Alpha

Top Perpetual DEX Platforms for Point Farming

Perpetual DEXs are reshaping the crypto derivatives landscape—offering CEX-level speed with full user control, no KYC, and transparent on-chain trading. As traders seek decentralization without compromise, Perp DEXs are leading the next DeFi wave.

TL;DR

- Trade perpetuals on-chain with full control and no KYC

- Lower liquidity and complex UI vs. CEX

- Top DEXs: Paradex, Hibachi, Vest, Satori, Vessel, CUBE

- Farm points via trading, staking, bots, and quests

- Watch for risks: leverage, liquidations, volatility

- Perp DEXs are shaping the future of DeFi trading

What Is a Perpetual DEX and How It Differs from Centralized Exchanges

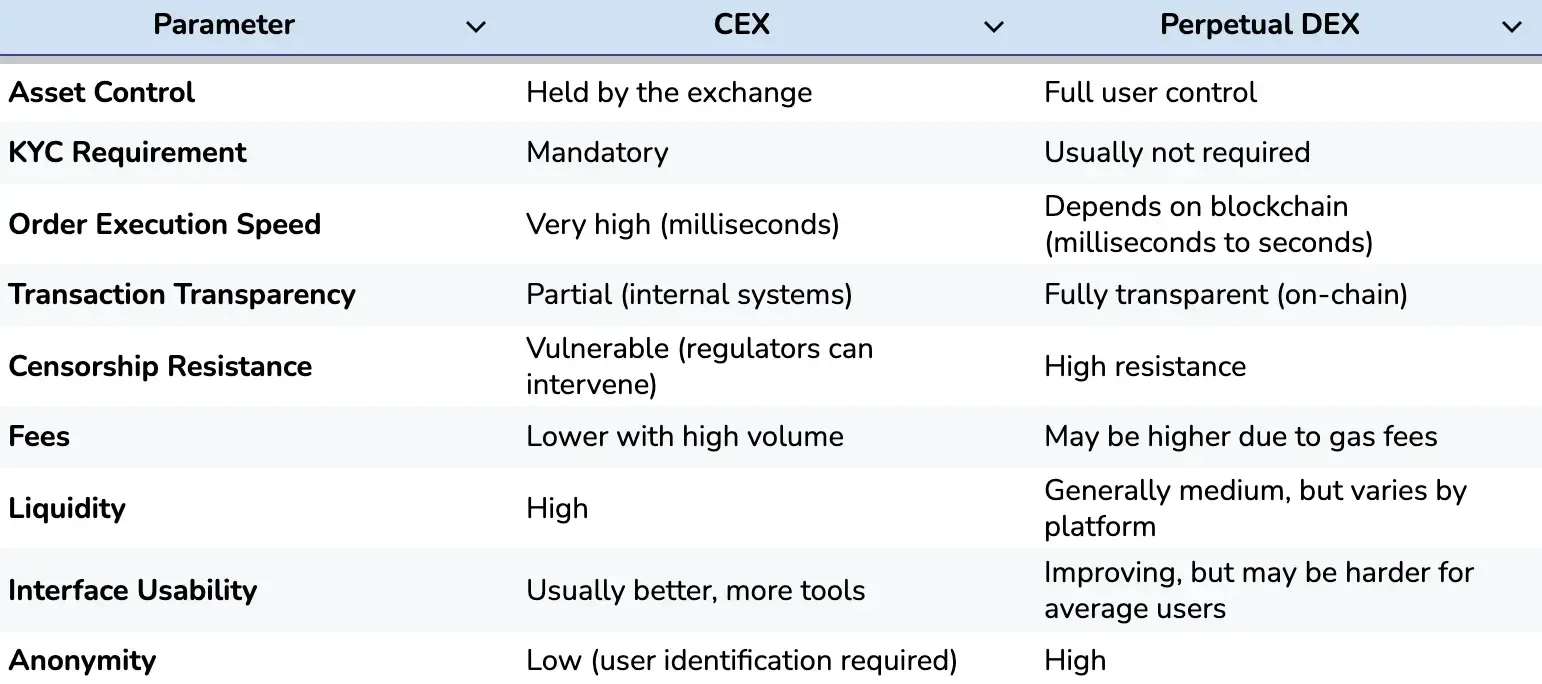

A Perpetual DEX is a decentralized exchange for trading perpetual futures across various blockchain networks. Unlike traditional CEXs (such as Binance, Bybit, etc.), DEXs operate via smart contracts, allowing users to retain control over their assets and private keys. Perp DEXs generally do not require verification (KYC), and all trades are conducted on-chain (or with the help of an additional off-chain mechanism).

This increases platform transparency and resilience, but often limits certain functionalities: for example, fiat onramps via bank cards may be unavailable, and liquidity can be lower than on major centralized platforms. However, Perpetual DEXs preserve core mechanisms of futures trading (margin, leverage, funding rates), but implement them using decentralized technologies. Additionally, just like Binance alpha points incentivize CEX users through loyalty rewards tied to trading activity, many Perpetual DEXs now implement similar point-based systems to encourage on-chain engagement.

Thus, Perpetual DEXs offer CEX-level speed and functionality (often via L2 networks or specialized solutions) while maintaining DEX-level security (i.e., no transfer of keys to third parties) and transparency. However, traders must be aware that in cases of liquidations and high volatility, risks are distributed differently: for instance, DEXs often use strict insurance fund mechanisms or smart liquidations. Overall, Perp DEXs represent a successful attempt to combine the speed and capitalization of CEXs with the advantages of DeFi—Hyperliquid is a vivid example.

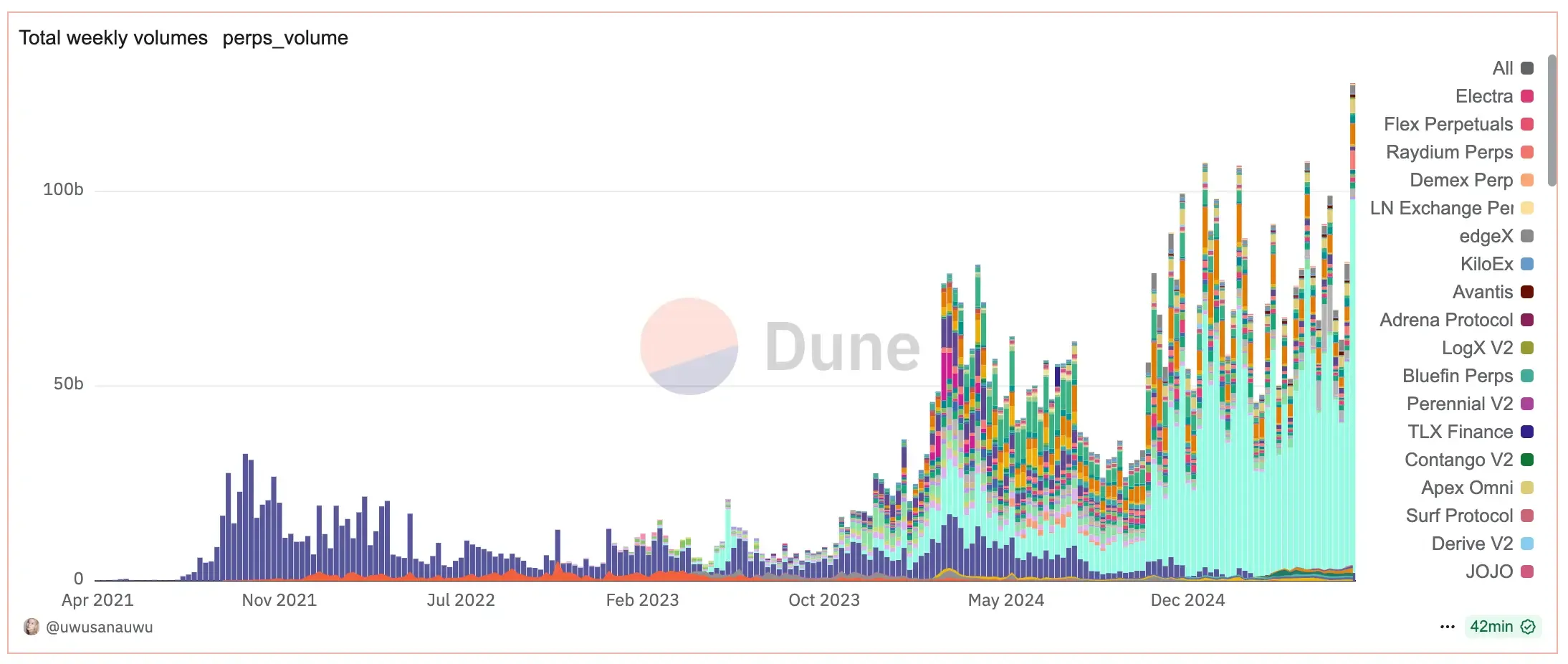

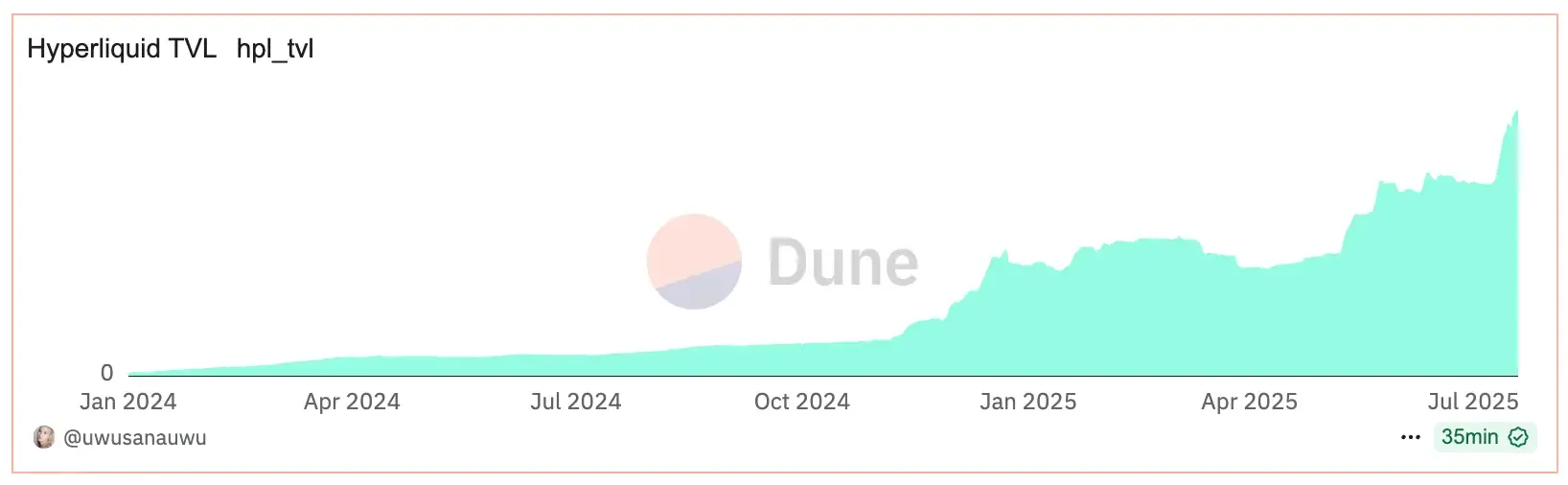

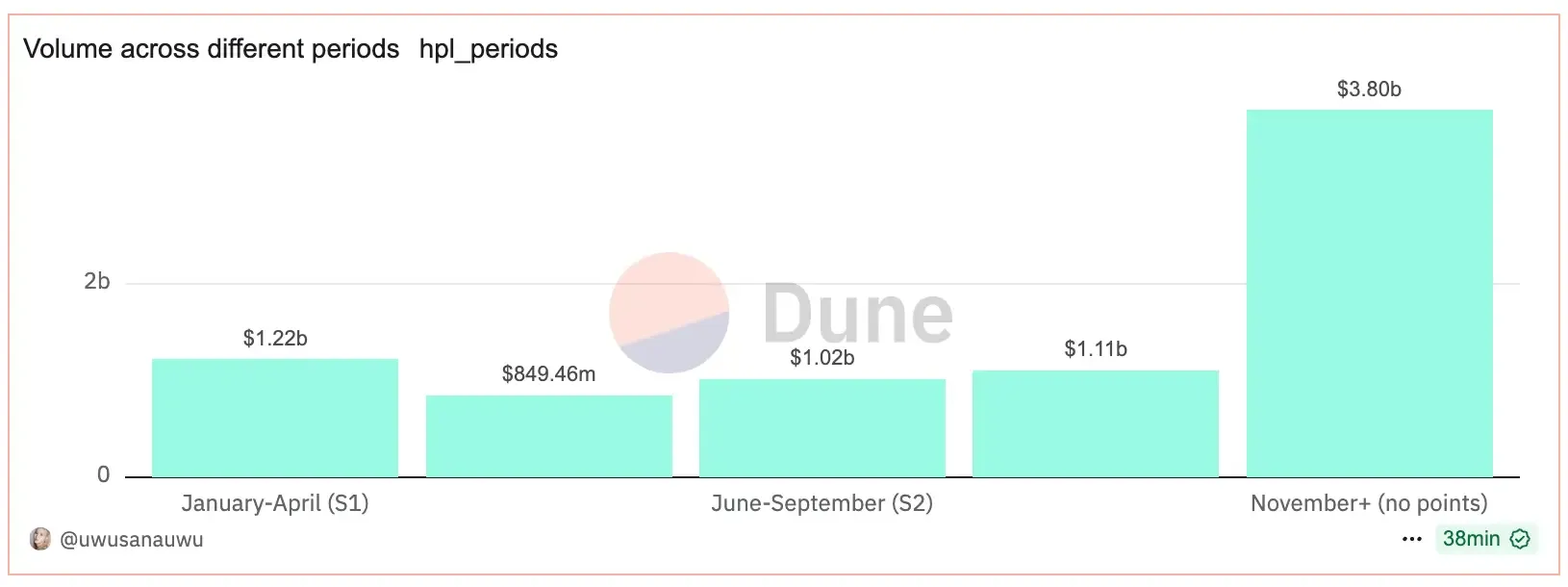

As we can see from the charts, TVL (Total Value Locked) and volumes on Hyperliquid continue to grow steadily every day, signaling the undeniable popularity of Perp DEXs among users. They eagerly switch to this form of trading, leaving CEX platforms behind—even though the Points program on Hyperliquid has ended and the airdrop has already been distributed. This shift mirrors a broader evolution in on-chain incentives, where trading volume, testnet activity, and loyalty systems are increasingly rewarded — as detailed in this guide to airdrops in 2025, where point farming and multi-phase campaigns now define the most competitive drops in crypto.

Overview of Key Perp DEX Projects

Let’s take a look at other players in the market that either don’t yet have their own token or are actively continuing point programs to distribute remaining tokens.

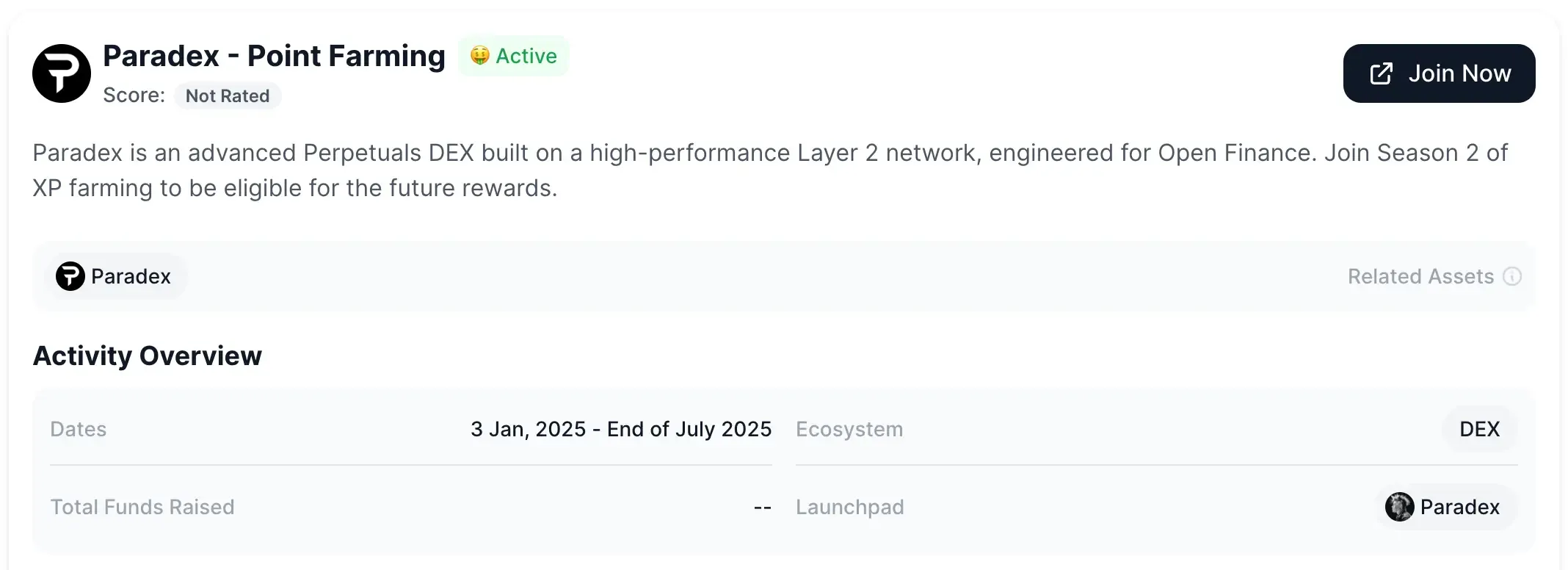

Paradex

A DEX built on Starknet technologies: its proprietary L2 blockchain, Paradex Chain (zk‑STARK, Cairo), supports up to 1,000 transactions per second. The Paradex ecosystem unites spot trading, perpetual futures, and perpetual options under one protocol. A key feature is the synthetic stablecoin DIME, used for margin and rewards. The project is described as a “DeFi Superstack” with cross-product liquidity streaming. A major airdrop (20% of total token supply) is planned for 2025.

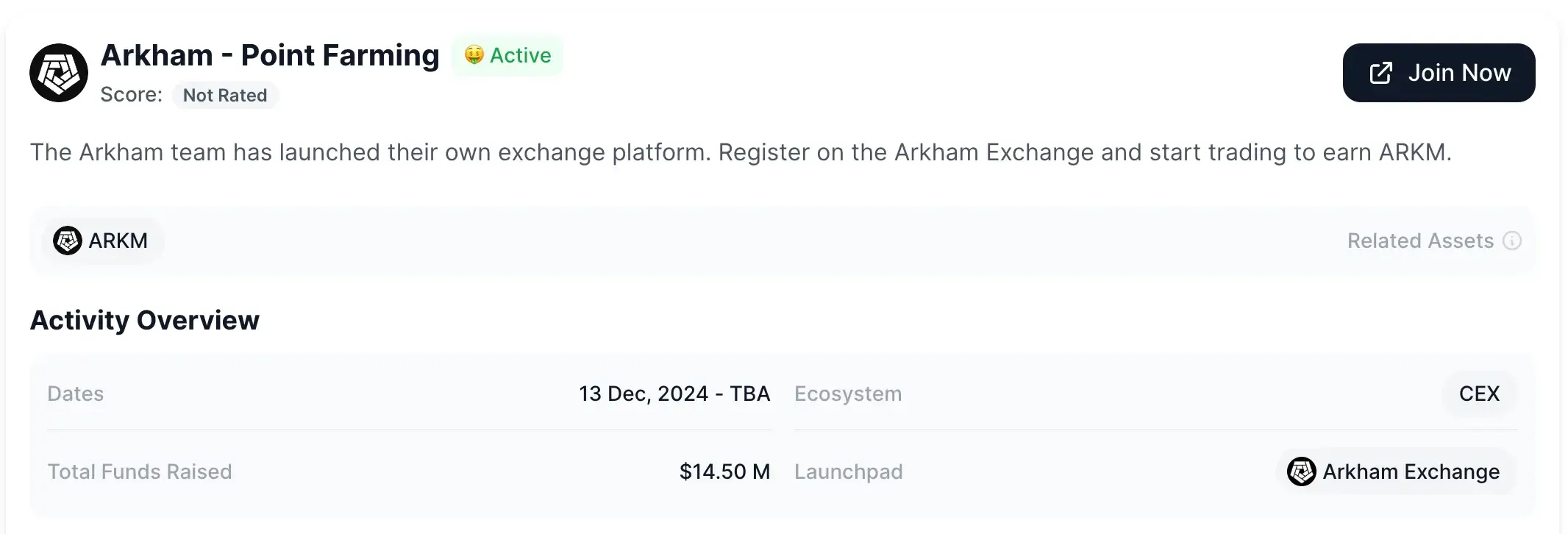

Arkham Exchange

An exchange launched by analytics project Arkham Intelligence in November 2024 as an “on-chain” platform for spot and perpetual futures. Notable features include transparency and proof-of-reserves (PoR).

The exchange introduced “Arkham points” rewards based on trading volume (VIP users get a 10% bonus). Points convert to ARKM tokens after the first month of trading. Currently, Arkham Exchange doesn’t serve U.S. accounts (due to regulation) but has attracted a strong user base in Europe and Asia. It is a hybrid model — decentralized infrastructure with KYC requirements for traders.

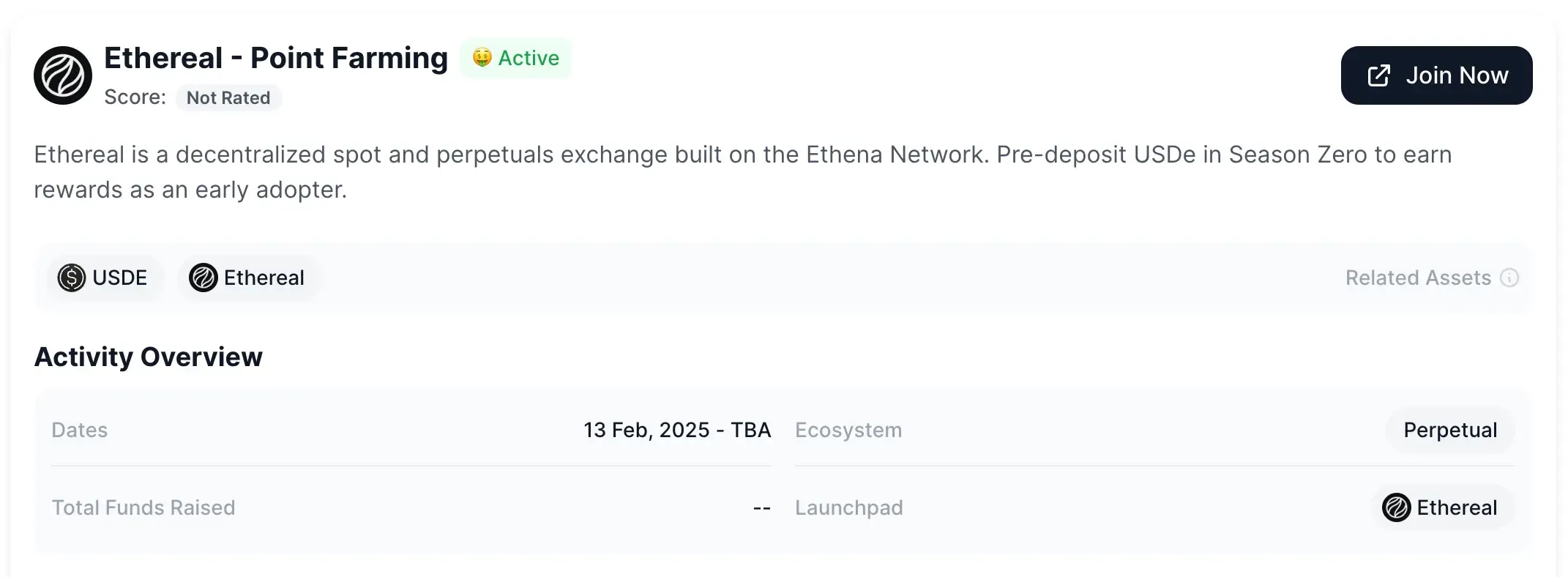

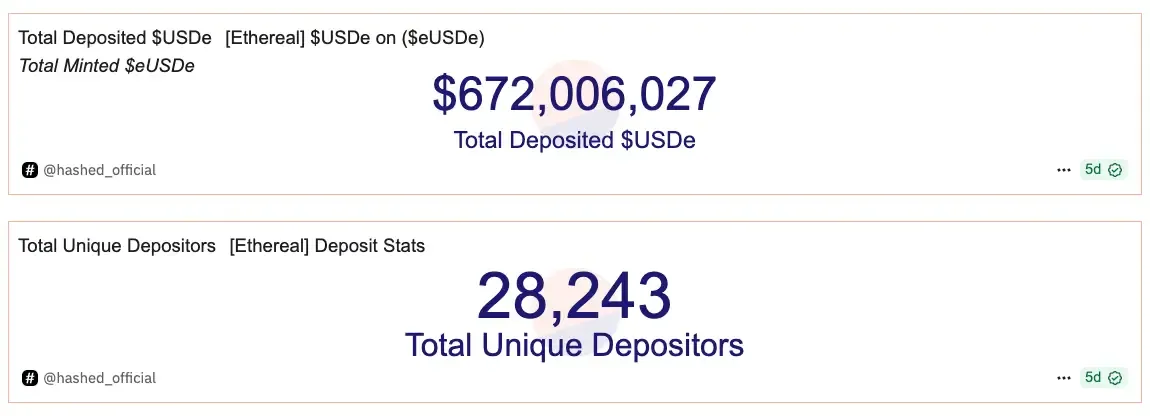

Ethereal

A Perp DEX built as an L3 solution atop Ethena (USDe protocol). Combines CEX speed with decentralization, using USDe as base margin. Launched in “Season 0” before full release, users deposited USDe to farm points convertible to tokens. With $672M in deposits before a working product, trader expectations are high. Novel aspects include deep integration with USDe and the Ethena network, plus high speeds and competitive fees.

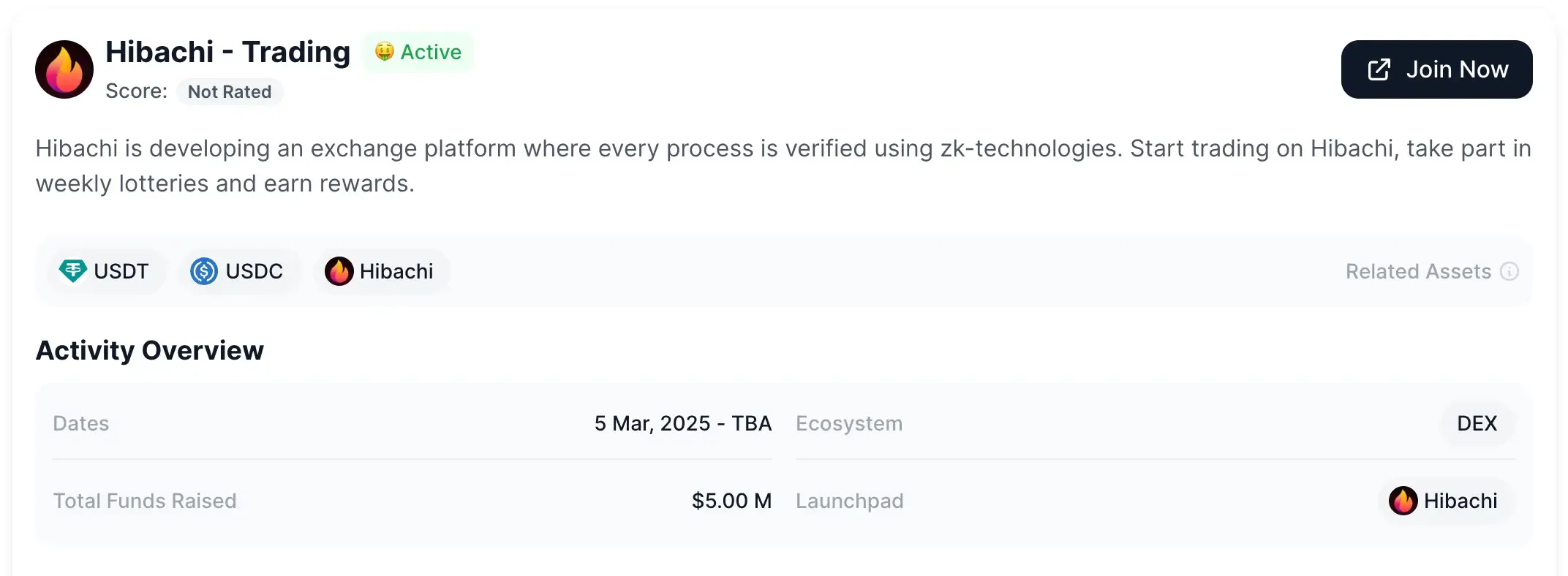

Hibachi

Perp DEX with orderbook built on Celestia and zk-tech for privacy: user positions, balances, and order sizes are encrypted. By March 2025, trading was live on Base (Coinbase L2) and Arbitrum. Raised $5M seed from Dragonfly, Electric Capital, and others — a sign of strong investor trust. Designed for pro traders, with future “vault” strategies and cross-margin. The “Hibachi Points” program began in March 2025, with rewards based on trading volume, referrals, and quests.

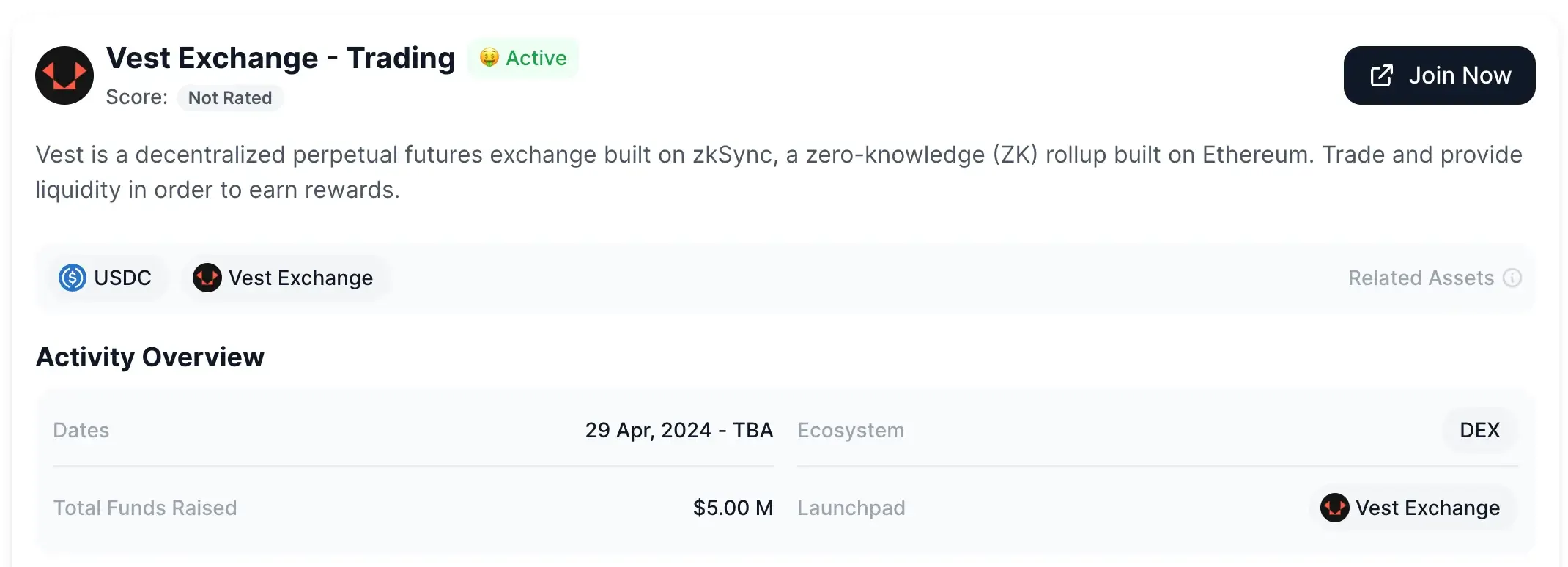

Vest Exchange

A multichain Perp DEX launched with support from Jane Street, QCP, and Modular Capital. Uses ZK tech to ensure fairness and liquidity. Raised $5M in early 2025 from Pantera, Founders Fund, Amber, etc. Focused on deep liquidity and low spreads (median spreads reportedly 4x lower than competitors). Available not only on Arbitrum, but also Ethereum, Solana, Base, Optimism, Polygon, and ZkSync Era (largest TVL here).

Key features: 50x leverage, USDC/USDT staking, and “Ignite” programs for liquidity providers. “Season 1” of the points program began in March 2025 — 1M points/week for 6 months. No token yet; all points will convert to an airdrop. New features include a hybrid orderbook with USDC-margin support and fiat off-ramps (via partners). Vest targets long-term traders and LPs.

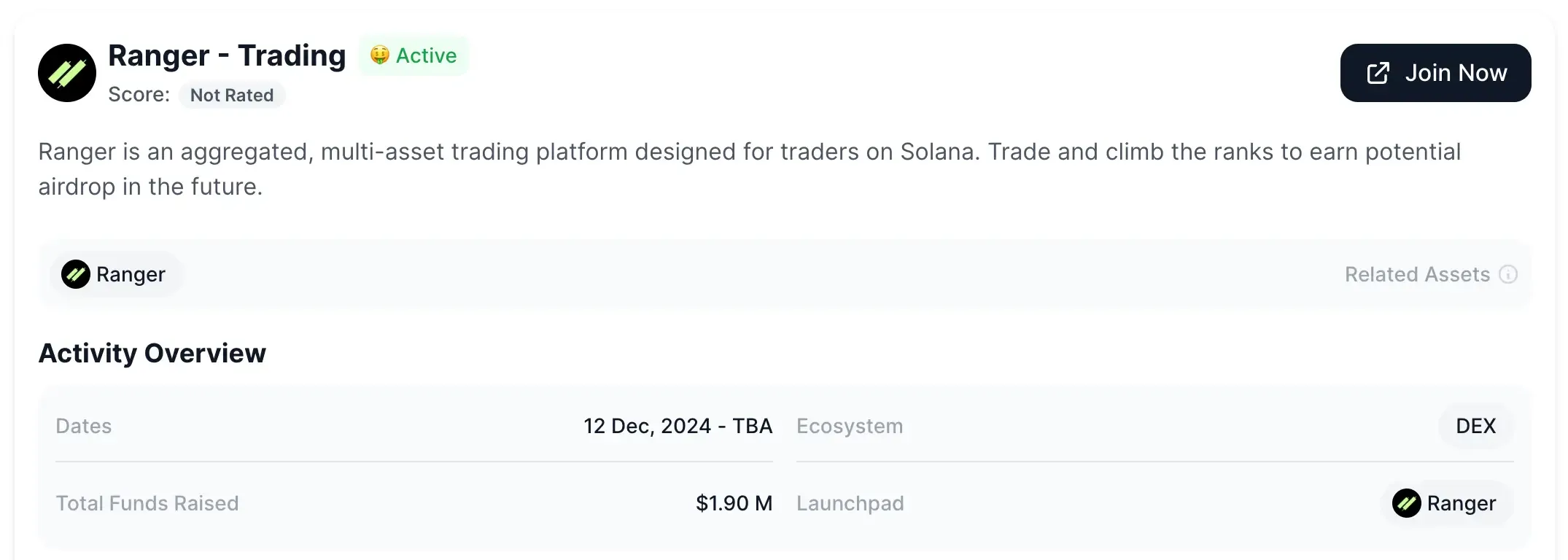

Ranger Finance

The first Perp market aggregator on Solana, launched in late 2024. Just as Swap handled spot trades like Jupiter, Ranger adapted this for futures — integrating multiple platforms and routing orders to minimize slippage. Designed to ensure sufficient liquidity for large trades. Raised $1.9M from Rockaway, Big Brain, Zee Prime, and Flow Traders. Community features include “Ranger Ranks” (leaderboard since Feb 2024) and a 5% referral discount program. Token $RNGR is planned but not yet launched.

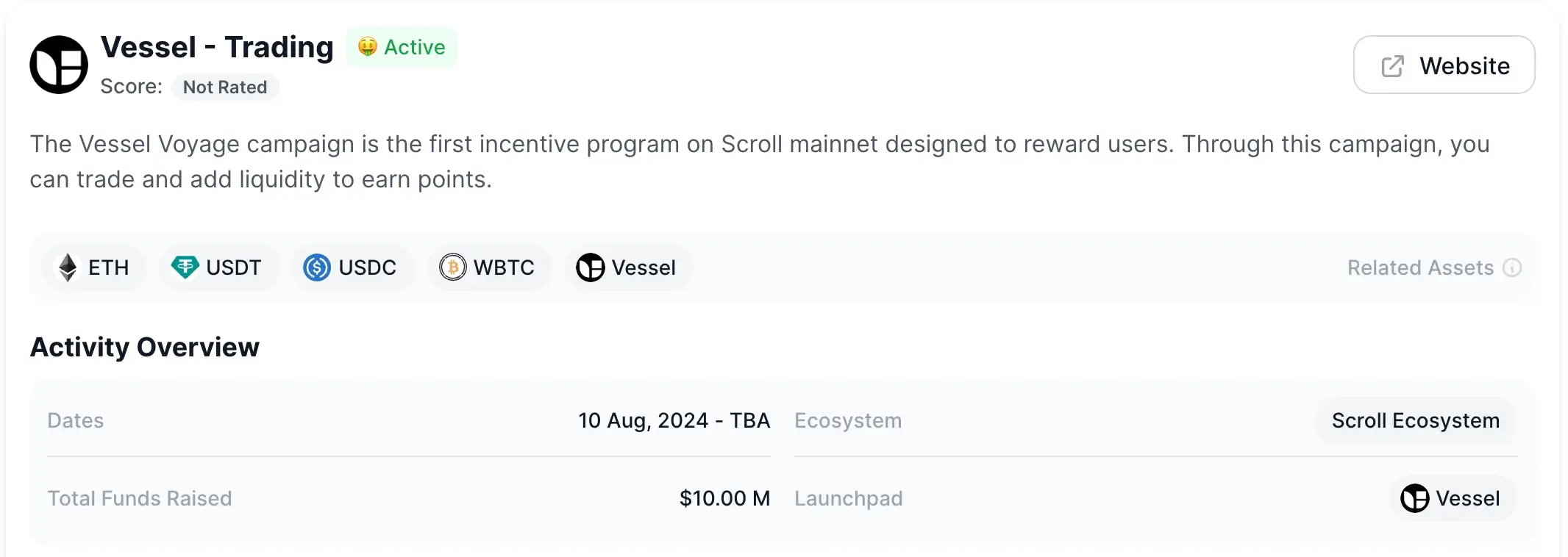

Vessel Finance

ZK‑DEX on Ethereum launched in August 2024. Built as an L3 over a rollup developed with Scroll. Uses a VAELOB (AMM+orderbook) hybrid model where liquidity pools act as “programmatic market makers” for order flow. This allows CEX-like liquidity with on-chain transparency. Raised $10M from Sequoia, Scroll cofounders, and others. Initially supports spot trading; perpetuals coming soon. Low fees (0.01% maker, 0.035% taker). Offers a loyalty program, “Vessel Voyage.” Aims to combine CEX UI with zk-backed DEX execution.

CUBE Exchange

Australian Perp exchange focused on multichain and speed. Known for its Web UI and gamified trading — instant response, mobile app in development, and trade-based rewards (e.g. “$45K SOL/BTC” campaigns). CUBE has a CEX-style feel: custodial wallet, fiat onramps (via integrations), and no mandatory KYC (email/Gmail login is enough). Actively promoted with hardware giveaways, token-hold bonuses, and trade incentives. More CeFi-DEX than true DEX. As of July 2025, still early-stage, no token yet, but potential rewards attract users.

Aster

Rebranded in March 2025 from Astherus/APX Finance. Multichain Perp DEX backed by YZi Labs (formerly Binance Labs). Offers two modes:

- Simple Mode — one-click, MEV-free trades on BNB Chain and Arbitrum with up to 1001x leverage

- Pro Mode — advanced UI, ultra-low fees, multiple trading tools on BNB, Ethereum, and Solana

Combined volume (APX + Astherus) exceeded $258B.

Features include high leverage, a 20% referral commission program, and a user-friendly interface. Plans include ZK-proof integration and a dedicated Layer-1 for trading. “Rh Points” program launched in Q1 2025 for future airdrop eligibility. Aster combines CEX and DeFi expertise with a strong roadmap.

Azura

A full-featured trading platform focused on memecoin trading and Web2 user onboarding. Raised $6.9M in June 2024. No leverage trading — thus no liquidations. Built-in wallet with Gmail login and fiat funding for beginners.

Core idea: spot trading of memecoins with volume-based rewards — the more you trade, the higher your chance for future airdrops. Azura is a CEX/DEX hybrid with farming mechanics and simplicity, but little decentralization. As of 2025, it's popular among memecoin traders thanks to marketing and design, with more social than technical potential.

Satori Finance

Cross-chain Perp protocol launched in March 2023. Unique for off-chain order aggregation with partial on-chain execution — blending CEX-like speed with DEX security. Known as the first DEX to support RWA futures (e.g. via partnership with Plume). Supports up to 25x leverage and a wide range of assets and pro tools (limit orders, analytics).

Raised $10M from Polychain, Coinbase Ventures, Jump, etc. since mid-2023. Runs an ongoing points program — users earn based on deposits, trade volume, and position duration. 12% of tokens reserved for airdrops. Farming seasons already distributed 3% and 4%; Season 2 (5%) is live now. Satori is a mature, well-funded, multi-network protocol with trader incentives.

IVX

Decentralized derivatives platform on Berachain L1. Offers two product lines:

- Levo — CLOB for perpetuals across many tokens with deep liquidity via solver network

- Diem AMM — 0DTE options with up to 500x leverage on BTC, ETH, and BERA

Key feature: smart contracts with “portfolio margining” — a unified account to hold all positions and collateral, enabling advanced strategies without margin calls. Security via Berachain’s Proof-of-Liquidity and gas savings via Gelato. Summer 2025 testnet (Artio/Bartio) rewards users for options trading. Backed by Animoca, Avid3 Ventures, and integrated with Orbs L3 (Perpetual Hub). As of July 2025, one of the most “institutional” Perp projects with advanced tools and an upcoming token.

Avantis

Decentralized perpetuals platform on Base, launched in Feb 2024 after a two-month testnet. Features a “risk protector” — protocol compensates part of losses for traders going against market trend.

The “Avantis Loss Protection” model paid $450K during testnet. Supports up to 75x leverage and retail access to futures on forex and commodities (gas, oil, gold) — a first for blockchain platforms. Backed by Pantera, Galaxy, Founders Fund, Base Fund, and Modular. Avantis is a prime example of “CeFi innovation in DeFi,” combining digital products with robust LP infrastructure.

Defx

An innovative Layer-1 blockchain purpose-built for perpetual trading. Uses ZK tech to privately encrypt orderbooks and trade parameters: size, leverage, liquidation levels remain hidden, with only execution proof revealed. Raised $2.5M in June 2025 to launch a “dark DEX” — like a CEX hidden orderbook but with verifiable on-chain execution.

Natively supports Ethereum and Solana — ETH/SOL/USDC holders use assets directly as margin. Liquidity is pooled into centralized registry-vaults — users can deposit BTC, ETH, stablecoins, or LSTs and earn fees and protocol shares. Defx aims to become a “decentralized CME” with a broad range of instruments: crypto, FX, commodities, even interest rate perps. Still in development mid-2025, but backed by Pantera and others. Defx is one of the most ambitious and tech-driven projects, aiming for real-time anonymous trading for everything.

Conclusion

Perp DEXs are the next logical step in the evolution of decentralized finance. They aim to combine the functionality and convenience of centralized platforms with the autonomy and transparency of blockchain-based solutions. Today, as both institutional players and retail traders seek new ways to engage with derivatives without intermediaries, projects like Paradex, Vest, Hibachi, and Satori offer fresh ideas and original mechanics. That said, Perp DEXs are still in an active development phase: not all platforms have sufficient liquidity, and their interfaces and UX sometimes lag behind traditional CEXs.

However, even now these platforms allow not only trading but also efficient point farming — targeting future airdrops and long-term yield opportunities. Many go further by encouraging deeper community participation — similar to models seen in Web3 ambassador programs, where users earn tokens and rewards by growing ecosystems through content, outreach, and engagement.

It’s important to remember: as with any high-risk environment, success favors those who carefully assess risks, test strategies, and stay informed about ecosystem updates. Perp DEXs aren’t just a trendy innovation — they may become the foundation of the next wave of DeFi infrastructure. And right now is the perfect time to claim your place in it.

All current point farming are published in the Activities section: https://dropstab.com/activities