Crypto

Aster vs Hyperliquid – Who Leads the DeFi Perpetuals?

Aster’s lightning-fast rise challenges Hyperliquid’s dominance in DeFi perpetuals. This analysis breaks down TVL, trading volumes, adoption, risks, and investor outlook.

Quick Overview

- Hyperliquid leads with $5B TVL, $106M monthly revenue, and 70–79% market share.

- Aster hit $2B TVL in 24h but has cooled to $655M; token surged 9,900% at launch.

- Hyperliquid offers stability, buybacks, and institutional trust.

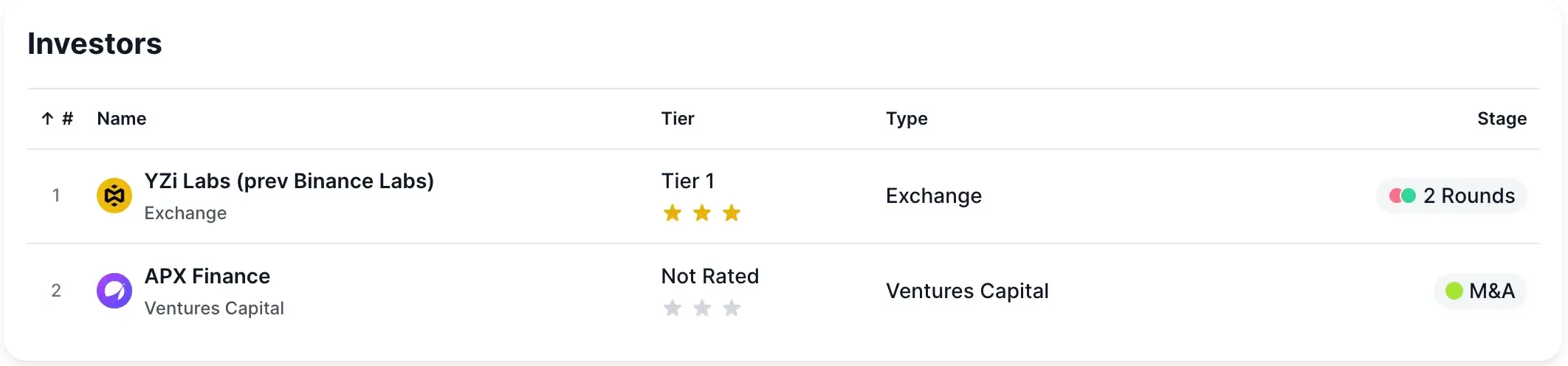

- Aster leans on multi-chain access, yield collateral, and CZ backing.

- Both platforms face regulatory and sustainability tests in a $319B market.

Comparative Market Overview

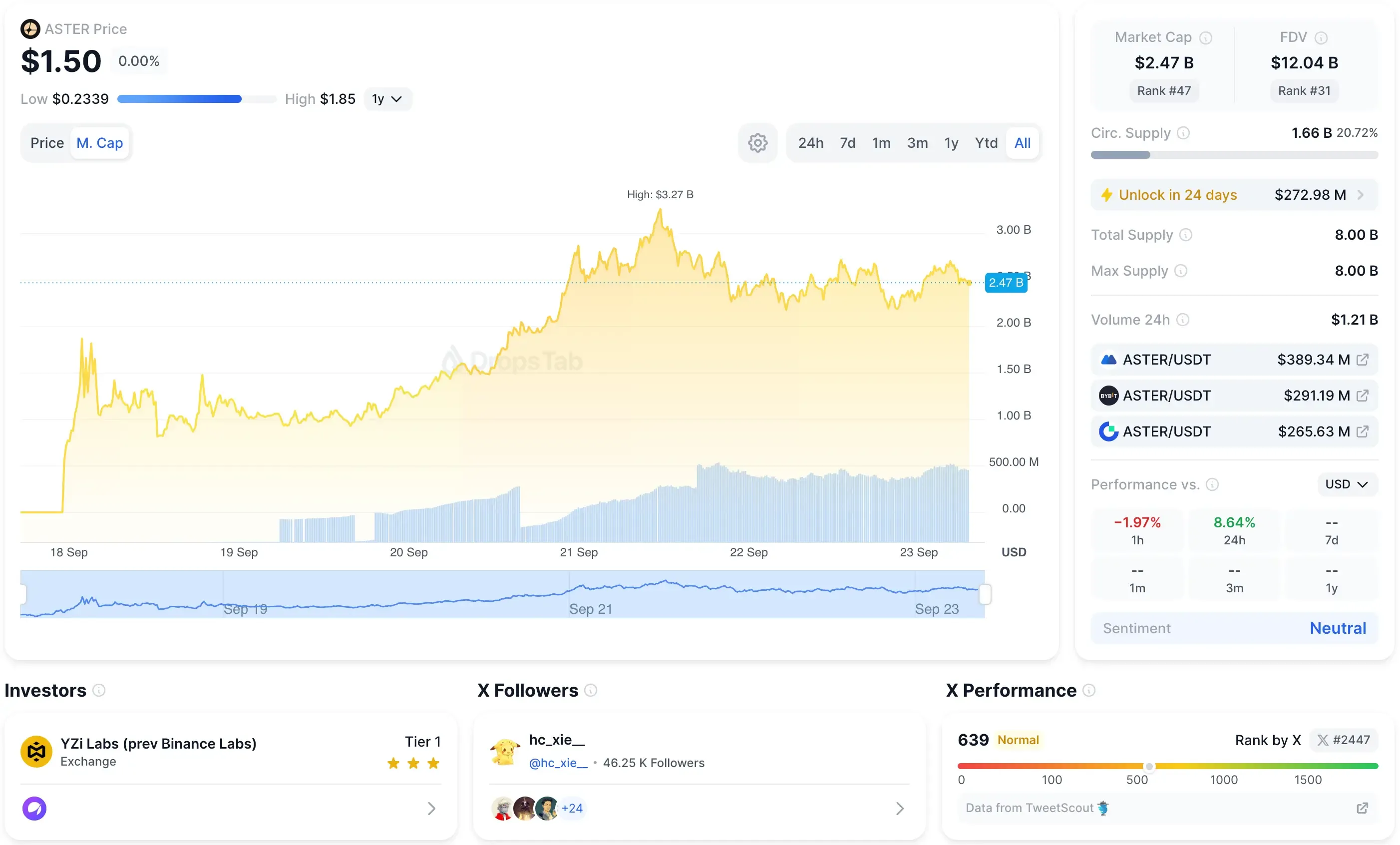

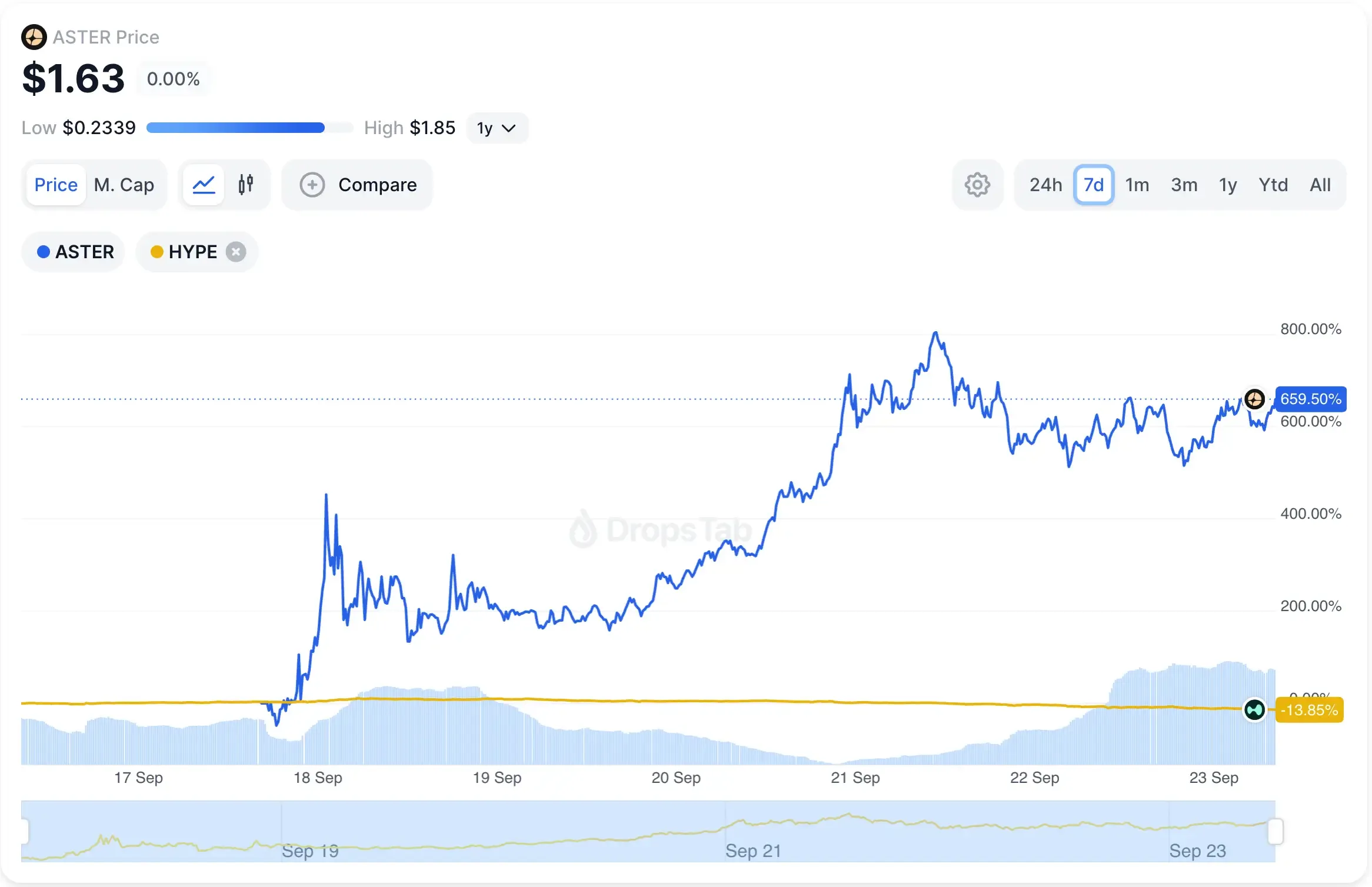

September 2025 felt like a shockwave in DeFi. Aster exploded onto the scene with a 9,900% surge, shooting from a $0.02 launch price to $2.00 in just four days. At its peak, TVL briefly touched ~$2 billion before cooling to ~$655 million by September 22. The token now trades around ~$1.5 with a market cap of ~$2.5 billion. Even so, the signal is clear: appetite for a new perpetuals platform is real.

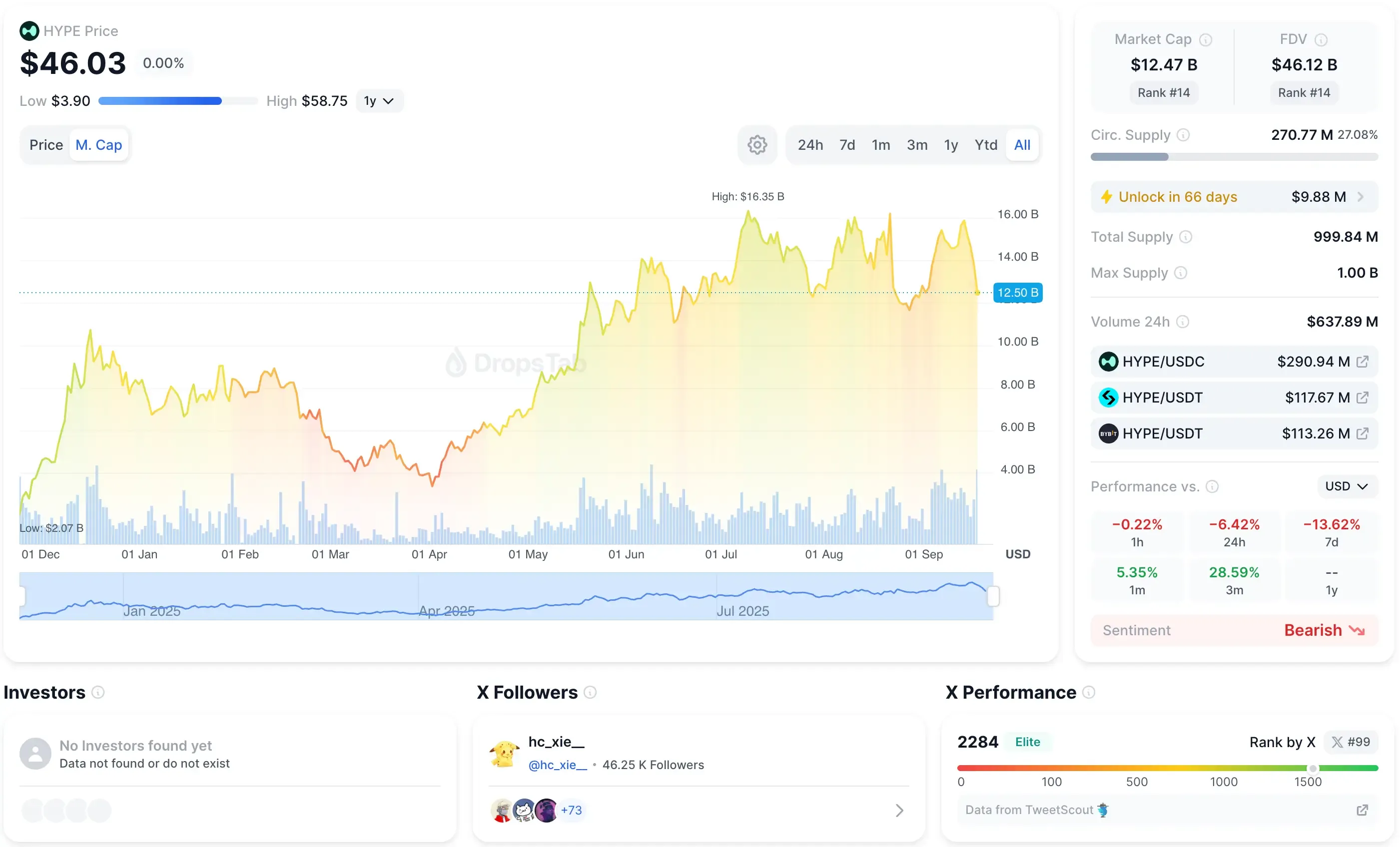

Hyperliquid sits on the other side of the ring, battle-tested and massive. Since its November 2024 launch, it’s grown into a ~$5B+ TVL machine with a ~$12.5B market cap. Daily volumes average ~$12B, and lifetime trading has already crossed ~$2 trillion. The token, HYPE, climbed from an all-time low of ~$3.8 to a September peak of ~$59, before consolidating near $50.

The differences are stark. Hyperliquid runs on its own custom chain, processing 200,000 orders per second with sub-second finality and no gas. Its leverage caps out at 40x. Aster, meanwhile, stretches across BNB, Ethereum, Solana, and Arbitrum with leverage cranked up to 1001x. It bakes in yield-bearing collateral, hidden orders, and stock perpetuals—features that Hyperliquid’s architecture doesn’t touch.

On users, Aster boasts 2 million wallets already, with 330,000 arriving in the first 24 hours—though some may just be airdrop farmers. Hyperliquid’s base is smaller, around 300,000 active traders, but its growth from 31k in 2024 shows steady adoption.

And while Hyperliquid prides itself on being community-funded, Aster carries the endorsement of YZi Labs and CZ. That backing boosts credibility, but also invites regulatory attention.

TVL, Trading Volume, and Liquidity Depth

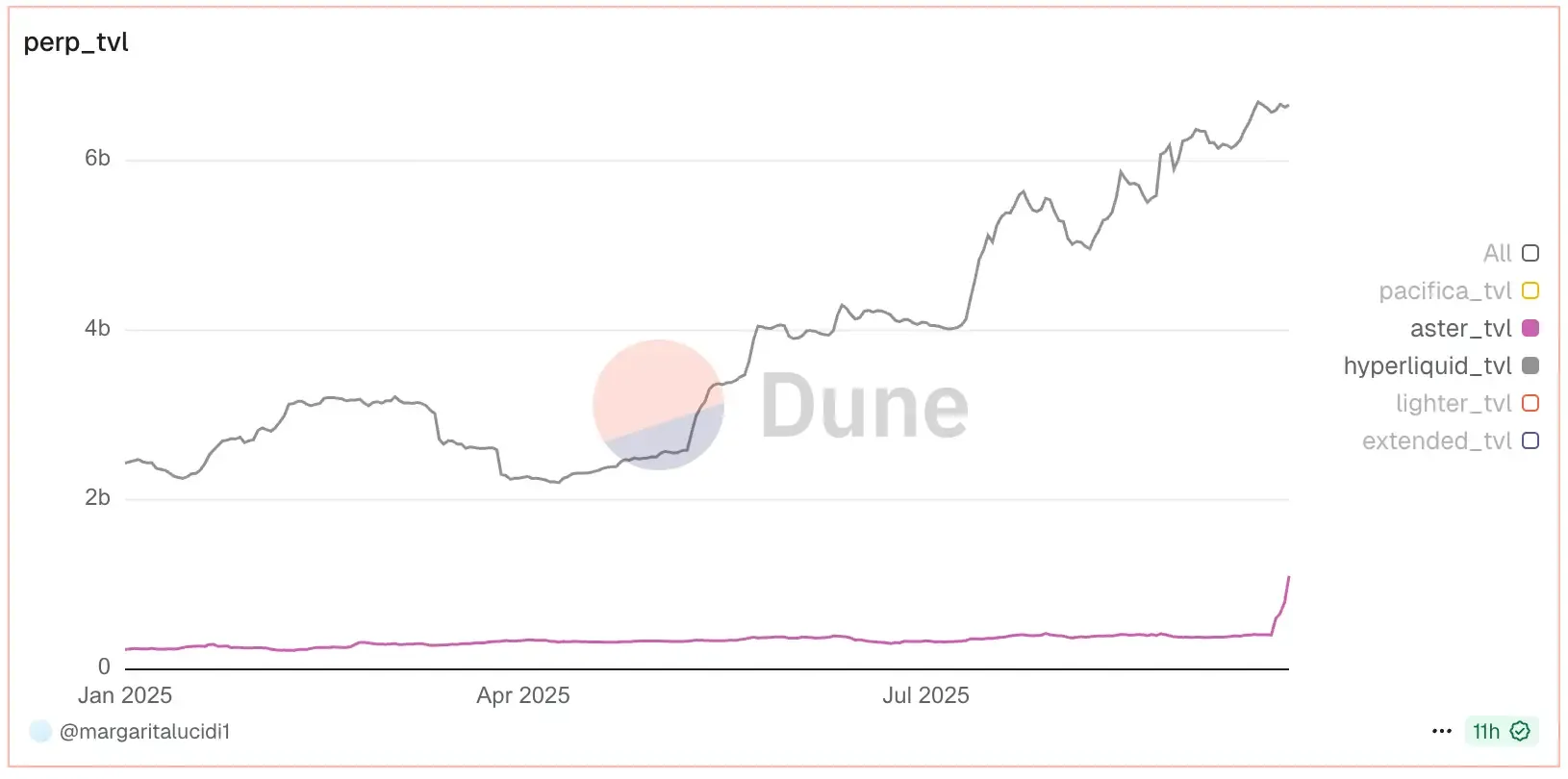

Hyperliquid still dwarfs its rivals. TVL sits above $6 billion today, while Aster hovers near $1 billion. But the raw numbers miss the real story: Aster pulled in $2 billion within its first 24 hours of launch — something we’ve never seen before in DeFi. Hyperliquid’s climb was slower, methodical. From $564 million in late 2024, it built to $2 billion by the end of that year and pushed past $3.5 billion by mid-2025.

Trading activity shows the same split in tempo. Hyperliquid clears $12.8 billion every single day, with cumulative volume already past $2 trillion.

Aster doesn’t match that firepower yet, but its debut still impressed: $3.67 billion in daily volume during September and $514 billion traded since its March soft launch.

Hyperliquid’s weekly averages in H1 2025 sat around $47 billion, spiking to $78 billion during peak weeks.

Open interest reveals maturity gaps. Hyperliquid commands $15 billion, equal to roughly 61% of Bybit’s book and even surpassing OKX’s levels. Aster? Just $3.72 million locked in as of September 2025. That gulf says everything about who’s established and who’s still proving they belong.

Adoption, User Growth, and Ecosystem Activity

Hyperliquid’s user growth has been steady and organic. From just 31,000 wallets in early 2024, the platform scaled to 300,000 by year’s end — a ninefold jump that came without flashy gimmicks. Aster’s numbers look flashier on paper: 330,000 wallets spun up within 24 hours of its token launch, and the project now claims 2 million total users. But scratch the surface and you’ll hear the same caveat repeated — airdrop farmers probably inflate those counts.

Critics also point to Binance’s market muscle. A chart circulating on Sept 20, 2025 showed Binance handling $2.1B in Bitcoin spot volume on a single day — more than 4x Bybit and 10x Coinbase. For skeptics, it’s evidence that Aster’s rise is less organic and more tied to Binance’s dominance.

The ecosystems also feel different. Hyperliquid runs deep rather than wide: 158 perpetual pairs, 128 native spot assets, plus in-house tools like HypurrScan and HypurrFun. On top, it’s plugged into Synapse, deBridge, and DEX Screener. Aster plays a multi-chain card instead, spreading across BNB Chain, Ethereum, Solana, and Arbitrum. Its selling point is dual trading modes and yield-bearing collateral — blending leverage with passive income.

Market share is where Hyperliquid flexes hardest. By August 2025 it processed $400B in monthly volume, locking in 70–79% of the DeFi perpetuals pie. Aster’s slice is still small, but its multi-chain design hints at a different kind of reach: less concentrated, more accessible, and potentially sticky if users stay after the airdrops dry up.

Governance, Tokenomics, and Incentives

The two platforms run very different supply games.

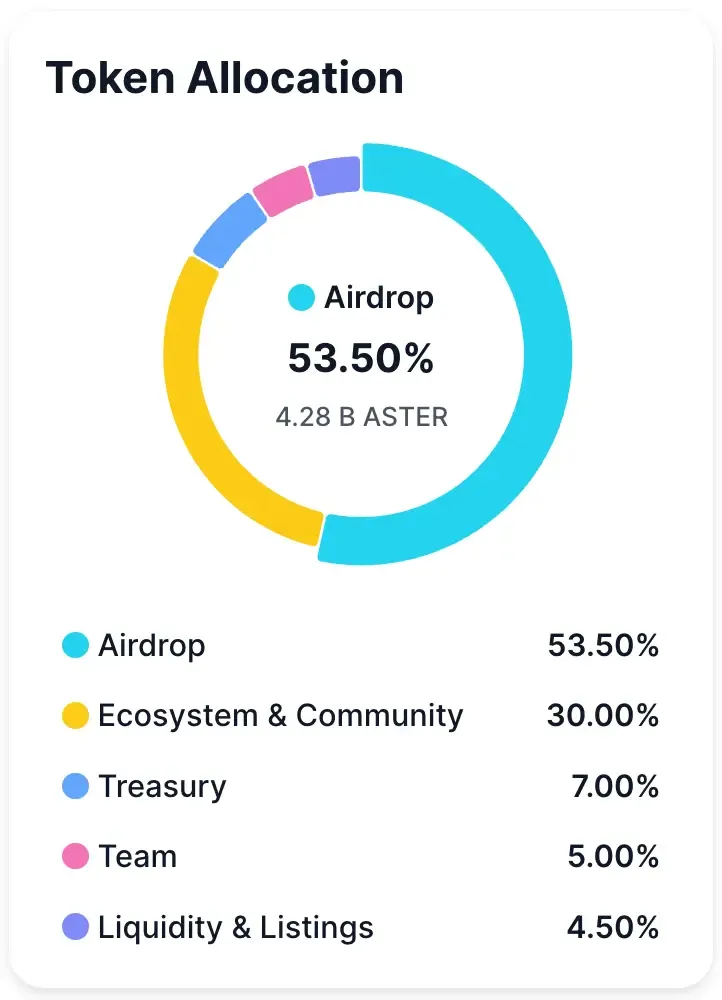

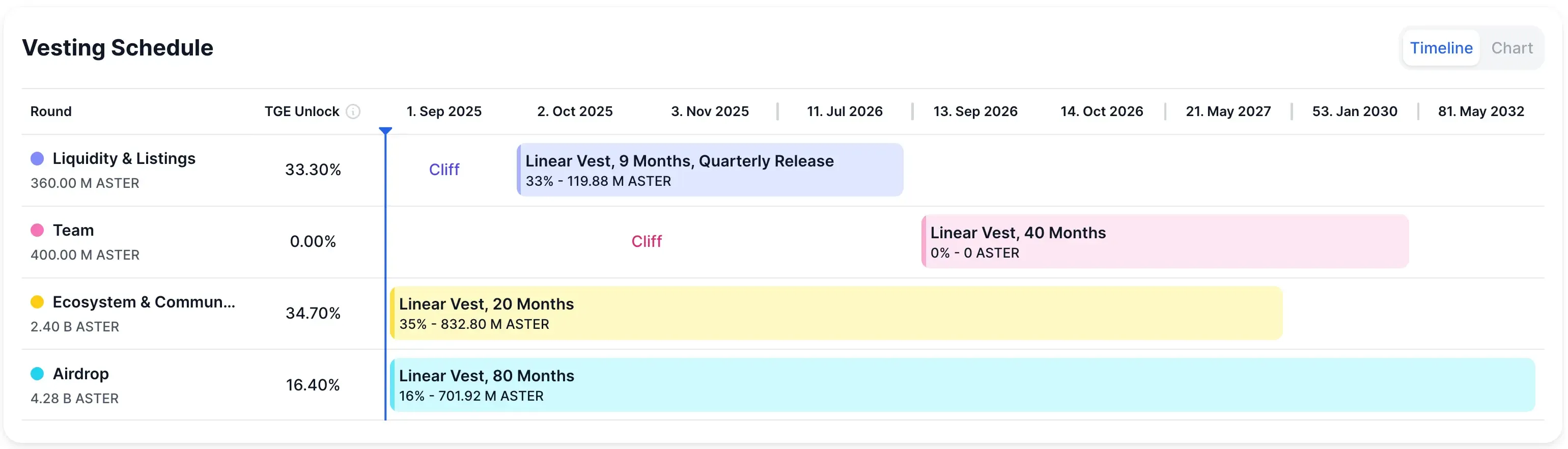

Aster launched with a massive 8B max supply, of which 1.66B (20.7%) is already circulating. That puts its market cap at $2.21B versus a $10.68B fully diluted value. More than half of supply (53.5%) sits in airdrops, another 30% fuels ecosystem and community growth, while smaller slices go to treasury (7%), team (5%), and liquidity (4.5%). The setup leans hard into distribution and growth — but at the cost of dilution risk.

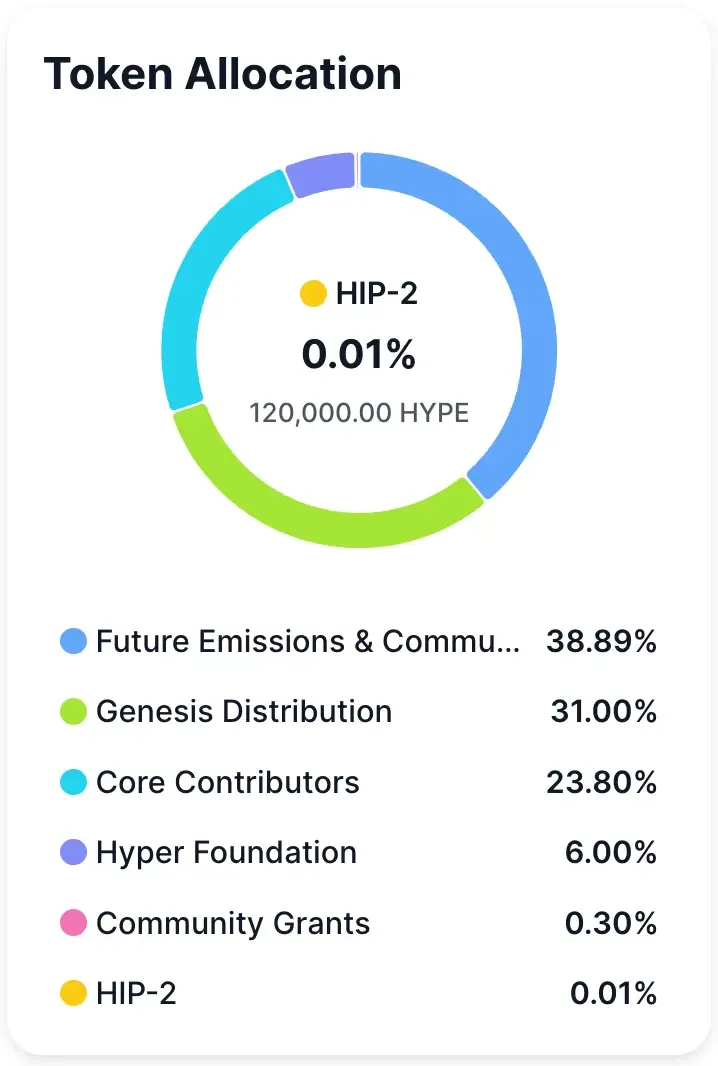

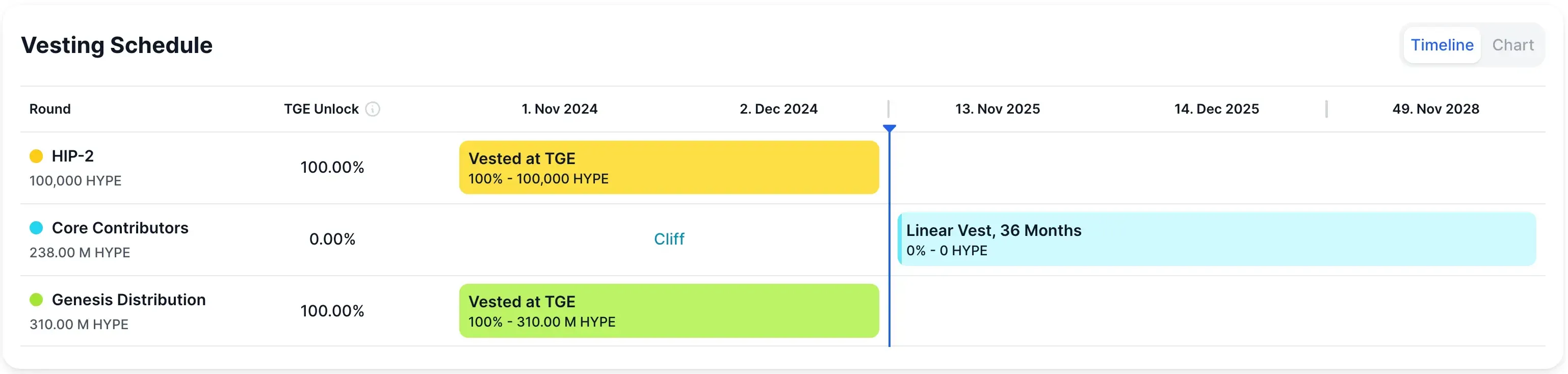

Hyperliquid is much tighter. Out of a 1B total supply, 270.77M HYPE are in circulation (27.08%). Market cap sits at $12.98B against a $47.88B FDV. Its token pool is split across future emissions and community (38.9%), genesis distribution (31%), core contributors (23.8%), and smaller allocations for the Hyper Foundation (6%) and grants. Less noise, fewer moving parts, and a supply model built to stay lean.

Revenue mechanics sharpen the contrast. Hyperliquid channels 97% of trading fees into its Assistance Fund, which already controls 29.8M HYPE worth about $1.5B — a buyback engine that constantly props up token value. Aster also uses buybacks, but distribution flows through governance, letting token holders steer rewards.

Aster has also begun rolling out direct utility for its token. Updated docs in late September confirmed that holders can unlock a 5% discount on perpetual trading fees by paying with ASTER.

Unlock schedules may be the clearest divider. Aster has only 20.7% of tokens liquid; the rest (5.79B) are locked. The next unlock on October 17, 2025, will release 183.13M ASTER (≈$244.9M), equal to 11% of its market cap. Unlocks then continue monthly, alternating between ~183M and ~123M batches. That’s heavy overhang.

Hyperliquid’s unlocks look feather-light by comparison: just 214K HYPE (0.02% of supply, ≈$10.3M) scheduled for November 29, followed by similar daily trickles for core contributors. For investors, that means dilution pressure at Aster could be relentless, while HYPE feels far steadier.

Key Risks

Regulation looms large. Aster has a target on its back thanks to two things: the CZ connection and leverage that stretches all the way to 1001x. Both raise eyebrows. Hyperliquid, meanwhile, leans on its community-funded model and decentralized setup — not immune, but less exposed.

On the tech side, neither setup is bulletproof. Hyperliquid’s custom Layer 1 is fast and clean, yet still a single point of failure. If the chain stumbles, the whole platform stumbles. A recent case in point: Hyperliquid’s XPL market was exploited by a handful of whales who drove spot prices with just $184K WETH, triggering a cascade that erased $130M in open interest and handed $47.5M in profit to the attackers.

Aster spreads risk across multiple blockchains, but bridges and cross-chain routes come with their own baggage — hacks, exploits, operational chaos.

Supporters argue the opposite — that Aster’s multi-chain design flips fragmentation into strength. One viral post claimed it executes 25,000 orders/sec across four chains, compared to Hyperliquid’s congestion at 3,100/sec on a single chain. The framing: $1.9B upstart with parallel settlement vs a $60B incumbent locked to one path.

Then there’s the question of staying power. Aster has to prove it can keep users once the airdrop farmers exit and the launch buzz fades.

Some in Crypto Twitter even mock Aster as “CZ’s revenge DEX,” suggesting the real winners so far are Hyperliquid traders riding the volatility.

Others are harsher, pointing to CZ’s track record. Past endorsements like SafePal, WazirX, and Trust Wallet saw 80–90% drawdowns after the pump. With ASTER still concentrated — 96% of supply reportedly in just four wallets — critics warn that history could repeat.

Hyperliquid’s threat looks different: it’s not the upstarts, it’s Wall Street. Traditional finance is circling DeFi derivatives, and that competition won’t play nice.

Final Comparative Insights

Hyperliquid wears the crown for now. It’s the established giant: $5B locked, $106M in monthly revenue, and 70–79% of all DeFi perpetuals volume flowing through its pipes. Its custom Layer 1 isn’t just fast — it’s industrial-grade, pushing sub-second finality and handling 200,000 orders a second. That’s the moat.

Aster, though, has something Hyperliquid can’t copy overnight. Multi-chain reach. Yield-bearing collateral. A design that feels closer to DeFi-native experimentation than institutional polish. Even with TVL cooling to $655M, the fact it briefly hit $2B in its first 24 hours shows just how much capital is willing to chase the next thing.

For investors, the profiles are almost opposites. Hyperliquid is the DeFi blue chip — steady buybacks, proven resilience, institutional adoption. Aster is the gamble: higher dilution risk, experimental features, and regulatory baggage, but also the potential to eat into Hyperliquid’s lead if users stick around. Both ride the same backdrop: a $319B monthly perpetuals market that keeps expanding. Who wins in the long run will come down to execution — and maybe, who survives the regulators.

The October 10, 2025 market crash was an early test of that execution. While Binance suffered outages during $19B in liquidations, Hyperliquid stayed fully online — processing half of those trades without downtime. We covered the event in detail in Hyperliquid vs. Binance.

As trader Sisyphus put it bluntly, the bigger Hyperliquid gets, the bigger the whole perp DEX sector becomes — but for most projects, standing out against Hyperliquid’s product will be the real challenge.