Crypto

Trump Media Bitcoin Holdings Hit $1B

Trump Media has quietly built a $1B Bitcoin treasury, holding 11,542 BTC at a ~20% unrealized loss. On-chain data shows no selling. The bet hinges on ETF approval, regulation, and capital allocation.

Quick Overview

- Trump Media holds 11,542 BTC, worth ~$1.08B as of late Dec 2025

- On-chain data shows no Bitcoin sales despite a ~20% drawdown

- Bitcoin makes up 93%+ of the company’s tracked crypto holdings

- Truth.Fi aims to monetize the treasury via a spot Bitcoin ETF

- The strategy only works if BTC recovers, ETFs are approved, and dilution stays controlled

Trump Media — The $1 Billion Barrier Crossed

Trump Media & Technology Group Corp. (DJT) crossed a key threshold on December 21–22, 2025, when its Bitcoin treasury exceeded $1 billion in aggregate value for the first time.

On-chain tracker Arkham identified the catalyst: the acquisition of 451 BTC, roughly $40.6 million at execution.

The purchase came during a volatile consolidation phase for Bitcoin, with spot prices around $87K, well below the October 2025 highs near $125K. Despite that backdrop, TMTG continued accumulating, bringing total holdings to 11,542 BTC.

At an average cost basis of approximately $108 000 per BTC, the position currently reflects an unrealized loss of about 20% relative to spot prices near $87 000. The inventory built across the 2024–2025 cycle rather than opportunistic trading. The December addition confirms that accumulation remains active, even while the position sits underwater.

TMTG’s On-Chain Forensics

TMTG’s Bitcoin is custodied across multiple addresses linked to Crypto.com institutional custody infrastructure rather than a single, easily identifiable wallet. That structure limits address-level attribution while still allowing analysts to verify the aggregate position on-chain—standard practice for public companies managing nine-figure crypto balances.

What stands out more than wallet design is behavior. Despite sitting materially underwater on cost basis, TMTG has executed no observable Bitcoin sales. On-chain data shows continued holding, not trimming or hedging, even through recent volatility. For a corporate treasury, that absence of distribution is the clearest signal of intent.

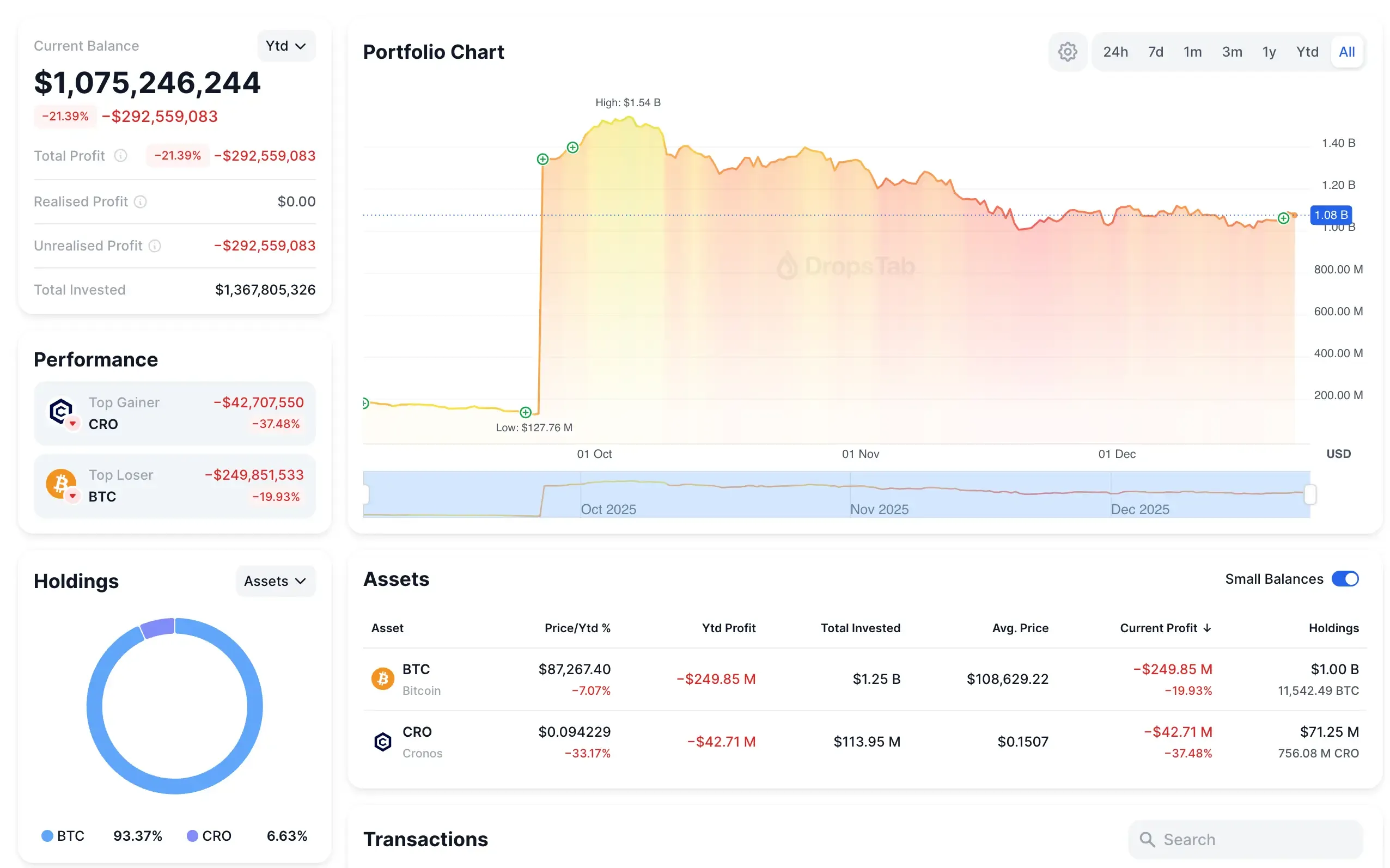

TMTG’s Bitcoin position can be verified directly on-chain. Portfolio aggregation tools like DropsTab consolidate wallet activity into a single timeline, showing both accumulation points and drawdowns. As of late December 2025, the chart reflects roughly 11,542 BTC worth about $1.08B, down ~21% YTD, with Bitcoin making up over 93% of total holdings. The step-change in Q4 confirms active accumulation—and the absence of sell events confirms continued conviction.

Truth.Fi as the Monetization Vector of TMTG

TMTG’s Bitcoin holdings aren’t designed to sit idle. They’re meant to be working inventory, and Truth.Fi, launched in January 2025, is the mechanism meant to put that inventory to use. The core idea is simple: convert balance-sheet Bitcoin into regulated financial products that institutions and retail investors can access without touching self-custody.

Truth.Fi’s product lineup—spot Bitcoin and Ethereum ETFs, “Made in America” thematic funds, and SMAs custodied at Charles Schwab—all point in the same direction. Different wrappers, same source of liquidity. TMTG’s treasury becomes seed capital that can be packaged, distributed, and scaled, rather than a passive reserve exposed only to price swings.

The regulatory process is already in motion. On June 3, 2025, NYSE Arca filed a Form 19b-4 to list the Truth Social Bitcoin ETF. As of December 2025, the filing remains under review—no approval, no rejection. That limbo matters less now than it did earlier in the year, as the regulatory backdrop has shifted in a more crypto-tolerant direction following Michael Selig appointment and the passage of the CLARITY Act.

If approval comes, the upside is immediate. TMTG’s 11,542 BTC—roughly $1 billion at current prices—can seed an ETF at launch, creating a fee-generating asset instead of a static treasury. That’s the bet: not just that Bitcoin rises, but that owning distribution turns volatility into monetization.

Trump Media — Regulatory Outlook

The regulatory tone shifted in December 2025. Michael Selig was confirmed and sworn in at the CFTC, signaling a move away from enforcement-first crypto policy toward clearer market structure. Selig has publicly emphasized predictability over ad-hoc actions—a friendlier default for issuers trying to launch regulated products.

At the same time, the CLARITY Act will reduce uncertainty around spot digital commodities by drawing cleaner lines for Bitcoin’s regulatory treatment. The practical effect isn’t instant approval, but fewer reasons to stall. For Truth.Fi’s pending spot Bitcoin ETF, that matters.

Net effect: approval is still not guaranteed, but the odds improved meaningfully versus mid-2025. What was once a binary risk now looks probabilistic, with a plausible Q2–Q3 2026 window if reviews proceed without new objections.

TMTG’s Risk Assessment

Bitcoin volatility: A sharp BTC drawdown directly pressures the balance sheet. TMTG has no active hedging in place, so price moves flow straight through to treasury value and sentiment.

Dilution risk: The all-stock TAE Technologies merger materially increases share count. Every percentage point of dilution reduces BTC per share unless offset by additional accumulation, making equity structure a critical variable.

ETF approval risk: Truth.Fi’s spot Bitcoin ETF is still pending. A delay into 2026—or a denial—would leave TMTG with Bitcoin exposure but without its primary monetization pathway.

Offset: Bitcoin remains a liquid, globally tradable asset, and the current regulatory environment is more defined than in prior cycles. That narrows downside uncertainty, but doesn’t eliminate it.

Conclusion

TMTG isn’t a Bitcoin proxy—it’s a regulatory timing bet. The company is wagering that U.S. crypto rules stabilize, that Bitcoin becomes an approved institutional product, and that holding inventory before that shift pays.

This only works if BTC returns to $100K+, Truth.Fi’s ETF gets approved, and dilution stays contained. If any one of those breaks, the strategy degrades fast. If all three land, TMTG isn’t just holding Bitcoin—it’s positioned to monetize the transition.