Crypto

MetaMask USD (mUSD) Launch

MetaMask just dropped mUSD — its own wallet-native stablecoin. Built with Bridge and M0, it launches on Ethereum and Linea, blending DeFi utility with real-world payments through the MetaMask Card.

Quick Overview

- MetaMask launches mUSD — the first wallet-native stablecoin (Aug 21, 2025).

- Issued by Bridge (Stripe-owned), powered by M0 protocol.

- Debuts on Ethereum + Linea, with Linea boosted by its token launch and dual burns.

- Fully GENIUS Act compliant, giving it U.S. regulatory clarity from day one.

- Integrated into MetaMask wallet + Card, bringing stablecoins into daily payments.

What Is MetaMask USD (mUSD)?

On August 21, 2025, MetaMask shook the stablecoin market by announcing MetaMask USD (mUSD) — its first wallet-native dollar token. For a company known mainly as the “front door” to Ethereum, this is more than an upgrade. It’s a pivot: from simple wallet to full-stack financial platform. $mUSD contract address: 0xaca92e438df0b2401ff60da7e4337b687a2435da

MetaMask called mUSD a “critical step in bringing the world onchain.” That’s PR-speak, but the intent is clear — cut out the clunky external stablecoin integrations and let users hold, move, and spend digital dollars without leaving the app.

The timing feels calculated. U.S. lawmakers just passed the GENIUS Act, offering rare clarity for dollar-backed tokens. At the same time, banks and payment giants have warmed up to stablecoins. Launching mUSD now positions MetaMask at the center of this new, regulated wave.

And the human pitch? Gal Eldar, Product Lead, put it bluntly: with mUSD you can “bring your money onchain, put it to work, spend it almost anywhere, and use it like money should be used.” That’s less about compliance, more about everyday utility — and it hints at where wallets are heading next.

Who Issues and Powers mUSD?

Bridge: Compliance and Issuance

The issuer behind mUSD isn’t MetaMask itself but Bridge, a stablecoin platform Stripe scooped up for $1.1 billion back in February 2025. Bridge does the heavy lifting: regulatory filings, reserve management, liquidity ops. What used to take over a year of integrations can now be shipped in weeks. That’s how MetaMask sidestepped the slow grind of building its own compliance stack.

By anchoring mUSD to a U.S.-licensed entity, MetaMask also plugs directly into the GENIUS Act framework. This gives the token a level of regulatory clarity that Tether and even USDC took years to secure.

M0: The Decentralized Engine

On the technical side sits M0, the protocol supplying the programmable plumbing. Think real-time transparency dashboards, cross-chain operability, and smart-contract rails that make a “digital dollar stack” actually flexible.

As Luca Prosperi, M0 co-founder, put it: the protocol lets builders “truly control the digital dollar stack they utilize in order to deliver the best end user experience.” Translation — no more one-size-fits-all stablecoins; mUSD can be tuned for DeFi, payments, or something in between.

First Stop: Ethereum and Linea

mUSD won’t scatter across chains at launch. Instead, it’s rolling out on Ethereum and Linea in late 2025. The reasoning makes sense: Ethereum brings liquidity and trust, while Linea — Consensys’ zkEVM Layer-2 — offers speed and low fees.

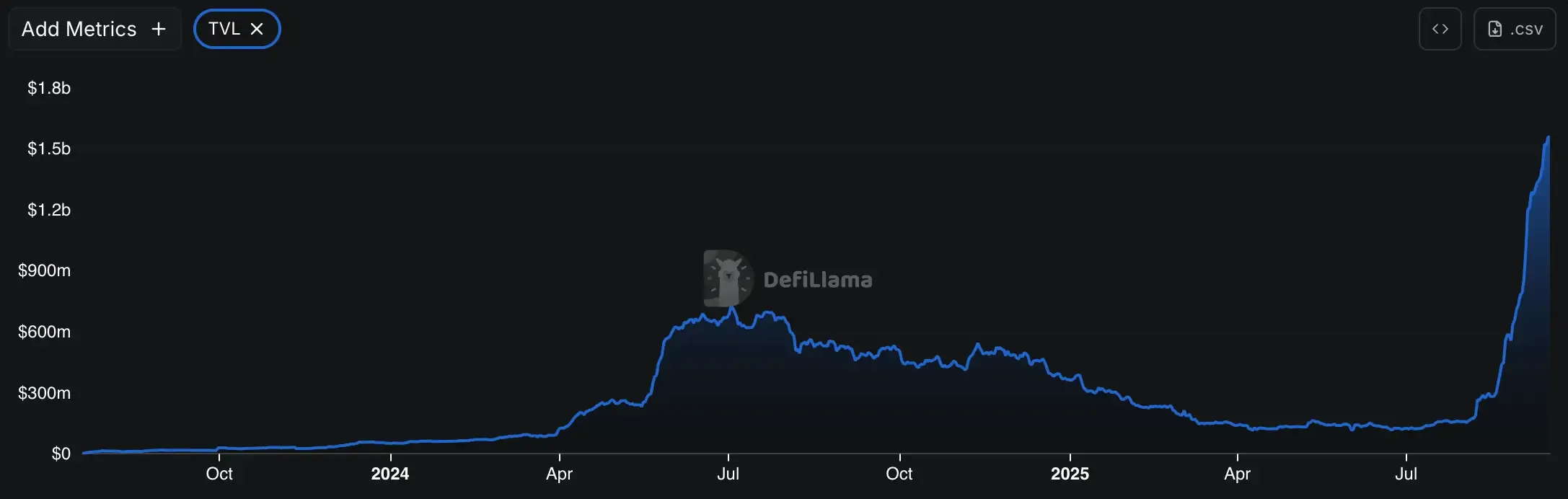

Linea’s numbers are already eye-catching. TVL sits around $1.3 billion, with usage growing quickly across lending protocols and DEXs. The Linea token launch earlier this year added fuel — a 72B rollout with dual burn mechanics and 85% of supply aimed at users and builders. That design turned Linea into more than just another L2; it became a community-led experiment tied directly to ETH. Making mUSD a “native dollar” here isn’t just symbolic; it could cement Linea as a serious DeFi playground.

The rollout plan is clear: use Ethereum for credibility, Linea for growth, and then expand. If it works, mUSD could become the default stablecoin inside the MetaMask universe.

How mUSD Works Inside MetaMask

Wallet-Native by Design

mUSD isn’t an add-on. It’s baked right into the MetaMask wallet — the same place 30 million people already swap, bridge, and track assets. That means no juggling USDT contracts or hunting for USDC liquidity pools just to send $50. You’ll get seamless on-ramps, swaps, cross-chain transfers — all without leaving the familiar MetaMask interface.

For certain payment rails, the wallet even supports 1:1 fiat-to-crypto onboarding. Deposit dollars, get mUSD. No third-party hoops, no separate stablecoin custody. It’s the “dollar button” MetaMask never had.

Spending with the MetaMask Card

And it doesn’t stop online. By December 2025, mUSD will be spendable through the MetaMask Card, accepted anywhere Mastercard runs — literally millions of merchants worldwide. That’s coffee, groceries, flight tickets, whatever.

The card already has a rewards program called Coinmunity Cashback, and more perks are expected once mUSD use ramps up. This move matters. Most stablecoins live and die inside DeFi. mUSD jumps that fence, plugging directly into everyday payments and turning a crypto wallet into something closer to a full bank alternative.

mUSD vs USDT, USDC, DAI, and PYUSD

Market Position

As of September 2025, stablecoins total about $289.4B in circulation. USDT still rules with nearly 59% market share. USDC sits at ~$73B, then comes DAI ($5.1B) and PYUSD ($1.35B). mUSD isn’t here to chase those numbers right away. Instead, it’s aiming at something new: distribution through the wallet itself. No exchange listing battles. No liquidity mining races. Just a direct pipeline to 100M+ MetaMask users.

Technology Differentiation

This is where things get interesting. USDT and USDC rely on integrations with centralized exchanges and DeFi protocols. DAI leans on MakerDAO governance — which can be slow, political. PYUSD is basically PayPal’s digital dollar, strong in payments but weak in DeFi.

mUSD skips all that. It’s embedded inside MetaMask. No setup. No contracts to add. Just “click and spend.” It’s not a liquidity-first approach, it’s a user-first approach.

Regulatory Compliance

Here’s another edge. mUSD launches fully GENIUS Act compliant, with federal clarity in the U.S. from day one. Compare that to USDT, still juggling multiple jurisdictions, or DAI, which exists in a gray zone regulators can’t easily categorize. USDC has solid footing with Circle’s attestations, and PYUSD runs under New York’s NYDFS license. But MetaMask wants to frame mUSD as the compliant, wallet-native dollar — and that’s a strong narrative for institutions.

Risks and Challenges for mUSD

Liquidity is a moat. USDT clears $137.39B in daily trades and holds nearly 60% of the market. That kind of volume creates switching costs that are brutal for newcomers. Even USDC, with Circle’s regulatory polish, needed years of exchange listings and institutional deals to carve its niche.

mUSD won’t get a free pass. If PayPal’s PYUSD is any lesson, even a global payments brand can struggle to grab share. MetaMask has distribution, but breaking into entrenched liquidity pools is another battle entirely.

Yes, the GENIUS Act gives mUSD a compliant launchpad. But rules don’t stand still. Europe’s MiCAR and other global frameworks could force new disclosures or collateral requirements. The wallet-native model itself raises questions: if something goes wrong, who protects the end user?

With Bridge licensed and M0 decentralized, regulators may see a messy split in responsibility. That gray area will need ongoing negotiation as adoption scales.

mUSD’s design leans hard on partners. Bridge, acquired by Stripe for $1.1B, is the compliance and issuance engine. If Stripe shifts its stablecoin strategy, MetaMask could find itself boxed in.

Meanwhile, M0 protocol isn’t exclusive. If rival stablecoins adopt the same stack, developer resources could fragment. And don’t forget the usual on-chain headaches: smart contract bugs, bridge exploits, cross-chain failures. Those risks don’t disappear just because MetaMask is a household name in wallets.

Conclusion

mUSD is MetaMask’s bid to reshape the stablecoin game. It’s the first wallet-native dollar, backed by Bridge for compliance and M0 for programmability. GENIUS Act approval gives it a regulatory head start, while MetaMask’s 100M+ users provide direct distribution no other issuer can match.

Add the MetaMask Card and you get stablecoins bleeding into everyday spending — not just DeFi trades. The challenge is execution: competing with USDT’s liquidity, staying ahead of shifting regulations, and proving users actually want a built-in stablecoin. If MetaMask clears those hurdles, mUSD could set the standard for how dollars move onchain.