Alpha

What Are the Top Platforms for Farming Perp DEX Points in 2026?

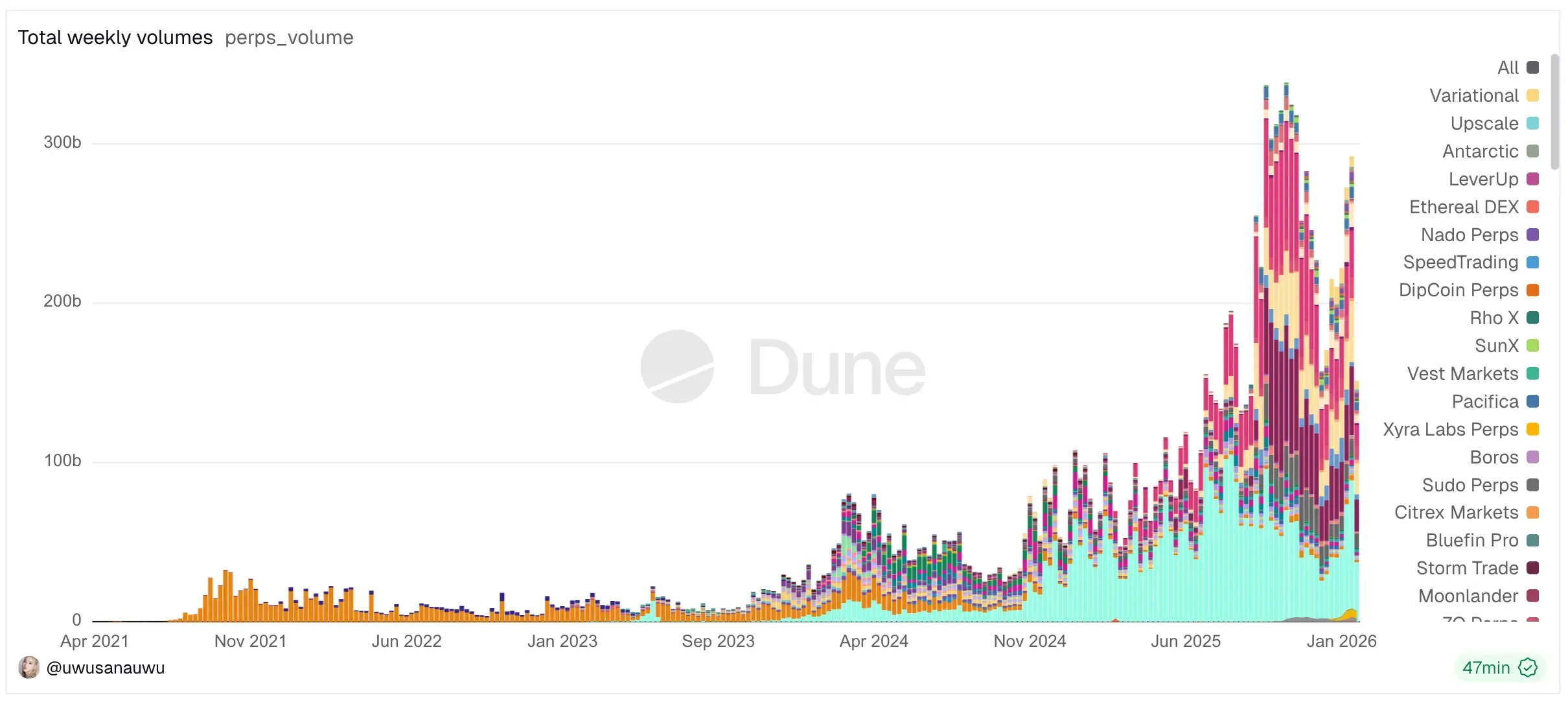

Perpetual DEXs are reshaping the crypto derivatives landscape—offering CEX-level speed with full user control, no KYC, and transparent on-chain trading. As traders seek decentralization without compromise, Perp DEXs are leading the next DeFi wave.

Key Points

- CEX Speed, DeFi Security: Trade perpetual futures on-chain with full asset control, bypassing KYC while maintaining centralized-level execution speeds.

- The Point Farming Meta: Accumulate points ahead of Token Generation Events (TGEs) through trading volume, liquidity provision, staking, and referrals to maximize airdrop allocations.

- 18 Top Platforms: The expanding landscape includes highly anticipated L2/L3 protocols (Paradex, Reya Network, Defx), mobile-first apps (Liquid, Mass), and high-performance terminals.

- Risks & Rewards: While early "Seasons" and closed betas offer strategic advantages for airdrop farmers, traders must carefully manage risks like liquidation, volatility, and developing UI trade-offs.

What Is a Perpetual DEX and How It Differs from Centralized Exchanges

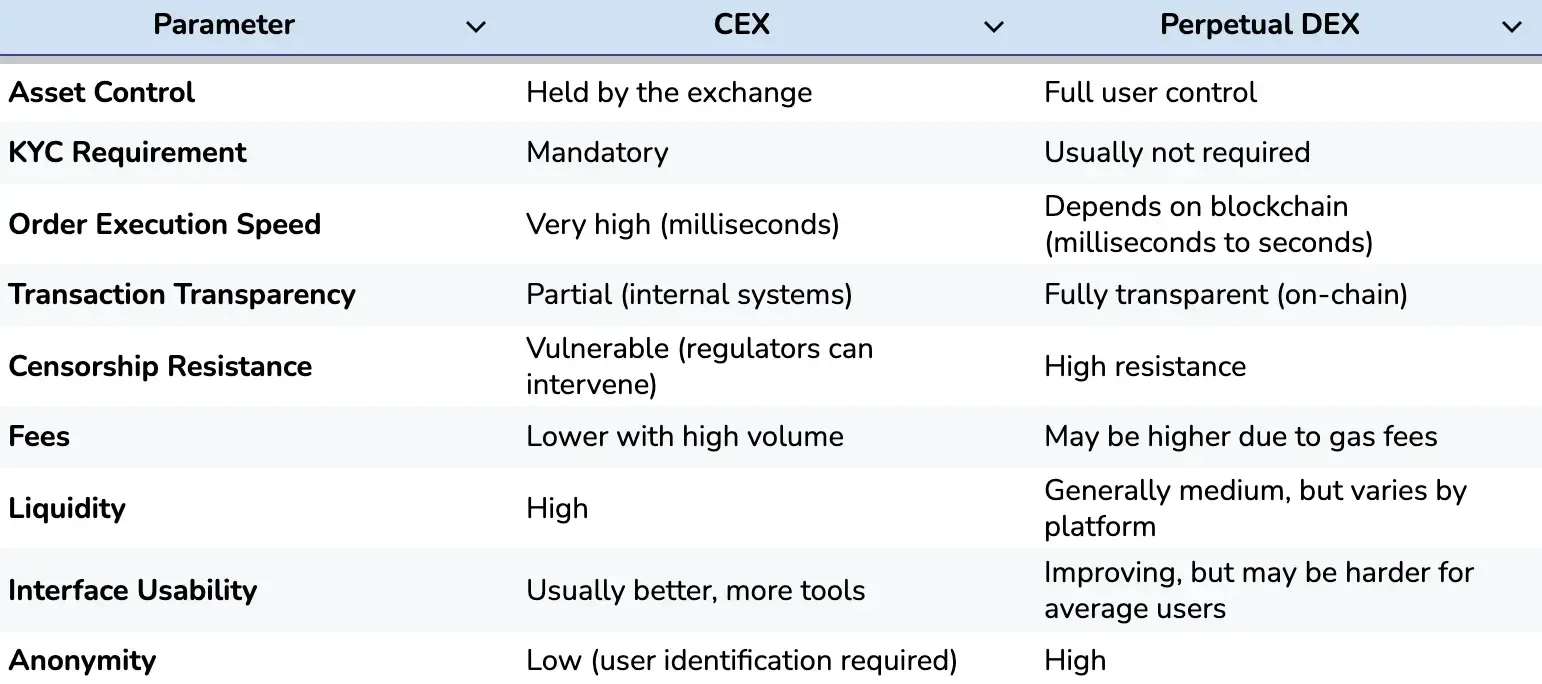

A Perpetual DEX is a decentralized exchange for trading perpetual futures across various blockchain networks. Unlike traditional CEXs (such as Binance, Bybit, etc.), DEXs operate via smart contracts, allowing users to retain control over their assets and private keys. Perp DEXs generally do not require verification (KYC), and all trades are conducted on-chain (or with the help of an additional off-chain mechanism).

This increases platform transparency and resilience, but often limits certain functionalities: for example, fiat onramps via bank cards may be unavailable, and liquidity can be lower than on major centralized platforms. However, Perpetual DEXs preserve core mechanisms of futures trading (margin, leverage, funding rates), but implement them using decentralized technologies.

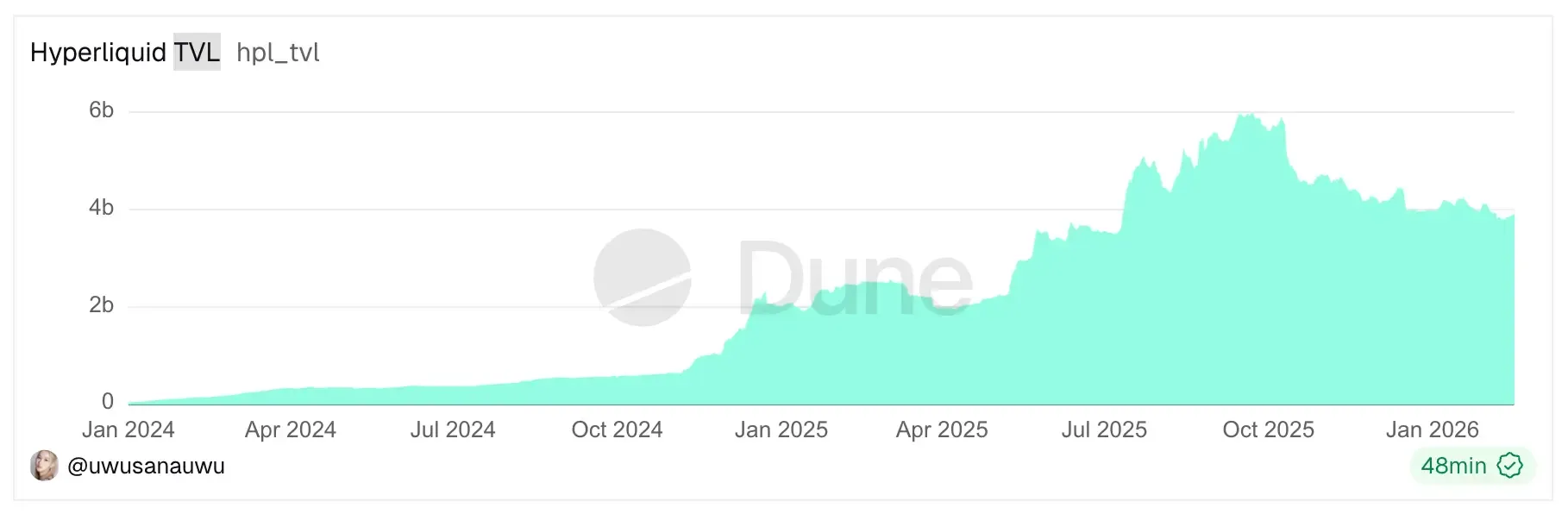

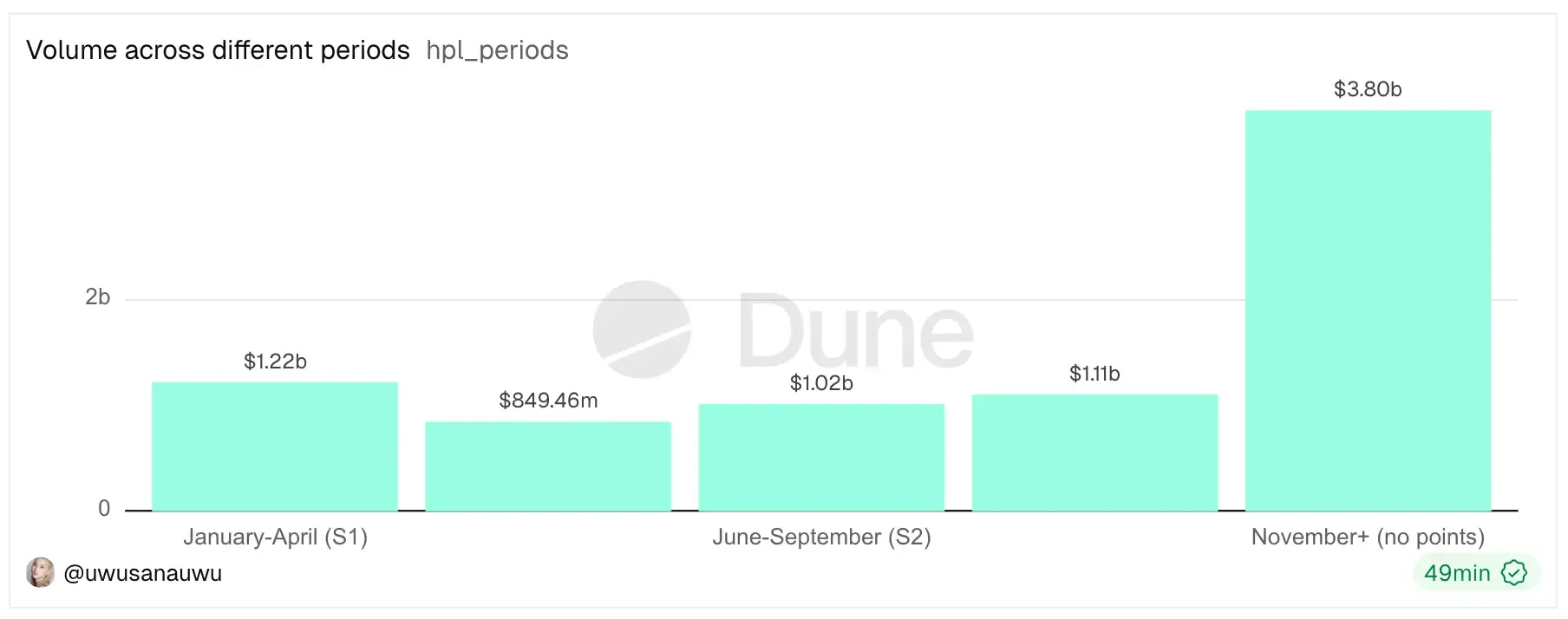

Thus, Perpetual DEXs offer CEX-level speed and functionality (often via L2 networks or specialized solutions) while maintaining DEX-level security (i.e., no transfer of keys to third parties) and transparency. However, traders must be aware that in cases of liquidations and high volatility, risks are distributed differently: for instance, DEXs often use strict insurance fund mechanisms or smart liquidations. Overall, Perp DEXs represent a successful attempt to combine the speed and capitalization of CEXs with the advantages of DeFi—Hyperliquid is a vivid example.

As we can see from the charts, TVL (Total Value Locked) and volumes on Hyperliquid continue to grow steadily every day, signaling the undeniable popularity of Perp DEXs among users. They eagerly switch to this form of trading, leaving CEX platforms behind—even though the Points program on Hyperliquid has ended and the airdrop has already been distributed.

Overview of Key Perp DEX Projects

Let’s take a look at other players in the market that either don’t yet have their own token or are actively continuing point programs to distribute remaining tokens.

1. FOMO

FOMO is a Telegram messenger application for perp trading, focused on analyzing the trading strategies of top traders from Hyperliquid and other DEXs. The project is currently in closed beta with a waitlist system. Participants can trade popular pairs from both crypto and traditional markets.

2. Pacifica

Pacifica is a perp DEX on Solana created by a team of former FTX employees. The platform offers CEX-level speed and broad functionality with full decentralization and no KYC. Active traders are rewarded in the closed beta (invite-only) phase. According to the Pacifica Points system, 10,000 points are distributed weekly for trading activity.

3. Variational

Variational is a decentralized P2P derivatives protocol on Arbitrum, supporting hundreds of trading pairs and commission-free trading. The Omni reward system allows users to earn points for trading and for referred users.

4. Extended (formerly X10)

Extended is a perp DEX based on Starknet technologies from the ex-Revolut team. The platform offers high liquidity, trading with up to 100x leverage, and minimal execution delays. The reward system is structured by seasons: Season 1 started on April 29, 2025, and up to 1.2M points are distributed to traders every week. Early participants have already been credited with over 4.3M points for activity between February and April 2025. Traders can also participate in a referral program: a referral code is unlocked upon reaching $10,000 in trading volume.

5. StandX

StandX is a perp DEX operating on BNB Chain and Solana. A distinctive feature is its proprietary "stable" coin, DUSD, which generates yield for holders through staking. Thus, traders benefit from both trading and staking, accumulating points ahead of a potential airdrop.

6. Liquid

Liquid is a mobile application that combines trading, staking, and relevant news in one app. Participants earn points for activity on the platform. The points program started on November 18, 2025, and since then, 100,000 points have been distributed among participants each week. Users can invite friends and earn bonuses. For a trader, Liquid is convenient due to instant access: simply install the mobile app, register, and fund the account — then you can trade and participate in internal promotions, increasing your chances for a future airdrop.

7. Mass

Mass is a multifunctional mobile app for trading crypto, tokenized stocks, and participating in prediction markets. Traders earn $MASS tokens for activity within the app.

For example, a one-time deposit of ≥$100 earns 10 $MASS, and completing KYC earns 5 $MASS. In addition, there is a daily “Spin the Wheel” feature, social media tasks, and a referral program. All rewards are paid out in $MASS tokens.

8. Axiom

Axiom Exchange is a terminal for trading on Solana and Ethereum, bringing memecoins, perpetual futures, and staking under one roof. The platform's official launch took place in February 2025. By trading, users receive fee rebates and points, which may qualify them for a future airdrop. More than $83M has been credited to users in the form of commission returns and trading bonuses. Thus, by trading on Axiom, you receive tangible benefits immediately, and accumulated points can be profitably converted during the TGE.

9. Bullpen

Bullpen is a multichain terminal working with Solana and Hyperliquid. The project's goal is to simplify trading through a single interface. To stimulate trading activity, the $BULL Points system has been launched: traders automatically accumulate points for trading volume, social activity, and referrals. There is no official token release date, but the $BULL ticker has been mentioned by the project several times, hinting at a future airdrop.

10. EdgeX

EdgeX is a perp DEX focused on high-performance perpetual futures trading. The platform launched the EdgeX Points program as a way to reward traders. Points are distributed weekly among active traders. The number of points awarded depends on trading volume and other actions, such as referral activity. A pre-TGE campaign is underway ahead of the official token launch. By trading and inviting friends, you can simultaneously accumulate points and participate in bonus campaigns with large prizes.

11. Reya Network

Reya Network is an ultra-fast perp DEX on Ethereum, where trade execution time is <1 ms and there are no trading fees. The project has an active point system called Reya Chain Points: points are awarded weekly across three categories — trading, srUSD staking, and network contribution. 40% of the future $REYA token supply is allocated for distribution to the community through the points system.

12. Nado

Nado is a perp DEX on the Ink blockchain (L2 by Kraken) featuring orderbooks for perpetual contracts. The project is currently in the Open Beta stage. In Season 1, traders are actively farming Ink Points for trading and providing liquidity, while "Templars" NFTs, distributed for participating in the closed beta, significantly boost these earnings. The earned points are intended to be converted into tokens at TGE. By working with Nado, you can catch two potential airdrops: from Ink and from Nado.

13. Paradex

A DEX built on Starknet technologies: its proprietary L2 blockchain, Paradex Chain (zk‑STARK, Cairo), supports up to 1,000 transactions per second. The Paradex ecosystem unites spot trading, perpetual futures, and perpetual options under one protocol. A key feature is the synthetic stablecoin DIME, used for margin and rewards. The project is described as a “DeFi Superstack” with cross-product liquidity streaming. A major airdrop (20% of total token supply) is planned for 2025.

14. Ethereal

Ethereal is a perp DEX on the Ethena Network, combining spot and perpetual trading with USDe as collateral. In early 2025, a beta was held in the form of Season 0, where users made pre-deposits of USDe and earned Ethereal Points. In May 2025, Mainnet Alpha was launched, accessible to a limited circle of users. In Season 1 on the Ethereal platform, participants earn points for trading, holding USDe as collateral, and referring new users. All Season 0 participants receive a 100% bonus to points earned in Season 1.

Accumulated Ethereal Points will be taken into account for token distribution in the future. Official announcements state that 15% of the supply will be allocated to $ENA holders (the Ethena token), while point holders will receive a share of the future airdrop.

15. Hibachi

Perp DEX with orderbook built on Celestia and zk-tech for privacy: user positions, balances, and order sizes are encrypted. By March 2025, trading was live on Base (Coinbase L2) and Arbitrum. Raised $5M seed from Dragonfly, Electric Capital, and others — a sign of strong investor trust. Designed for pro traders, with future “vault” strategies and cross-margin. The “Hibachi Points” program began in March 2025, with rewards based on trading volume, referrals, and quests.

16. Vest Exchange

A multichain Perp DEX launched with support from Jane Street, QCP, and Modular Capital. Uses ZK tech to ensure fairness and liquidity. Raised $5M in early 2025 from Pantera, Founders Fund, Amber, etc. Focused on deep liquidity and low spreads (median spreads reportedly 4x lower than competitors). Available not only on Arbitrum, but also Ethereum, Solana, Base, Optimism, Polygon, and ZkSync Era (largest TVL here).

Key features: 50x leverage, USDC/USDT staking, and “Ignite” programs for liquidity providers. “Season 1” of the points program began in March 2025 — 1M points/week for 6 months. No token yet; all points will convert to an airdrop. New features include a hybrid orderbook with USDC-margin support and fiat off-ramps (via partners). Vest targets long-term traders and LPs.

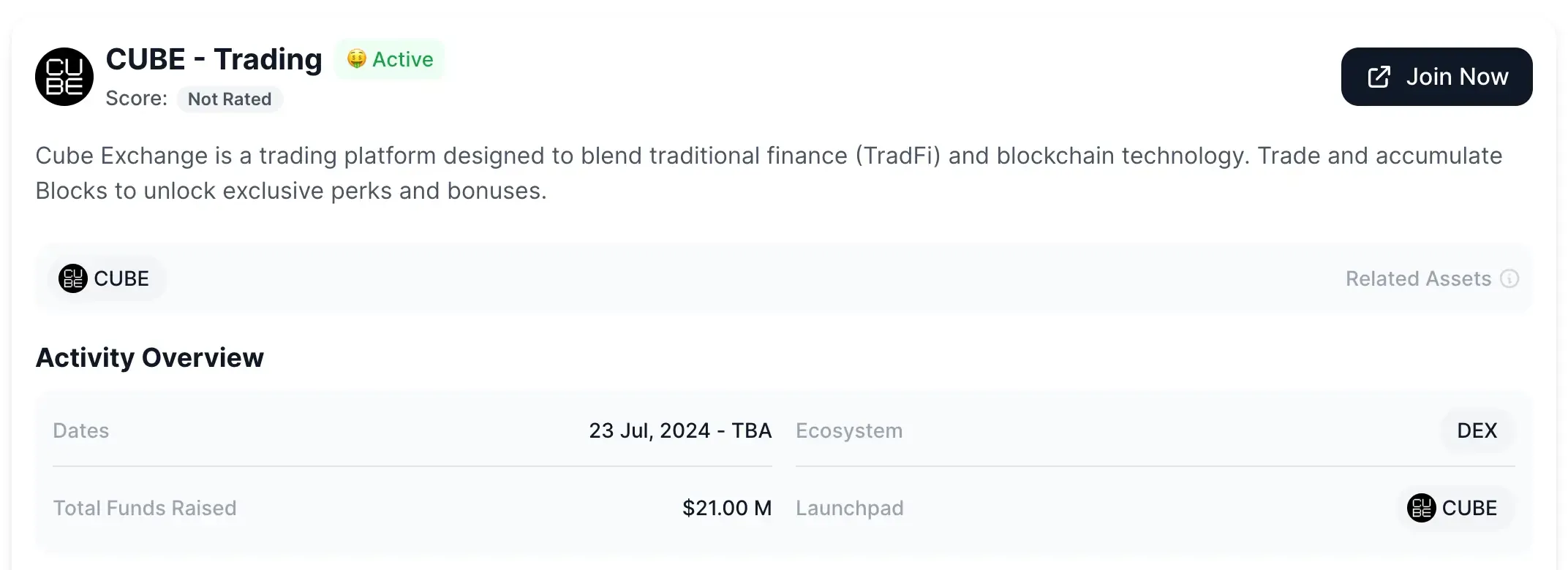

17. CUBE Exchange

Australian Perp exchange focused on multichain and speed. Known for its Web UI and gamified trading — instant response, mobile app in development, and trade-based rewards (e.g. “$45K SOL/BTC” campaigns). CUBE has a CEX-style feel: custodial wallet, fiat onramps (via integrations), and no mandatory KYC (email/Gmail login is enough). Actively promoted with hardware giveaways, token-hold bonuses, and trade incentives. More CeFi-DEX than true DEX. As of July 2025, still early-stage, no token yet, but potential rewards attract users.

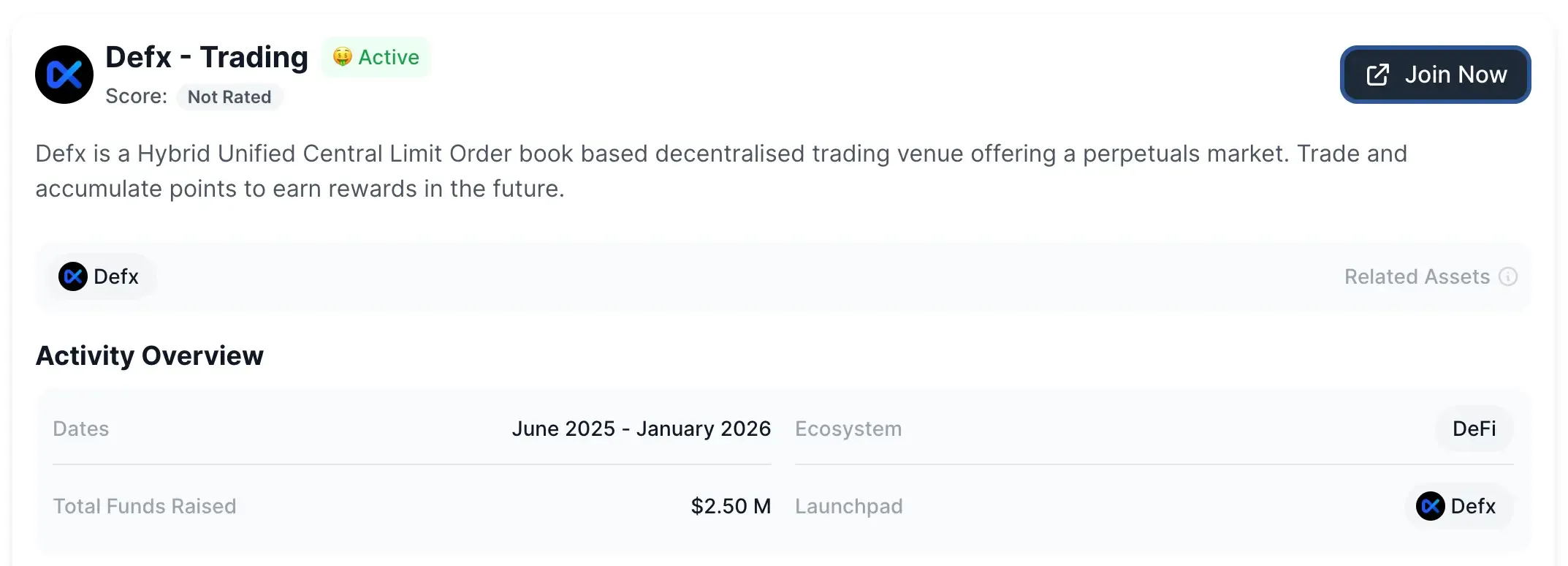

18. Defx

An innovative Layer-1 blockchain purpose-built for perpetual trading. Uses ZK tech to privately encrypt orderbooks and trade parameters: size, leverage, liquidation levels remain hidden, with only execution proof revealed. Raised $2.5M in June 2025 to launch a “dark DEX” — like a CEX hidden orderbook but with verifiable on-chain execution.

Natively supports Ethereum and Solana — ETH/SOL/USDC holders use assets directly as margin. Liquidity is pooled into centralized registry-vaults — users can deposit BTC, ETH, stablecoins, or LSTs and earn fees and protocol shares. Defx aims to become a “decentralized CME” with a broad range of instruments: crypto, FX, commodities, even interest rate perps. Still in development mid-2025, but backed by Pantera and others. Defx is one of the most ambitious and tech-driven projects, aiming for real-time anonymous trading for everything.

Conclusion

Perp DEXs are the next logical step in the evolution of decentralized finance. They aim to combine the functionality and convenience of centralized platforms with the autonomy and transparency of blockchain-based solutions. Today, as both institutional players and retail traders seek new ways to engage with derivatives without intermediaries, projects like Paradex, Vest, Hibachi, and Satori offer fresh ideas and original mechanics. That said, Perp DEXs are still in an active development phase: not all platforms have sufficient liquidity, and their interfaces and UX sometimes lag behind traditional CEXs.

However, even now these platforms allow not only trading but also efficient point farming — targeting future airdrops and long-term yield opportunities. Many go further by encouraging deeper community participation — similar to models seen in Web3 ambassador programs, where users earn tokens and rewards by growing ecosystems through content, outreach, and engagement.

It’s important to remember: as with any high-risk environment, success favors those who carefully assess risks, test strategies, and stay informed about ecosystem updates. Perp DEXs aren’t just a trendy innovation — they may become the foundation of the next wave of DeFi infrastructure. And right now is the perfect time to claim your place in it.

All current point farming are published in the DropsTab Activities section: https://dropstab.com/activities