Crypto

Bonk vs Shiba Inu: Which Meme Coin Wins?

Bonk vs Shiba Inu through a trader’s lens: prices, volume, volatility, token burns, exchange reach, community signals, and the catalysts that could move both in 2025. Data-first, no fluff.

Quick Overview

- Positioning: SHIB is bigger and older; BONK is smaller but livelier on volume.

- Risk: BONK swings harder; SHIB is centralized at the top and less explosive.

- Tokenomics: BONK’s burns bite more by percentage; SHIB fights its giant supply.

- Adoption: BONK rides Solana speed; SHIB builds utility via Shibarium + DeFi.

- Catalysts: BONK’s 1T burn + 1M holders; SHIB’s Shibarium growth and fee burns.

Bonk vs Shiba Inu: Market Overview

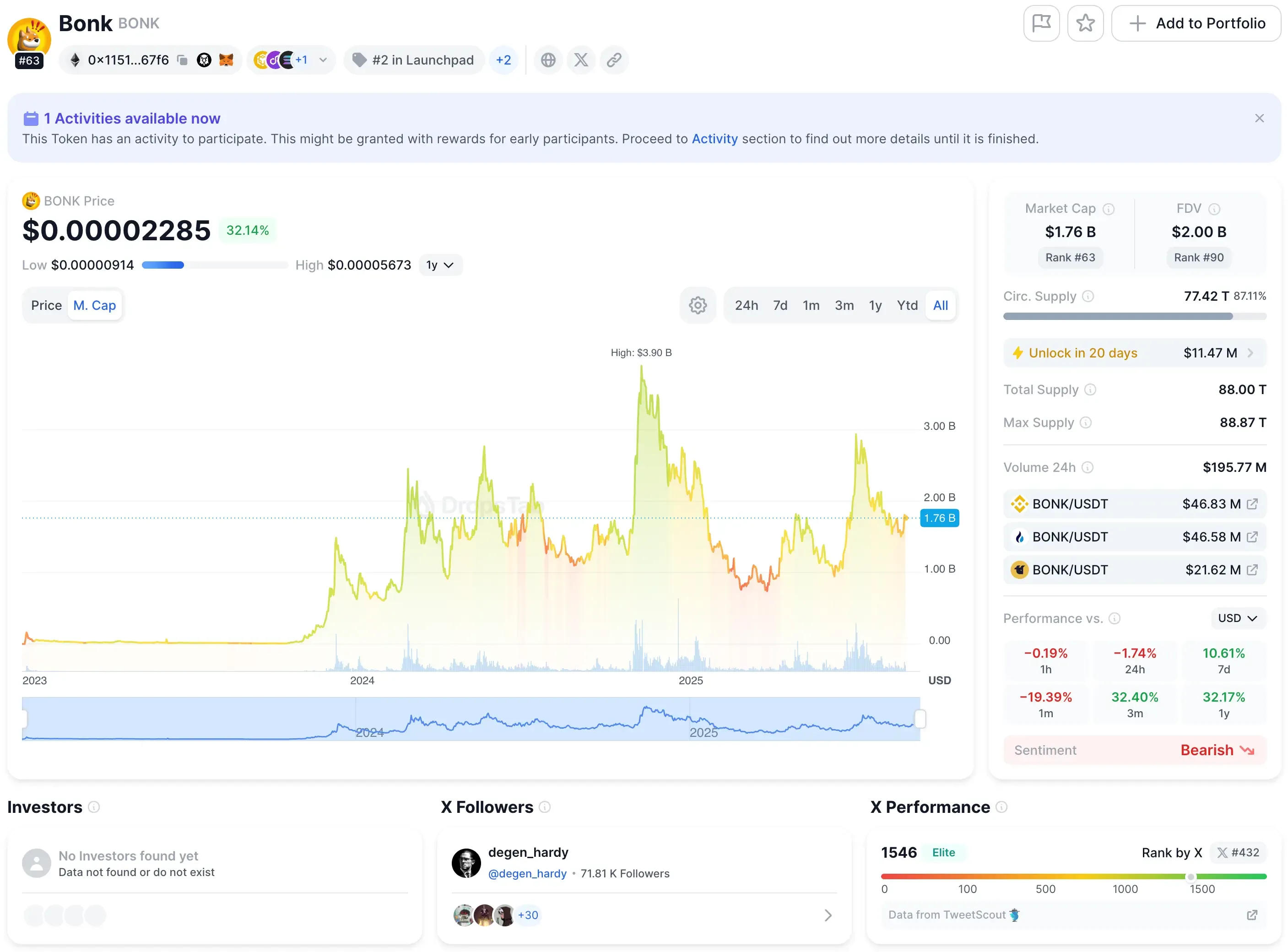

Shiba Inu still sits comfortably higher in the rankings — #24 worldwide with a $7.65 billion cap and a price near $0.00001295. Bonk is further down at #64, worth $1.75 billion at $0.0000228. That gap, roughly 4.8x, is a reminder that SHIB has been around since mid-2020, while BONK only entered the scene in late 2022.

But here’s where things flip. Bonk’s daily trading volume hovers around $200 million, showing traders are still plenty engaged. Shiba, meanwhile, is slipping. Its turnover has sagged to about $140 million — not catastrophic, but thin for a token of its size and history. Some would call it meager.

The 2025 scoreboard adds more contrast. Bonk is up 21% year-to-date, despite the roller-coaster, including an 85% pump in July. Shiba is going the other way — a slow bleed. By September, it was down roughly 3% for the month, leaving it negative on the year.

And zooming out? Both are trading far below their glory days. Bonk topped at $0.00005417 (Nov, 2024). Shiba peaked earlier in its life cycle at $0.00006752. Current levels put both at steep discounts — a sharp reminder of how unforgiving the meme-coin cycle really is.

Volatility and Risk Metrics

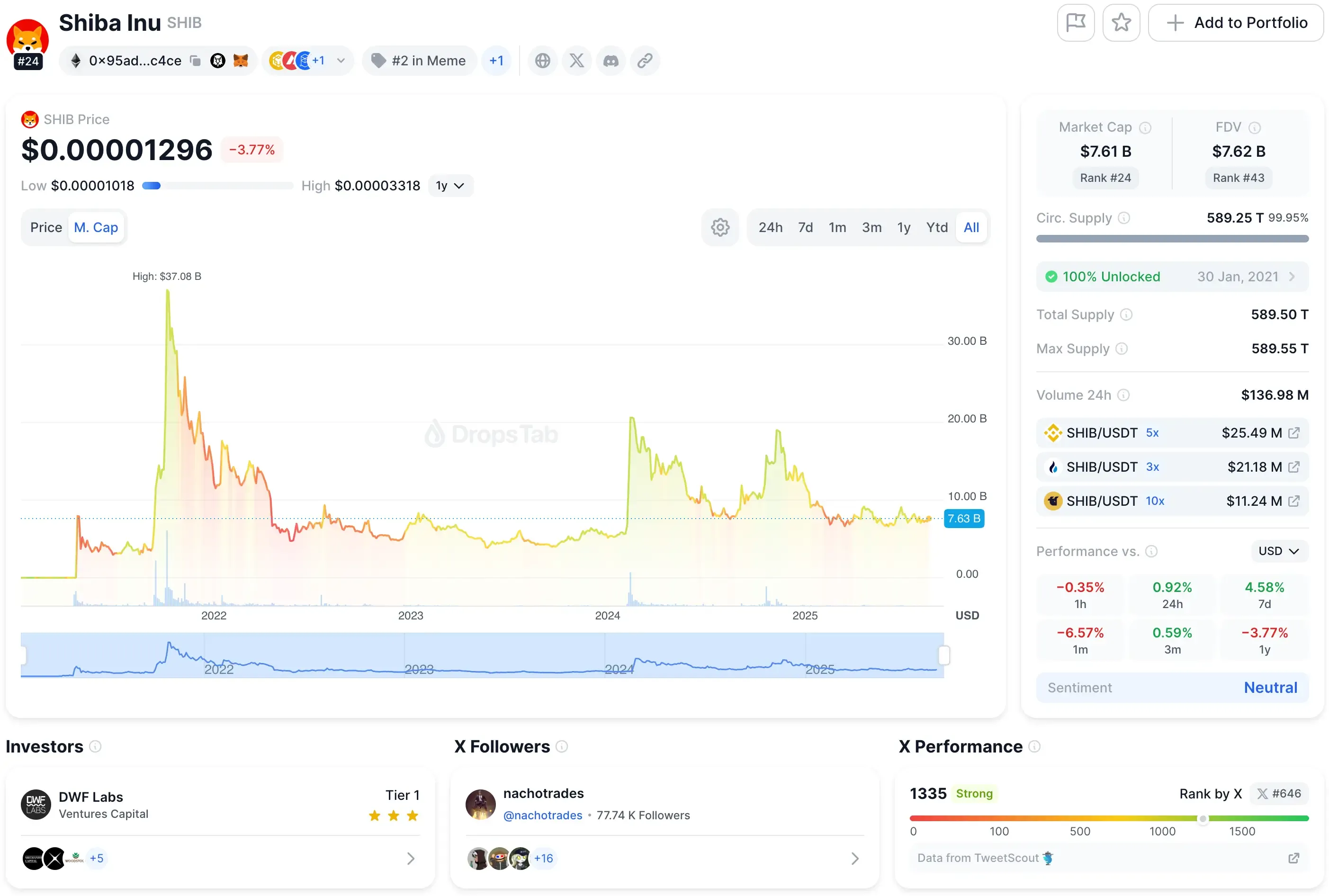

Bonk lives up to its meme-coin reputation with very high volatility. Daily swings above 10% aren’t unusual — the most recent being an 11% jump in a single session. Shiba Inu still shows plenty of movement, but it’s tamer. Current volatility sits at 3.67%, with RSI around 47.44 — a neutral read rather than a breakout.

Whale concentration is where Shiba stumbles. Its top ten wallets control 61% of supply, leaving it open to sudden dumps or coordinated pressure. Bonk looks healthier on this front, edging toward one million unique holders and distributing supply more evenly. It doesn’t erase risk, but manipulation gets harder.

Liquidity tells a different story. Shiba’s long tenure on major exchanges ensures deep order books and reliable flow. Bonk also trades actively — its 24-hour turnover ratio at 0.267 shows decent liquidity — but its smaller base means it’s more vulnerable to sharp moves when volume dries up.

Ecosystem exposure adds another layer of risk. Bonk’s price often shadows Solana’s fortunes, which means network hiccups or DeFi shocks can spill over instantly. Shiba leans on Ethereum’s base layer plus its Shibarium expansion. Yet Shibarium itself is unsettled, with TVL bouncing between $1.5 billion and $2.25 billion, raising questions about long-term stability.

Tokenomics and Supply Dynamics

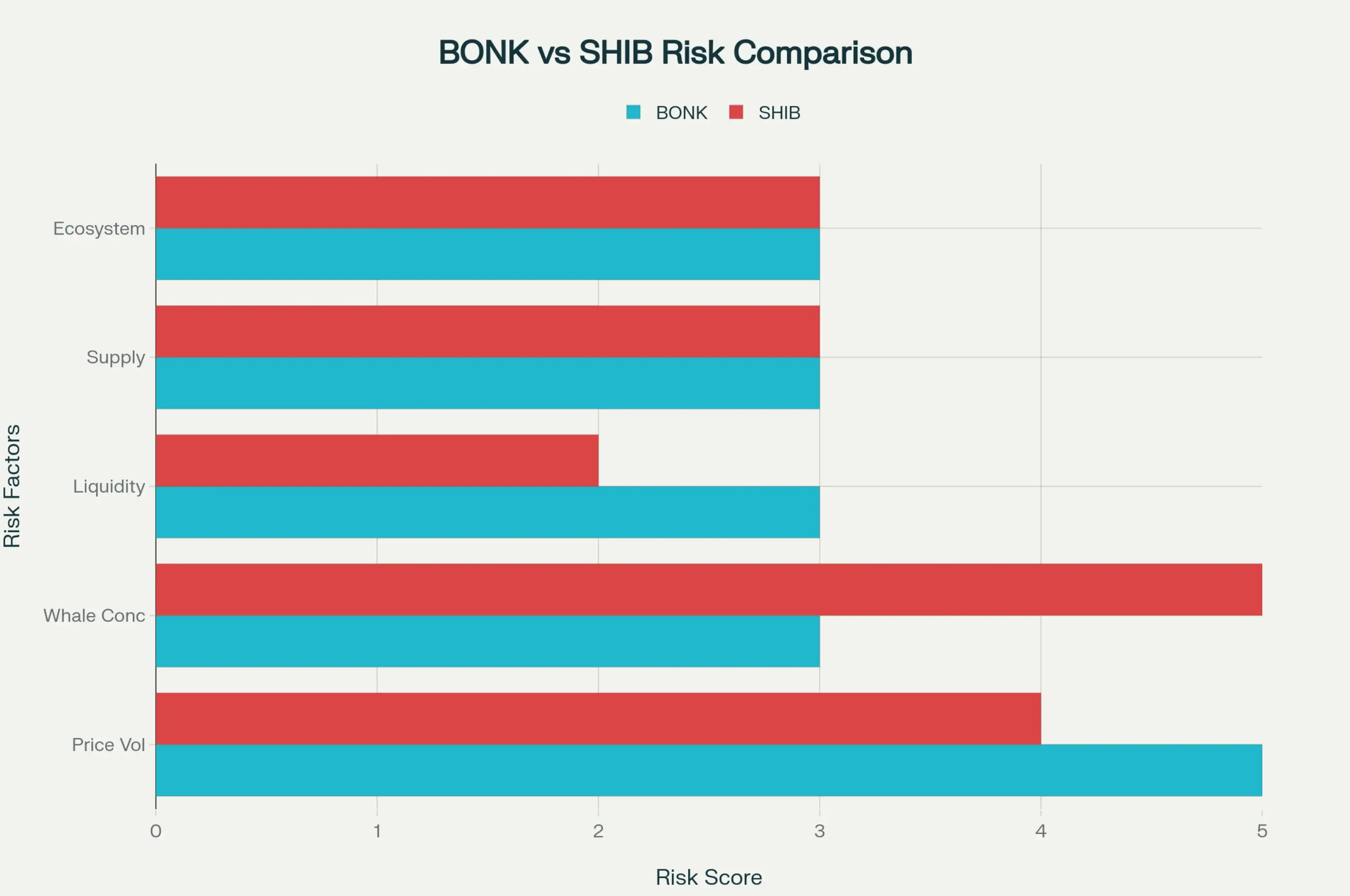

Bonk is already highly circulated, with 77.42 trillion tokens in play out of an 88 trillion max — about 87.8%. Shiba Inu’s numbers are harder to wrap your head around: 589.25 trillion tokens circulating today, from an original 1 quadrillion. That sheer scale makes any burn mechanism an uphill climb.

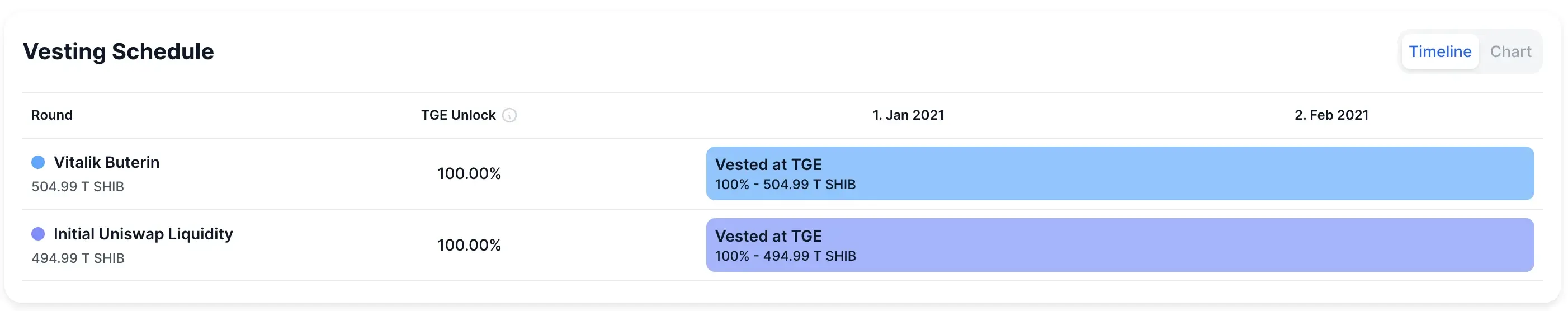

Shiba’s early token distribution also set the stage. Half the supply — 504.99T SHIB — was sent to Vitalik Buterin, while another 494.99T SHIB went straight into Uniswap liquidity. Both allocations were fully unlocked at TGE, leaving no vesting runway.

Bonk’s approach to token supply has been different. At launch, major allocations like supply distribution, marketing, liquidity, DAO, and ecosystem grants were released in full. The one big overhang is early contributors, who hold 18.66T BONK under a 36-month linear vest running until early 2026. This setup means gradual unlocks rather than sudden cliffs, reducing shock risks.

More than 65% of Bonk’s max supply has already been burned, with another 1 trillion burn queued once the project crosses one million holders. Shiba, by contrast, has burned more in absolute terms — 410 trillion tokens, about 41% of launch supply — but still wrestles with scale.

Sometimes SHIB makes headlines with sudden burn spikes. In September 2025, activity surged 6,260%, destroying 4.55M tokens daily. Yet the impact barely moved the market. Bonk’s upcoming 1T cut — roughly 1.2% of supply — may prove more meaningful.

Both coins brand themselves as deflationary, but only one shows real percentage impact. Bonk’s smaller base makes each reduction count. Shiba routes 70% of Shibarium fees into burns, but against its enormous supply, the process is slow.

Adoption and Ecosystem Growth

Bonk has scored major exchange wins — it’s now listed on Binance, Coinbase, OKX, and Bitstamp, giving it liquidity and visibility that once separated top-tier assets from the pack. Shiba Inu already enjoys that same reach, with even deeper liquidity pools and infrastructure built over years of market presence.

On the product side, Bonk leans hard into Solana’s speed. It plugs directly into Telegram with BonkBot, powers Bonk Arena for gaming, and anchors itself in DeFi, now commanding about 64% of Solana meme launchpads. That dominance also ties into the broader battle between Pump.fun and LetsBonk, where Pump.fun ultimately reclaimed market share after LetsBonk’s short-lived July surge.

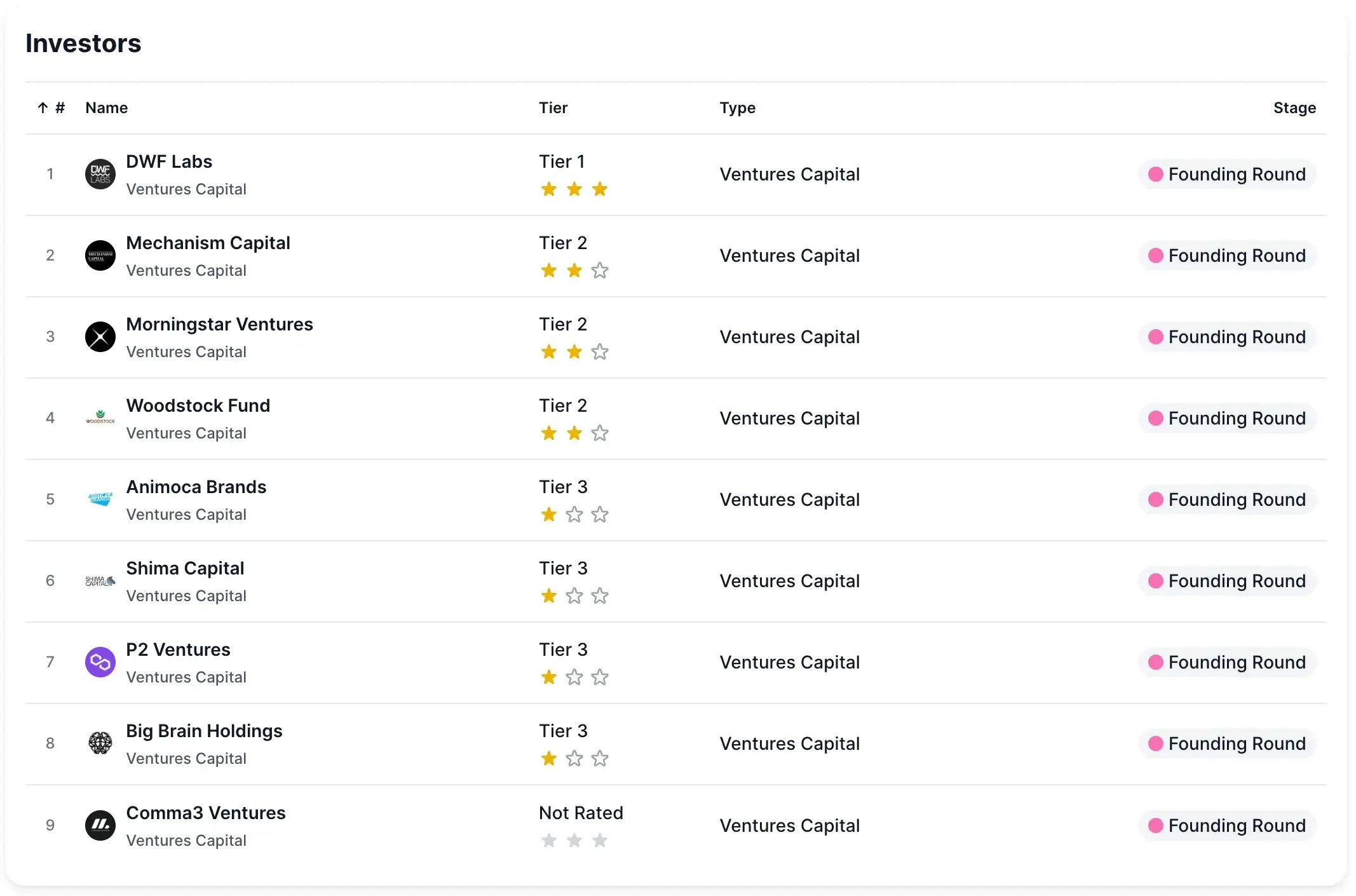

For Shiba Inu, adoption has been boosted not just by its products but also by early venture support. Backers included DWF Labs, Mechanism Capital, Morningstar Ventures, Woodstock Fund, Animoca Brands, Shima Capital, P2 Ventures, and others, signaling that SHIB wasn’t purely grassroots.

For Shiba Inu, adoption has been boosted not just by its products but also by early venture support. Backers included DWF Labs, Mechanism Capital, Morningstar Ventures, Woodstock Fund, Animoca Brands, Shima Capital, P2 Ventures, and others, signaling that SHIB wasn’t purely grassroots.

The on-chain story highlights their divergence. Shibarium surpassed 1 billion transactions by September 2025, proof of meaningful usage. Bonk, meanwhile, rides Solana’s 50,000 TPS engine — far faster than Ethereum’s base layer, though Shibarium’s scaling helps narrow that gap.

Developer integration rounds out the picture. Bonk is embedded across Solana with 140+ app and protocol partnerships, making it feel like part of the chain’s DNA. Shiba benefits from Ethereum’s broad compatibility but has shown weaker momentum in fresh development lately.

Community, Hype, and Narrative Trends

Bonk is racing toward 1 million unique holders, an impressive climb for a token that only launched in late 2022. Shiba Inu still commands one of the largest meme-coin communities in crypto, but its engagement has clearly thinned compared to the energy newer projects are pulling in.

On social, Shiba isn’t punching like it once did. In late August 2025, it generated about 791,600 interactions — solid, but well behind PEPE’s 1.5 million. Bonk, by contrast, leans into Solana’s grassroots energy and meme culture, fueling steady organic growth.

Sentiment also highlights the split. SHIB sits at a Fear & Greed Index score of 44 — firmly “fear” — and institutional appetite looks softer. Bonk rides Solana’s comeback story and excitement around future burns, giving it a more bullish narrative.

Shiba’s identity is shifting. It’s no longer just a meme coin, but a project pushing utility with Shibarium, DeFi tools, and metaverse land. Bonk isn’t abandoning its meme roots either — but it’s embedding itself inside Solana’s DeFi rails. That duality, meme plus utility, keeps the story fresh.

Conclusions for Traders and Investors

Risk vs Reward

Bonk is the classic high-risk, high-reward bet. It has serious upside, but only if Solana keeps firing on all cylinders. Shiba Inu is steadier. It holds a stronger market position, yet its whale-heavy supply and sheer token scale act like anchors on future growth.

Volatility Check

Neither coin is for the faint-hearted. Bonk’s smaller cap makes it swing harder — which can mean both fireworks and wipeouts. Shiba’s bulk offers a bit more stability, but that same size limits its ability to deliver explosive runs.

Catalysts and Timing

Bonk has two clear near-term sparks: a planned 1 trillion token burn and the symbolic million-holder milestone. Shiba’s path is longer, tied to Shibarium’s expansion and burn mechanics. The problem? Timelines are fuzzy, and execution has been uneven.

Portfolio Fit

For seasoned traders chasing speculative upside, Bonk fits as the riskier meme coin play within a broader basket. Shiba may work better for investors who want meme exposure but prefer something that leans more on utility development than hype.

Bigger Picture

Both face heat from fresh meme tokens entering the arena, plus the usual macro swings that dictate risk appetite across crypto. Community engagement, tokenomics discipline, and the overall health of the market will decide which of these two keeps its edge.