Alpha

2025 Airdrops Guide: Testnets, Points, and Profit Paths

Airdrops in 2025 are evolving fast — testnets, point systems, social quests, and trading campaigns now dominate the landscape as users chase high-value rewards in the most anticipated season of the year.

Quick Overview

- Airdrops have evolved into complex, multi-stage campaigns with points, quests, and gamification.

- Testnet activity is now a major path to airdrop eligibility — Monad and others lead the trend.

- Social tasks, trading volume, and loyalty programs are increasingly used to reward user engagement.

- Perpetual DEXs and point farming platforms are reshaping on-chain participation incentives.

- Telegram Mini Apps sparked a massive but short-lived airdrop boom via tap-to-earn games.

- Top watchlist: Monad, Abstract, and Base — high-potential projects with rumored or likely airdrops.

- Active contribution matters more than luck — thoughtful content, DAO participation, and consistency are key.

What Are Airdrops

An airdrop is a distribution of tokens to users in the crypto community who have completed a set of specific actions. Typically, projects "allocate" tokens to the wallets of the most active participants. In essence, an airdrop is a strategic marketing move: by distributing tokens, projects attract attention, stimulate network effects, and ignite community interest.

For users, it offers a chance to receive "free" tokens and profits without large investments — essentially a form of incentives and rewards for early-stage user loyalty. At the same time, projects grow their audience and boost brand recognition, as successful airdrops often lead participants to eagerly share their "rewards" on social media. It’s important to remember that for projects, an airdrop is primarily a marketing tactic — not a promise of “free money.”

History of Airdrops

The concept of airdrops emerged in the early days of cryptocurrency. One of the first cases was a campaign by Auroracoin in March 2014: this "Icelandic startup" distributed 50% of all its coins to the residents of Iceland. Although the project had its own issues, it went down in history as an example of mass token distribution.

Other initiatives soon followed: in 2017, OMG Network allocated 5% of its total supply (150 million tokens) to Ethereum holders, thereby stimulating network growth. This mechanism caught the attention of users, and new formats quickly began to emerge.

Amid the ICO competition of the early 2020s, many DeFi projects replicated the success of these "retro-distributions" by retrospectively rewarding early users. A classic example is Uniswap (2020): the protocol distributed its UNI token to everyone who had ever interacted with the platform. More than 250,000 addresses received 400 UNI each — worth about $1,200 at launch, and peaking at around ~$16,000.

This and other distributions established a new trend: rewarding users for their loyalty and activity became the norm. Since then, the format has continually evolved — from simple giveaways to complex reward programs and seasonal quests.

Landmark Airdrops of the Past

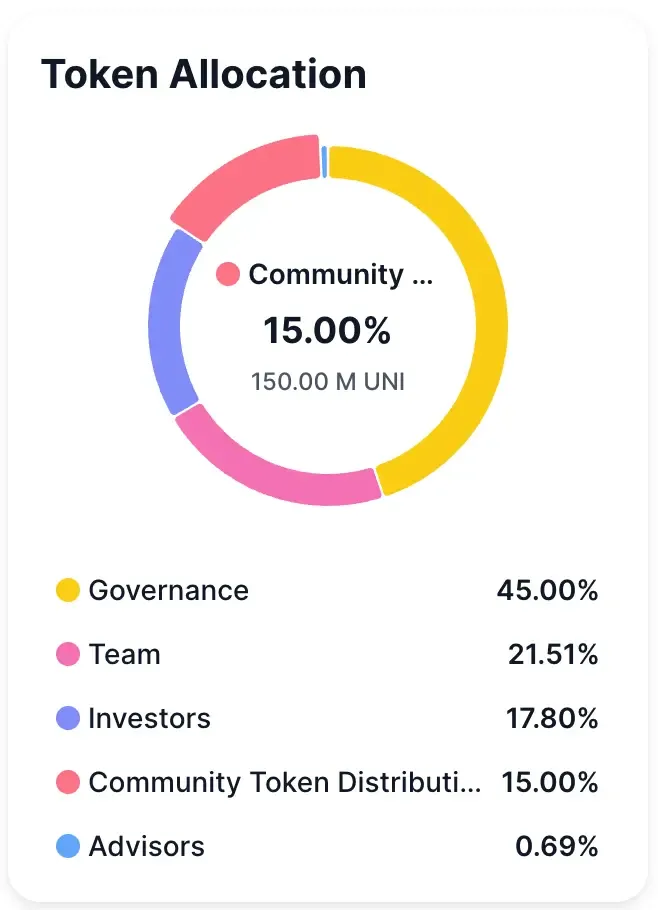

Uniswap (2020)

The legendary DeFi airdrop. Every “early” Uniswap user (LP holders or traders) received 400 UNI as a reward. The distribution covered approximately 250,000 addresses in total. At launch, 400 UNI were worth about $1.2K (around $3–4 per token), and later the price soared above $40, allowing “diamond hands” to sell at a premium. The most active users received significantly more tokens — tens of thousands of UNI. According to estimates, this was one of the largest airdrops ever, with a peak value of around $6.4 billion.

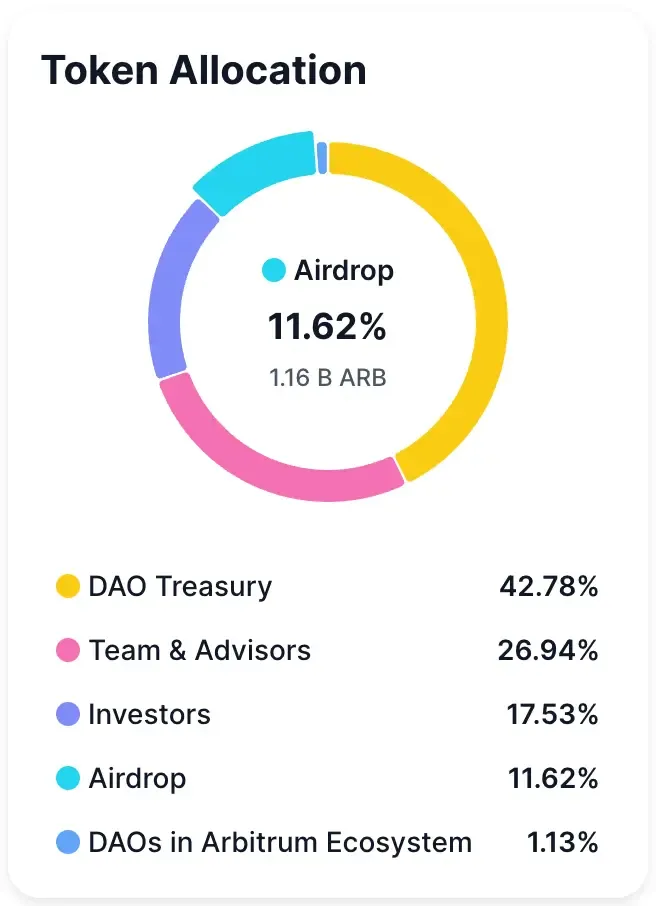

Arbitrum (2023)

The largest airdrop from an L2 network. The developers took a snapshot in early 2023 and distributed ARB tokens to those who had previously used Arbitrum (transferred funds, voted, or provided liquidity). On March 23, 2023, approximately 1.275 billion ARB were distributed to over 625,000 wallets. According to some data, the total market value of the airdrop reached ~$1.97 billion (at a price of $1.69 per ARB). On average, each participant received about $1,300 worth of ARB. Arbitrum’s popularity was so high that the network’s TVL surged 147% prior to the airdrop — from $1.5 billion to $3.7 billion.

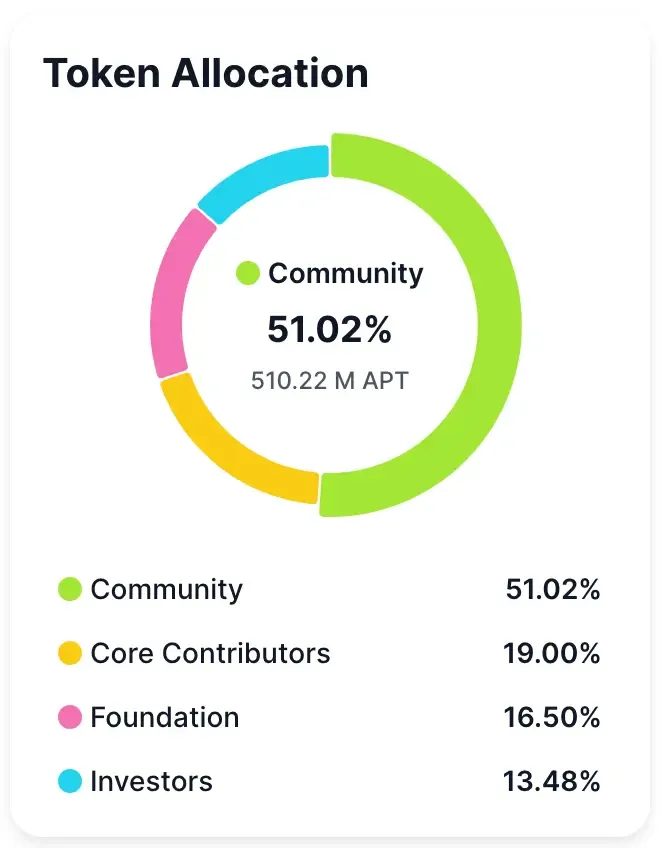

Aptos (2022)

A Layer-1 network launched by ex-Facebook developers. In the fall of 2022, the Aptos Foundation rolled out a testnet with tasks, and in October of that year conducted the first APT airdrop as a reward. A total of 20–23.45 million APT (≈2–2.3% of the initial supply) were distributed among 110,000–125,000 participants. The main eligibility requirement was minting a free NFT.

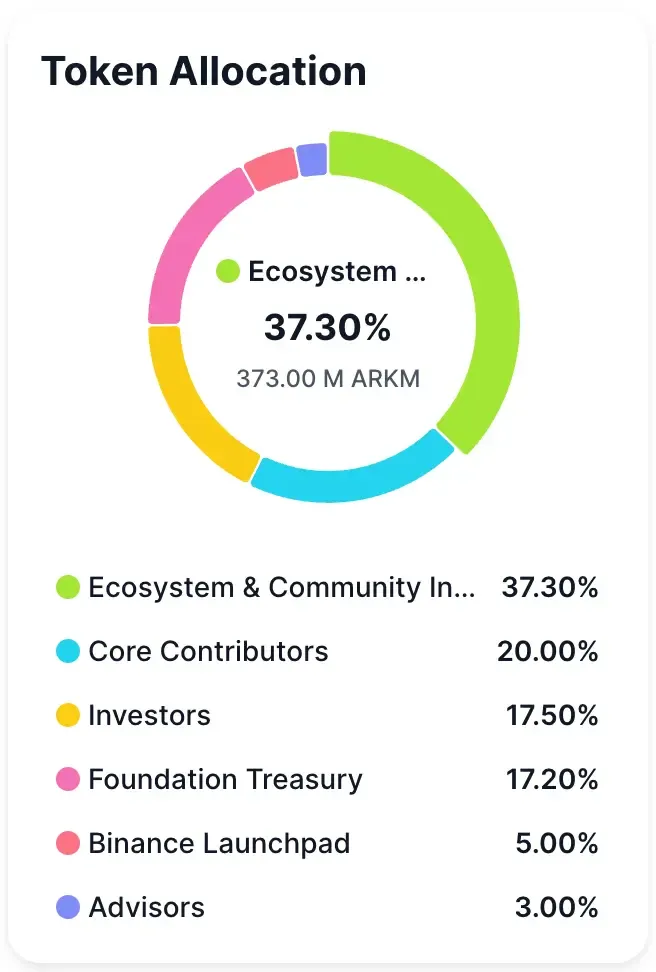

Arkham Intelligence (2023)

A crypto platform for on-chain activity analytics. In July 2023, the ARKM token airdrop was launched. According to available data, more than 60,000 people were included in the first distribution round (that’s how many addresses received tokens), with about 30 million ARKM allocated (~7% of the projected supply). The value of distributed tokens totaled around $18.4 million, giving users an average of $285 each. The airdrop mechanics involved referral invitations and platform interactions: users earned “points” for activity, which were later converted into ARKM. As a result, most received fewer than 200 tokens, while top addresses got tens of thousands. The airdrop had no financial cost and attracted attention for its “unconventional” approach.

Airdrop Categories in 2025

Testnet Airdrops

One of the most popular themes is token distributions for participation in testnets. Projects invite users to interact with test networks, complete tasks (such as bug hunting, token transfers, smart contract creation, etc.), and sometimes promise future tokens as rewards. Essentially, it’s a form of “labor-based distribution” during the development phase of a project.

The main advantage is that real investment isn’t always required: in many testnets, transactions are covered with free test tokens. Popular examples include Monad, Succinct, Anoma, Pharos, and others.

For Monad in particular, this Monad testnet airdrop tutorial offers a complete guide to joining the testnet, deploying contracts, minting NFTs, and trading — all designed to help maximize your chances of qualifying for a future airdrop.

As experts point out, “participating in protocols at early stages is one of the most promising opportunities of 2025.” To join, users usually need to pre-register on the project’s website (fill out a waitlist form), connect a wallet to the testnet, and start completing various tasks.

However, in 2025, testnets have gained the status of a sort of exclusive club. It has become much harder to get into truly popular testnets, as access is increasingly distributed via invite codes. Obtaining them isn’t easy — they’re issued by project team members only to those who genuinely earn them through activity (e.g., social media support, helping newcomers in Discord, etc.).

Social Tasks and On-Chain Quests

Many modern airdrops are distributed in exchange for social activity and completing “quests.” These can include social media threads and reposts, joining Telegram/Discord groups, interacting with the platform, completing other quests, or collecting unique NFTs. Projects assign tasks like “share this post” or “make a meme.”

It’s essentially crowd-marketing: users bring others into the project and earn a chance at token rewards. This approach is often described as “rewards for social engagement.” For those looking to go deeper, structured reward paths like Web3 ambassador programs offer even more: crypto users can earn perks, tokens, and experience by creating content, growing communities, and driving visibility — turning participation into long-term value.

At the same time, on-chain quests are gaining popularity — tasks within the blockchain itself, such as bridging tokens from one network to another, interacting with a DeFi application, or performing a series of transactions.

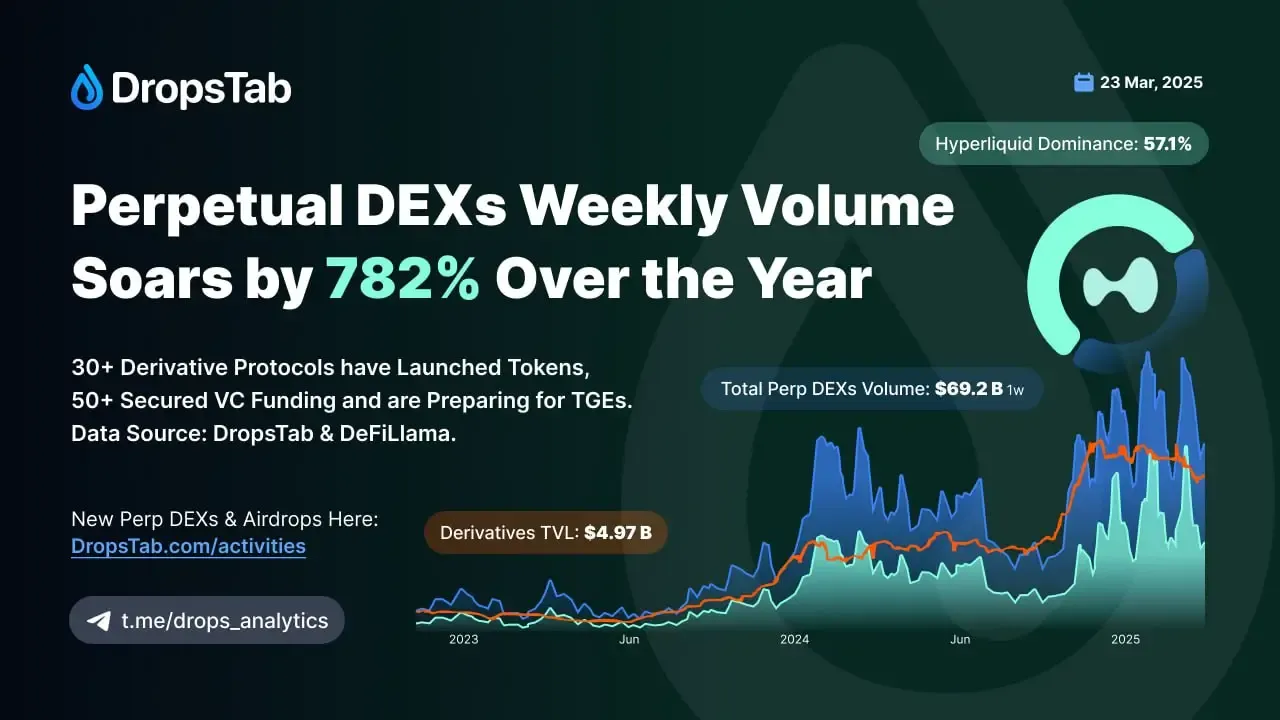

Trading Activity on DEXs/CEXs

Some airdrops are targeted specifically at traders. This type of activity is similar to quests but focused on trading tasks, such as “make X trades on our exchange” or “maintain Y in trading volume.” A classic example is reward campaigns for active traders by services like HyperLiquid, which distributed HYPER tokens based on trading volume. Centralized exchanges also run their own reward programs: for example, Binance’s Binance Alpha Points program enjoys significant popularity. In 2025, such campaigns are expanding rapidly — especially amid the rise of L2 DEXs and aggregators.

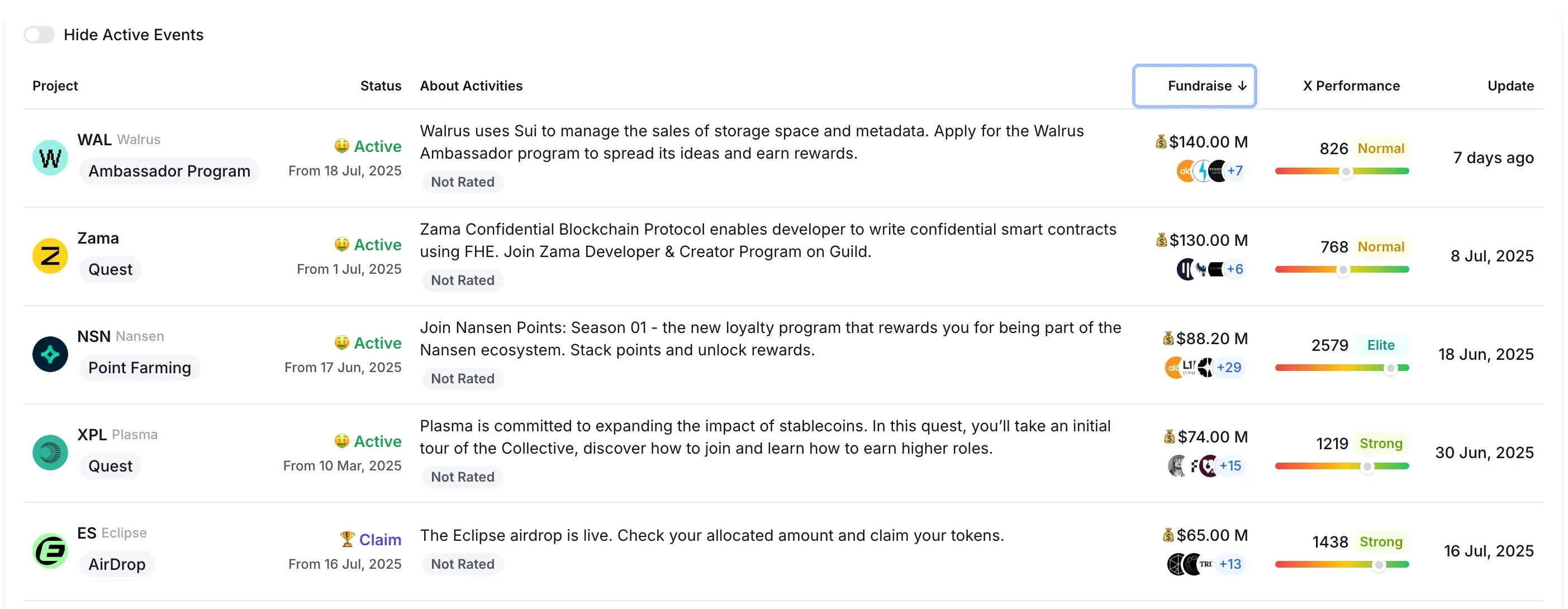

This trend is also reflected in the growing popularity of perpetual DEX platforms, which combine CEX-level performance with full user control and no KYC requirements. As highlighted in top perpetual DEX platforms for point farming research, these platforms are driving a new wave in DeFi by offering transparent, on-chain derivatives trading optimized for reward campaigns and farming opportunities.

Evolution of the Airdrop Format

Airdrops from 2017–2020 were relatively simple: token distributions to all addresses from a snapshot (like Uniswap’s 400 UNI per user), or token rewards for simply holding ETH. But by 2025, the format has radically evolved. Instead of one-time “free” distributions, projects are increasingly launching multi-stage programs involving point accumulation and gamification.

Projects now build mini-ecosystems: quests, games, and tournaments are organized. For example, Arkham Intelligence calculated points based on referrals and platform activity; Blast introduced “multipliers” and “gold” for applications. Thus, the airdrop has transformed from a one-off promotional event into a continuous reward program.

As a result, mini-ecosystems emerge with partner projects and crowd-marketing campaigns: popular influencers and DAOs discover their “own” airdrop campaigns, promote them to their audiences, and users collaboratively “farm” drops across various platforms. By 2025, every new L1/L2 or DEX launches its own loyalty system — and this is significantly reshaping the rules of the game.

Points Programs

A completely new trend — loyalty programs based on points. Projects award Points (virtual credits) for various actions: staking, holding tokens, using services, participating in testnets. Then, at the end of a campaign, tokens are distributed proportionally to the points accumulated. Notable examples include EigenLayer and Blast. EigenLayer awarded points for staking ETH, while Blast took it further: half of the points were distributed as Points (to users), and the other half as “Blast Gold” (to DApps, encouraging project development).

These programs are changing the dynamic: it’s no longer about a one-time “click,” but rather sustained participation in the ecosystem.

Telegram Mini App Boom After the Launch of Notcoin

In the fall of 2024, a wave of airdrops from Telegram mini-apps on the TON blockchain erupted. The catalyst was the launch of Notcoin — the first clicker-style game in Telegram Mini Apps. It distributed 80 billion of its tokens to over 11 million users — totaling approximately $3.5 billion! On average, each user received around $300.

The success of Notcoin spawned numerous clones: Hamster Kombat, BLUM, Empire-X. This was followed by the $DOGS airdrop, which reached another 30 million people and distributed 550 billion tokens (~$500 million total, or about $12 per user on average). Interest was massive — combined MAU (monthly active users) nearly hit one billion.

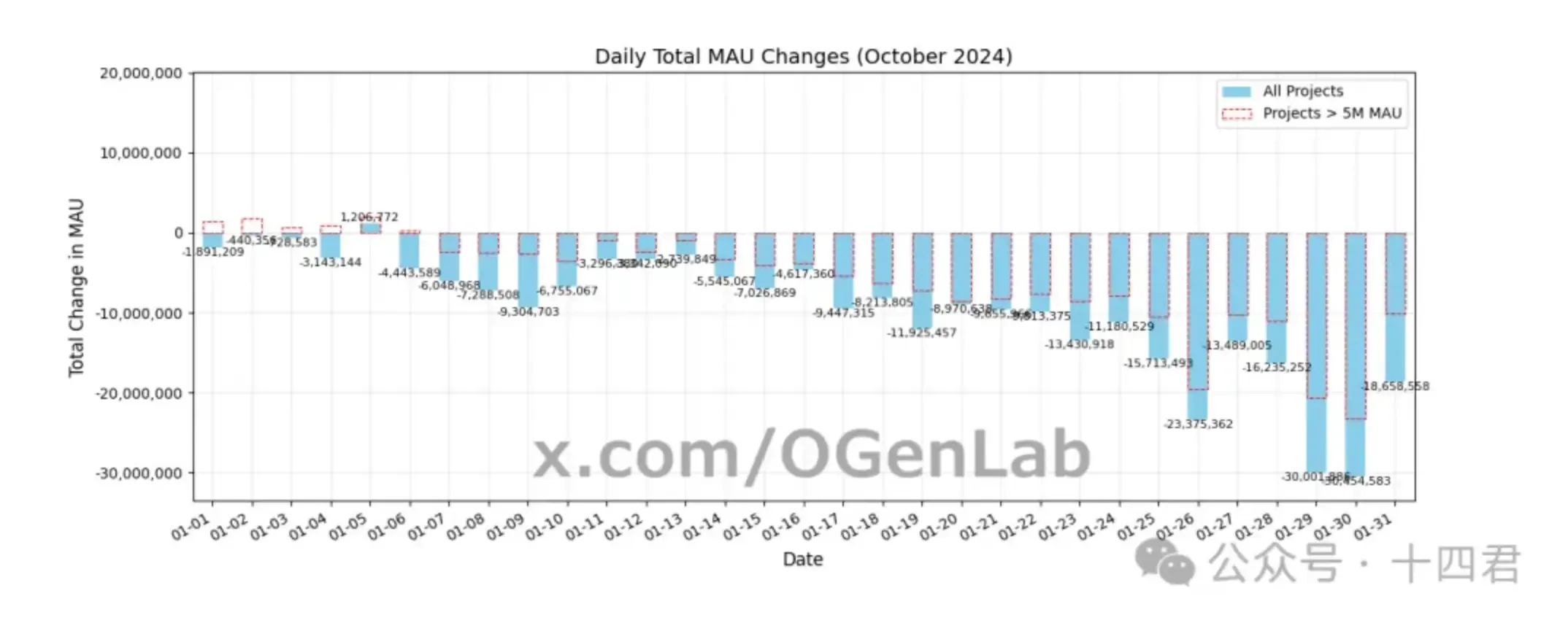

However, by late 2024, the trend began to fade. Users grew tired of the repetitive “tap-clicker” games where one simply tapped the screen to earn cheap tokens.

@OGenLab provided stark figures: in October 2024, total MAU for Telegram games dropped by 33%.

Virtually every popular project — Hamster Kombat, Dogs, Catizen, and others — had already launched their tokens, followed by a sharp decline in player activity. New games (with under one million users) continue to appear, but their growth doesn't offset the decline of the old ones.

Analysts link this shift to post-hype fatigue: after the gaming boom, users found the gameplay too repetitive and short-lived. Projects are now exploring new content formats: integrations, quests, and other ideas — but the previous airdrop boom turned out to be a localized phenomenon.

Most Anticipated and Talked-About Airdrops of 2025

At the start of 2025, several projects captured the spotlight, with the crypto community placing high hopes on their potential:

Monad (MON)

A detailed guide on how to interact with the Monad testnet can be found here: latest Monad activities.

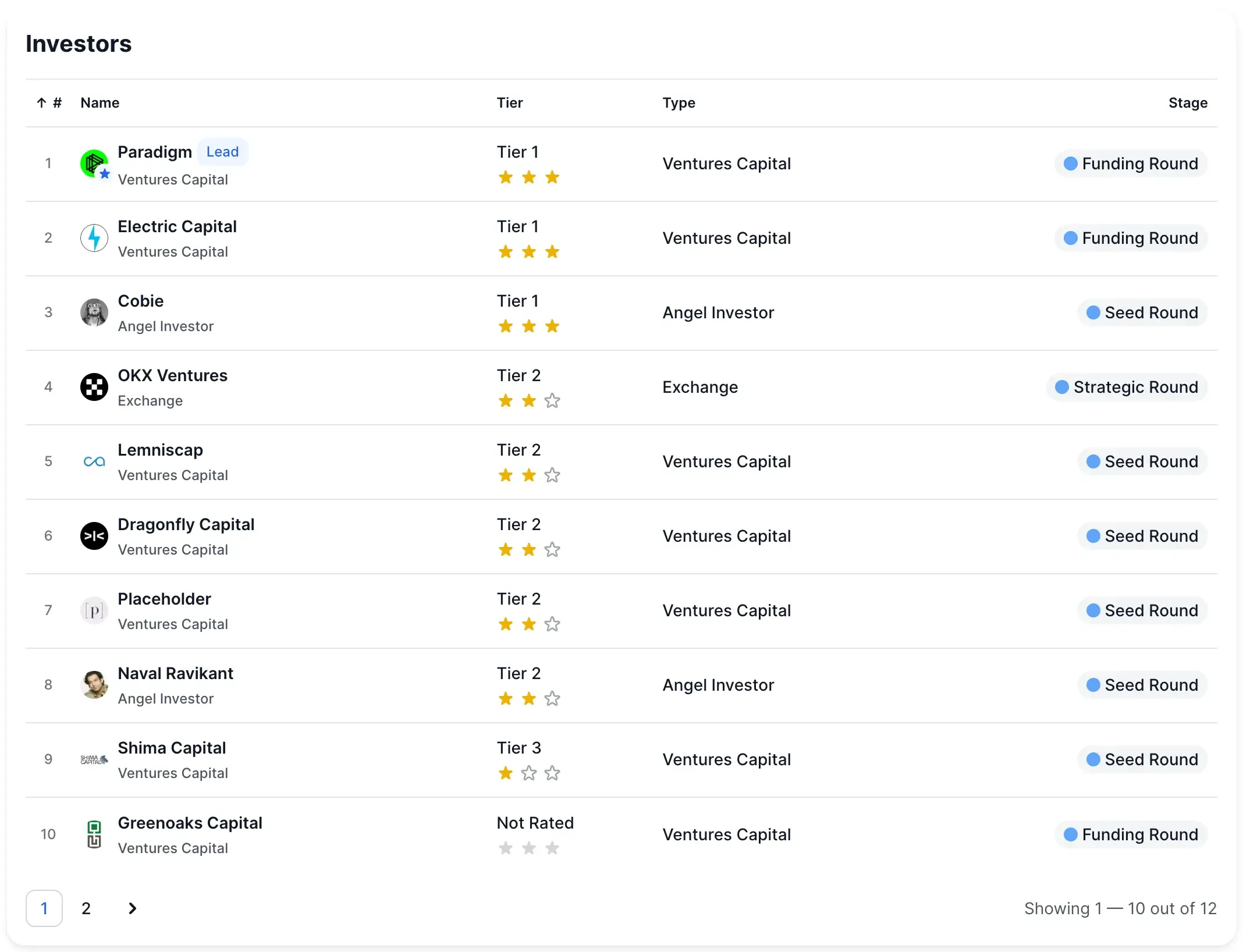

A new Layer-1 with big ambitions: EVM compatibility and a promised throughput of 10,000 TPS. The startup raised $225 million from leading funds (Paradigm, a16z, Coinbase Ventures, and others). The scale of this investment practically guarantees the launch of its own token.

The mainnet hasn’t gone live yet, but the Monad testnet has been active since February 2025. Participants are incentivized to trade test tokens, deploy smart contracts, and even play simple games on the testnet to earn “points.”

As anticipation builds, crypto researcher @Va7ss summed up the sentiment: “When people complain that good airdrops are over — they clearly haven’t seen the Monad/CoinMarketCap listing leak.”

While no official airdrop has been confirmed, the community is convinced that early interaction with Monad could lead to major rewards.

Abstract Chain

A full guide on interacting with Abstract is available here: latest Abstract activities.

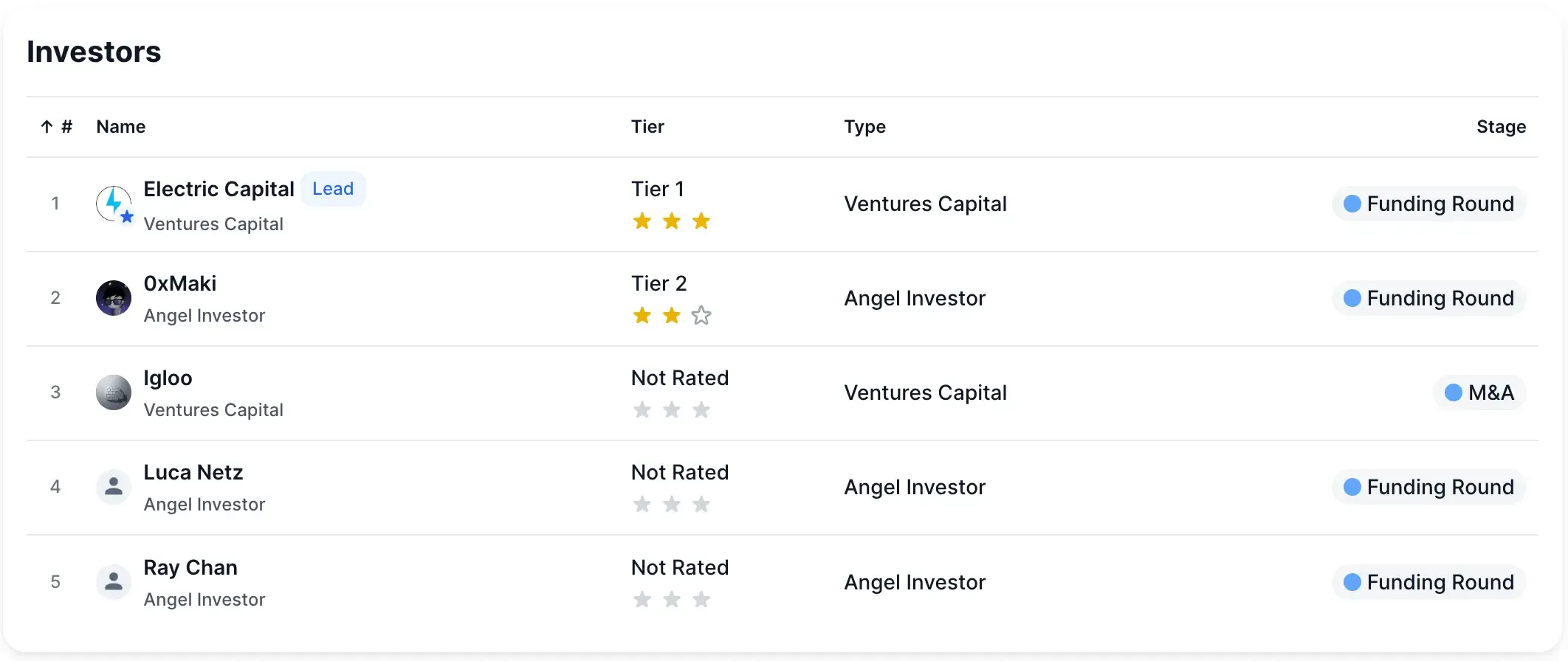

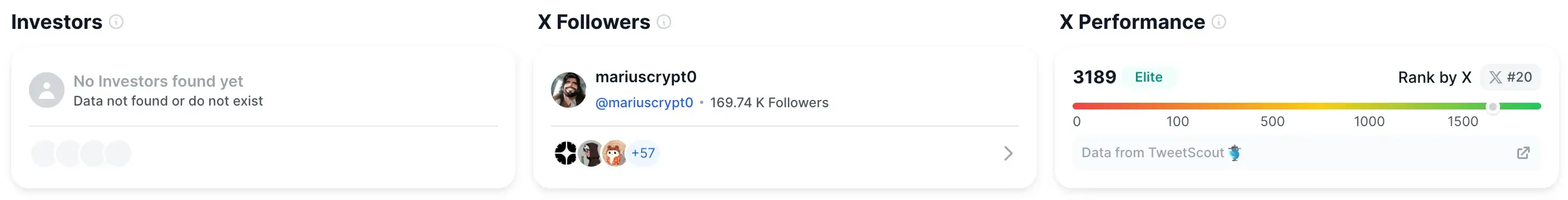

A Layer-2 by the team at Igloo (best known for NFT project Pudgy Penguins). The campaign began in January 2025. From the very first week, an XP system was introduced: users earn points and badges for using the Abstract Global Wallet, transferring tokens to the Abstract network, participating in the DAO, and more. An official airdrop hasn’t been announced yet, but the mechanics suggest the points may convert into tokens. Holding their memecoin PENGU even provides bonus XP. The community is actively engaging with Abstract, aware that their hard-earned points could influence token distribution.

Base

A full guide on interacting with Base is available here: latest Base activities.

A Layer-2 from Coinbase, launched in 2023. Now one of the largest blockchains (TVL > $3.6 billion), Base has been drawing users with persistent airdrop rumors. On forums and in Telegram chats, users speculate about possible eligibility criteria — for example, a high number of unique transactions, large trading volumes, participation in quests, etc.

However, experts remain skeptical: analysis by Bankless Times suggests that the likelihood of a Base airdrop in the near term is low — a prediction market poll estimated it at just ~10%. That said, if a drop does occur, it could be massive (the project could aim for an FDV of ~$10 billion, given Coinbase’s $62 billion market cap).

For now, the recommendation is to use Base as usual: bridge tokens, participate in official quests, and trade on DEXs — in case these actions are considered during a potential “surprise” snapshot.

Conclusion

Overall, many users are eagerly anticipating not just an “altseason,” but a full-blown airdrop season in 2025. The community is betting on high-investment projects with unique technology stacks. While the airdrop meta has evolved over time, the Telegram Mini Apps boom clearly demonstrated that money can come from unexpected places. The key is to stay proactive and committed. Developers are increasingly valuing thoughtful, high-quality interaction with their projects.

Don’t stop at basic trading — try writing a detailed thread on X (Twitter) about a platform. Such dedication to a project is often appreciated far more than a few empty weekly transactions.

To avoid missing your shot at a potential life-changer, stay closely tuned to official project channels and take part in as many activities as possible. As in the past, it’s the active and forward-thinking participants who “win” — luck alone no longer cuts it; your consistent contribution to the ecosystem is what truly matters.

You can find all potential airdrop campaigns on our website in the Activities section. Check it regularly — so you don’t miss that long-awaited life-changer: https://dropstab.com/activities