Crypto

What is Ore Mining in Solana

ORE began as a fair-launch mining project on Solana before transforming into a revenue-driven, deflationary gambling protocol. Here’s how it works.

Quick Overview

- Started as a Solana hackathon mining experiment by pseudonymous dev HardhatChad.

- Transitioned in 2024 to V2, replacing mining with 5×5-grid wagering rounds.

- Deflationary tokenomics: 10 % SOL fee funds buybacks; 90 % of repurchased ORE burned.

- Explosive growth: $389 K daily revenue and 6,300 % price surge by Nov 2025.

- High innovation—and high risk—as regulators eye on-chain gambling models.

What Is ORE

ORE didn’t begin as a casino or even a DeFi experiment — it started as a hackathon side project. Its pseudonymous creator, HardhatChad, wanted to see if Bitcoin-style mining could actually live on Solana’s proof-of-stake rails. The idea was simple but strange: mimic proof-of-work’s fairness without importing Bitcoin’s inefficiency. No ASICs, no rigs, just computation and curiosity.

Early chats in Solana dev circles about Bitcoin bridges and Layer 2s gradually turned into something else — a native experiment in on-chain distribution fairness. By April 2, 2024, the first version of ORE went live, powered by a custom hash function called DrillX. Anyone with a phone or laptop could mine. Every 60 seconds, exactly 1 ORE was emitted, split proportionally among miners who solved valid hashes. Those who locked tokens got stake multipliers, boosting rewards up to 2×. It felt democratic — a “fair launch” in the most literal sense.

For a brief moment, it worked too well. ORE exploded in popularity, hitting 124,000+ users and pushing 12 million transactions within days. Suddenly, this quirky mining game was the most active program on Solana. But that kind of traffic came with a price. Solana’s network gasped under the load — block congestion, failing transactions, queues stretching for seconds that felt like minutes. A grassroots experiment had just stress-tested an entire blockchain.

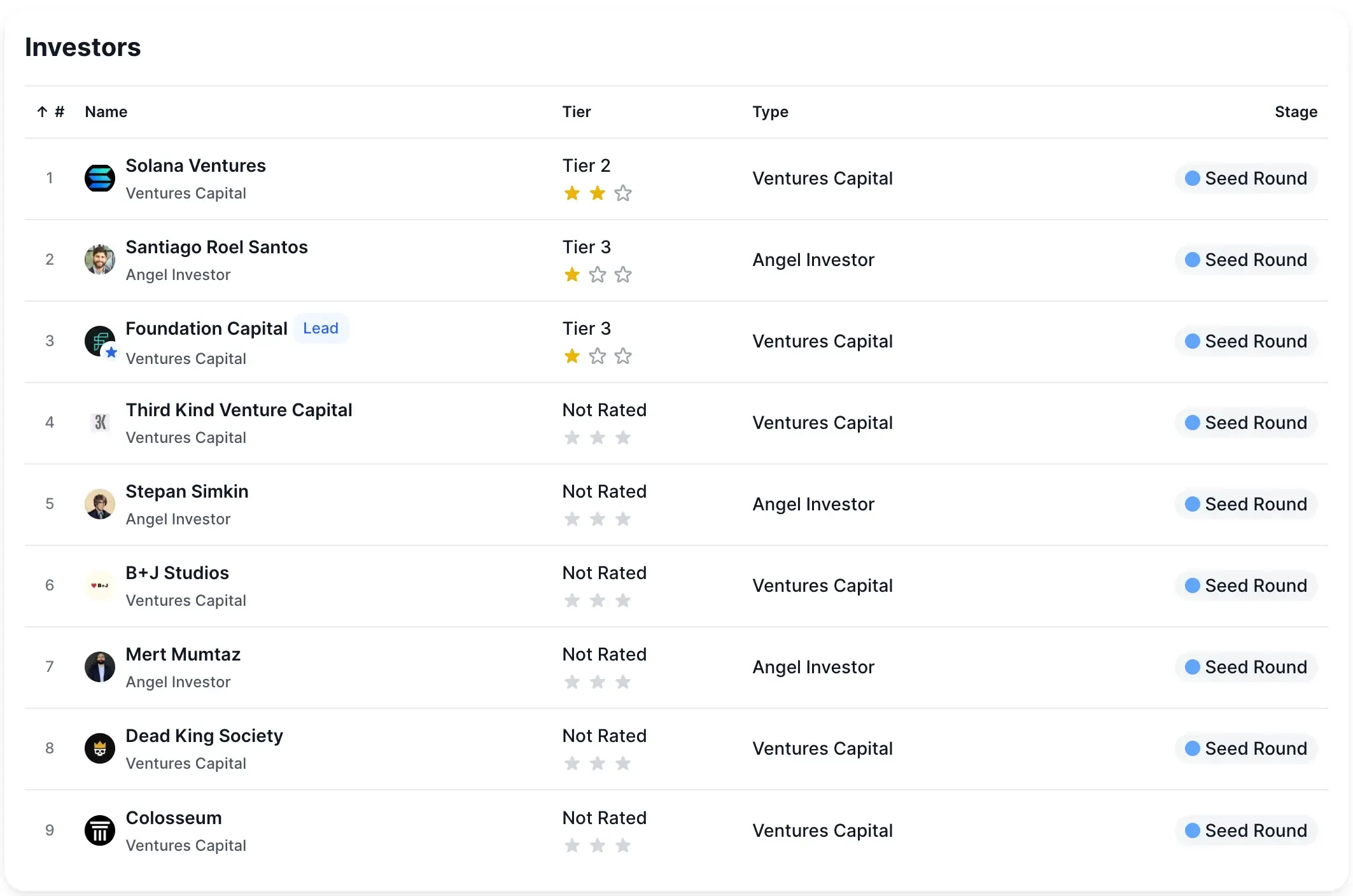

Although ORE began as a grassroots experiment, it quickly attracted early backing from prominent Solana-aligned investors and angels, including Solana Ventures, Foundation Capital, and Santiago Roel Santos. Their involvement signaled that what started as a hackathon project had grown into a funded protocol exploring gamified tokenomics at scale.

Transition from Mining to a Gambling-Based Model

By mid-April 2024, Solana was choking. ORE’s proof-of-work experiment had gone from “innovative” to “network-breaking” in just two weeks. Roughly three out of every four non-vote transactions were failing, a staggering figure even for Solana’s high-throughput system. The problem wasn’t malicious miners — it was math. The V1 algorithm rewarded constant submissions, so players flooded the network with hash attempts, spamming the chain into paralysis.

On April 16, 2024, HardhatChad hit pause. Mining was halted immediately. In a short, almost apologetic post, he called the break “necessary” — a chance to rebuild ORE into something sustainable. The new version, V2, would fix the spam problem, rebalance rewards, and add built-in incentives for holding rather than dumping tokens. Every old ORE could be upgraded 1:1 into the new version. No expiry, no rush, just a hard reset.

What came next wasn’t just a patch — it was a transformation. After months of redesign and quiet testing, ORE V2 launched publicly on October 22, 2024. The DrillX hash puzzles were gone. In their place: a strange new hybrid that looked less like mining and more like on-chain roulette. Miners became players. The network congestion disappeared, but so did the old notion of work — replaced by chance, risk, and reward woven directly into tokenomics.

Inside the V2 Gambling Model

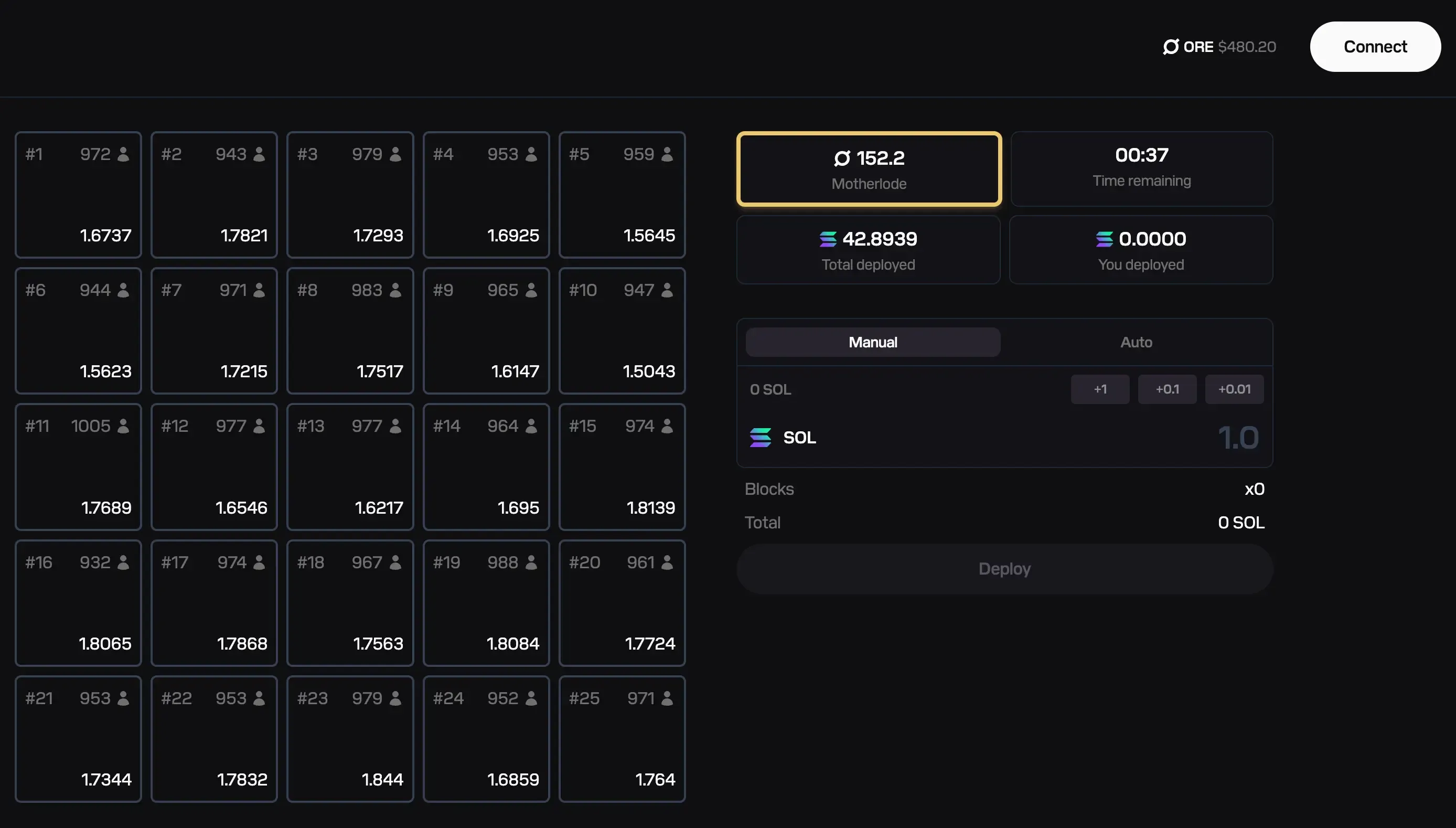

In ORE V2, mining has been replaced by gameplay. Each round unfolds on a 5×5 grid of 25 blocks where players (still called “miners”) deploy SOL tokens on any block they choose. Every minute, a random number generator selects a single winning block. The SOL from the 24 losing blocks is redistributed to the winners, scaled by their stake.

Occasionally, a lucky address on the winning block receives a +1 ORE bonus — a nod to the project’s mining roots — while every round also feeds 0.2 ORE into the Motherlode, a jackpot pool with a 1-in-625 chance to trigger and distribute its accumulated rewards. If not hit, it continues to grow until the next lucky round.

How to Play (or “Mine”) ORE

To start, you’ll need SOL in a Phantom wallet (or Seeker’s built-in wallet).

Go to ore.supply and connect your wallet from the top-right corner. You’ll see the same 5×5 grid displayed in real time — each round lasting one minute. Select your blocks, choose how much SOL to deploy, and hit Deploy. Winners on the chosen block share the SOL from all others, and about half the time, one participant (or all proportionally) also earns 1 ORE.

Most players use the Autominer, which handles block selection and deployment automatically. You can set the number of blocks, SOL per block, and total rounds — and stop anytime. When claiming rewards, note the 10% refining fee, redistributed to miners who haven’t yet claimed. It discourages quick selling and rewards those who hold longer.

ORE Tokenomics — Emission, Buybacks, and Deflation

ORE’s economy still rests on a simple spine: a 5 million-token hard cap and a steady emission of 1 ORE per minute. What V2 adds is a set of feedback loops that can flip that steady drip into net deflation.

Every wager on the 5×5 grid sends 10 % of deposited SOL to the protocol treasury, which automatically buys ORE on the open market. Ninety percent of those tokens are burned, the rest go to stakers. The result: more play = more burn = less supply.

A second mechanic, the refining fee, takes 10 % off every reward claim and redistributes it to unclaimed balances. It’s a behavioral nudge that taxes impatience and rewards holders — the on-chain version of delayed gratification.

By early November 2025, on-chain data showed net emissions turning negative: –631 ORE over seven days, about 400 burned that same week. When buybacks exceed the base emission rate, supply contracts in real time.

It’s the same principle behind Binance’s BNB or PancakeSwap’s CAKE, but without treasuries or marketing burns. ORE’s deflation is earned — each round literally funds the next token reduction, turning gameplay itself into a scarcity engine.

ORE On-Chain Metrics

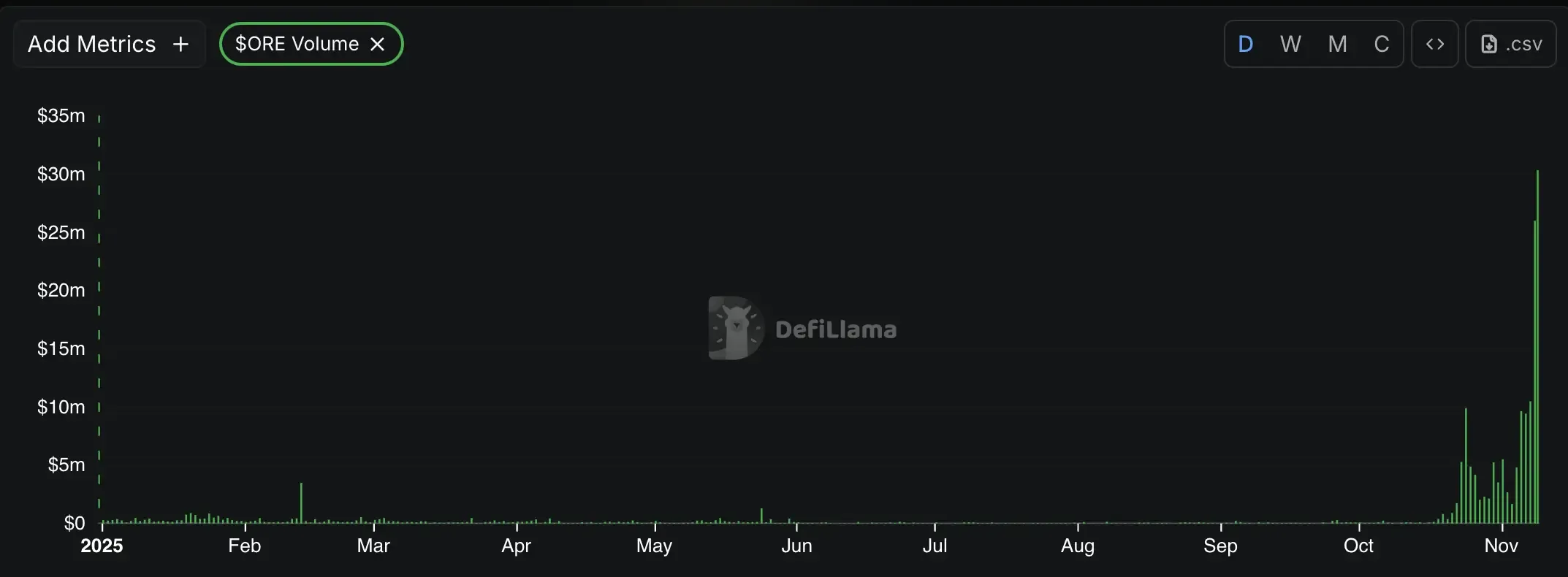

Post-V2, ORE’s on-chain metrics erupted across every visible gauge. Daily protocol revenue topped $389K on November 6, 2025, with deposits peaking around $3,500 per minute — a ten-fold jump since October. That implies roughly $3–4 million in daily SOL wagering volume, most of which cycles back into ORE buybacks and burns.

Dan Smith of Blockworks Research highlighted ORE’s rapid revenue acceleration on November 5, 2025 — marking yet another all-time-high day for Solana’s top-earning application.

Trading mirrored the frenzy: $13–26 million in 24-hour volume and a 16 % volume-to-cap ratio, more casino chip than utility token. About 20 K wallets now hold ORE — modest next to Solana’s millions but notable for a niche DeFi game.

Price action tells the same story of heat and hazard: from $10 on September 25 to $500 by November 8 — a 6,300 % climb in six weeks. A staggering rebound, still well below its 2024 all-time high, and proof that speculation, not stability, currently drives the protocol’s pulse.

Beyond ORE, Solana is seeing a broader boom in gamified speculation and digital collectibles. Tokenized gaming and collectibles have surged in parallel — especially in 2025, when Collector Crypt and Courtyard drove over $124.5M in Pokémon card trading in a single month. Built on Solana, Collector Crypt’s $CARDS token reached a $450M FDV within a week of its August launch, showing how real-world collectibles and GambleFi are starting to blur.

Tulip King also highlighted the shifting market narrative connecting ORE to the Zcash “store-of-value” thesis — suggesting that investor focus may be rotating from privacy-based projects like Railgun toward scarcity-driven assets within the Solana ecosystem.

Conclusion

ORE’s transformation from fair-launch mining to on-chain gambling pushed the limits of what’s possible on Solana — and of what regulators might tolerate. Its deflationary mechanics and revenue-linked design show genuine innovation, but they come wrapped in high risk. Legal gray zones, one-minute wagering loops, and a math model where most players lose make ORE both fascinating and fragile. For now, ORE stands as a reminder that in crypto, every breakthrough walks a fine line between genius and gamble.