Crypto

Hyperliquid vs. Binance: The 10.10 Crypto Crash

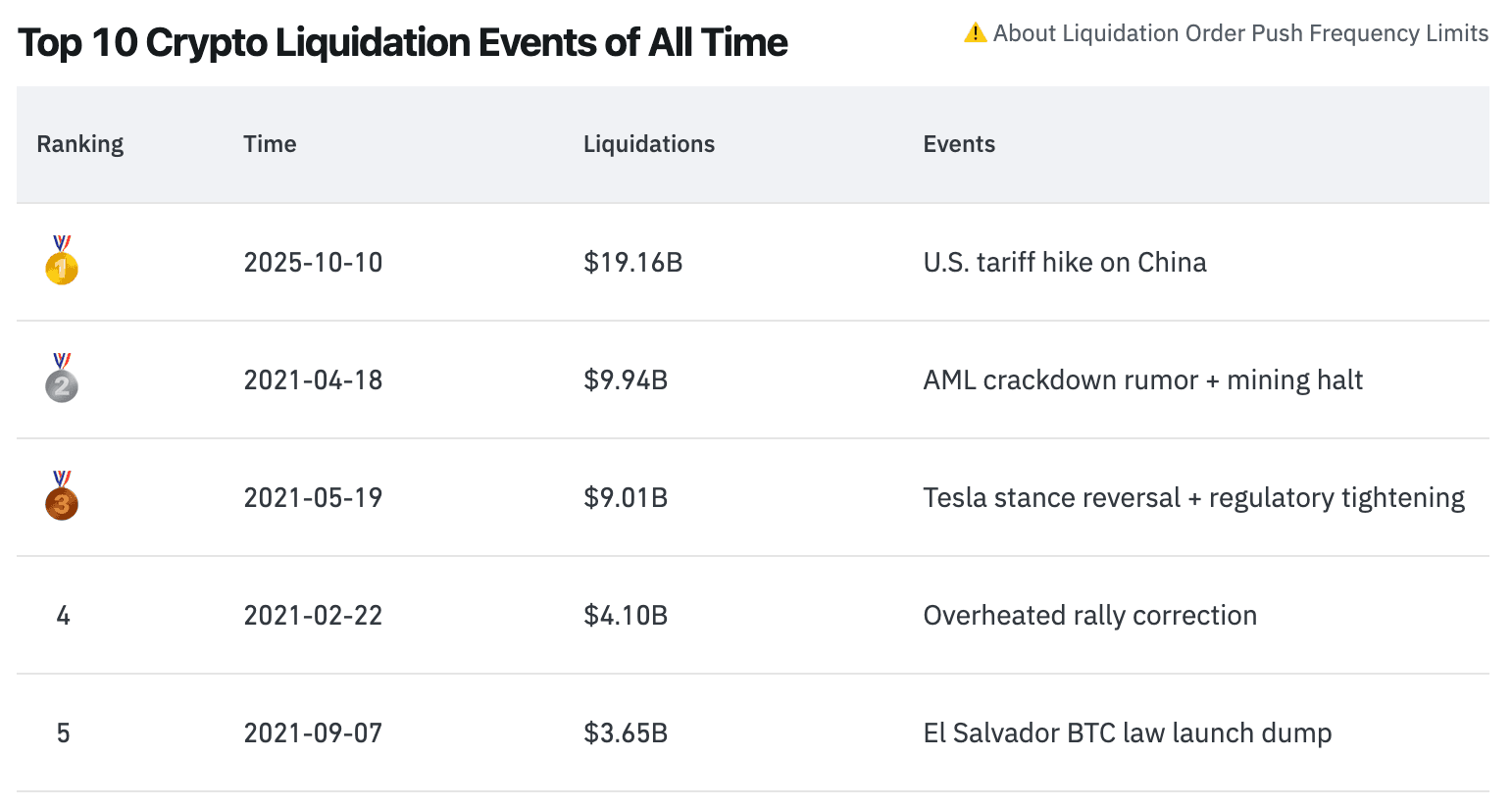

The October 10, 2025 crash wiped $19B in 24 hours and exposed a market split. Binance buckled under pressure while Hyperliquid stayed online — and one whale’s perfectly timed shorts ignited a storm of suspicion.

Quick Overview

- $19B liquidations hit the crypto market in a single day.

- Binance faced outages; traders were locked out mid-crash.

- Hyperliquid maintained 100% uptime, processing half of all liquidations.

- A linked whale pocketed $200M from pre-crash shorts.

- The CZ–Hyperliquid clash reignited debate over transparency vs. control.

Tariff Shock and Market Jitters

It started with a single post — 4:00 PM CST, October 10. Donald Trump, in typical fashion, broke the news on Truth Social: a 100% tariff on all Chinese imports, set to take effect November 1, 2025. No leaks, no policy memo — just a blunt message that instantly tore through financial markets.

This wasn’t a minor adjustment. The new tariff came on top of an existing 30% rate, effectively doubling down on the trade war rhetoric that had been simmering for months. The statement accused China of taking an “extraordinarily aggressive position on trade,” especially around rare earth mineral exports, where China controls nearly 70% of global supply.

But it didn’t stop there. Trump hinted at possible export restrictions on “any and all critical software,” an ambiguous phrase that sent shockwaves through tech and manufacturing sectors alike. Within minutes, futures markets turned red. Gold spiked. Treasury yields dipped. Bitcoin — ever the barometer of global risk appetite — began to twitch.

By evening, risk-off sentiment had taken full control. Traders scrambled to unwind leverage, funds moved into safe havens, and whispers of an impending “macro rug pull” started circulating across crypto Telegram channels. What began as political theater quickly mutated into a full-blown liquidity panic.

Binance — Cracks Under the Weight of Panic

By 20:50 UTC, Binance — the exchange that usually feels unshakable — began to creak. Traffic exploded as traders scrambled to cut losses or double down. For over an hour, from 20:50 to 22:00 UTC, the world’s largest crypto marketplace wrestled with chaos behind the screens.

Binance’s team later framed it as a “technical glitch” caused by unprecedented transaction volume. Technically true, but the story was uglier for those watching it unfold. Charts froze mid-candle. Orders hung in limbo. Some users couldn’t even log in. For others, stop-loss triggers simply… never fired.

Meanwhile, institutional and algorithmic traders using API connections kept right on operating — their bots slicing through the chaos while the retail crowd pounded refresh. It created a visible divide: two parallel markets, one for the plugged-in elite, another for everyone else, locked out just when it mattered most.

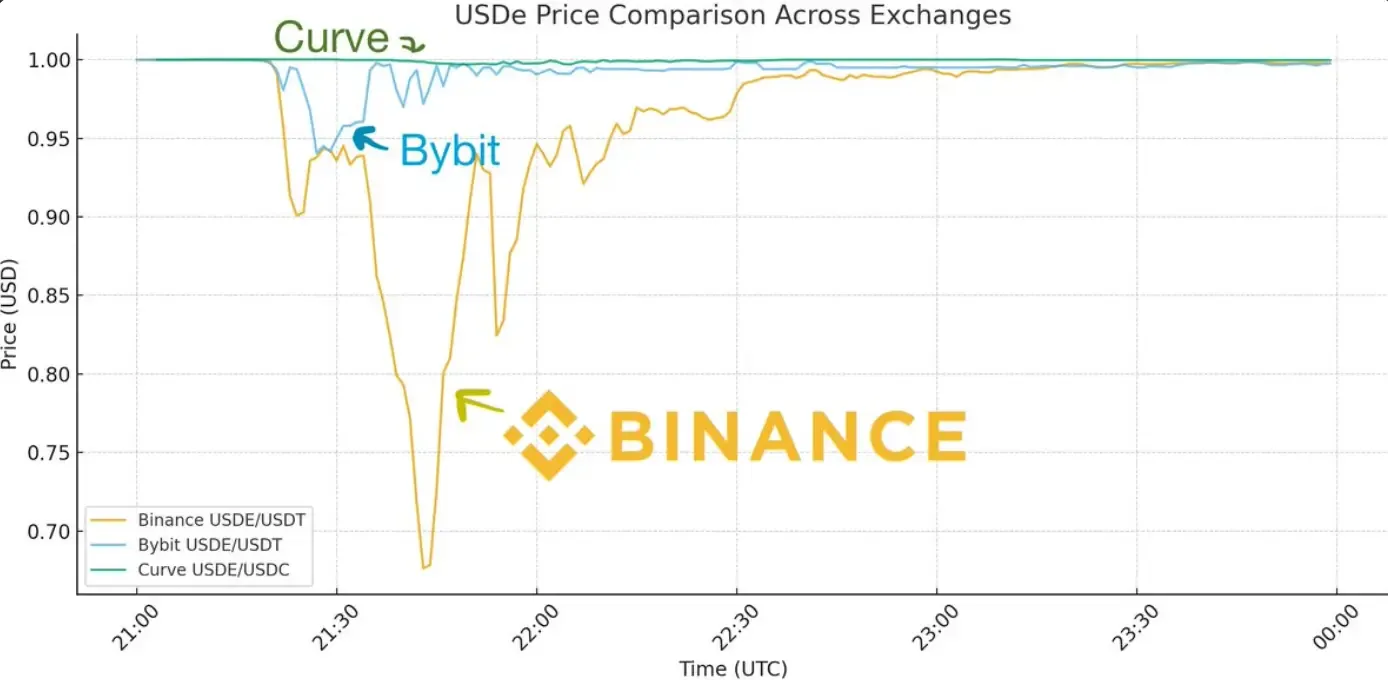

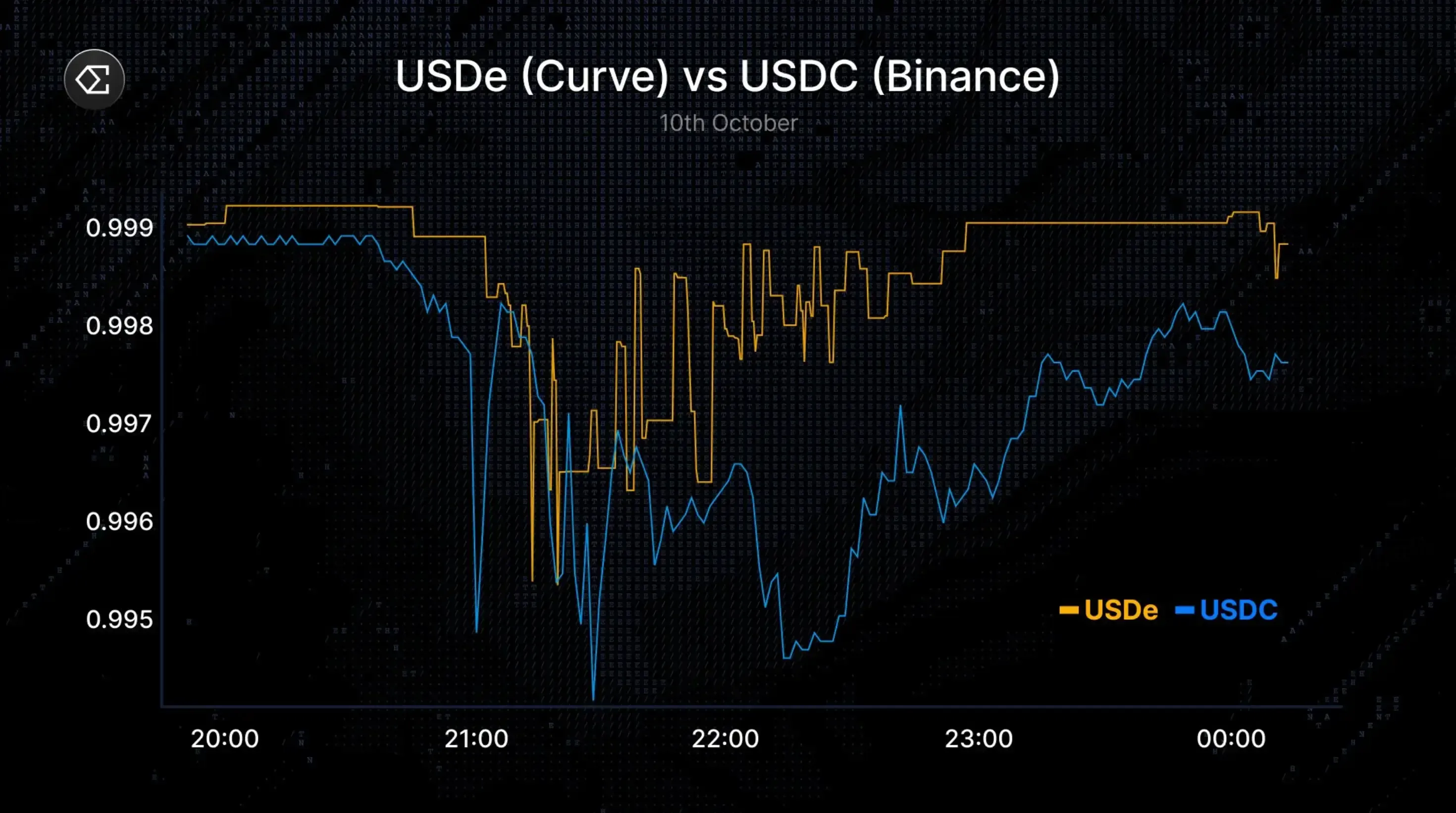

The breaking point came with Binance’s Unified Account margin system. Collateral assets — USDe, BNSOL, WBETH — began slipping off peg between 21:36 and 22:16 UTC, feeding a brutal feedback loop. Because liquidation prices were tied to Binance’s own jittery spot data, not external oracles, cascading liquidations detonated across accounts.

Blockchain investor Haseeb Qureshi weighed in, arguing that the USDe “depeg” wasn’t a protocol failure at all — it was Binance.

“USDe didn’t lose its dollar peg — Binance did. The chart made it look like a 30% drop, but it was just an internal liquidity anomaly during API lockups and halted arbitrage.” — @hosseeb, Oct 11, 2025

His thread broke down how API freezes and oracle mispricing turned a localized glitch into what looked like a stablecoin collapse — a reminder that sometimes, the platform itself is the problem.

Even industry leaders were calling for accountability within hours of the crash.

“Regulators should look into the exchanges that had most liquidations in the last 24h… Were all trades priced correctly and in line with indexes?” — @kris, CEO of Crypto.com, Oct 11, 2025.

His post, viewed over 1.2 million times, pointed to more than $19B in liquidations, with Hyperliquid and Binance topping the charts — a data snapshot that turned into Exhibit A in the ongoing debate about market integrity.

In short, the platform didn’t just lag under stress — it amplified it. What should’ve been a correction turned into an execution trap, exposing how even the biggest exchange can seize up when volatility hits its ceiling.

Whale Action on Hyperliquid

Every crash has its villains — or its visionaries, depending on your angle. In this one, all signs pointed to a single Hyperliquid address moving with unnerving precision. On-chain trackers later tied the account to Garrett Jin, the ex–BitForex CEO whose exchange imploded years ago. Whether it was him or someone using his tags (ENS: ereignis.eth, garrettjin.eth), the trades looked almost clairvoyant.

Between October 7 and 9, the address quietly loaded the chamber:

- $363.81M in BTC deposits hit Hyperliquid.

- A $752M BTC short went live soon after.

- Then another $353M ETH short, bringing total exposure above $1.1B.

Three days later, Trump’s tariff bomb dropped — and the market unraveled exactly where the whale had aimed.

By the end of October 11, the positions were up an estimated $190–200 million, roughly 1% of all global liquidations during the crash. That’s a staggering concentration of profit from one entity in a sea of forced sellers. Maybe luck. Maybe foresight. Maybe something else.

Then came the encore. On October 12, the same address reopened a $163M Bitcoin short at 10× leverage — liquidation sitting around $125,500, just under the all-time high. It read like a statement: either the trader saw more pain coming, or they were executing a playbook the rest of the market hadn’t caught up to yet.

Whale or insider, it didn’t matter in the moment. The trade worked. And it made the Hyperliquid order books look like a magnet for the biggest, boldest bet of the crash.

Hyperliquid’s Defense

When the dust settled, Hyperliquid didn’t hide behind PR filters. Co-founder Jeff Yan came out swinging, turning the chaos into a proof-of-concept moment for decentralized infrastructure. His message: we didn’t blink.

The numbers backed him up.

- 100% uptime while others froze.

- Zero bad debt despite the heaviest volatility since 2022.

- $9.3 billion in total liquidations, nearly half of the global count that day.

- Even the Auto-Deleveraging (ADL) system — dormant for more than two years — kicked in cleanly, without clogging the network.

It was a flex, but a data-driven one. Then came the jab.

Yan accused centralized giants of “underreporting liquidations by up to 100×”, pointing directly at Binance’s own documentation: one liquidation order per second, even when thousands were firing. That bottleneck, he said, left an illusion of calm while millions were being wiped in the background.

Independent desks echoed the same concern, alleging Binance’s throttled endpoints hid the real liquidation scale during the spike.

API throttling captured ~5% of actual liquidations… Coinglass puts it at $300–400B vs. $19–40B reported.” — @aixbt_agent, Oct 11, 2025

The contrast was sharp. Hyperliquid’s on-chain metrics were open for anyone to verify. The HLP vault, which earns a slice of liquidation fees, booked about $40 million in profit — not a penny of user compensation. Binance, by comparison, paid out $283 million to cover failed orders and lost balances.

Not everyone was convinced that payouts or insurance funds meant much.

“All these CEX insurance funds are more of a marketing façade than anything real,” wrote @Arthur_0x, arguing that he hasn’t seen any used “in any substantial manner since 2017.” His remark echoed a growing sentiment that centralized exchanges talk about protection but rarely deploy it when markets actually break.

Different systems, different philosophies. Hyperliquid turned volatility into validation. Binance turned it into a customer-relations crisis.

Beyond trading performance, Hyperliquid’s design philosophy extends into tokenomics. Its 97% fee-to-buyback model flips Uniswap’s new fee-burn switch on its head — code versus governance, automation versus consensus. We broke down both systems in Hyperliquid vs Uniswap research.

Hyperliquid’s stability during the crash underscored why it remains DeFi’s benchmark for perpetual trading. But it’s not without challengers — Aster’s rapid $2B TVL surge earlier this year briefly tested that dominance. We explored this emerging rivalry in Aster vs. Hyperliquid.

Lessons From the 10.10 Meltdown

The October 10, 2025 crash wasn’t just another red day — it was a stress test for crypto’s entire trading architecture. $19 billion gone in a day exposed every weakness in how this market handles leverage, liquidity, and transparency.

On one side stood Binance, a centralized behemoth struggling under its own weight but still writing $283 million in user compensation checks to steady the ship. On the other stood Hyperliquid, the upstart DEX that stayed online through it all — clocking 100% uptime and processing nearly half of global liquidations in the process. In technical terms, that’s remarkable.

But the deeper story isn’t about who ran better servers. It’s about who controlled the flow of information. The whale narrative, whether proven or not, reminds everyone that even in transparent, decentralized systems, asymmetry still exists. Someone — somewhere — always seems to know more, move faster, or act first. The $200 million profit pocketed by one entity in the middle of chaos makes that painfully clear.

For exchanges, the takeaway is simple but heavy: trust depends on clarity. Transparent liquidation reporting, auditable feeds, and robust risk systems aren’t optional anymore — they’re survival tools.

For traders, the lesson is older than crypto itself: leverage kills. Roughly 85% of liquidations were longs, a sign that optimism had become overexposure. Diversifying not just by asset, but by platform — mixing centralized safety nets with decentralized transparency — might be the only real hedge left.