Alpha

Stable’s $500M Pre-Deposit Campaign

After a chaotic first phase that raised $825M in 22 minutes, Stable returns with a $500M Phase-2 campaign on Hourglass — enforcing KYC, wallet caps, and anti-bot rules to rebuild trust.

Quick Overview

- Phase-2 targets $500M in USDC deposits via Hourglass, converting to USDT on Stable.

- Mandatory KYC and one-wallet-per-user limit block multi-wallet exploits.

- $1K–$100K first-hour cap protects retail before big treasuries move in.

- Phase-2 fixes Phase-1’s insider imbalance that eroded community trust.

- Depositors bet on Stable becoming the core USDT settlement layer.

Campaign Mechanics

Phase 2 of Stable’s pre-deposit went live on Hourglass at 2 PM UTC, November 6 (10 PM UTC+8). Participants deposit USDC on Ethereum, which is instantly converted into USDT native to Stable’s L1. That conversion isn’t cosmetic—it’s the engine that seeds Stable’s internal dollar economy, transforming external liquidity into the chain’s own working capital.

The total campaign cap sits at $500 million in eligible deposits, but there’s no on-chain hard stop; only the first $500 million count toward official allocation. To join, users must sign the Terms of Service before depositing and complete KYC verification by November 8, 2 PM UTC. Only one wallet per verified user is accepted, and bot or Etherscan deposits are automatically excluded.

Deposit Structure

- Minimum deposit: $1,000 per user

- First hour (14:00–15:00 UTC): $1,000 – $100,000 cap per wallet

- After the first hour: up to $20 million per verified user

- Deposit asset: USDC (Ethereum)

- Withdrawal asset: USDT0 on Stable

The structure gives retail users a real shot in the opening hour before larger funds move in. From there, the pool scales to accommodate institutional treasuries looking for long-term exposure.

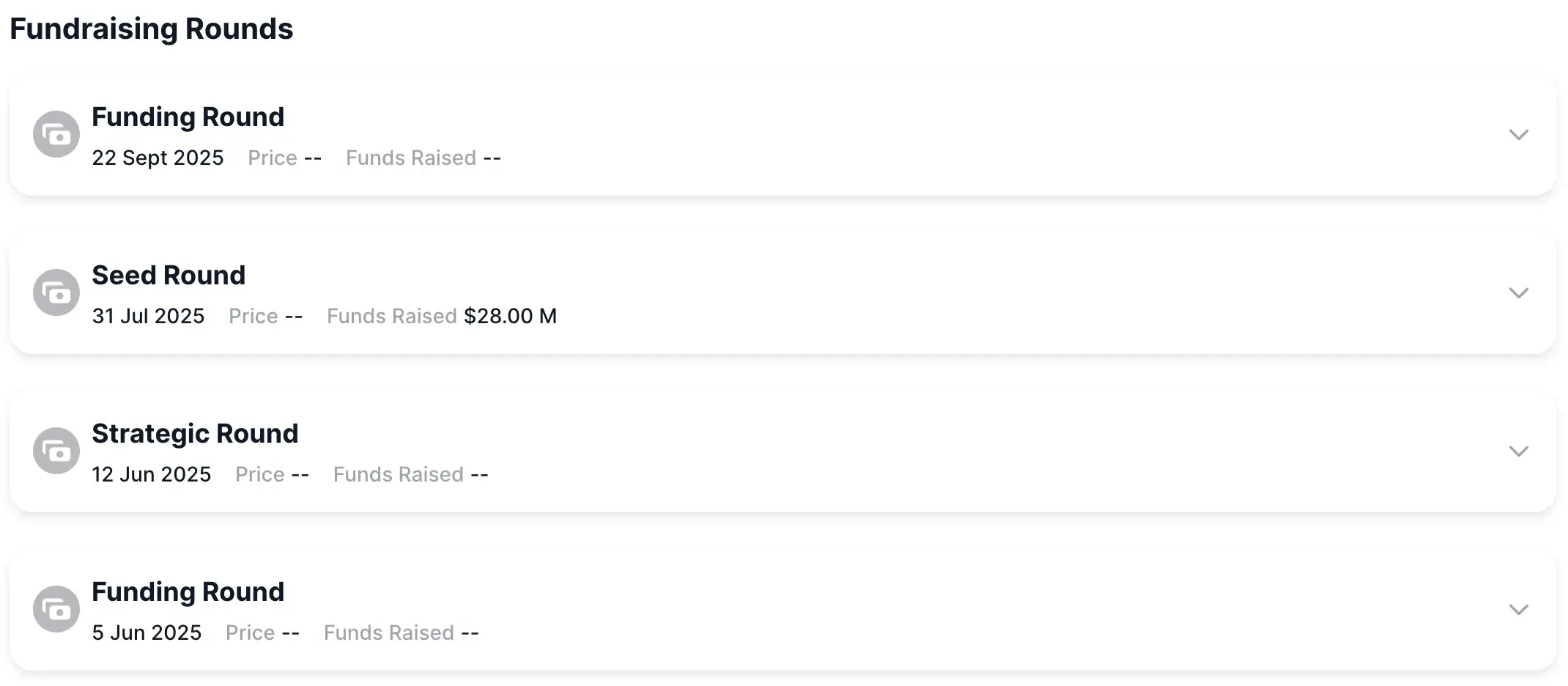

Phase 1 Controversy

Phase 1 looked like a success on paper — $825 million filled in twenty-two minutes — but the on-chain data told a different story. Roughly 70 percent of deposits landed before the public announcement, and just 274 wallets joined the sale.

One address alone supplied over 60 percent of the total, allegedly tied to a Bitfinex-connected entity that pledged 300 000 ETH to borrow $500 million USDT for the event.

On-chain data later shared by researcher @EmberCN showed this same address borrowing roughly 500 million USDT against 300 000 ETH on Aave, then redirecting funds from Plasma to Stable’s pre-deposit — a pattern that reinforced accusations of insider-linked whale activity.

It felt less like an open campaign and more like a pre-wired liquidity transfer.

Retail users were furious. Many said they never even saw the window open. X threads and Discord logs turned toxic within hours — screenshots, hash traces, conspiracy graphs. Whether or not insider coordination actually happened, the optics were brutal. Trust took a hit.

How Phase 2 Tries to Fix It

Stable came back with a list of guardrails:

- Per-wallet limits — $1 k – $100 k in the first hour, then capped at $20 million. No one can drain the pool solo.

- Mandatory KYC — verify identity or lose eligibility. The sybil farms that gamed Phase 1 are effectively shut out.

- One wallet per user — no network of look-alike wallets feeding the same owner.

Together, these rules rebuild a sense of fairness — at least on paper. Still, some critics point out what’s missing: there’s no blind-bidding phase, no randomized queue, nothing to guarantee everyone starts at the same second. In crypto, information always leaks somewhere… and that shadow of early-access advantage hasn’t disappeared yet.

Compliance and Risk Landscape

Stable’s decision to enforce mandatory KYC isn’t a small tweak — it’s a philosophical shift. Every wallet must be tied to a verified identity. That makes Stable immediately compatible with frameworks like the EU’s MiCA and the U.S. GENIUS Act — both designed to bring stablecoin payments under regulated oversight.

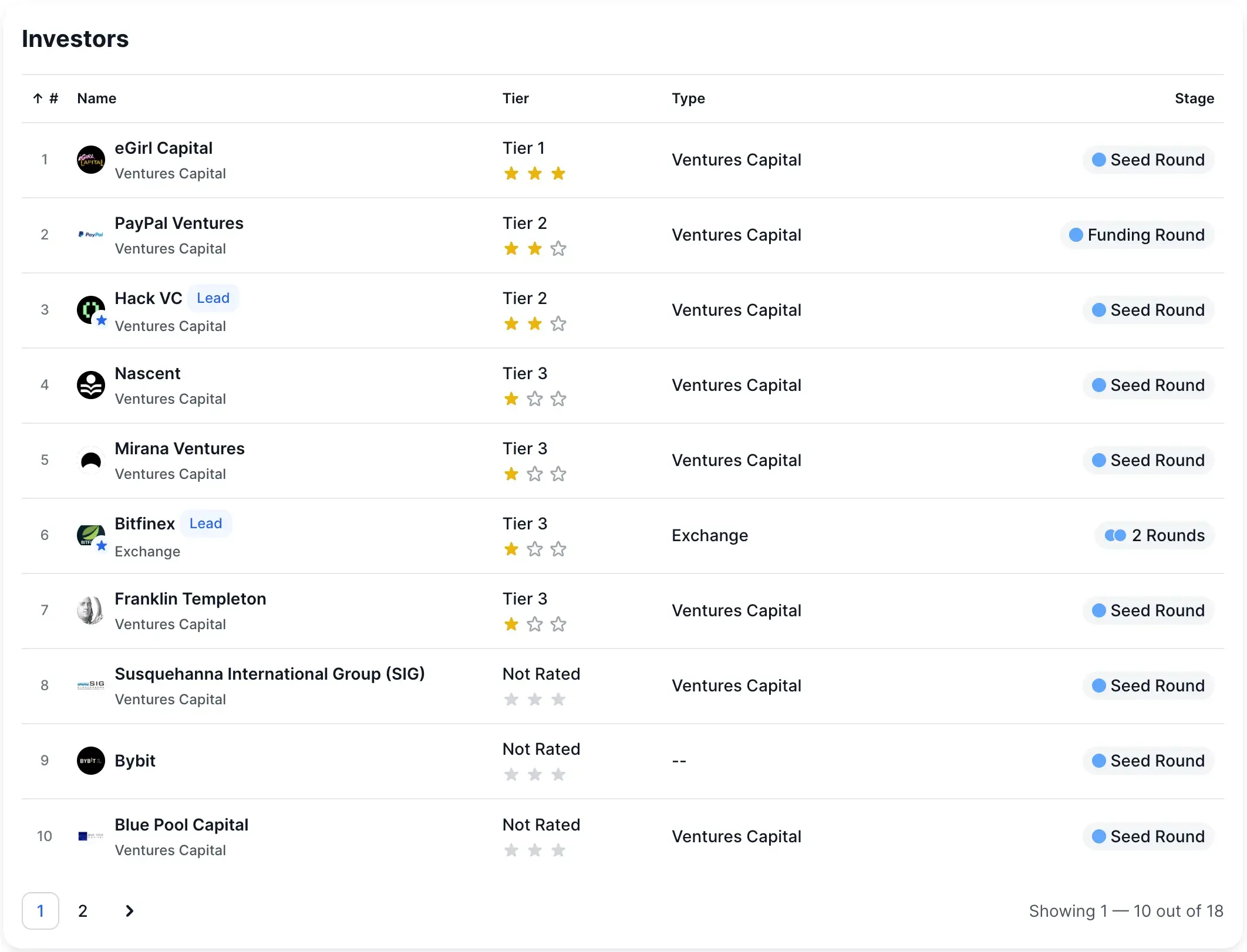

Adding to its institutional credibility, PayPal Ventures disclosed an investment in Stable on September 22, 2025, with plans to integrate PYUSD into Stable’s ecosystem via LayerZero for omnichain interoperability. The move positions Stable as a potential settlement hub for both USDT and PYUSD, aligning tightly with PayPal’s cross-border payment ambitions.

It’s part of the same trend pulling traditional finance on-chain — from regulated stablecoins to tokenized stocks, which turn real shares into blockchain assets that trade 24/7 with instant settlement and fractional ownership.

The upside? Serious capital can finally play without compliance fear. The downside? Many privacy-minded users won’t even try. And because the KYC provider and jurisdiction list remain undisclosed, some participants could find out mid-deposit that they’re simply not allowed. That kind of uncertainty has already spooked a few early sign-ups.

Bot Exclusion and Redemption Friction

The one-wallet-per-user rule does more than block sybils — it effectively kills the bot swarms and pseudo-institutional treasury networks that gamed Phase 1. It’s a clever filter disguised as compliance.

But there’s a trade-off. During the campaign, deposits of USDC (Ethereum) convert 1:1 into USDT on Stable, locking in nominal value. Getting back out isn’t instant. To withdraw, users will later need to re-convert through Stable’s own infrastructure, which may add delay, cost, or gas overhead.

So yes, KYC brings legitimacy — but it also adds friction.

Market Participation

From the structure alone, Phase 2 screams “institutional.” KYC walls, wallet limits, and a $500 M cap aren’t crowd-pleasing decisions; they’re compliance cues. Stable clearly built this round for funds and treasury desks that need legal clarity before moving size.

Its choice of Hourglass as host—known for tokenizing time-bound or semi-fungible assets—wasn’t random either. It frames deposits more like vault commitments than speculative punts. There’s talk of duration-based incentives under the hood, but for now, details stay locked behind NDAs.

The reduced cap—from $825 M to $500 M—might look like caution, yet it also signals calibration. Less chaos, cleaner distribution, fewer accusations. After the Phase 1 backlash, Stable seems intent on showing control over frenzy.

Reading the Early Metrics

If history repeats, the math’s easy: $825 M in 22 minutes translates to roughly $37 M per minute. Apply that to Phase 2’s $500 M ceiling and the theoretical fill time drops to about 13 minutes. But this round isn’t frictionless. KYC gates and first-hour limits will slow the pace, giving retail users a shot—at least briefly—before institutions max out the $20 M slots.

The interesting test isn’t speed; it’s composition. Who fills it? If retail manages to claim a meaningful slice before the big treasuries move in, Stable can prove its fairness revamp worked. If not, even perfect compliance won’t fix the optics.

Liquidity Implications for the Stablecoin Market

If Phase 2 reaches its $500 million cap, it will seed Stable’s entire dollar economy in one sweep. The deposits don’t just sit idle—they fuel gas reserves, DEX pools, and lending protocols. The USDC → USDT conversion keeps the broader market neutral yet expands USDT’s footprint, moving capital into a faster, cheaper domain without minting or burning new supply.

Just days before the campaign opened, Stable announced its Public Testnet launch on November 4, 2025 — giving developers access to deploy and test on the USDT-native chain.

@Stable framed it as the start of a “new era of payments,” signaling that the pre-deposit drive wasn’t just about liquidity, but about priming builders for mainnet.

That mechanism also solves the cold-start problem every new chain faces. By offering future airdrop eligibility instead of yield, Stable turns idle funds into patient liquidity and buys time to build real utility. Still, the wager cuts both ways: if the team ships its token and mainnet on schedule, early participants win. If timelines slip or rewards disappoint, those deposits become expensive waiting positions. With $28 million in seed backing from Bitfinex, Hack VC, and others, Stable has the runway—it just needs to prove that this $500 million isn’t hype capital but the foundation of a lasting USDT network.

Conclusion

Stable’s $500 million Phase-2 pre-deposit feels less like a rerun and more like a redemption arc. After the Phase-1 fiasco, the team rebuilt the system around fairness and structure — hard wallet caps, mandatory KYC, and one-wallet-per-user rules meant to prove the network can handle institutional volume without turning into another insider playground.

But this isn’t a quick-flip opportunity. Success depends on KYC throughput, transparent jurisdictional rules, and delivery of tokenomics and mainnet milestones on schedule. Until then, every depositor is effectively betting that Stable will mature into the settlement layer for global USDT payments — the chain where the dollar finally moves as easily as data.

It’s not yield farming. It’s infrastructure building. And that’s a longer game — but one worth watching closely.