Crypto

BYDFi: The Safe Perpetuals Exchange with Real On-Chain Power

BYDFi blends regulated CEX stability with MoonX’s on-chain speed. US traders get full perps access, while degens gain same-block snipes, MEV protection, and real-time contract audits in one unified platform.

Quick Overview

- BYDFi mixes compliance and degen tools: 200x perps, low fees, optional KYC.

- US traders get full derivatives access without geoblocks.

- MoonX delivers same-block Solana/BNB execution and MEV protection.

- Built-in contract audits and smart-money tracking reduce on-chain risk.

- One account covers safe trading and fast memecoin hunting.

Safe Crypto Exchange

Crypto trading still feels like the Wild West some days — shifting rules, disappearing exchanges, sudden geoblocks. BYDFi has tried to carve out a different lane entirely: something that feels compliant enough for cautious traders but still fast and flexible for people who want 200x swings without worrying about which VPN city they’re supposed to pretend they’re in.

The Trust Signals (2025 Milestones)

BYDFi’s credibility didn’t come from a single announcement. It built gradually, through moves that changed how traders framed the exchange. The first was visibility. A long-term partnership with Newcastle United pushed BYDFi into the mainstream, signaling operational maturity rather than short-term hype.

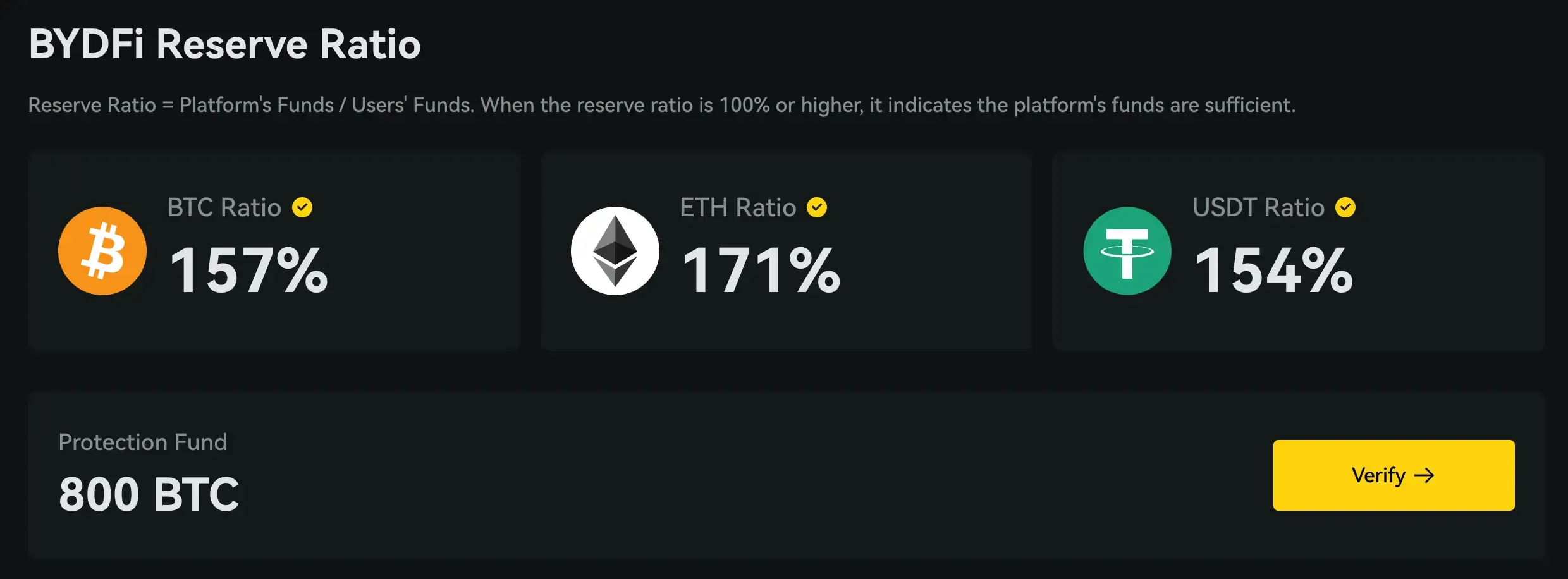

The second was balance-sheet transparency. In October 2024, BYDFi began publishing regular Proof of Reserves reports, confirming more than 1:1 backing across major assets. Nearly a year later, in September 2025, the exchange added an 800 BTC Protection Fund, explicitly ring-fenced to absorb shocks during extreme volatility. Those steps grounded the platform’s “safe” positioning in verifiable numbers, not assurances.

BYDFi vs. Competitors

Where this starts to matter is in comparison. Many high-leverage exchanges still ask users to trust opaque balance sheets or internal attestations. BYDFi takes a different approach: public reserve ratios well above 100%, clear segregation of user assets from operating funds, and an external protection buffer designed for stress events.

That structure doesn’t eliminate risk — nothing does — but it narrows the gap between what the platform claims and what traders can actually verify. In a market shaped by sudden bank runs and delayed disclosures, that difference is no longer cosmetic. It’s structural.

For U.S. traders in particular, the result feels unusual. A derivatives engine that offers offshore-level leverage, paired with visible reserves and capital buffers, without the usual platform roulette. That combination explains why BYDFi’s adoption curve has accelerated where others stalled.

BYDFi Perpetual Contracts

Ask any serious trader what keeps them planted on a platform — it’s never the logo. It’s the engine. How it holds up when the candles start sprinting. BYDFi’s perp contracts have that “built for grinders” feel: quick execution, real leverage, and fees that don’t bleed you out on busy days.

Key Advantages

Most major venues trimmed leverage down to 100x–125x over the past two years, which quietly pushed many scalpers elsewhere. BYDFi kept its 200x ceiling on BTC and ETH. It’s dangerous, sure, but for small-stack traders trying to squeeze opportunity out of thin moves, that headroom matters.

Maker sits at 0.02%, taker at 0.06%. Clean numbers — and on heavy trading days, they matter more than any slogan. Fees decide whether an edge survives. BYDFi keeps that baseline light, and for volume traders it gets even thinner. Through its VIP program, futures fees step down as activity or balances grow, with top tiers pushing maker rates as low as 0.008% and taker fees toward 0.03%. It’s a quiet incentive structure: trade more, bleed less. Exactly what grinders care about.

You can trade without verification and still withdraw up to 0.5 BTC per day. That’s the middle ground most platforms abandoned: some privacy, but still tied to a centralized system that won’t vanish mid-trade. It’s not perfect freedom, but it’s enough for many.

USDT-M and COIN-M contracts sit under one roof, no juggling sub-accounts or constantly topping up collateral. When the market picks up speed, shaving even a few seconds off your workflow can mean catching — or missing — the move.

A Quick Note for US Traders

BYDFi’s edge for U.S. users is simple: full perpetuals access without geoblocking.

MoonX On-Chain Ecosystem

MoonX launched during Paris Blockchain Week in April 2025, and it immediately felt like BYDFi was trying to solve the old CEX-versus-DEX tension — speed on one side, raw access to new tokens on the other. MoonX stitches the two together. One interface, two engines, no juggling multiple wallets or bouncing between apps just to chase something fresh on Solana.

Why Degens Actually Need MoonX

People who trade Solana memes know the routine: a wallet, a bot, another bot, and a handful of private-key steps you hope you don’t mess up. MoonX compresses all of that into a single button inside BYDFi. It’s not even about convenience — it’s survival in markets that move faster than any manual workflow.

Same-Block Execution — Sniper Mode

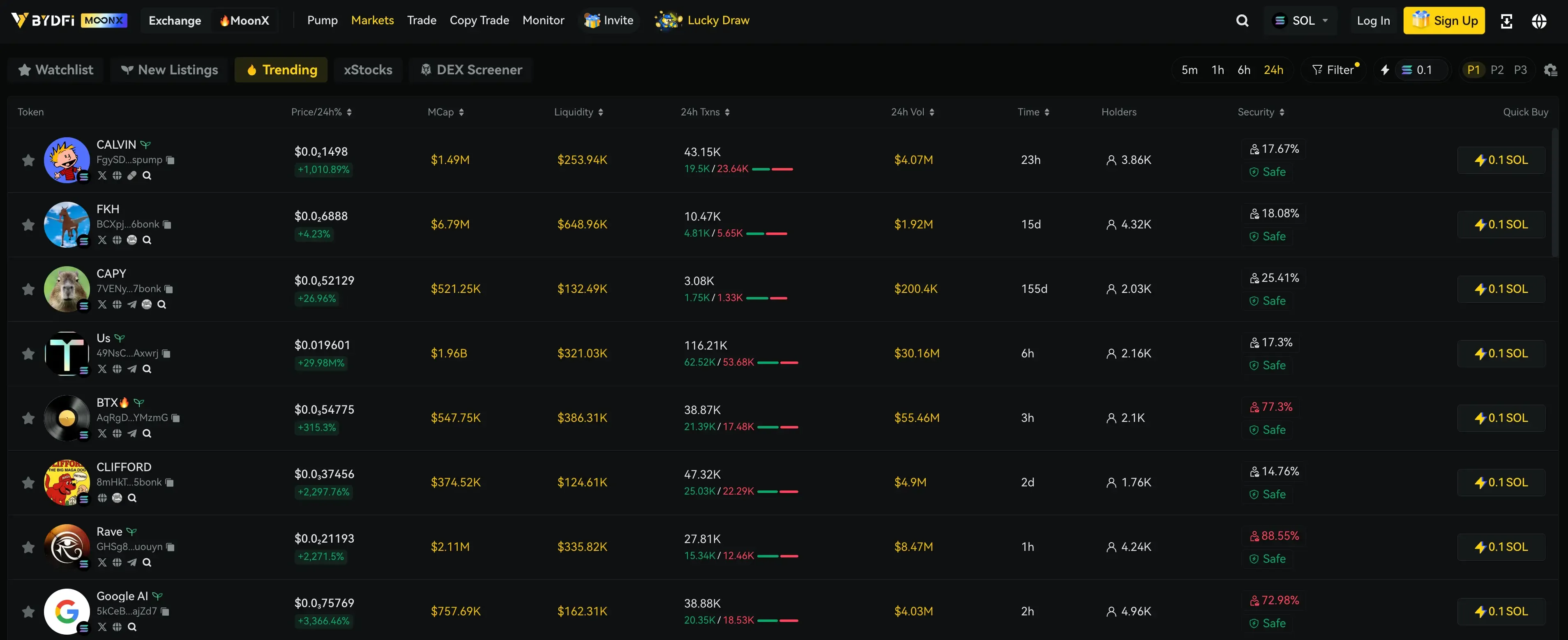

This is the feature that got traders talking. MoonX pulls liquidity directly from Raydium, Pump.fun, and other on-chain pools, then pushes the order into the same block. No RPC lag, no waiting for centralized listings. If a token starts moving, you’re reacting at chain speed — not UI speed.

MEV & Sandwich Protection

DEX trading often feels like fighting ghosts: bots front-running your entry, then dumping right after. MoonX routes through protected paths so the execution respects the slippage you set, not whatever a bot decides to steal. It won’t erase MEV from the universe, but it neutralizes most of the damage.

Compact Security Audit Layer

Rug pulls are still everywhere, so MoonX pipes in real-time contract checks from GoPlus and QuickIntel. Tokens get a simple, intuitive risk label — safe enough to act quickly, clear enough to avoid the obvious traps. It won’t save you from every mistake, but it filters out the disasters.

Smart Money Tracking

MoonX doesn’t just show wallet balances — it highlights addresses with real, proven win rates. Their trades appear live in the dashboard, and if you want, you can follow their moves with a click. Tools like this used to be locked behind expensive analytics suites; now they sit next to your perp contracts.

Conclusion

For US traders, this solves a long-running headache. No more platform roulette. No more hoping a VPN doesn’t disconnect mid-trade. And for everyone else — anyone juggling KYC friction, or terrified of copy-pasting private keys at 2 a.m. — the appeal is even simpler: everything you need sits inside one account. Safe collateral management on the CEX side, and the chaos (the fun kind) of MoonX when you want to chase new Solana or BNB-chain tokens before they even have a logo.

If you want a practical way to use it: keep your core long/short strategies on the CEX engine. The 0.02% maker fee is built for disciplined trading. Then carve out a smaller, more reckless slice — a Degen Portfolio — and let MoonX hunt. Same-block snipes, MEV protection, contract audits in real time, all without jumping between five different wallets and bots.