Crypto

MicroStrategy’s Risky Bitcoin Gamble May Backfire

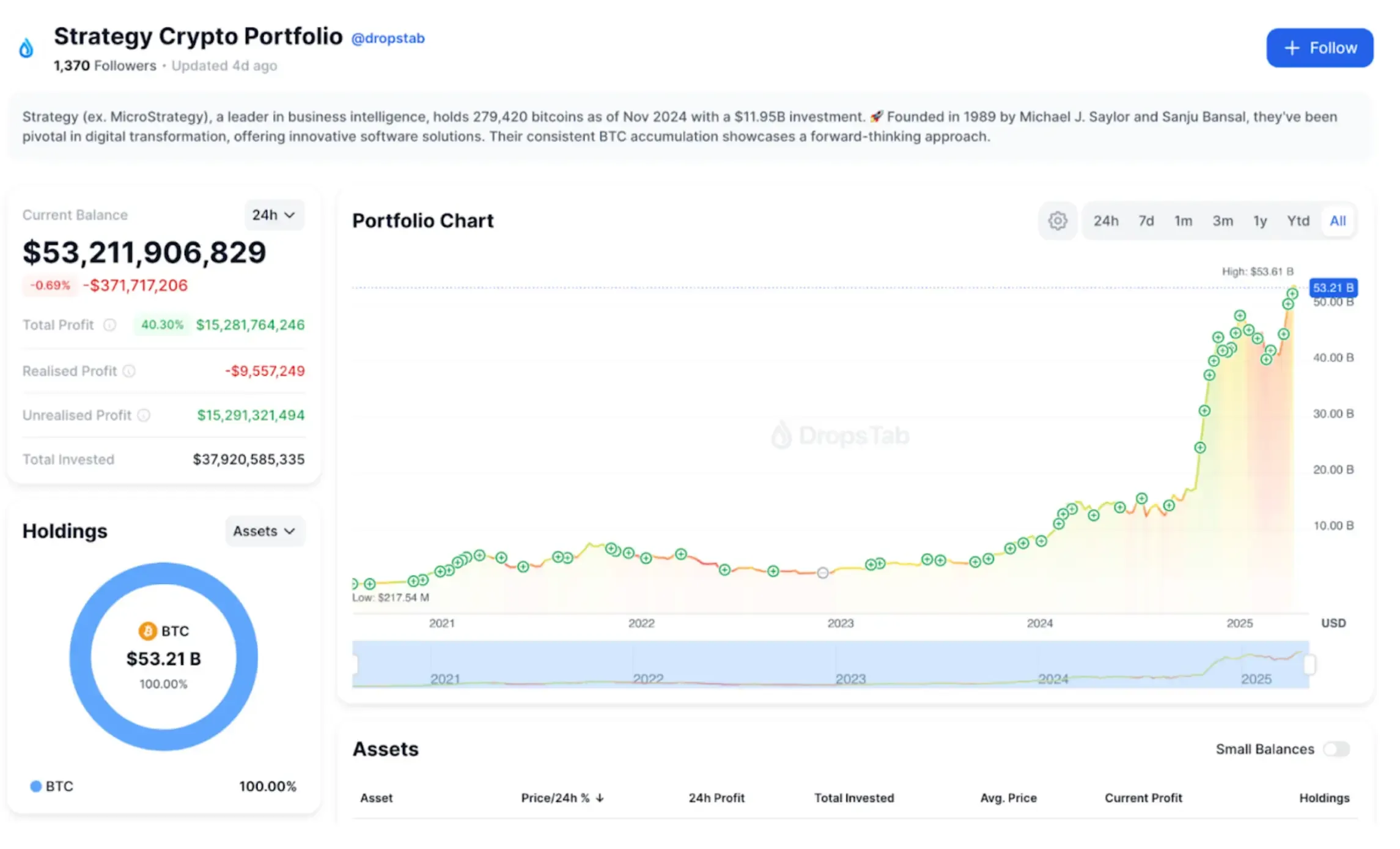

As of 2025, MicroStrategy’s Bitcoin holdings have surpassed $50 billion, making it one of the largest institutional BTC holders in the world.

TL;DR

- MicroStrategy’s Bitcoin holdings have surpassed $50B, making it one of the largest institutional BTC players

- CEO Michael Saylor views Bitcoin as a hedge against inflation and has funded purchases via discounted convertible bonds and stock issuance

- Every capital raise is followed by massive BTC buys — turning MSTR stock into a leveraged Bitcoin proxy

- Critics warn of concentration risk, extreme volatility, and potential collapse if BTC crashes

- Supporters hail Saylor as a visionary aiming to accumulate 1 million BTC, but concerns around sustainability and shareholder dilution persist

Table of Contents

- 1. Microstrategy Bitcoin Acquisition Clarity

- 2. How Much Crypto Does Microstrategy Own

- 3. Why Did MicroStrategy Start Buying Bitcoin?

- 4. Where Did the Money Come From?

- 5. What’s Next? Everything Into BTC

- 6. The Feedback Loop of Growth

- 7. Why This Divides the Community

- 8. Saylor’s Personality: Visionary or Gambler?

Microstrategy Bitcoin Acquisition Clarity

At the start of 2020, few had heard of MicroStrategy — a typical B2B software company making money from analytics and BI. But everything changed when its CEO, Michael Saylor, made a move that not only redefined the company's direction but also impacted the entire crypto market. MicroStrategy essentially transformed from a mediocre software business into a "pseudo Bitcoin ETF," with its stock price soaring more than 10x.

The pivot to Bitcoin brought instant popularity as the company's fate became tied to the fast-growing crypto market. This strategy also gained social media traction. Enthusiasts praised Saylor for recognizing Bitcoin’s potential early and giving traditional investors a chance to ride the wave.

“MicroStrategy is basically a leveraged way to hold Bitcoin in your ISA,” explained one user, highlighting how even those unable to buy crypto directly used MSTR stock as a proxy.

How Much Crypto Does Microstrategy Own

As of this writing, MicroStrategy’s assets amount to nearly $48 billion and 553,555 BTC, with a net investment of $38 billion. The net profit stands at $15 billion according to DropsTab Microstrategy crypto portfolio.

Why Did MicroStrategy Start Buying Bitcoin?

The motive was simple: fear of inflation. Saylor openly called cash a “melting ice cube” and declared that the only way to preserve capital was to move it into a “hard asset.” For him, that was Bitcoin.

He even publicly stated that Michael Saylor believes Bitcoin will one day become unaffordable, urging investors to act before it’s too late.

Where Did the Money Come From?

Profits from its core business weren’t enough to cover even modest BTC purchases, so MicroStrategy pursued large-scale financing:

- Convertible bonds — at 0% interest, which is absurdly cheap. In 2021 alone — $1 billion, followed by multiple rounds in 2023–2025. Some of these rounds included convertible securities issued at a discount, allowing the company to raise capital with minimal short-term cost.

- Stock issuance — over $3 billion in shares sold during 2024–2025.

Saylor used the company’s balance sheet — issuing bonds and equity — to buy more Bitcoin. This aggressive financial engineering concerns some observers. Critics on Reddit sometimes compare MicroStrategy’s strategy to a Ponzi scheme or “free money glitch,” where new funding is constantly raised to buy more BTC.

What’s Next? Everything Into BTC

Every fundraising round was followed by immediate Bitcoin purchases. In November 2024 — $1.3 billion. In February 2025 — another $623 million. This is no longer a strategy — it’s a mission. In one instance, MicroStrategy acquires $243 million worth of Bitcoin, showcasing the scale of each purchase.

The Feedback Loop of Growth

BTC rises → MicroStrategy’s asset value rises → its stock price rises → the company issues more shares or bonds → buys more BTC.

The result? MicroStrategy stock has soared due to its substantial Bitcoin holdings, turning it into a de facto leveraged BTC vehicle. It is not an ETF but a leveraged Bitcoin vehicle traded on NASDAQ.

Saylor is creating leverage through market trust. The higher BTC goes — the higher MSTR goes — the more cash he can raise to buy more BTC. It’s a cycle.

While the buying seemed endless, Microstrategy Bitcoin purchases halt at times — a signal that even bold strategies may face limits.

Why This Divides the Community

Pros: MicroStrategy became a hero to Bitcoin maximalists. Even those who couldn’t buy BTC directly bought MSTR shares.

Cons: High debt levels, concentration risk, potential corporate collapse. MicroStrategy’s challenge is extreme volatility and the binary nature of its bet. If Bitcoin soars, MicroStrategy wins big. But if BTC crashes, the company could be ruined. “I have a strong feeling this ends badly,” one Reddit user admitted, though they added that if Saylor somehow succeeds, even skeptics holding BTC will profit with him.

On WallStreetBets and other skeptical forums, users joke that Saylor “found an infinite money printer,” diluting shareholders to raise cash for Bitcoin. This highlights the community’s awareness that MicroStrategy is betting on a high-risk, high-reward asset.

This level of exposure is why many say MicroStrategy’s risky Bitcoin gamble may backfire if the market turns against them.

But the bigger issue isn’t whether Bitcoin rises or falls — it’s the structure of the balance sheet itself. Strategy have rebranded and scaled past $50B in BTC, but the underlying mechanics didn’t change much. As analysts now argue, the company essentially tried to run a sovereign-style Bitcoin reserve on a corporate balance sheet, leaving it with $48B in BTC, $16B in liabilities, collapsing NAV premiums, and looming forced MSCI selling. Our deep dive in Strategy’s $48 billion bath error explores why those mechanics begin breaking down in early 2026 — even if Bitcoin keeps rallying.

Saylor’s Personality: Visionary or Gambler?

Supporters call him a visionary. Detractors — a manipulator cashing out on the hype and exposing shareholders to volatility. Especially after it was revealed that he sold part of his holdings near all-time highs.

Saylor became a well-known Bitcoin evangelist, frequently promoting BTC on podcasts and Twitter, gaining a loyal following. Some rallied around his bold goal to accumulate 1 million BTC, echoing his mantra:

The only thing better than Bitcoin — is more Bitcoin.