Crypto

Crypto Prediction Markets: A New Trend in Q4 2025

Q4 2025 marked a structural shift in crypto prediction markets. Liquidity moved toward U.S.-regulated platforms, while wallets and DeFi models pushed prediction markets deeper into everyday crypto usage.

Quick Overview

- Liquidity in crypto prediction markets shifted toward U.S.-regulated platforms in Q4 2025

- Kalshi overtook Polymarket by scaling through brokerage and app-based distribution

- Robinhood and Gemini built a regulated U.S. prediction market stack via CFTC approvals

- Wallet integrations (Phantom, Trust Wallet, MetaMask) turned prediction markets into native features

- DeFi alternatives like Probable pushed zero-fee, oracle-based models at the edges

Kalshi vs. Polymarket

The defining shift in Q4 2025 wasn’t product innovation—it was where liquidity concentrated.

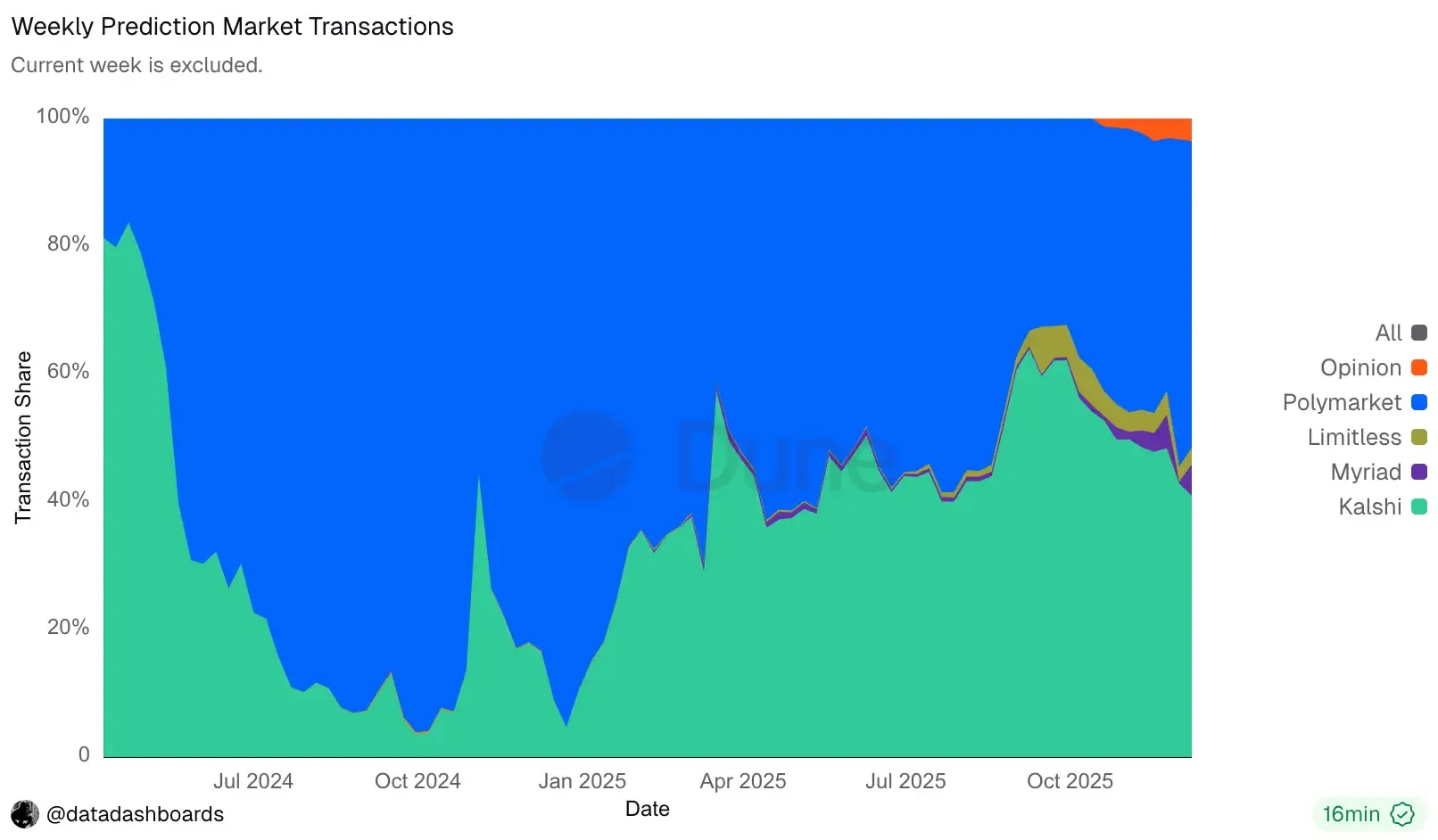

As late as December 2024, Polymarket dominated reported crypto prediction-market volume, often cited above 90% on on-chain dashboards. By November 2025, that balance flipped. Kalshi posted $5.8 billion in monthly volume (up 32% from October’s $4.4B), while Polymarket reached $3.7 billion (up from $3.02B). Combined activity approached $10 billion, with Kalshi capturing roughly 60% of the two-platform flow.

The driver was structural. Kalshi’s CFTC Designated Contract Market status—originally granted in 2020 and later expanded—enabled clean distribution through U.S. brokerages. Robinhood disclosed that a “very large chunk” of Kalshi’s volume was routed via its platform; in October alone, Robinhood users traded roughly 2.5 billion prediction contracts. Liquidity followed the on-ramp.

That momentum was reinforced publicly in December, when Kalshi founder Tarek Mansour disclosed a $1B raise at an $11B valuation, framing prediction markets as a newly unlocked consumer category.

The Flippening isn’t final. Polymarket’s November rebound coincided with the CFTC’s Amended Order (Nov 24, 2025), which permits intermediated U.S. access via registered brokers and FCMs. The implication is clear: distribution under U.S. regulation now decides scale, and Polymarket has a path back—without abandoning its core on-chain model.

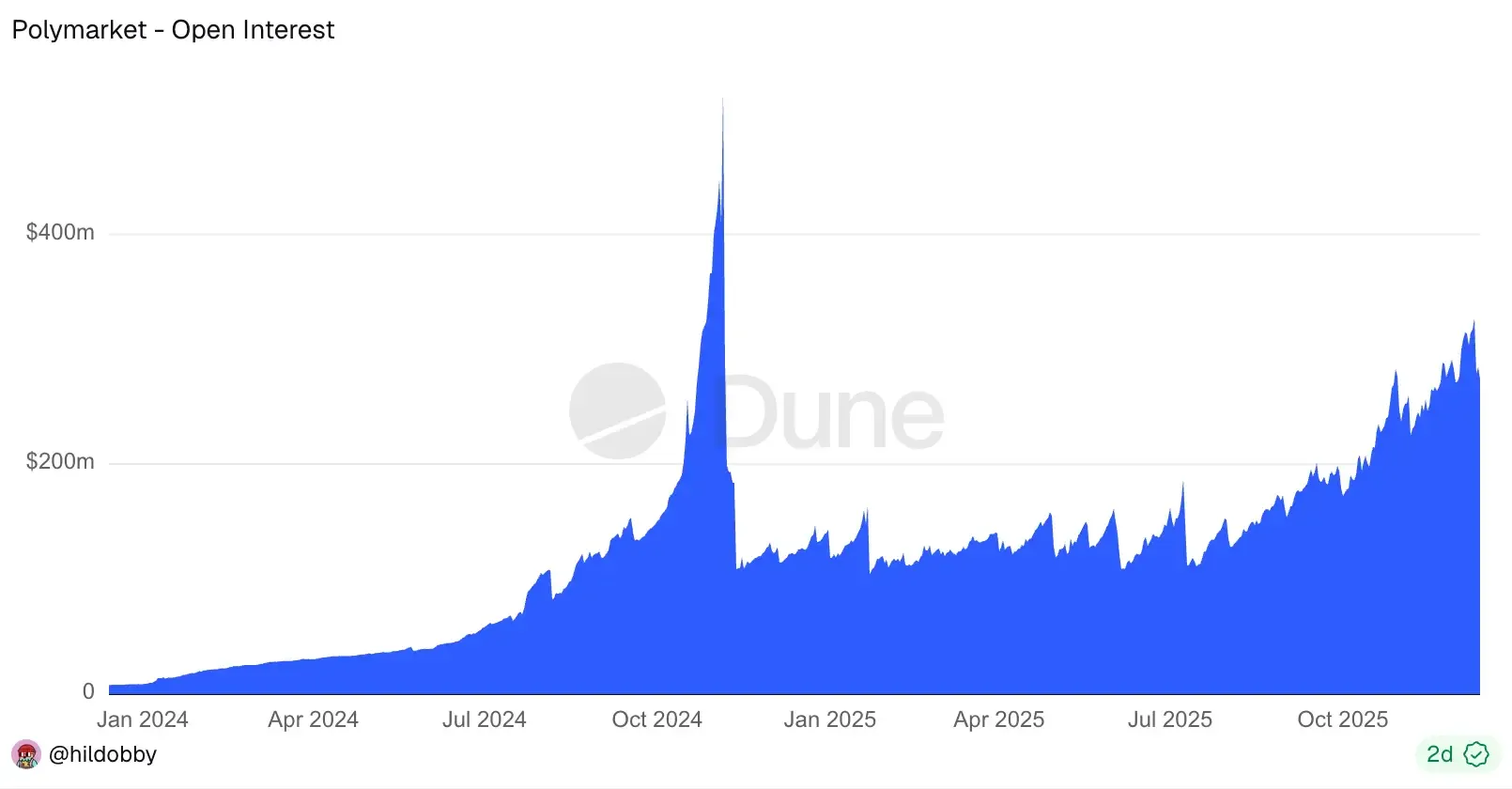

Despite losing the volume lead, Polymarket’s user base has shown unusually strong persistence compared with the rest of cryptocurrency. For active traders, that persistence isn’t ideological—many continue using Polymarket because real profits still come from information edges, arbitrage, and market-making strategies rather than directional bets.

That persistence is now visible in positioning as well, with open interest steadily rebuilding rather than draining out.

The Regulated U.S. Stack of Prediction Markets

Robinhood’s role in prediction markets shifted in 2025 from distributor to owner. Alongside Susquehanna International Group, Robinhood agreed to acquire a 90% stake in LedgerX, the CFTC-regulated derivatives exchange previously owned by MIAX. The move pulls the entire stack in-house: exchange, clearing, liquidity, and retail distribution.

Why it matters is simple. As a Kalshi partner, Robinhood earned a revenue share on routed trades. With LedgerX, it controls listings, market structure, and order flow. That changes the economics—spreads and market-making stay internal, and product decisions no longer depend on an external venue. Robinhood has already framed prediction markets as a nine-figure revenue line, a trajectory that only works if the plumbing is owned.

LedgerX also brings regulated clearing, reducing reliance on third-party FCMs and tightening settlement. Combined with Robinhood’s existing user base, the result is a super-app model where prediction markets become just another native trading behavior.

Gemini Titan — a new CFTC-approved competitor

On December 10, 2025, the CFTC approved Gemini Titan, LLC as a Designated Contract Market, putting Gemini on the same regulatory footing as Kalshi. The approval capped a multi-year process and marked Gemini’s formal entry into regulated U.S. prediction markets—without abandoning its crypto-native stack.

The impact is practical, not philosophical. A DCM license allows Gemini to operate under a federal framework rather than navigating state-by-state approvals. That doesn’t eliminate local friction, but it materially simplifies distribution compared with the patchwork regulated venues still face. Kalshi’s own experience in late 2025—state-level pressure in Nevada, Maryland, and New Jersey—underscored how fragile scale can be even with federal status.

Operationally, Gemini Titan uses a centrally cleared, fully collateralized model. Contracts resolve cleanly to $1 or $0 based on predefined sources, with no dispute windows or governance layers. For institutional traders and compliance teams, that predictability matters more than ideological purity.

The longer-term implication is optionality. Once inside the DCM framework, Gemini can expand beyond event contracts into other regulated cryptocurrency derivatives. Gemini Predictions looks less like a standalone product and more like an entry point into a broader regulated trading stack.

Prediction Markets Move Into Crypto

Another quiet shift in Q4 2025 has been distribution moving one layer deeper—into wallets themselves. Phantom integrated Kalshi-powered prediction markets directly into its interface, allowing users to trade binary event contracts on sports, politics, cryptocurrency trends, and cultural moments without leaving the wallet. Positions open with a swap-like flow, update in real time, and settle in supported tokens, though access remains jurisdiction-dependent.

Trust Wallet followed with its own prediction markets feature, launching first with Myriad Markets on BNB Chain. Users trade directly from wallet balances, close positions early, and avoid external accounts. Support for Polymarket and Kalshi is planned, signaling intent to aggregate multiple venues under a single self-custodial interface.

MetaMask took a similar step by embedding Polymarket into its mobile app. Users can fund predictions in one tap from any EVM network, retain full self-custody, and withdraw winnings instantly after resolution. Participation also feeds into MetaMask Rewards, blending prediction markets with broader wallet engagement incentives.

The pattern is consistent: prediction markets are no longer destinations. They’re becoming features—distributed through wallets that already control user attention and balances.

Probable — the new DeFi prediction market

Probable is PancakeSwap’s on-chain answer to prediction markets—and it’s aimed straight at the crypto-native crowd. Built on BNB Chain and incubated by PancakeSwap with backing from YZi Labs (formerly Binance Labs), it strips the product down to basics: wallet in, trade, settle on-chain. No accounts, no custodians, no intermediaries. And for launch, no prediction fees.

Resolution runs through UMA’s Optimistic Oracle (OOv2): an outcome is posted, it stands unless someone disputes it within a liveness window, and contested results escalate to UMA’s stakers via the Data Verification Mechanism vote.

Probable also auto-converts deposits (e.g., ETH, USDC, DAI) into USDT on BNB Chain, keeping settlement simple and gas costs low. The limit is obvious: it sits in a regulatory gray zone for U.S. access and institutional adoption, and early liquidity will likely stay concentrated in cryptocurrency events until real depth shows up.

Conclusion

Prediction markets aren’t fighting over volume. They’re fighting over who gets to define truth.

By late 2025, regulation stopped being the question and became the filter. The CFTC cleared a U.S. path for Polymarket, approved Gemini as a full DCM, and signaled that objective, verifiable outcomes are in—while subjective markets won’t scale. The rules are no longer theoretical.

That clarity reshaped the field. Regulated platforms bet on certainty and distribution. Polymarket bets on transparency and on-chain credibility. DeFi bets on cost and self-custody. Wallets turn prediction markets from destinations into features.

These models will coexist—and whichever becomes the default way outcomes are resolved will matter more than who trades the most.

That’s the bet.