Crypto

Plasma $XPL Mainnet Launch

Plasma (XPL) went live on Sept 25, 2025, with $2B in liquidity, zero-fee USDT transfers, and a 14.6x ICO-to-market surge. Backed by Tether and Founders Fund, the chain targets stablecoin payments at scale.

Quick Overview

- Mainnet launched Sept 25, 2025 with $2B in day-one TVL.

- Zero-fee USDT transfers powered by PlasmaBFT consensus.

- XPL debuted at ~$0.73, a ~14.6x jump from $0.05 ICO.

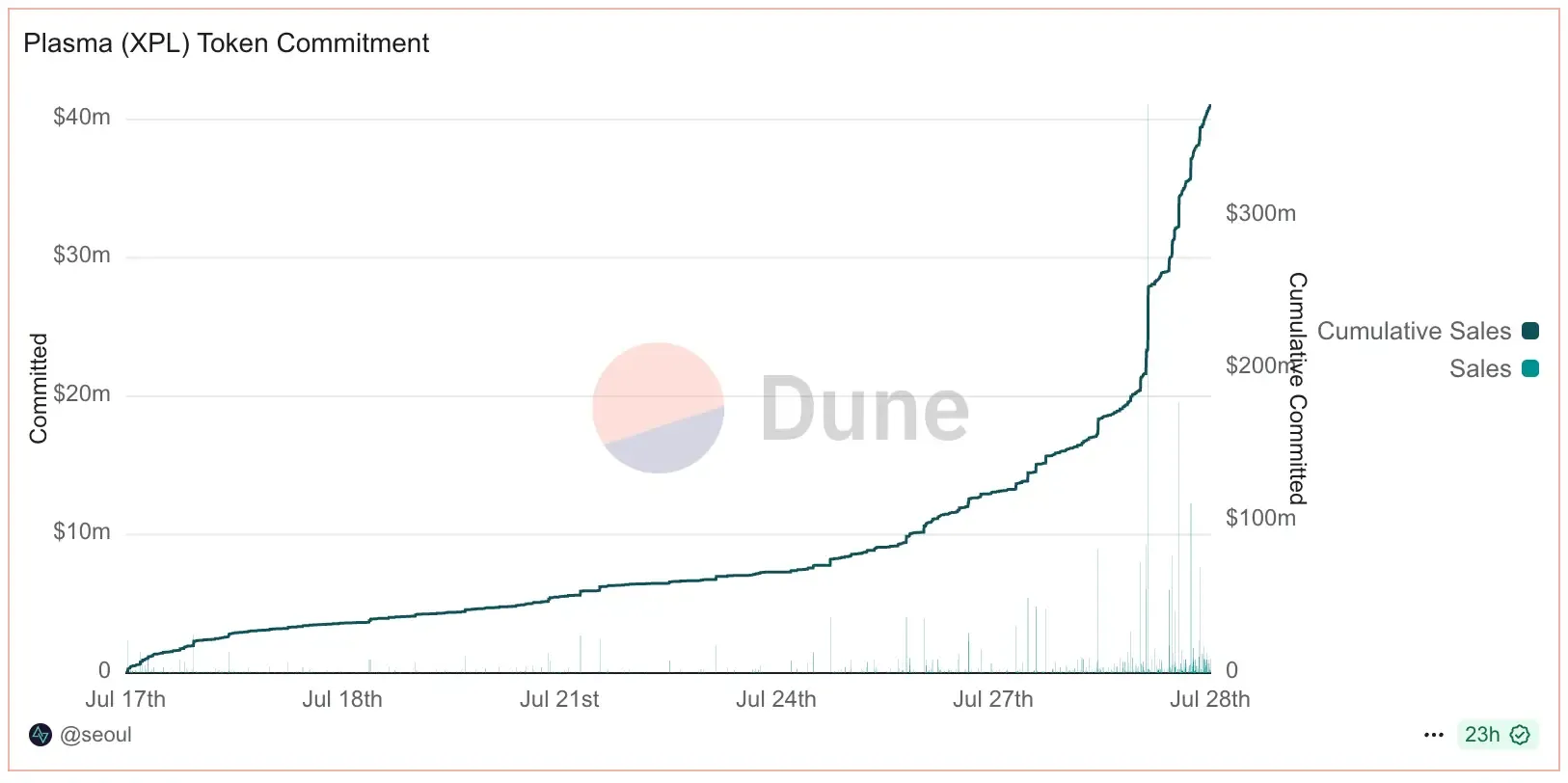

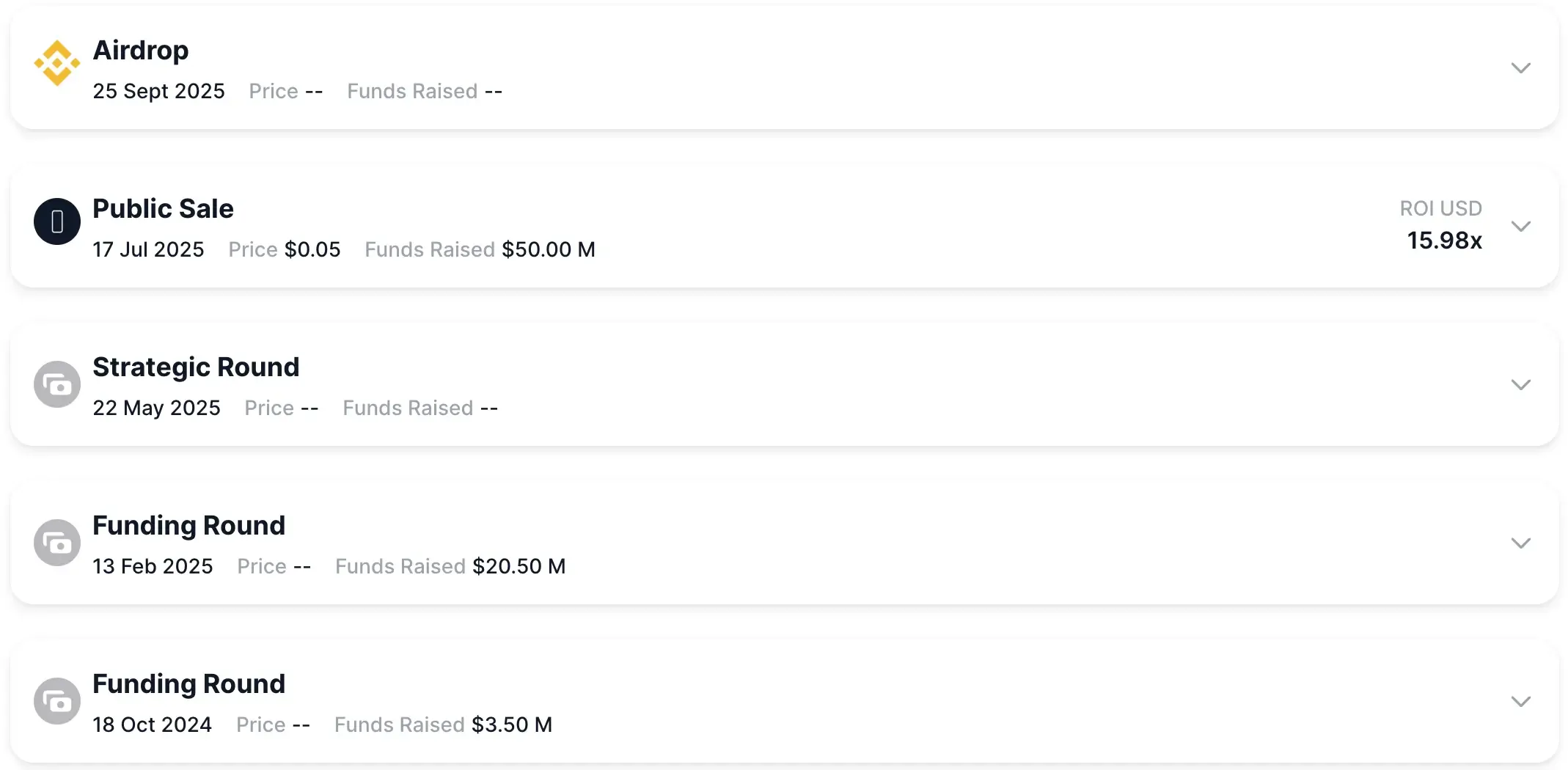

- $373M raised in public sale; $7.7B FDV at launch.

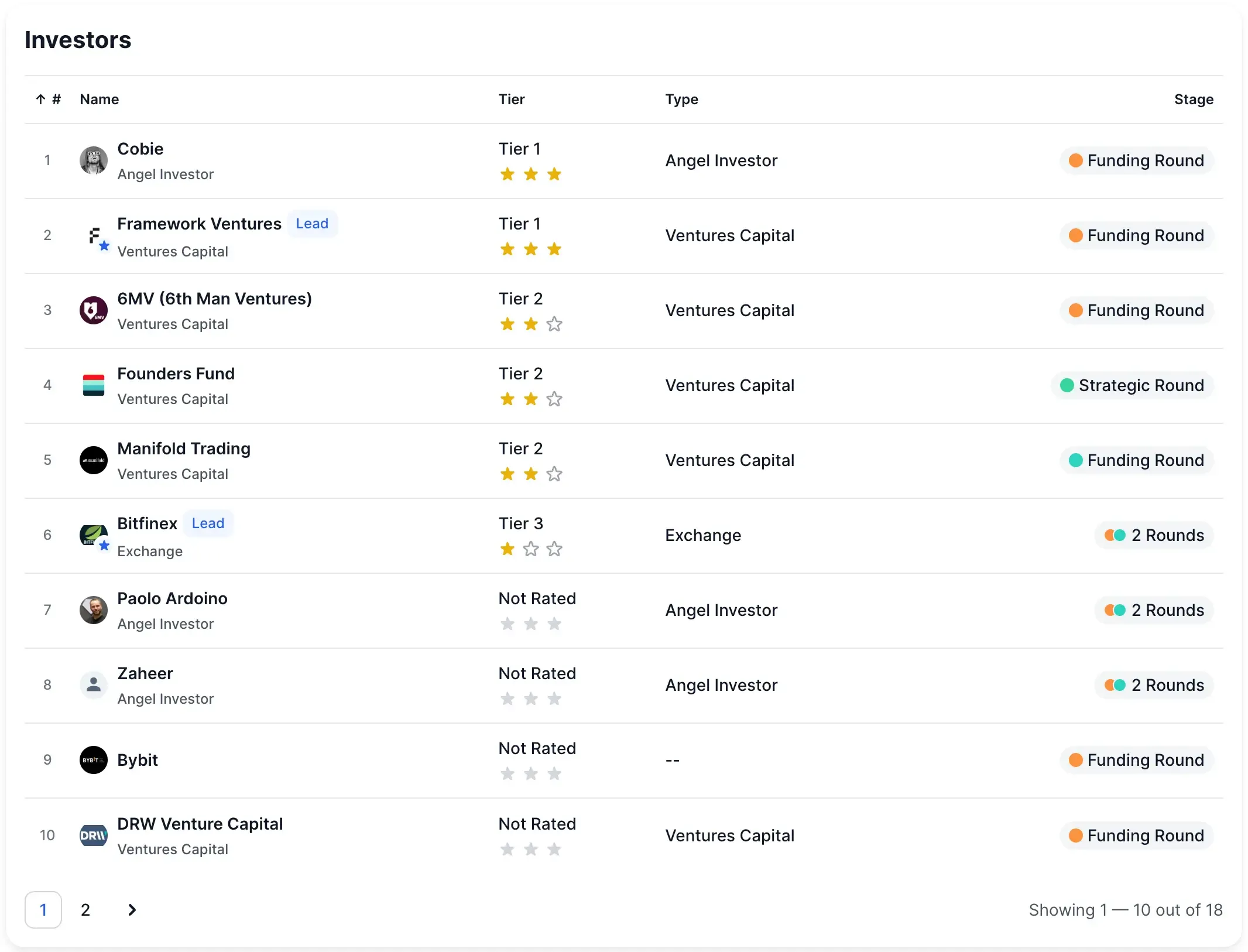

- Backers include Tether’s Paolo Ardoino, Founders Fund, Bitfinex, Framework.

What is Plasma (XPL)?

Plasma isn’t another “do-it-all” chain. It’s a Layer 1 laser-focused on one thing: moving stablecoins at scale. The network runs as an EVM-compatible Bitcoin sidechain, using its own PlasmaBFT consensus to push USDT transfers with zero fees. Blocks finalize in under a second, and throughput already clears 1,000+ transactions per second — speeds designed for payments, not experiments.

Three pillars hold the pitch together:

- Free transfers for stablecoins at the base layer, cutting costs for everyday USDT moves.

- Bitcoin-anchored security, with finality tied back to proof-of-work.

- Deep liquidity access, pre-integrated with more than 100 DeFi protocols (Aave, Ethena, Fluid, Euler, and others).

A neat twist: users don’t need XPL to cover gas. Plasma supports custom fee tokens, so transaction costs can be paid directly in stablecoins. That small shift could matter for mainstream adoption — people think in dollars, not governance tokens.

Mainnet Launch Details

Plasma flipped the switch on its mainnet beta at 8:00 AM ET, September 25, 2025. The debut came with an eye-catching stat: $2 billion in stablecoin TVL seeded across 100+ DeFi protocols on day one. That wasn’t symbolic capital — it was immediately plugged into savings products, lending pools, and deep USDT markets to lock in low borrowing rates for big players.

At the core of the launch sits PlasmaBFT, a tuned-up take on Fast HotStuff consensus. Instead of probabilistic confirmations, blocks hit deterministic finality in seconds. The trick is a two-phase commit pipeline — block proposals and confirmations overlap, pushing throughput while keeping Byzantine Fault Tolerance intact under a validator committee.

For users, the first proof point is already live: zero-fee USDT transfers through Plasma’s own dashboard at app.plasma.to. Wider integration with wallets and apps will roll out after stress testing.

Worth noting: the hype wasn’t manufactured. During the pre-launch deposit campaign, more than $1B in stablecoins flooded in within 30 minutes — a signal that market demand for a purpose-built stablecoin chain is very real.

Trading Debut — Market Reactions and Volumes

Plasma’s token, XPL, hit exchanges on September 25, 2025, and the market wasted no time. Pre-market activity ran hot, printing trades between $0.55 and $0.83. Average price? ~$0.7.

Once official listings went live, liquidity concentrated fast. Binance Futures took the lion’s share at 55.1%, booking $361.48M in 24h volume. OKX and Hyperliquid each grabbed ~19.4% of the pie, clearing more than $127M daily apiece.

Binance didn’t just open spot pairs — it also tied Plasma into its 44th HODLer Airdrops campaign. Users who staked BNB in Simple Earn products between Sept 10–13, 2025 are receiving a share of 75M XPL (0.75% of supply). Combined with the Sept 25 listing, this widened early token distribution beyond traders to passive Binance users.

Exchanges staggered rollouts to manage order flow:

- Binance: spot pairs with USDT, USDC, BNB, FDUSD, TRY at 13:00 UTC.

- KuCoin: call auction 12:00–13:00 UTC before spot opened.

- Upbit: fiat access for KRW, plus BTC and USDT pairs.

- Gate.io: 3M XPL on launchpad at $0.35 — a cheaper entry for retail.

Numbers told the story: across venues, $632M in futures volume cleared within 24h. At ~$0.73 trading levels, that pegs XPL near a $7.8B FDV, with circulating supply at launch valued around $1.4B (18% unlocked).

For a brand-new chain, those are Solana-style debut numbers. The question now is whether volumes hold once the opening-day adrenaline fades.

Tokenomics and Supply Metrics

Plasma set its genesis supply at 10B XPL, running on an inflation schedule that starts at 5% in year one and drops 0.5% each year until stabilizing at a 3% floor. The idea: steady emissions early to bootstrap activity, then tapering into a long-term equilibrium.

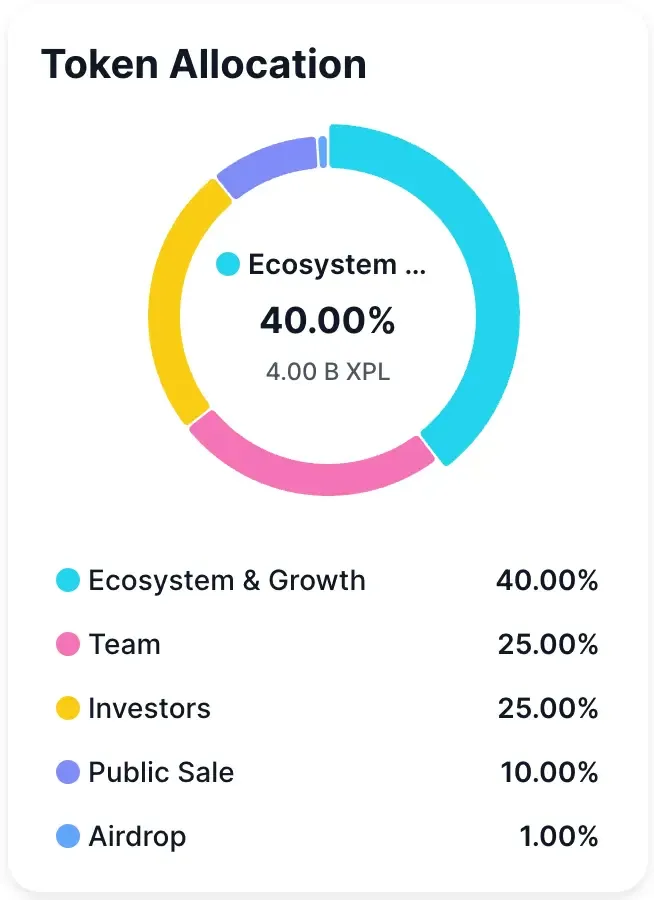

The allocation leans heavily into growth:

- 40% → ecosystem development + incentives

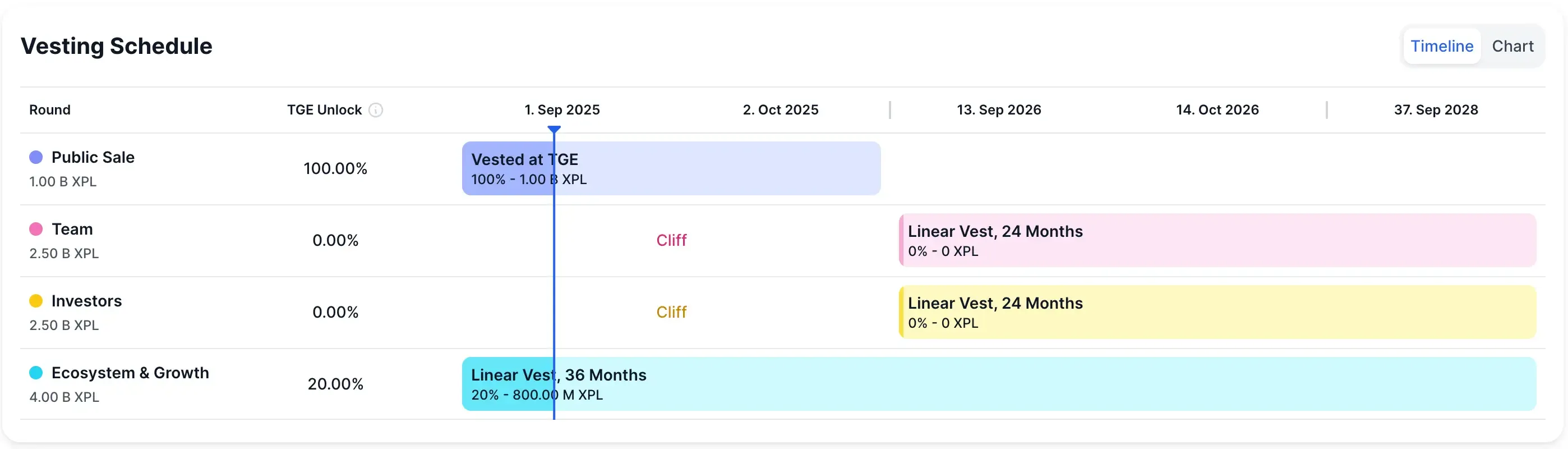

- 25% → team (1-year cliff, 2-year vesting)

- 25% → investors (same schedule as team)

- 10% → public sale

That public sale smashed expectations — $373M raised vs. a $50M target, pricing tokens at $0.05.

Compliance rules shaped the rollout: non-US buyers got tokens immediately at mainnet, while US allocations stay locked until July 28, 2026.

Community rewards also matter here. Plasma set aside 25M XPL for small depositors who passed Sonar verification, plus 2.5M XPL for members of the Stablecoin Collective.

At launch, 1.8B tokens (18% supply) were in circulation. Monthly unlocks now drip-feed ecosystem and growth allocations over a 36-month schedule. Validator rewards kick in at 5% inflation, but with base fees burned — meaning heavy usage could flip supply dynamics deflationary.

Ecosystem Positioning

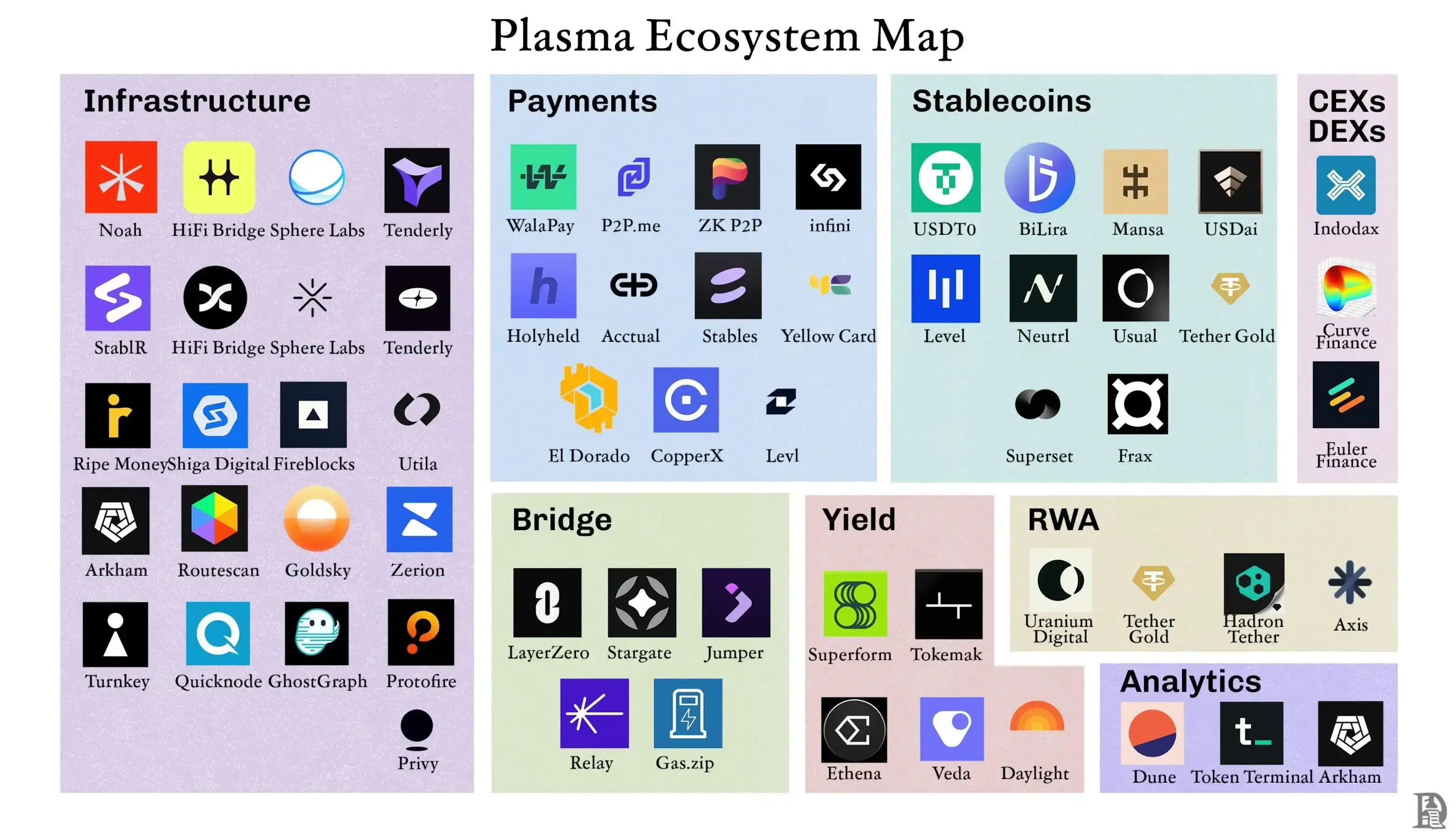

Plasma is trying to wedge itself into the cracks left by today’s stablecoin giants. Networks like Tron and Ethereum still dominate, but both have friction points — high fees, liquidity silos, scaling bottlenecks. Other challengers are emerging too: projects like STBL, built by Tether co-founder Reeve Collins, are experimenting with yield-splitting and governance-driven models to shake up the $225B stablecoin sector.

Plasma’s answer? Drop $2B in day-one TVL across established DeFi protocols so users instantly have yield, lending, and markets at their fingertips without chain-hopping. That’s not just liquidity — it’s a moat.

Beyond protocol integrations, Plasma is also pushing into consumer finance. The project announced plans for Plasma One, a neobank tied directly to the blockchain. Users will be able to top up a debit card with stablecoins and spend straight from balance, earn 4% cashback on purchases, and capture 10%+ APY on idle stablecoin holdings without lockups. Coverage will span 150+ countries, with zero-fee USDT transfers baked in. The card is being issued by Rain, using Plasma as the payment backbone, with yield sourced from its DeFi ecosystem.

The institutional buy-in is hard to miss.

Binance Earn plugged in $1B USDT through Plasma, marking the single biggest campaign in the program’s history. Early backers weren’t retail dabblers either: Bitfinex (seed lead, $3.5M round), Framework Ventures, DRW, Flow Traders — names that usually signal longer-horizon bets.

On the technical side, adoption cues are already forming. Plasma is prepping integrations with peer-to-peer cash networks for merchant payments and daily transactions — a big leap if stablecoins are ever to touch street-level commerce. The roadmap also flags a Bitcoin bridge built with LayerZero’s Omnichain Fungible Token (OFT) standard, designed to let BTC flow across chains as pBTC without carving liquidity into fragments.

Zoom out and you see breadth: support for 15+ stablecoins, across 100+ countries and 100+ fiat currencies. That reach, if delivered, moves Plasma from being just another DeFi sandbox to something closer to financial infrastructure.

Risks and Challenges

The launch metrics look strong, but Plasma isn’t immune to big risks. A few stand out:

Zero-Fee Transfers and Abuse

The free transfer model sounds great for adoption, but it hinges on categorizing transactions correctly and keeping throughput high. Congestion could turn “free” into frustrating. Worse, open rails invite spam — attackers could flood the system, forcing Plasma to deploy collateral requirements or throttles that cut into the user experience.

Regulatory Pressure

Stablecoin compliance is a moving target. Plasma already pushed US token distribution back to July 2026 to avoid early clashes. But the heavy reliance on Tether’s USDT creates a concentration risk — any regulatory hit on Tether would ripple straight into Plasma’s core value proposition.

Market Competition

The stablecoin race isn’t happening in a vacuum. Ethereum and Solana still dominate volumes, and both are tightening their pipes for stablecoin flows. Meanwhile, new chains are rolling out “low-cost” or “zero-fee” transfer gimmicks. Plasma has to prove its $2B TVL wasn’t just day-one hype — daily active users and sticky liquidity will decide if it holds ground.

Technical and Security Risks

Building a trust-minimized Bitcoin bridge is notoriously hard. Plasma has to keep it secure while maintaining decentralization, not an easy balance. Early validator centralization during the launch phase is another weak spot. Add the challenge of scaling PlasmaBFT under real-world traffic and the modular design’s hidden complexity, and you’ve got a lot of moving parts where something could crack.

Outlook

Plasma’s launch has carved out a distinct lane in the stablecoin race — zero-fee transfers at the base layer, Bitcoin-secured finality, and $2B of liquidity from day one. Add the $373M raise and a 14.6x ICO-to-trading debut and you get early proof the market is paying attention.

Near-Term Focus

Three numbers will matter most in the coming months:

- TVL retention once the initial commitments cool.

- Daily active users converting hype into habit.

- Third-party integrations for zero-fee transfers beyond Plasma’s own dashboard.

Competitive borrowing rates and deep USDT pools will be key to keeping capital sticky.

Long-Term Vision

Plasma’s bigger play is global payments. Merchant integration, cross-border remittances, and a Bitcoin bridge via LayerZero could expand use cases well past DeFi. Supporting more stablecoins beyond USDT widens the funnel further.

The stablecoin market is still climbing toward the $1T mark. Plasma’s chance is real — but only if it can prove network effects are durable, not just launch-week hype. With $632M in early daily trading volume and backing from heavyweight investors, the foundation looks solid. The next test: turning that foundation into an ecosystem people use every day.