Crypto

Strategy’s $48 Billion Math Error

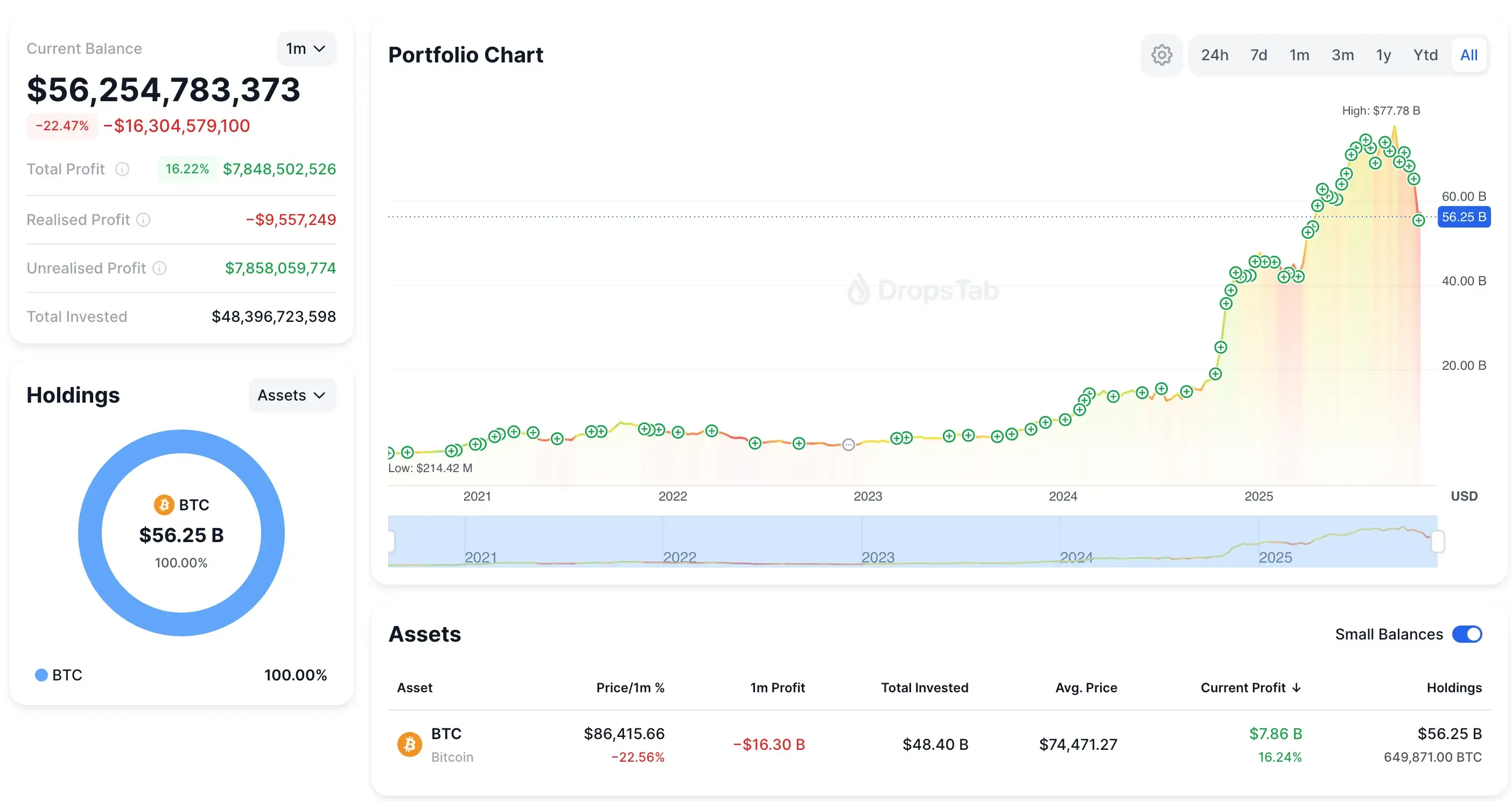

Strategy tried to run a sovereign-style Bitcoin reserve on a corporate balance sheet. Now $48B in BTC, $16B in liabilities, a collapsing NAV premium, and forced MSCI selling guarantee the math breaks in early 2026.

Quick Overview

- Strategy’s Bitcoin reserve isn’t a scam — it’s a balance-sheet design error.

- Cash flow can’t cover obligations, forcing constant borrowing or BTC sales.

- STRC preferreds create a rate-driven death spiral.

- MSCI removal triggers up to $8.8B in forced selling.

- By Q1 2026, only three outcomes remain — and Beta (slow BTC liquidation) is the base case.

Anatomy of a Ponzi-Style Engine

Strategy sells itself as a Bitcoin treasury company, but its financials point to a far tougher reality. The firm burned $45.6M in operating cash through the first nine months of 2025 and ended the period with just $54.3M — barely enough to cover one month of preferred dividends. Even the software arm, which was supposed to fund the operation, only produces about $363M a year in gross profit, covering just 56.7% of the $640M annual dividend bill.

Meanwhile, the company raised $19.5B in 2025 — none of which went to growth. It all went to servicing old liabilities and buying more Bitcoin to keep the machine running.

Strategy’s latest BTC acquisition: 8,178 BTC (~$835M at ~$102,171). Portfolio now 649,871 BTC — while MSTR stock drops ~40% and the portfolio slides by ~$16B in a month.

It all went to servicing old liabilities and buying more Bitcoin to keep the machine running. We covered this dynamic before in MicroStrategy’s risky bitcoin gamble — the same pattern of convertibles, equity issuance, and escalating Bitcoin bets was already visible long before the $50B mark.

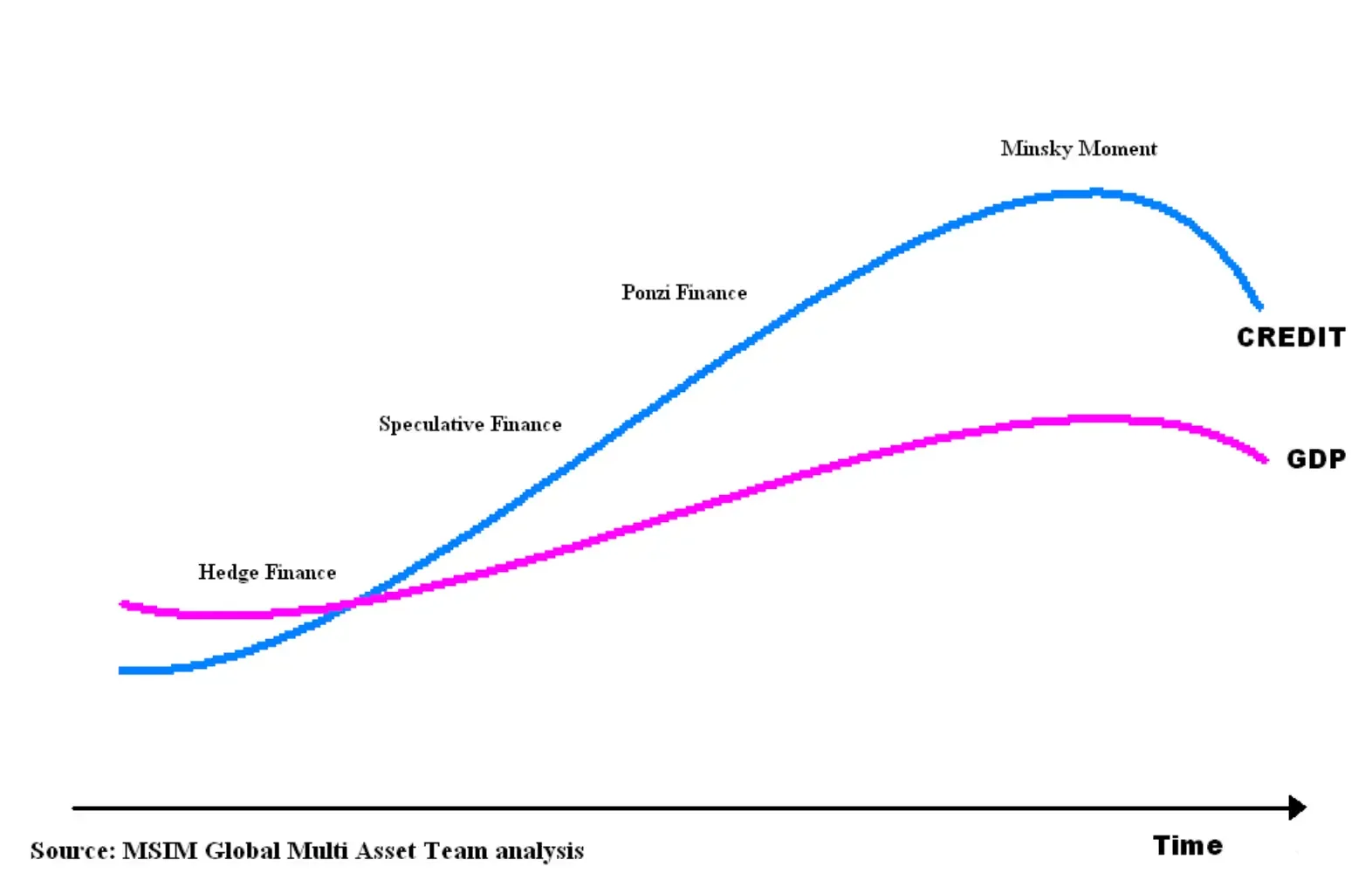

Strategy’s model fits Minsky definition of Ponzi finance — cash flows can’t cover obligations, so the company must constantly borrow or sell assets to survive.

And the one lifeline holding it together — issuing equity above its Bitcoin NAV — is disappearing. The premium collapsed from 2.7× in late 2024 to about 1.16× by November 2025. Without that premium, the model stops working entirely.

The STRC Death Spiral

STRC was meant to be clever — a variable-rate perpetual preferred stock that stays near $100 par because management can adjust the dividend monthly. On paper, it’s self-correcting. In reality, it’s a financial boomerang aimed straight at the company’s balance sheet.

The rate itself shows the problem. STRC’s annual yield jumped from 9.0% in July 2025 to 10.5% by November — a 167 bps spike with no improvement in fundamentals. The only reason it rose is because STRC slipped below par, forcing management to hike payouts.

Once you see the loop, it’s impossible to unsee it:

- STRC drops below $100

- Dividend is raised

- Cash burn spikes

- Market reads distress

- Selling increases

- STRC drops again

- Repeat

It’s the same doom-loop logic that broke Auction Rate Securities in 2008 — a rate mechanism that stabilizes nothing once confidence cracks.

And Strategy’s “71 years of dividend coverage” claim collapses instantly under real math:

- 10,000 BTC/month sales would overwhelm current market depth

- Price impact is nonlinear (Kyle’s Lambda → big orders detonate liquidity)

- 21% federal tax erases a fifth of proceeds immediately

- Selling BTC kills the NAV premium, eliminating equity issuance

- Debt covenants are likely triggered by asset liquidation

STRC isn’t financing. It’s a volatility amplifier — a machine that turns minor stress into catastrophic cash obligations. No operating business can survive this math.

And if the pressure ever forces Strategy to quietly unload size, the setup is already in place — we broke down how 165,709 BTC shifted into Fidelity’s omnibus custody, giving the company a clean path to sell 50,000–100,000 BTC without leaving on-chain traces.

The MSCI Guillotine: The Mechanical Trigger That Finishes the Model

January 15, 2026 is the real deadline. That’s when MSCI decides whether companies with more than 50% of their assets in crypto get kicked out of its Global Investable Market Indexes. Strategy sits at 77% BTC exposure, making it the most obvious removal candidate.

And the danger isn’t emotional — it’s mechanical.

JPMorgan estimates $2.8B in forced selling from MSCI-linked funds alone. When you add Nasdaq-100, Russell 2000, FTSE, and the rest of the passive universe, the number jumps to $8.8B. These funds don’t “react.” They must sell. It’s rules-based liquidation.

This is also where JPMorgan’s role drew heat. Right after the MSCI announcement, JPM released one of its sharpest bearish notes on Strategy in years — and the timing set crypto-Twitter on fire. The bank reiterated its $8.8B outflow estimate, then quietly raised margin requirements for MSTR exposure across its brokerage platform. That alone can trigger a cascading unwind: higher margin → forced deleveraging → more selling → lower price → more margin calls.

Is it a coordinated hit? There’s no proof — most accusations are just crypto-Twitter being crypto-Twitter. But JPM’s timing, its report, and its margin changes did amplify the instability around Strategy right as the index-flow mechanics were already stacked against it.

This sentiment began spreading across crypto-Twitter, framing the MSCI decision and JPMorgan’s actions as part of a broader “banking vs Bitcoin” conflict — a view not supported by hard evidence but widely circulated nonetheless.

The narrative then spilled into politics, with Eric Trump publicly claiming his family had been debanked by major U.S. banks, including JPMorgan — framing Bitcoin as an escape from traditional finance.

The backlash widened as high-profile entrepreneurs joined in, with Grant Cardone openly urging followers to close their JPMorgan accounts.

When the Dominos Start Falling

Strategy was added to the Nasdaq-100 in December 2024 with a 0.47% weight, pulling in about $2.1B. Exclusion simply reverses that flow — instantly.

Once that first domino falls, the chain reaction is brutal:

- January 15: MSCI says “out”.

- February: passive funds liquidate en masse.

- The stock drops under mechanical pressure.

- Market cap shrinks → the NAV premium collapses.

- No NAV premium → equity issuance becomes impossible.

- No equity issuance → no more Bitcoin purchases.

- No accumulation → the entire narrative dies.

- Narrative breaks → discretionary investors exit.

There is no management strategy that overrides index rules governing $590B in passive assets.

And MSCI’s logic is simple: a company with 77% of its balance sheet in Bitcoin and only $128.7M in quarterly software revenue doesn’t behave like a software company. With ASU 2023-08 pushing Bitcoin’s unrealized gains and losses directly into net income, Strategy now reports exactly like a levered Bitcoin investment fund.

From MSCI’s perspective, this isn’t a tech stock — it’s a classification error.

But Strategy’s CEO responded publicly, insisting the company is an operating business, not a fund — a stance that directly clashes with MSCI’s classification logic.

The Category Error

Strategy’s core mistake is simple: it tried to act like a sovereign while operating under corporate rules. Sovereigns can hold reserves for decades; corporations live on refinancing cycles measured in months. Bitcoin works as a long-horizon asset, but Strategy paired it with short-duration liabilities, monthly reset rates, and a funding model that collapses the moment the equity premium disappears.

Saylor himself has repeatedly emphasized that Bitcoin only works when you can ignore volatility and think in multi-year cycles. That’s exactly the one thing Strategy can’t do anymore.

This isn’t a problem of execution — it’s a structural mismatch. By concentrating 77% of assets in Bitcoin while relying on capital markets for constant liquidity, Strategy attempted a monetary strategy that only works for entities with sovereign timeframes and sovereign tools. Corporations don’t get those. They get cash flow, collateral requirements, and deadlines. That’s why the math breaks.

Q1 2026 Resolution — Three Paths to Collapse

By early 2026, Strategy’s entire structure hits a hard mathematical limit. There are only three realistic outcomes — each a different way the same imbalance resolves.

Alpha (low chance)

MSCI delays or softens its rule, giving the company a brief lifeline — but nothing in the structure actually gets fixed.

Beta (most likely)

MSCI removes Strategy, passive funds dump billions, and the company is forced into steady BTC selling just to meet obligations. The model survives, but the Bitcoin-accumulation story dies.

Gamma (danger zone)

MSCI exclusion collides with weak markets, cutting off refinancing entirely and forcing a massive fire-sale liquidation that collapses both the equity and part of the Bitcoin market.

And the reason one of these must happen is simple: $54.3M in cash, $640M in annual obligations, a crushed NAV premium, rising STRC yields, and $8.8B of forced selling ahead. Strategy can’t raise debt, can’t issue equity, and can’t sell Bitcoin without detonating the thesis.

Beta is the favorite. Gamma is the cliff. Alpha is hope.

Conclusion

Strategy isn’t a scam — it’s a company pinned under the weight of a balance-sheet design that can’t survive its own math. Too much Bitcoin, too much debt, and a collapsing equity premium have left the entire model dependent on constant capital inflows it can no longer access.

With $8.8B of forced MSCI selling on the horizon, the structure breaks no matter what Bitcoin does. The realistic outcomes are simple: Alpha (a delay) is unlikely, Beta (slow BTC liquidation) is the base case, and Gamma (forced collapse) is the tail risk no one wants to price. Strategy’s fate now hinges on mechanics, not belief — and the mechanics point to a model that cannot hold.