Crypto

Vanguard’s Crypto Investments

Vanguard publicly downplays Bitcoin while holding billions in crypto-linked equities. The ETF reversal was forced by this contradiction, not by belief.

Quick Overview

- Vanguard holds roughly $10B in crypto-linked equities via Strategy and Coinbase.

- The December 2, 2025 ETF reversal wasn’t ideological—it was operational pressure.

- Public skepticism clashes with deep portfolio exposure to Bitcoin-driven businesses.

- Bitcoin may lack yield, but Vanguard profits one layer up through real earnings.

- Ignore the metaphors—Vanguard’s allocations show the real bet.

The “Digital Labubu” Thesis

On December 11–12, 2025, John Ameriks, Vanguard’s global head of quantitative equity, made a remark that cut through institutional finance: if tokenization doesn’t become meaningful, it’s hard for him to see Bitcoin as more than a “digital Labubu.”

The line sounded dismissive. It wasn’t. Ameriks wasn’t mocking Bitcoin—he was classifying it. Under a traditional asset-pricing framework, Bitcoin is a non-productive asset. No dividends. No coupons. No cash flows to discount. Value depends on scarcity and future demand, not present output. That’s a standard quantitative view, even if it irritates crypto investors.

Tokenization is the escape hatch in his model. If blockchains become core settlement and collateral infrastructure for real-world assets, Bitcoin’s role shifts from scarce object to financial backbone. Without that shift, Ameriks argues, Bitcoin remains speculative.

That framing matters—because it collides directly with what Vanguard actually owns.

Vanguard’s Policy Update

To understand why Vanguard’s decision mattered so much, it helps to understand who Vanguard actually serves.

As Fred Krueger noted at the time, Vanguard isn’t just another asset manager competing with BlackRock at the margins—it dominates U.S. retirement accounts, index mutual funds, and direct-to-consumer investing. This is the default home of long-term, middle-class capital. So when Vanguard opens the door to Bitcoin ETFs, even reluctantly, it changes who can access crypto—not traders, but savers.

On December 2, 2025, Vanguard quietly did something it had spent nearly two years refusing to do. It opened its retail brokerage platform to spot Bitcoin and Ethereum ETFs. No rebrand. No philosophical U-turn. Just a policy update that effectively ended the freeze imposed back in January 2024, when Vanguard blocked third-party crypto ETFs and mutual funds despite full regulatory approval and rising institutional participation.

The timing is the tell.

This reversal landed barely ten days before John Ameriks went public with the “digital Labubu” line. Which means the decision wasn’t triggered by a sudden change in how Vanguard’s leadership thinks about Bitcoin. The firm had already decided—internally—that denying access no longer made sense. Public skepticism continued. Operational reality moved on.

That gap matters. Vanguard’s own materials still wrap crypto in disclaimers and caution language. Yet clients can now trade IBIT, BlackRock’s spot Bitcoin ETF, FBTC from Fidelity, and other approved products directly through Vanguard’s platform. This wasn’t an endorsement. It was an admission that the wall had become impractical to maintain.

Client pressure did the work. Vanguard sits on roughly $11 trillion in assets, spread across millions of retail accounts and advisory relationships. By late 2025, a meaningful slice of those clients either wanted crypto exposure—or were openly weighing platforms that already offered it. Fidelity, Schwab, and others were happy to oblige. The #BoycottVanguard backlash after the 2024 ban wasn’t noise. It showed up in account transfers and advisor complaints.

So the reversal happened.

The Operational Pragmatism Reality

The December 2, 2025 reversal wasn’t ideological. Vanguard’s leadership didn’t soften its view on Bitcoin, and Ameriks’ skepticism didn’t disappear once the gate reopened. What changed was pressure. The contradiction had become impossible to manage.

Vanguard was blocking client access to spot crypto ETFs while holding close to $10 billion in crypto-linked equities through MicroStrategy and Coinbase. From a client and advisor standpoint, that position was untenable. Restricting access while profiting indirectly created friction—complaints, transfers, and competitive leakage to platforms that let clients decide for themselves.

Allowing ETFs wasn’t an endorsement. It was damage control. Vanguard didn’t change its beliefs. It acknowledged that denying access no longer aligned with what its own portfolio already reflected.

In the same period Vanguard was reassessing its crypto stance, capital was pouring aggressively into its core products. Vanguard’s S&P 500 ETF was posting one of its strongest inflow streaks in years, with tens of billions added in a single month and year-to-date inflows on track for a record. This wasn’t a firm dealing with withdrawals or marginal clients—it was absorbing sustained demand from long-term investors at scale. Against that backdrop, maintaining artificial restrictions in one corner of the platform became harder to justify.

Vanguard’s Crypto Portfolio

Vanguard has spent years urging caution around Bitcoin. Read its public guidance and crypto looks like a fringe risk, something best kept at arm’s length. Inside the portfolio, the posture is very different.

Through index funds and systematic strategies, Vanguard has built one of the largest institutional exposures to crypto-linked equities in public markets. Not tokens. Not ETFs—at least until December. Companies whose equity prices move directly with Bitcoin itself.

There’s another layer to this exposure that often gets missed: concentration.

When Vanguard opens crypto access, it doesn’t offer a sprawling marketplace of tokens. It channels demand through a narrow set of large, institutionally palatable assets. With trillions in retirement capital and only a limited menu, diversification doesn’t expand—flows compress. The result is predictable. Capital aggregates around Bitcoin-linked equities and core infrastructure providers, reinforcing the same names already embedded in Vanguard’s portfolios.

Strategy Inc Bitcoin Exposure

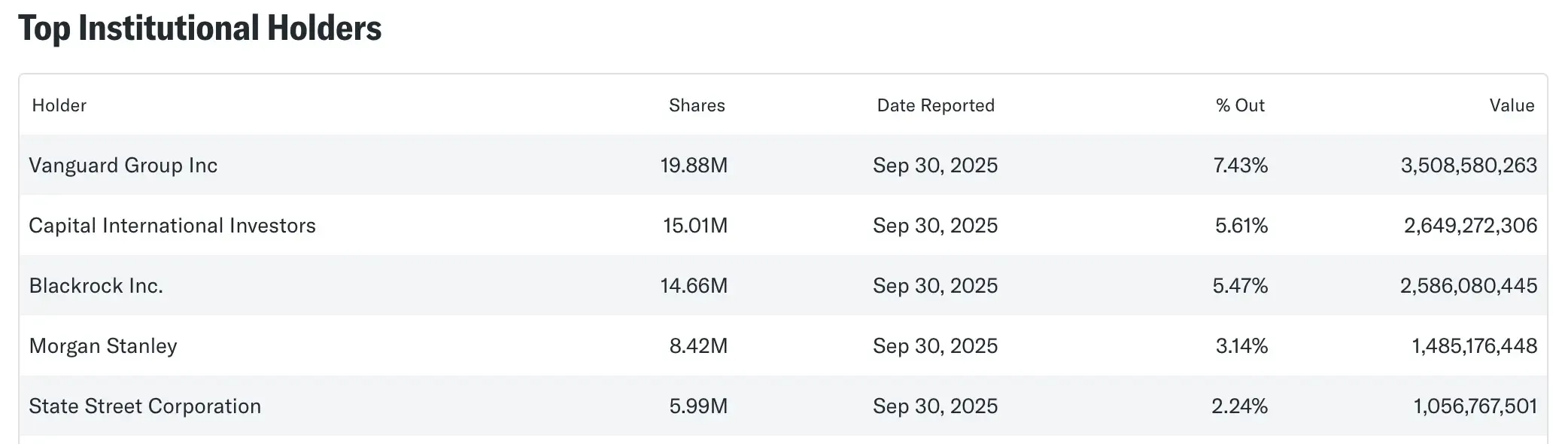

As of spring 2025, Vanguard owned roughly 19 to 20.5 million shares of Strategy Inc, representing about 8.5% of the company. At several points during the year, that stake alone was worth more than $7 billion. It no longer behaves like a software company in any meaningful sense. Strategy functions as a Bitcoin treasury vehicle with a Nasdaq ticker.

By November 2025, the firm reported holding approximately 649,870 BTC, worth around $56 billion at the time. The equity doesn’t merely track Bitcoin—it amplifies it. When BTC moves, MSTR tends to move harder. That means Vanguard’s index investors are carrying leveraged Bitcoin exposure, whether they intended to or not.

This isn’t a discretionary bet. Vanguard holds Strategy because its funds are required to own index constituents by market capitalization. As MSTR grew, exposure followed automatically. The result is a structural position in Bitcoin volatility, embedded deep inside portfolios marketed as conservative and long-term.

Coinbase Exposure

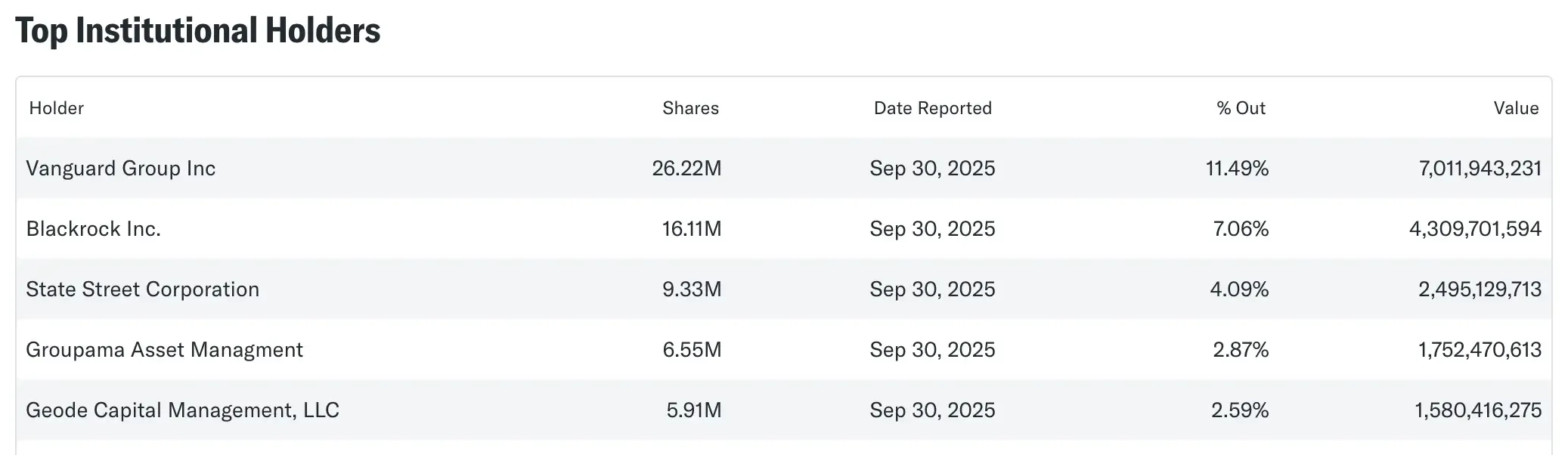

Coinbase adds a different layer. Vanguard owned roughly 18.3 million COIN shares by late 2024—around 9% of the company—and filings in 2025 showed that position growing by roughly 5 million shares by Q3. At December 2025 prices, the stake was worth about $7 billion.

Whether those additions came from index changes or model portfolios is hard to isolate. What matters is the outcome: Vanguard is one of Coinbase’s largest shareholders.

Unlike MicroStrategy, Coinbase isn’t a proxy built on balance-sheet mechanics. It’s a cash-flow business. Trading fees, custody, derivatives, infrastructure. When crypto activity rises, Coinbase earns real revenue. Vanguard’s exposure here isn’t theoretical—it’s tied directly to Bitcoin being used, traded, and custodied at scale.

What the Portfolio Is Signaling

Taken together, Strategy Inc and Coinbase give Vanguard roughly $10 billion in crypto-linked equity exposure, depending on prices and filing dates. That’s not incidental. It’s large enough to swing with Bitcoin cycles and large enough to matter inside a $10+ trillion asset manager.

This doesn’t mean Vanguard “believes” in Bitcoin. It means something more revealing. The firm’s skepticism lives in quotes and frameworks. Its exposure lives in the portfolio.

And portfolios, unlike rhetoric, are hard to argue with.

Yield vs. Scarcity

John Ameriks’ math is clean, but incomplete. Bitcoin produces no yield—no dividends, no cash flows to discount—and by classical finance rules that matters. Where the framework breaks is treating “no yield” as “no utility.” Vanguard’s own portfolio shows the gap. Bitcoin’s usefulness expresses itself one layer up, through companies that monetize its activity.

Coinbase turns trading and custody into real earnings. MicroStrategy converts Bitcoin’s scarcity into balance-sheet leverage. Yield doesn’t exist at the protocol level—but it shows up in the equities Vanguard already owns.

Conclusion

Vanguard’s actions point to a simple wager. Bitcoin doesn’t need yield to matter—it just needs to stay liquid, scarce, and useful enough that institutions keep building businesses around it. That belief is already embedded in billions of dollars of exposure to Coinbase’s earnings and Strategy’s balance sheet.

The December 2, 2025 ETF reversal wasn’t about belief. It was about friction.

Blocking access while profiting indirectly had become untenable, so Vanguard stepped aside and let clients choose.

The real bet isn’t on tokenization theory or valuation debates. It’s that Bitcoin remains structurally relevant long enough that avoiding it outright is no longer possible.

Watch the exposure. Ignore the metaphors.