public sale on Sonar, a new platform spun out from Echo, both founded by Jordan Fish (Cobie). If Echo was the testbed, Sonar is the stage.

- Registration opened: October 15, 2025

- Registration closes: October 27, 2025

- Registration link: token.megaeth.com

- Platform account required: Sonar (Echo) account needed to participate

- Payment method: USDT on Ethereum mainnet

- Discount option: 10% for one-year lockup participants

- U.S. investors: Must be accredited, with mandatory 12-month lockups

- KYC: Mandatory for all participants

- Restricted countries: Afghanistan, Belarus, Bosnia and Herzegovina, Burkina Faso, Cameroon, Central African Republic, China, Cuba, DR Congo, Ethiopia, Eritrea, Iran, Iraq, Lebanon, Libya, Mali, Myanmar, North Korea, Palau, Russia, Somalia, Sudan, Syria, Ukraine, United Kingdom, Venezuela, Yemen

- Allocation notice: Registration does not guarantee allocation and does not obligate participation

- Sale focus: Prioritizes verified, authentic users over airdrop farmers

Echo and Sonar Platform Context

Echo launched in March 2024 and has already helped raise over $100 million for more than 30 projects. It built a reputation for curated, high-speed rounds that balanced retail inclusion with strict quality control.

Sonar turns that model outward. It’s a public, founder-controlled sale platform, allowing open participation while maintaining control over pricing, lockups, and allocation logic. Think of it as Echo’s public mirror — same credibility, broader reach. The system uses English auctions with fixed ceilings and time-weighted deposits to reduce gas spikes and bot-driven sniping.

A few months before MegaETH’s listing, Plasma held its own XPL token sale on Sonar — a high-profile event backed by Tether and Cobie himself. That campaign, built around transparent mechanics and fair allocation, set the tone for what Sonar aims to be: a platform where verified users — not insiders — get early access to major projects.

Funding Timeline

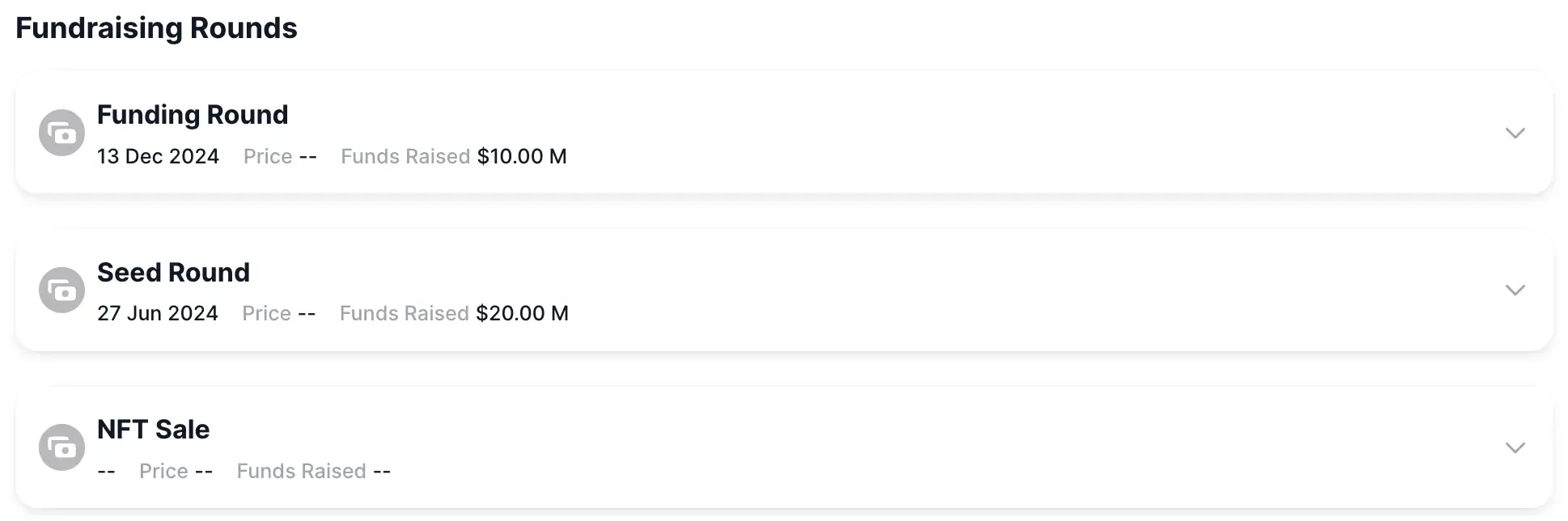

MegaETH’s funding story reads like a roadmap of conviction — early believers, viral community energy, and a dash of controversy that only made it more visible.

It began on June 27, 2024, with a $20 million seed round led by Dragonfly Capital. This wasn’t your typical anonymous VC roster. Among the backers were Vitalik Buterin, Joseph Lubin of ConsenSys, and Sreeram Kannan, the mind behind EigenLayer. That mix alone signaled how deeply MegaETH was plugged into Ethereum’s inner circle. The round closed at a $100 million post-money valuation, setting a confident tone for what came next.

Then came the community. On December 13, 2024, MegaETH opened a $10 million Echo round — and the response was explosive. The first $4.2 million sold out in 56 seconds. The team added another $5.8 million, gone in just 70 seconds more. Roughly 3,200 investors from 94 countries joined in, averaging $3,140 each. For a testnet-stage Layer 2, that kind of grassroots traction was rare — almost cult-like.

But the headline that truly split opinions came a few months later. In February 2025, MegaETH raised $27 million through an NFT drop called “The Fluffle.” Ten thousand soulbound NFTs, priced at 1 ETH apiece, tied to 5% of total token supply. The math implied a $540 million fully diluted valuation, and not everyone was thrilled. Critics called it a “stealth ICO.” Supporters saw a creative way to involve early believers without the usual token farm rush. Either way, it worked — and it made sure everyone in crypto was suddenly talking about MegaETH.

Market Position

MegaETH is entering a Layer-2 arena already dominated by heavyweights like Base ($3.6B TVL), Arbitrum ($2.9B), and zkSync ($4.0B) — each with its own narrative. Base thrives on Coinbase’s ecosystem and DeFi hits like Aerodrome and Morpho Blue. Arbitrum still leads in composability and active users, while Optimism builds out its Superchain vision. Against them, MegaETH sits in testnet — zero TVL for now, but also zero baggage.

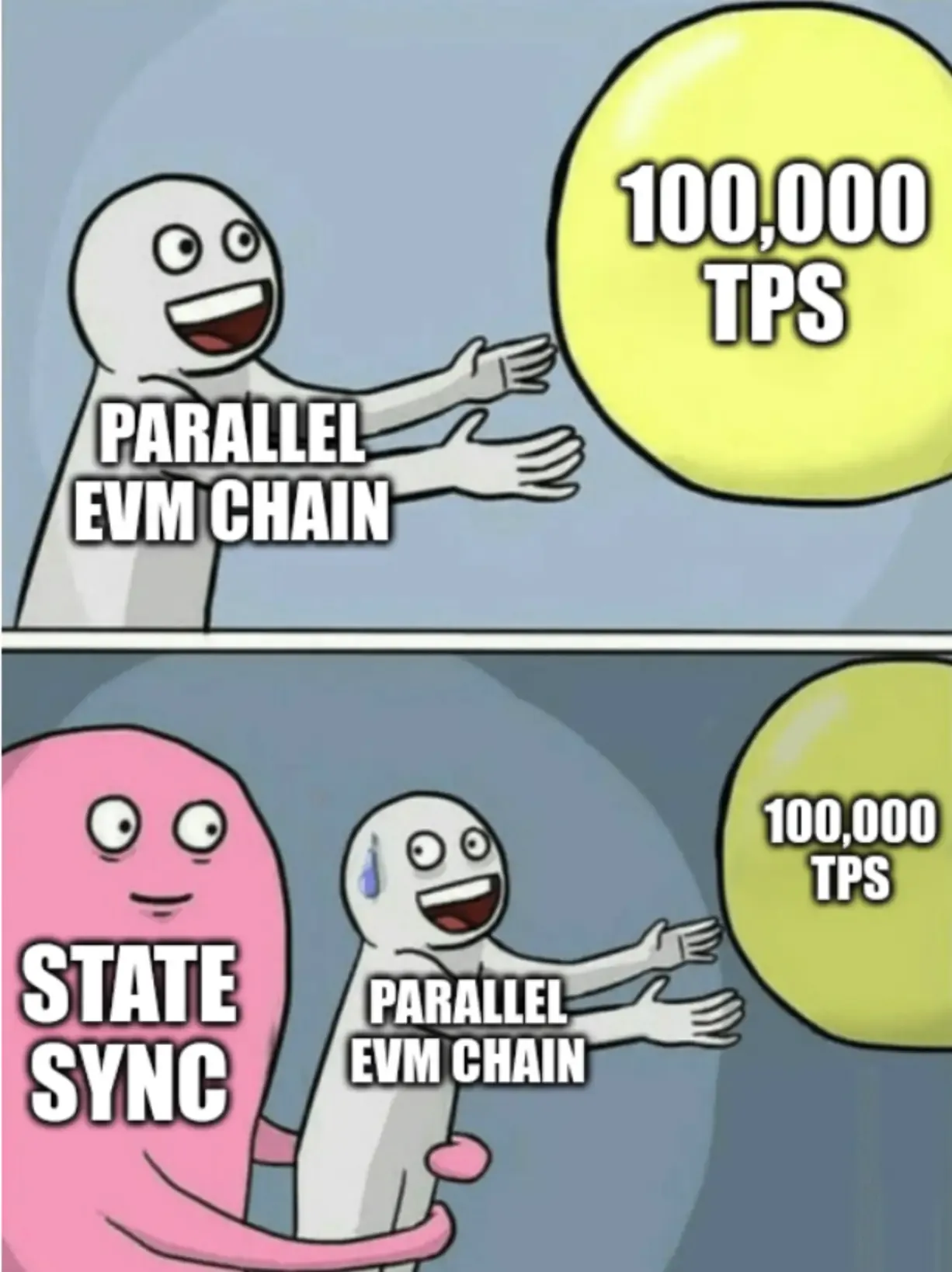

Its angle is clear: real-time performance. Where rivals process transactions in seconds or hundreds per second, MegaETH targets 100,000+ TPS and 10-millisecond block times, a speed gap that could redefine how Ethereum apps feel to use. zkSync remains its closest rival in both tech and scale, but MegaETH’s focus on responsiveness — the kind needed for high-frequency trading, real-time gaming, and interactive dApps — makes it a different beast entirely.

A similar pattern is playing out beyond L2s. Zama’s recent public auction — priced at a $55M FDV versus its $1B VC valuation — showed how demand for infrastructure-heavy projects can surge when pricing is transparent and access is broad. Its sealed-bid Dutch format reinforced a trend: investors want fair discovery, not insider-preloaded valuations.

Community sentiment mirrors that tension. Enthusiasts point to the $57M total raise — tiny next to zkSync’s $4.2B or Starknet’s $19.5B — as proof of restraint and engineering focus. Vitalik Buterin’s endorsement only reinforces that perception. Critics, meanwhile, still question the Fluffle NFT sale, calling it a “disguised ICO.” With mainnet expected between late 2025 and early 2026, some worry the team might time exits with the bull market rather than push through to full deployment.

Yet confidence among backers like Dragonfly Capital and Robot Ventures remains firm, and retail interest is still strong — the Echo round’s 56-second sellout says it all. For now, the mood is one of guarded optimism. MegaETH has the vision and backing; what it needs next is proof that real-time blockchain isn’t just fast — it’s feasible.

Strategic Outlook

If MegaETH can turn its “real-time blockchain” pitch into reality, it won’t just be another Layer-2 — it could reset how crypto matches the speed of traditional systems. Its architecture targets Web2-level responsiveness, aiming for instant transaction feedback loops that financial apps, traders, and gamers have long wanted but never had on-chain.

One of its boldest moves is the integration of USDm, a yield-bearing stablecoin developed with Ethena Labs. Instead of relying on inflationary rewards, MegaETH plans to fund network operations through programmatic yield, keeping gas fees low while sustaining validator incentives — a model that blends DeFi economics with network sustainability.

If the mainnet launch delivers, MegaETH could mark the moment Ethereum scaling finally feels instant. If not, it will still stand as one of the most daring experiments in blockchain performance — proof that even the fastest chains still need trust to keep up.