Crypto

What Was Behind ALPACA’s 4,000% Pump?

The ALPACA token jumped by an amazing 4,000% in just five days. It went from $0.029 to $1.20 after the April 24, 2025 announcement about its delisting from Binance.

⚡ TL;DR

- ALPACA token skyrocketed 4,000% in 5 days after Binance delisting news

- Whales accumulated tokens early and triggered a strategic short squeeze

- Over $86M in shorts liquidated as price jumped from $0.02 to $1.20

- System issues on Binance amplified volatility and retail losses

- Case shows how low liquidity enables extreme manipulation in crypto

$ALPACA Accumulation and Artificial Demand

When token dropped to its all-time low of $0.02, large players began quietly accumulating tokens. Thanks to the low liquidity, they were able to acquire a significant share without causing much price movement. Once positioned, they began generating artificial demand, which slowly pushed the Alpaca Finance crypto value upward. However, this spike turned out to be far from organic. It was the result of deliberate manipulation, which led to major losses for many traders.

Crypto analyst Budhil Vyas called the behavior of these large players a textbook example of tactical manipulation. According to him, whales first crashed the price by nearly 80% to trigger liquidations and panic.

Then, less than two hours before the delisting, they drove the price up 15×. Vyas observed that there was no real growth happening. This was a strategic move in an unstable crypto market.

Short Sellers Got Trapped

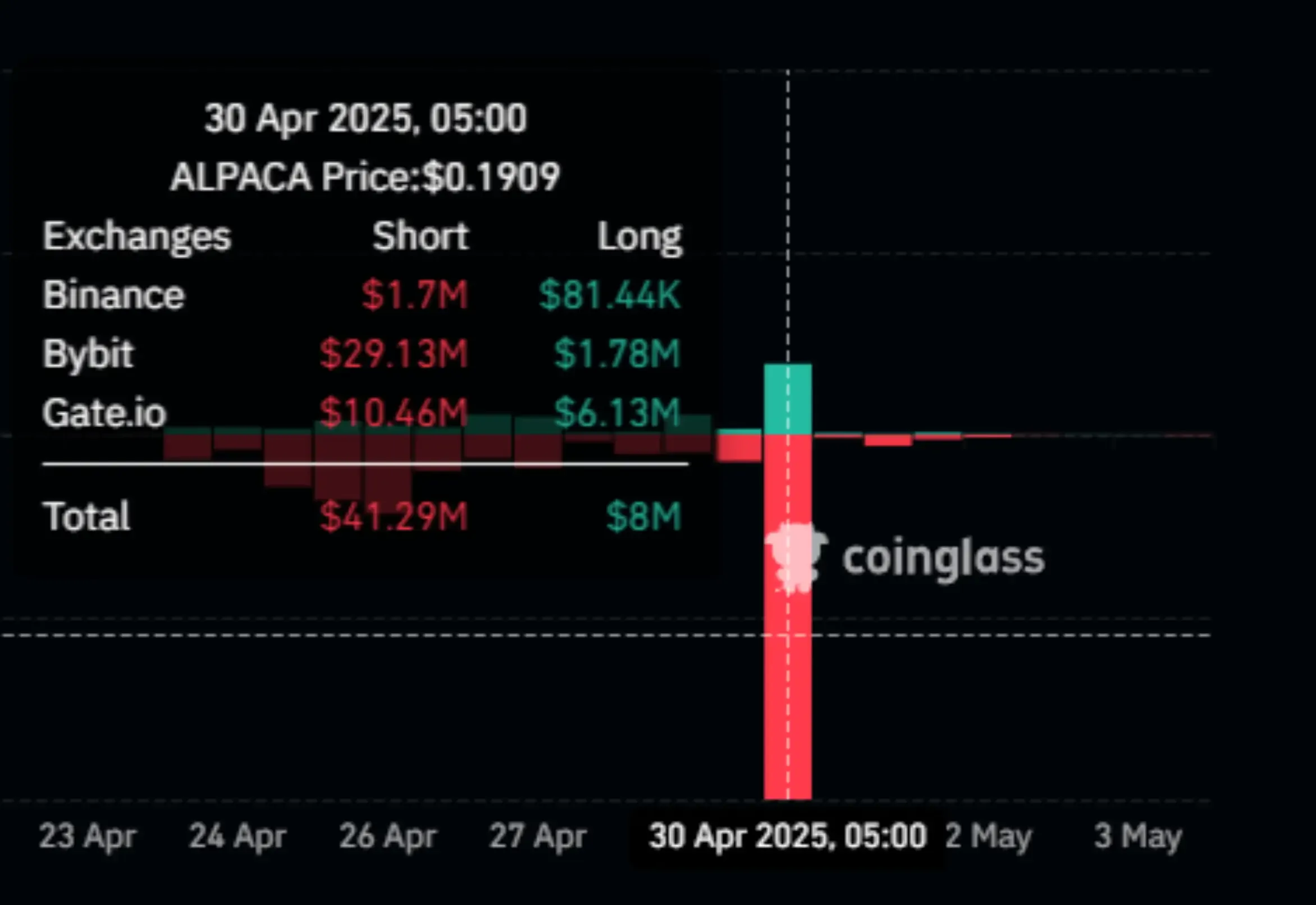

When the alpaca coin price climbed above $0.10, many traders believed it was a typical dead cat bounce and began opening short positions. But what followed was an explosive rally — within two days, the trading range jumped nearly 10×. A record $45 million in short liquidations occurred within 24 hours, further accelerating the pump.

Between April 24 and April 30, traders liquidated short positions worth $86.7 million.

ALPACA Delisting on Binance: Spot and Futures

As a result, the price peaked at $1.20, only to crash shortly afterward. At the time of writing, the token trades at $0.20.

- April 30, 2025 — Binance closed all perpetual futures contracts on alpaca crypto

- May 2, 2025 — Alpaca Finance token was removed from all spot trading pairs

System Failures and Investor Losses

The spike in this asset was largely driven by system instability on Binance. After the announcement of the delisting, traders increased the trading volume for alpaca finance coin futures to $3 billion. Open positions reached $110 million.

Binance, aiming to cool down the busy market, changed the funding rate interval from 8 hours to 1 hour. They also set a ±2% limit. However, that didn’t help much. On April 29, they widened the limit to ±4%, which only increased volatility.

The sharp price changes caused problems on Binance. Many retail traders lost money due to sudden liquidations, slippage, and failed transactions.

This case shows how low liquidity and weak rules can lead to market manipulation and big losses for investors — a dynamic that also plays out in highly speculative token launches like the recent AI-powered token sale that drew massive oversubscription and top-tier VC support, amplifying the broader AI crypto hype.

Key Takeaways

- Bad news ≠ sell-off. The Binance delisting became a trigger for a pump, not a dump.

- Low liquidity = high vulnerability. Small capital can move the market in illiquid tokens.

- Protections are needed. Futures trading limits and auto-leverage caps for at-risk tokens like this asset should become industry standards.

Were You Involved in the Action?

Did you short or long alpaca finance price during this madness? Do you think someone could have predicted this pump?