Crypto

Plasma Raises $1B on Sonar Platform

Plasma, the first project launched on Cobie’s Sonar platform, stunned the crypto world by raising $1B in days. With high-speed deposits, major backers, and a stablecoin-first blockchain design, Plasma is shaping up to be a serious player in DeFi.

TL;DR

- Plasma raised $1B in stablecoin deposits in under 30 minutes on Cobie’s Sonar platform.

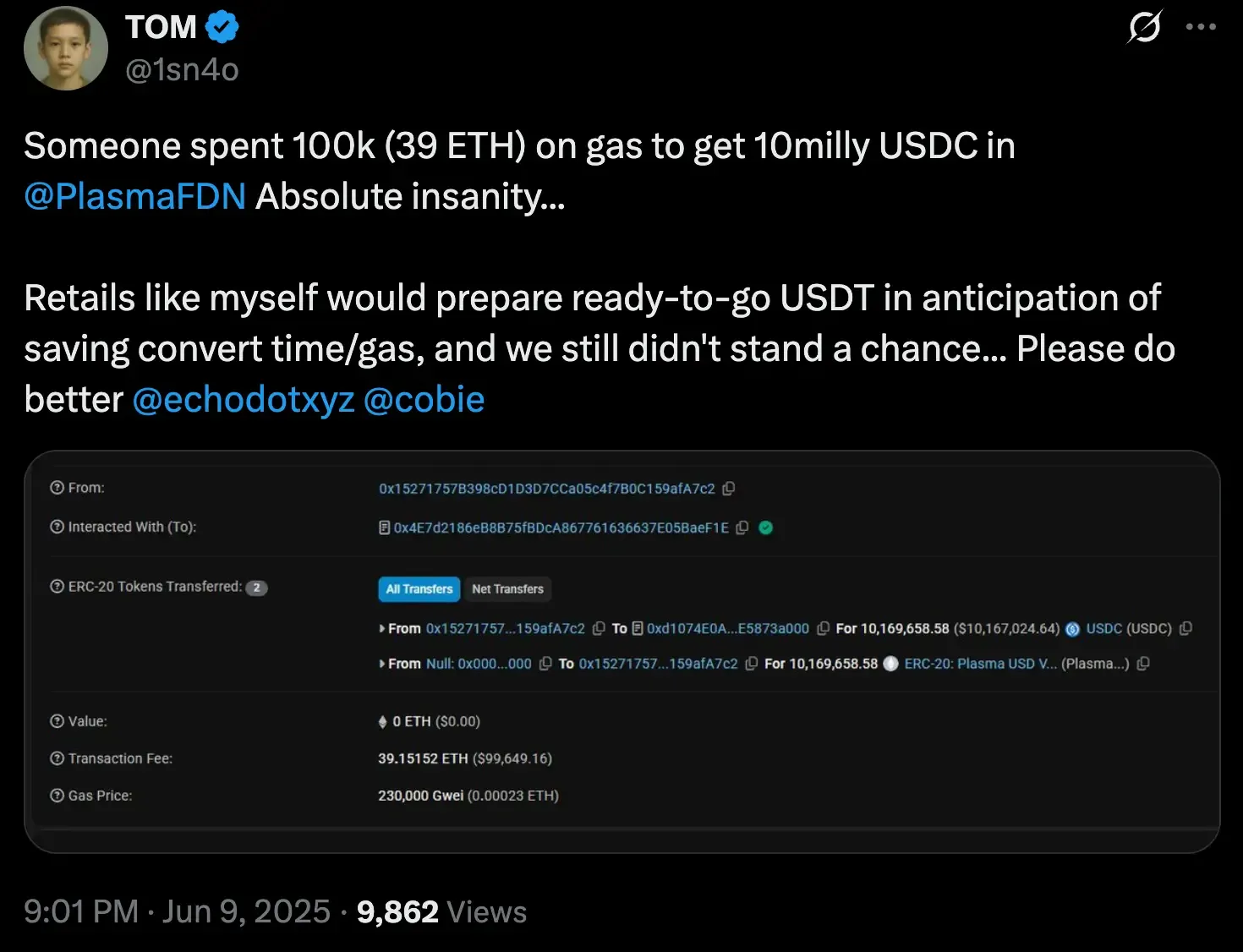

- A whale paid ~$100K in gas fees to secure a $10M USDC spot.

- XPL token sale to raise $50M at a $500M valuation via time-weighted staking.

- Backed by Founders Fund, Tether’s CEO, and Framework Ventures.

- Plasma is a high-speed Layer-1 built for stablecoin payments, anchored to Bitcoin.

Inside the ICO Details and What’s Next for the Project

The Sonar platform, created by renowned crypto influencer Cobie, has launched its first project — Plasma — which has attracted massive interest from investors and the crypto community. During the deposit campaign, the project raised a record $1 billion in just a few days, marking a milestone event in the world of crypto investments. This launch is part of a broader trend—ICOs are making a strong comeback in 2025, fueled by bullish sentiment, retail demand, and new platforms like Sonar.

Record-Breaking Deposit Speeds

On June 9, 2025, Plasma opened its first deposit round with a cap of $250 million, which was fully filled in about a minute. This prompted the team to increase the limit, which was soon raised to $500 million — that amount was also collected within minutes. The high demand confirmed the enormous interest in the project.

On June 12, the team announced another limit increase to $1 billion, doubling the previous cap. According to the announcement, the deposit limit increased by $500 million within an hour, and the full $1 billion was collected in less than 30 minutes. These results demonstrate a high level of trust in the project and active participation from large investors.

On June 17, the team stated that there would be no further deposit cap increases. The total deposit amount is now limited to $1 billion.

Goals of the Deposit Phase

The goals of the deposit phase were clear: to ensure broad global participation through a fair process, prioritizing real users over bots, and to provide day-one stablecoin liquidity for the Plasma mainnet beta.

It is important to clarify that the $1 billion in stablecoin deposits should not be confused with fundraising. The public sale of XPL tokens has not yet started.

Notable Campaign Highlights

A particularly notable case is that of a whale investor who deposited $10 million in USDC and paid around 39 ETH (approximately $100,000) in gas fees on the Ethereum network — an extraordinary amount by transactional cost standards. This reflects the willingness of major investors to incur significant expenses to participate in the project.

XPL Token Sale Terms

Plasma has announced an XPL token sale aiming to raise $50 million at a $500 million project valuation. A total of 10 billion tokens will be issued, of which 1 billion (10%) will be sold at a price of $0.05 per token. The sale format is time-weighted staking through the Sonar platform, allowing participants to lock in their deposits and gain the right to purchase XPL tokens proportional to the duration and size of their contributions.

XPL Public Sale

The public sale for XPL has commenced, with 10% of the total XPL supply (1,000,000,000 XPL) allocated to participants from the deposit campaign. Over 4,000 wallets participated, with a median deposit value of approximately $12,000. Depositors can no longer deposit or withdraw assets from the Veda vault until Plasma’s mainnet beta launch, at which point funds can be withdrawn to the Plasma blockchain.

Sale Details

- Total for Sale: 10% of XPL supply (1,000,000,000 XPL)

- Valuation: $500M

- Sale Start: Thursday, July 17 at 9:00 AM ET

- Sale End: Monday, July 28 at 9:00 AM ET

- Sale Page: Participate in the XPL Sale

All sale participants must complete KYC and onboarding via Sonar by Echo. Vault balances cannot be used in the sale — make sure to prepare separate funds in your connected wallet.

Allocations and Overcommitments

Participants with a confirmed allocation (via deposits + Sonar onboarding) are guaranteed the ability to purchase XPL anytime during the sale. Overcommitments are allowed: if any reserved XPL remains unpurchased by the end of the sale, it will be redistributed proportionally to those who committed additional funds during the sale window.

To qualify for overcommitments, extra funds must be included within your sale commitment. Any unused overcommitted capital will be refunded after the sale concludes.

Confidence in the Project and Its Backers

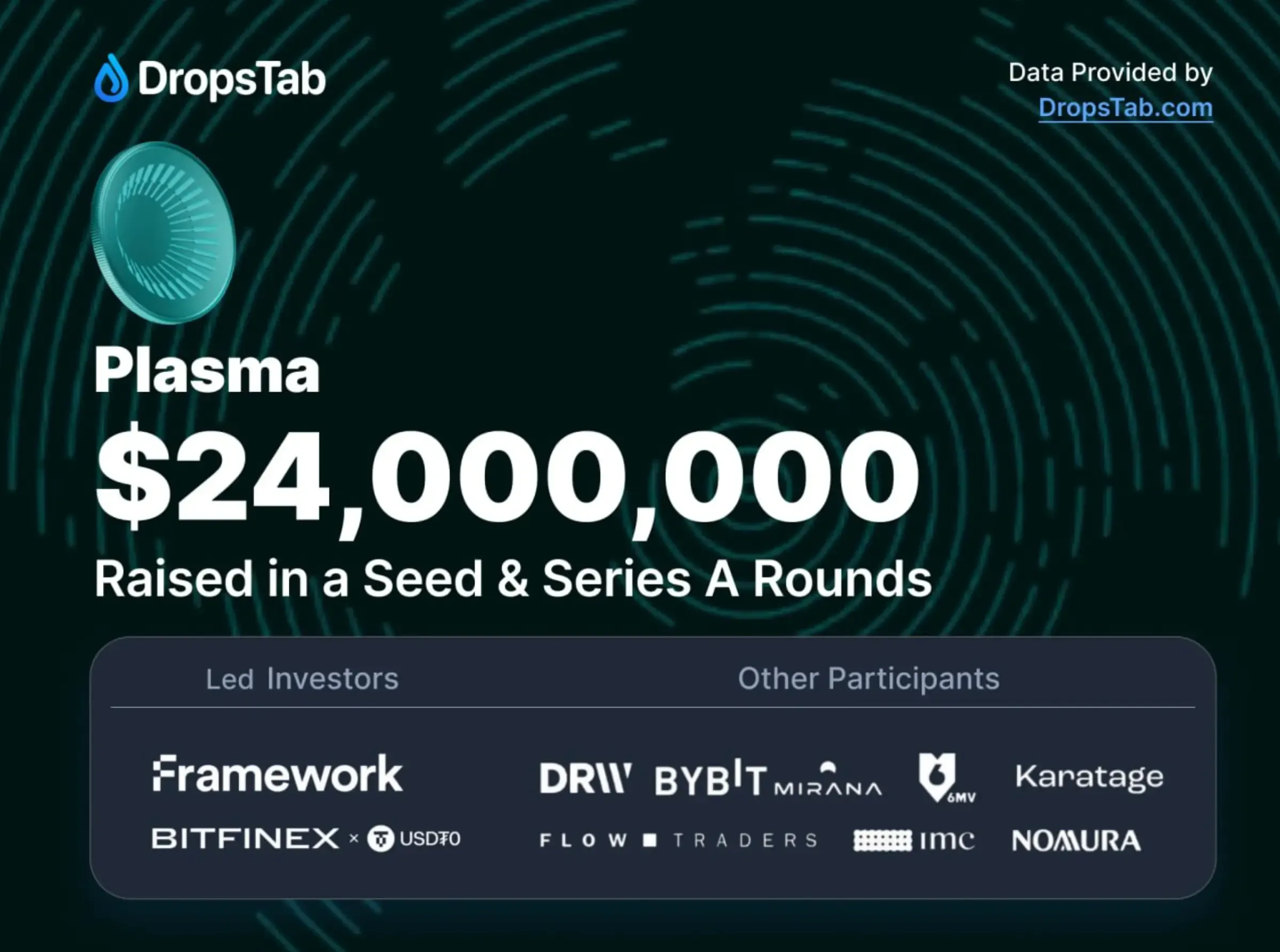

The Plasma project is backed by leading market players and venture funds. Among the investors are Founders Fund (founded by Peter Thiel), Paolo Ardoino (CEO of Tether and CTO of Bitfinex), Framework Ventures, and other reputable firms. In private rounds, the team raised $24 million. The most recent funding round valued the project at $500 million — the same valuation used for the upcoming public sale. This level of backing reflects a broader trend of crypto firms seeking greater institutional alignment — many are now pursuing IPOs to raise capital, gain legitimacy, and expand globally.

Plasma Team

The project team consists of experienced professionals. Paul Faecks — founder of Plasma — is also the CEO and co-founder of Alloy (an institutional investment management system for digital assets). He previously worked at Deribit. Hans Walter Behrens — CTO of Plasma — was formerly CEO of Topl (a Bitcoin layer 2 protocol). The team also includes experts in smart contract security and liquidity management, which increases investor trust and mitigates risk.

Decreased Potential Returns

The deposit increase from the original $250 million to $1 billion means significant dilution for each participant. This is due to the fixed number of tokens available for purchase, while the total invested capital has quadrupled. For example, a $10,000 deposit may now yield the right to purchase approximately $500 worth of XPL tokens.

Nevertheless, investors who contributed during the early deposit waves retain an advantage and receive higher weight in the time-weighted staking distribution.

What Is Plasma?

Plasma is a high-performance Layer-1 blockchain designed specifically for large-scale stablecoin usage, such as USDT. It is optimized for low fees, high throughput, and instant transaction finality. Unlike general-purpose blockchains, Plasma is focused on payment scenarios, allowing users to pay transaction fees in stablecoins and enabling nearly zero-cost transfers.

A key feature of Plasma is its trust-minimized bridge with Bitcoin: the network state is regularly anchored to the Bitcoin blockchain, adding security and making it a kind of Bitcoin sidechain. This combination of Bitcoin’s stability, Ethereum compatibility, and focus on payment use cases makes Plasma a unique infrastructure for digital money.