Crypto

Probable: CLOB Prediction Market on BNB Chain

Probable.markets is a BNB Chain prediction platform built on CLOB trading, UMA-based settlement, and frictionless deposits and withdrawals.

Key Takeaways

- Probable uses a CLOB + UMA Optimistic Oracle, prioritizing price discovery over AMM curves.

- Deposits and withdrawals are frictionless, with any supported token and no platform withdrawal fees.

- Market and limit orders mirror traditional trading behavior, not swaps.

- The Points Program rewards PnL-weighted, real trading activity, not wash volume.

- The core thesis: as prediction markets scale, the cheapest and least annoying rails win.

How Probable Works

At a structural level, probable.markets makes a conservative — and intentional — choice. Trading runs on a Central Limit Order Book (CLOB), while outcomes are resolved via UMA’s Optimistic Oracle.

CLOBs are how traditional markets operate. Traders place bids and asks, size is visible at each price level, and prices form through real supply and demand. That’s very different from AMMs, which dominate DeFi but lose efficiency once trades get large or markets get crowded.

For prediction markets, that distinction matters quickly. Thin liquidity or distorted pricing doesn’t just hurt execution — it corrupts the signal. Probable’s order-book approach keeps probabilities anchored to actual flow, not curve math.

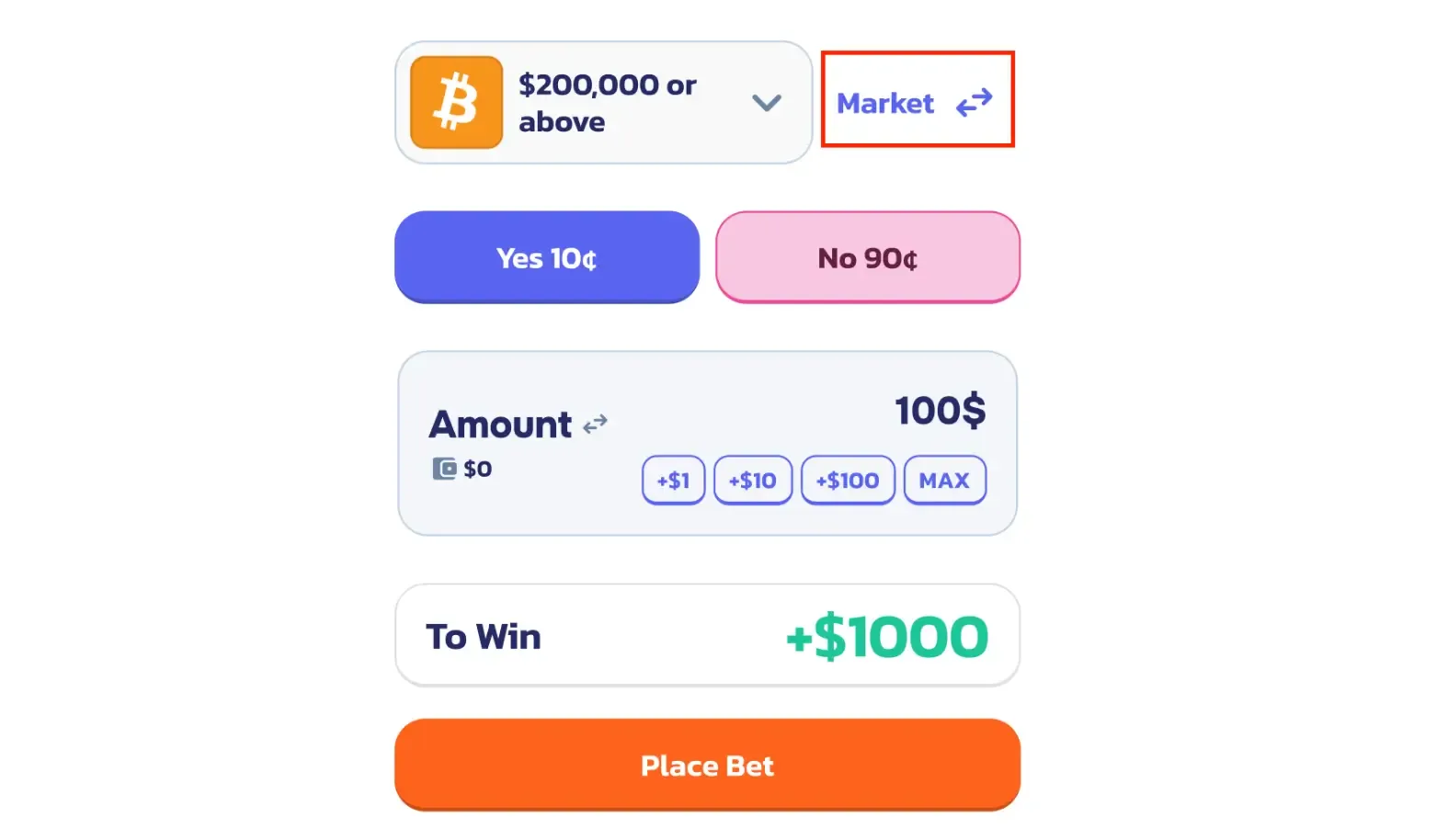

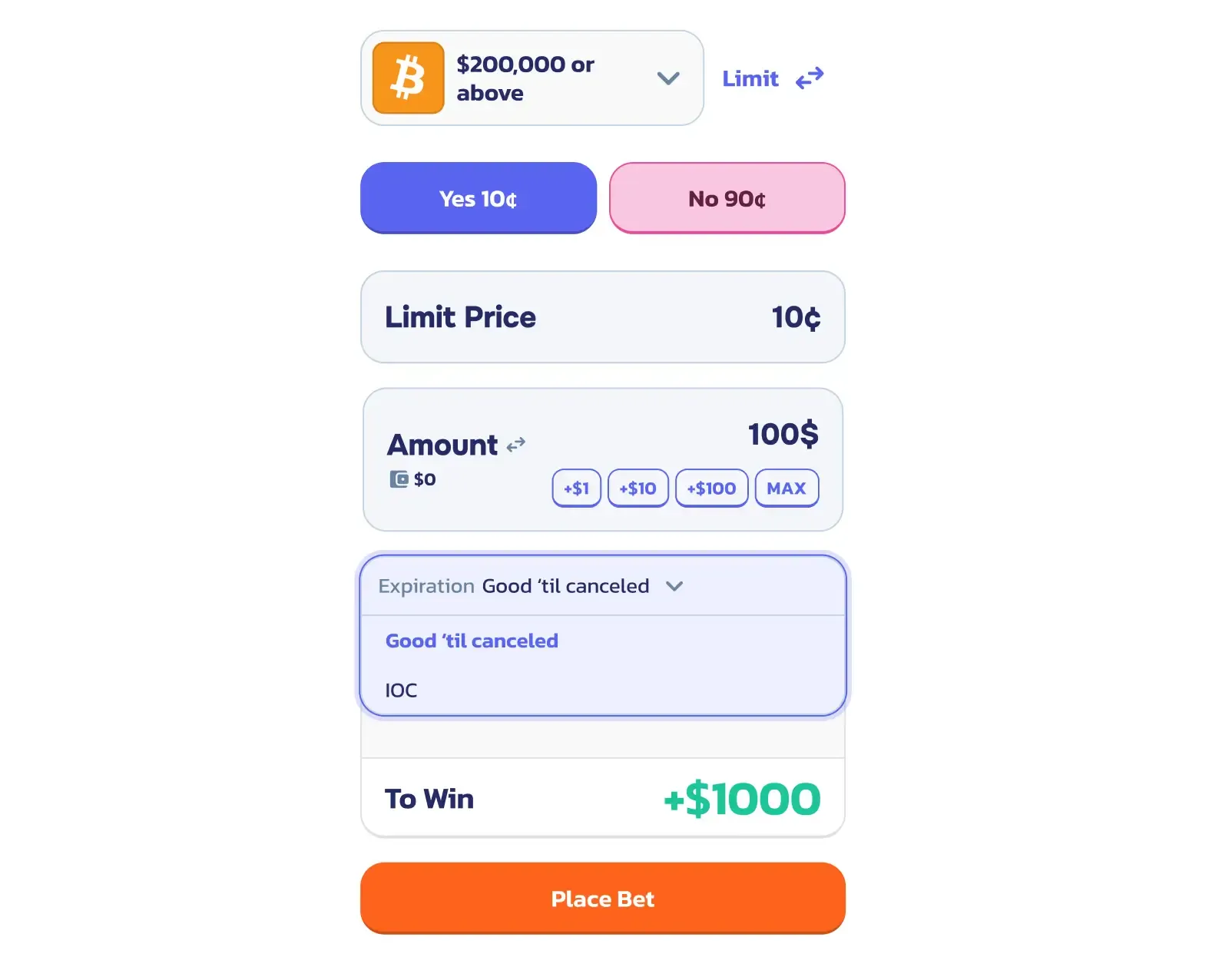

Market and limit orders

Because Probable uses a CLOB, traders interact with markets using familiar market and limit orders rather than AMM-style swaps.

Market orders execute immediately against the best available bids or asks, which can introduce slippage or partial fills in fast-moving or thin markets.

Limit orders allow traders to specify an exact price for YES or NO shares, sit in the book until matched, and may fill gradually over time. Both GTC (Good-Till-Canceled) and IOC (Immediate-or-Canceled) modes are supported, enabling either passive liquidity provision or aggressive execution.

This execution model reinforces Probable’s focus on price discovery rather than algorithmic pricing.

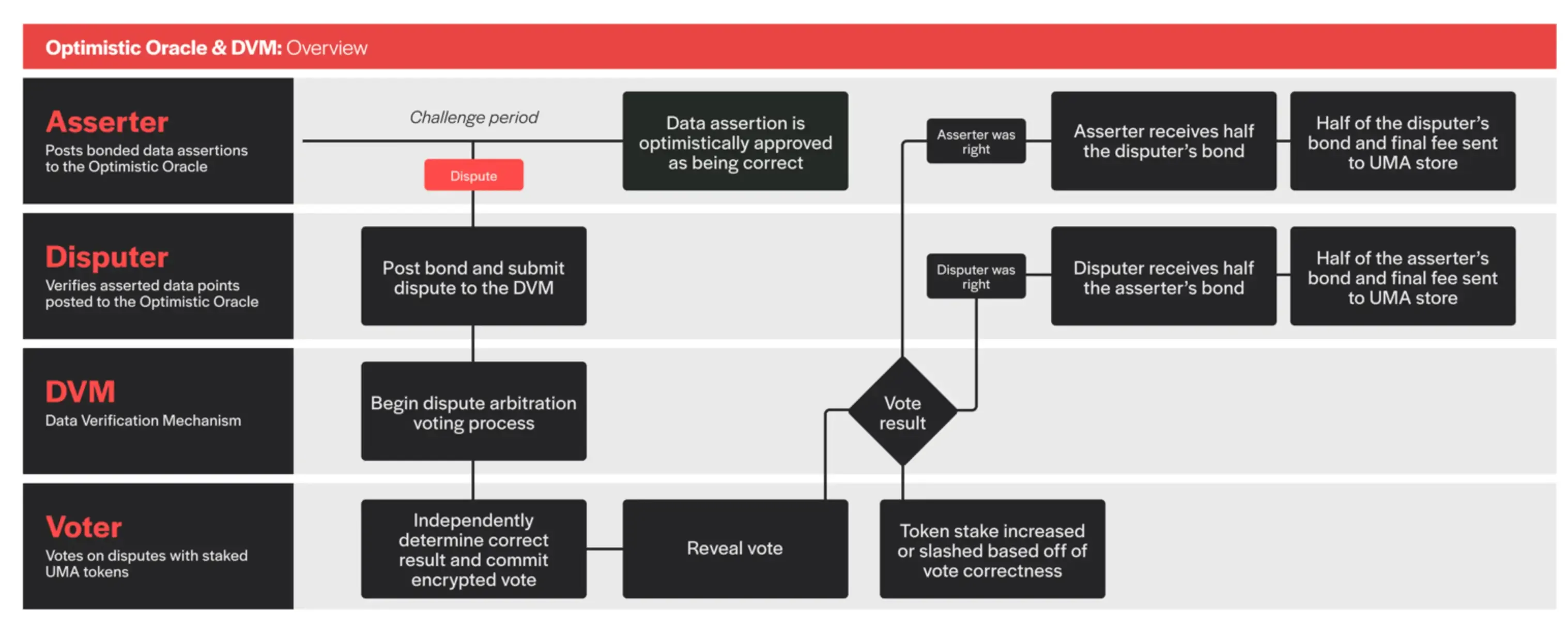

UMA’s Optimistic Oracle

For settlement, Probable relies on UMA Optimistic Oracle V3, which assumes outcomes are correct unless challenged.

In practice:

- an outcome is proposed with collateral,

- a short challenge window opens (often ~2 hours),

- if disputed, UMA token holders vote to resolve it, and the losing side pays.

The trade-off is latency. Most markets settle quickly, but disputed or subjective events can take days to resolve — a cost users accept in exchange for decentralized, dispute-driven outcomes.

Deposits and capital flow

Probable’s most important UX feature isn’t the oracle or the order book — it’s the deposit flow.

Users don’t need the “right” stablecoin on the “right” chain. Any BNB Chain token can be deposited, routed through PancakeSwap V3, converted to USDT, and settled in a single transaction.

No bridges. No waiting. No chance to mess it up.

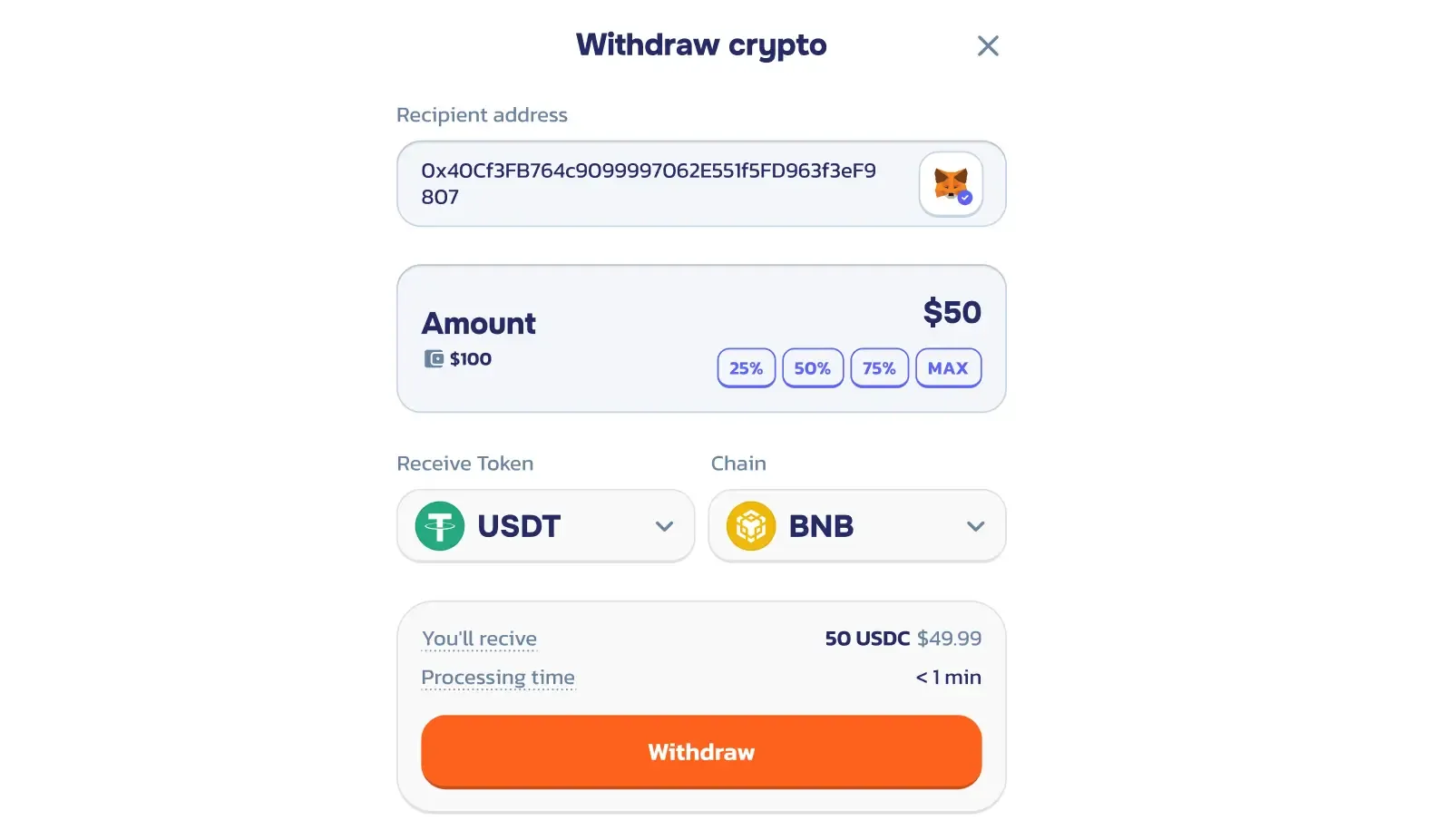

The same friction-minimizing logic applies on the way out. Funds can be withdrawn to the connected wallet or any external address, in any supported token and chain, with no withdrawal fees charged by Probable. Withdrawals typically settle within a minute, reinforcing the platform’s positioning as a low-friction trading rail rather than a sticky, captive system.

By contrast, Polymarket users holding USDC on Ethereum must bridge to Polygon first, adding fees, delay, and friction. On BNB Chain, costs drop to fractions of a cent and execution is immediate — a difference that matters for retail users, especially in Binance-heavy regions like Southeast Asia.

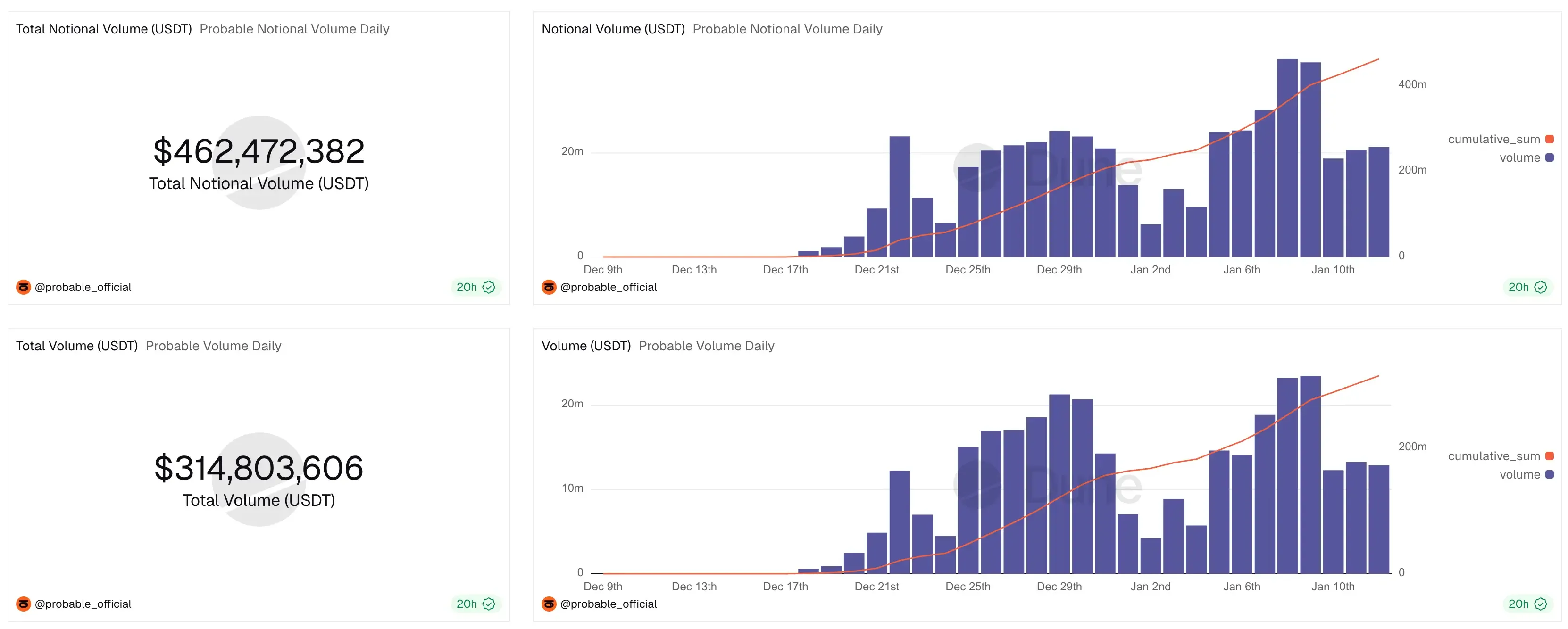

That friction advantage is already visible in early on-chain activity.

Probable Markets Comparing to Competitors

Opinion Labs takes a very different path. It runs on an AMM model, uses AI-curated outcome proposals with human oversight, and applies variable fees (0–2%). Early volume was heavily incentive-driven, suggesting an experimental, curated product rather than a retail on-ramp.

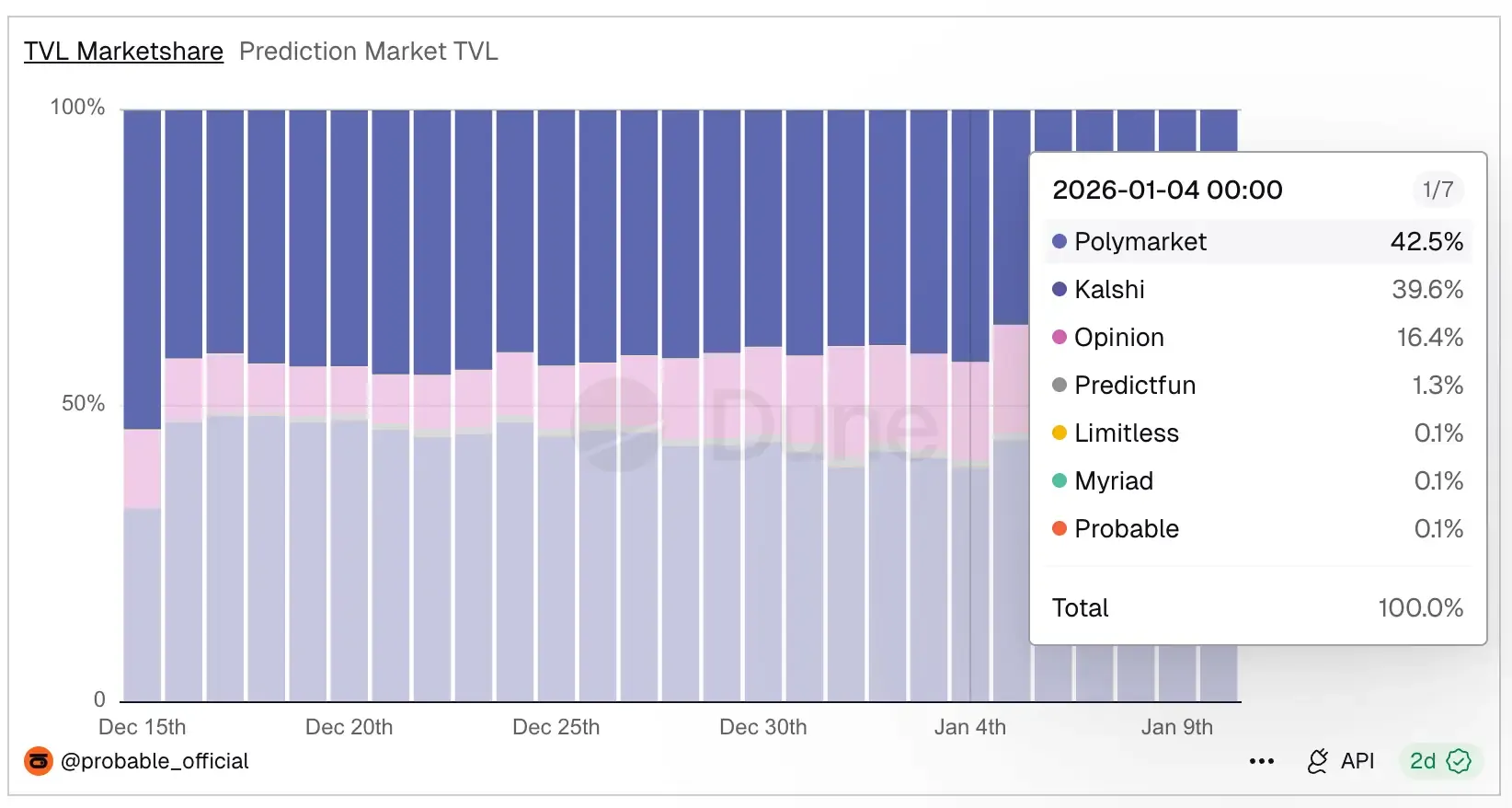

Polymarket remains the category benchmark, with more than $10B in lifetime volume. It defines scale, but its volume metrics have faced scrutiny due to event double-counting, and zero trading fees don’t remove deposit friction — bridges, relayers, and $0.20–$3+ entry costs still matter for smaller users. TVL data shows how concentrated the prediction market landscape still is — and how early newer venues remain.

This is where Probable separates itself. Built on BNB Chain, it strips out setup friction: cheap deposits, in-flow conversion, no bridges, no chain gymnastics. Combined with CLOB trading and zero fees at launch, Probable targets a simple niche — retail users who just want to place a trade without overhead.

YZi Labs backs Probable alongside PancakeSwap, providing capital and launch-stage distribution. That backing improves credibility and adoption odds by plugging Probable directly into existing BNB Chain liquidity, users, and DeFi surfaces.

That positioning wasn’t subtle. It was publicly acknowledged by CZ when Probable was announced as part of the emerging BNB Chain prediction market stack:

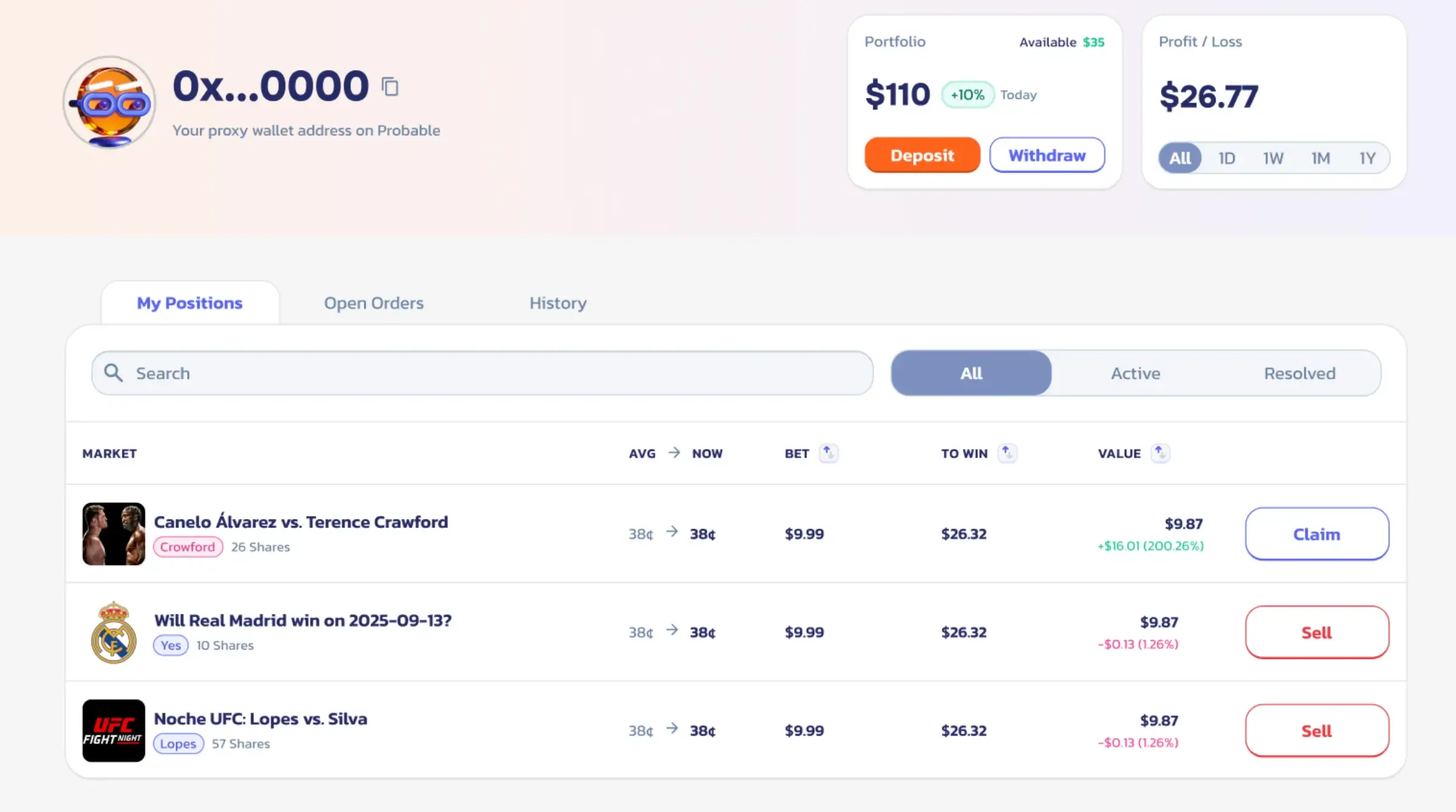

Probable.markets Airdrop Strategy

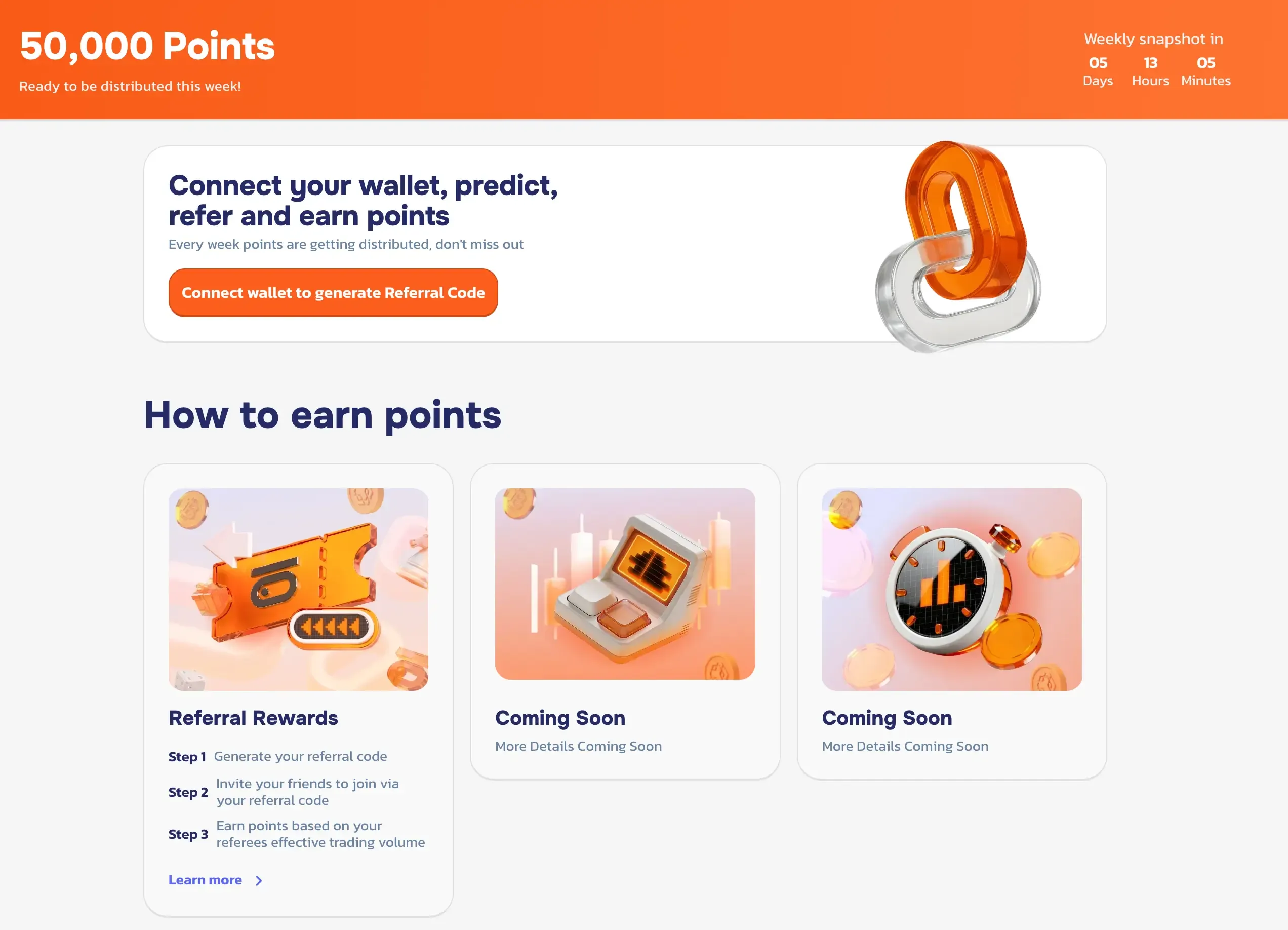

Probable’s incentives are structured around a Points Program designed to reward meaningful trading activity, not raw volume. Points are not tokens; they are accounting units that will later be used to determine future token airdrops, with distribution mechanics announced separately by the team.

Points are distributed in weekly epochs (7 days), with rewards credited every Monday at 00:00 UTC. Each week, a fixed pool of points is allocated across active reward programs, with weights set by the Probable team and adjustable between epochs. Early and consistent participation increases potential airdrop allocation.

Referral Program

The Referral Program is the first live component of the Points Program (launching 12/01/26). It rewards both referrers and new users, while explicitly discouraging wash trading.

- Eligibility (Referrer): Users unlock referral codes after reaching >$100 lifetime trading volume.

- Referrer rewards: Earn 10% of the points generated by referees, distributed weekly per epoch.

- Referee rewards: Earn 100% of the points generated by their own activity.

- PnL-weighted volume: Points are calculated using PnL-weighted trading volume. Volume with near-zero PnL (typical of wash trades) earns minimal points. Whether PnL is positive or negative doesn’t matter — only that it reflects real trading outcomes.

This design shifts incentives away from spam volume and toward genuine, sustained trading behaviour across epochs.

Delta-neutral activity

Delta-neutral positioning can be used to reduce directional exposure while remaining active on the platform, but it is not arbitrage. Liquidity, settlement timing, and pricing differences still introduce risk. The strategy mainly supports consistent participation across epochs, with any mispricing capture treated as secondary.

- Liquidity risk: thin books increase slippage

- Probability drift: prices can diverge during news shocks

- Time risk: short-dated markets limit adjustment

- Settlement risk: one market may void while another resolves

- Platform risk: pauses or disputes can lock capital

Probable’s airdrop design rewards real trading and real outcomes, not mechanical farming. Points are upside, not income — and treating them otherwise usually ends badly.

Conclusion

Yes — Probable is the favorite, but only within the BNB Chain stack.

The bet isn’t that it outperforms every prediction market. The bet is that friction wins. When prediction markets stop being a novelty and start being used for hedging and positioning, users drift toward whatever is cheapest, fastest, and least annoying. That’s exactly what Probable is built for.

If Probable becomes the place Binance-native users naturally trade — even after incentives fade — it succeeds. And if that happens, the real winner is BNB Chain, which captures the flow no matter which front end users choose.