Crypto

STBL: A New Breed of Stablecoin 2.0

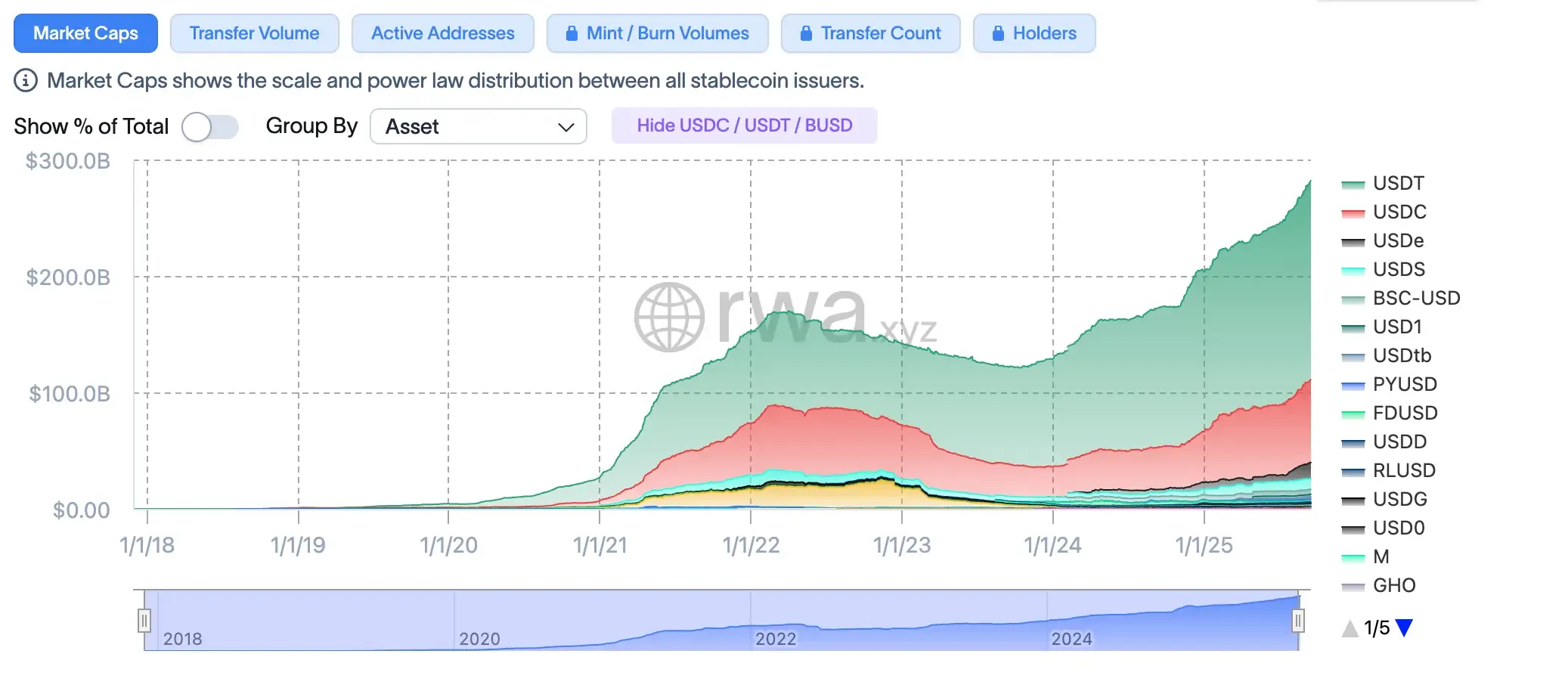

STBL, created by Tether co-founder Reeve Collins, blends RWA collateral, yield-splitting, and community governance. It’s aiming to shake up a $225B stablecoin market dominated by USDT and USDC.

Quick Overview

- Launched 2024, founded by Reeve Collins (ex-Tether CEO).

- Three-token system: USST (stable), YLD (yield), STBL (governance).

- Yield from Treasuries flows back to users, not issuers.

- Backed by Wave Digital Assets ($1B+ AUM).

- Competes with USDT, USDC, DAI; early but positioned in $225B market.

Table of Contents

- 1. Background and Founding

- 2. How STBL Works: Smart Contracts, RWA, and Yield Model

- 3. How STBL Stacks Up Against Other Stablecoins

- 4. Tokenomics and Supply Mechanics

- 5. Adoption, Integrations, and Liquidity Pools

- 6. Governance, Transparency, and Risks

- 7. Market Positioning in the Stablecoin Ecosystem

- 8. Key Takeaways for Traders and Investors

Background and Founding

STBL came to life in 2024, introduced by Reeve Collins — a name most crypto veterans recognize. Collins co-founded Tether, the world’s first and still largest stablecoin, and later steered it as CEO. His career has always circled around digital finance: BLOCKv ($22M raised), Pala Interactive (sold after raising $70M), and even a string of early marketing ventures. In other words, this wasn’t a rookie move.

Backing for the idea arrived quickly. Wave Digital Assets, a U.S. SEC-registered advisory firm overseeing more than $1B AUM, led the pre-seed round. Their presence gave STBL an institutional anchor from the start — a rare advantage for a stablecoin still in incubation.

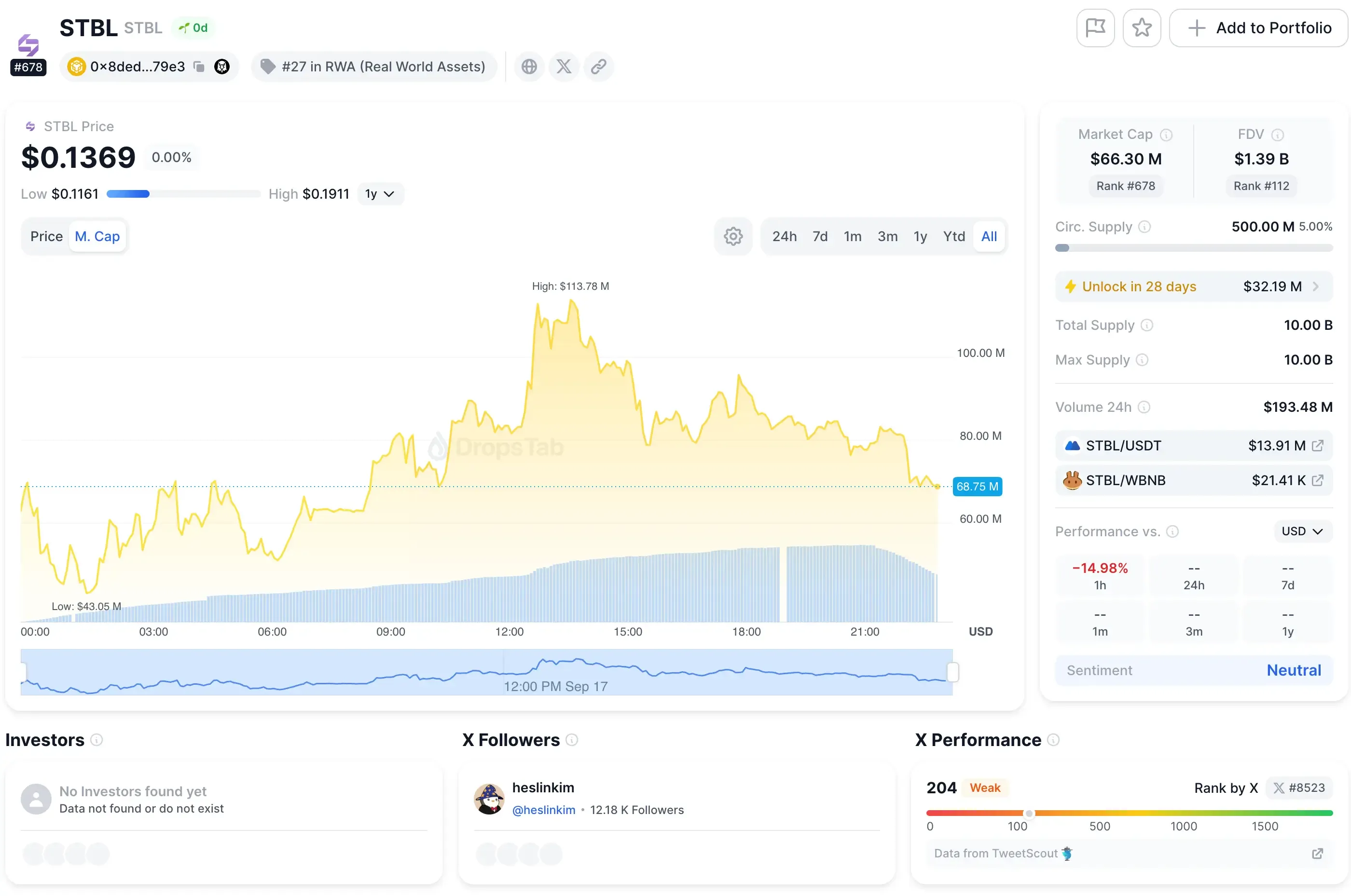

Collins calls the project “Stablecoin 2.0.” The pitch is simple but pointed: in the old model, issuers keep the yield from Treasuries and cash equivalents. In STBL’s design, that yield flows back to users. To kick things off, the governance token (STBL) went live on September 16, 2025, debuting on Binance Alpha and Kraken. Traders noticed — the token spiked 455% in its first 24 hours, peaking near $0.17.

How STBL Works: Smart Contracts, RWA, and Yield Model

At the core of STBL is a three-token setup — unusual, but deliberate. Each token has its own role: one for liquidity, one for yield, one for governance.

USST Stablecoin is the stable dollar. It’s pegged 1:1 to USD and backed by regulated real-world assets like U.S. Treasuries and AAA-rated money market funds. Users can mint it directly from their wallet — no staking, no lockups, no hoops.

YLD Token is where things get interesting. Every time someone mints USST, they also receive YLD, which tracks the yield from the underlying Treasuries and fixed-income collateral. In practice, it turns passive bond income into a tradable on-chain stream.

STBL Governance Token ties the system together. Holders decide what assets can back USST, how reserves are managed, what fees apply, and which upgrades get pushed through. It’s the steering wheel of the protocol.

This architecture enables what Collins calls yield splitting. Liquidity stays in USST, yield flows through YLD, and governance sits with STBL. Instead of the usual trade-off — earn yield or stay liquid — users can do both at once. Smart contracts handle the minting, reserve checks, and distributions in real time, with caps and ratios set by governance votes.

How STBL Stacks Up Against Other Stablecoins

Every stablecoin ends up in one of a few camps — centralized, overcollateralized, or experimental hybrids. STBL’s model doesn’t fit neatly into any of them.

Centralized giants: USDT and USDC

Tether sits at ~$158.6B and still dominates liquidity, though transparency questions never go away. USDC is smaller (~$62.2B) but wins on audits and reporting. Both rely on issuers pocketing the yield from Treasuries. STBL flips that: the yield is split back to users, not locked inside a corporate balance sheet.

Crypto-backed models: DAI and LUSD

MakerDAO’s DAI (~$3.6B) uses a basket of collateral, while LUSD (~$300M) is ETH-only with immutable contracts. These setups remove centralized trust but expose users to crypto market swings. STBL’s real-world asset (RWA) base is steadier — less reflexive to a bad day in ETH.

Hybrid/algorithmic plays: FRAX

FRAX (~$600M) mixes partial collateral with algorithmic stabilization. That design worked until it didn’t for other projects (remember UST). STBL sidesteps that fragility by leaning entirely on regulated Treasuries and money market funds.

Why it matters

STBL offers something the majors don’t: yield without locking up liquidity, and governance that isn’t just a corporate boardroom. Still, let’s be real — adoption is a mountain. It’s new, it’s small, and it’s up against incumbents with billions in liquidity. For a wider view of how different stablecoins balance strengths and risks, see our breakdown of the pros and cons of stablecoins.

Tokenomics and Supply Mechanics

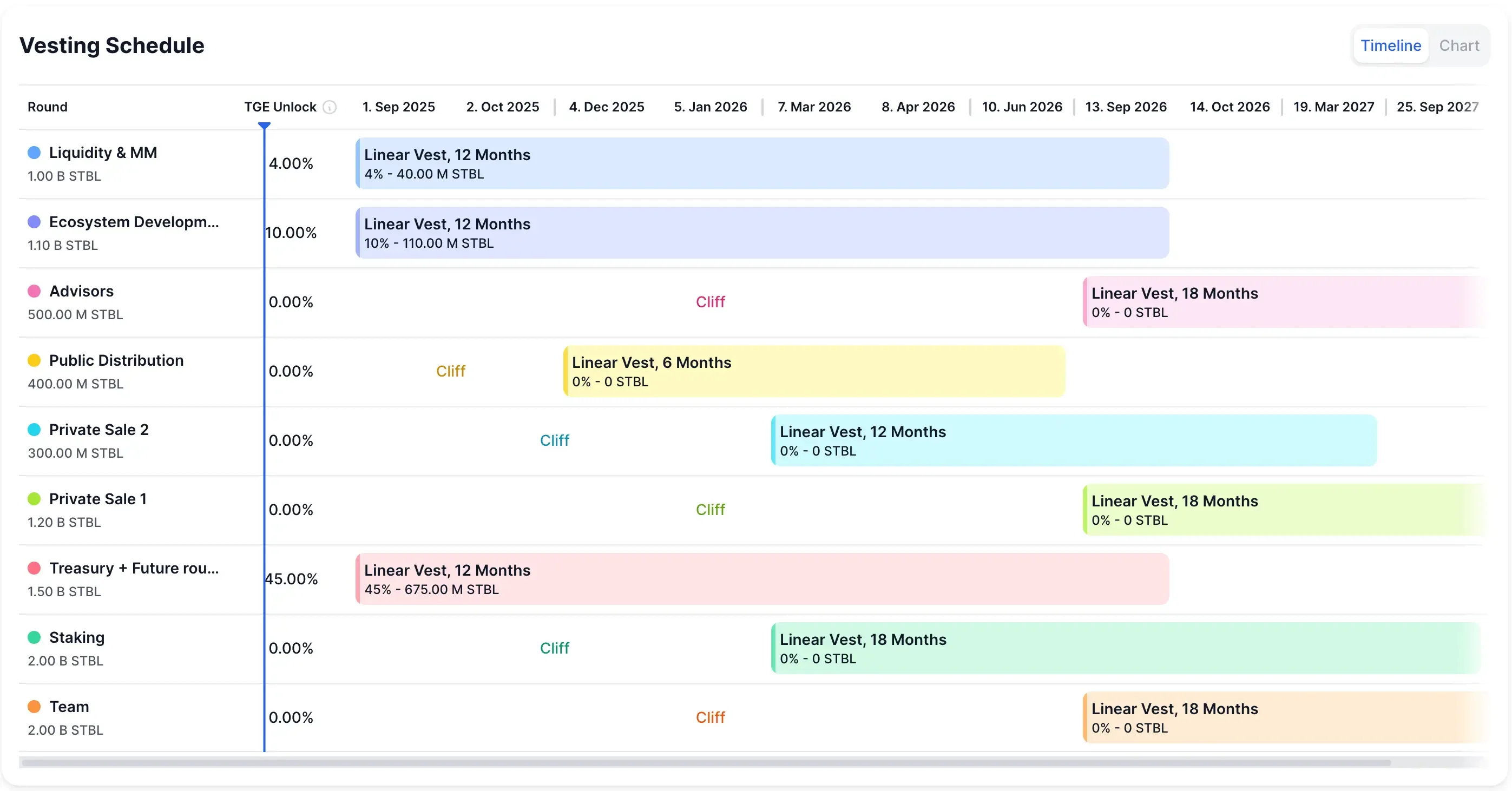

STBL’s token design is deliberately tight. The maximum supply is capped at 10 billion, but only 500 million (≈5%) are in circulation today. That scarcity creates immediate pressure on price action — a small float against growing attention.

The other 95% of supply remains locked, with vesting spread across liquidity, ecosystem funding, private sales, advisors, and the team. The actual release schedule shows cliffs and linear vests stretching into 2026–2027, meaning the bulk of tokens won’t enter circulation for months or even years.

As the chart makes clear, treasury and future rounds account for the largest share (45%), unlocking gradually over 12 months, while categories like team and advisors face longer 18-month vests. Public distribution, staking, and ecosystem development also follow staggered timelines.

This means scarcity may hold near term, but future unlocks could reshape liquidity and governance dynamics. For traders, watching those cliffs is just as important as watching the price chart.

The governance token itself isn’t just a speculative chip. It carries weight: voting on fees, collateral choices, yield rules, and treasury management. In short, STBL isn’t just a coupon for future upside — it’s a lever on how the entire protocol runs.

Adoption, Integrations, and Liquidity Pools

STBL didn’t tiptoe into the market — it went straight for big venues. Binance Alpha and Kraken carried the token on day one, with Alpha Points holders getting early access. That exclusivity helped fuel the 455% launch spike. Traders love a gate to push through.

On the DeFi side, the roadmap stretches further. Phase 3 calls for cross-chain interoperability plus staking mechanics to juice yields. The pitch is that USST can flow across chains while YLD keeps generating income, making it portable without losing its edge.

The beta dApp is already live. Users can mint USST stablecoins and YLD tokens directly against RWA collateral — no smoke, no promises, just working code. Security checks by Nethermind and Cyfrin add a layer of credibility, at least for now.

And then there’s the institutional angle. Wave Digital Assets, with $1B+ AUM, sits behind the project. That’s not just a line in a press release — it signals that someone in TradFi thinks this model belongs in portfolios, not just Telegram chats.

Governance, Transparency, and Risks

STBL leans on community governance rather than corporate boardrooms. Holders of the token set the rules: what collateral gets accepted, how fees are structured, how yield gets split, even when the treasury pivots. It runs on the familiar DeFi playbook — token-weighted voting — but with the stakes tied directly to real-world assets.

Transparency isn’t a side note here. The minting process, collateral reserves, and yield flows all sit on-chain, tracked by smart contracts. The pitch is simple: more visible than USDT, less discretionary than USDC, with programmatic asset management doing the heavy lifting.

Where the risks sit:

- Regulation. RWA-backed designs walk into the storm of new stablecoin laws like the GENIUS Act. Compliance isn’t optional.

- Liquidity. Only 5% of supply is live. Thin float plus new token = potential bottlenecks for traders.

- Collateral. Heavy reliance on Treasuries and fixed-income markets means interest-rate moves ripple into the protocol.

- Governance. Token concentration could let a few whales tilt decisions — and not always in the community’s favor.

Market Positioning in the Stablecoin Ecosystem

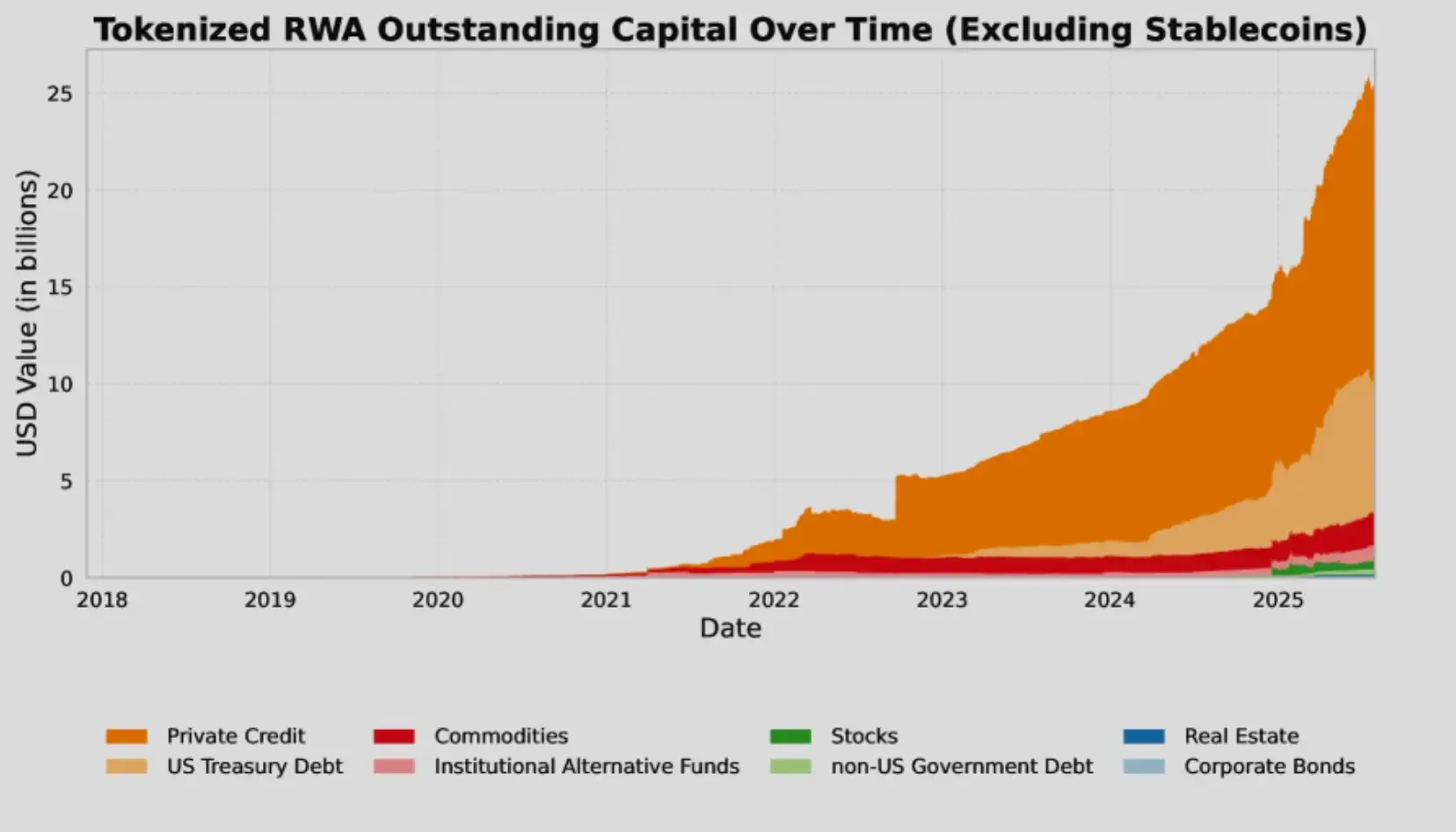

STBL isn’t launching into a vacuum. The stablecoin market now tops $225B, and its fastest-growing niche is real-world asset (RWA) tokenization.

By 2025, tokenized RWAs climbed to $24–25B, up 308% in just three years. Treasuries lead the charge: more than $7.4B tokenized, an 80% jump this year alone. That backdrop makes STBL’s model — yield from regulated Treasuries — look less like an experiment and more like a natural extension of where the market’s already heading.

STBL doesn’t yet rival the scale of USDT or USDC, but it isn’t trying to copy them either. Its differentiator is yield-sharing, plus institutional credibility from Wave Digital Assets and the Tether connection via Reeve Collins. Those signals matter when courting both DeFi users and TradFi allocators.

The launch lined up with two tailwinds: regulators finally drawing clearer lines around stablecoins, and institutions hungry for yield-bearing digital assets. The GENIUS Act’s Treasury-backing requirements map neatly onto STBL’s collateral design, giving it a regulatory narrative from day one.

Meanwhile, other players are chasing scale from a different angle — Plasma’s chain went live with $2B in liquidity and zero-fee USDT transfers, underscoring how fierce competition in stablecoin infrastructure is becoming.

Key Takeaways for Traders and Investors

STBL is early, messy, and potentially huge. That’s the short version.

Upside drivers

The founder’s track record (Reeve Collins, Tether) plus institutional backing from Wave Digital Assets gives credibility. The yield-splitting model ties directly into the surging RWA tokenization trend, positioning STBL for a grab at market share in a $225B stablecoin sector.

Investment considerations

Scarcity looks good now — only 5% of supply is liquid — but that concentration cuts both ways. Unlocks could hit hard. Add in regulatory uncertainty for RWA-backed designs and the fact it’s competing with giants, and the risk profile becomes obvious.

Timeline

The roadmap runs in phases: governance framework (Phase 2), cross-chain bridging (Phase 3), staking add-ons after that. Whether those milestones land on time — and whether users actually care — will decide if STBL sticks or slips.