Crypto

Is Linea (LINEA) Positioning as the Primary Institutional Settlement Layer for 2026?

Linea has transitioned from a high-hype testnet to a distressed asset priced for irrelevance. But the market may be missing the signal for the noise. This report analyzes Linea's Q1 2026 pivot: a radical shift from retail "engagement farming" to becoming the settlement rail for SWIFT and global custodians. We dissect the "Dual Burn" economics and the move to Type 1 zkEVM to see if this asymmetric bet holds water.

Key Points

- The September 2025 TGE and subsequent claim window successfully flushed mercenary capital, establishing a legitimate price floor around $0.0031.

- The active SWIFT pilot with BNP Paribas and BNY Mellon moves beyond messaging to on-chain atomic settlement, utilizing Linea’s privacy-preserving zk-tech.

- The "Dual Burn" mechanism (20% ETH burn / 80% LINEA burn) decouples token value from retail DAU, relying instead on high-value institutional margins.

- The Q1 2026 transition to a Type 1 zkEVM and the Maru consensus client removes execution risk, a non-negotiable requirement for regulated bank participation.

- Trading at an 82% discount to peers like zkSync, Linea is priced as a "ghost town," ignoring the option value of its TradFi integrations.

The Post-Voyage Paradox: A Market in Violent

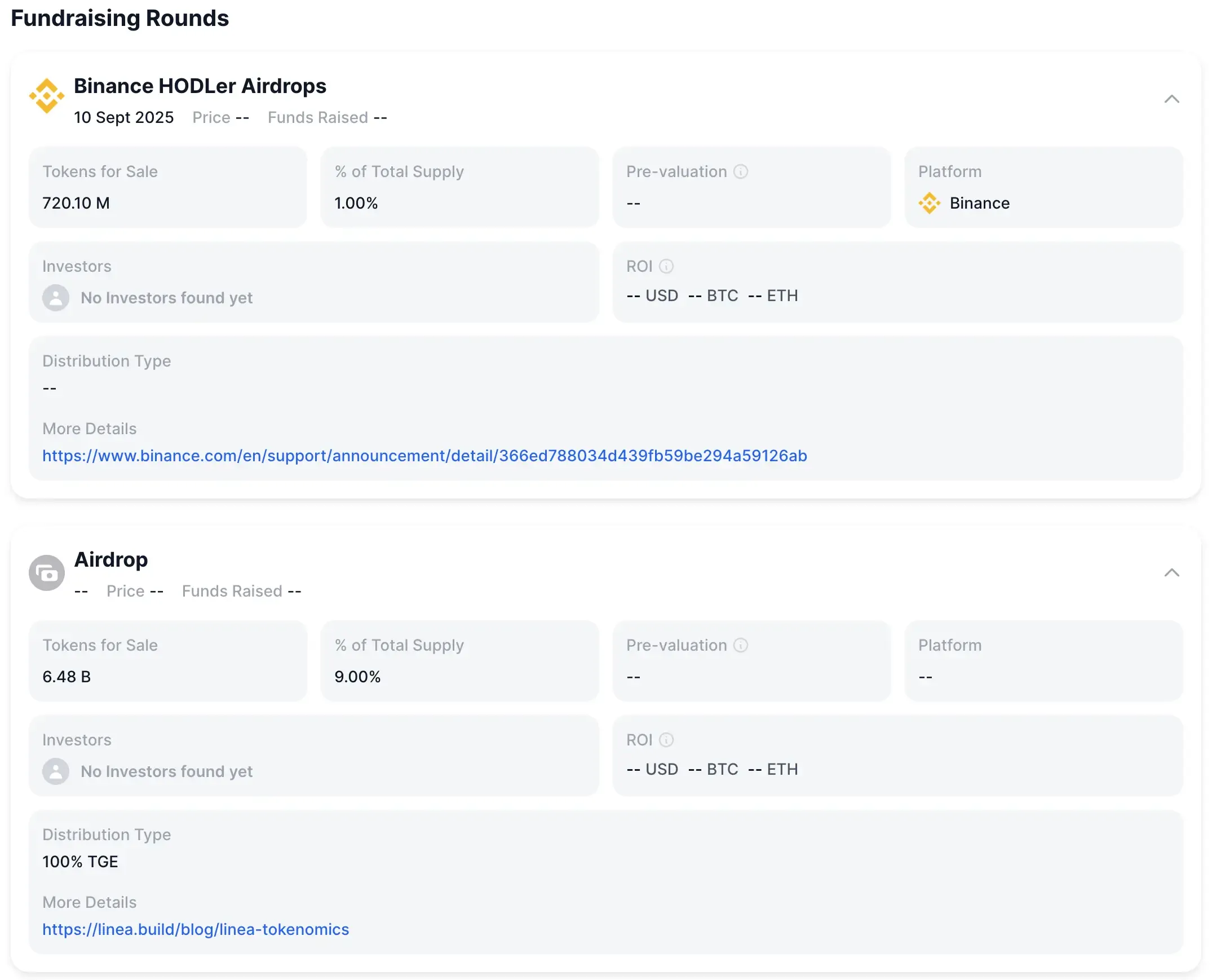

The long-standing speculation regarding Linea’s monetization strategy effectively ended in late 2025. The Token Generation Event (TGE) in September wasn't just a distribution; it was a strategic exorcism. By enforcing rigorous Proof of Humanity protocols during the "Voyage," the network filtered out the sybil farms that plague the Layer 2 ecosystem, leaving behind a smaller but cleaner set of holders.

The market response was brutal but necessary. The closure of the 90-day claim window in December 2025 triggered a liquidity shock, forcing an immediate drawdown as short-term mercenaries exited. But the capitulation didn't last. By early 2026, the asset orchestrated a bullish recovery, establishing a distinct price floor around $0.0031.

This price action is textbook "capitulation and recovery." The weak hands have folded. What remains is a holder base—including the newly formed Linea Consortium of Consensys, Eigen Labs, and ENS—that is ideologically committed to the long term.

Currently, Linea trades at a micro-cap valuation relative to its peers, with a Fully Diluted Valuation (FDV) of roughly $223 million. That is an 82% discount compared to private valuations of competitors like zkSync. The market is pricing Linea as a "distressed" asset because it lacks the retail virality of Base or Solana. This view is myopic. It ignores the structural pivot Linea is executing: swapping low-margin retail volume for high-margin institutional settlement.

Statement from ENS Domains (a core Ethereum infrastructure project) confirming its role as a founding steward in the Linea Consortium alongside Eigen Labs and Consensys. Validates the multi-entity governance model and Ethereum-aligned decentralization efforts referenced in the post-TGE holder base:

ENS Labs is proud to join the Linea Consortium as a founding steward alongside @eigen_labs, @sharplink, @ethstatus, and @Consensys

The Macro Lens: Vitalik’s "Post-L2" Pivot

To understand the stakes, we must look at the shifting philosophy of Ethereum itself. In early 2026, Vitalik Buterin signaled that the "rollup-centric" roadmap of 2020—where L2s were seen as mere scaling extensions—is outdated. With Layer 1 scaling effectively via blob-space expansions, the narrative has shifted from "Who has the most TPS?" to "Who aligns economically with Ethereum?"

The era of the "parasitic L2"—networks that siphon fees while returning pennies to the base layer—is over. The market now demands sustainable revenue models and "Based Rollup" architectures where the L2 inherits the censorship resistance of the L1.

Linea is uniquely positioned here. It has not chased the "sovereign chain" model of Optimism or Arbitrum. Instead, it has doubled down on Ethereum alignment through its Dual Burn mechanism. By denominating gas in ETH and implementing a protocol-level burn that destroys ETH on Layer 1, Linea acts as a value extension rather than a value extractor.

This alignment is a defensive moat. As blockspace becomes commoditized and data availability costs trend toward zero, L2 margins will compress. The only way to survive is to offer a specialized product that commands a premium. For Linea, that product is regulated, private, instant settlement.

The Institutional Moat: SWIFT & The Settlement Shift

While retail metrics languish, Linea has been digging a massive trench in the world of traditional finance (TradFi). The headline development is the SWIFT pilot integration.

Most crypto investors misunderstand SWIFT. Historically, it has been a messaging layer—it sends the "mail" telling banks to move money, but it doesn't move the money itself. That happens later, through a slow, capital-inefficient web of correspondent banking.

The pilot, involving giants like BNP Paribas and BNY Mellon, flips this model. It tests On-Chain Settlement, where SWIFT messages trigger atomic asset transfers on the Linea blockchain. This transitions SWIFT from a mail carrier to a value teleporter.

Why Banks Chose Linea

Institutions didn't pick Linea by accident. They operate in a risk-averse environment where two things matter above all else: Privacy and Finality.

- Privacy via Zero-Knowledge: Banks cannot trade on public ledgers where competitors can see their positions. If a hedge fund spots BNP Paribas moving $500M, they will front-run the trade. Linea’s zk-architecture enables Private Transaction Pools. Using zk-SNARKs, banks can prove a transaction is valid and compliant without revealing the sender, receiver, or amount to the public. Optimistic Rollups (like Arbitrum) fundamentally cannot offer this, as their fraud-proof mechanism requires data transparency.

- Settlement Finality: In the Optimistic model, finality is probabilistic for 7 days. A bank cannot wait a week to know if a billion-dollar settlement is truly irreversible. Linea’s zk-proofs offer mathematical certainty. As soon as the proof is verified on Ethereum, the state is final.

The inclusion of BNY Mellon—the world’s largest custodian with $45 trillion in assets—signals that this is about more than payments. It is about settling tokenized securities, bonds, and real-world assets (RWAs). If Linea captures even a fraction of a percent of this volume, the revenue implications dwarf anything currently seen in DeFi.

Reporting from a co-founder of a crypto media outlet (Grégory Raymond), confirming SWIFT's selection of Linea for on-chain settlement experiments involving major custodians like BNP Paribas and BNY Mellon. Emphasizes Linea's zk-privacy features as the decisive factor for regulated institutions, providing primary-source authority for the TradFi pivot:

SWIFT and several major global banks (including BNP Paribas and BNY) have chosen @LineaBuild... to experiment with migrating their messaging system on-chain

Technical Imperatives: De-Risking the Stack

For this institutional strategy to work, the tech stack must be flawless. Banks do not tolerate "execution risk." This drives two critical upgrades in the 2026 roadmap: the Type 1 zkEVM and the Maru Consensus Client.

Endorsement from Consensys founder and Ethereum co-founder Joseph Lubin of Linea's roadmap, which includes Q1 2026 Type-1 zkEVM upgrade and burn mechanics. Adds foundational credibility to technical de-risking and long-term Ethereum equivalence:

The Linea Ecosystem will soon be firing big and hard on all cylinders, including cylinders that can't easily be replicated by other L2s

The Type 1 Standard

Most zkEVMs are "Type 2"—they are mostly compatible with Ethereum but have minor differences to make proving easier. For a developer, this is annoying. For a bank, it is a liability. A smart contract audited for Ethereum Mainnet might behave differently on a Type 2 chain, leading to fund loss or regulatory breach.

Linea’s shift to a Type 1 zkEVM in Q1 2026 eliminates this variable. Type 1 means the network is identical to Ethereum in every way—same hash functions, same state trees, same gas logic. It provides absolute certainty that code will execute exactly as intended. This is the "regulatory grade" infrastructure banks require.

Decentralizing the Sequencer

Since launch, Linea has run on a centralized sequencer. This is a single point of failure. If the sequencer goes down, the chain halts. The Maru client upgrade replaces this with QBFT (Quorum Byzantine Fault Tolerance).

Unlike the probabilistic consensus of other chains, QBFT favors safety and consistency. It ensures immediate finality and prevents forks. If the primary sequencer fails, the quorum elects a new leader instantly. This creates the liveness guarantees necessary for a 24/7 global settlement layer.

The Economic Engine: The Dual Burn

While the text above outlines the "what" (Type 1 & Maru), this official mini-documentary visualizes the "how." It breaks down the specific zk-prover architecture that provides the mathematical certainty required by the SWIFT pilot participants:

The most sophisticated component of Linea is its economic model. Unlike governance tokens that act as mere voting shares, LINEA is engineered as a deflationary asset tied to network surplus.

The mechanism splits the network's net profit (Fees minus Data Costs):

- 20% is used to buy and burn ETH on Layer 1.

- 80% is used to buy and burn LINEA from the open market.

This creates a direct correlation between usage and scarcity. Crucially, following the EIP-4844 upgrade, data costs have plummeted, expanding Linea’s profit margins to between 60% and 90%.

Here is the kicker: Institutional transactions are high-margin. A retail user swapping a memecoin is price-sensitive; they will leave if fees rise by a cent. An institution settling a $50 million bond is value-sensitive. They will happily pay a $50 premium for privacy and instant finality.

This creates a scenario where Linea can generate massive surplus (and thus massive burn pressure) even with low daily active users (DAU). It decouples the token’s value from the "vanity metrics" of retail activity.

The Valuation Paradox & The Verdict

We are staring at a massive dislocation in value.

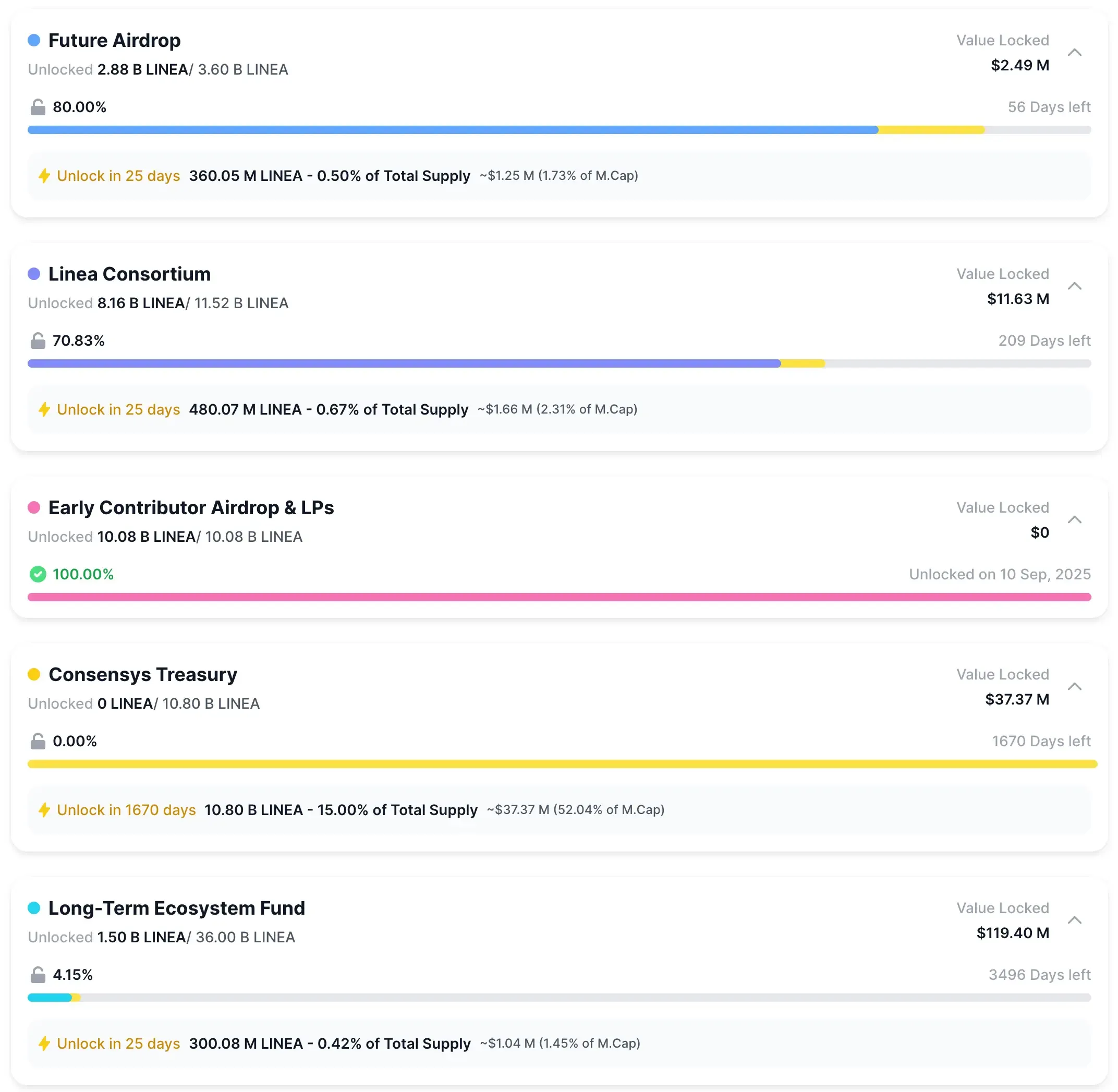

- The Bear Case: Linea is a ghost town. It has ~7,800 DAUs compared to Base’s hundreds of thousands. It has no native meme culture and a heavy supply overhang (only ~26% circulating).

- The Bull Case: Linea is the backbone of the next financial system. It secures over $400 million in TVL, mostly sticky institutional capital. It is the only chain meeting the privacy and finality needs of SWIFT banks.

Currently, the market is pricing Linea strictly on the Bear Case. It is valued at a fraction of its peers, as if its current retail user base is its terminal state.

This represents an asymmetric opportunity. You are buying a call option on the convergence of TradFi and DeFi. If the SWIFT pilot moves to production in 2026, the volume throughput will render retail DAU counts irrelevant. The Dual Burn will kick in, and the supply overhang will be absorbed by institutional demand for the token.

The Verdict for 2026:

Linea is not a play for the faint-hearted or the impatient. It will not moon because of a cat meme. It is a long-duration infrastructure play. If you believe Vitalik’s thesis that L2s must offer unique utility and align with the broader Ethereum ecosystem, Linea is the strongest candidate in the field. The discount is real, but so is the execution risk. Watch the SWIFT pilot results closely—they are the only metric that matters.