Crypto

Stablecoins: Digital Dollars Driving Crypto Growth

Stablecoins are pegged to currencies like the U.S. dollar and now total $297B in value. They’ve evolved from a niche tool into the foundation of trading, payments, and cross-border crypto finance.

Quick Overview

- Stablecoins hit $297B, now core to trading, payments, and DeFi.

- Tether (USDT $173B) expands with USAT, Rumble deal, WDK, and BTC reserves.

- New models (USDe, USDf, STBL, USD1, USDH, mUSD) show rapid innovation.

- Plasma XPL and Cloudflare’s NET Dollar push stablecoins into global rails.

- History proves one rule: without real reserves, stability won’t last.

The $297B Rise of Digital Dollars

When people talk about “digital dollars,” they’re usually referring to stablecoins. These tokens are pegged to traditional currencies—most often the U.S. dollar—at a 1:1 ratio. That simple peg solved one of crypto’s biggest headaches: how to step out of wild volatility without leaving the blockchain world entirely.

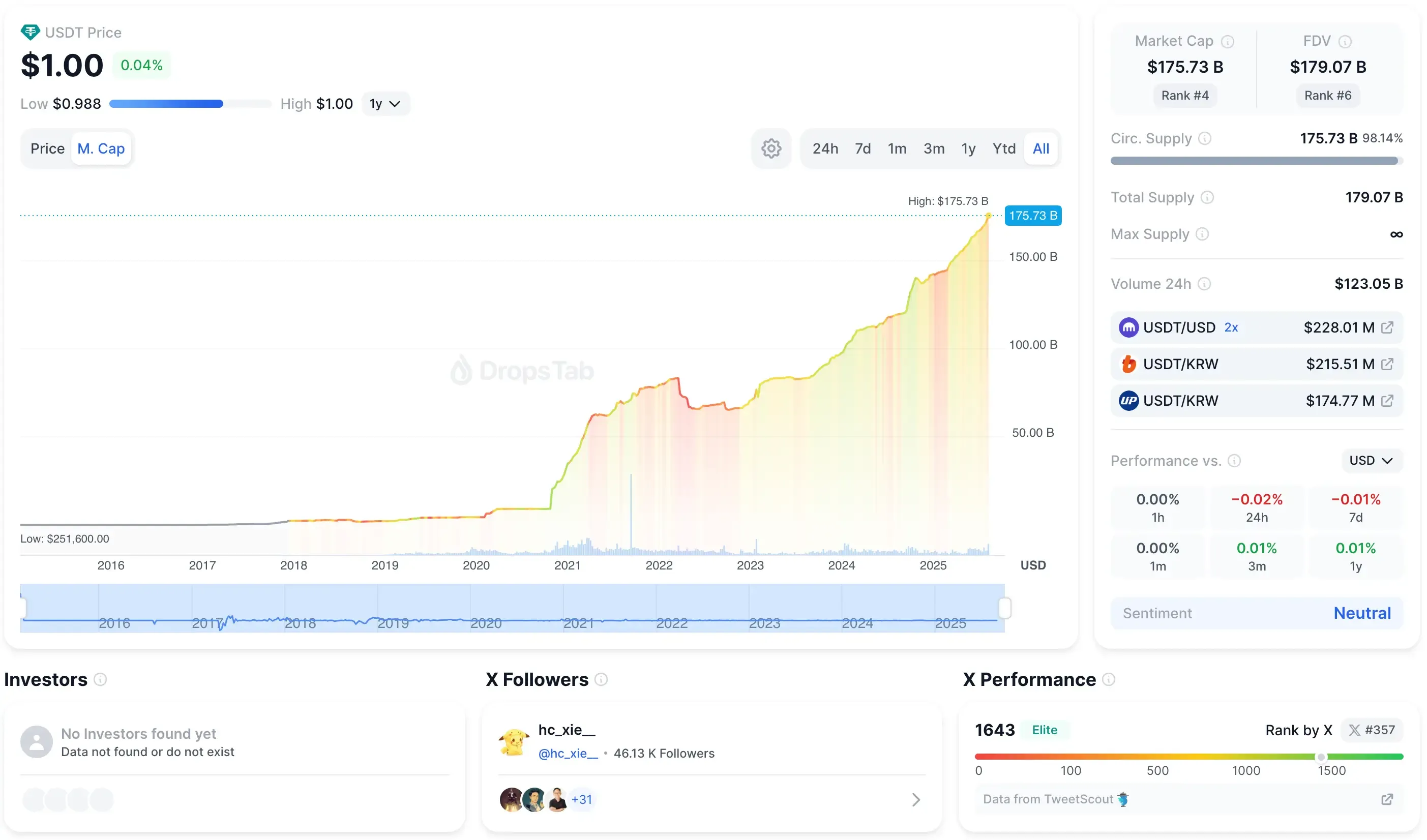

Today, the combined market cap of all stablecoins is around $297 billion. For perspective, five years ago the sector barely crossed $10 billion. That growth speaks for itself: stablecoins are no longer a side note, they’ve become a backbone of the market. Retail traders use them, institutions rely on them, and entire ecosystems are being built around these “digital dollars.” For a deeper dive into how stablecoins work — and the risks they carry — check out our analysis on the pros and cons of stablecoins.

Why Do We Need Stablecoins?

At their core, stablecoins exist to make crypto usable for everyday finance. They act as a parking spot for value — a place to store funds without getting whipsawed by market swings. Traders lean on them constantly: swapping volatile coins into stables to lock in gains, moving capital between exchanges in seconds, or bridging the gap between fiat and tokens.

The heavyweight here is Tether’s USDT, with a market cap near $173 billion. It’s everywhere. From centralized exchanges to DeFi protocols, USDT has become the de facto unit of account across crypto — a role once reserved only for the U.S. dollar itself.

Tether and Its Expansion Plans

Tether isn’t just sitting on its $173B stablecoin empire — it’s pushing for something bigger. In 2025, reports surfaced that the company was in talks to raise $15–20 billion at a valuation of roughly $500 billion. If the deal goes through, Tether would rank among the most valuable private firms on the planet, right next to names that rarely get mentioned in the same sentence as crypto.

The centerpiece of its next move is USAT, a new stablecoin designed for the U.S. domestic market. On October 1 at Token2049 in Singapore, Tether announced a partnership with video platform Rumble Inc. to promote USAT, integrating a wallet with support for USAT and other stables by year-end. Rumble — where Tether already holds a 48% stake after a $775M investment in late 2024 — boasts over 51 million monthly active users, giving USAT an instant adoption pipeline.

The project will be led by Bo Hines, formerly Director of the White House Crypto Council under Trump, with headquarters in Charlotte, North Carolina. Importantly, USAT will be positioned as the first U.S.-focused dollar stablecoin aligned with the new GENIUS Act, signed into law by President Donald Trump in mid-2025, which established a federal framework for stablecoins.

Tether is quietly laying technical foundations for broader adoption. In a late-September demo, CEO Paolo Ardoino showcased the company’s new Wallet Development Kit (WDK), describing it as the building block for “billions of wallets.” The kit is open-source, non-custodial, security-audited, and designed to integrate USDT, USAT, and DeFi primitives like lending and swapping.

Together, these moves signal that Tether is no longer just defending its lead with USDT — it’s planting a flag in the regulated U.S. market and building the rails for the next generation of stablecoin infrastructure.

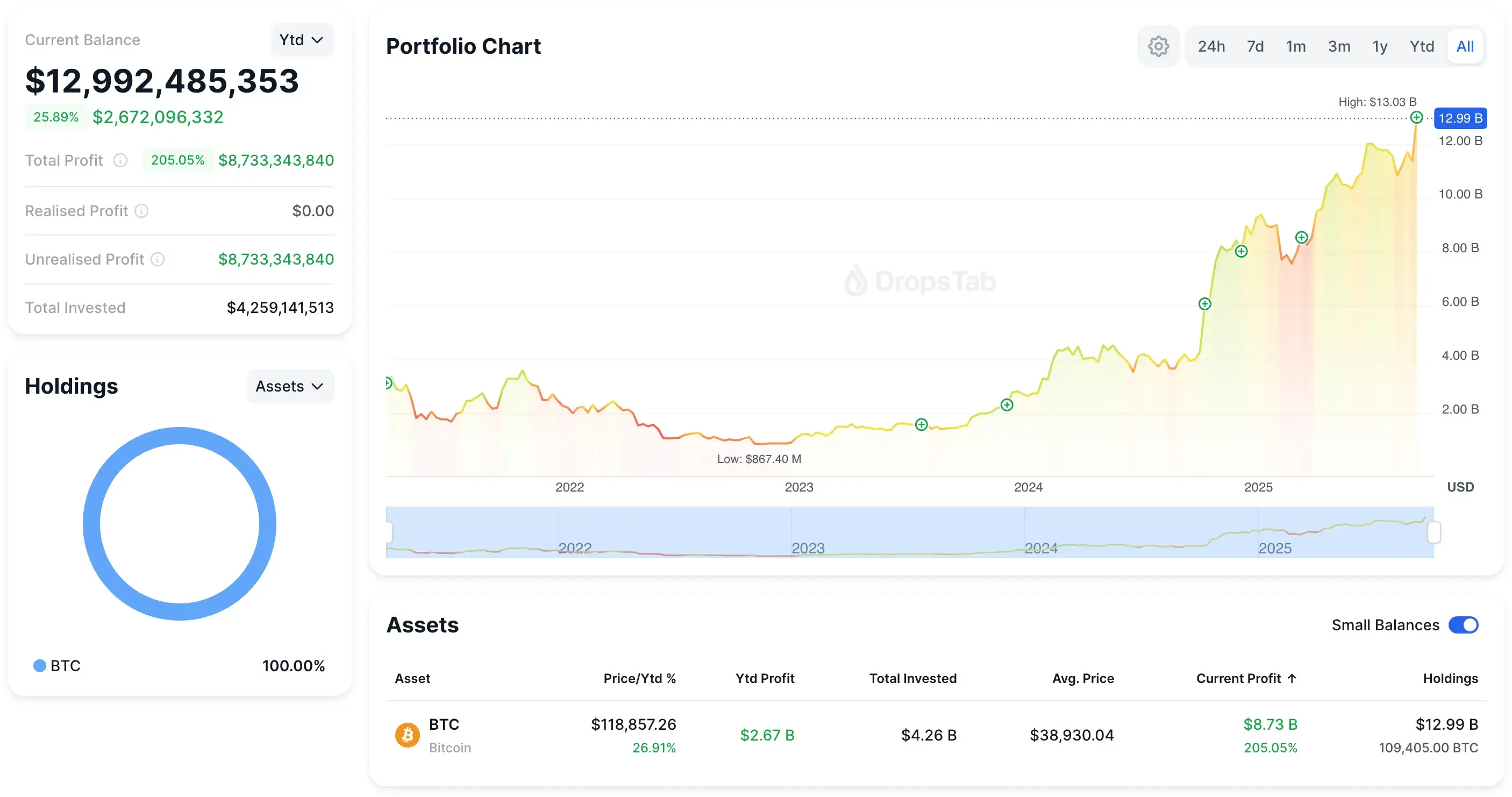

At the same time, Tether continues to diversify the reserves backing its tokens. On September 30, 2025, blockchain data showed a transfer of 8,889 BTC (worth roughly $1 billion) into Tether’s Bitcoin reserve wallet. This latest move highlights how the company is leaning further into Bitcoin as part of its collateral mix — a strategy it has promoted as both transparent and resilient in the face of dollar debasement.

Yet that same shift has sparked debate. As we outline in our research on USDT collapse concerns, Tether’s growing exposure to BTC and gold boosts profits but thins its $6.8 billion issuer buffer — meaning a sharp drawdown could trigger confidence shocks even without true insolvency.

The Political Context

It’s not just traders and investors watching stablecoins. Politicians have started framing them as a tool of economic influence — a kind of soft power wrapped in code. The idea is simple: if the world is already transacting in “digital dollars,” then the U.S. dollar’s reach stretches even further.

Voices like Eric Trump have hinted at this potential, framing stablecoins as a way to reinforce the dollar’s dominance. Meanwhile, Federal Reserve officials are openly studying how these tokens could extend the U.S. currency’s global footprint. That convergence of politics and protocol is what makes stablecoins so much more than a trader’s convenience — they’re becoming part of a geopolitical conversation.

A Diversity of Models and Approaches

Not all stablecoins are built the same. Behind the familiar “1:1 peg” are very different mechanics and risk profiles.

Several new projects illustrate how far the experimentation has gone:

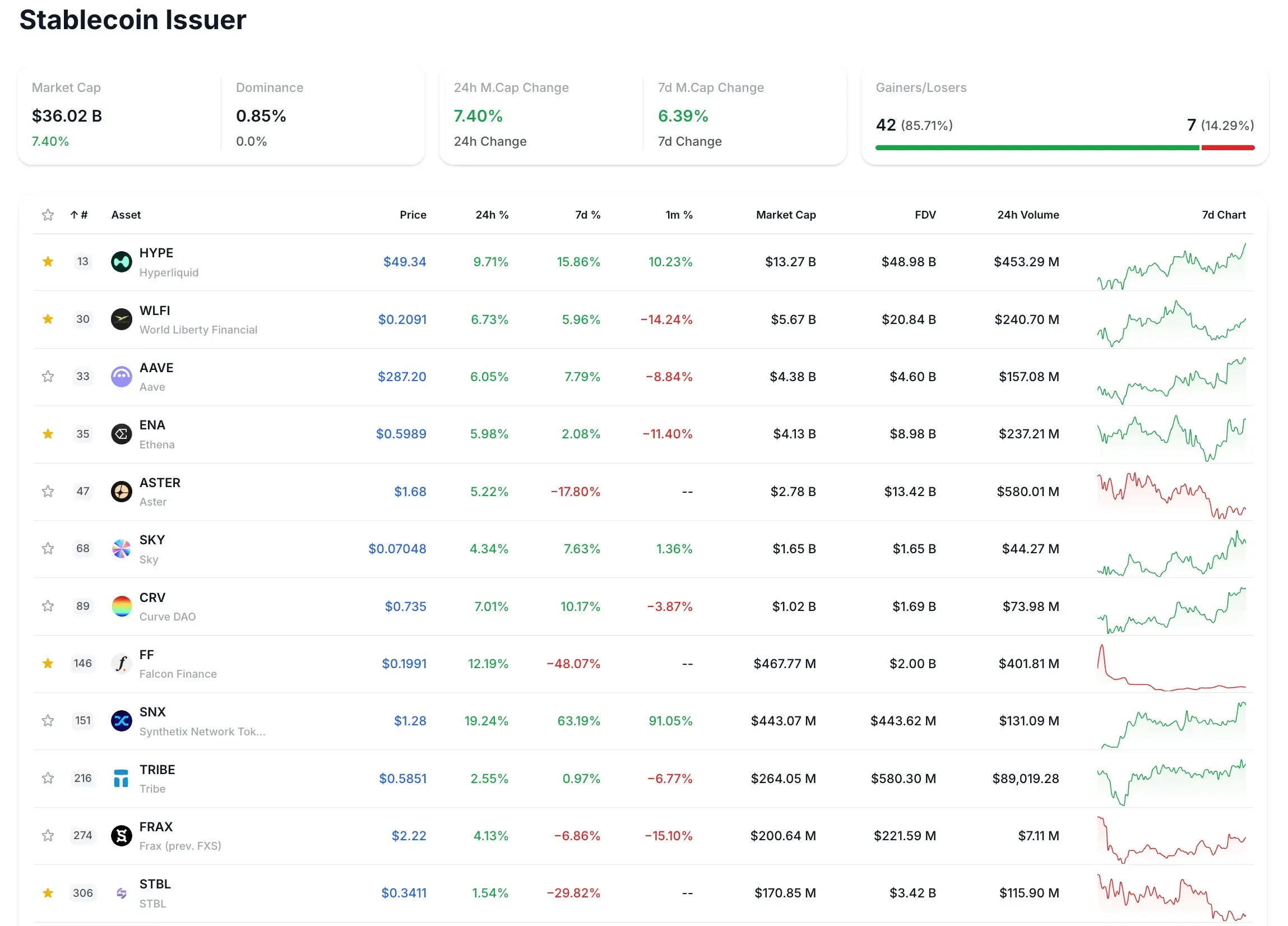

- Ethena (USDe): takes a delta-neutral approach. Users deposit stables, and the protocol opens short futures positions to offset crypto volatility. It’s a hedged design, less about collateral reserves and more about market structure.

- Falcon Finance (USDf): issues tokens backed by crypto, bonds, or even gold. Recently, it introduced redemptions where USDf can be swapped directly for physical gold or U.S. Treasuries — a rare bridge between tokenized and tangible assets.

- STBL (USST/YLD): splits collateral into a “base” and a “yield” layer. The base guarantees stability, while the yield portion earns interest, giving users returns without touching the principal value.

- WLFI (USD1): fully backed by high-quality reserves — bank deposits and short-term Treasuries. The clear institutional angle makes USD1 appealing to funds and professional market participants.

- USDH (Hyperliquid): emphasizes radical transparency. Reserves are openly verifiable, and revenue from those reserves is looped back into strengthening the platform’s economic model.

- MetaMask (mUSD): offers high liquidity and incentives on Linea, cheaper fiat on-ramps for crypto purchases, and native compatibility with MetaMask Swap and Bridge. Holders can even use the MetaMask card to spend with over 150 million merchants worldwide. By embedding a stable directly into the most popular Web3 wallet, MetaMask is positioning mUSD as both a payment tool and liquidity hub.

Meanwhile, voices in the Solana community argue it’s only a matter of time before the network enshrines a Solana-native stablecoin. As Mert from Helius put it:

“Stablecoins are commodities… Hyperliquid just showed how far these companies are willing to go to win business. Solana can command the same and more.”

He suggests Solana-based DATs (Digital Asset Treasury companies) could redirect stablecoin yield into buying or burning SOL — turning stable adoption into a direct flywheel for the network itself.

Together, these designs highlight a new theme: stablecoins are no longer just digital cash. They’re becoming structured financial products that blend safety with yield, each taking a different path toward balancing trust, collateral, and profit.

As Tether CEO Paolo Ardoino put it in September 2025:

“Copying is the best form of flattery. USDT tech and strategy is getting used as a template by all other dollars out there. Love to see it.”

His comment captures what the market already shows — even as new models emerge, USDT remains the standard blueprint.

Building Stablecoin Infrastructure

Stablecoins aren’t just tokens anymore; entire networks are being built to carry them at scale. Plasma (XPL), for example, offers zero-fee USDT transfers, flexible gas payments in multiple tokens, and even a native Bitcoin bridge — all aimed at making stablecoins function as true global payment rails.

That push toward dedicated infrastructure comes with a reminder from history. Algorithmic stables like TerraUSD (UST), Iron Finance, Basis Cash, and ESD showed what happens when designs rely on faith instead of reserves: depegs, cascades, and billions wiped out. Terra alone erased $40–60B in value in 2022, with $11B pulled from Anchor in days.

The lesson is clear: stability requires real backing. Without it, the most elegant infrastructure won’t matter. With it, stablecoins have a chance to anchor the next phase of crypto’s growth.

Opportunities and Risks

Stablecoins are no longer an experiment — they’ve become embedded in the fabric of crypto. Traders use them for liquidity, businesses adopt them for payments, and politicians debate their role in monetary strategy. Entire blockchains and even Web2 giants are building around these “digital dollars.”

But growth brings shadows. Regulation is still unsettled, reserve quality varies, and trust can vanish quickly. The Federal Reserve has warned that a sudden wave of redemptions could erode stablecoin value almost overnight. History has shown that weak designs collapse — TerraUSD, Iron Finance, Basis Cash — while stronger models keep consolidating their role.

In September 2025, Cloudflare (NYSE: NET) entered the race with NET Dollar, a USD-backed stablecoin designed for automated AI-driven payments and micropayments. It signals that stablecoins are expanding far beyond crypto-native circles into global internet infrastructure.

The future looks promising. Stablecoins are not perfectly secure, yet they are undeniably central to both crypto and the wider financial system.