Crypto

Solana Mobile Seeker: SKR Airdrop and Tokenomics

This article breaks down how Seeker enforces identity, how the SKR airdrop is structured, and why staking and retention decide whether the model holds.

Quick Overview

- Seeker uses hardware identity to make airdrops and governance hard to game

- About 20% of SKR supply was airdropped based on real Season 1 activity

- Average users received ~18,000 SKR, with builders ranked at the top

- Inflation starts high, so staking and Guardian delegation matter

- Saga proved incentives attract users — Seeker tests whether they stay

What Is Solana Mobile Seeker?

The Seeker is Solana Mobile’s second attempt at a crypto-native smartphone, but the device itself isn’t the point. What matters is how Seeker ties hardware identity to on-chain participation, making rewards and governance difficult to game.

That anchoring is handled through TEEPIN — a trust architecture that binds each device to a verifiable identity using secure hardware. Instead of treating wallets as apps, Seeker treats identity and custody as part of the device. This allows the network to verify that activity comes from real, unique hardware rather than disposable wallets, which is critical for enforcing fair distribution.

Each Seeker ships with a Genesis Token, a soulbound NFT permanently linked to the device’s wallet. This token proves ownership, gates ecosystem rewards, and determines SKR airdrop eligibility. During Season 1, it remained locked to a single wallet, making large-scale multi-wallet farming costly and inefficient. In practice, this is why the SKR airdrop favors sustained usage over scripted farming — and why Seeker’s hardware layer matters only insofar as it enforces that constraint.

The SKR Airdrop

SKR launched on January 21, 2026, at 2:00 AM UTC, with a fixed supply of 10 billion tokens. Roughly 20% of that supply — just under 2 billion SKR — is distributed via a single community airdrop tied to Seeker Season 1 activity. This was not a retroactive reward. The structure was known in advance, which meant users and builders were shaping behavior with the incentive already visible.

In concrete terms, about 1.82 billion SKR goes to Seeker users — just over 100,900 wallets active during Season 1. The average allocation lands around 18,000 SKR per user, though the distribution is intentionally uneven. Another 141 million SKR is reserved for developers, split across 188 teams or individuals, each receiving 750,000 SKR. In total, roughly 1.96 billion SKR is distributed to just over 101,000 recipients.

The unevenness is the design.

According to Solana Mobile, the first Seeker season processed over 9 million transactions, supported 265+ dApps, and generated roughly $2.6 billion in on-chain volume across more than 100,000 participating users. With the season complete, a snapshot has been taken and 20% of total SKR supply has been locked in for users and developers. From this point forward, allocations are finalized and visible in Seed Vault Wallet — and new activity in Season 2 does not affect the Season 1 airdrop.

Rather than flat rewards, the airdrop uses five engagement-based tiers with sharply increasing payouts. Lower tiers capture basic activation and light usage, while higher tiers reflect sustained activity across apps, transactions, and more complex behaviors like DeFi participation.

The top tier, Sovereign, allocates 750,000 SKR and is deliberately difficult to reach. Tier placement is calculated from Season 1 behavior — device usage, dApp Store interaction, transaction activity — with post-season anti-sybil filters removing low-quality farming.

One example was ORE mining, a live Seeker dApp during Season 1 that combined on-chain transactions, repeated sessions, and wallet interaction — the kind of sustained activity that directly fed into SKR tier calculations (see our full breakdown of how ORE mining works).

One choice is especially telling. Developers who shipped a legitimate dApp during Season 1 receive the same 750,000 SKR as Sovereign users. Builders sit at the top of the distribution curve by design, signaling that Solana Mobile is optimizing for ecosystem depth, not raw user counts.

Ahead of the claim window, Seeker users can already see where they landed. Solana Mobile has enabled an SKR allocation checker directly inside the Seed Vault Wallet, accessible via the Activity Tracking tab. The checker reveals each user’s tier and token amount after anti-sybil filtering, based on Seeker device usage, Solana dApp Store activity, and on-chain behavior during Season 1. This preview step removes guesswork and sets expectations before claims open.

Claiming SKR is straightforward but strict. Claims open January 21, 2026, at 2:00 AM UTC, directly inside the Seed Vault Wallet, with no external websites or browser flows. Users pay roughly 0.015 SOL in fees, and the claim must come from the wallet holding the Seeker Genesis Token at the end of Season 1. There is a 90-day claim window. After April 20, 2026, unclaimed SKR is permanently unavailable.

Seeker SKR Tokenomics & Utility

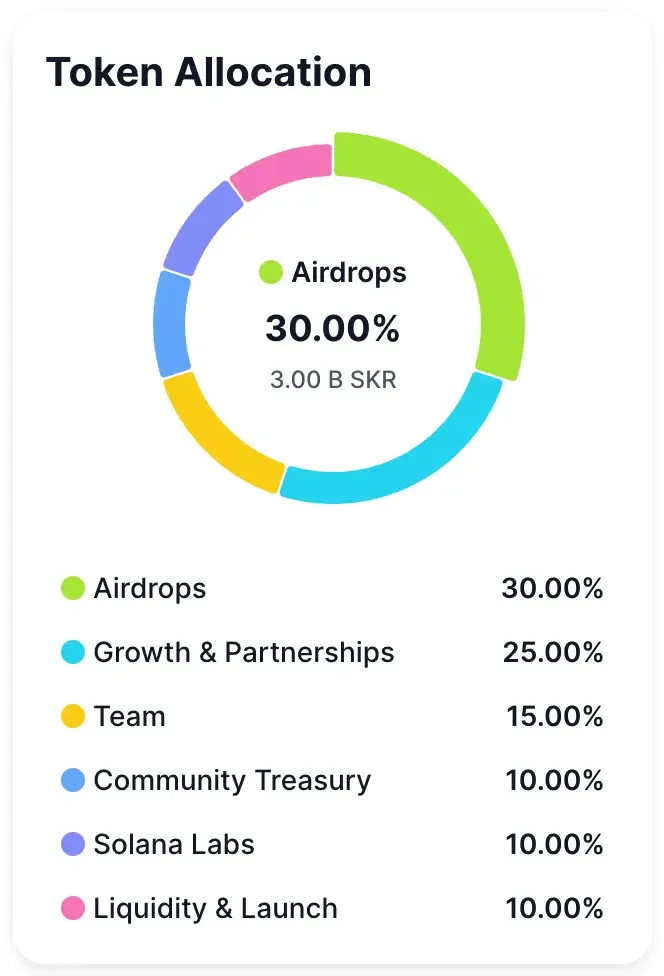

SKR has a fixed total supply of 10 billion tokens. Of that, 30% is allocated to the community, covering Seeker users, active participants, and developers.

This 30% community allocation formally caps airdrop dilution at 3 billion SKR, placing the Season 1 distribution of just under 2 billion SKR well within the predefined supply envelope rather than as an open-ended incentive.

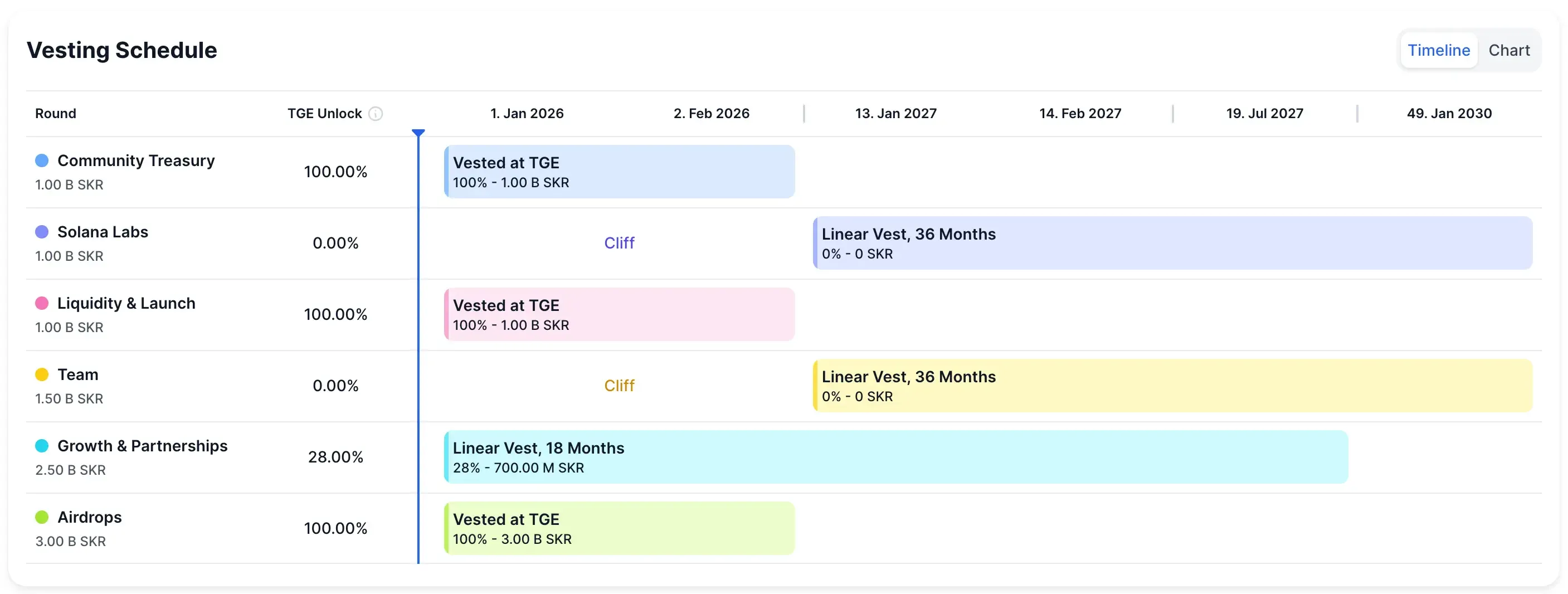

At launch, that community supply is fully liquid. The vesting schedule shows 100% of the 3.0 billion SKR airdrop allocation unlocked at TGE, alongside liquidity and community treasury tokens. In contrast, team and Solana Labs allocations remain fully locked, vesting linearly over 36 months after a cliff, while growth and partnership tokens unlock gradually over 18 months. The result is a front-loaded circulating supply dominated by users and ecosystem activity, not insiders.

Inflation, Staking, and Guardian Demand

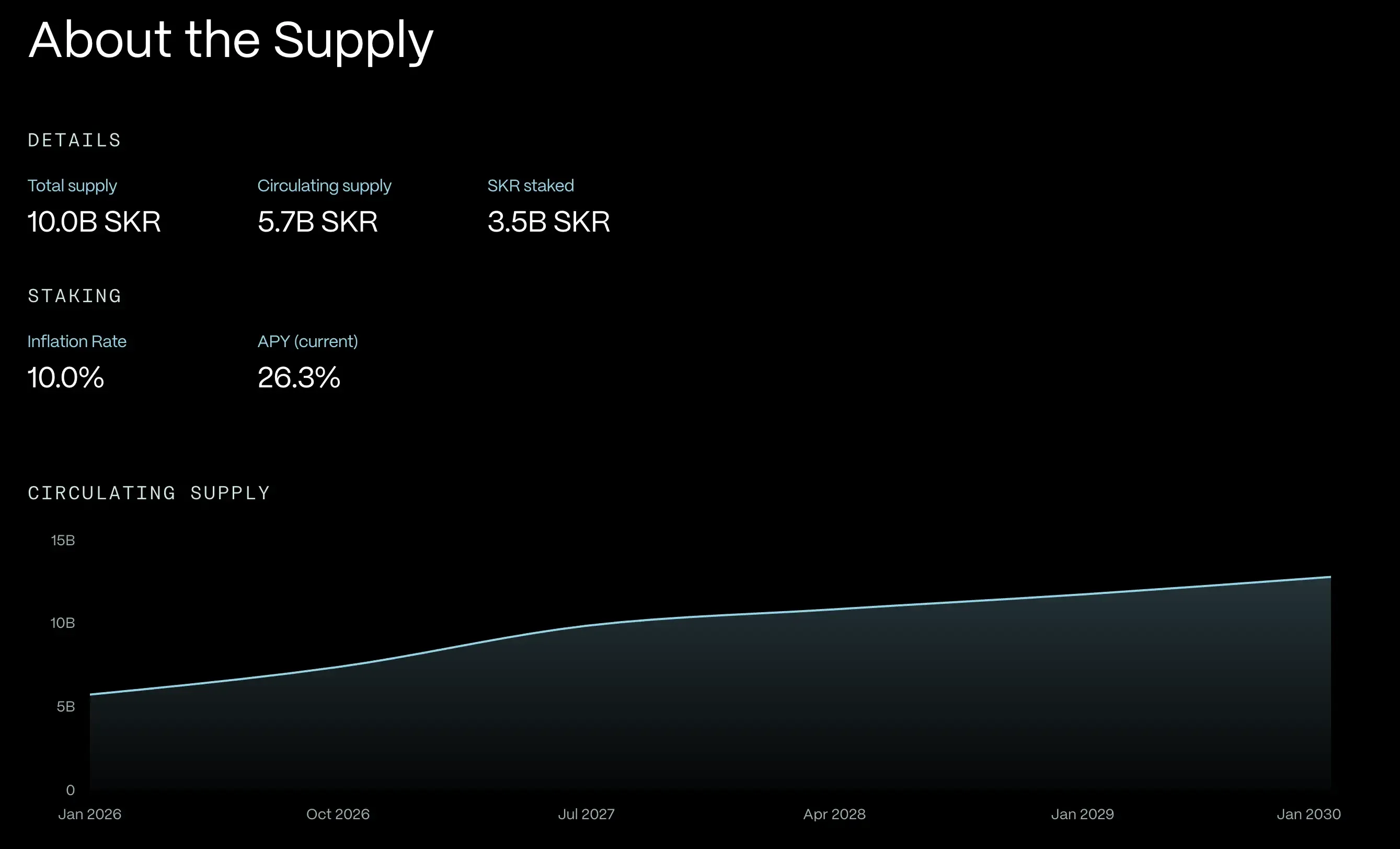

SKR is designed to push tokens into use quickly. Inflation starts at 10% in Year 1, distributing roughly 1 billion SKR to stakers and Guardians, then decays annually toward a ~2% terminal rate.

Staking is live immediately after claim, with 48-hour compounding and a 48-hour unstaking cooldown. The goal is simple: keep supply staked through the post-airdrop window. If it doesn’t happen, inflation pressure surfaces fast.

SKR demand comes from the Guardian delegation. Holders stake and delegate to Guardians — the operators securing devices and enforcing platform rules — and earn yield funded by inflation. Solana Mobile bootstraps the system at 0% commission, with independent Guardians expected to follow.

The loop is binary: if SKR stays staked and delegated, it functions as a security and governance token. If not, it behaves like unlocked supply looking for an exit.

Saga vs. Seeker Mobile Phones

The BONK airdrop flipped Saga into a negative-cost trade for a brief window, driving secondary prices into the thousands. Once the incentive ended, usage collapsed. Retention never arrived.

Seeker diverges where Saga failed. Lower pricing removes friction, but more importantly, identity, custody, and rewards are bound to the device itself, not bolted on. The SKR airdrop was disclosed upfront, tiers included, which reduced surprise-driven speculation and shifted incentives toward sustained activity. Scale reinforces that difference: roughly 150,000 pre-orders versus Saga’s ~20,000 units, alongside 265 dApps deployed during Season 1, not years later.

The economics now hinge on distribution and retention. With an average allocation of ~18,000 SKR per user, outcomes are sensitive to price but bounded by scale. At $0.01, the airdrop offsets part of the device cost. Around $0.05, it clears breakeven for the average user.

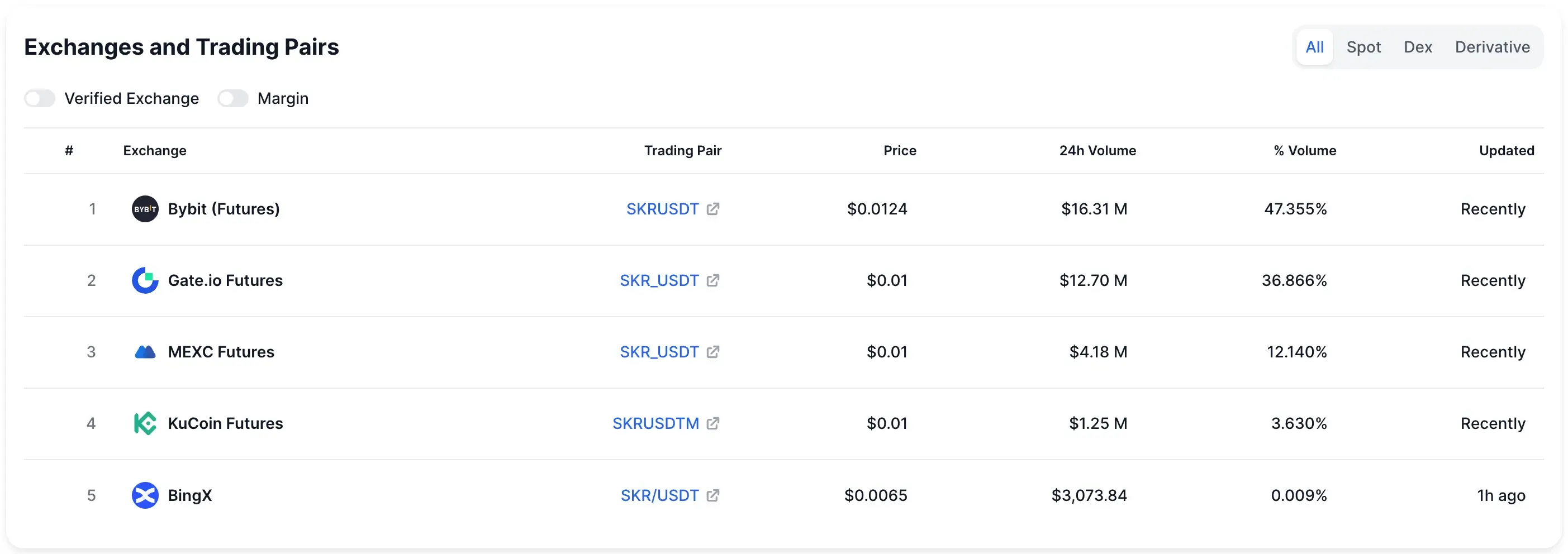

Initial SKR liquidity has concentrated on derivatives venues rather than spot markets, with futures volume led by Bybit, Gate.io, MEXC, and KuCoin. Prices have traded in a narrow band around the $0.01 level, with meaningful dispersion across venues — typical of early price discovery driven by leverage rather than sustained spot demand.

Higher prices amplify returns, but with 3.8× more users than Saga, upside is spread thinner and volatility cuts both ways. Early usage — 9 million transactions, $2.6 billion in volume, and 100,000+ active users in Season 1 — suggests engagement beyond pure farming, but retention after the airdrop remains the decisive variable.

That question started to answer itself even before SKR went live. In mid-January, Solana Gaming highlighted several live, mobile-native games actively running on Seeker, including MixMob, Aurory, Honeyland, and titles from Send Arcade. And this activity appeared after the Season 1 snapshot, when airdrop outcomes were already fixed, pointing to continued consumer use.

Conclusion

Saga failed because incentives ended. Seeker only works if users stay after SKR is claimed. The data shows early usage, but retention decides everything.

If SKR is staked and used for governance, Seeker becomes a real mobile crypto platform. If not, it’s just Saga with better timing.