Crypto

Canton Network: The Blockchain Powering Wall Street

Canton Network has evolved from an enterprise DLT pilot into a $6-trillion blockchain for regulated finance. With Basel-aligned compliance and privacy-first design, it bridges Wall Street infrastructure with on-chain settlement.

Quick Overview

- Backed by Goldman Sachs, DRW, and Tradeweb with $397M raised.

- 575+ validators and 600K+ daily transactions confirm real adoption.

- $6T in tokenized assets, $280B daily repo settlements on-chain.

- Fair-launch tokenomics with burn–mint equilibrium, no VC allocation.

- Basel III–compliant design built for banks, not retail speculation.

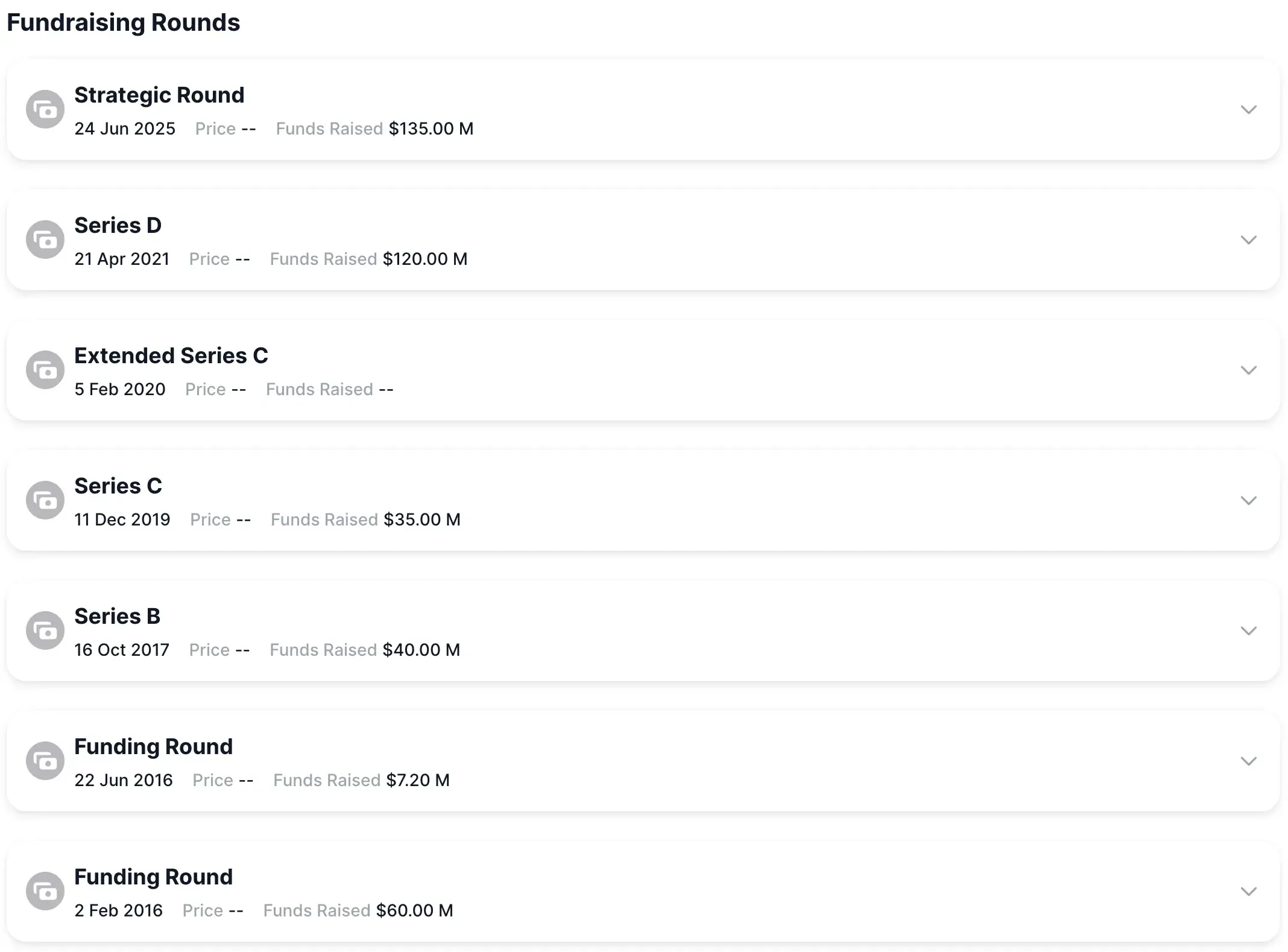

Canton Fundraising

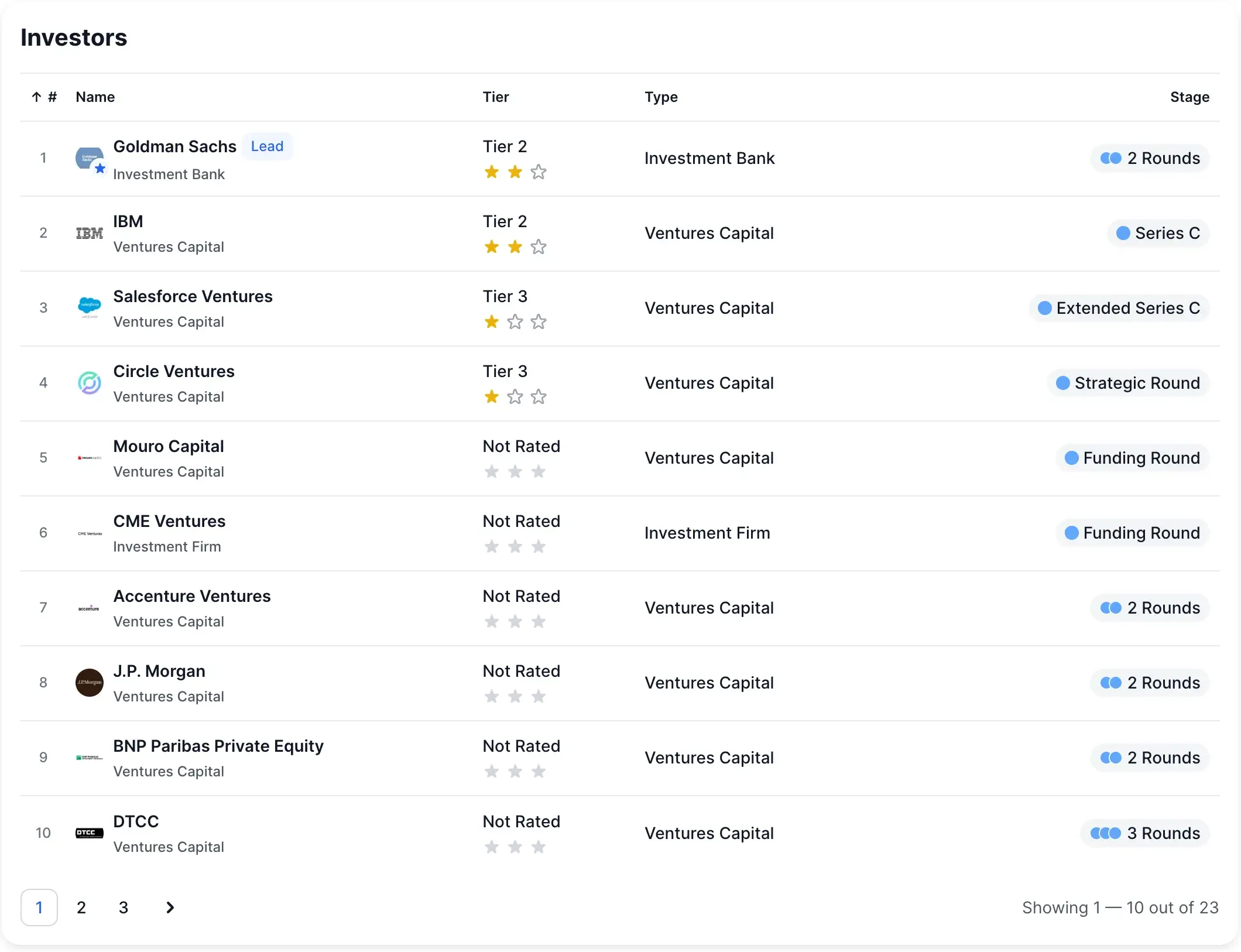

In June 2025, Digital Asset pulled in $135 million for its Series E, led by DRW Venture Capital and Tradeweb Markets. The roster looked more like a Wall Street cap table than a crypto startup’s — with names such as Goldman Sachs, BNP Paribas, DTCC, Citadel Securities, and Circle Ventures among the backers. Add up the earlier rounds and total funding tops $397 million — serious money for what began as a niche enterprise-DLT experiment.

That capital doesn’t just fund engineers — it validates a decade-long bet that institutions would adopt blockchains built for their own rules, not retail’s. Yuval Rooz, Digital Asset’s co-founder and CEO — formerly an algorithmic-trading lead at Citadel and DRW — built Canton Network to resolve a paradox most public chains still can’t: transparency for regulators without sacrificing confidentiality for counterparties.

He put it bluntly in June 2025: “This funding milestone validates the inevitability of what we envisioned years ago — a privacy-enabled public blockchain built for institutional adoption.”

By October 2025, momentum accelerated. DRW Holdings and Liberty City Ventures began assembling a $500 million token-treasury vehicle to hold Canton Coin (CC), operate as a super validator, and seed new institutional applications. Mark Toomey would chair the entity, with Mark Wendland, former DRW COO, running operations. External investors were expected to contribute $100–200 million in capital, with the rest denominated in CC tokens — a hybrid structure bridging traditional equity with on-chain participation.

What it signals is straightforward yet rare: real-world capital now chasing governance rights inside a permissioned blockchain ecosystem — not yield farming, not speculation, but infrastructure.

Network Activity Reaches Institutional Scale

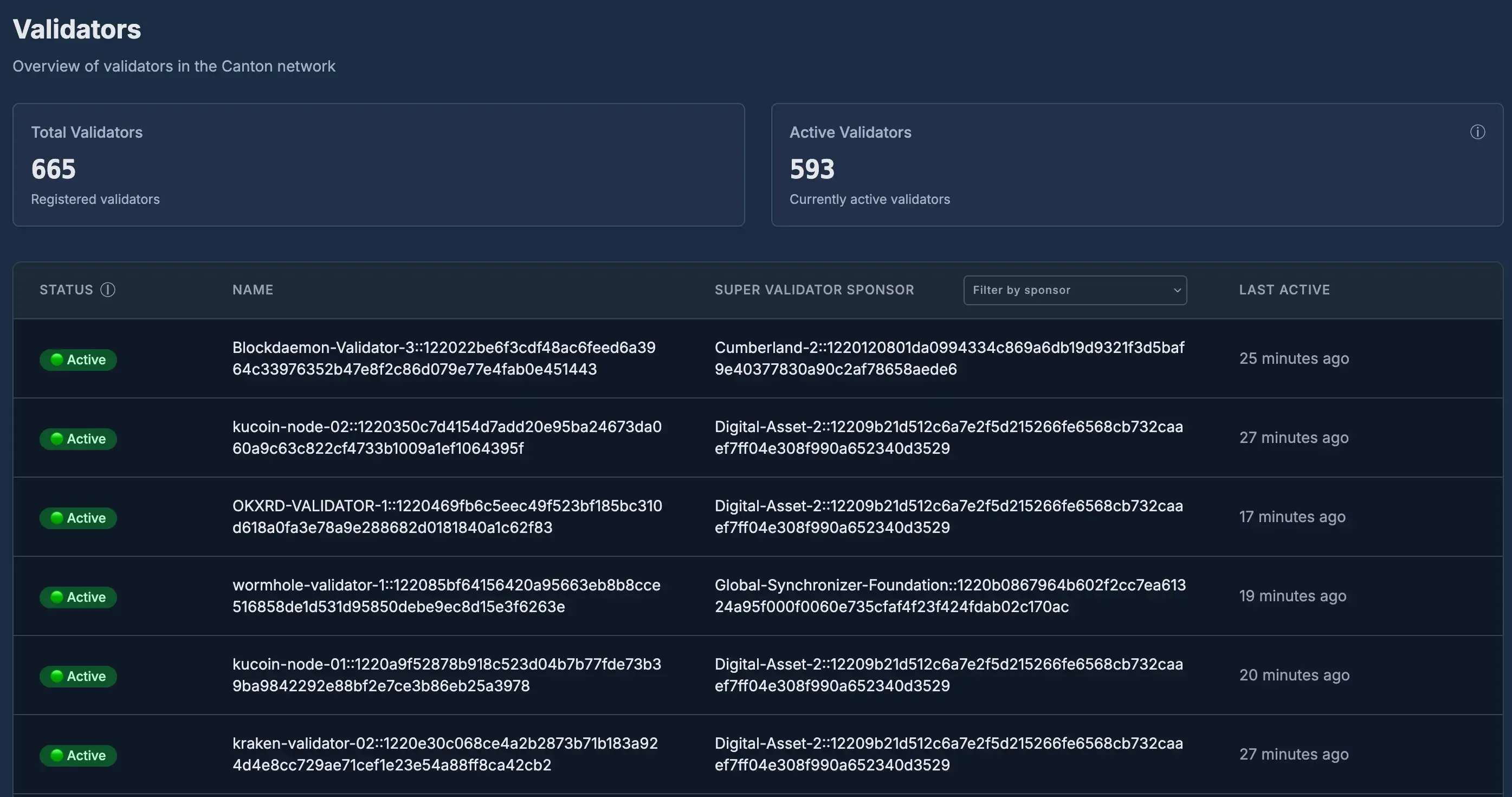

The numbers coming out of Canton Network don’t look like a testnet anymore. By October 2025, the chain was handling over 600,000 daily transactions — a clear leap from pilot demos to live financial workflows. On a monthly scale, that’s 15 million+ settlements in Canton Coin (CC), peaking near 7 TPS. Not flashy by retail standards, but enormous in nominal value.

Validator growth tells an even bigger story. From just 24 nodes at launch in July 2024, Canton now runs with 575+ active validators, including 26 super validators powering the Global Synchronizer, its heartbeat consensus layer.

And the names aren’t random: Goldman Sachs, HSBC, BNP Paribas, Circle, Chainlink, Coin Metrics, and P2P.org — plus U.S. exchanges like Binance.US, Crypto.com, Gemini, and Kraken, which has even hinted at a future CC spot listing.

It’s a rare validator mix — half Wall Street, half crypto infrastructure — giving Canton both regulatory credibility and market reach.

Roughly 28,000 wallets are now registered, mostly institutional desks and asset managers. The broader ecosystem counts nearly 400 participants, from global banks and clearing houses to trading firms and early DeFi integrations testing interoperability.

Part of what makes that scale possible is Canton’s architecture itself. Built on Daml smart contracts, it uses role-based permissions — signatories, observers, controllers — so each party sees only what it’s meant to. That’s privacy by design: enough transparency for auditability, enough discretion for billion-dollar bond or repo trades.

Under the hood, Canton scales through a “network-of-networks” model. Every institution runs its own private node but syncs atomically across the Global Synchronizer, which keeps performance steady even as adoption widens. Each new participant adds capacity, not congestion — a structural rarity in blockchain design.

$6 Trillion in Tokenized Assets

This is where the numbers stop sounding theoretical.

By late 2025, Canton Network was quietly hosting over $6 trillion worth of tokenized real-world assets (RWAs) — a mix that spans bonds, money market funds, alternative investment vehicles, commodities, repo agreements, mortgages, and even life insurance instruments.

At the center of it sits Broadridge’s Distributed Ledger Repo (DLR), the workhorse of institutional finance now running on Canton rails.

DLR alone moves about $280 billion in daily tokenized U.S. Treasury repo volume, translating to roughly $4 trillion each month. That’s not experimental liquidity — that’s Wall Street’s overnight funding machine running on-chain.

Then came a small Saturday in August 2025 that changed the tempo of institutional settlement.

Bank of America, Circle, Citadel Securities, and Tradeweb pulled off the first on-chain weekend funding transaction, swapping tokenized Treasuries for USDC.

For traditional markets, weekends have always meant dead time — trapped capital and idle collateral. With that single transaction, Canton demonstrated 24/7 funding, slicing away the liquidity buffers banks keep just to survive settlement downtime.

The bigger story is what all this unlocks.

Canton has become the quiet backbone for global collateral mobility, enabling atomic settlement between systems that never used to speak to one another.

Custodians and banks now operate on synchronized rails: securities move one way, cash the other, and no one outside the trade sees either side.

Canton Network Tokenomics

Canton Coin (CC) breaks from the standard playbook.

No pre-mine, no venture allocations, no foundation stash waiting to vest. Every CC in circulation has been earned the old-fashioned way — by running infrastructure, building applications, or driving real on-chain activity. In an era of seed-round airdrops and insider unlocks, that structure alone sets Canton apart.

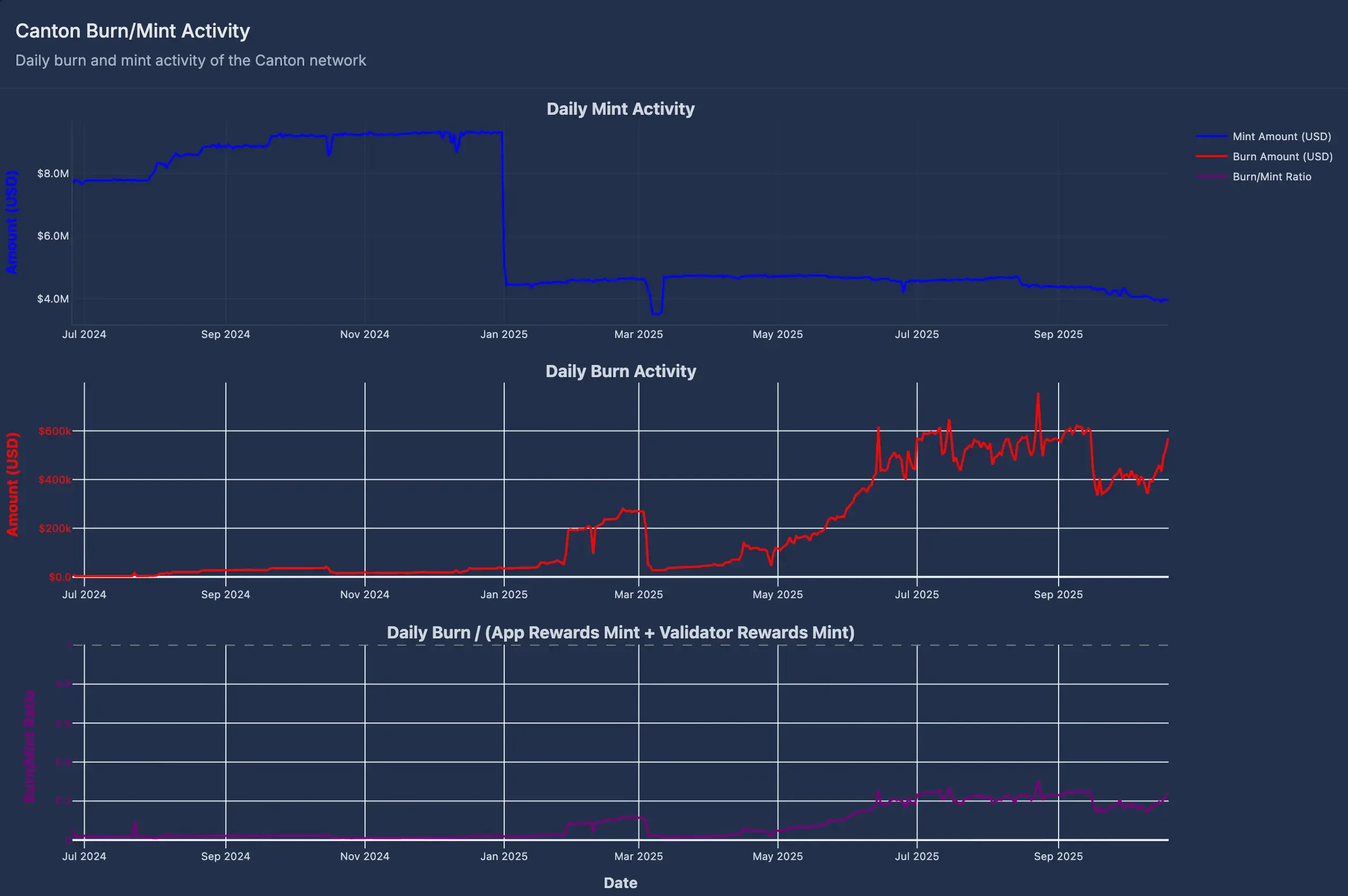

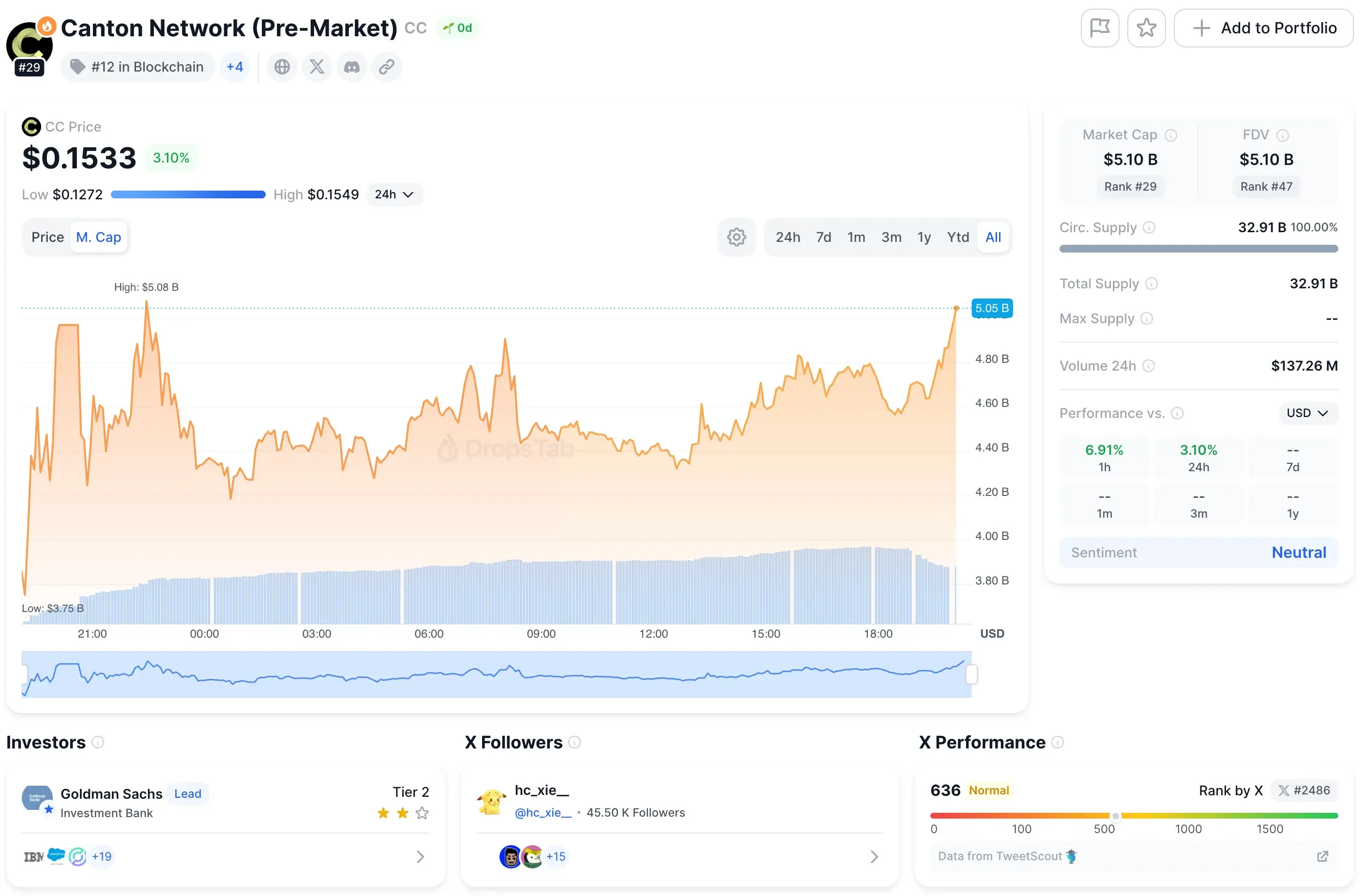

The network follows a 10-year minting curve toward 100 billion CC, after which supply expands by 2.5 billion per year — offset by an equivalent burn rate to maintain balance. As of October 2025, about 32.9 billion CC circulate, with roughly 517 million already burned — a quiet sign that network usage is compounding.

At its core lies a burn–mint equilibrium - transaction fees are paid in CC, denominated in USD, and then permanently destroyed; new tokens are minted to reward validators, developers, and infrastructure operators. The loop keeps supply and demand in sync — usage creates scarcity, contribution creates issuance. A scheduled halving in January 2025 cut daily rewards to roughly 51.5 million CC, trimming inflation to about 0.16 % per day and proving the model’s discipline.

Even the fee structure feels engineered for its audience. Rather than a flat gas tax, Canton applies a regressive schedule — the larger the transaction, the smaller the percentage fee. High-value flows get priority, and because those fees are USD-denominated, institutions avoid token volatility while the system still benefits from steady deflationary pressure as adoption scales.

Layered on top of that design is regulatory alignment.

Canton’s architecture was built to meet Basel III capital standards, letting banks treat tokenized assets as Group 1-compliant instruments — the same category as traditional securities. That alignment gives institutions regulatory comfort without sacrificing the benefits of on-chain settlement speed or atomic finality.

That regulatory comfort is arriving just as U.S. oversight itself is shifting. In December 2025, the Federal Reserve rolled back its toughest crypto-era restrictions, ending the Novel Activities Supervision Program and removing the presumption of denial for banks offering crypto services. The move marked a regime change — from blocking crypto banks to supervising them like any other institution — reinforcing why compliance-native networks like Canton are suddenly viable at scale.

Taken together, CC’s economics look less like speculative tokenomics and more like a closed-loop financial engine — demand burns supply, contribution mints it back, and compliance keeps it bank-ready.

Conclusion

Canton Network has quietly crossed the line from concept to infrastructure — $6 trillion tokenized, $280 billion settled daily, and now a Binance CC/USDT futures listing giving the asset its first public liquidity channel. Its mix of privacy, Basel-aligned compliance, and modular scalability makes it the first blockchain that truly fits the rules of traditional finance without breaking crypto’s composability ethos. Every burned CC reflects real economic activity, not synthetic yield.

The challenge from here isn’t technical — it’s political and procedural. Governance must stay light enough for innovation yet firm enough for trust. And as regulators push for visibility, institutions will test how far privacy can stretch inside compliant rails. Whatever the balance, the signal is unmistakable: institutional blockchain is no longer a theory. Unlike public networks like XRP or HBAR, Canton was purpose-built for regulated finance — and it’s already proving it can survive, and thrive, in that world.