Crypto

How Does Hyperliquid’s L1 Redefine On-Chain Trading in 2026?

Hyperliquid is redefining decentralized trading with its custom L1 and native order book. We analyze its HyperEVM architecture and the HYPE token's role in the 2026 market to see if it truly rivals centralized exchanges.

Key Points

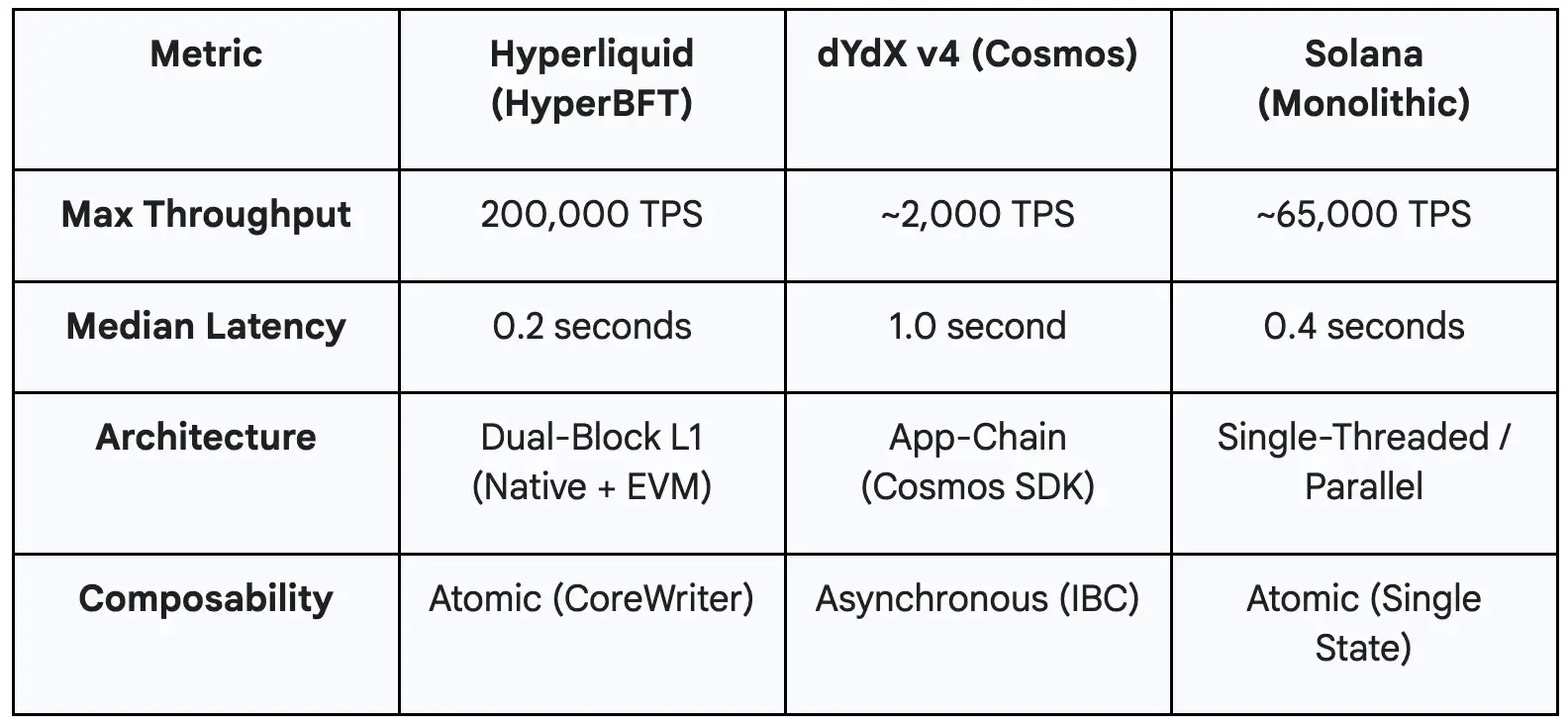

- Hyperliquid delivers 200,000 TPS with 0.2s latency via HyperBFT consensus.

- The HYPE token captures value via the Assistance Fund, permanently removing supply.

- HyperEVM allows atomic composability between the CLOB and smart contracts.

- Market analysis reveals a 60–69% dominance in perp volumes, displacing dYdX.

- The USDH stablecoin internalizes treasury yields, creating a sovereign economic loop.

- 1. The Catalyst: Why Speed Is No Longer the Enemy of Sovereignty

- 2. Technical Architecture: The Bifurcated Financial Stack

- 3. The Market Shift: The Fall of the Cosmos Thesis

- 4. HYPE Tokenomics: Engineering Scarcity

- 5. The Sovereign Ecosystem: Beyond The Order Book

- 6. Conclusion: The Era of Sovereign Performance

The Catalyst: Why Speed Is No Longer the Enemy of Sovereignty

‘You can have speed, or you can have decentralization—pick one.’ For nearly a decade, this binary fallacy defined the architecture of the crypto ecosystem. Traders accepted a brutal compromise: if you wanted the sub-second execution required for high-frequency strategies, you surrendered custody to black-box entities like Binance or FTX. If you prioritized sovereignty, you paid the "latency tax" of Ethereum—tolerating slippage, MEV sandwich attacks, and gas wars.

By early 2026, however, this paradigm has collapsed. The industry is witnessing a foundational pivot from experimental fragmentation toward high-performance, vertical integration. Hyperliquid has emerged not merely as a decentralized exchange (DEX), but as a sovereign Layer-1 blockchain that challenges the very hegemony of general-purpose networks.

Hyperliquid co-founder Jeff Yan explains why building a custom L1 was the only way to achieve CEX-grade performance without sacrificing decentralization:

Key Highlights from the Interview:

- [01:01] – The Vision for Hyperliquid L1: Why building a custom blockchain from scratch was the only way to rival CEX performance.

- [06:45] – HyperCore & HyperBFT: Insights into the consensus mechanism that enables sub-second finality and high throughput.

- [12:15] – Solving the Liquidity Fragmentaton: How Hyperliquid integrates a native order book directly into the L1 architecture.

- [16:21] – The Evolution of HyperEVM: Moving from a pure trading platform to a permissionless ecosystem for developers.

- [22:34] – Institutional Adoption & Market Dominance: Strategies that allowed Hyperliquid to capture significant market share from incumbents.

- [26:03] – The Role of USDH: How the native stablecoin creates a sovereign economic loop within the protocol.

At its heart, Hyperliquid represents the "app-chain" thesis taken to its logical extreme. Unlike modular stacks that fragment liquidity across bridges and sequencers, Hyperliquid optimizes every layer of the stack—from the HyperBFT consensus to the end-user interface—for a singular purpose: financial meritocracy. The result is a protocol that commands a staggering 60–69% of the decentralized perpetual futures market as of early 2026.

This report dissects the technical orchestration behind Hyperliquid’s dominance, exploring how its bifurcated architecture solves the "noisy neighbor" paradox and why the HYPE token’s post-cliff dynamics signal a shift from speculative reflexivity to sustainable value accrual.

Technical Architecture: The Bifurcated Financial Stack

The fatal flaw of general-purpose blockchains like Solana or Monad is that they treat a $100 million perpetual swap with the same computational priority as a $5 NFT mint. This lack of specialization creates systemic fragility; a memecoin frenzy can degrade the latency of critical financial infrastructure. Hyperliquid’s primary technical advantage lies in its rejection of this "one-size-fits-all" consensus model.

Instead, the protocol employs a bifurcated architecture. It splits execution into two distinct but atomically linked domains: HyperCore, a highly optimized native layer for order placement and matching, and HyperEVM, a general-purpose environment for smart contracts.

HyperBFT and the Conquest of Latency

Latency is the invisible killer of on-chain liquidity. In high-frequency trading (HFT), market makers price-in risk. If block times are slow, they must widen their spreads to protect against being "picked off" by arbitrageurs who see price moves faster than the chain can confirm them.

Hyperliquid mitigates this through HyperBFT, a custom consensus algorithm inspired by HotStuff. Unlike the asynchronous nature of standard blockchains, HyperBFT achieves responsiveness that supports approximately 200,000 orders per second with a median end-to-end latency of roughly 0.2 seconds.

Crucially, this architecture avoids the "off-chain matching, on-chain settlement" compromise pioneered by early dYdX versions. Hyperliquid executes matching, risk checks, and settlement atomically on-chain. This ensures the Central Limit Order Book (CLOB) remains transparent and verifiable, eliminating the "black box" risk of centralized sequencers while delivering the responsiveness of a Web2 database.

HyperEVM: The Dual-Block Bulkhead

The introduction of HyperEVM in February 2025 marked Hyperliquid's evolution from a niche derivative platform to a generalized financial ecosystem. However, integrating an EVM poses a risk: how do you prevent a complex smart contract loop from stalling the order book?

The solution is a novel dual-block architecture. The network produces two distinct streams of blocks:

- Small Blocks: Generated every ~1 second with a strict gas limit of 2 million. These are reserved for ultra-fast, lightweight transactions like order cancellations and simple transfers.

- Big Blocks: Generated every ~60 seconds with a gas limit of 30 million. These handle complex computations and heavy smart contract interactions.

This design creates a "bulkhead" between heavy compute and high-frequency trading. A complex lending protocol update or a high-volume NFT mint cannot clog the high-frequency lane. It is an engineering recognition that financial transactions require different resources than generalized compute.

Atomic Composability via System Contracts

The most profound innovation in Hyperliquid’s stack is CoreWriter. In modular ecosystems like Cosmos, communicating between a lending app and a trading app requires asynchronous message passing (IBC), which breaks atomicity. If a trade fails after a loan is taken, the user is left with a fractured position.

Hyperliquid solves this through specialized System Contracts. These contracts allow the HyperEVM layer to read the state of the HyperCore order book and execute transactions within the same bundle. This unlocks "Atomic Hedging"—a vault can accept a USDC deposit, mint a synthetic asset, and hedge the exposure on the CLOB in a single, indivisible transaction. If any part fails, the entire sequence reverts. This capability is virtually nonexistent on other chains and fundamentally changes the risk profile for institutional DeFi strategies.

The Market Shift: The Fall of the Cosmos Thesis

The period between 2024 and 2025 provided a brutal case study in user friction. dYdX, once the undisputed king of on-chain perps, migrated to its own Cosmos app-chain (v4). While technically impressive, this move forced users to bridge funds to a non-EVM ecosystem, manage new wallets, and navigate distinct validator sets.

The market’s verdict was swift and unforgiving. As dYdX introduced friction, Hyperliquid removed it. By leveraging Arbitrum for bridging and maintaining EVM wallet compatibility, Hyperliquid captured the liquidity exodus.

The data underscores a dramatic inversion of power. As of early 2026, Hyperliquid controls approximately 60–69% of the decentralized perpetual futures market, while dYdX’s share has plummeted from a peak of 73% to roughly 7–10%. In January 2026 alone, Hyperliquid generated gross revenues of ~$71.88 million , figures that rival established CEXs. This validates the thesis that while "sovereignty" matters, it cannot come at the expense of user experience.

HYPE Tokenomics: Engineering Scarcity

The HYPE token challenges the "VC dump" narrative that plagues most L1 launches. Its design reflects a careful orchestration of incentives, balancing the need for security (staking) with the imperative of value capture.

Navigating the 2025 Cliff

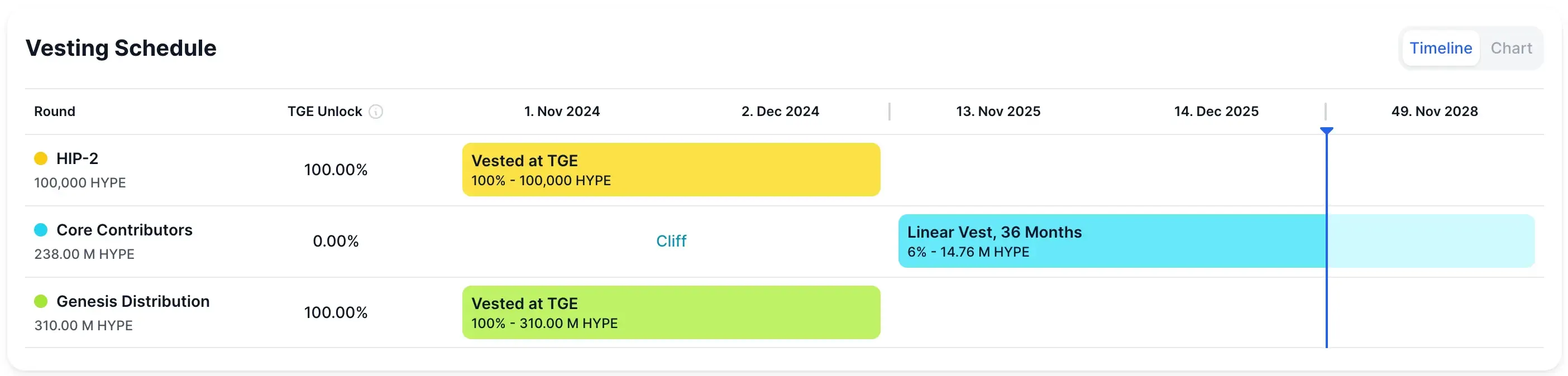

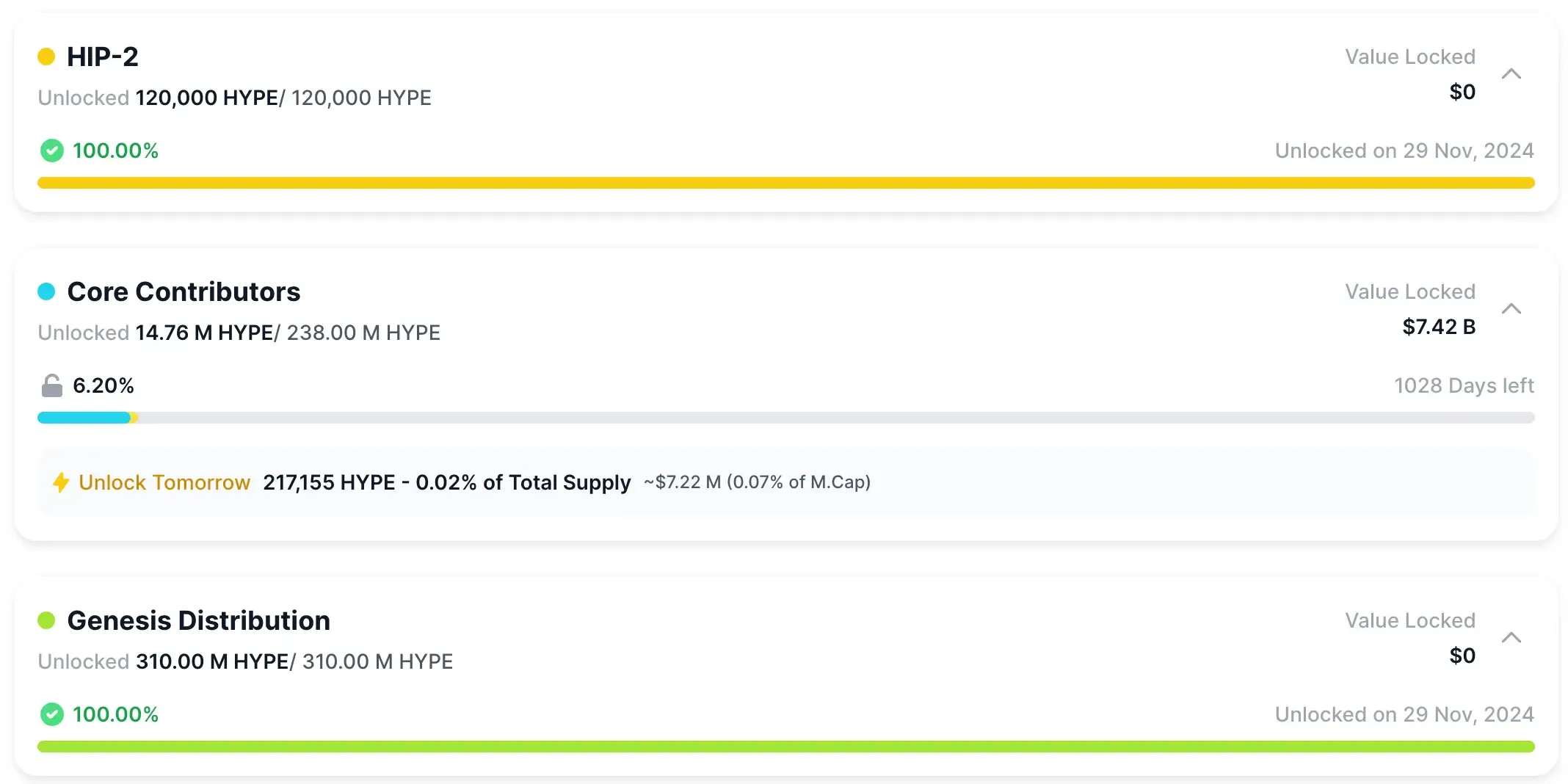

Investors often fear the "one-year cliff"—the moment when early contributors and investors unlock their tokens, flooding the market. For Hyperliquid, this cliff arrived on November 29, 2025. However, unlike the chaotic dumps seen in other protocols, the Hyperliquid team implemented a rigid linear vesting schedule for the 23.8% of supply allocated to core contributors.

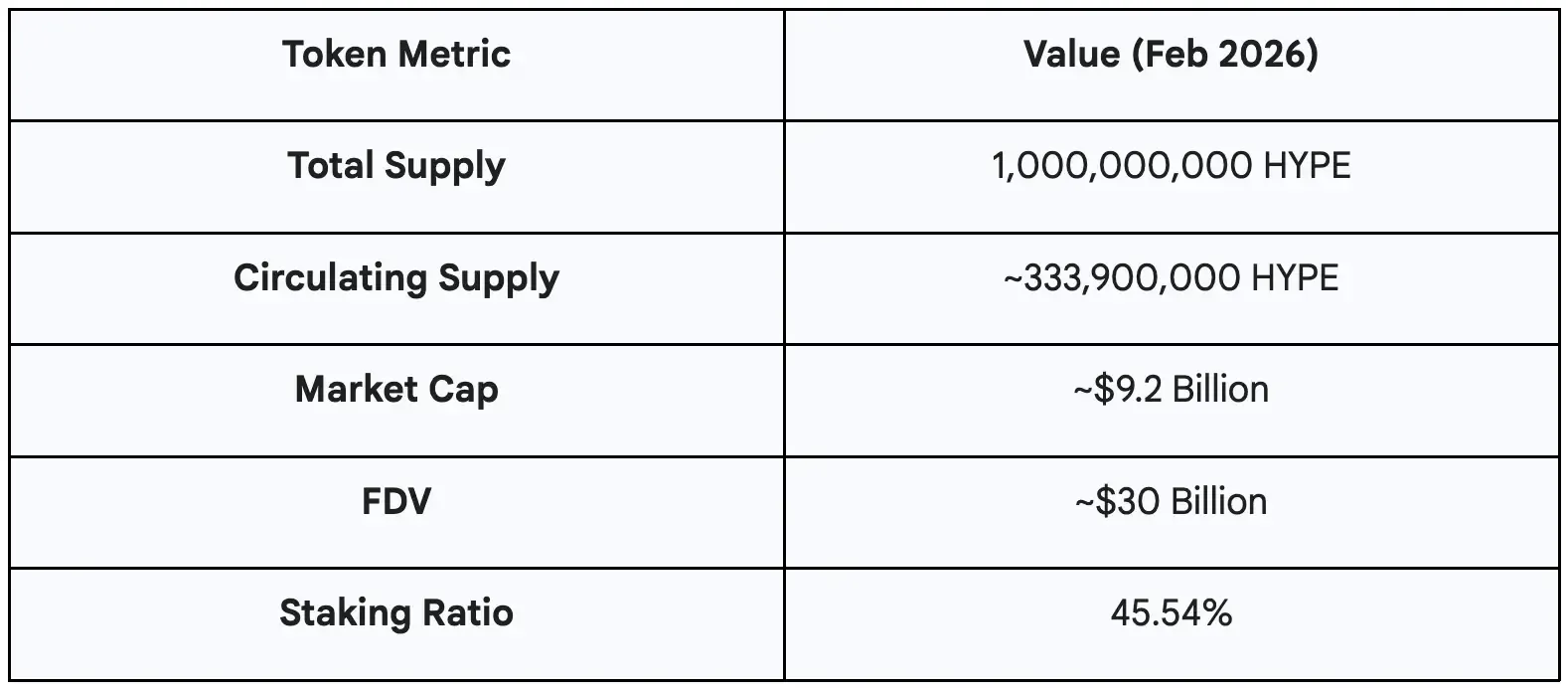

The unlock releases approximately 9.9 million HYPE (roughly 1% of total supply) on the 6th of each month. Crucially, the market absorption of this supply has been robust. On January 6, 2026, the distribution of 1.2 million tokens from the team's allocation was met with price stability rather than volatility. This suggests that the market has repriced HYPE from a speculative asset to a cash-flow-generating commodity.

As of February 2026, HYPE's market resilience is further bolstered by the HIP-4 (Outcome Trading) announcement, pushing the token toward a new local high of $37, with a circulating market cap exceeding $10 billion.

The Assistance Fund: A Value Black Hole

Hyperliquid rejects the "yield farming" model where tokens are printed to subsidize usage. Instead, it employs the Assistance Fund. Protocol fees are not distributed as dividends (which risks regulatory classification as a security) nor burned (which benefits passive holders). They are used to buy back HYPE on the open market, which is then held in the fund.

By late 2025, this mechanism had removed over 28 million HYPE from circulation—nearly 3% of the total supply. This creates a "value black hole," where the more the platform is used, the scarcer the underlying asset becomes. It transforms revenue into structural buy pressure, aligning the incentives of traders, stakers, and the protocol itself.

The Sovereign Ecosystem: Beyond The Order Book

Directly expanding its functional surface, Hyperliquid announced the launch of HIP-4, introducing Outcome Trading to the HyperCore engine:

"Outcomes are fully collateralized contracts that settle within a fixed range. They are a general-purpose primitive that are useful for applications such as prediction markets and bounded options-like instruments."

Industry analysts, such as @DefiIgnas, highlight that HIP-4 enables unique cross-margin strategies that traditional prediction markets cannot match:

"If Outcomes compose with perps, you can long ETH + buy an 'ETH below $2k' outcome as a hedge, and your margin drops because the positions offset each other."

While the exchange remains the engine, the HyperEVM ecosystem has become the hull of the ship. The most aggressive strategic move in this domain is the USDH stablecoin.

The Vampire Attack on Yield

In traditional crypto ecosystems, users hold USDC or USDT. The yield generated by the backing assets (US Treasuries) is kept by the issuer (Circle or Tether). Hyperliquid identified this as a leakage of value. With over $5.5 billion in stablecoin deposits, the community realized they were effectively subsidizing traditional finance.

The launch of USDH, backed 1:1 by cash and Treasuries, flips this model. The protocol explicitly mandates that 100% of the yield generated by reserves is distributed back to the ecosystem. This is a sovereign economic loop: users trade on Hyperliquid, hold USDH, and the yield from their deposits funds the Assistance Fund or ecosystem grants. It is a direct "vampire attack" on incumbent stablecoins, incentivizing capital to migrate not just for trading, but for the fundamental efficiency of the asset itself.

Conclusion: The Era of Sovereign Performance

Hyperliquid enters 2026 as a rare example of a crypto protocol that has crossed the chasm from experimental tech to critical infrastructure. It has successfully navigated the "L1 Wars" not by making a faster Ethereum, but by building a purpose-specific machine that outperforms centralized entities at their own game.

The bifurcated architecture of HyperCore and HyperEVM provides a technical moat that general-purpose chains struggle to bridge. By isolating high-frequency state from general compute, Hyperliquid avoids the congestion that plagues Solana and the fragmentation that hampers Cosmos.

Looking forward, the risks are no longer technical but geopolitical. As the protocol expands into commodities and permissionless markets, it inevitably attracts the gaze of regulators. However, with a decentralized validator set, a high staking ratio, and a community-led governance model (HIPs), Hyperliquid is arguably better positioned to resist censorship than any centralized competitor. The "original sin" of DeFi has been absolved; speed and sovereignty are no longer mutually exclusive. They are the new standard.