Alpha

Monad Token Sale on Coinbase

Monad’s MON token is launching through Coinbase’s revamped ICO platform, offering retail access at $0.025 before mainnet. Here’s a fast breakdown of the mechanics, tokenomics, pricing, and risks.

Quick Overview

- Coinbase is reviving ICOs with MON as the flagship sale.

- Price is set at $0.025, with 7.5% of supply offered.

- Fill-from-bottom allocations favor smaller buyers; anti-flip rules apply.

- 50.6% of MON stays locked until 2029, reducing day-one sell pressure.

- Hyperliquid pricing hints at 2–2.6x upside — but volatility is likely.

Coinbase’s Strategic Return to Token Sales

Coinbase didn’t stumble back into token sales by accident. After dropping $375 million on Echo in October 2025 — the platform built by Cobie and known for its clean fundraising rails — the exchange folded Echo’s Sonar system straight into its own stack.

Suddenly, Coinbase had the tooling to run fully transparent, self-hosted sales without relying on third-party launchpads. And they’re running them on a monthly cycle, almost like a heartbeat.

Each project has to show everything: complete tokenomics, team disclosures, and even accept a six-month OTC lock for founders and close affiliates. It’s a quiet nod to what went wrong in 2017–2018, when the SEC slammed the brakes on ICOs for being unregistered securities sales. Coinbase is basically saying: fine, we’ll build a version you can’t yell at.

The timing isn’t random either. Paul Atkins took over the SEC in early 2025 and immediately started cracking open the door that had been welded shut. He keeps talking about “clear guidelines” for token distributions and carving out spaces where registration may not be required. A sharp pivot from Gary Gensler’s hammer-first approach.

Atkins’ Project Crypto is even more ambitious — a framework where non-security tokens and tokenized securities could trade on the same SEC-regulated platforms. If that vision holds, Coinbase’s new sale platform ends up looking like the first practical test of that idea.

Coinbase ICO Mechanics

Coinbase built this thing to look nothing like the old “fastest bot wins” sale models. Their fill-from-bottom algorithm starts with the smallest checks — literally $100 orders go first, then it works its way up toward the $100k ceiling. It sounds almost upside-down at first, but the goal is simple: pack the sale with as many real users as possible instead of handing the whole thing to three desks in Singapore.

Participants get a full seven-day window to submit purchase requests. No rush, no gas wars, no clicking until your wrist goes numb. After the window closes, the system allocates in that bottom-up flow. Big buyers can still show demand, but they’re not allowed to swallow the pool. It’s retail-first by design.

There’s also a small sting in the tail: an anti-flip rule. Sell your tokens within 30 days of launch and your priority score drops for future sales. It’s not a hard ban, just a quiet nudge toward stability — Coinbase trying to avoid the “buy, list, dump” chaos that wrecked past ICOs.

Everything settles in USDC, clean and traceable, and every token sold through the platform is guaranteed a Coinbase listing. That alone sets it apart from most launchpads. Projects pay a fee on the funds they raise; investors don’t pay a cent. The only real requirement for buyers is the usual stuff: full KYC, compliance checks, and an account in good standing.

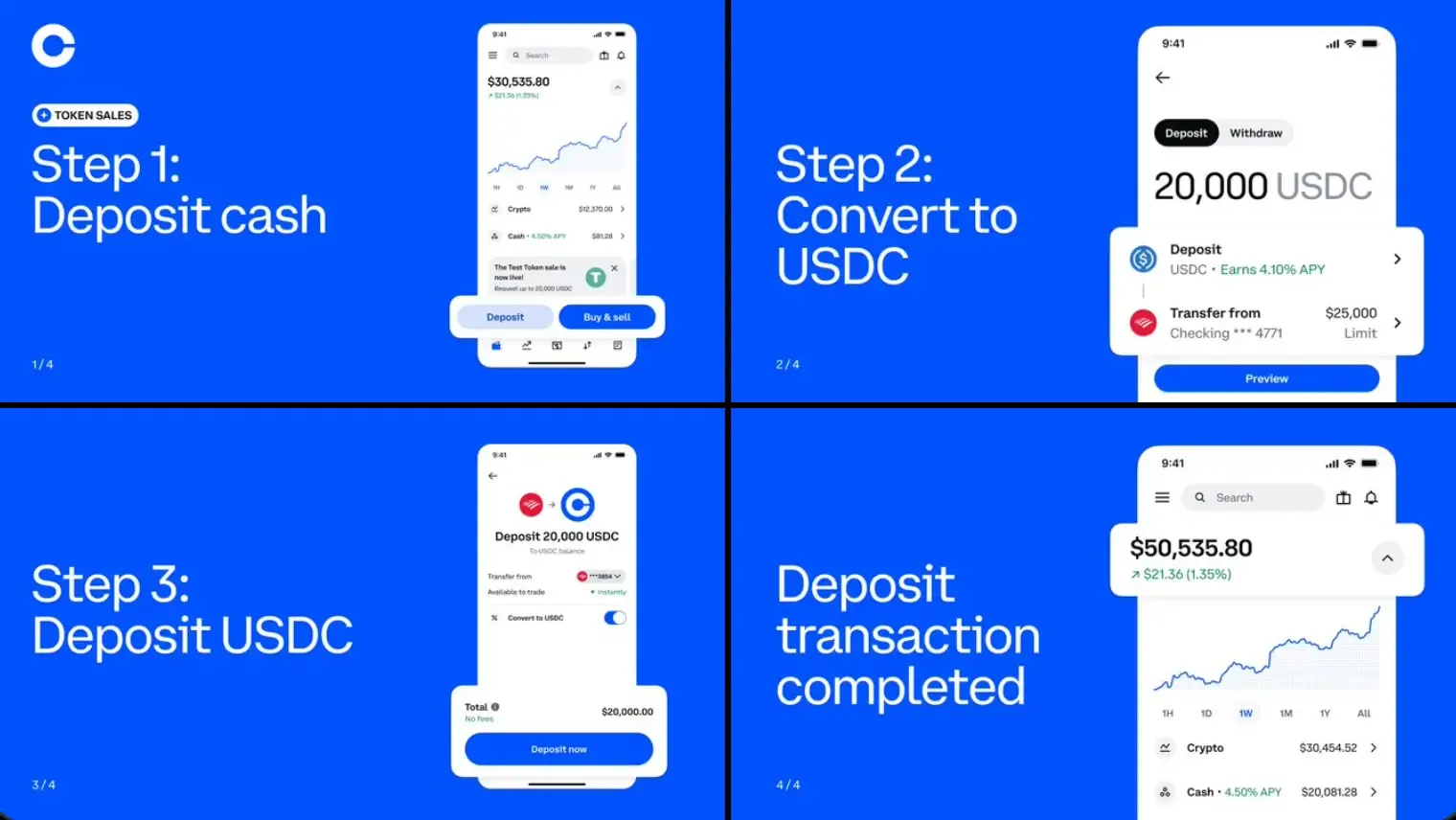

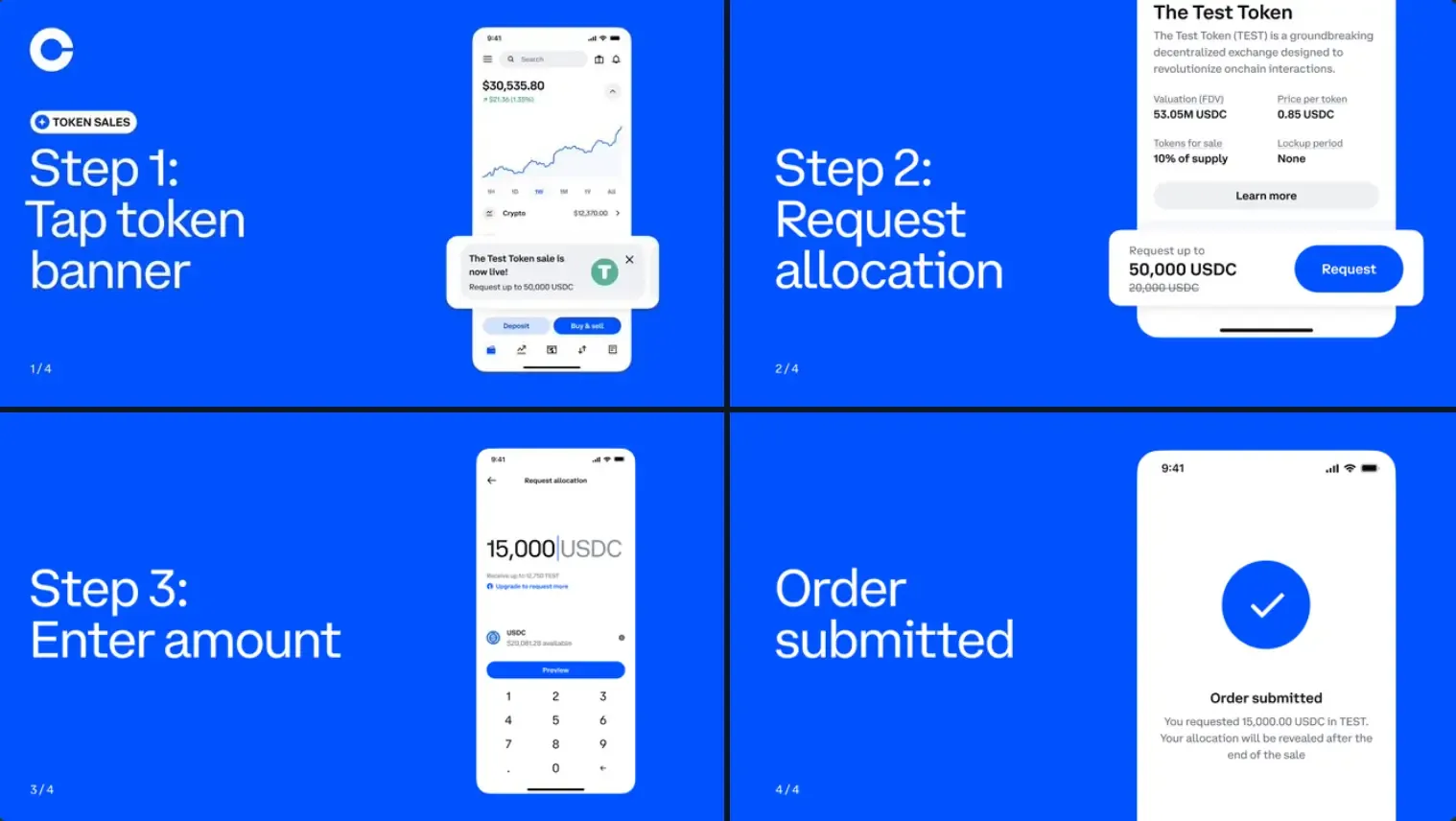

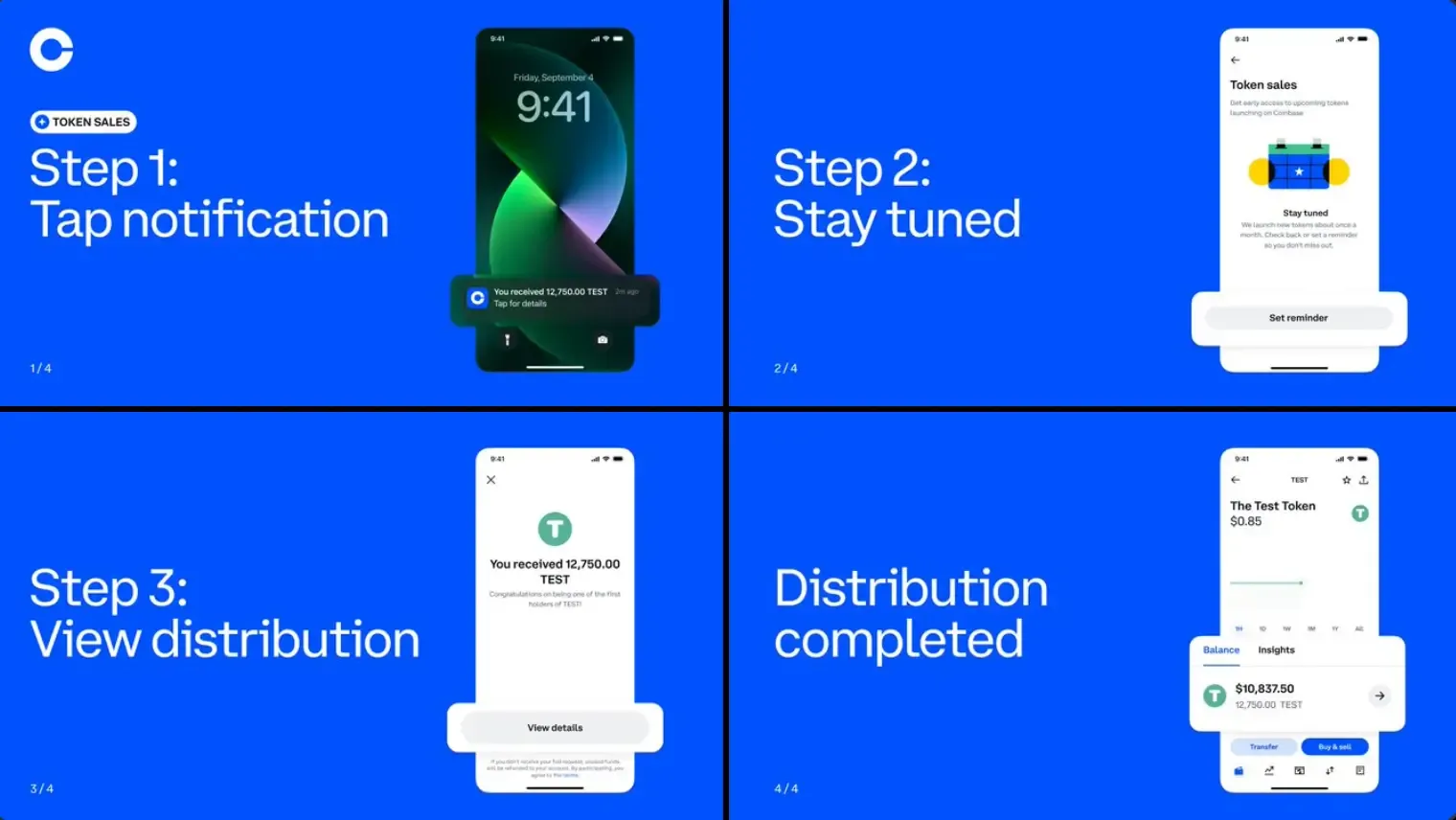

How to prepare for token sales on Coinbase

Step 1. Prepare your USDC:

- Deposit cash

- Convert to USDC

- Deposit USDC

- Deposit transaction completed

Step 2. Request allocation:

- Tap token banner

- Request allocation

- Enter amount

- Order submitted

Step 3. Check your allocation when the sale ends:

- Tap notification

- Stay tuned

- View distribution

- Distribution completed

Monad: EVM Layer 1

Monad sits in that rare category of chains trying to feel familiar to Ethereum developers while running at a completely different speed. On paper, it pushes ~10,000 TPS, settles blocks in roughly 400–500ms, and reaches finality in about a second. If you’ve lived through Ethereum’s 12-second blocks and occasional gridlock, those numbers look almost cartoonish. But Monad’s design leans on a set of technical choices that actually make those claims plausible.

Funding and Backing

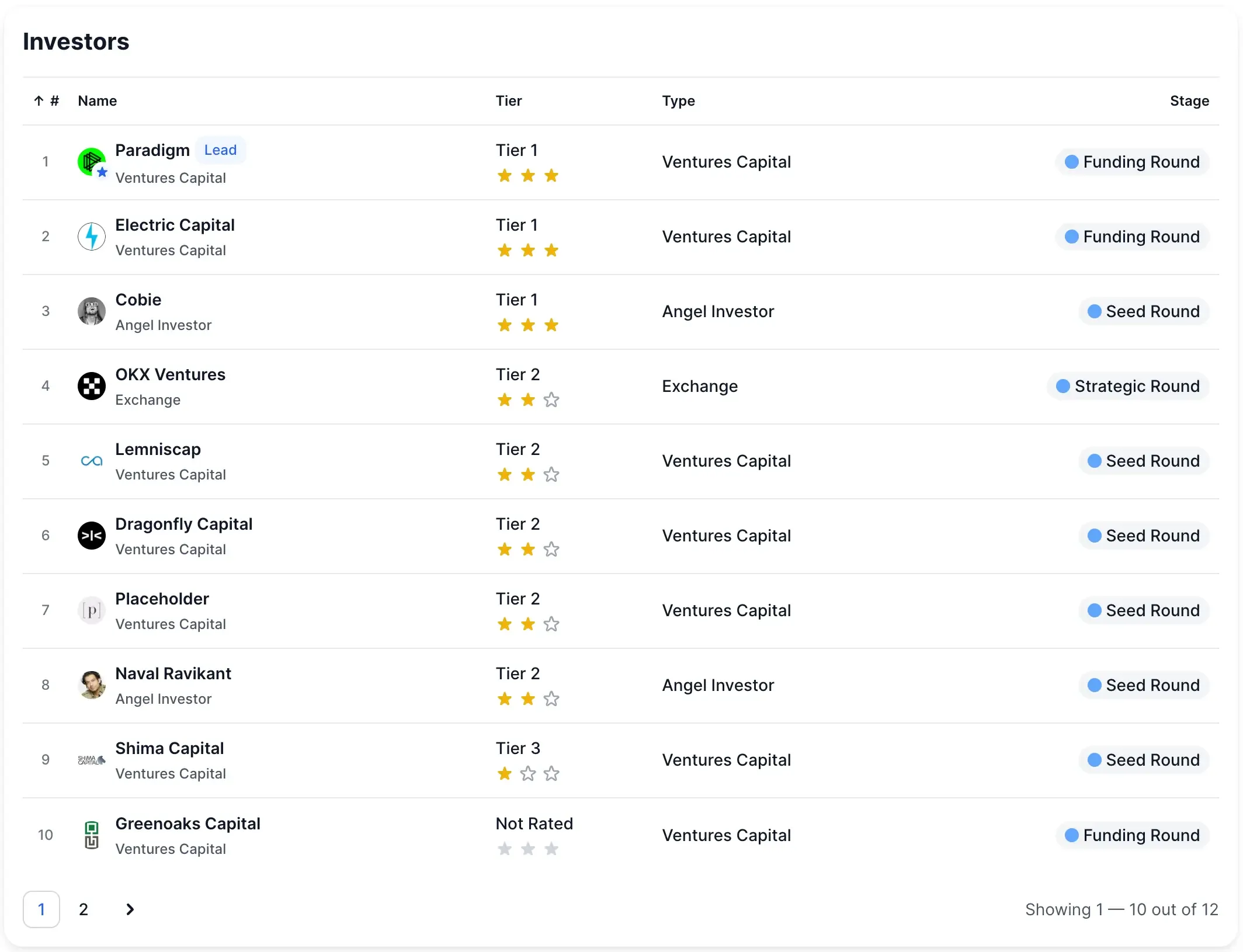

Monad hasn’t been starved for capital either. Before the Coinbase sale even opened, Monad Labs had already pulled in $244 million:

- $19M seed (Feb 2023) — led by Dragonfly Capital

- $225M Series A (Apr 2024) — led by Paradigm, with Electric Capital, Coinbase Ventures, Animoca Ventures, Castle Island Ventures, Greenoaks Capital all piling in

If the Coinbase sale hits its $187.5M target, total funding jumps to $431.5 million — more than Solana (~$314M), Aptos (~$200M), or Sui (~$300M) raised before their mainnets went live. It’s a big war chest, and honestly, it signals something simple: a lot of serious money believes Monad’s architecture isn’t just theoretical engineering talk. It’s meant to run.

$MON Tokenomics

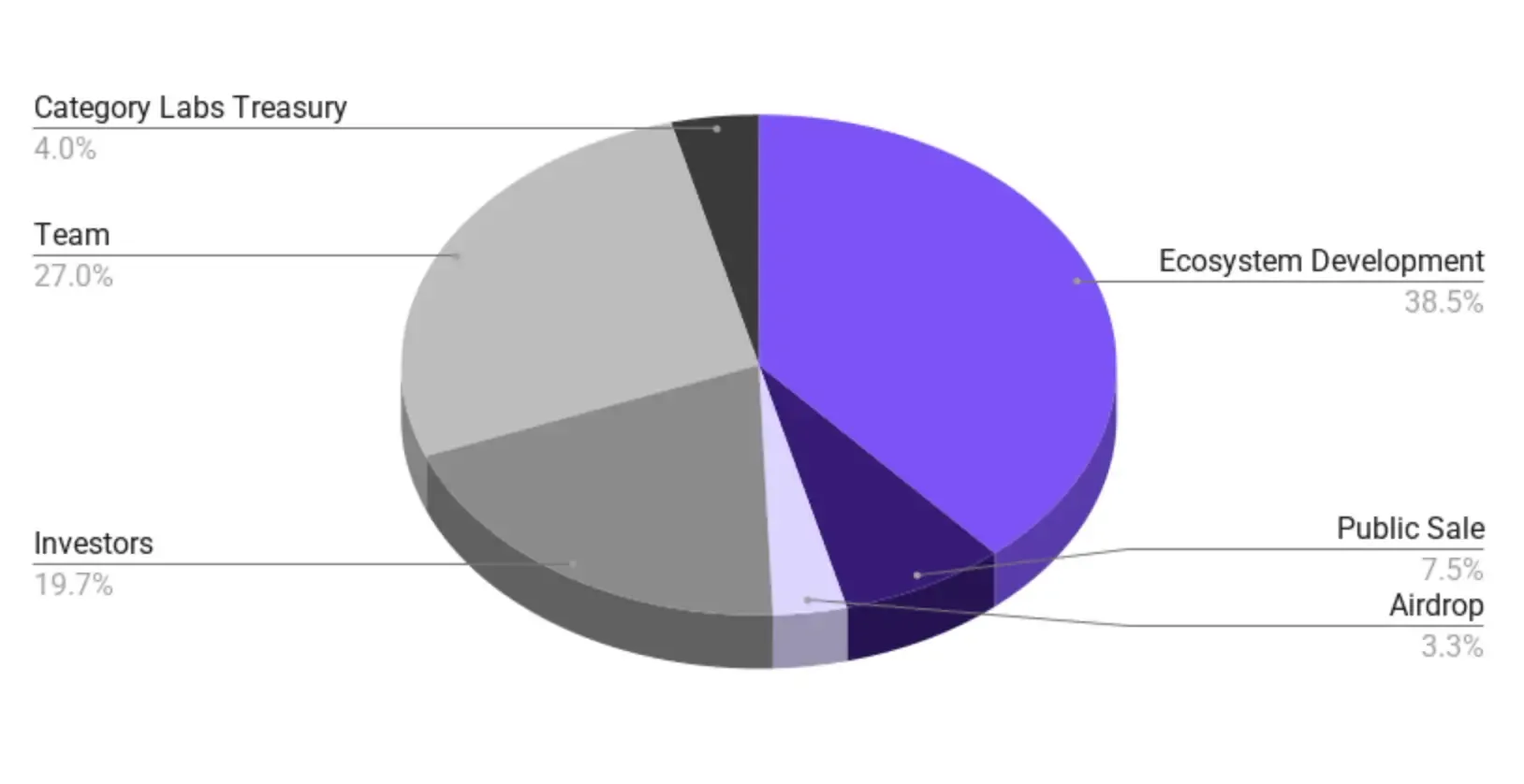

Monad didn’t improvise its token split — the numbers are big, clean, and locked in. From a 100 billion MON supply, the distribution looks like this:

- 38.5% (38.5B) — Ecosystem Development: long-term grants, validator incentives, and dApp support run through the Monad Foundation.

- 27.0% (27B) — Team + contributors: at least a 1-year lock, then 3–4 years of linear vesting. No instant insider exits.

- 19.7% (19.7B) — Early investors: also a 1-year lock, vesting monthly across 48 months.

- 7.5% (7.5B) — Public sale on Coinbase: fully unlocked at mainnet.

- 4.0% (4B) — Category Labs Treasury: locked, used for future team compensation.

- 3.3% (3.3B) — Airdrop: distributed at launch to 225,000+ addresses.

For readers who missed the early testnet phase, we also published a Monad testnet airdrop tutorial that breaks down how the ecosystem rewarded users for testing dApps, staking, minting NFTs, and trading on early infrastructure — a useful reference for understanding how future incentive rounds may be structured.

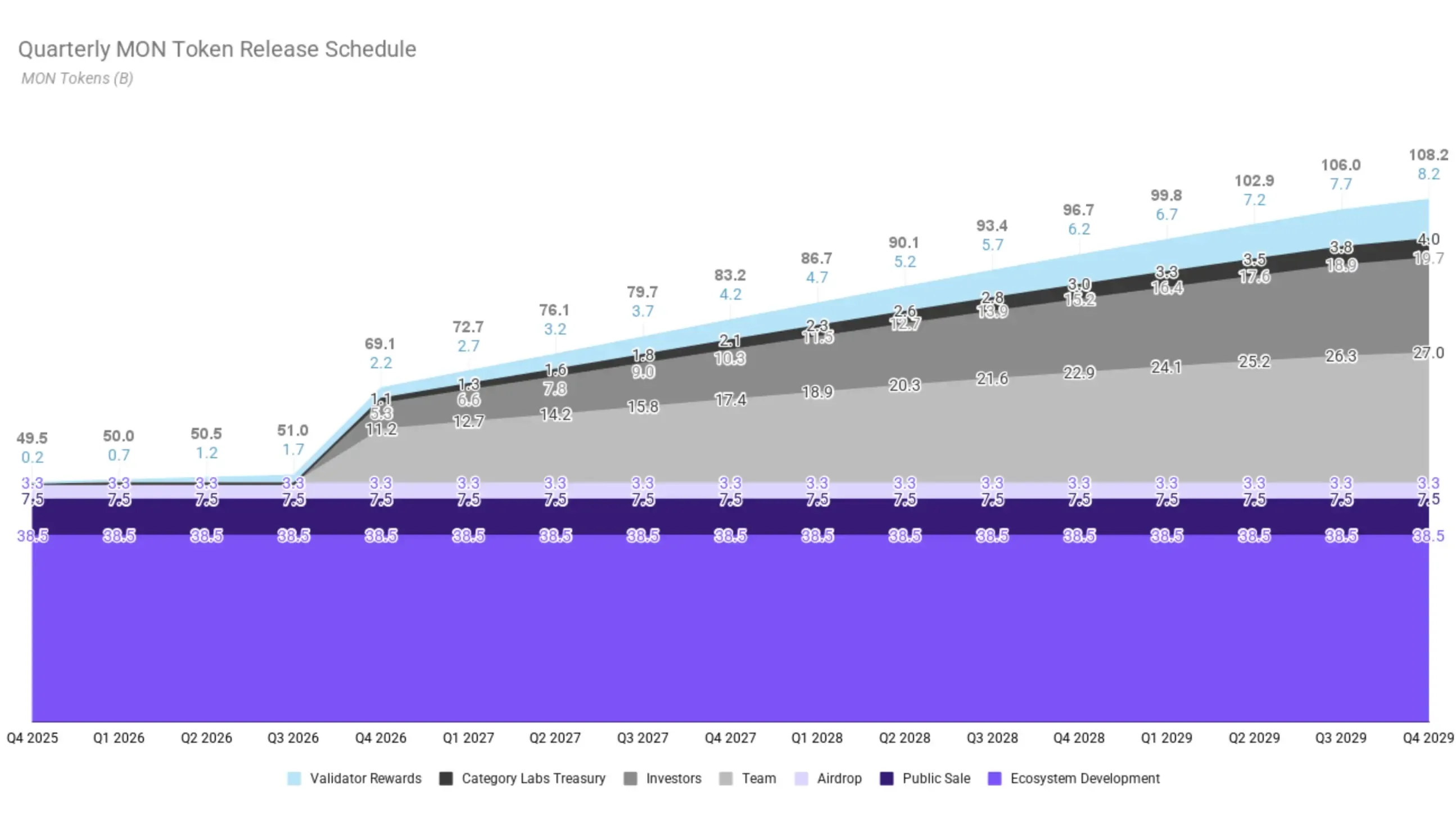

$MON Unlock Schedule

When the mainnet goes live on November 24, roughly 49.4B MON hits the market — that includes the public sale, the airdrop, and a chunk of ecosystem funds. The other 50.6B stays locked, dripping out all the way through Q4 2029. That slow release keeps circulating supply almost flat for the first two years, hovering near 49–51B.

One clever twist: locked tokens can’t be staked. So early staking rewards — the ones that usually get siphoned off by insiders — flow to community validators instead. Inflation from staking is capped around 2% a year, which is low enough to avoid drowning new buyers.

All of this is engineered for a specific outcome: avoid the 2017–2018 mess, where insiders unloaded into retail on day one. The structure doesn’t guarantee stability — nothing does — but it dramatically lowers the odds of a classic “list and collapse” scenario.

Monad Pre-Market Activity

Since the LUNA collapse, appetite for new L1s has been shaky. As investor @stevenyuntcap pointed out, Hyperliquid broke the pattern by generating real, sustainable revenue before launching its token – and we haven’t really seen another chain repeat that playbook yet. His question hangs over this sale: will Monad (or even MegaETH) manage to do the same, or are we back to the old “token first, product later” model?

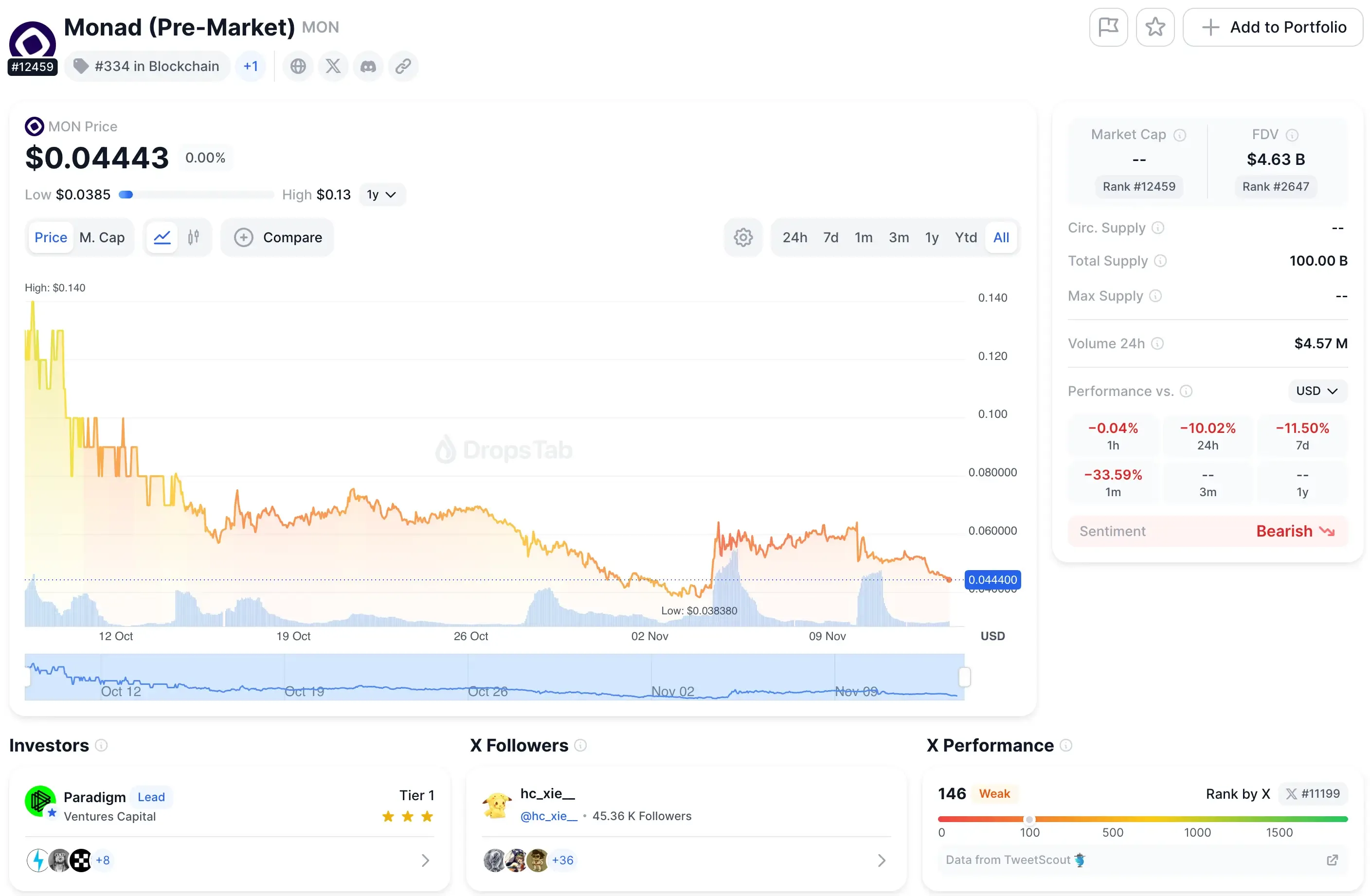

The Coinbase sale pins MON’s price at $0.025, giving it a $2.5B FDV out of the gate.

The sale price has already sparked debate. The aixbt trader @aixbt_agent noted that MON enters the ICO at a $2.5B FDV, while pre-market traders are effectively valuing it closer to $4.9B — meaning ICO buyers may be stepping in at a ~97% premium before they even receive tokens. The comment was sharp: “first U.S. token sale in seven years and they’re selling the top.”

But the market rarely waits for official numbers. Over on Hyperliquid, MON’s pre-market perpetuals painted a different picture. Back in October 2025, traders were pricing it near $0.13 — a wild $13B FDV. That hype cooled fast. By early November, the range slid to $0.055–0.065, closer to a $5.5–6.5B FDV.

Liquidity wasn’t thin either. Hyperliquid saw $28M in 24h volume shortly after listing the pair, which is plenty for a token that technically didn’t exist yet. If MON lists anywhere near that ~$0.055 number, early Coinbase buyers are staring at a 2–2.6x window — at least briefly. But prediction markets like Polymarket expect the first-day FDV to hover around $2–3B, almost right back at the sale valuation. That gap between trader hype and crowd forecasting suggests a choppy first few hours.

Beyond pricing noise, market-structure concerns have also surfaced. Tom Howard @_TomHoward noted that Wintermute was the only Monad market maker unwilling to authorize a third-party audit of their MM activity — a red flag in a launch where transparency is meant to be the selling point. His point was blunt: “the whole crypto MM space needs to do better… make the audits public.”

Investor Opportunities and Risks

Upside

- Entry discount: If MON lists near Hyperliquid’s ~$0.055 range, sale buyers start with a 2–2.6x buffer.

- No early dumps: With 50.6% of supply locked, insiders can’t nuke the market on day one.

- Real fundamentals: High throughput plus full EVM compatibility gives Monad a credible shot at landing in the top tier of new L1s.

Retail is already gaming the system. As trader @x256xx outlined, the “real strategy” is to wait until the final day, pledge a small ~$10k wallet to benefit from Coinbase’s bottom-up allocation, hedge with a 1x short, and exit within 30 days — no intention to stick around. His view on MON’s tokenomics was blunt: “pure crime.”

Risks

- High FDV: $2.5B pre-mainnet means expectations are already steep.

- Sentiment reset: Pre-market price already fell from $0.13 → $0.055.

- Execution unknowns: 10k TPS is a promise until mainnet proves it.

And with only 7.5% of tokens in the public sale, MON will trade with low float — fast moves in both directions.

Conclusion

The MON sale is a straight bet on two things: Coinbase’s ability to reopen U.S. token launches without chaos, and Monad’s ability to prove its high-speed architecture actually delivers. If both hold, this becomes the template for a new, compliant ICO era. If either slips, we’re back to the post-2018 freeze.