Alpha

Tokenized Stocks Are Bringing Wall Street to the Blockchain

Tokenized stocks are digital versions of real shares, backed 1:1 and powered by smart contracts. They offer 24/7 trading, lower fees, and fractional ownership — all on-chain, without intermediaries.

⚡TL;DR

- Tokenized stocks are on-chain representations of real shares, backed 1:1

- Enable 24/7 trading, instant settlement, and fractional ownership

- Remove intermediaries using smart contracts and blockchain

- Popular platforms include xStocks on Solana, traded via Kraken and Bybit

- Benefits: global access, low fees, transparency, and enhanced liquidity

- Drawbacks: regulatory uncertainty, limited shareholder rights, tech risks

- Market is small ($350M+) but projected to grow into the trillions

- Tokenized stocks are bridging crypto and traditional finance

What are Tokenized Stocks

Tokenized stocks are, in essence, ordinary company shares represented digitally on-chain. Put simply, imagine turning a paper share into a “token.” Each token is strictly linked to a real share and is 1-to-1 asset-backed.

In other words, every token stands behind an actual company share. Holders of tokenized stocks obtain the same rights as shareholders—for example, participation in company profits through dividends—while every obligation (buying, selling, dividend accounting) is enforced by smart contracts on the blockchain.

This setup removes intermediaries (banks and clearinghouses) completely, making settlement faster and more transparent.

History of Tokenized Stocks

The idea of “tokenizing” securities had been circulating for a long time, but the first real products appeared only in the late 2010s. Among the earliest platforms were Estonia’s DX.Exchange and Belarus’s Currency.com. In 2019, DX.Exchange began selling security tokens for NASDAQ-listed shares, while Currency.com launched tokens tied to U.S. stocks as well as gold, oil, gas, and even Belarusian government bonds.

Over time, major crypto-industry players picked up the idea. In 2021–2022, crypto exchanges and blockchain companies became interested in stock tokenization. For instance, the well-known exchanges Kraken and Bybit introduced the xStocks project in 2023—a set of tokenized U.S. equities on the Solana blockchain.

In 2025, other exchanges followed suit: the crypto exchange Gemini began trading stock tokens (the first was MicroStrategy) for European users, and Coinbase announced tokenized shares of its own company on the Ethereum L2 network (Base). Thus, within a few years, tokenized stocks evolved from an experimental concept into a real market involving prominent players.

Key Features and Operating Principles

Asset Backing (Collateral)

Every tokenized stock is collateralized by a real company share. This means that real securities back the tokens: an exchange of a token for the underlying share can be formally provided for in the issuance terms. Moreover, the holder’s rights (e.g., to dividends) are written into a smart contract that automatically fulfills those obligations. This digital format simplifies record-keeping and protects against forgery.

Smart Contracts and Automation

Transactions with tokenized stocks are processed by smart contracts—special programs on the blockchain. This means that when buying, selling, or paying dividends, all conditions are checked and executed automatically without third-party involvement. Streamlined automation reduces errors and speeds up settlement.

Fractionalization

A token allows an equity share to be divided into parts. Even if a stock costs, say, $1 000, an investor can buy just a fraction—for example, for $10 or even $1. Fractionalization lowers the investment threshold: now a beginner can own a slice of Tesla or Apple.

24/7 Trading and Settlement Speed

Unlike the classical stock market, tokenized stocks can be traded without exchange hours. For example, the xStocks platform on Kraken offers trading almost 24/5 (weekdays) and promises a full 24/7 mode. Settlement is near-instant—liquidity and clearing are handled by the blockchain, accelerating execution.

Advantages of Tokenized Stocks

Broader Investor Access

Thanks to fractionalization and a low entry barrier, anyone can buy a slice of a blue-chip share. There is no need to accumulate a large sum for a single security—just a few dollars is enough. This opens the door for small investors and young people eager to try the stock market.

Enhanced Liquidity and Flexibility

Tokenization boosts the liquidity of shares, even those previously in low demand. Trading is possible 24/7 (or almost without breaks), and every action is instantly recorded on-chain. Other instruments (e.g., private shares) also become more attractive: their portions can now be resold quickly. In effect, tokens help invigorate the traditional securities market.

Lower Costs

Blockchain removes many intermediaries (banking and clearing agents), so fees are often significantly lower. Compared with an IPO or broker-mediated exchange trading, issuance and registration costs for tokens are smaller, and a smart contract automatically monitors compliance.

Transparency and Security

All transactions with tokenized stocks are written to a blockchain that is open for audit. Regulators and market participants can therefore see the ownership history and executed trades. This immutable record reduces fraud risk. In addition, the blockchain’s cryptographic protection makes token forgery difficult.

Global Reach

Tokens trade on crypto exchanges and platforms worldwide, eliminating geographic barriers: an investor in Asia can easily buy a tokenized U.S. share without the complex process of registering on a foreign exchange. As a result, the market widens, and companies potentially gain access to investors from many countries.

Disadvantages of Tokenized Stocks

Regulatory Uncertainty

In many jurisdictions, the legal status of tokenized stocks is still unclear. Authorities are trying to classify them either as ordinary shares or as new instruments. Exchanges and platforms therefore need special licenses, and token availability can be restricted. For example, xStocks on Kraken is officially accessible only to non-U.S. residents; American investors are prohibited from buying them. Much will depend on how governments regulate digital securities in the future.

Trust and compliance frameworks remain critical—especially after recent missteps in broader token-based finance. One notable recovery effort is Stable’s $500M Phase-2 pre-deposit campaign on Hourglass, which enforces strict KYC and wallet caps to correct the insider imbalance that eroded trust in its first phase.

Limited Shareholder Rights

A token usually delivers only price exposure to the real share and does not always confer the full bundle of shareholder rights. Even after buying a tokenized stock, you may formally receive no voting rights or full economic benefits that an original‐share holder would get (all dividends might be reinvested into additional tokens instead of being paid out in cash). For now, blockchain tools cannot always provide comprehensive investor protection.

Technological and Operational Risks

Blockchain systems are not immune to disruptions: during network congestion, transactions can be delayed or become more expensive due to high fees. Smart-contract vulnerabilities or attacks (e.g., oracle manipulation) also pose risks. Moreover, storing tokens requires basic crypto-tech knowledge (wallets, private keys), adding complexity for retail investors.

The xStocks Ecosystem

One of the best-known and most popular stock-tokenization projects is xStocks (by Backed Finance). These are tokenized versions of U.S. stocks and ETFs. Every xStock is an SPL token on Solana, backed by one share or fund unit. Launched officially on 30 June 2025, the project offered users more than 50 financial instruments, including well-known companies such as Apple, Tesla, Amazon, Netflix, and Microsoft. xStocks thus provide exposure to traditional equities through a crypto environment.

"With xStocks, we're not launching a novelty. We're unlocking something foundational," said Arjun Sethi, Kraken's co-CEO. "For the first time, people all over the world can own and use a share of a tokenized stock like they would use money. You can move it, hold it, spend it, or borrow against it. All from your wallet, with no intermediaries, no borders, and no delays.

xStocks trade on Kraken and Bybit, as well as on decentralized exchanges like Jupiter and Raydium. Anyone can buy tokens with a minimum investment of $1—i.e., even a tiny slice of a share. When buying for dollars (USD) or their digital analogue (USD Coin) on Kraken, the fee is zero. Trading runs 24/5 (round-the-clock on weekdays), and a full 24/7 mode is promised.

Striking examples of xStocks tokenized shares include tech and consumer-sector giants: Coinbase (COINx), Nvidia (NVDAx), Apple (AAPLx), Tesla (TSLAx), SP500 (SPYx), Circle (CRCLx), and others.

These companies are available because of their popularity and liquidity, making the tokens more attractive. You can find the full list on the official website xStocks.

"xStocks represent a monumental leap forward in democratizing access to financial markets," said Adam Levi, co-founder of Backed. "By bringing familiar assets onto the blockchain with unprecedented accessibility, we are not just bridging traditional finance and DeFi; we are building the foundational blocks for a truly open, efficient, and inclusive global financial system where everyone can participate in wealth creation."

In the future, the project team promises to integrate its tokenized stocks into lending protocols (Kamino) and to provide support on the Byreal platform.

How to Buy Tokenized Stocks (xStocks)

There are two ways to purchase xStocks tokenized shares: centralized (e.g., through Bybit) and decentralized (e.g., via the Jupiter aggregator). Let’s look at both options.

Buying Nvidia tokenized shares via Bybit

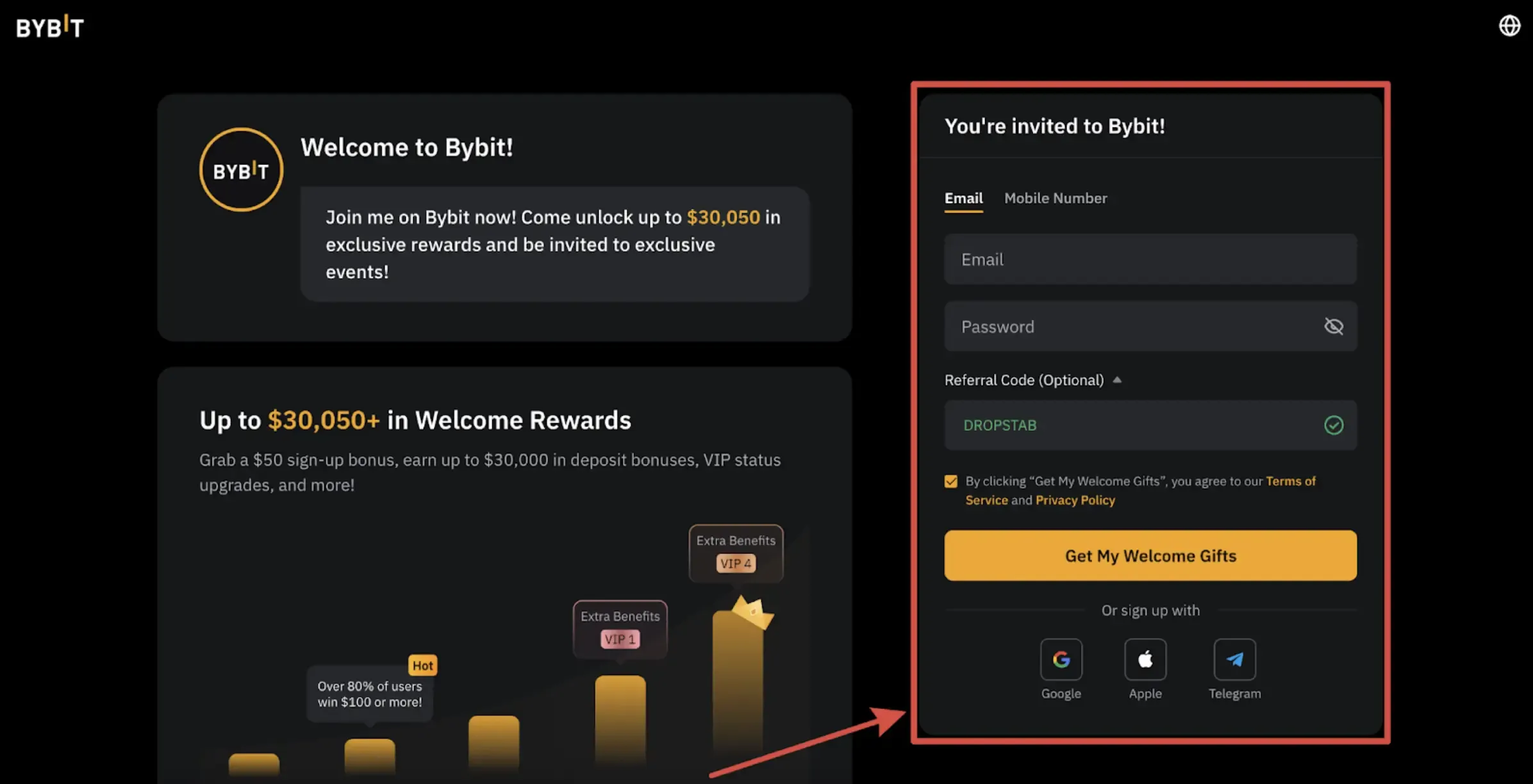

1. Go to the Bybit exchange website.

2. Register or log in to your account (KYC verification on the account is mandatory).

3. Top up your exchange balance with USDT using your bank card.

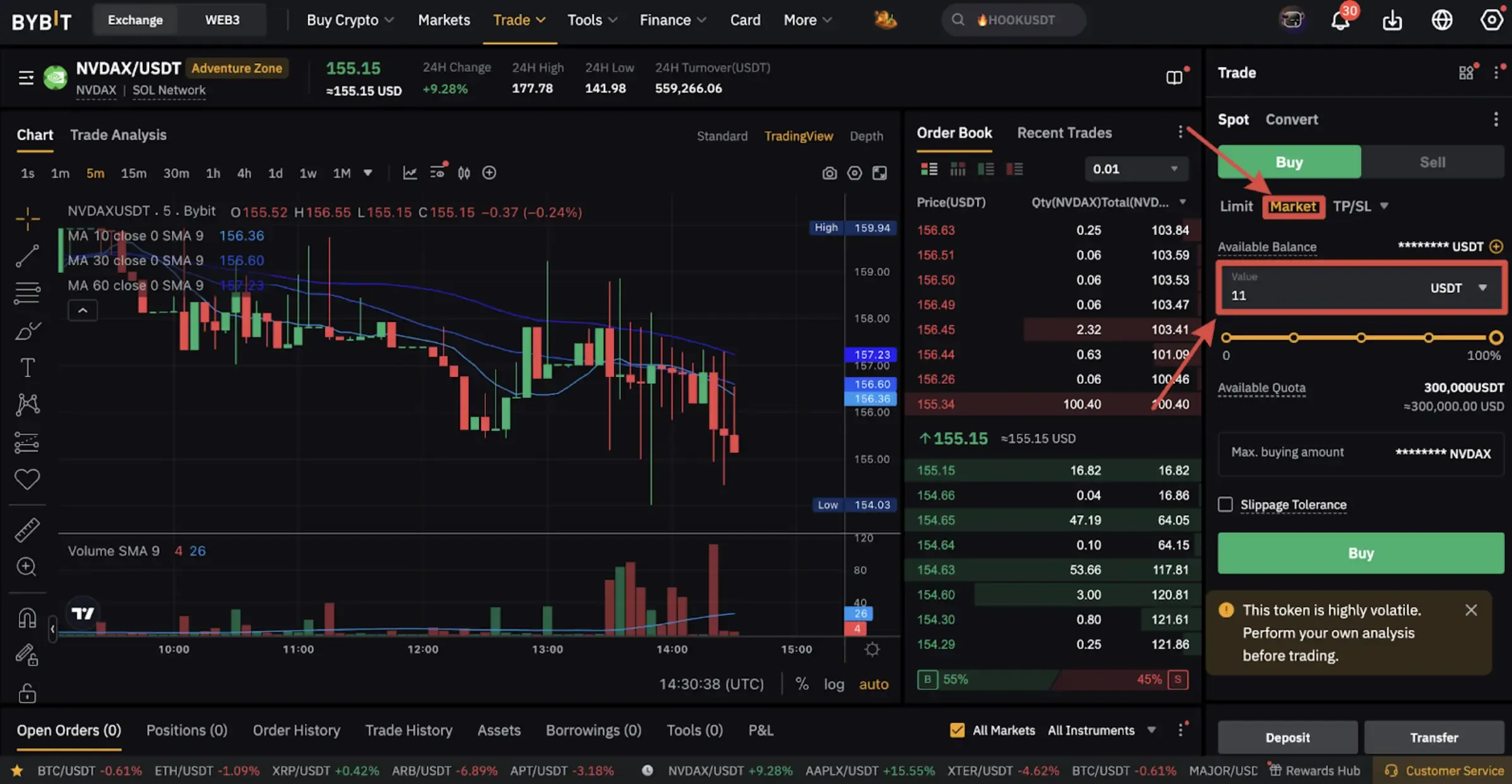

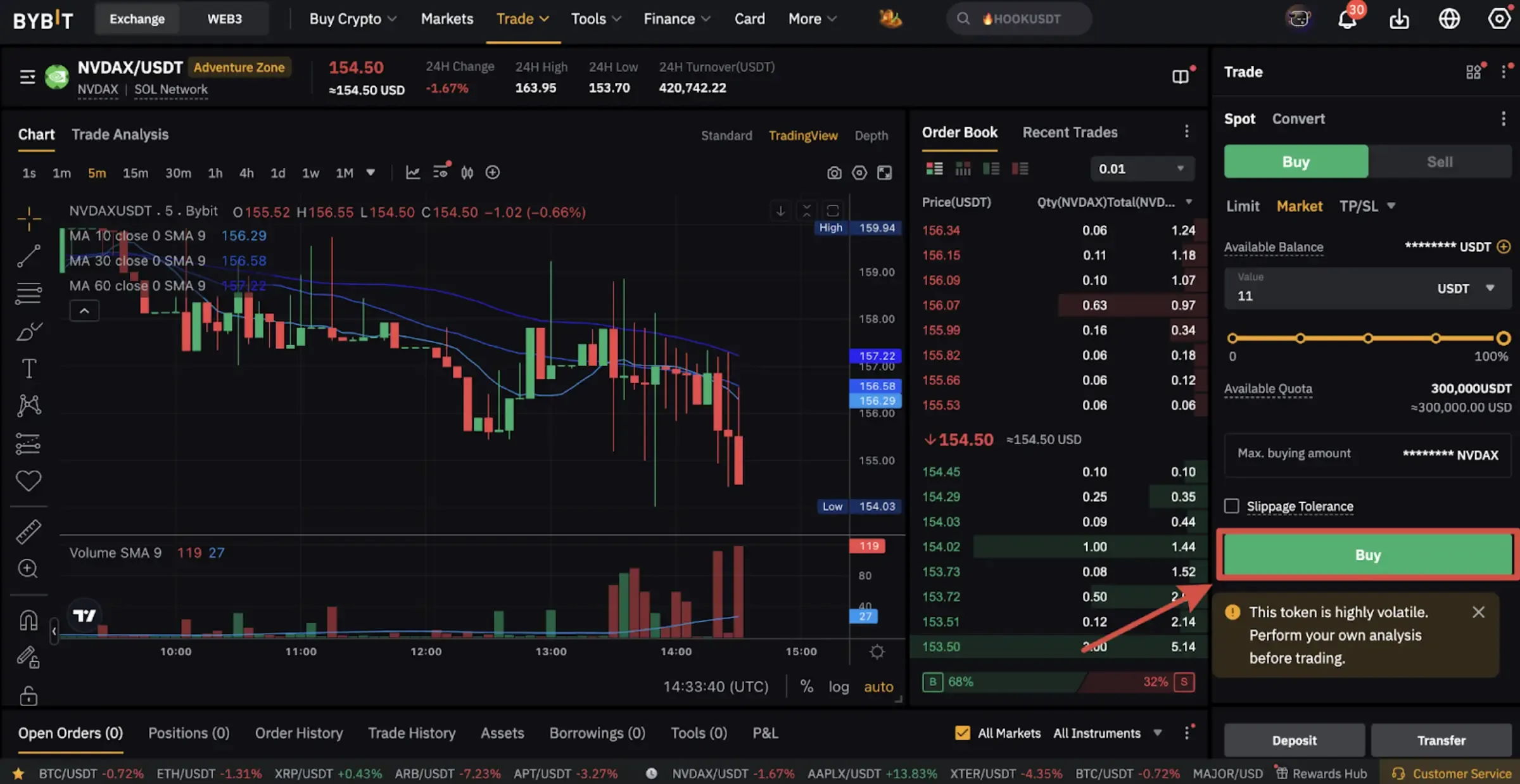

4. Select the desired token from the list of tradable assets - https://xstocks.com/products. We will buy Nvidia tokenized shares — NVDAx.

5. On the trading panel, choose a market buy and specify the amount of USDT you want to spend on the shares.

6. Click the buy button to execute the trade.

7. Done! You can track your balance status in your profile.

Buying Apple tokenized shares via decentralized wallet

1. First you need any Solana wallet, e.g., Phantom or Backpack.

2. After installing the extension, create a wallet or import your existing one by following the on-screen instructions.

3. Once you have a wallet, top it up with SOL, which is used to pay network fees and will also be needed to buy tokenized stocks. You can fund the wallet by simply withdrawing SOL from any centralized exchange such as Bybit.

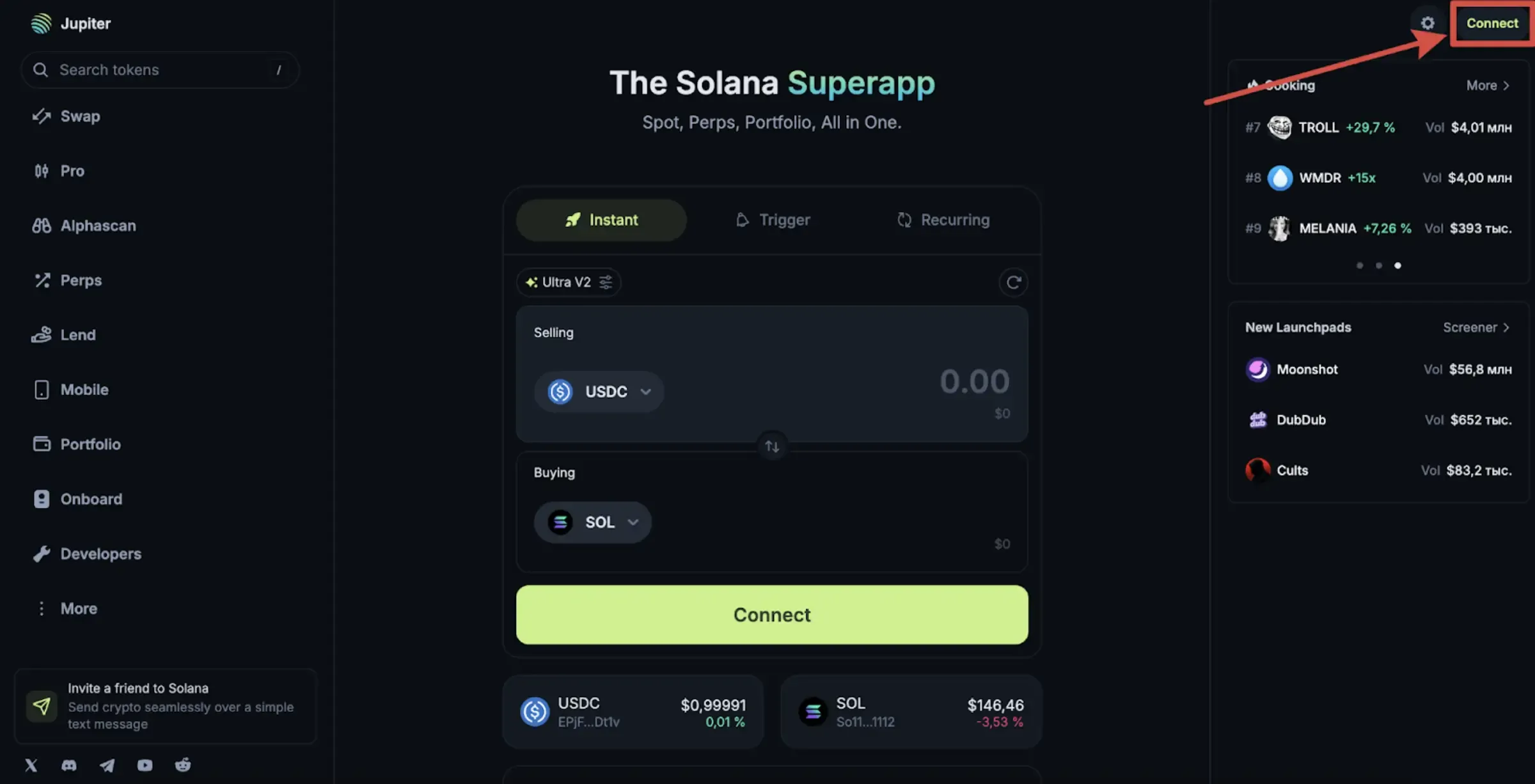

4. After funding the wallet, go to the Jupiter aggregator website.

5. Connect your Solana wallet to the platform.

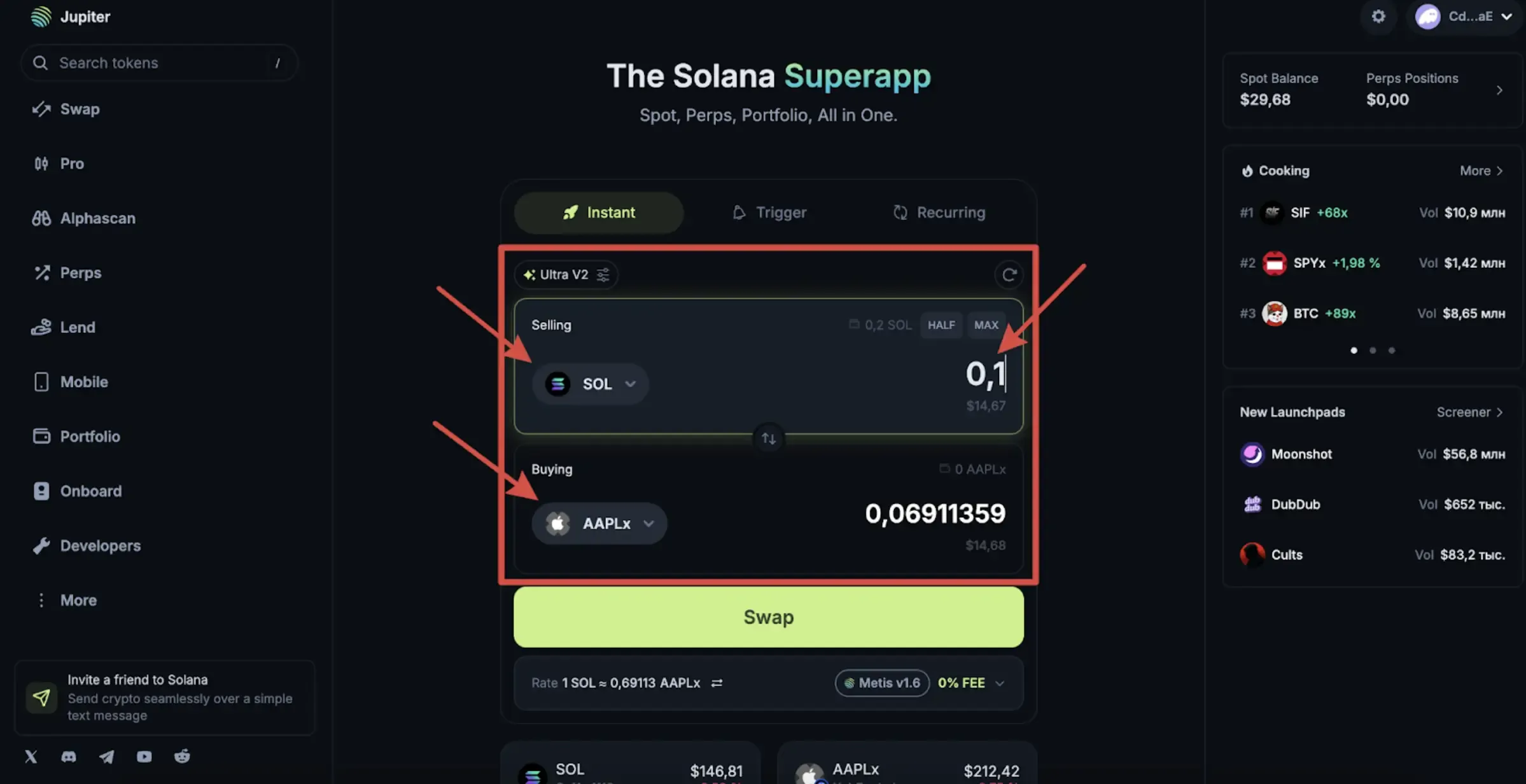

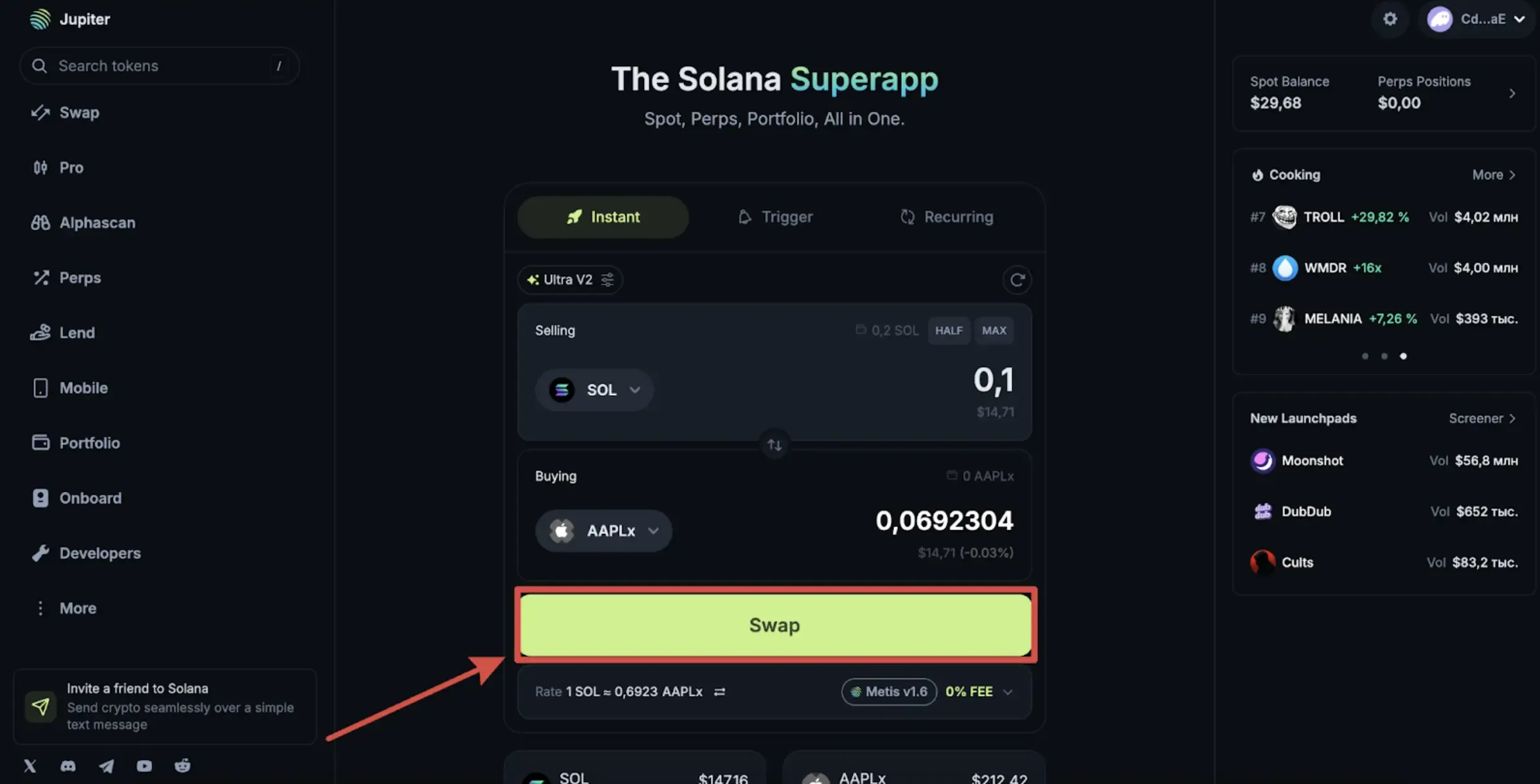

6. Choose SOL as the token you want to sell and specify the amount. As the token to buy, select any listed on the xStocks site. This time we will purchase Apple shares.

7. After double-checking the data entered, click Swap and confirm the transaction in your wallet.

8. Done! You can now track your balance in your wallet.

Potential and Outlook

The market for tokenized stocks is growing but remains a relatively small niche. By April 2025, the total market cap of such tokens had exceeded only $350 million, although analysts forecast potential growth to trillions of dollars in the future.

"A lot of money is about to enter solana ecosystem through #xStocks" said @WisdomMatic on X. "The whole ecosystem is going to explode. $Sol at 150 is a steal"

Many experts agree that, with advances in technology and regulation, tokenized stocks could become a significant part of the global financial system. They attract additional investors, expand asset liquidity, and simplify cross-border investing.

Nevertheless, tokenized stocks are unlikely to displace traditional markets entirely in the near term. More likely, they will serve as an additional instrument for crypto-oriented investors.

"Tokenized stocks means that there will be a 24/7 stock casino going forward" said @BowTiedBull on X. "If you thought people stared at markets all day in crypto wait till you see what happens when stocks are also 24/7"

Many hurdles remain: legal uncertainty, the need for user education, and the task of building liquidity. When these issues are resolved—e.g., through unified international rules for tokenized securities—their full potential will unfold. But even today it is clear that blockchain technology is gradually entering traditional finance, and tokenized stocks are gaining momentum—a kind of “mirror” between cryptocurrency and classic investments.