Analytics

ETH Strategy Reserve Targets

In 2025, public companies are racing to stockpile Ethereum, growing their combined holdings from $7.6B to a planned $30.4B—turning ETH into a core corporate reserve alongside Bitcoin.

Quick Overview

- Public companies currently have about $7.6B in ETH and aim to reach $30.4B—a 300% jump in 2025.

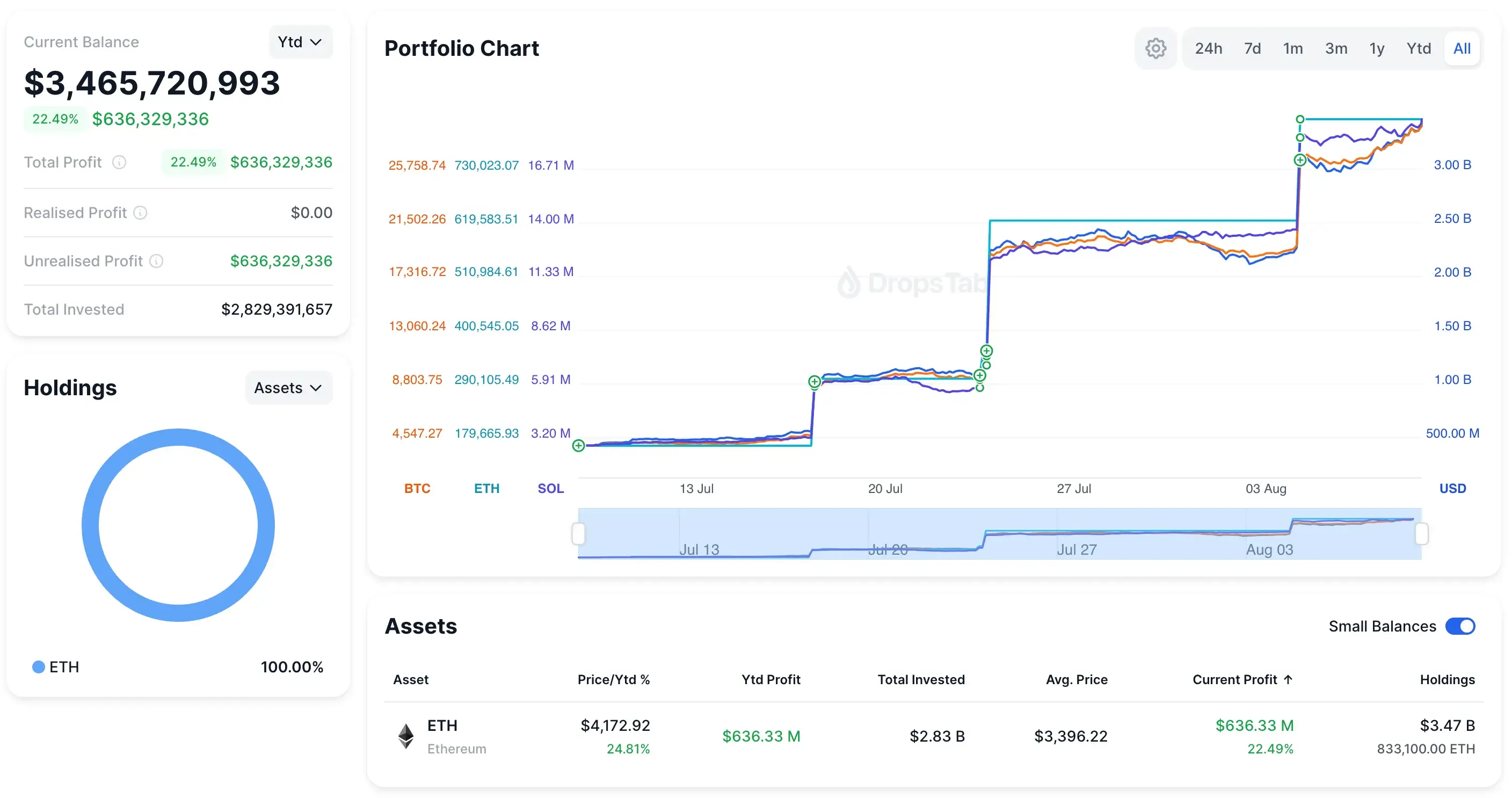

- BitMine Immersion has 833,137 ETH (~$2.9B) gathered in 35 days, targeting 5% of all ETH (~6M ETH, ~$22B), with backing from Bill Miller and Cathie Wood.

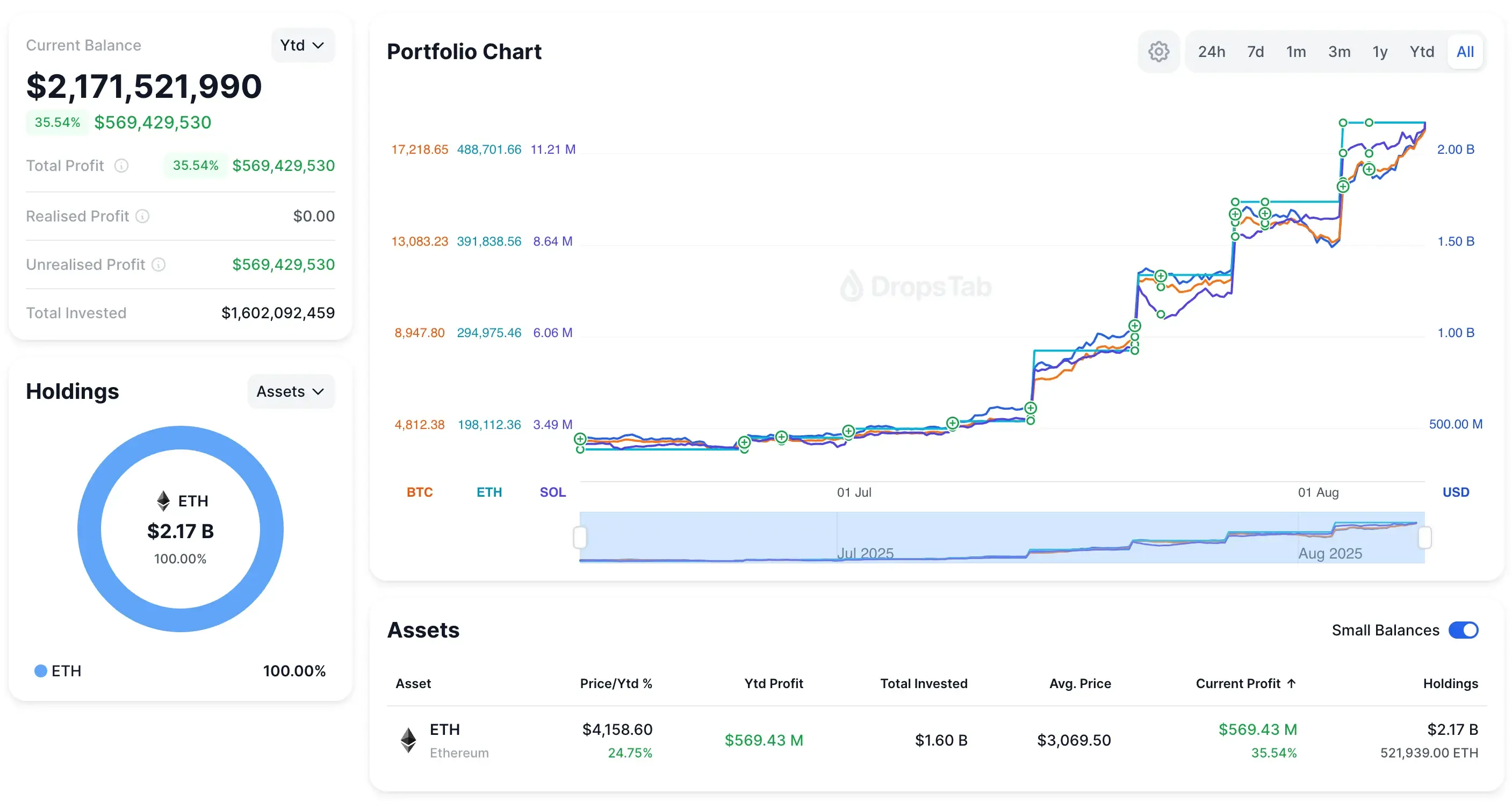

- SharpLink Gaming holds 521,939 ETH (~$1.9B); its stock is up 400% since shifting to ETH reserves. It may invest up to $5B over time.

- BTCS has 70,000 ETH ($275M) and plans to raise $2B to buy more. Bit Digital has 120,000+ ETH ($430M) after a $67M equity raise. Both use staking to earn yield.

- The Ether Machine (DYNX) will list with 400,000 ETH (~$1.6B), backed by Kraken and Pantera, offering 5%+ staking yield and strong institutional interest.

Ethereum Corporate Treasury Boom

More and more public companies are starting to see Ethereum (ETH) as a key asset to hold, similar to how Bitcoin was treated in the past. Major firms already own around $7.6 billion in ETH and plan to boost that to $30.4 billion—about three times more than they have now.

This push comes after Ethereum’s price jumped roughly 40% in the last month, along with strong investment from big institutions and the chance to earn rewards through staking. ETH isn’t just being held for its value—it’s also used to earn income and support the growing world of decentralized finance.

The next sections break down the main companies and their approaches to building ETH reserves.

BitMine Immersion (BMNR)

By early August 2025, BitMine Immersion Technologies had built up 833,137 ETH (worth about $2.9 billion at ~$3,492 each) in just 35 days after starting its Ether treasury program on June 30.

Plan to Own 5% of Ethereum

The company’s goal, called the “alchemy of 5%,” is to own 5% of all Ethereum in circulation—around 6 million ETH, worth roughly $22 billion. This plan is supported by well-known investors like Bill Miller III, Cathie Wood, Founders Fund, Pantera, Kraken, DCG, and Galaxy Digital.

Chairman Thomas “Tom” Lee says the speed of their purchases set a record for how quickly they deployed capital.

BitMine’s stock (NYSE: BMNR) is now one of the most actively traded in the U.S. The company plans to stake its ETH in the future, turning it into a source of regular income. In short, BitMine is trying to do for Ethereum what MicroStrategy did for Bitcoin—become one of the biggest corporate holders and potentially influence the market.

BTCS Inc. (BTCS)

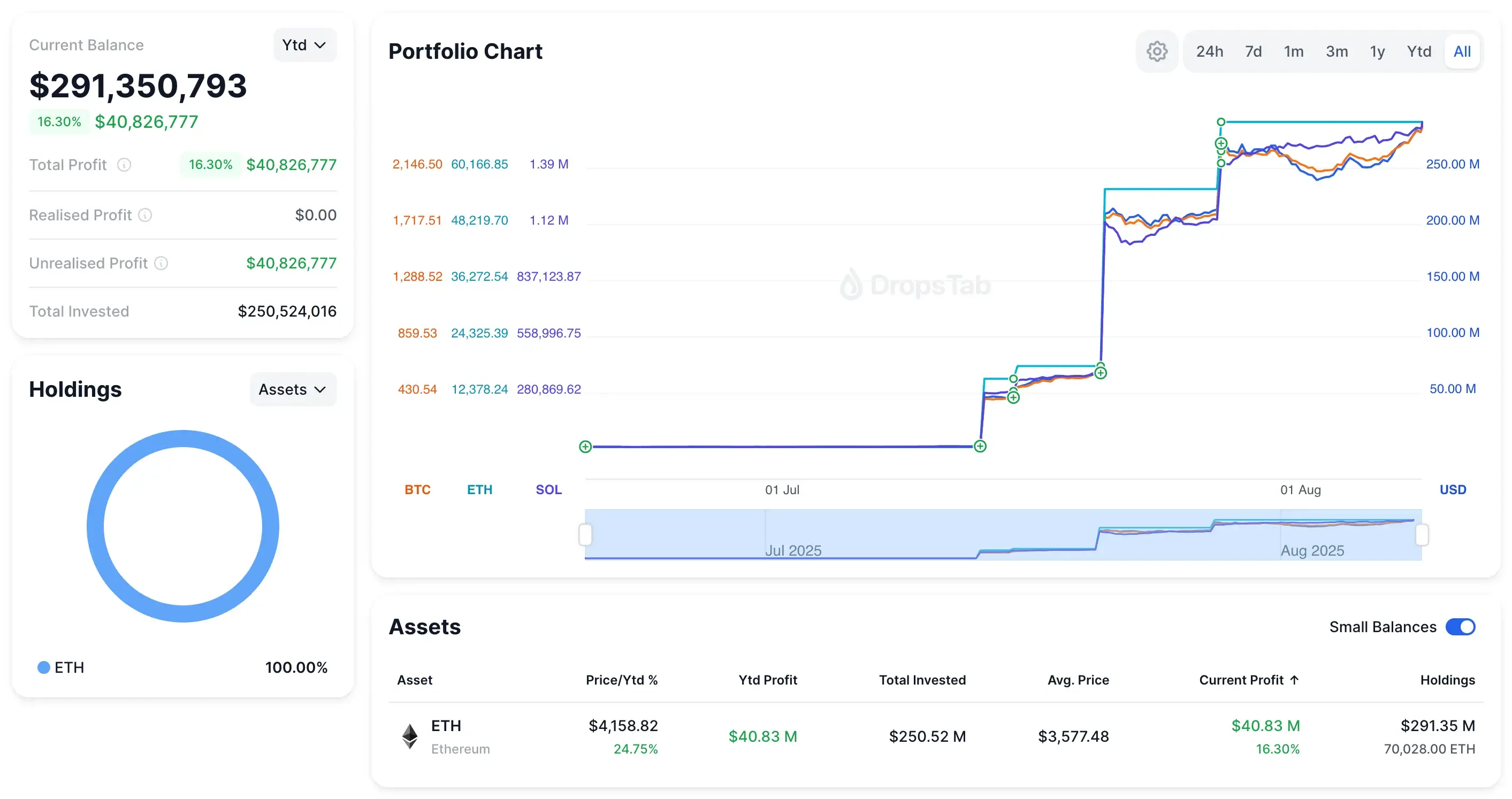

In 2025, BTCS Inc. shifted its focus to Ethereum. By late July, it owned 70,028 ETH (about $270–$275 million), up from 55,788 ETH (~$242 million) just two weeks earlier.

Ethereum-First Plan with $2B Growth Goal

To grow more, BTCS asked the SEC for permission to raise up to $2 billion by selling stock, with most of the money planned for buying more ETH. Earlier, it raised around $207 million through stock sales, convertible notes, and DeFi loans—calling this mix its “DeFi/TradFi Accretion Flywheel.”

BTCS doesn’t just hold ETH. It runs staking nodes (NodeOps) and helps build blocks (Builder+) to earn rewards and yield. This brings in income beyond ETH’s price gains. In 2025, its stock price has nearly doubled, and it now ranks among the top five public ETH holders.

The Ether Machine (DYNX/ETHM)

In Q4 2025, The Ether Machine will go public through a SPAC merger with Dynamix (NASDAQ: DYNX). It will start with 400,000 ETH (about $1.6 billion), making it one of the biggest public Ethereum holders.

400,000 ETH via SPAC Merger

The project is backed by Blockchain.com, Kraken, and Pantera Capital, with $800 million set aside to grow its ETH stash. The goal is to be the largest publicly traded company focused only on Ethereum.

Incoming chairman Andrew Keys says ETH’s staking yield (around 5%) gives it an edge over Bitcoin. He also points to Ethereum’s lead in tokenizing real-world assets and hosting most stablecoins, comparing its potential to major internet platforms.

When it starts trading as ETHM, the company wants to be the main stock choice for investors who want Ethereum exposure, showing the growing trend of bringing crypto into public markets.

Bit Digital (BTBT)

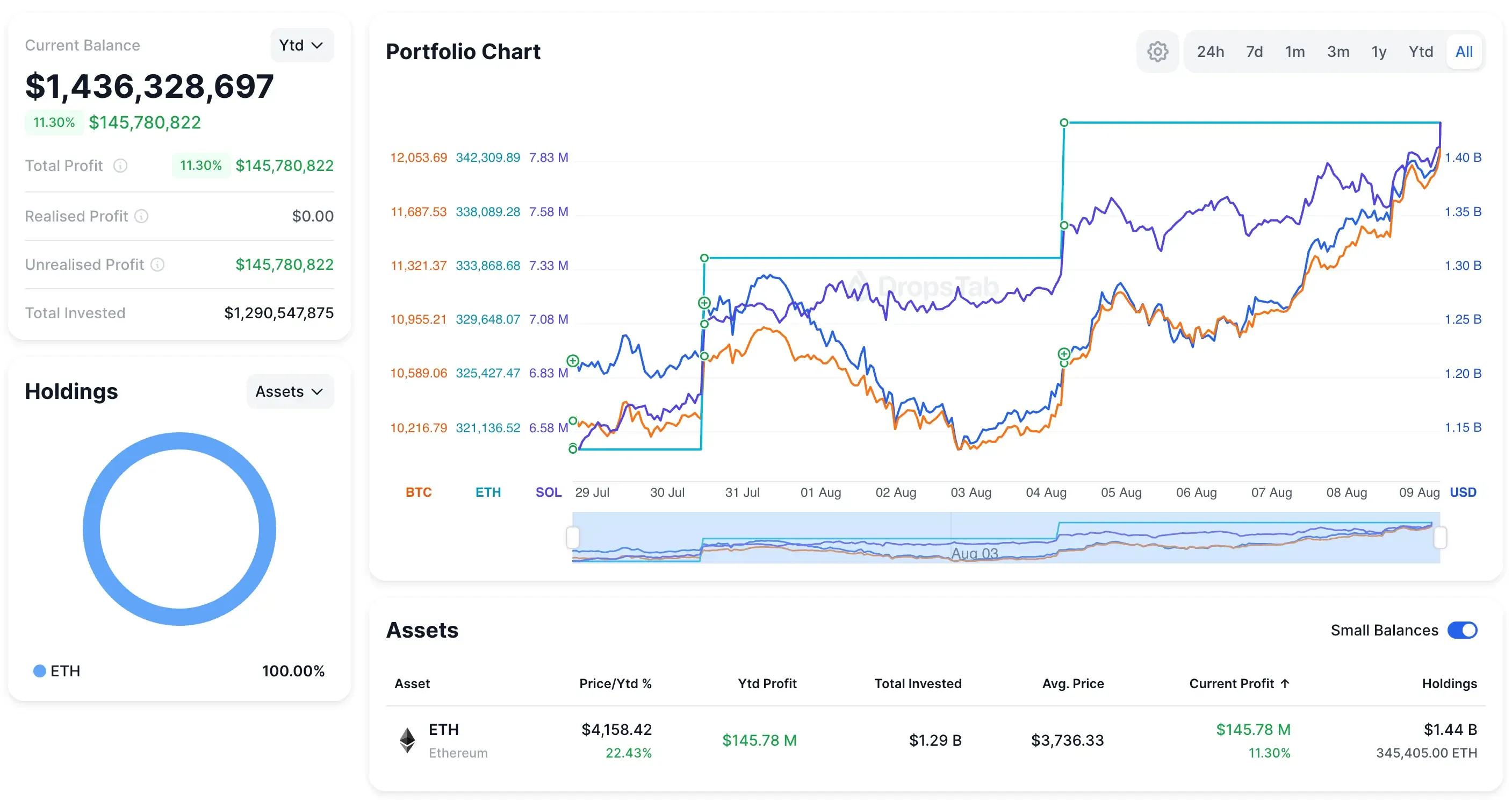

In 2025, Bit Digital, Inc. ended its Bitcoin mining operations and focused on Ethereum staking and treasury management. In July, it purchased 19,683 ETH using $67.3 million from a stock sale, raising its total holdings to over 120,000 ETH (~$432 million).

From Bitcoin Miner to 120k ETH Holder

The company’s stock jumped about 10% after the announcement before leveling off. With 120k ETH, Bit Digital is now one of the largest public Ethereum holders, alongside SharpLink and BTCS.

This change reflects a growing trend of mining companies moving into asset management. Since Ethereum’s proof-of-stake system can earn staking rewards, Bit Digital shifted its capital from mining hardware to ETH, gaining both yield and potential price growth. By late July, the company had fully transitioned into an Ethereum-focused asset holder.

Game Square (GAME)

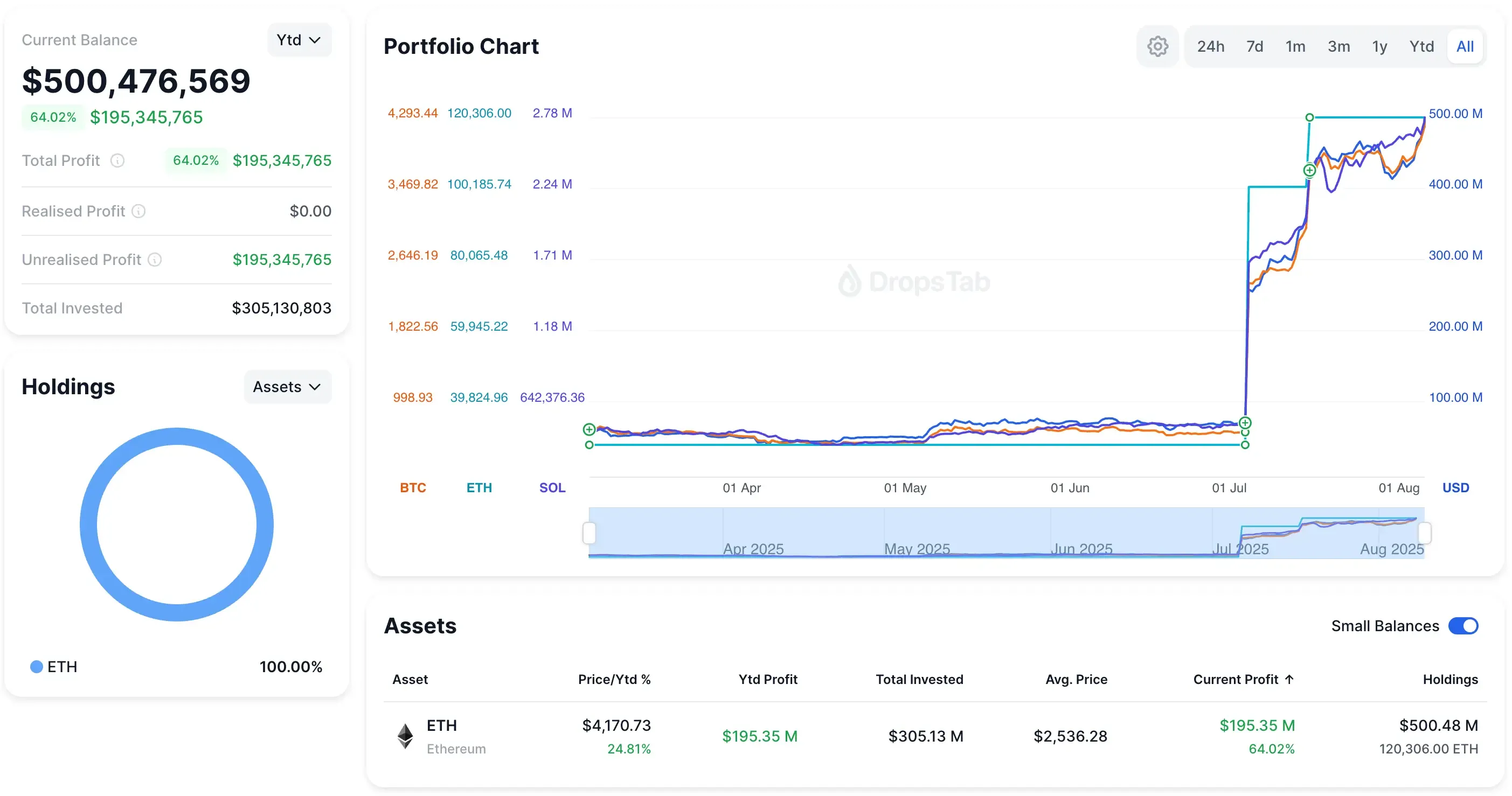

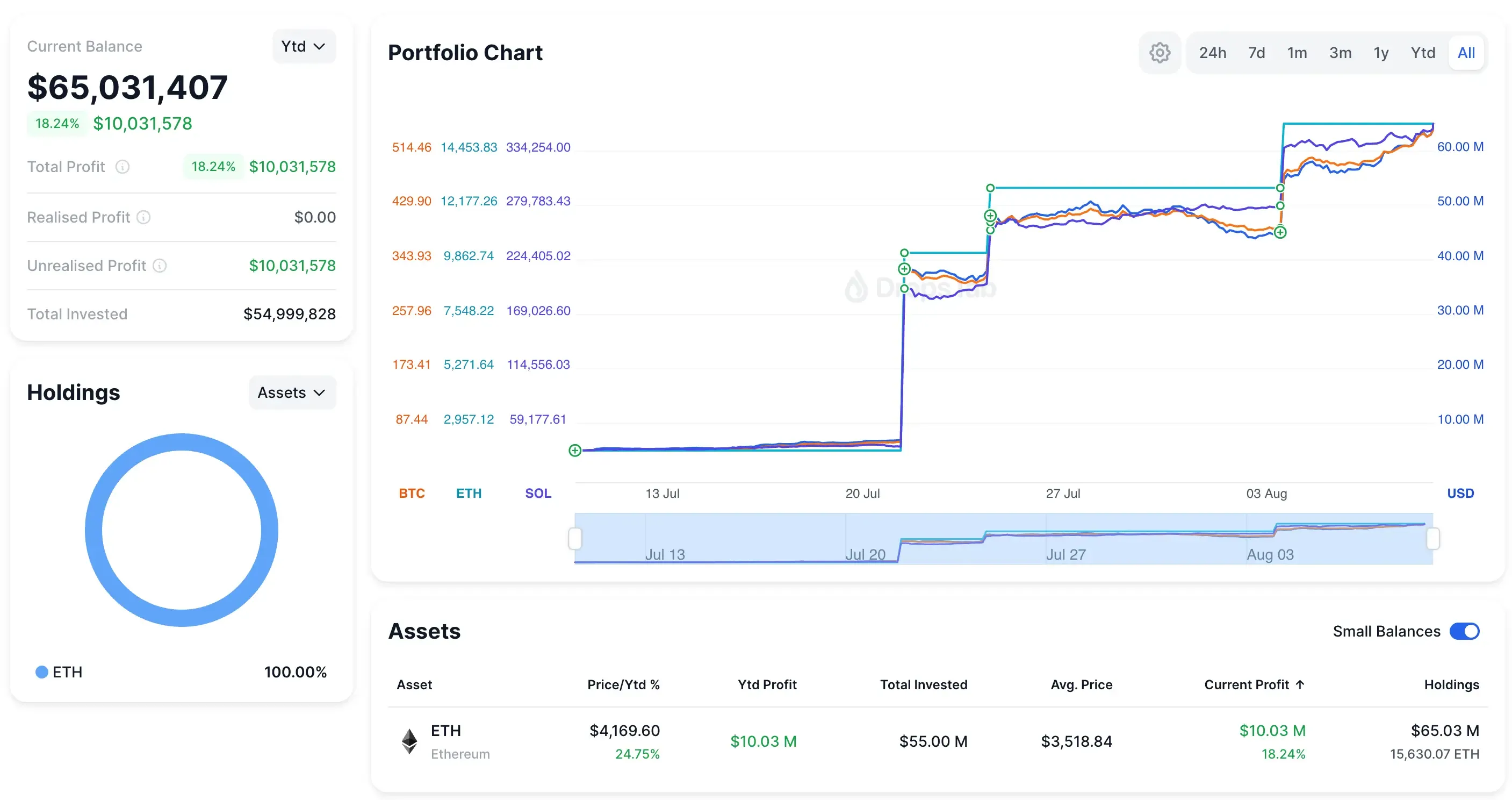

GameSquare Holdings, Inc. (NASDAQ: GAME), a digital media and gaming company, started building an Ethereum reserve in 2025. By August, it owned 15,630 ETH (about $60 million) and set aside up to $250 million for future ETH buys.

Small-Cap ETH Yield Strategy

Instead of just holding ETH, GameSquare works to earn extra income from it. With Dialectic’s on-chain platform, it invests in strategies aiming for 8%–14% yearly returns using DeFi and staking. Profits help fund a $5 million stock buyback.

CEO Justin Kenna says the plan is to make ETH a steady source of income, treating it like working capital.

Even as a smaller player, GameSquare shows how non-crypto companies in 2025 are using Ethereum for both potential price gains and ongoing earnings.

Why Are Companies Building ETH Reserves Now?

In 2025, Ethereum’s strong performance is drawing in more companies. ETH, the second-largest cryptocurrency, has climbed over 40% in the past month, with $9.5 billion flowing into Ethereum funds and ETFs—beating Bitcoin’s numbers.

Ethereum has advantages Bitcoin doesn’t. Thanks to proof-of-stake, holders can earn 4–6% a year by staking. Companies like GameSquare and BTCS use this to make their reserves generate income. ETH also powers most of DeFi, stablecoins, and tokenized assets, giving companies a role in major blockchain markets.

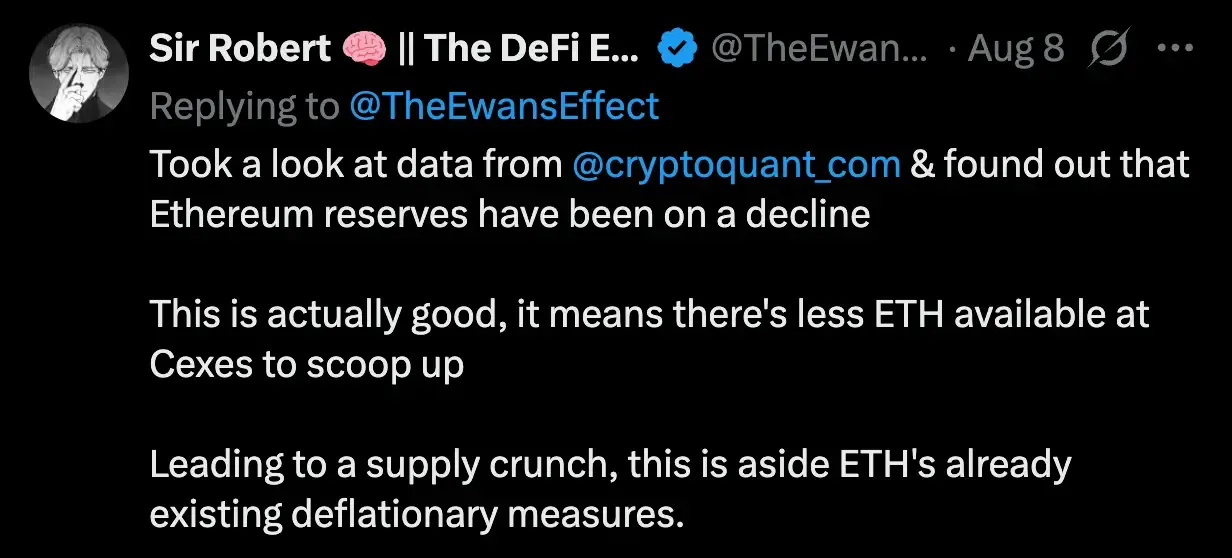

Beyond staking, Ethereum powers most of DeFi, stablecoins, and tokenized assets, giving holders access to key blockchain markets. On-chain data shows exchange ETH reserves falling.

Analyst @TheEwansEffect notes, “This is actually good, it means there's less ETH at CEXes… leading to a supply crunch, aside from ETH's deflationary measures.” Combined with EIP-1559’s burn, this supports Ethereum’s long-term scarcity.

Like MicroStrategy’s early move into Bitcoin, these firms are preparing for broader adoption. Backing from figures like Bill Miller and Joseph Lubin, along with friendlier U.S. regulations, makes Ethereum an appealing, income-producing asset with strong tech potential.

Impacts of a $30B Corporate Ethereum Drive

Plans to hold over $30 billion in ETH show a clear change in how Wall Street views crypto. If companies reach this goal, millions of ETH will be locked up long-term, lowering supply and making it more scarce—especially with EIP-1559 burning fees. Even today’s $7–8 billion in public firm holdings is about 2% of all ETH.

When multiple companies put part of their treasury into Ethereum, it strengthens ETH’s reputation, much like when big firms started buying Bitcoin. It also lets investors gain ETH exposure by buying stocks such as BitMine or SharpLink, not just the token itself.

There are still risks, like price swings, storage security, and regulations. Investors have mostly reacted positively so far, but future success will depend on earning yield safely and managing capital well. In 2025, Ethereum is becoming a main reserve asset for forward-thinking public companies—whether for supply control, staking rewards, or preparing for an ETF.

Explore which public companies are building the biggest Ethereum reserves: https://dropstab.com/portfolio/discover