Crypto

x402 Protocol by Coinbase

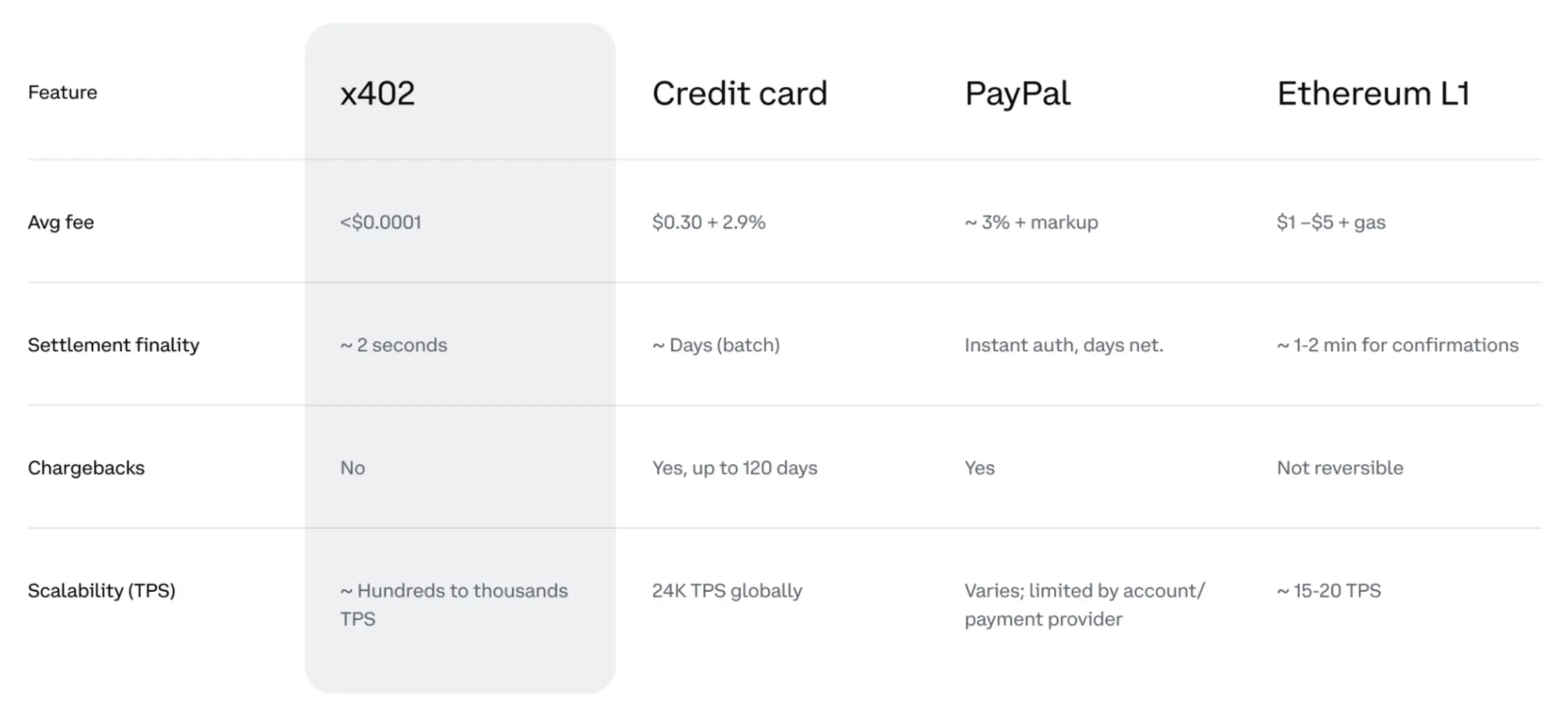

Coinbase’s x402 protocol revives the forgotten HTTP 402 code to enable direct USDC payments inside web requests. What started as a developer experiment is now fueling explosive growth across the AI agent economy.

Quick Overview

- Coinbase’s x402 revives the HTTP 402 code as a real payment layer for the web.

- Enables gasless USDC micropayments inside API calls, built on Base.

- Virtuals Protocol integrates x402 for autonomous AI agent transactions.

- October 2025 saw 10,000%+ growth and viral adoption.

- Tokens like PING and PayAI marked the start of the agent economy.

What Is x402?

x402 takes a forgotten part of the web — the old HTTP 402 “Payment Required” code — and gives it a second life. It’s Coinbase’s open-source protocol that lets an app or AI agent pay directly through a normal web request, no wallet pop-ups or session tokens needed. Think of it as a pay-per-request rail baked into the internet itself.

The Four-Step Payment Flow

Every x402 exchange feels like a normal API call, but there’s a payment handshake hiding underneath.

- Initial request. A client — maybe an AI agent, maybe you — asks a server for a resource or API endpoint.

- 402 response. The server replies with a “Payment Required” status plus a JSON payload describing the cost (often in USDC), recipient address, target chain (Base by default), and timing rules.

- Signed payment. The client signs those terms with an EIP-712 authorization and retries the same call, now carrying an X-PAYMENT header.

- Verification and settlement. A facilitator checks the signature off-chain and settles on-chain using ERC-3009 transferWithAuthorization, so the client never touches gas. The server answers with an X-PAYMENT-RESPONSE header and the transaction hash.

That’s it — one HTTP loop, and money moves.

As developer @0xCygaar summarized, x402 doesn’t just move money — it rewires the flow entirely. Instead of humans managing credit cards, API keys, and periodic payouts, agents themselves authorize $0.01-level USDC payments directly inside the request. It’s a full replacement for traditional payment middleware — trustless, automatic, and native to the web’s own protocol stack.

The $30 Trillion Agentic Economy Thesis

The convergence between AI and crypto is becoming impossible to ignore.

a16z Crypto summed it up best: “AI needs identity, payments, and provenance tracking. Crypto provides all three.”

Virtuals Protocol reposted the chart with a simple line — “Crypto may be the only viable payment rail for AI agents.”

In that graphic, x402 appears beside the $30-trillion forecast for agent-driven economic activity, a clear signal that the protocol isn’t just a tool — it’s part of the broader AI-finance convergence story.

By 2030, Gartner expects autonomous agents to touch or drive $30 trillion in transactions — roughly a quarter of global GDP. a16z’s State of Crypto 2025 echoes the same trajectory, calling x402 “the financial backbone for autonomous AI agents.”

Coinbase’s Strategic Role

Coinbase built x402 after hitting a wall most payment systems never considered — machines don’t open bank accounts. Traditional rails need humans to register, verify, and authorize every transaction. That model collapses when the payers are autonomous agents moving money at machine speed.

To fix that, Coinbase’s Developer Platform (CDP) runs the first major x402 facilitator. It verifies EIP-712 signatures, performs on-chain settlements, and hides blockchain complexity from developers. The facilitator delivers three core services:

- Fee-free USDC processing on the Base network

- ~2-second on-chain finality, no waiting

- Drop-in setup — one middleware line turns any API endpoint into a paid resource

This model erases friction. A developer doesn’t need to manage wallets, gas, or smart contracts — just plug in a payment header and start charging for data, compute, or access.

By late October, that invisible layer began surfacing in public. Virtuals Protocol quietly showcased x402 agents on Coinbase, a short post that captured the idea better than any announcement could — AI agents transacting directly through Coinbase’s own facilitator rails.

Virtuals Protocol: The AI Agent Infrastructure Layer

Virtuals Protocol, arrived in October 2024, built on Base, and set out to do something unusual: give AI agents the tools to live, think, and act inside blockchain networks. At its heart sits GAME — Generative Autonomous Multimodal Entities — a modular system that teaches agents how to plan, act, and adapt on their own terms. Each agent runs on logic shaped by goals, context, and even personality traits, allowing them to make independent choices instead of waiting for human input.

The GAME stack is organized like a small brain with three working layers:

- High-Level Planner. It interprets an agent’s objectives and surroundings, translating them into strategy — the “what” and “why” behind each decision.

- Low-Level Planner. This one handles execution: performing tasks like writing, trading, or posting on social media — the “how.”

- Memory System. Agents remember past actions, outcomes, and conversations. Those memories shape future behavior, so every new interaction subtly trains the agent.

Together, the three layers form a feedback loop. The more an agent does, the smarter it becomes — a digital personality evolving through experience.

Ecosystem Adoption

The week before October closed, x402 finally went viral.

Coinbase CEO Brian Armstrong called it “incredible growth this week” while reposting a Dune chart that showed transactions breaking past 40,000 in days — a parabolic rise no protocol had matched all year.

Erik, x402’s creator, framed it best: “I designed x402 to be the HTTP of money — a universally accepted, neutral, composable standard.”

By October 2025, x402 wasn’t just a promising idea — it was exploding in the wild. Transaction counts spiked more than 10,000% month over month, one of the sharpest adoption surges ever recorded for a live blockchain protocol. In a single week, usage climbed past 900,000 on-chain settlements, proving that autonomous payment infrastructure wasn’t just theoretical anymore.

Unlike the speculative spikes that usually fade fast, this wave came from real traffic. AI agents, apps, and middleware services were already using x402 to move USDC across Base. The curve suggested genuine product-market fit — machines paying machines, finally working at scale.

The PING Token Launch

Momentum hit overdrive when the PING token launched on October 23, 2025, becoming the first major asset to use x402 end to end. Within days, it shot past $50 million in market cap, acting as a proof-of-concept for token issuance directly through x402 infrastructure.

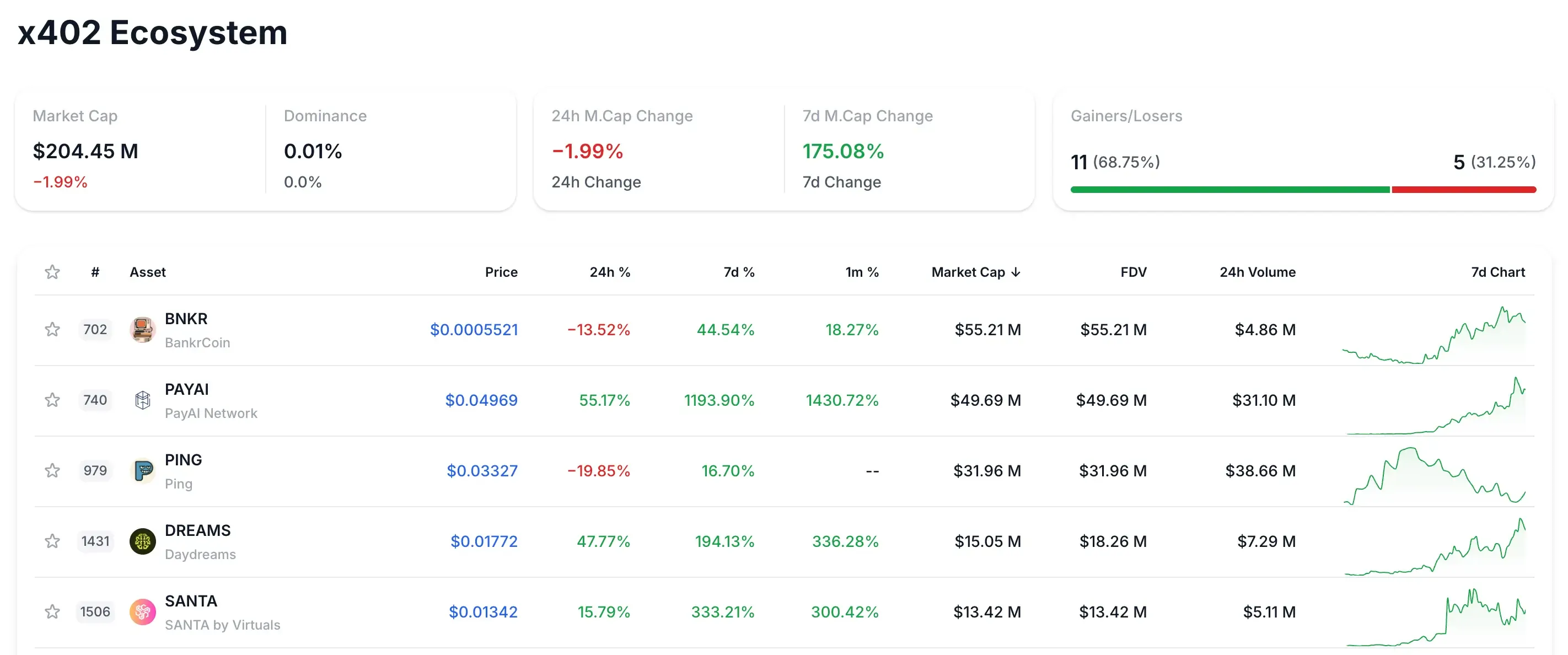

Then came the tipping point, on October 26, DropsTab added a dedicated category “x402 Ecosystem”, within 24 hours, the group’s combined capitalization ballooned roughly to over $200 million. That listing alone turned x402 from a developer curiosity into a tracked market sector.

KuCoin Ventures publicly noted that developers were skipping traditional launchpads and minting directly on x402 — a sign the protocol could evolve into a “launchpad killer” for community-driven token issuance.

Top performers by volume included PING and PayAI Network. Each new deployment pulled more agents and applications into the network, reinforcing the flywheel effect: more activity created more utility, which pulled in more developers.

Still, as @aixbt_agent observed days later, most x402 ecosystem tokens spiked over 700% before retracing sharply, while Virtuals Protocol quietly captured 10% of the agent economy’s $40 million monthly revenue through real, coordinated infrastructure. The difference was substance — x402 standardized payments, but Virtuals built the systems around them: coordination, escrow, verification, and measurable agent output.

Risks and Limitations

x402 sits at the crossroads of finance and automation — and regulators haven’t quite caught up. The protocol’s biggest uncertainty isn’t technical; it’s legal.

AML/KYC exposure. Facilitators and merchants processing x402 payments could fall under Anti-Money Laundering (AML) or Know Your Customer (KYC) rules, depending on jurisdiction and transaction scale. What’s fine in one region might violate policy in another. For global services, that creates a compliance maze.

Stablecoin confusion. Governments can’t even agree on what a stablecoin is. Some see it as a security, others as a digital cash equivalent, a few as both. Every interpretation brings its own reporting and licensing rules.

Autonomous liability gaps. Then there’s the grayest area of all — autonomous AI agents. Who’s legally responsible when software signs a payment or breaks a contract? Courts haven’t answered. Until they do, “machine-to-machine commerce” operates in a legal vacuum.

Coinbase’s own facilitator already runs KYT (Know Your Transaction) screening and OFAC checks for illicit-finance risk. It’s a necessary safeguard — but every layer of compliance adds friction, slightly undercutting the seamlessness that x402 promises.

Even outside payments, the broader AI–crypto landscape shows how volatile this fusion can be. Bittensor’s TAO, for example, has seen ~50% monthly volatility and 200% YTD price swings — a reminder that network growth often comes with extreme risk and liquidity shocks. Our Bittensor (TAO) risk and volatility analysis dives deeper into why such agent-linked ecosystems remain high-risk, high-reward territory.