Crypto

Bitcoin Ecosystem in 2025: Key Insights

Bitcoin’s ecosystem in September 2025 shows strength on all fronts—price steady near $108K, record ETF inflows fueling adoption, and new layers like Lightning, Stacks, Ordinals, and Runes turning it from digital gold into a full-stack network.

Quick Overview

- Bitcoin holds near $108K in September after August’s $124K peak and pullback

- Market dominance sits around 57% despite capital rotation into altcoins

- Spot ETFs drew $35B+ in 2025, pushing AUM toward $150B

- Corporates like MicroStrategy and Tesla deepen treasury exposure

- Layer-2 growth accelerates with Lightning payments, Stacks DeFi, Ordinals NFTs, and Runes tokens

Market Overview – Price, Dominance, and ETF Flows

Bitcoin is holding around 108,000 dollars in early September, a level traders keep circling back to after the August shakeout. Buyers have stepped in each time the tape dipped under that line, treating it as psychological support. Remember, just a few weeks earlier the market pushed to a new high at 124,533 before giving back six and a half percent into month-end. That retrace also weighed on listed crypto treasury stocks, with CNBC noting how August ended in muted ETF inflows and erased summer gains.

Market share tells its own story. Bitcoin still commands roughly 57 percent of crypto’s total value, though it’s slipped a touch from mid-year when it hovered closer to 64. Part of that slack went straight into altcoins, with Ethereum’s slice growing to about 14.5 percent as DeFi activity roared back. Traders also rotate into more speculative plays such as Bittensor’s TAO, whose extreme volatility and thin liquidity highlight the risks of stepping outside Bitcoin’s relative stability. We covered the full picture of Bittensor risk and volatility.

ETF flows mirrored that trend: Bitcoin fund subscriptions slowed into early September, while Ethereum ETFs recorded fresh highs, reinforcing the rotation narrative.

Seasonality lingers in the background. September has almost always been Bitcoin’s soft spot, posting an average drop of 3.77 percent since 2013. Traders talk about a “Red September” curse, and after the summer run-up it’s no surprise positioning feels cautious.

Flows have been the big counterweight. Spot ETFs, live since January 2024, opened the floodgates. In 2025 alone they’ve pulled in more than 35 billion dollars, with a wild streak in July when nearly 7.8 billion poured in during just nine trading sessions. By now, combined assets in these funds are circling the 150-billion mark. That kind of demand helped push Bitcoin up about 26 percent year-to-date by mid-Q3.

Still, late August reminded markets how fragile momentum can be—crypto funds saw 1.4 billion in net outflows in a single week, including roughly 1 billion from Bitcoin products, one of the sharpest weekly reversals of the year.

The bigger picture is that Bitcoin remains the reserve asset for the crypto market. Even when money rotates into high-beta plays, the gravity of ETF inflows and corporate adoption keeps it anchored at the center. Traders may worry about September’s reputation, but institutions are still writing checks, and that changes the texture of the market.

From a technical lens, the key battleground sits between 100,000 and 110,000. This zone marks the summer breakout point, the six-figure psychological line, and the level bulls have defended on every dip. A break below would open the door to deeper correction levels in the 90,000s, while the ceiling remains clear: 120,000 to 125,000 is the supply zone that capped August’s rally. Until one side gives way, expect chop. September’s curse urges caution, but history also shows that dips into this band often set the stage for stronger Q4 recoveries.

Institutional Adoption and Corporate Treasury Use

Institutional money has never been this deep in Bitcoin. The January 2024 approval of multiple spot ETFs flipped the switch, and by now those vehicles hold a staggering share of supply. BlackRock’s iShares Bitcoin Trust alone manages more than 83 billion dollars, translating to roughly 746,000 coins—close to four percent of all Bitcoin that will ever exist. Fidelity, Grayscale, ARK, they all sit on their own massive stacks, each running into tens or even hundreds of thousands of BTC.

Together, these ETFs have pulled in more than 50 billion dollars since launch. That’s not just a big number—it’s become one of the main forces behind Bitcoin’s price climb in 2025. Analysts on Wall Street openly call spot ETF flows the year’s primary driver. Even BlackRock has admitted crypto products are no longer a side gig; 14 billion in inflows during the second quarter alone made up more than a sixth of its ETF business. For a firm of that size, that’s seismic.

Corporates haven’t stood still either. Strategy remains the poster child. By early September the company lifted its holdings to 636,505 BTC after acquiring another 4,048 coins at an average of ~111,000 dollars each.

Tesla, with more than 11,000 BTC, has also benefited from new accounting rules that now allow it to mark those holdings to market every quarter. Block holds thousands of coins too, and miners keep significant treasuries on their books, doubling as operators and long-term holders.

A new entrant is Twenty One Capital, which has quickly positioned itself as a Bitcoin-first public company with heavyweight backing. Its acquisitions and reserve strategy, supported by investors like Tether and SoftBank, underline how new institutions are scaling up to make Bitcoin a centerpiece of future finance.

It isn’t just passive balance sheet exposure. Some firms are actually using the network. Coinbase integrated the Lightning Network in 2024, and within a year, about 15 percent of its Bitcoin withdrawals were already running through Lightning channels. That’s real usage, not theory. Coinbase also trialed a Bitcoin Income Fund this year, promising yields in the four to eight percent range. The pitch is simple: give investors a way to earn on BTC without leaving the ecosystem.

Step back and the pattern is clear. ETFs brought in pension funds and wealth managers. Corporates brought credibility and direct balance sheet exposure. Exchanges brought usage at scale. By mid-2025, Bitcoin isn’t just another risk asset on the fringe. It’s firmly woven into global finance—treasuries, trading desks, retirement accounts, even retail payment rails.

Bitcoin Layer 2 Growth

Bitcoin isn’t standing still. Over the past two years its Layer-2 landscape has exploded—payments, smart contracts, NFTs, even tokens—all stacked on top of the base chain. Each piece has its own quirks.

Start with the Lightning Network. Public channel capacity looks smaller now, about 4,200 BTC compared to 5,400 at the 2023 peak. At first glance that feels like shrinkage, but the reality is messier: much of the liquidity shifted into private channels and multiplexing. Actual usage is climbing. By mid-2025, fifteen percent of Bitcoin withdrawals on Coinbase were already routed through Lightning. Processors like CoinGate report the same direction—16 percent of BTC payments ran over Lightning last year, up from 6.5 two years back. And with Tether launching USDT on Lightning early this year, it’s no longer just about BTC payments; dollar transfers now zip across the network too. In short, the raw capacity number hides a simple truth: Lightning is busier than ever.

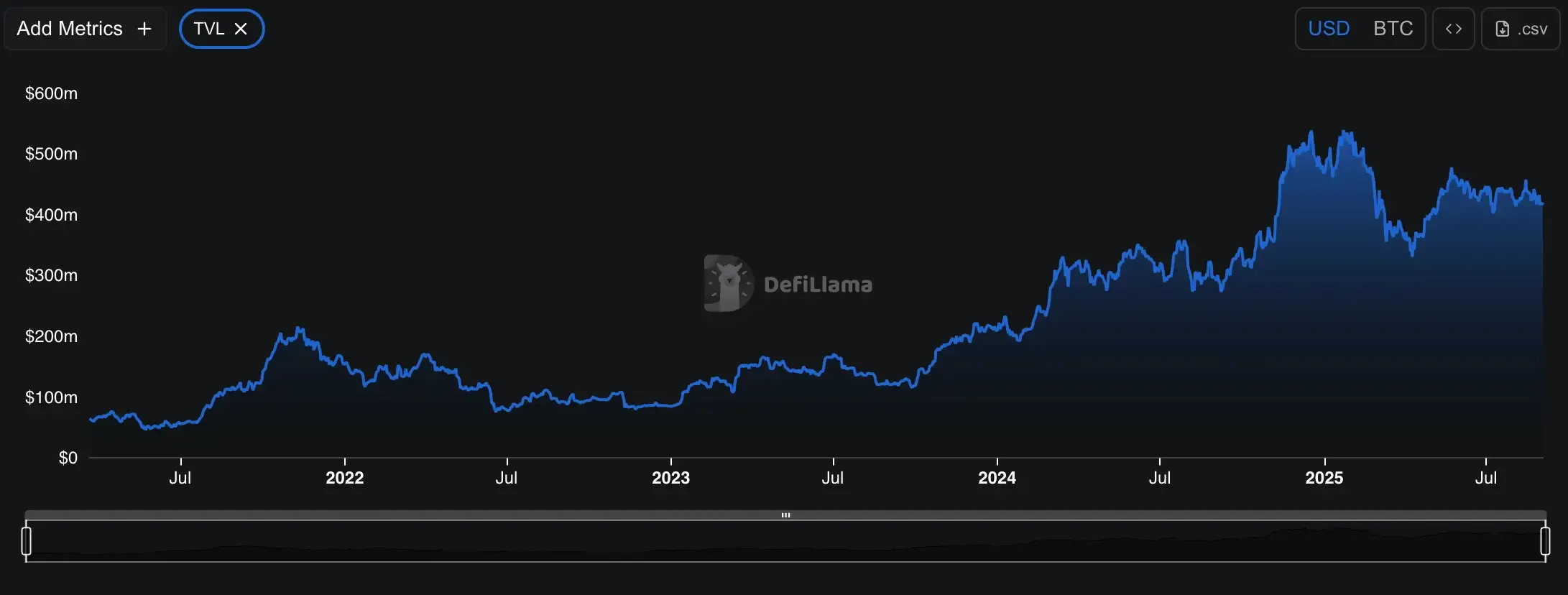

Stacks tells a different story. Think of it as Bitcoin’s DeFi playground. Total value locked has climbed beyond six hundred million dollars by late summer, powered mostly by sBTC and the ALEX exchange. Developer activity is heavy—more than nine thousand commits over the past year—putting Stacks among the most active crypto repos on GitHub. Its Nakamoto upgrade in 2024 sped up block times and locked in 100 percent Bitcoin settlement finality, making it feel less like an experiment and more like an extension of the base chain. By mid-2025, the ecosystem had dozens of live dApps, from lending desks to NFT marketplaces, backed by a half-billion STX endowment to fuel more growth.

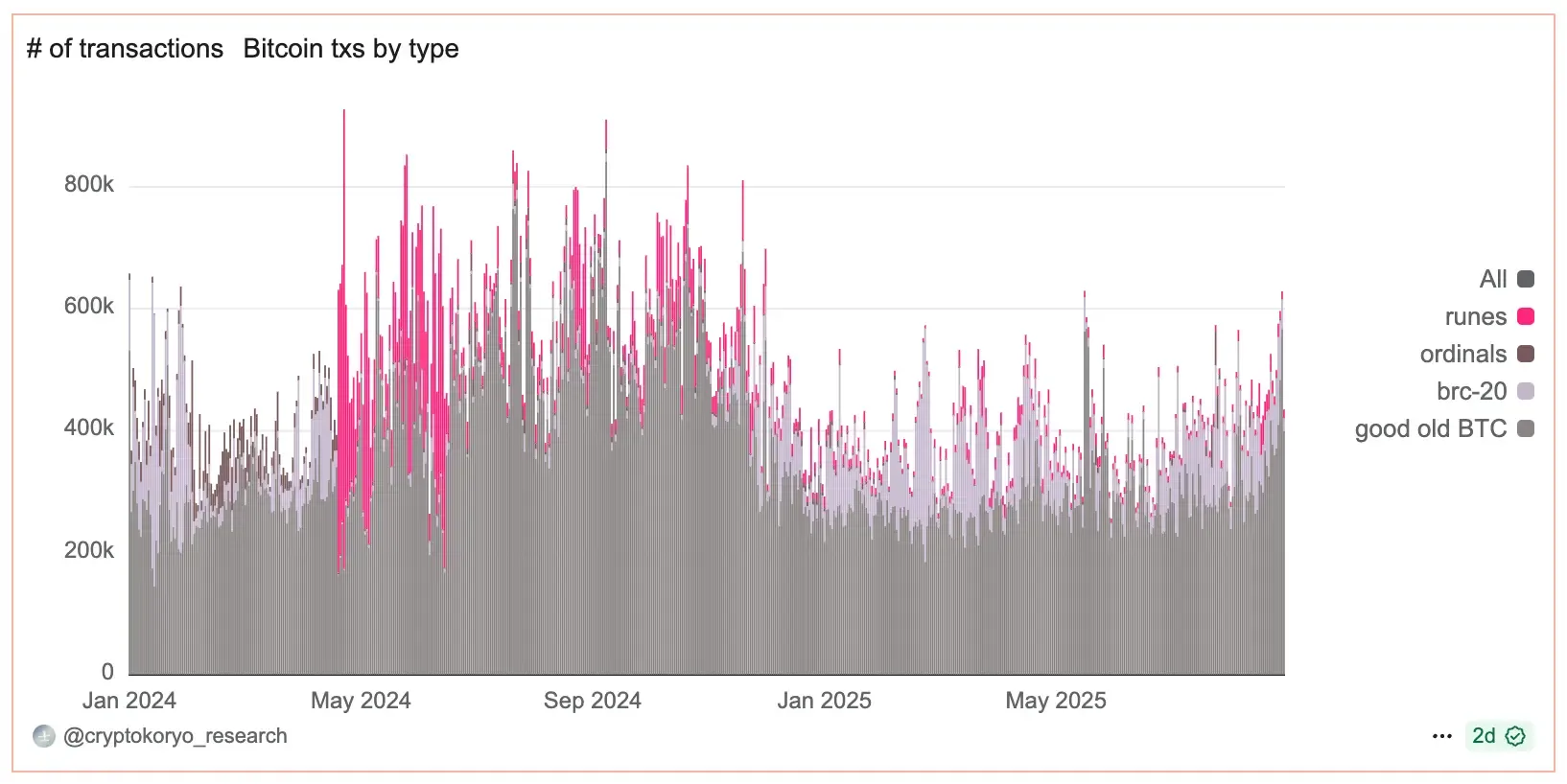

Culturally, nothing has shifted Bitcoin’s vibe like Ordinals. Since their 2023 launch, inscriptions have blown past seventy million, a leap from just a couple hundred thousand the year before. That surge birthed a full-blown NFT culture on Bitcoin: more than a million assets across collections, with NodeMonkes and Bitcoin Puppets emerging as blue-chips. The trade-off was higher fees and heavier blocks, especially during the 2023 memecoin mania, but even after the frenzy cooled, Ordinals still accounted for as much as forty percent of all transactions on the network. Marketplaces and wallets quickly adapted, and suddenly Bitcoin—long branded as “boring money”—was hosting its own wave of digital art and collectibles.

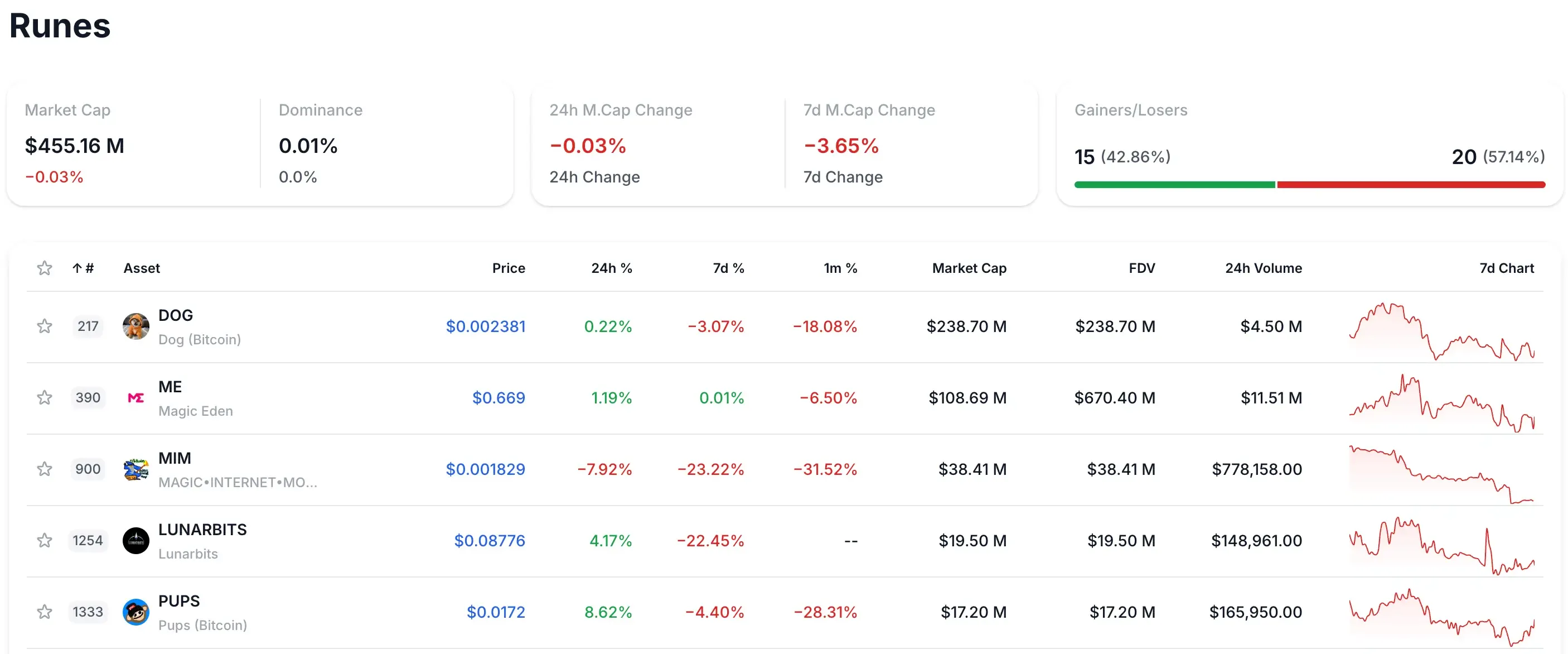

Then came Runes. Dropped by Casey Rodarmor at the April 2024 halving, the protocol gave Bitcoin a cleaner way to issue fungible tokens. The launch was chaos: over 40,000 tokens etched and more than three million transactions in the first week alone, with blockspace clogged and fees spiking. By late July, that tally had grown to 86,000 tokens, 14 million transactions, and over 2,500 BTC paid in fees. Some projects jumped ship from BRC-20s to Runes for efficiency. The hype has cooled, but the niche remains—community coins, gaming tokens, experiments in tokenized assets. It’s another strange layer in Bitcoin’s growing identity crisis: is it digital gold, or the base layer for a messy Web3? Maybe both.

The pattern is obvious: Lightning for fast cash, Stacks for programmable money, Ordinals for culture, Runes for token speculation. All of it layered on the same base chain that hasn’t changed much at all. Together they form a new chapter—Bitcoin not just as a static store of value, but as the backbone of a broader ecosystem that keeps finding new ways to surprise.

Still, Bitcoin’s dominance in scale and transparency keeps inviting comparison to privacy-focused networks that chose a different path. Zcash’s explosive 300% rally this fall reignited that old debate of openness versus anonymity — a tension we explored in Zcash vs Bitcoin.

Conclusion

Bitcoin holds steady near 110,000 as ETFs approach 150 billion in assets and corporates expand treasuries, embedding BTC deeper in global finance. Layer-2 growth through Lightning, Stacks, Ordinals, and Runes shows Bitcoin evolving beyond store-of-value into payments, DeFi, and culture. For trad ers, the 100K–110K range is the key support band this September, while long-term investors see Bitcoin’s dual role as reserve asset and ecosystem hub. In short: the long-term thesis looks bullish, but short-term timing remains choppy.