Crypto

Is Ethereum Still the Market Leader? Ecosystem Outlook for 2026

As of February 2026, Ethereum has abandoned its monolithic "World Computer" origins to become a specialized global settlement layer. This research evaluates the technical success of the Fusaka upgrade, the economic implications of the L2 era, and the critical risks posed by liquidity fragmentation and high-velocity competitors.

Key Points

- The Fusaka upgrade (Dec 2025) successfully integrated Peer Data Availability Sampling (PeerDAS), enabling the ecosystem to surpass 100,000 TPS by stabilizing L2 data costs.

- Ethereum’s "Ultrasound Money" deflationary narrative has paused, with the asset settling into a modest 0.74% annualized inflation rate as execution revenue migrates to rollups.

- Ethereum retains a decisive moat in the "Bank" vertical, securing 65% of RWA tokenization and 57% of the $165B stablecoin market.

- The Optimism Superchain now commands 58.5% of L2 volume, bolstered by a governance-driven 50% sequencer revenue buyback that aligns the OP token with network usage.

- The loss of synchronous composability and the friction of bridging between isolated Layer 2s remain the primary vulnerabilities against Solana’s monolithic user experience.

- 1. The Structural Transformation

- 2. Technical Deep Dive: Fusaka and the Data Availability Revolution

- 3. The Unbundling: B2B Settlement vs. B2C Execution

- 4. The Layer 2 Wars: Superchain vs. AggLayer

- 5. Institutional Moat: The Bank vs. The Casino

- 6. Structural Risks: The Fragmentation Threat

- 7. Future Outlook: The Road to Glamsterdam

The Structural Transformation

By February 2026, the Ethereum network has navigated a historical inflection point, successfully shedding its identity as a monolithic "World Computer" to emerge as the specialized "World Settlement Layer." This pivot—technically realized through the "Rollup-Centric Roadmap"—marks the transition from a general-purpose chain where all computation competes for the same block space, to a modular anchor securing a constellation of high-performance rollups.

Vitalik Buterin recently defined this as the primary theme for the year:

"2026 is the year we take back lost ground in computing self-sovereignty... Sending all your data to third party centralized services is unnecessary. We have the tools to do much less of that." — Vitalik Buterin

Yet, this technical maturation has birthed a "Valuation Paradox." While the network has achieved critical milestones like the Fusaka upgrade, the market price of ETH (~$2,000) reflects a consolidation phase, trapped between the sovereign store-of-value appeal of Bitcoin and the high-velocity execution of Solana. This price action underscores a deepening identity crisis: Ethereum is no longer the fastest chain, a title ceded to parallelized architectures, nor is it the primary hedge against monetary debasement.

Crucially, however, the "death of Ethereum" narrative collapses under the weight of fundamental data. The network is not shrinking; it is specializing. Mainnet daily active addresses reached a record 1.2 million in January 2026, and the Total Value Secured (TVS) across the rollup ecosystem has breached $40 billion. Rather than abandoning the Layer 1, users are finding a new equilibrium where Mainnet serves as the premium venue for high-value clearinghouse settlements, while the "B2C" (Business-to-Consumer) economy migrates entirely to Layer 2s.

Technical Deep Dive: Fusaka and the Data Availability Revolution

The activation of the Fusaka upgrade on December 3, 2025, represented the culmination of the "Surge" phase, specifically engineering a solution to the data availability bottlenecks that constrained the network throughout 2024. Fusaka’s success lies not in user-facing features, but in backend optimizations that fundamentally altered the economics of block space.

While the market has priced in the upgrade, the architectural shift was substantial. For readers needing a refresher on how PeerDAS differs from the previous 'Dencun' blob structure, this technical overview is essential viewing:

The Ethereum Foundation outlines the transition to Peer Data Availability Sampling (PeerDAS), the mechanism now responsible for stabilizing L2 data costs.

At the heart of this upgrade is Peer Data Availability Sampling (PeerDAS). Prior to Fusaka, validators were forced to download full data blobs to verify availability, creating a hardware bottleneck that capped throughput. PeerDAS introduced a paradigm shift by allowing validators to verify data by sampling small, random chunks rather than downloading the entire dataset. This mechanism reduced bandwidth requirements by up to 85%, enabling the network to safely increase blob limits without centralizing the validator set.

Complementing this was the introduction of Blob Parameter Only (BPO) forks. These "mini-forks" allow the network to dynamically adjust blob counts without the coordination overhead of a full hard fork. The execution of BPO1 in December 2025 and BPO2 in January 2026 incrementally raised blob targets to 14 per block, effectively slashing L2 data posting costs by nearly 60%. Consequently, the ecosystem’s combined throughput has stabilized above 100,000 TPS, proving that modular scaling can deliver sub-cent transaction fees without compromising the security of the settlement layer.

The Unbundling: B2B Settlement vs. B2C Execution

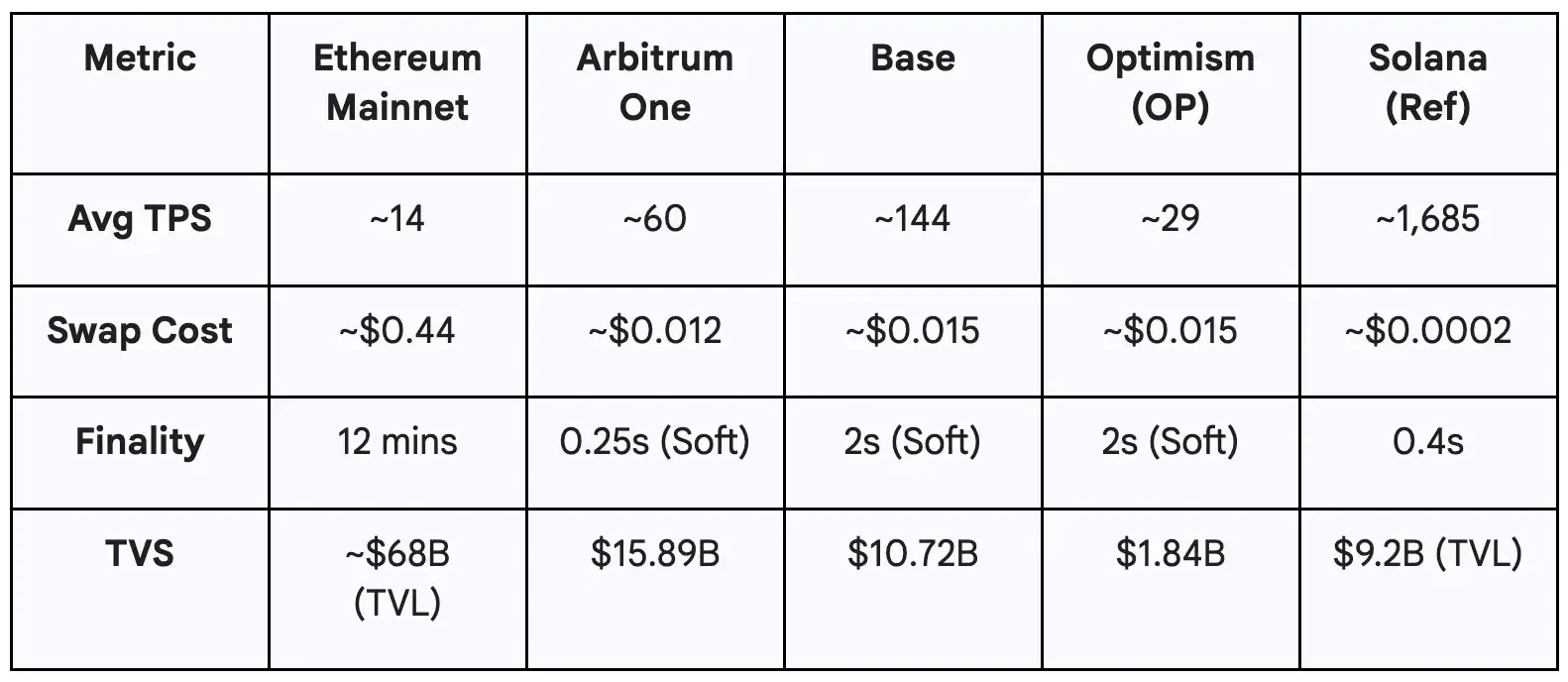

The most profound economic shift of 2026 is the "Unbundling of Ethereum." The Mainnet has effectively transitioned into a B2B (Business-to-Business) chain, servicing rollups and institutions, while Layer 2s act as the B2C interface for retail. This bifurcation explains the coexistence of record network usage and plummeting Mainnet gas fees, which now average just $0.44.

High-frequency retail activity—gaming, swaps, and arbitrage—has migrated off-chain, altering the "Ultrasound Money" revenue model. With fewer execution fees burned via EIP-1559, the ETH asset has entered a slightly inflationary state, currently running at 0.74% annualized inflation. The investment thesis has thus pivoted from pure scarcity to a "Yield-Bearing Commodity" play, where ETH serves as the pristine collateral for the restaking economy, generating a base yield of roughly 3.5%.

The Layer 2 Wars: Superchain vs. AggLayer

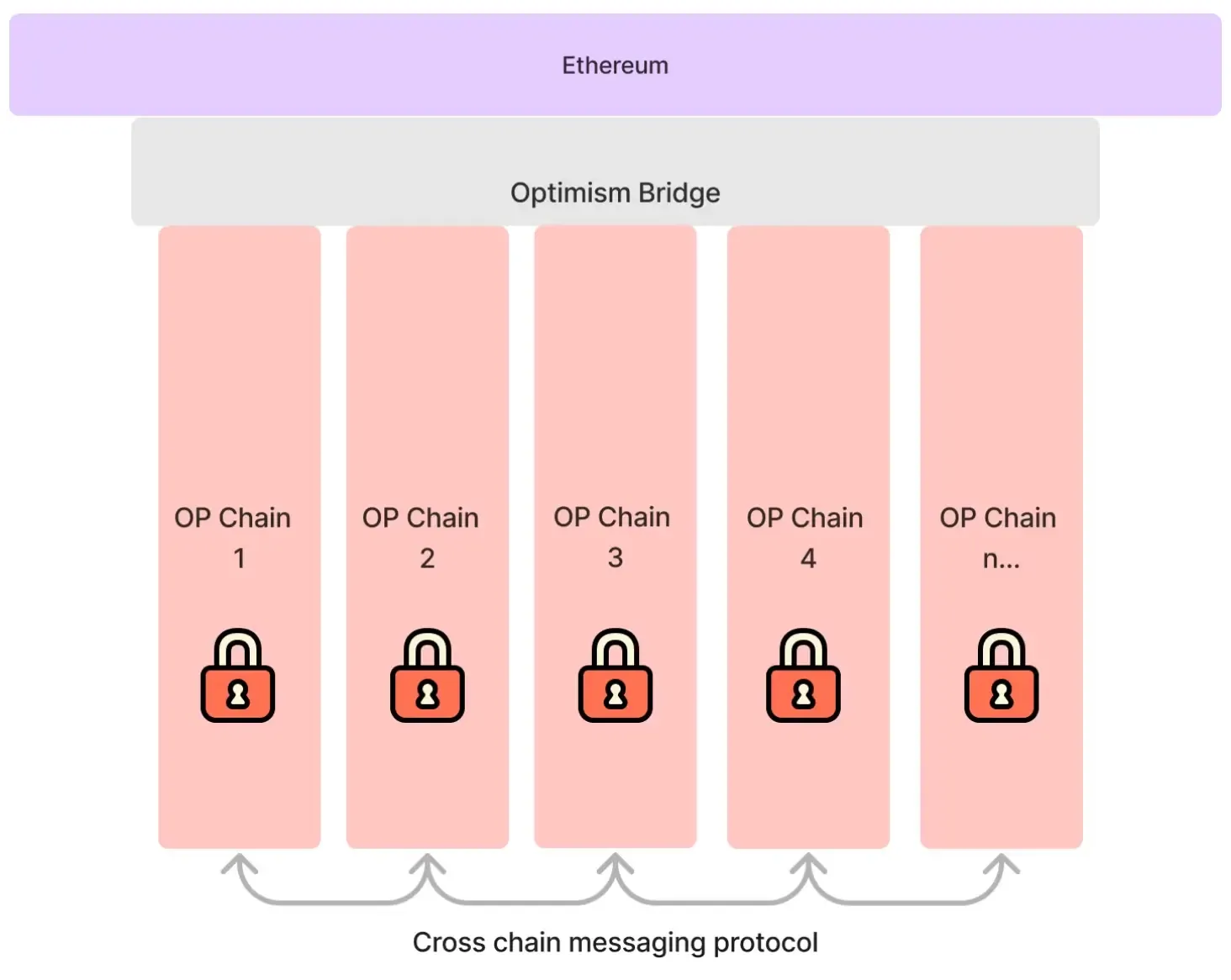

The Layer 2 landscape is consolidating rapidly, with power concentrating in two dominant architectures: the Optimism Superchain and the Polygon AggLayer.

The Optimism Superchain has emerged as the volume leader, capturing 58.5% of the market. This dominance is reinforced by a radical shift in tokenomics. In early 2026, the Optimism governance collective initiated a 50% sequencer revenue buyback program. Under this model, half of the net revenue generated by Superchain sequencers is used to purchase OP tokens from the open market, finally addressing the "governance-only" criticism that plagued L2 tokens in previous cycles.

Conversely, the Polygon AggLayer bet on cryptographic unification over economic alignment. By utilizing Zero-Knowledge (ZK) proofs to aggregate liquidity across diverse chains—including the Polygon PoS chain and specialized rollups—the AggLayer offers a stack-agnostic solution. While Optimism wins on volume, Polygon maintains a stronghold in payments and enterprise applications, processing over 1.4 billion stablecoin transactions in 2025.

BTW in early 2026, Vitalik Buterin explicitly declared the end of the "generic L2" era, arguing that as L1 scalability returns, L2s must offer unique utility beyond simple throughput:

"The original vision of L2s [as branded shards] no longer makes sense... L1 itself is scaling, fees are very low... We need a new path. What would I do today if I were an L2? Identify a value add other than 'scaling'. Examples: privacy, efficiency specialized around a particular application, or a totally different design for non-financial applications." — Vitalik Buterin

Institutional Moat: The Bank vs. The Casino

While Solana has successfully captured the "Casino" vertical of memecoin speculation and high-frequency trading, Ethereum has firmly secured the "Bank" vertical. The network’s primary defensive moat is its dominance in Real-World Assets (RWA) and stablecoins.

Ethereum Mainnet facilitates over 65% of all RWA tokenization, hosting institutional giants like BlackRock’s BUIDL fund. Furthermore, it secures 57% of the $165 billion stablecoin market. This data suggests a clear dichotomy in user psychology: while high-velocity "spending" (M1 money supply) may occur on Solana, the "savings and collateral" (M2/M3 money supply) remain anchored on Ethereum.

Structural Risks: The Fragmentation Threat

Despite these successes, the modular roadmap has introduced a critical vulnerability: Liquidity Fragmentation. The user experience of navigating isolated Layer 2s remains significantly inferior to the seamless, monolithic experience of Solana. The loss of "Synchronous Composability"—the ability to execute complex, atomic transactions across protocols in a single block—limits capital efficiency and increases friction for retail users.

Furthermore, the "Parasitic L2" debate has intensified. With L2s paying significantly less "rent" to Mainnet due to PeerDAS efficiencies, the economic value capture has shifted away from the L1 asset to L2 equity holders (e.g., Coinbase via Base). This imbalance has sparked governance discussions regarding a potential "Interlayer Tax" to ensure the security budget of the settlement layer remains sustainable.

Future Outlook: The Road to Glamsterdam

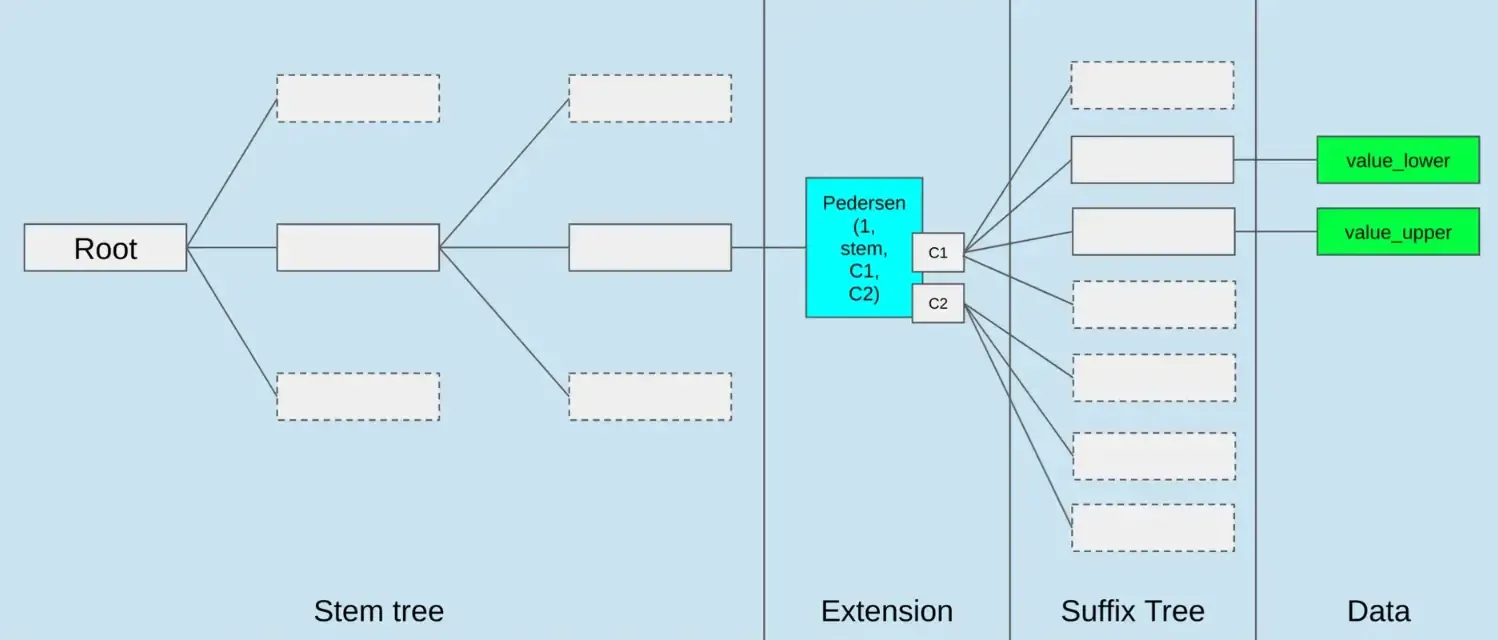

Looking ahead, the post-Fusaka roadmap focuses on the Glamsterdam upgrade, slated for mid-2026. Glamsterdam aims to solve "State Bloat" through the implementation of Verkle Trees.

Vitalik Buterin (Ethereum Co-Founder): "Verkle trees will enable stateless validator clients, allowing staking nodes to run with near-zero hard disk space and sync nearly instantly. This is the path to true decentralization."

This technology will enable "Stateless Clients," allowing nodes to verify the chain without storing the entire multi-terabyte state history. This creates the conditions for Ethereum to maintain decentralization even as it scales to global capacity, ensuring it remains a credible, neutral settlement layer for the digital economy.

While the technical specifics of 'Glamsterdam' can be dense, the architectural necessity of these upgrades is best articulated by Ethereum's co-founder. For a complete understanding of how these components fit into the multi-year vision, we recommend reviewing this primary source presentation:

Vitalik Buterin breaks down the transition from the Merge to the Verge, explaining why statelessness is non-negotiable for the network's long-term survival.