Crypto

The State of the BNB Ecosystem in 2025

BNB Chain surges in 2025 with record users, $17B DeFi TVL, and a $1,330 BNB price. Fueled by memecoin mania and AI-driven upgrades, it’s evolving from an exchange token into core Web3 infrastructure.

Quick Overview

- BNB price record: $1,330 with market cap at $184 B, now the #3 crypto asset.

- Massive activity: 58 M monthly users, 12–17 M daily transactions, $17.1 B TVL.

- DeFi & memecoins: PancakeSwap and Four.meme drive liquidity and user growth.

- Scalability upgrades: “Yellow Season” roadmap targets 20,000 TPS by 2026.

- Outlook: Institutional adoption rising; BNB poised to remain a top-three blockchain.

BNB Token Performance

BNB’s climb to $1,330 on October 7, 2025 wasn’t just another rally — it marked the token’s leap into heavyweight status. A 50% monthly gain pushed its market cap to $184 billion, overtaking XRP and securing that coveted #3 spot behind Bitcoin and Ethereum.

Daily trading volume now averages over $3 billion, powered by both organic growth and the speculative rush from BNB Chain’s memecoin boom. Thousands of small trades, endless hype — but also genuine liquidity flow through the network.

Underneath all that volatility runs a quiet mechanism of control: Binance’s quarterly burns, which erase more than 1.2% of total supply each year. With 139.18 million BNB still circulating, each burn tightens supply — a slow, mechanical rhythm that reinforces long-term scarcity.

Network Growth and DeFi Expansion

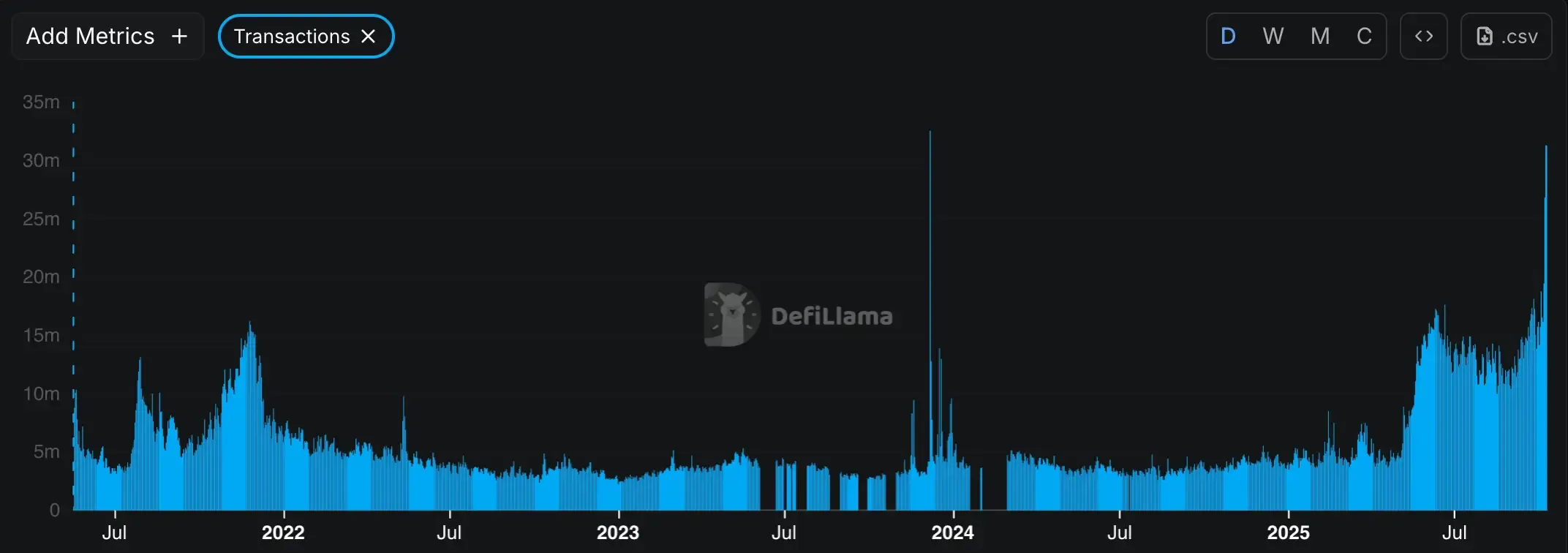

BNB Chain is moving at a scale few expected. In September 2025, the network crossed 58 million monthly active addresses, overtaking Solana’s 38.3 million for the first time since 2024. Every day, more than 2.37 million users transact on-chain, pushing through 12 to 17 million daily transactions. It’s not hype — it’s sustained throughput, and it shows.

Gas fees have collapsed to 0.05 Gwei, a 98 percent drop since April 2024, while block times now average 0.75 seconds with 1.875-second finality. The system can technically handle 100 million daily transactions at full load — and it’s getting close. That combination of scale and efficiency has turned BNB Chain into crypto’s busiest highway.

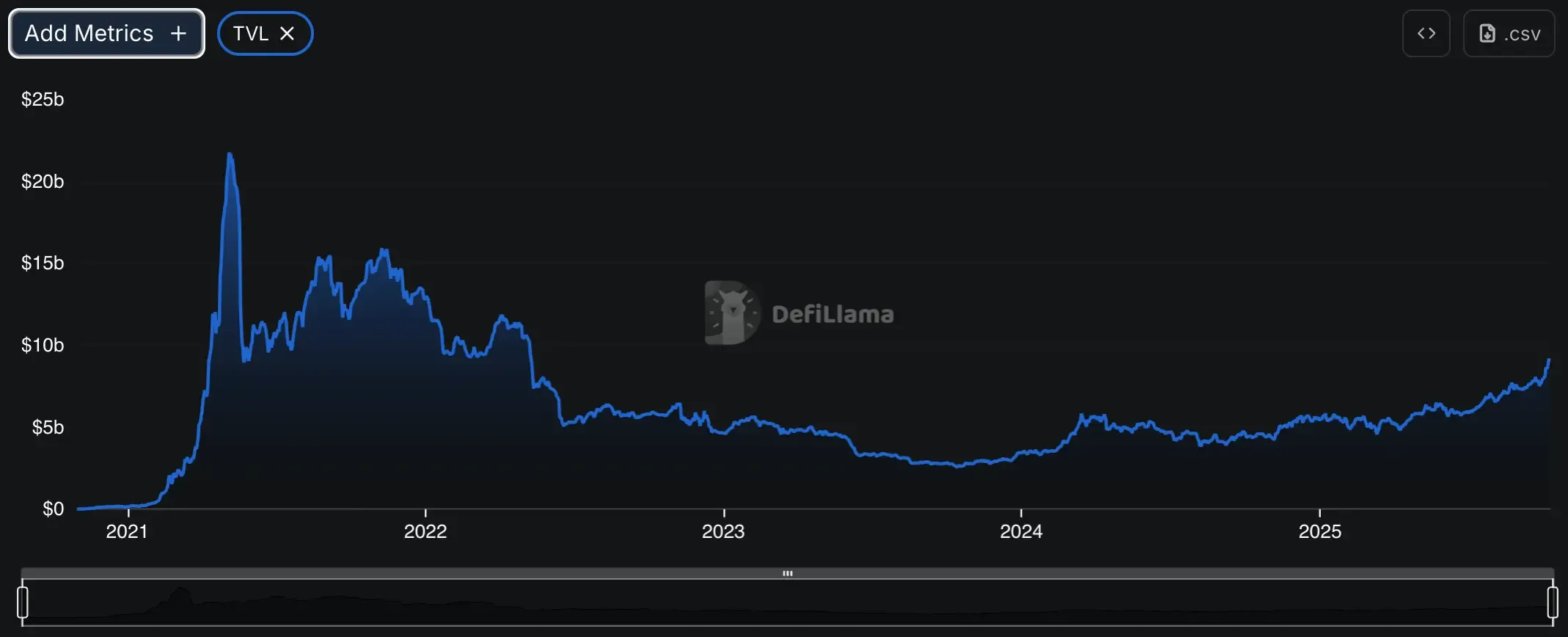

All that activity feeds directly into DeFi. Total value locked across the ecosystem has surged to $17.1 billion, led by PancakeSwap’s $2.5 billion TVL and a staggering $772 billion in Q3 2025 trading volume — a 42 percent jump from the previous quarter. Aster Protocol was the breakout story, its TVL soaring 570 percent in a month to $2.34 billion.

Market commentators within the ecosystem didn’t stay quiet. @0xTulipKing put it bluntly: “The BNB bull case is that you idiots bridged more than $5B to a ‘neo banking chain’ yielding 13% when you can get that just by holding PancakeSwap for a day.”

His sarcasm aside, the numbers tell a similar story — BNB’s capital rotation isn’t built on narrative; it’s grounded in liquidity flow and real returns.

Beyond those giants, Venus Core Pool remains BNB’s cornerstone lending protocol, anchoring an ecosystem of over 4,000 active dApps across DeFi, NFTs, and gaming. On the DEX side, BNB Chain recently hit $178 billion in 24-hour trading volume, eclipsing Solana’s $143 billion.

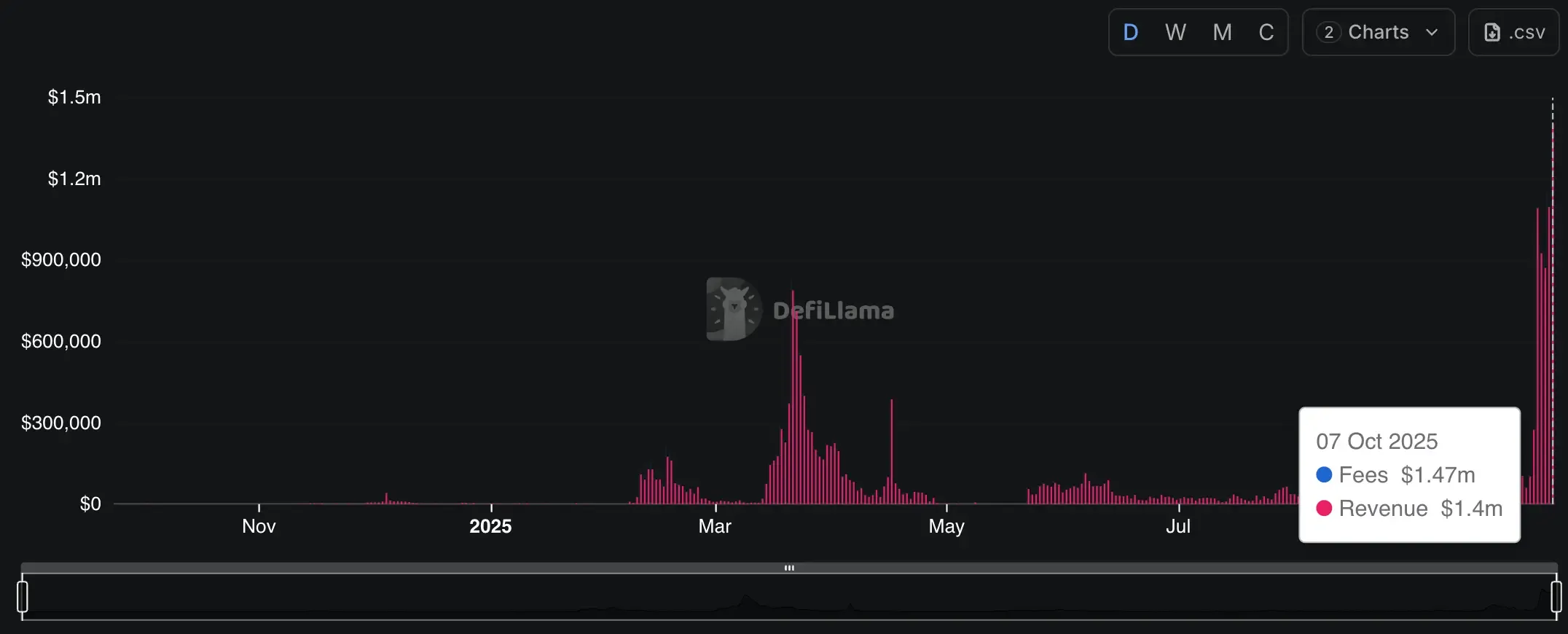

On-chain data supports the scale of that activity. Lookonchain highlighted that BNB Chain led all networks with $6.05B in DEX volume and $5.57M in fees over a single 24-hour period — ranking #1 among all chains, according to DeFiLlama.

Even perpetuals added $2.7 billion to the total, underscoring just how much liquidity now lives natively on BNB. This isn’t just a growth story — it’s proof of network maturity.

The Yellow Season

BNB Chain’s 2025 “Yellow Season” marks the next evolution — a push toward sub-second block times, gasless transactions, and an AI-first infrastructure layer. The network already supports 36 million daily transactions, yet only a third of that capacity is being used. Future upgrades are designed to change that. Future upgrades are designed to change that.

The opBNB Layer 2 roadmap targets 10,000 TPS with fees dropping to $0.001, while gas limits will expand from 100 million to 1 billion per block, unlocking a path toward 20,000 TPS by 2026. Security enhancements have followed the same pace: the Maxwell upgrade (June 2025) improved validator coordination, and the Lorentz Hard Fork (April 2025) reduced block times for latency-sensitive dApps.

Together, these technical strides signal something bigger — a network evolving from reactive scaling to proactive architecture. BNB Chain isn’t just chasing throughput anymore.

The Rise of Four.meme

If DeFi was BNB Chain’s proving ground, then memecoins became its ignition switch.

It started with CZ’s “BNB meme szn” post on October 7, a phrase that instantly caught fire across X. Within hours, the freshly minted “4” token rocketed to a $212 million market cap, creating 21 new millionaires and sparking a tidal wave of copycat launches. Over 100,000 new traders poured into the ecosystem, and around 70 percent of them remain in profit — a rarity in memecoin history.

On-chain data quickly confirmed the scale of those wins. Arkham Intelligence reported that one trader, 0xcE5, turned a $68.6K buy (6% of supply) into over $13.6 million, without selling a single token.

Outside traders quickly caught on. As @ashrobinqt observed, “what’s happening on BNB right now also happened on ETH in 2023 and on SOL in 2024.” — signaling that BNB had become the next frontier in the cross-chain memecoin rotation.

The engine behind it all? Four.meme — BNB Chain’s answer to Solana’s Pump.fun. The platform has turned token creation into a frictionless experience, minting 10,000+ tokens per day at peak and crossing 384,000 total launches with a 1.34% graduation rate (meaning only the strongest projects survive). On October 3, Four.meme generated over $1 million in fees, bringing its cumulative take above 26,300 BNB. At its height, it pulled in $1.4 million in 24-hour revenue, with a combined market cap of over $1 billion across its tokens.

Veteran market voices chimed in too. @0xSisyphus quipped, “BNB and CAKE probably continue to offer the best risk reward of the Binance crime coins…” With all the memecoins on Binance Smart Chain themselves… well, does anyone remember when CZ had a dog named Broccoli?”

It was tongue-in-cheek, but it captured the moment.

Meme Rush

For developers and traders alike, Four.meme feels less like a fad and more like an experiment in permissionless speculation — an institutional-grade launchpad with instant PancakeSwap integration, analytics dashboards, and rapid token deployment tools. Over 100,000 traders now use the platform, blurring the line between degens and professionals.

The success of Four.meme didn’t go unnoticed. On October 9, Binance Wallet unveiled Meme Rush — a co-developed platform with Four.meme for launching and trading memecoins directly inside the Binance Wallet app.

The platform introduces a tiered launch system (New Stage → Finalizing → Migrated) where verified Binance Wallet users can buy early-stage tokens before they migrate to DEXs. Projects that hit the $1M capitalization threshold become fully transferable and visible to all users.

With Meme Rush offering 4× trading multipliers for Binance Alpha points, it effectively turns the memecoin frenzy into a structured, reward-driven experience — merging retail energy with exchange-grade tooling.

But with that growth comes scrutiny. DeFiLlama’s removal of Aster’s perpetual-trading data, citing suspicious correlations with Binance volume, revived concerns about data integrity inside BNB’s ecosystem. The same skepticism extends to the memecoin surge itself, where many suspect insider coordination and algorithmic wallet clustering.

Still, the results speak for themselves. BNB Chain now commands 11.4 percent of global meme-trading volume, closing in on Ethereum’s 12 percent — an almost symbolic shift in ecosystem dominance. It’s a reminder that in crypto, cultural momentum can be as powerful as code. And right now, that momentum clearly lives on BNB.

Risks and Challenges

Despite its growth, BNB Chain still carries weighty risks. Regulation remains the biggest. Its deep ties to Binance keep it under scrutiny — the $4.3 billion DOJ settlement in 2023 proved that. Binance’s efforts to lift its compliance monitor show progress, but the link between the two entities remains inseparable.

Centralization is another pressure point. About half of all BNB sits in the top 10 wallets, and Binance controls much of the infrastructure. That allows fast decisions, yet it weakens the decentralization narrative that Ethereum and others lean on.

On the technical side, DeFiLlama’s delisting of Aster’s perpetual data raised questions about volume manipulation and data transparency. Combined with the speculative memecoin surge, it creates a volatile mix — great for activity, less so for stability.

In short, BNB’s next challenge isn’t scaling — it’s trust.

Outlook

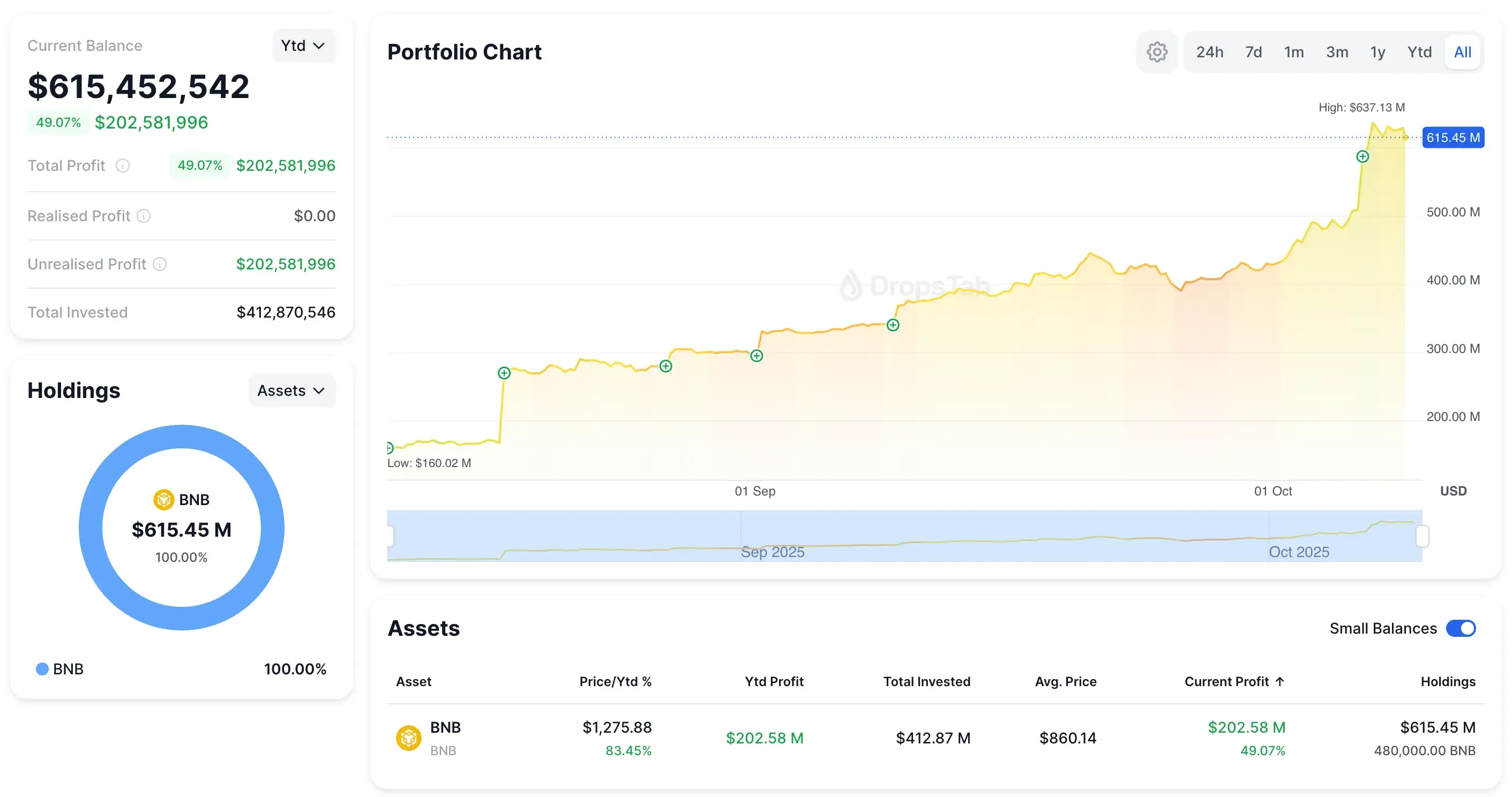

CEA Industries ($BNC) now holds 480,000 BNB (worth roughly $611 million) in its treasury, while Kazakhstan’s Alem Crypto Fund went as far as naming BNB its first national reserve asset.

Adding to that momentum, YZi Labs — the venture arm formerly known as Binance Labs — launched a $1 billion Builder Fund to support founders building within the BNB ecosystem. The program channels grants and early-stage capital into DeFi, AI, RWA, and DeSci projects through BNB Chain’s Most Valuable Builder (MVB) initiative, creating a direct bridge between funding and infrastructure.

Looking ahead, the roadmap feels ambitious but tangible. Block gas limits are set to jump to 1 billion, paving the way for 20,000 transactions per second by 2026. Planned upgrades — from native privacy modules to upgradable virtual machines — aim to give developers enterprise-grade flexibility without sacrificing speed.

At current throughput and fee levels, BNB Chain already rivals Solana and Ethereum’s Layer 2 ecosystems — an early signal that its scaling vision is already playing out in practice.

Of course, challenges remain. Regulatory pressure in key markets could flare up again, and Ethereum’s L2 expansion plus Solana’s institutional progress keep the competitive field sharp. But BNB Chain’s strength lies in its balance — raw throughput paired with mature infrastructure and a massive active user base.

If it can continue scaling without losing trust, sustain institutional confidence, and stay aligned with global compliance trends, BNB has a clear path to hold its top-three status — and perhaps cement itself as the backbone of a faster, more pragmatic Web3.