Crypto

Why USDT Collapse Concerns Are Rising

Tether’s rate-driven shift into Bitcoin and gold boosted profits but shrank its protection layer. A 30% drop can erase the issuer’s $6.8B buffer on paper — fueling USDT collapse concerns driven more by confidence shocks than actual insolvency.

Quick Overview

- Tether’s issuer buffer is only $6.8B against $22.8B in BTC + gold risk assets.

- A 30% drop in both wipes the buffer and shows technical insolvency on paper.

- The parent company has $30B equity, but it’s not legally pledged to USDT holders.

- S&P’s “weak” rating amplifies optics risk more than balance-sheet risk.

- USDT collapse concerns hinge on confidence, not reserves — redemption waves start on psychology.

USDT Collapse Concerns Data

Tether’s Q3 2025 BDO attestation reads like something between a stablecoin reserve report and the quarterly filing of a sprawling investment group. You can almost feel two entities layered on top of each other — the issuer that actually prints USDT, and the parent company that looks more like a lightly regulated macro fund.

The Solvency Gap

Start with the issuer.

Tether International holds $181.2B in reserves backing $174.4B of USDT liabilities. That thin $6.8B excess is where most critics focus. It’s only about 2.8% of assets and roughly 3.9% of liabilities, which is exactly the number Arthur Hayes keeps circling.

But step back to the parent company — Tether Holdings — and the tone shifts completely.

On a consolidated basis, the group controls $215B in assets with $30B in equity, including an eyebrow-raising $23B in retained earnings. Those retained earnings do not appear in the issuer’s attestation and are legally separate from token reserves, but they exist. And they’re large enough to soak multiple stress events.

So you end up with two solvency stories running in parallel:

- Issuer reality: a $6.8B buffer protecting a $174.4B liability stack

- Group reality: a $30B equity base supporting a $215B balance sheet

No single document makes those two worlds reconcile cleanly, which is why the debate keeps resurfacing.

Tether the Sovereign Investor

The reserve composition is where things start to look surreal.

With $112.4B in U.S. Treasuries, Tether now sits between South Korea and Germany in global sovereign rankings.

From this alone, Tether earns around $500M every month, or $6B per year, just from yield.

The rest is where things get spicy:

- $9.856B in Bitcoin

- $12.921B in gold

- smaller lines in secured loans and corporate bonds

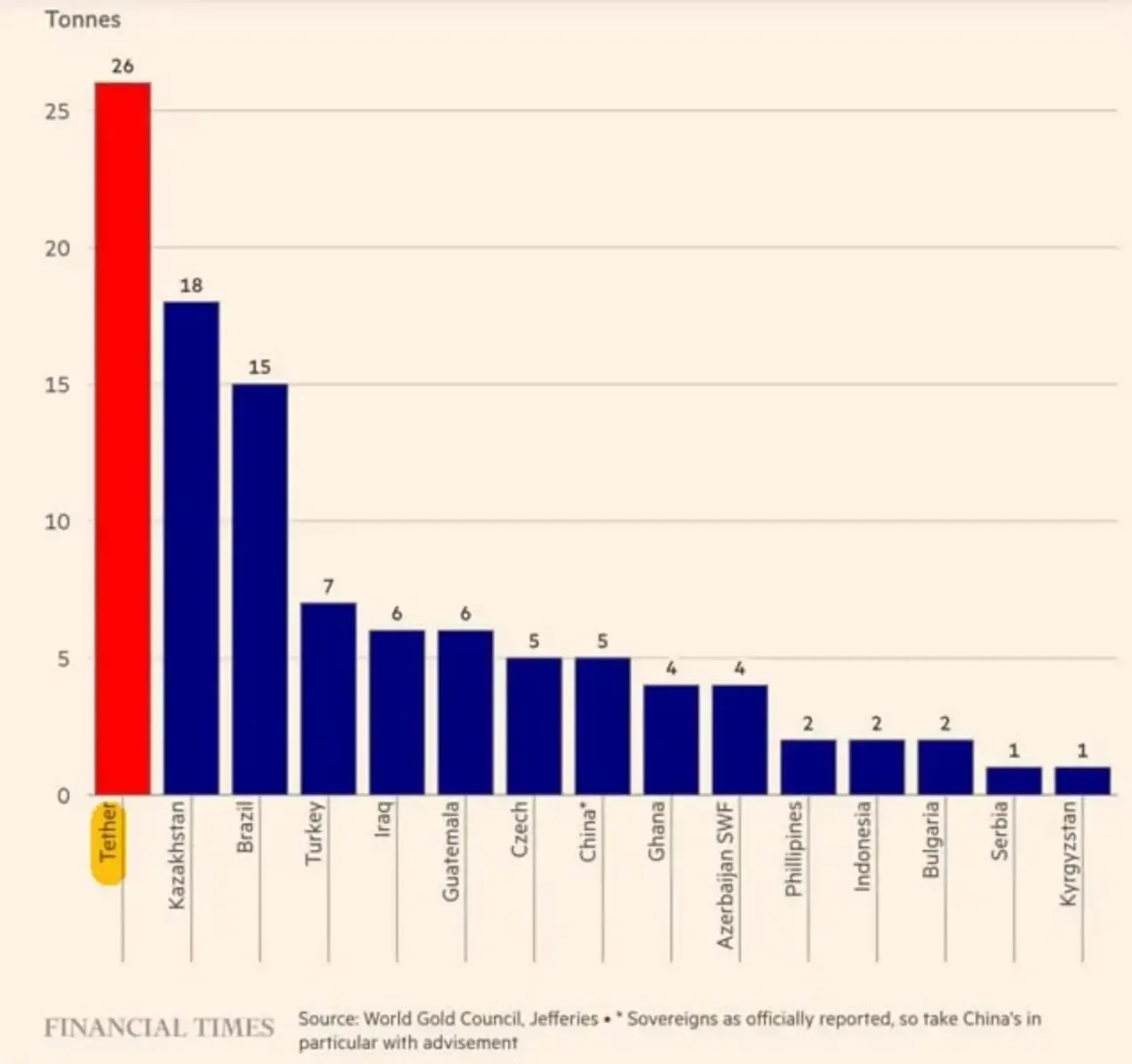

And the scale of that gold allocation became even clearer in Q3 2025. According to the Financial Times, Tether was the single largest gold buyer in the world that quarter — purchasing 26 tonnes, more than any central bank.

Together, the BTC+gold sleeve totals $22.8B — the exact exposure people center his insolvency scenario on.

Why Tether Loaded Up on $12.9B Gold and $9.9B BTC

This rotation wasn’t some whimsical crypto gamble. It’s connected to interest rates.

Futures markets expect the Fed to cut rates through late-2025 — the December meeting alone carries an 87.4% probability of a 25 bps cut. Lower rates mean lower income from Treasuries, which is Tether’s main cash machine.

So the company pivoted toward assets that could produce something uncorrelated. Gold acts like a macro shock absorber. Bitcoin behaves like Bitcoin — volatile, sometimes brilliant, occasionally brutal.

And here’s the uncomfortable part: this shift introduces mark-to-market volatility directly into the issuer-level buffer. Treasuries barely move day-to-day. BTC and gold move constantly.

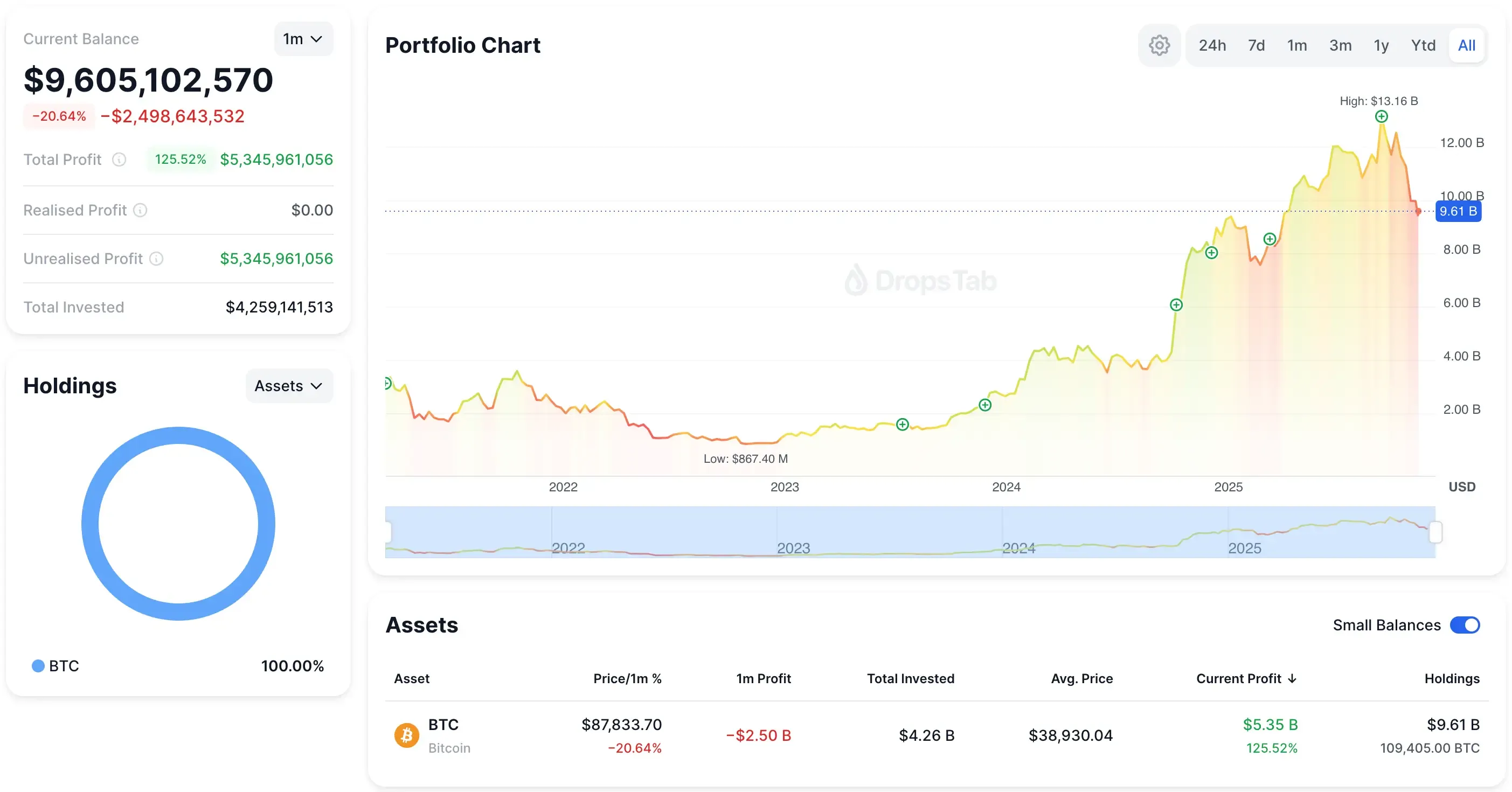

And it’s not theoretical — Tether’s BTC portfolio already swings billions month-to-month. The portfolio chart below shows how a single month of volatility can erase nearly $2.5B in value on paper.

What the attestation really shows is that Tether isn’t hedging USDT itself. It’s hedging its business model.

The $6.8B excess reserve is less “safety cushion” and more “volatility sponge.” If the risk sleeve drops 30%, the issuer takes the hit first, while the parent company holds a much larger — but structurally separate — pool of capital above it.

The Hayes Thesis vs. the Ardoino Defense

Arthur Hayes’ math is straightforward: Tether’s $22.8B BTC + gold position can lose $6.84B in a 30% drawdown — almost identical to the issuer’s $6.8B buffer. On paper, that pushes Tether International into roughly -$100M equity. It’s a technical insolvency, not a liquidity freeze, but it’s enough to shake confidence.

His argument relies on a simple premise: USDT holders can only claim issuer-level reserves, not the parent company’s capital stack. If the issuer’s buffer disappears, even temporarily, the optics alone can trigger redemption pressure.

Paolo Ardoino counters from the consolidated view: the parent company holds $23B in retained earnings and roughly $30B in total equity. In his framing, Tether has more than enough capital to absorb the hit — just not inside the narrow entity Hayes focuses on. That’s the gap that matters.

The money exists, but it’s not automatically pledged to protect USDT. Whether the parent can legally or operationally rescue the issuer in real time is unclear, and that uncertainty is what amplifies any downturn.

Stress Testing the 30% Crash

A 30% hit to BTC and gold erases roughly $6.84B from Tether’s $22.8B risk sleeve — almost the exact size of the issuer’s $6.8B buffer. On paper, that pushes Tether International slightly negative, about -$100M, even though the parent company remains comfortably solvent.

And this is where the real danger sits. Not the loss itself — the optics. With Bitcoin now representing 5.6% of all circulating USDT, a fast drawdown drags Tether’s visible coverage ratio below the psychological 3.9% threshold institutions track. The moment that coverage dips, traders stop arguing about accounting definitions and start pulling liquidity.

If enough desks believe the parent may hesitate — or legally struggle — to patch the issuer, a redemption wave can form purely from sentiment. Nothing fundamentally breaks; the appearance of fragility is enough.

And honestly, this is the same structural fragility you see across the $297B stablecoin stack. Traders trust the peg only as long as reserves look real. We broke down this dynamic — from USAT to USDe to mUSD — and the pattern repeats here: once the reserve picture gets fuzzy, confidence moves first.

In stablecoins, confidence doesn’t leak slowly. It snaps.

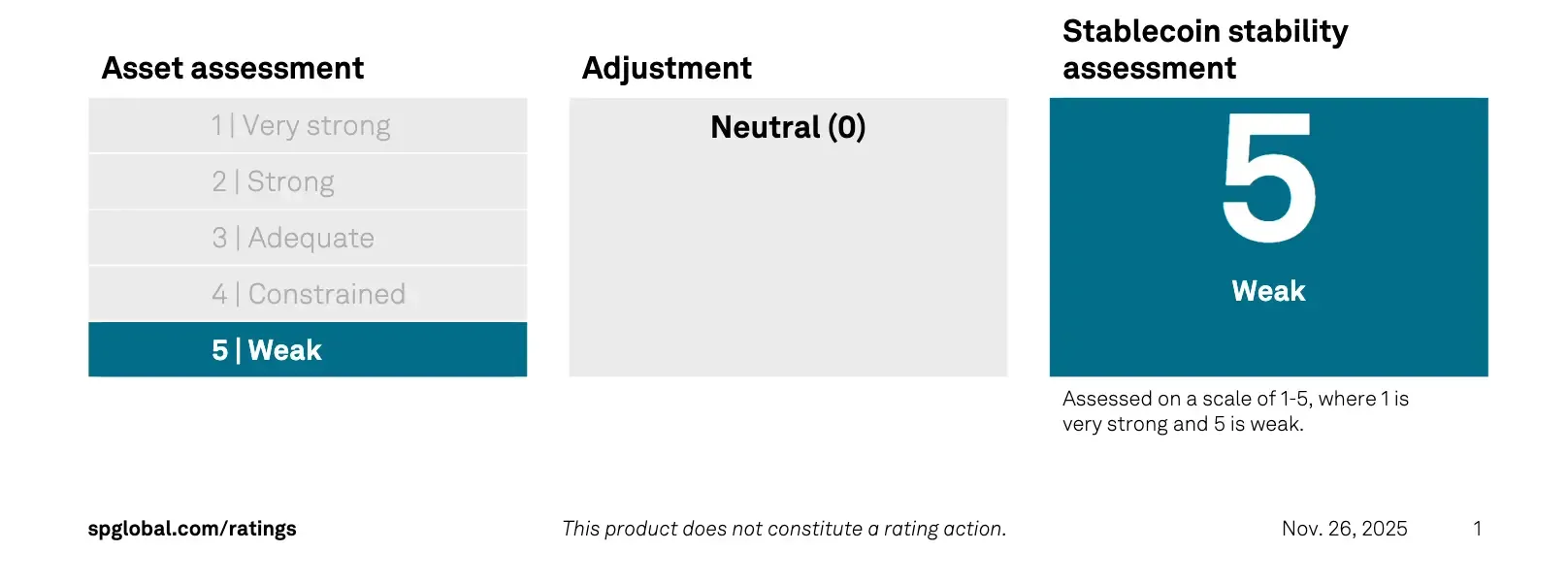

External Pressure: S&P Downgrades USDT to ‘Weak’

And that confidence issue isn’t theoretical anymore.

In late November, S&P Global slapped USDT with its lowest rating — “5 (weak)” — citing the very same things: BTC volatility, gold exposure, secured loans, and persistent disclosure gaps.

Their framework was built to measure whether a stablecoin could hold its peg under stress. Tether’s risk assets turned that into a red flag.

Ardoino Fires Back

Paolo Ardoino didn’t let it slide.

He argued the rating system was built for “legacy finance,” not a company sitting on $30B of group equity and no toxic assets. His tweet made the rounds fast:

Strip away the theatrics and the message is simple: S&P looked only at the issuer-level buffer, not the parent-level fortress. But that doesn’t erase the psychological damage a “weak” label causes during a downturn.

Conclusion

Tether looks financially solid at the Group level — $30B in equity and massive Treasury income — but the issuer still runs on a thin $6.8B buffer that a 30% BTC+gold drawdown can erase on paper. Hayes is right about the fragility; Ardoino is right that the parent can cover it. The gap is the legality, not the math.

So what’s the real takeaway? Tether only fails if regulators block the parent from rescuing the issuer. Tether survives every price crash you can model. The real bet: whether it survives Washington’s curiosity.