Alpha

Zama Public Auction

Zama’s public auction offers entry at a $55M FDV—over 94% below its $1B VC valuation. Here’s how the sealed-bid sale works and why demand may run far higher.

Quick Overview

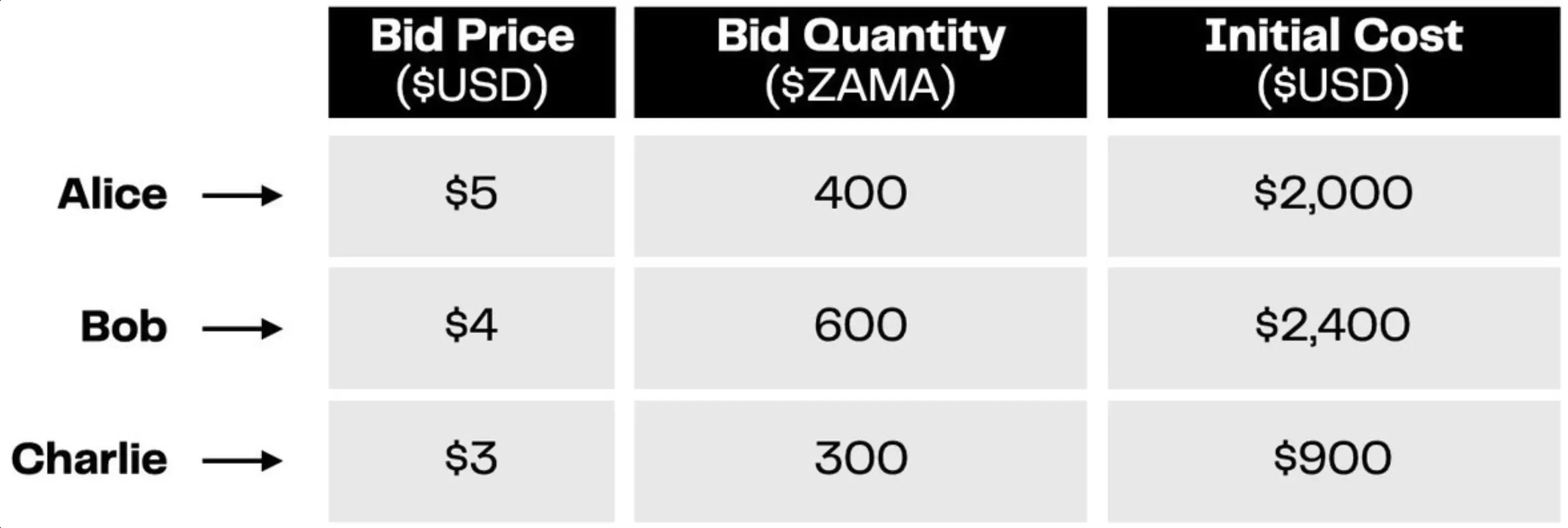

- Zama is auctioning 1.1B ZAMA at a $0.005 floor, a $55M FDV versus its $1B VC valuation.

- A sealed-bid Dutch auction: bid high to secure allocation; all winners pay one clearing price.

- Clearing is likely above the floor, supported by Hyperliquid pre-market and infra-token demand.

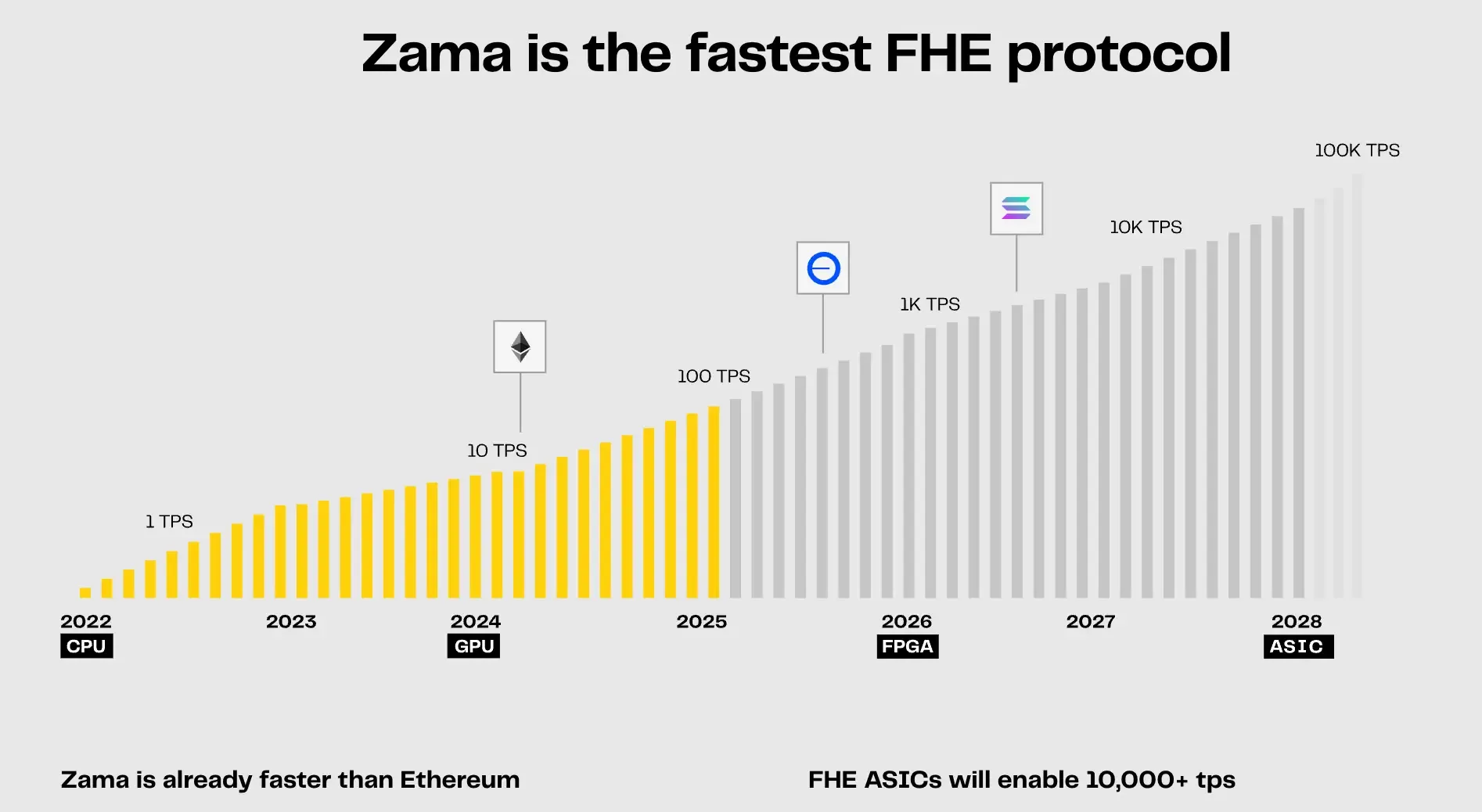

- Zama leads FHE performance (1 TPS → 10k+ TPS roadmap), positioning it as crypto’s confidentiality layer.

- Users shield stablecoins, bid Jan 12–15, and receive unlocked tokens on Jan 20.

Zama ICO at a $55M Floor

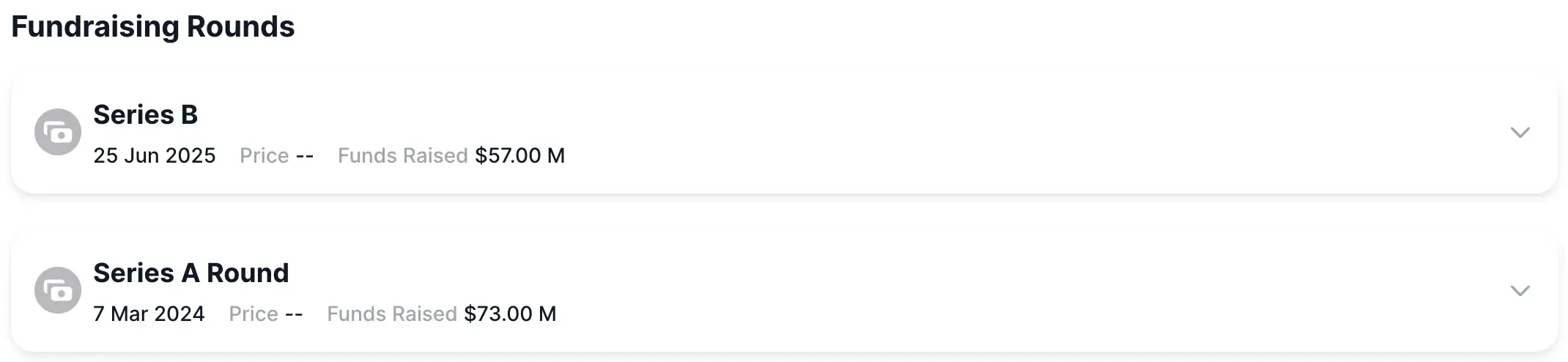

Zama’s June 2025 Series B pushed the company into unicorn territory — $1B+ valuation, Pantera and Blockchange leading, and more than $150M raised across its lifecycle. So you’d expect the public sale to price close to that orbit.

Instead, the auction floor drops the token at $0.005, which implies a $55M FDV. A 94%+ discount to where VCs stepped in. The spread is almost surreal unless you remember how this works: private rounds are priced for uncertainty, for the headaches of pre-mainnet risk. The public auction lands after the mainnet shipped.

How the Zama Sealed-Bid Auction Works

Zama uses a single-price sealed-bid Dutch auction — a format normally reserved for sovereign debt — because it forces every participant to bid without seeing anyone else’s numbers. In a market where mempool visibility and MEV distort most token sales, it’s one of the few mechanisms where bidding higher increases your odds but never increases your final price.

From Shielding → Bidding → Clearing

Participants first shield USDC, USDT, or DAI into ERC-7984 confidential tokens using the Zama app or Bron.org. Only the deposit is public; everything after that becomes encrypted. Many bidders shield extra to avoid signaling their real intent.

When bidding opens (Jan 12–15), each user submits an encrypted bid. The chain sees ciphertext only — no quantities, no prices. Every winner pays the same clearing price, the lowest winning bid.

After the auction closes, bids are sorted from highest to lowest until the 1.1B ZAMA allocation is filled. Bid high and you get filled; bid too low and you get nothing; everyone who wins pays the clearing price.

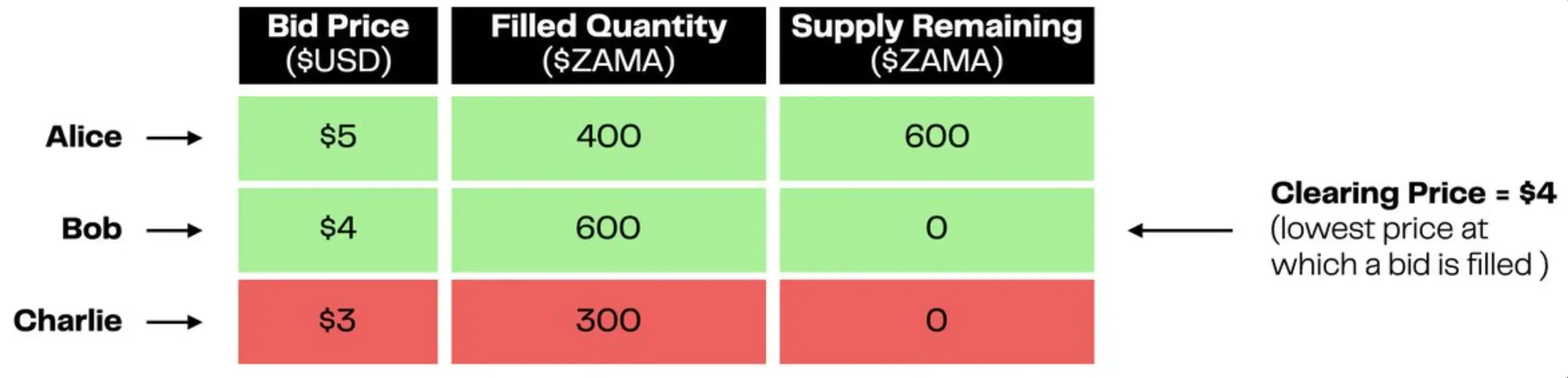

Example: What the Clearing Price Looks Like

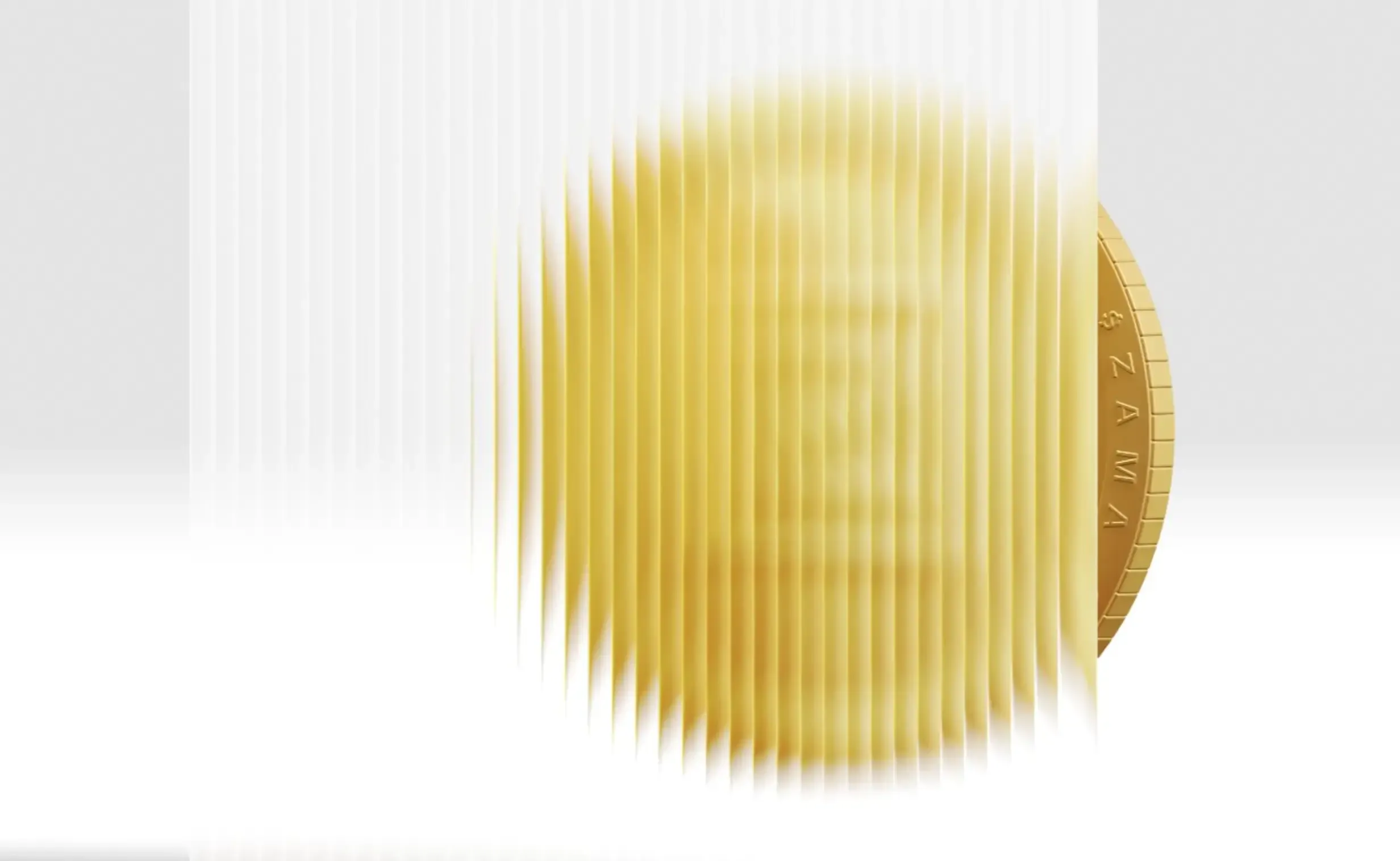

To make the logic intuitive, imagine three bidders — Alice, Bob, and Charlie — competing for 1,000 ZAMA tokens.

Demand exceeds supply, so the contract fills highest bids first:

Bob’s $4 bid is the lowest winning price, so the clearing price becomes $4.

Next, everyone’s final cost is recalculated at that clearing price:

- Alice receives her 400 tokens and a $400 refund.

- Bob pays exactly what he bid.

- Charlie receives a full refund because his $3 bid fell below the clearing level.

After the clearing price is published on Jan 19, all tokens unlock immediately on January 20 — no cliffs, no vesting, no staged release.

Zama Price Dynamics

The $55M floor is exactly what it sounds like: a minimum. No one genuinely believes it reflects expected demand. Early pre-market chatter on Hyperliquid already points at much higher price regions. Some funds treat $0.02 as the rational baseline.

We saw a similar pattern just a few weeks ago with MegaETH token sale on Cobie’s Sonar platform, where a Vitalik backed real-time Ethereum L2 drew heavy demand after showcasing 100,000+ TPS performance targets — a reminder that the market is still willing to pay up for genuinely differentiated infrastructure.

And you can feel a similar market momentum building around other high-performance plays too — for example, MegaETH’s upcoming token sale on Sonar, where a Vitalik-backed, real-time Ethereum L2 is pushing toward 100,000+ TPS and setting its own expectations for what next-generation infrastructure should look like.

To get a feel for the ranges, imagine five anchor points:

- $0.005 → the floor, a 94% discount to the VC round. A bizarrely low number for a post-mainnet FHE protocol.

- $0.01 → doubles the raise and still leaves buyers at an ~89% discount.

- $0.02 → roughly $220M FDV, around 78% below where Series B priced Zama.

- $0.05 → the institutional “comfort zone,” around $550M FDV, still far below VC entry.

- $0.09 → where public buyers begin overlapping with Series B valuation — the psychological ceiling for many.

What matters isn’t memorizing these numbers but noticing the shape of the curve: bidders placing sealed bids above $0.01–$0.02 capture most scenarios, whether the auction runs hot or cool. If demand is explosive, they still pay the clearing price. If demand collapses toward the floor, they inherit far more upside.

Zama Sale Exit Scenarios

Buyers are effectively betting that Zama will be valued far closer to its $1B private-round pricing than the $55M auction floor, with upside if FHE becomes essential infrastructure and downside capped near the floor if adoption stalls. Clearing anywhere between $0.01–$0.10 reflects that spread: a venture-style wager that Zama becomes the default confidentiality layer rather than a speculative trade. Anyone participating should view this as a multi-year bet on FHE’s relevance, not a short-term price game.

And this is where the real thesis emerges. Zama isn’t just earlier — it’s faster. Much faster. Its FHE engine already outpaces Ethereum-level throughput and is accelerating toward ASIC-powered performance that competitors simply can’t match.

1 TPS (2022) → 10 TPS (2024) → 100 TPS (2025) → 1,000+ TPS (2026) → 10,000+ TPS with ASICs.

This curve is what underpins the belief that Zama could evolve into the default FHE backend for crypto, and why the auction’s $55M floor may look absurdly low in hindsight.

How to Participate in Zama ICO

1. To join the auction, load your wallet with USDC, USDT, or DAI on Ethereum mainnet, then shield those funds into ERC-7984 via Zama auction portal or Bron.org.

2. Once shielded, submit your sealed bid during the January 12–15 window — the amount stays encrypted until settlement.

3. After bidding closes, simply wait for the clearing price announcement around January 19. If your bid qualifies, you’ll be able to claim your unlocked ZAMA tokens starting January 20.

Conclusion

This auction is a bet on one thing: Zama becoming the default FHE layer for crypto. Among all contenders, it’s the clear favorite — the only team with a running mainnet, real funding, and years of lead time.

The goal for participants is simple: enter at a valuation far below the VC rounds and hold long enough for the market to decide whether FHE becomes essential infrastructure.