Crypto

Why Bitmine Is Buying Ethereum So Aggressively

Bitmine has quietly become one of the largest Ethereum holders in the world. This article breaks down how it accumulated 4.2M ETH, what it paid, how dilution funds the strategy, and why the bet hinges on Ethereum’s institutional future.

Quick Overview

- Bitmine holds ~4M+ ETH, equal to ~3.5% of total Ethereum supply

- The company accumulated 1.35M ETH in ~3.5 months, targeting 5% ownership

- ETH was bought mostly through equity raises, causing heavy dilution

- Reported cost basis ranges from ~$3000 to ~$4,000 per ETH, a major risk variable

- The strategy works only if ETH price growth outpaces dilution

Bitmine’s Ethereum Holdings and Accumulation Pace

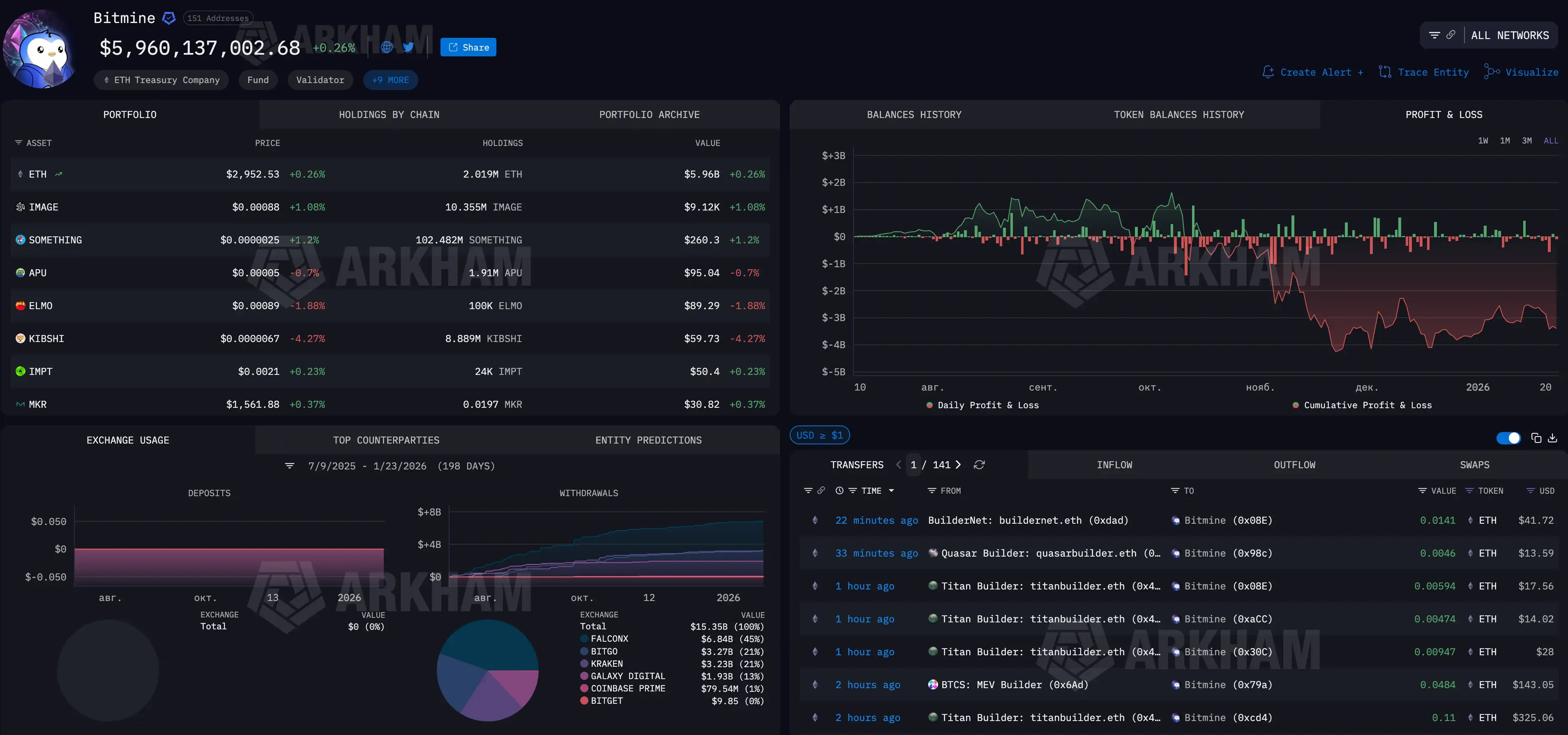

As of January 20, 2026, Bitmine Immersion Technologies’ Ethereum holdings total 4,203,036 ETH. At a Coinbase price of $3,211, this Ethereum is worth about $13.5 billion. That makes it a major part of the company’s balance sheet.

Ethereum’s circulating supply is around 120.7 million ETH. Bitmine’s ETH holdings equal roughly 3.48% of all ETH that exists today. No other publicly traded company owns anywhere near this amount. Most hold less than 2%.

In simple terms, one company controls almost three and a half percent of Ethereum. So, how much Ethereum does Bitmine own? As of January 2026, the answer is 4,203,036 ETH.

Bitmine has publicly confirmed this position.

The increase in Bitmine’s Ethereum holdings accelerated after the company changed its strategy in June 2025. The fastest period was from October 11 to January 19, which is about 3.5 months. During that time, the company bought 1.346 million ETH, or around 380,000 ETH each month.

Some of the buying happened in short bursts. According to Chairman Tom Lee, Bitmine bought 35,268 ETH in just one week in mid-January. This shows the company was actively adding ETH, not buying slowly over time.

If this pace continues, Bitmine could reach its 5% ownership goal, or about 6.0 million ETH, within 12 to 18 months.

Where the Risk Comes From for Bitmine

One number matters most for Bitmine: the price it actually paid for its Ethereum. This average cost tells us whether the company has a safety cushion or is already taking risk.

Bitmine says it paid about $2,840 per ETH on average by late November 2025. If this is true, the company is slightly in profit at current prices, and the value of its ETH is close to the value of the whole company.

Some independent analysts disagree. Based on public data showing $12.934 billion spent to buy 2.857 million ETH by October 11, 2025, they estimate the average price was closer to $3,997–$4,000 per ETH. If that higher number is correct, Bitmine would now be facing more than $4 billion in unrealized losses.

This difference is important. A lower cost means Bitmine bought ETH carefully and has more room if prices fall. A higher cost means the company needs ETH prices to rise just to break even. So far, Bitmine has not shared a detailed list of transactions to clearly explain which number is correct, leaving investors with uncertainty about the real state of the treasury.

Bitmine’s Ethereum position can also be observed through its public portfolio on DropsTab, which tracks holdings, average price, and unrealized profit in real time.

Tom Lee and Bitmine’s Ethereum Strategy

Tom Lee became Chairman of Bitmine in June 2025, giving him direct control over capital allocation and treasury strategy. Bitmine’s Ethereum purchase strategy reflects Lee’s conviction that early, large-scale ownership matters as Ethereum becomes institutional infrastructure. That belief underpins the pace of buying and the explicit goal of reaching 5% of total ETH supply.

That view is increasingly echoed by large financial institutions. In January 2026, Bitmine pointed to BlackRock’s tokenized credit products being built exclusively on Ethereum, citing comments from BlackRock CEO Larry Fink that a single dominant blockchain is likely to underpin future financial infrastructure.

In Bitmine’s view, that chain is Ethereum — reinforcing the logic behind its large and fast-moving ETH treasury strategy.

How Bitmine Uses Its Scale Beyond the Balance Sheet

In January, Bitmine announced a $200 million investment into Beast Industries, the company behind MrBeast. The deal closed on January 19.

While the investment is not an Ethereum purchase, it shows how Bitmine is thinking beyond passive treasury management. Beast Industries controls one of the largest content distribution platforms in the world, reaching hundreds of millions of users globally.

Shanaka Anslem Perera described the move this way: “This isn’t a crypto company buying marketing exposure. It’s buying the distribution channel.”

For a company that already holds the largest publicly disclosed Ethereum treasury, the deal signals an attempt to pair balance-sheet scale with direct access to mass distribution, rather than relying solely on financial market adoption.

How Bitmine Built Its ETH Position

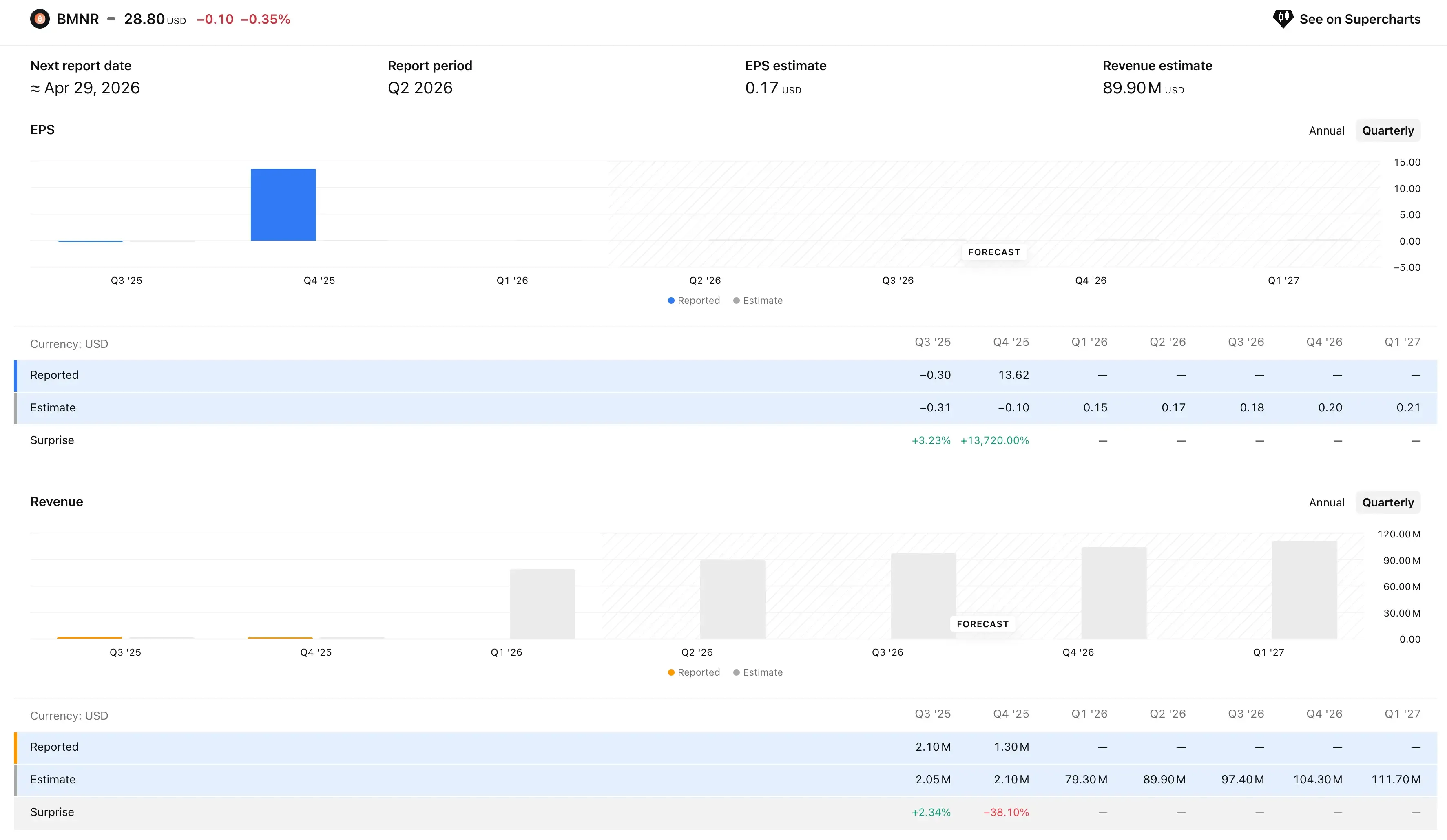

What is Bitmine Immersion? The company abandoned its mining business in 2025 and fully shifted to managing crypto assets. Mining revenue collapsed: self-mining fell from $484,000 in Q3 2024 to just $2,000 in Q3 2025. After that, the company began winding down operations and stopped investing in infrastructure.

Today, Bitmine Immersion makes money mainly by accumulating Ethereum and preparing to earn staking yields. Its results depend mainly on ETH price movements, staking yields, and the ability to raise capital through equity issuance, rather than on traditional operating performance.

Bitmine’s public communications reinforce this positioning. In January 2026, the company echoed comments from Binance founder Changpeng Zhao, who said crypto could enter a “supercycle” in 2026. Bitmine publicly agreed, framing Ethereum as a core beneficiary of renewed institutional and retail interest.

In this model, sustained bullish sentiment around Ethereum and the broader crypto market is not just narrative — it directly supports Bitmine’s ability to continue building its ETH position.

Bitmine built its Ethereum treasury mainly by selling new shares, not by taking on debt. In 2025, the company raised more than $615 million, almost entirely through equity offerings.

The largest raise was a $250 million private placement in July 2025, which increased the share count by about 13×. In September, Bitmine raised another $365.24 million by selling new shares and warrants. The company also set up a $20 million at-the-market (ATM) program, which allows it to sell shares gradually when conditions are favorable.

This funding was used to build Bitmine’s Ethereum treasury holdings, adding roughly 1.35 million ETH. Bitmine’s reported earnings are still small, and the company does not generate enough operating cash to pay for these purchases on its own. Management has avoided borrowing money, choosing equity instead, even though this increases the number of shares. As a result, shareholder returns depend on Ethereum’s price rising faster than the share count grows.

As long as capital markets stay open and ETH trends higher, Bitmine can keep converting equity into coins. But every raise spreads that ETH across more shares. The upside leaks unless price acceleration compensates.

That’s the quiet cost of the strategy.

Staking Strategy (MAVAN)

Bitmine plans to make extra money by staking its Ethereum using a system called MAVAN. The company expects MAVAN to start working in early 2026. If Bitmine is able to stake all of its roughly 4.2 million ETH, it estimates this could generate up to $374 million per year at current rates.

Right now, MAVAN is not fully running. Only part of the ETH is being staked through outside providers. This means staking is a possible future benefit, not guaranteed income, and it depends on whether Bitmine can launch and operate MAVAN successfully.

Early data suggests staking has already begun at scale. On January 7, 2026, crypto analyst Sjuul of AltCryptoGems noted that Bitmine had staked roughly 771,000 ETH in just two weeks, representing about 18.6% of its total holdings at the time.

“This isn’t just ETH bought with dollars — they’re now earning ETH through staking rewards as well,” Sjuul wrote, citing CryptoQuant data.

Conclusion

Bitmine (BMNR) can be a good investment if Ethereum becomes widely used by large institutions.

The company has one main goal: to own a large amount of Ethereum. As of January 2026, Bitmine controls 3.48% of all ETH and plans to increase this to 5%. This level of ownership is rare and matters if Ethereum turns into an important part of the financial system.

The idea is simple. Bitmine succeeds if the price of Ethereum rises faster than the number of company shares increases, and if the company can keep buying ETH through staking and access to markets. If Ethereum adoption slows down or dilution grows faster than the ETH price, the strategy does not work.

For investors asking how to invest in Bitmine, buying BMNR shares offers direct public-market exposure to Ethereum, BitMine Immersion Technologies (BMNR) is one of the most direct choices available.