Product

Top Telegram Trading Bots for Crypto

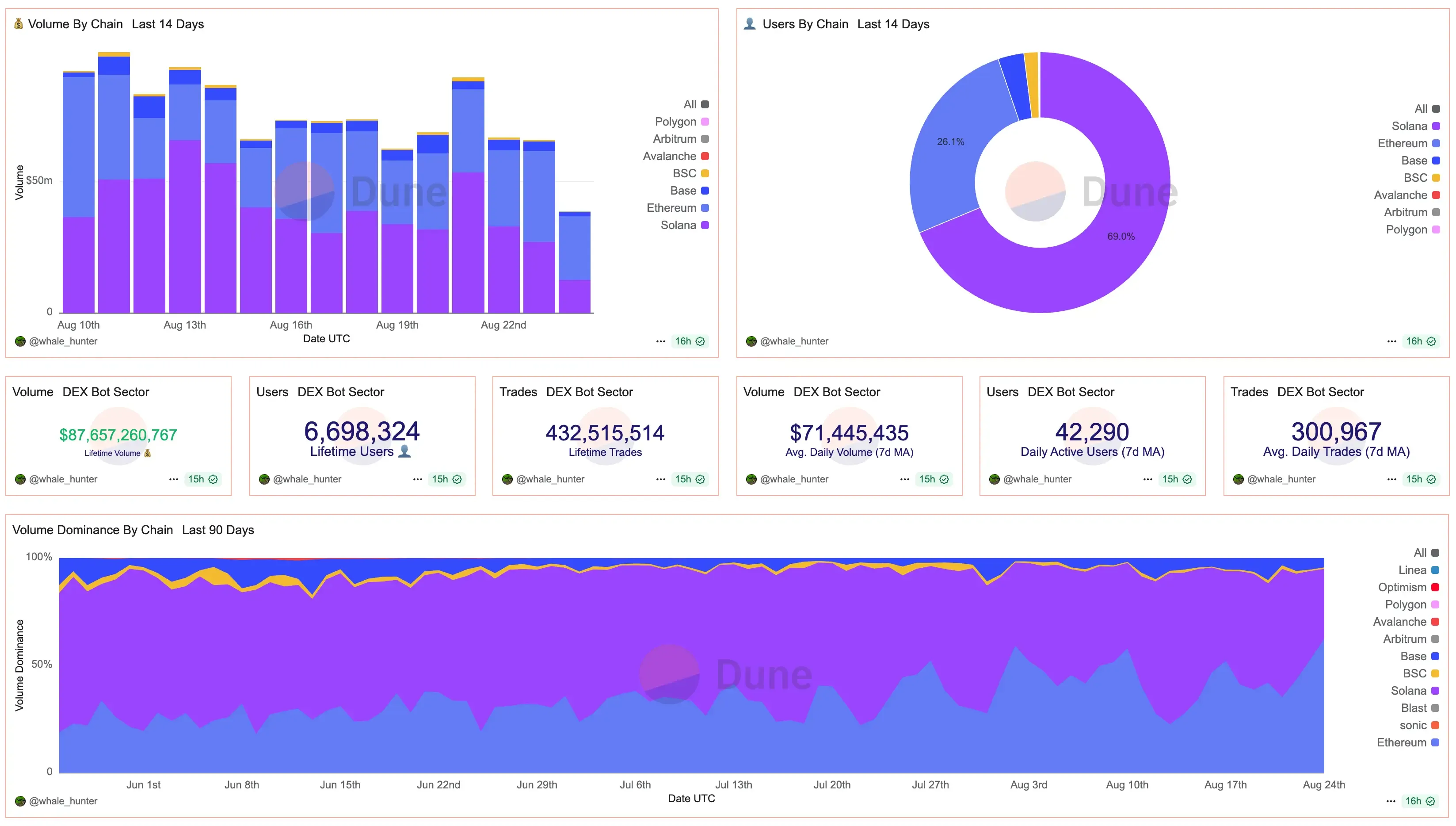

Telegram trading bots went from zero to $70M+ daily volume in just a year. With Solana fueling 70% of that activity, bots like Trojan, BONKbot, and Drops Bot are reshaping how retail traders snipe, copy, and trade on-chain.

Quick Overview

- Telegram trading bots process over $70M daily with ~42K active users, mostly on Solana

- Trojan leads with 2M users and $24B+ traded, BONKbot follows with ~500K users and $14B volume

- Maestro and Banana Gun offer multi-chain coverage with sniping and anti-rug tools

- Drops Bot focuses on alerts first, now adding Solana trading for 700K+ users

- Fees cluster around 1% per trade, while Drops Bot uses a flat subscription model

Why Telegram Trading Bots Are Exploding in 2025

Telegram’s trading bots didn’t even exist a couple years ago. The first wave hit in 2024, and suddenly anyone could buy, sell, or snipe memecoins by typing a few commands into chat. No browser extensions, no clunky wallet pop-ups — just tap, trade, done. That frictionless design changed everything.

The numbers are wild. On Dune dashboards you’ll see about $71 million moving through bot trades every day and roughly 42,000 active users playing along. And most of that action? It’s happening on Solana — around 70% of the total. Why there? Because Solana’s cheap fees and fast blocks are tailor-made for bots chasing micro-movements in fresh tokens. Add in Telegram’s always-on culture and you get a perfect loop: global, retail-heavy, 24/7 trading.

This shift is pulling traders away from older setups. Instead of paying for CEX-linked automation like 3Commas or firing up a desktop terminal, they’re dropping SOL into a bot wallet and letting it rip on Raydium or Jupiter. Technically, these bots are just hot wallets with scripts layered on top — deposit funds, set your triggers, and the bot handles orders: market buys, limit sells, trailing stops, even DCA and copy trades.

Security remains the big caveat. Some bots bundle in MEV-protection or anti-rug simulators, but at the end of the day you’re trusting a contract with your keys. Smart traders treat it like a throwaway wallet: keep balances small, separate from your main stash. The upside is speed. The downside is risk. Everyone in 2025 seems willing to play that trade-off.

Solana-Native Bots

The Solana memecoin boom didn’t just launch coins — it birthed an entire generation of trading bots. And the heavyweight here is Trojan (the project formerly known as UniBot). By late 2025 it was clocking in at roughly 2 million users and more than $24 billion in total volume. That scale dwarfs every other Solana bot. Trojan isn’t just fast swaps either — you get limit orders, DCA scheduling, copy-trading, MEV-protection, and even a built-in bridge for ETH↔SOL transfers. Traders usually pay about 1% per trade, though referrals shave that down to 0.9%.

Then there’s BONKbot, the Solana-native darling tied to the BONK meme. It has ~500,000 users and close to $14B in processed trades. BONKbot routes through Jupiter for speed and markets itself as the fastest Solana bot. Sub-two-second fills aren’t unusual when the network isn’t congested. Beyond speed, it adds limit and trailing orders plus MEV-protection. The catch: a flat 1% swap fee.

Maestro plays a different role. It isn’t just Solana — it spans ten or more chains (Ethereum, BSC, Solana, Tron, Base, Arbitrum, Avalanche, TON). User base? Around 600,000. Core feature: token sniping with anti-rug and honeypot detection layered in. It also runs a “Whale Bot” that tracks big wallet moves. The pricing is flexible: free with a 1% tax on trades or $200/month for Maestro Premium (faster execution and multiple trades at once).

Banana Gun sits in between. It runs bots on Solana and EVM, counting about 600,000 users and $12B in total volume. The Solana bot handles auto-sniping and whale-copying. A neat twist: the simulator that tries to execute a dummy trade before it commits real funds, blocking scams or rug attempts. Fees: 1% for snipes, 0.5% for manual trades. Plus, the BANANA token brings rebates and perks.

All of them push hard on speed. BONKbot calls itself the fastest; Maestro advertises millisecond-level swaps. Reality: Trojan and BONKbot can get trades off in under two seconds when Solana’s network behaves. Maestro and Banana aren’t far behind but sometimes burn a bit more in fees to do it.

Fees across the board cluster near 1% per trade. Trojan takes 1% (0.9% if you refer a friend). BONKbot, also 1%. Maestro too, unless you pony up for Premium. Banana is the outlier — cheaper for manual orders at 0.5%. Almost every bot dangles referral rewards to soften the blow. It’s not nothing — traders grumble — but most accept the cut as the price of convenience.

Drops Bot: From Alerts to Trading on Solana

Drops Bot didn’t start as a trading bot at all. Back in 2021 it was just an alert engine — a way to get pinged inside Telegram when something happened on-chain. Prices, swaps, token unlocks, whale wallets, NFTs ... you name it. We’ve detailed its evolution in this guide, which shows how it became one of the most versatile crypto price alerts bots for Telegram.

Over time, it spread across 22+ blockchains and picked up more than 700,000 users. Traders leaned on it for pump alerts, wallet trackers, or simple filters like “tell me if BONK jumps 20%” or “alert me when this wallet buys SHIB.” The kicker: the basic tier is free, and the paid ones just stack on more alerts and customizations.

Then 2024–25 flipped the script. Drops Bot quietly pushed out real trading on Solana — straight from chat. No switching apps, no extra interface. You can drop in market or limit orders, set take-profit and stop-loss, or even hit a one-click copy trade when a watched wallet moves. Suddenly, the line between “alert service” and “trading platform” blurred.

The scale matters here. With its ~700K users, Drops Bot sits right alongside Banana Gun (~502K) and above most smaller newcomers. It’s still shy of Trojan or BONKbot, but the positioning is different. Where those bots live on sniping culture, Drops Bot is built for retail traders who want clean alerts with the option to trade if they feel like it. The entry is simple: free to start, no signup fee. Compare that with Maestro’s $200/month premium tier or Banana’s token-based rebate system.

The monetization also feels different. Instead of clipping a 1% trade fee every time, Drops Bot runs on flat monthly subs — $29, $79, $179 depending on how much power you want. That’s attractive to traders who hate paying tax on every swap. In short, Drops Bot’s pitch is: alerts first, trades second. A broad, retail-friendly gateway rather than a specialized sniper tool.

Feature Comparison: Alerts, Trading, Copy-Trading, Whale Tracking

- Drops Bot — ~700K users, 22+ chains, subscription model ($0–179/mo). Alerts (price, swaps, wallets, NFTs) + Solana trading (limit, TP/SL, copy-trade).

- Trojan (UniBot) — ~2M users, $24B+ volume, ~1% fee. Limit/DCA orders, copy-trading, MEV-protection, ETH–SOL bridge.

- BONKbot — ~500K users, $14B volume, 1% swap. Ultra-fast Solana swaps via Jupiter, limit & trailing-stop orders, MEV-protection.

- Maestro — ~600K users, $13B+ volume, 10+ chains, 1% fee or $200/mo Premium. Token sniping, anti-rug checks, copy-trading, whale alerts.

- Banana Gun — ~600K users, $12B+ volume, 1% snipes / 0.5% manual. Auto-sniping, copy-trading, scam simulator, BANANA token rebates.

Which Bot Is Best for Solana Traders?

If you’re chasing Solana’s memecoin launches at full speed, the choice usually narrows to Trojan and BONKbot. Trojan (ex-UniBot) still leads the pack by raw numbers — 2M users, $24B+ traded — and packs in advanced tools like a cross-chain bridge and layered automation. BONKbot, on the other hand, stays single-minded: built only for Solana, routing through Jupiter for blistering execution times. Both skim about 1% per trade, though referrals can cut that down.

For traders who bounce between ecosystems, Maestro and Banana Gun are the obvious picks. Maestro has Solana, Ethereum, BSC, and half a dozen more chains wired in, plus anti-rug checks that screen out scam tokens before you buy. Banana Gun blends Solana and EVM, and its simulator tries a dummy trade first — if it fails, you’re spared the rug.

Then there’s Drops Bot, which plays to a different crowd. With 700K+ users, it floods you with alerts — prices, swaps, whale moves — and now lets you one-click a Solana trade when you spot something worth chasing. It won’t front-run a brand-new liquidity pool the way Trojan does, but it’s free to start, clean to use, and designed for retail traders dipping into memecoins without all the sniper complexity.

So the “best” really depends on how you trade:

- Alerts and simplicity: Drops Bot.

- High-frequency sniping: Trojan or BONKbot.

- Multi-chain hunting: Maestro or Banana Gun.

One last note: all of these bots handle your funds directly. They’re hot wallets with scripts. Smart traders run them with separate wallets, keep balances light, and stick to bots with visible safety checks — like Maestro’s rug filters or Banana Gun’s trade simulator. Convenience has a price, and in this case the price is both fees and risk.