Crypto

Sahara AI Token Sale Ignites AI Crypto Hype

Sahara AI community token sale exploded with nearly 9× oversubscription, backed by top VCs. With rapid ecosystem growth and strict KYC, it highlights the soaring momentum behind the Crypto + AI narrative.

TL;DR

- $74M pledged for just $8.5M in $SAHARA tokens — ~9× oversubscribed.

- 100,000+ subscribed, but only ~34,000 verified investors passed strict KYC.

- Backed by Sequoia, Pantera, Binance Labs, and more.

- Ecosystem includes soulbound NFTs, an AI incubator, and live SIWA testnet with 200K+ users.

- Only 1.42% of supply was sold at a $600M FDV, with 100% TGE unlock.

- ~69,000 bots filtered out; $23.78M in clean deposits still overshot cap.

- Mainnet launch mid-2025; Sahara is now a key signal in the AI–crypto boom.

The AI-Blockchain Hype Reaches Fever Pitch

Sahara AI – a relatively new AI-focused Layer-1 blockchain project – became the talk of crypto circles after its community token sale was met with astonishing demand. In a scene reminiscent of the 2017 ICO frenzy (but now supercharged by AI buzz), investors rushed to grab a piece of Sahara’s $SAHARA token. By the sale’s close, over 74 million had been committed for a token allocation of just 8.5 million, reflecting nearly 9× oversubscription.

Such eye-popping demand underscores the zeitgeist of 2025: the convergence of crypto and artificial intelligence has ignited investor FOMO, even for projects still in development. But Sahara AI’s story is more than just hype; it intertwines big-name backers, community engagement, and a bold vision for decentralized AI infrastructure.

Let’s unpack how Sahara AI went from launching soulbound NFTs to securing tens of millions in would-be funding – and what it means for the broader DeFi and Web3 landscape.

Backed by Heavyweights and Building an AI Ecosystem

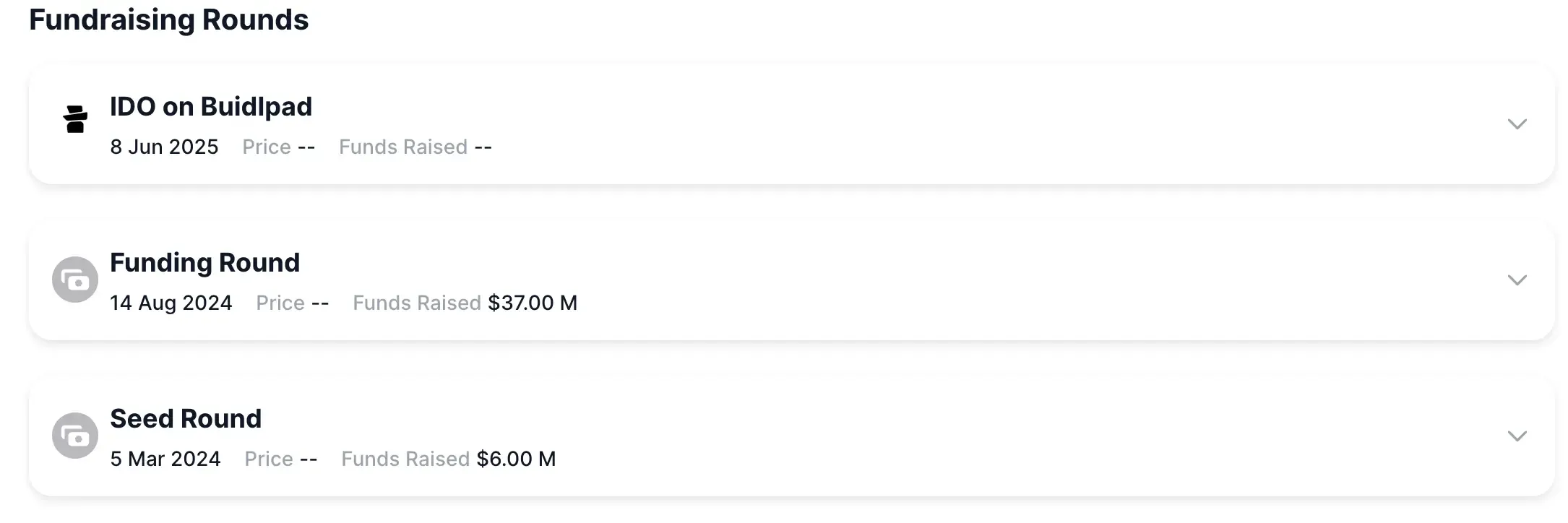

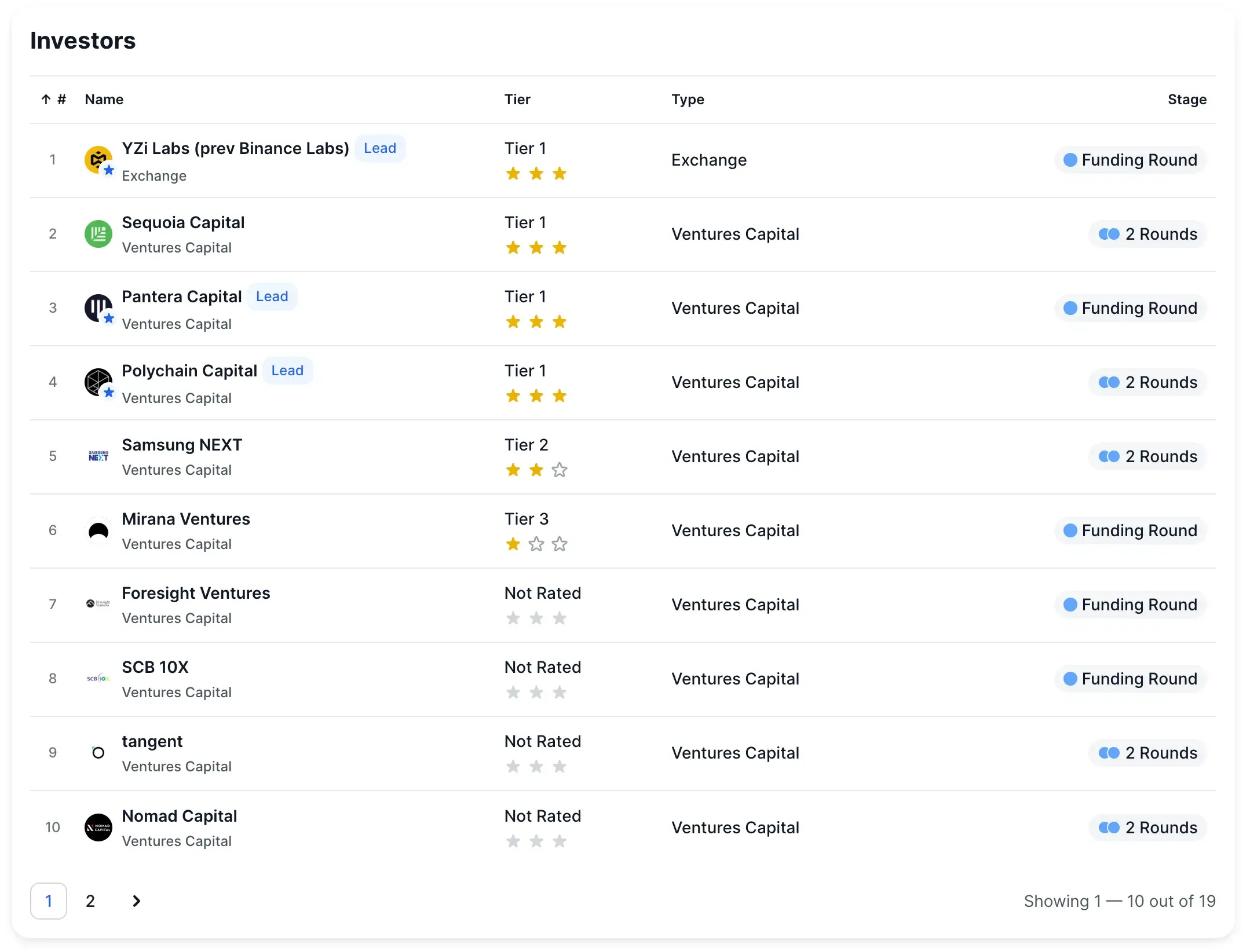

From its inception, Sahara AI signaled serious intent by assembling top-tier investors and crafting an active community. In late January 2025, the project – notably backed by Sequoia Capital and Pantera Capital – kicked off a “Legends” campaign inviting users to mint soulbound NFTs and earn rewards.

This early initiative helped bootstrap user engagement and spread awareness of Sahara’s platform in a crypto crowd increasingly intrigued by AI narratives.

By March 2025, Sahara’s development team launched the Sahara Incubator, a program to nurture AI×Web3 startups within its ecosystem. This move wasn’t just a marketing ploy; it demonstrated Sahara’s strategy of fostering a broader AI development community on its network.

With hands-on support and a network of mentors/investors (including figures from Anthropic, Midjourney, and Together AI), the incubator added to Sahara’s credibility as an emerging hub for AI innovation on blockchain.

In short, Sahara AI positioned itself not as a lone project, but as the center of a growing ecosystem of AI applications, tools, and startups.

SIWA and Data Transparency

Technical progress kept pace as well. By April and May, attention turned to Sahara’s technology roll-outs.

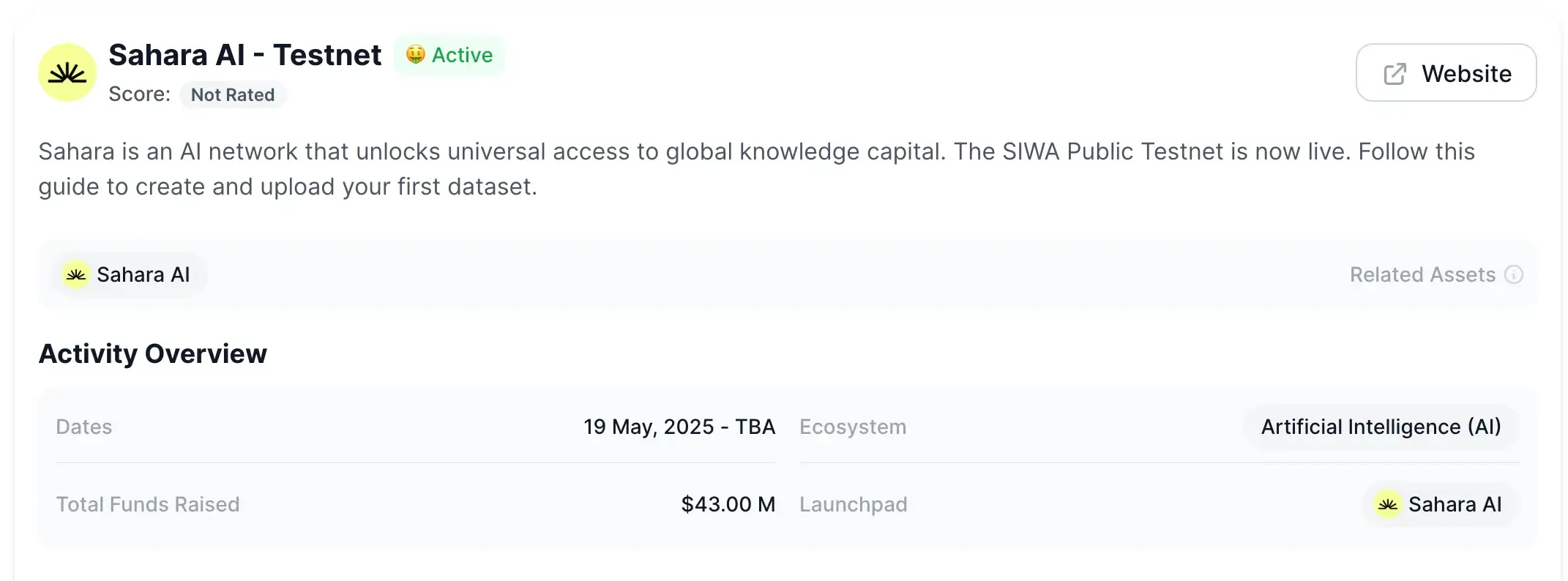

The team announced the SIWA public testnet – which went live on May 19, 2025 – marking a major milestone in Sahara’s roadmap. SIWA (Sahara’s test network) is heralded as the first on-chain platform for AI asset ownership and provenance tracking, allowing developers and contributors to register AI datasets and models with verifiable on-chain records.

In other words, Sahara aims to tackle a big problem in AI: ensuring those who contribute data or models are recognized and can monetize their contributions via blockchain.

During the private testnet phase, interest in this concept was significant – Sahara reported millions of accounts and hundreds of thousands of users testing its data platform. By the public SIWA launch, 40+ partners (from cloud giants like AWS and Google Cloud to AI firms and universities) were on board to experiment with Sahara’s decentralized AI infrastructure.

This combination of community-building, venture backing, and technical milestones set the stage for Sahara’s token sale.

By the end of May, anticipation was high: a new AI-driven blockchain, still in testnet but already boasting use-cases and a waiting list of eager participants, was about to open its doors to public investors.

The $SAHARA Token Sale

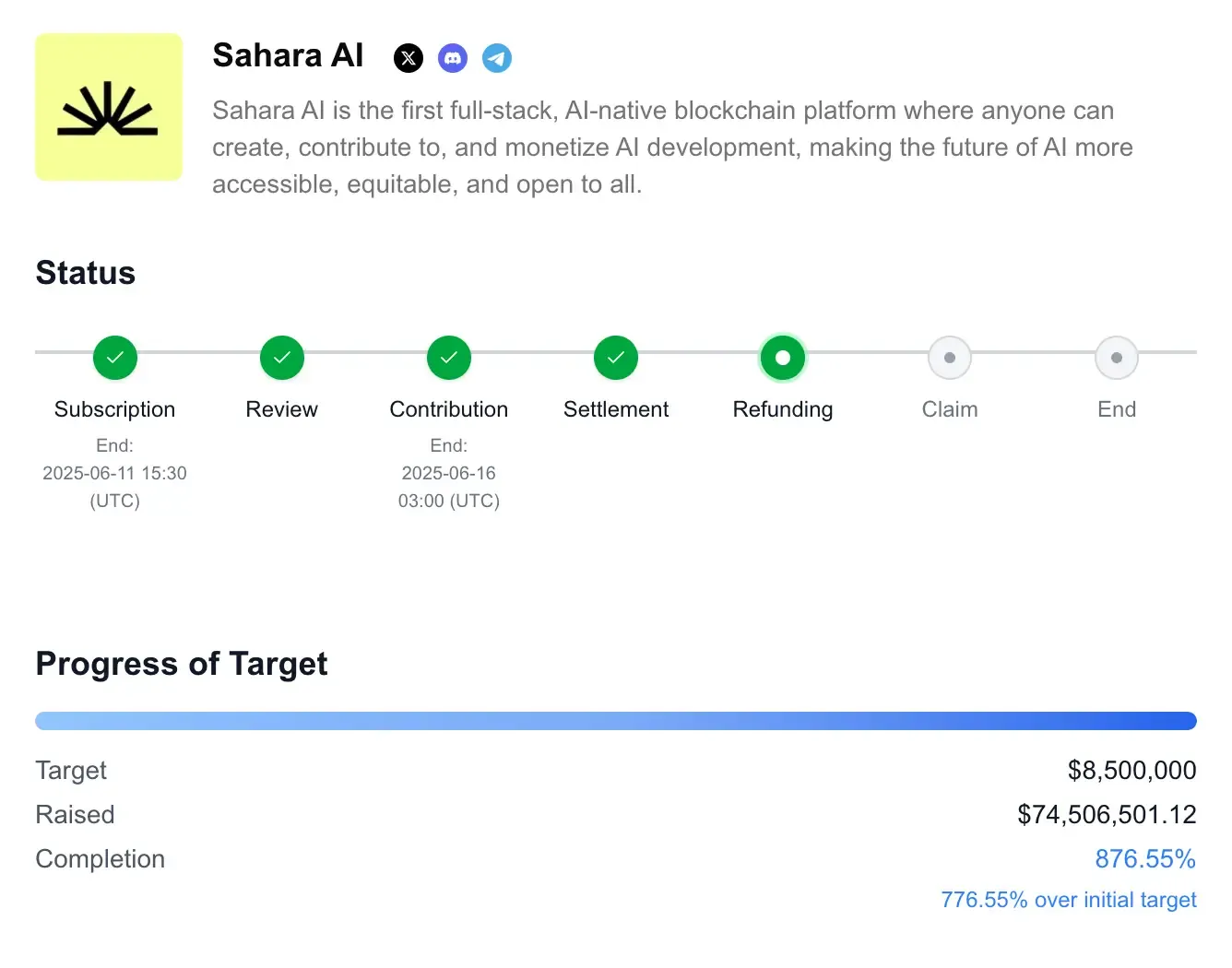

Sahara AI’s Community Distribution (effectively its public token sale or IDO) kicked off in June 2025 on the Buidlpad platform. The terms were conservative: only 1.4167% of the total $SAHARA token supply was up for grabs, with a target raise of 8.5 million.

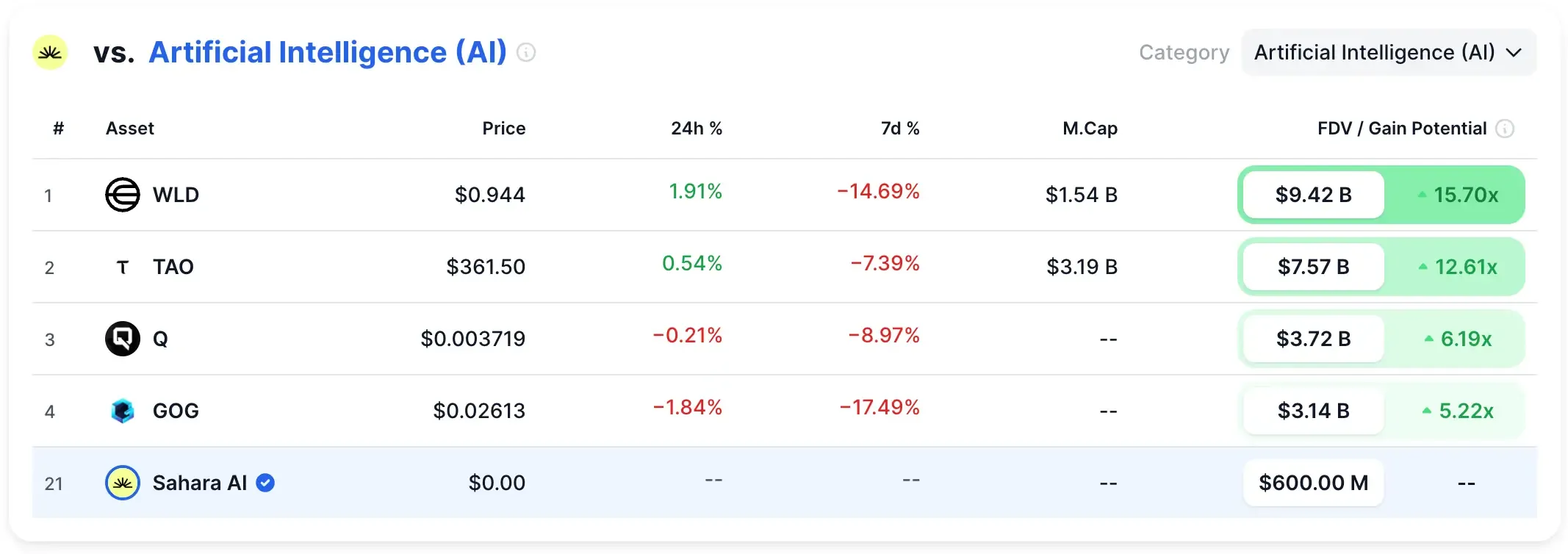

This implied an approximate 600 million fully diluted valuation (FDV) for the project at the token sale price. Such a valuation for a pre-mainnet project is bold – but not unheard of when AI is part of the pitch (indeed, some observers noted that rumors and excitement gave Sahara an almost “unicorn” aura even before launch).

Contributing to the sale required either USD1 or BNB tokens, with investment capped per person (e.g. 50 min, 3,000 max) to encourage wider community participation.

Notably, the tokenomics of this sale were very trader-friendly: all tokens purchased in the round would be fully unlocked at the Token Generation Event (TGE) – i.e. no vesting period. For participants, this meant immediate liquidity and the option to flip tokens once they list on exchanges.

From an investment perspective, a 100% unlock can be a double-edged sword: on one hand, early buyers aren’t forced to hold long and can realize gains quickly, but on the other, the absence of vesting can invite high volatility (as nothing stops a flood of selling at TGE by short-term speculators). Nonetheless, the promise of instant liquidity likely boosted interest in the sale, making it even more attractive to crypto traders.

As soon as the sale opened, demand skyrocketed. Buidlpad’s platform was inundated with sign-ups and deposits from eager investors. Within the subscription period, it became clear the 8.5M cap would be overshot many times over.

According to Buidlpad officials, the event drew more than 100,000 subscription requests – a staggering figure – and ultimately over 30,000 KYC-verified individuals from 118 countries contributed funds. In aggregate, these contributors pledged upwards of 74 million to the sale, overshooting the target by roughly 777% (nearly 9× the allocation).

In simple terms, for every 1 of $SAHARA tokens available, investors were trying to put in about 9 – a testament to how fervently the market wanted in on this AI-blockchain project.

Such a feeding frenzy even had noticeable market side-effects. Observers noted that USD1 (a stablecoin used for contributions) briefly traded at a premium above its 1 peg due to the surge in demand – a phenomenon akin to past ICO booms where people bid up “gateway” tokens just to participate in a hot sale.

It’s a small but telling sign of the hype: investors were willing to pay extra on a stablecoin just to secure their spot in Sahara’s distribution.

Rigorous KYC and Oversubscription Handling

Confronted with overwhelming demand, the Sahara AI team and Buidlpad had to ensure the sale remained fair and wasn’t gamed by bots or a few whales using multiple accounts.

In line with industry best practices, a strict KYC (Know Your Customer) process was enforced. This went beyond just checking IDs – the organizers actively monitored for duplicate or suspicious registrations. The results were striking: about 69,000 sign-ups were flagged and removed as likely bots or fake accounts, dramatically whittling down the participant count.

“Buidlpad has removed approximately 69,000 suspicious accounts, with only around 34,000 accounts passing review and participating in this round of public sale,” noted Ai Yi, an on-chain analyst at Buidlpad.

This heavy pruning ensured that real human investors – roughly 30–34k of them – got a chance at the tokens, rather than a swarm of bots. It also built trust: in an era of Sybil attacks and oversubscription controversies, Sahara’s team showed a commitment to transparency and equal opportunity by leveling the playing field.

Oversubscription Math

After the dust settled, even the legitimate contributions far exceeded the sale’s limit. Final tallies indicate about 23.78 million in verified deposits were made by genuine participants.

In effect, the sale was ~280% oversubscribed after filtering (2.8× the target). Practically, this means many participants will receive only a fraction of the tokens they tried to buy (with the rest of their funds to be refunded according to Buidlpad’s rules).

For example, an individual who committed 1,000 might only get roughly ~357 worth of $SAHARA tokens allocated, given the pro-rata scaling due to oversubscription.

The upside is that thousands of community members will still get at least some allocation, spreading the tokens widely – a positive for decentralization.

The downside is, of course, many will not get their full desired stake, which can lead to post-sale buying frenzies (as those who got less than they wanted might rush to the market to acquire more once trading begins).

Importantly, the oversubscription doesn’t directly net Sahara AI 74M – the project will receive the planned ~8.5M (perhaps a bit more if they included an allocation for platform or fees).

The 74M figure represents excess demand that will largely be returned to investors or remain unfilled. However, symbolically, it places Sahara AI in a very exclusive club of crypto sales that achieved such outsized interest, evoking memories of top-tier exchange launchpads or ICOs of years past.

What’s Next: Mainnet Launch

With the community sale concluded (and final allocations set to be confirmed by June 18, 2025), all eyes turn to Sahara AI’s next milestones.

The team plans to launch the Sahara mainnet in the coming months (targeting mid-2025), transitioning from testnet to a live network. This is where the rubber meets the road: the project will need to deliver on its promises of a scalable, AI-friendly blockchain where data contributors, model builders, and users can interact in a fair, transparent economy..

Given the impressive stats from testnet – including hundreds of thousands of users and data points already processed – expectations are high that Sahara’s mainnet could quickly gain traction. Successful launch and user retention will be key to justifying the hefty valuation implied by the token sale.

Initial Token Dynamics

Market-wise, the $SAHARA token is poised to hit trading platforms with a lot of buzz. Thanks to the 100% TGE unlock, roughly 1.4% of the total supply will enter circulation immediately.

On one hand, this means high float liquidity relative to many token sales (where often only a tiny sliver circulates initially due to vesting). A larger immediate float can help mitigate extreme price spikes, since more people have tokens to sell if the price runs too high.

On the other hand, short-term volatility is almost guaranteed – early buyers may flip for quick profit, while those who missed out could aggressively buy in, all in a market environment intensely sensitive to AI narratives. Flash rallies and speculative behavior have become more common in token markets — as seen recently in ALPACA’s wild 4,000% price surge following its Binance delisting, which you can read about here.

Traders should brace for a potential roller coaster in $SAHARA’s early days.

As one analysis noted, the lack of vesting could lead to “increased volatility in the token’s price” even as it offers liquidity.

Sahara’s Ripple Effect on AI Tokens

Risk management will be crucial for participants, as with any new token launch.

Looking more broadly, Sahara AI’s oversubscribed round is likely to resonate across the AI-crypto sector. In much the way a DeFi project’s hot sale in 2020 signaled the DeFi summer, Sahara’s success could be a bellwether for investor sentiment towards AI-integrated crypto projects.

Analysts suggest that Sahara, as one of the leading projects in the Crypto+AI space, could “have a ripple effect on the broader AI token market,” influencing how both investors and other projects behave in the coming months.

Hype vs. Execution

We might see renewed interest (and perhaps lofty valuations) for other AI-focused tokens, as well as a surge of new projects branding themselves at the intersection of AI and blockchain to capitalize on the trend.

However, amid the excitement, there are also notes of caution. Seasoned observers will recall that huge fundraising and hype are just the first act; what comes next – product delivery, user growth, and real-world traction – will determine if Sahara AI can justify its valuation and become an enduring platform.

Sahara AI Ecosystem FAQ

What is Sahara AI?

Sahara AI is a decentralized AI infrastructure project building a Layer-1 blockchain optimized for AI data ownership, monetization, and model training. It features a testnet called SIWA and plans to launch its mainnet in mid-2025..

Who backs Sahara AI?

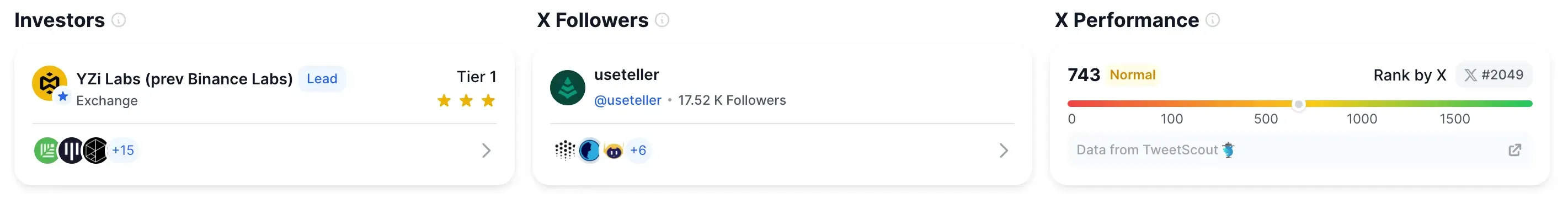

Sahara is backed by top-tier investors including Sequoia Capital, Pantera Capital, Polychain, Binance Labs, and others — signaling high institutional confidence in the project’s vision.

What happened during the $SAHARA token sale?

The community sale raised $8.5M with over $74M pledged, reflecting ~9× oversubscription. Despite capping contributions per person, demand far exceeded supply, showing intense market interest.

How many participants were approved?

After rigorous KYC checks, around 34,000 real investors from 118 countries were approved. Over 69,000 bot/suspicious accounts were filtered out by Buidlpad.

How much of the token supply was sold?

Just 1.4167% of the total supply was allocated to the community sale at a $600M FDV, with 100% of those tokens unlocked at TGE.

When will the mainnet launch?

Sahara’s mainnet is expected to go live by mid-2025, transitioning from its current SIWA testnet. It aims to support on-chain AI data sharing and ownership.

What makes Sahara different?

Sahara combines a soulbound NFT rewards system, a startup incubator, and AI model/data tracking on-chain, positioning itself at the forefront of the Crypto+AI movement.

Is there risk involved with the unlocked tokens?

Yes. The full unlock at TGE offers high liquidity, but also increases the risk of price volatility as early investors may quickly sell, impacting short-term price stability.